There are three things that seem to excite investors at the moment, at least if we go by the focus of the current crop of teaser ads and the number of questions we’re getting: Figuring out how to deal with income investing in a higher-rate world, Buying oil stocks to benefit from continuing demand and relatively low valuations, and buying AI stocks. To that, I guess we can add a new wave of “End of America” doom pitches, now that Porter Stansberry is back in the saddle at his eponymous firm, and a little undercurrent of “buy uranium” pitches in the junior mining world (not as much excitement about gold, oddly enough, even though it’s tickling the psychologically important $2,000/oz level again, but I’m sure the gold bugs will be filling my inbox again soon, too).

So today I thought, in the interest of rotating our coverage, that we’d look at a uranium pitch.

Uraniun is certainly having a moment, with prices finally getting back to profitable range for the established producers, which is gradually showing signs of bringing production back online at a lot of plants, mostly because of a gradual re-acceptance of the fact that nuclear power is generally a lot cleaner and safer than coal (and some worrying about the fact that Kazakhstan, a strategically questionable supplier after the Ukraine invasion, is the biggest exporter of uranium, and the US has grown to be fully dependent on uranium imports).

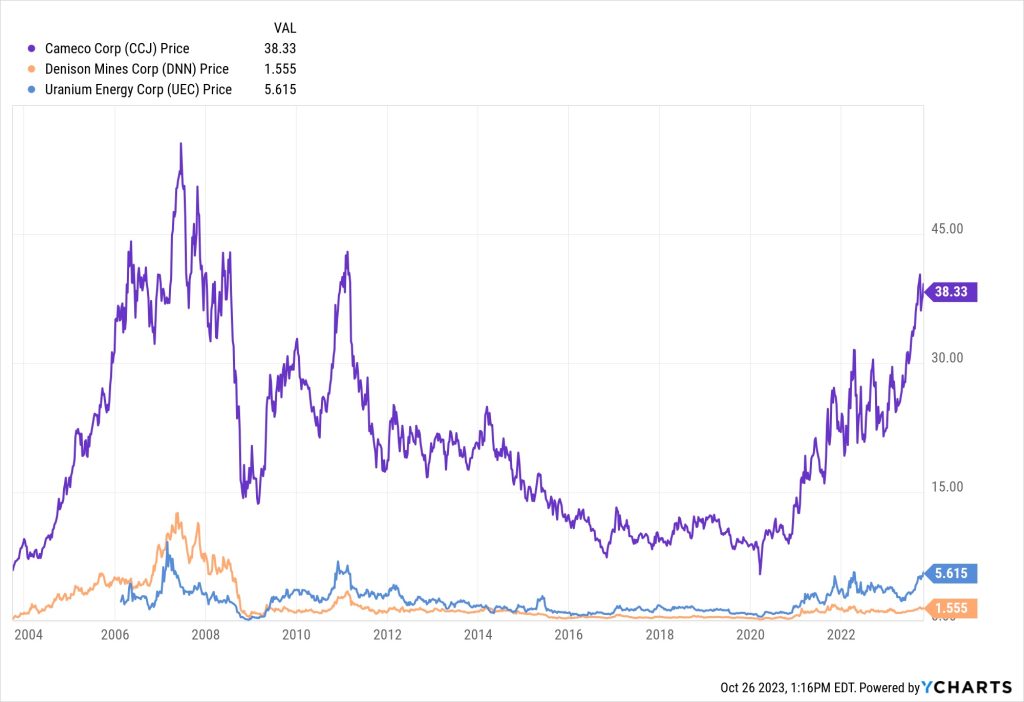

There isn’t much of a “spot price” for uranium, it’s tightly controlled and doesn’t trade on the big commodity exchanges or futures markets, but there is a quoted spot price that supposedly represents short-term demand, and Cameco, the largest North American producer, also publishes the prices for uranium being bought on long-term deals (which is most of it). Here’s what Cameco shows as the historic pricing dynamic for the past couple decades, the big runup in 2007 and the smaller one in 2011 (just before Fukushima) have been the notable drivers in the past, generating big gains for uranium speculators… and the decade from 2012 to 2022 was generally a disaster for uranium companies:

The nice thing about uranium, as an investor, is that while the price does go up when more nuclear energy is produced and more uranium is needed, demand doesn’t really get depressed by higher prices. Unlike with other fuels like oil, natural gas or coal, uranium is a very small part of the cost of operating a nuclear power plant, nobody shuts down a nuclear plant because uranium got a little too expensive… though they do shut down mines because uranium got too cheap to make it worth producing. Here’s what the stock prices have looked like for a few of the companies who have been around for almost that long (UEC really got started in 2006, during the runup to the 2007 blowoff top in uranium prices, Denison and Cameco have been around for much longer):

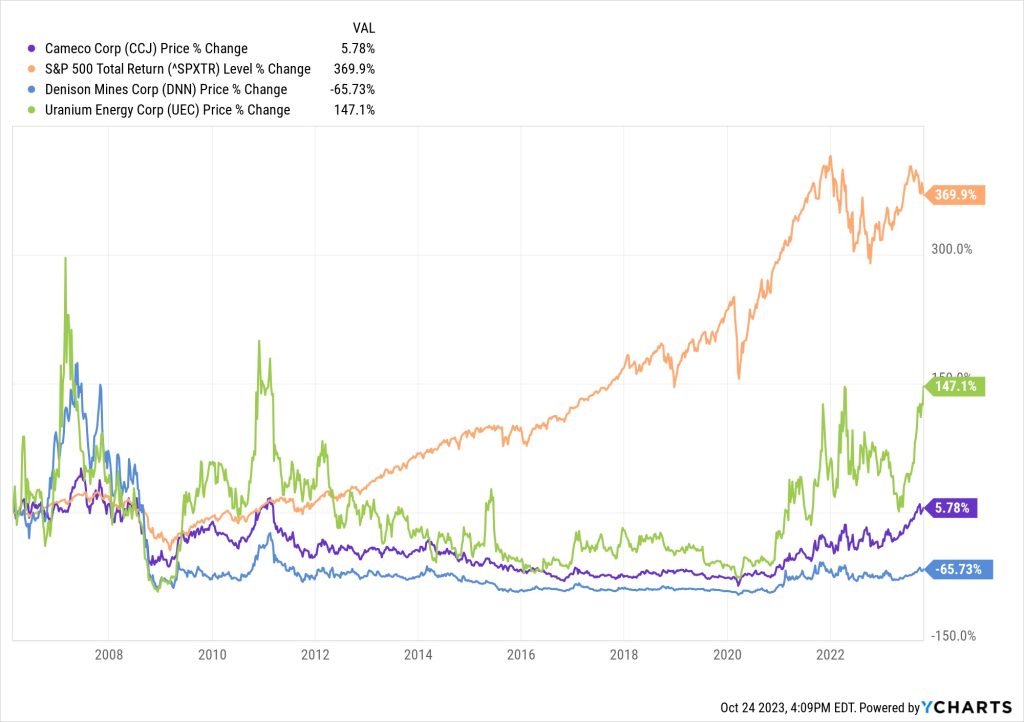

So before we get into looking at some of those little miners, the best of which, if bought at absolutely dismal times, could have generated massive windfall returns, we should remind you of how generally terrible the mining business is if you don’t have the luck (or perhaps skill) to just buy miners or speculative juniors when prices are low and sell them during the bull cycle of rising prices. This is roughly that same chart, adding in the S&P 500 for context:

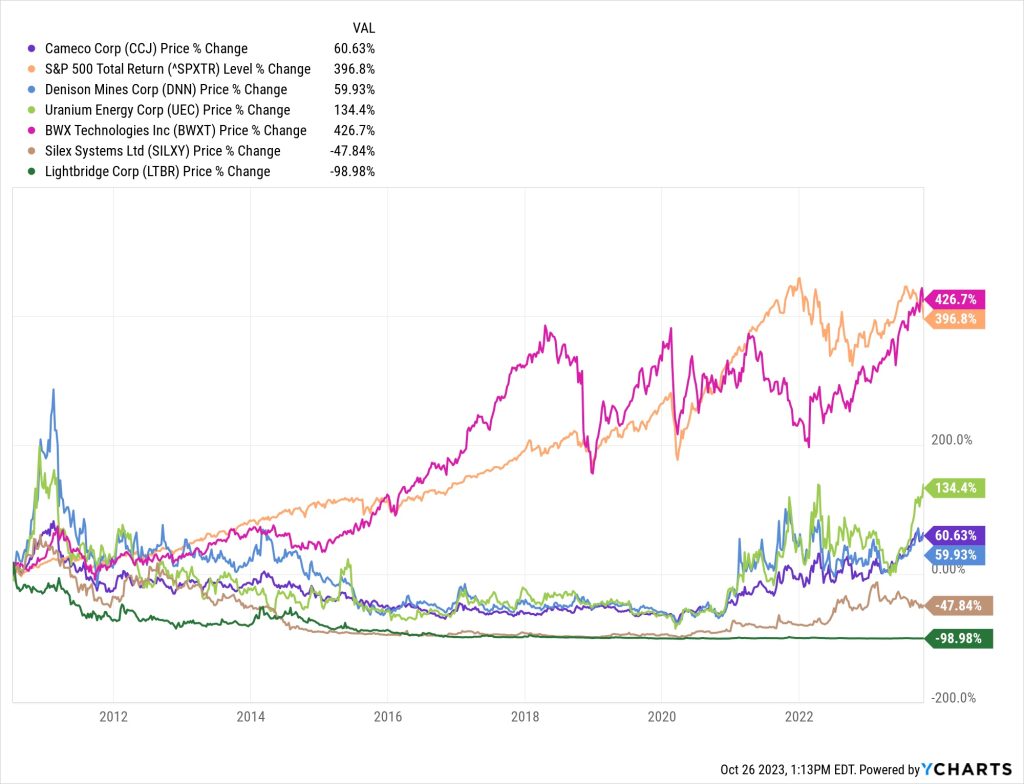

And if you are wondering whether buying nuclear companies that aren’t actual uranium miners works better, the answer is… maybe. We have to tighten the timeframe a little to make room for some smaller companies, which means we’re also starting at a lower uranium price before the 2011 spike, but if you add in BWX Technologies (BWXT, in pink) as well as the nuclear fuel processors and hopefuls Silex Systems (SILXY, brown) and Lightbridge (LTBR, dark green), you can see it’s possible to either win or lose in nuclear power, even if you’re not directly dealing with the commodity prices. Lightbridge, incidentally, is still pretty regularly being teased for its “Trifuel-238” uranium fuel rod design … BWXT is one of the easier companies to like in the nuclear space given the stability of their core business of building and servicing reactors for the nuclear navy, and the stock has been pretty consistently teased by Porter Stansberry for the past six months or so.

And more recently, Whitney Tilson has been promoting his “E-92” nuclear power stocks, some of which are uranium companies and some more consistent businesses, like companies which own nuclear power plants (Constellation Energy (CEG), Vistra (VST), etc.), and a few of those bigger companies have done quite well over the past year or so.

But today’s pitch is much more in the “uranium mining” world… here’s the lead-in for the ad that a few readers asked about:

“EXTREME FORTUNES Will Be Made As Uranium Surges To $200 Per Pound!

“Those Who Get In BEFORE This New Peak Cycle Could Make Over 1,300-Times Their Money… Just Like Investors Did in the Last Uranium Boom!”

“Tiny Uranium Miners Can Make You Extreme Fortunes Like Becoming a ‘One Stock Millionaire’ In Less Than Four Years”

Well, sure. That has happened. Also, every few months, someone wins the Powerball lottery. And sometimes people hit the trifecta at the Kentucky Derby and win big on a few underdogs. I’m as much a fan of daydreaming about riches as the next guy, and I certainly make a little room for wild speculations in my portfolio… but there’s a big difference between “can” and “will.”

We’ve probably already talked enough “big picture,” so I’ll skip right ahead to the teases — this ad from Gerardo Del Real for his Junior Resource Monthly ($199/first year, renews at ?) hints at three specific picks for this uranium “bull cycle”, so we’ll jump right to the clues…

“Uranium Extreme Fortune Stock #1: America’s Next Uranium Producer

“Take a look at this picture… because it could be worth a LOT of money to you.

“Now, to most people, this just looks like any old tree-covered hill at the edge of a prairie.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“However, there’s something currently hidden from view within this hill and beneath the prairie floor…

“A massive deposit of uranium.

“And it’s all owned by the first uranium company I’m recommending.”

That photo looks familiar, what other details do we get?

“How much uranium is there? At least 46 million pounds….

“… this company recently received both its NRC license and all of its final EPA permits after a decade of waiting. It’s perfect timing for uranium’s peak profit cycle.

“And that’s just one of its projects.

“It has several others, including one that is scheduled to come online in the first half of 2023.

“These recent developments position it to become the newest major uranium producer in the US.

“And once it does, it could be incredibly exciting for early investors…

“As they could potentially watch this uranium producer’s share price go from below $5.00 to $200.”

So what’s that one? This is a repeat of the same newsletter’s pitch for enCore Energy (EU) back in January, the only real change is that the company has now gotten a US listing (it used to trade over the counter at ENCUF on this side of the border). The current ad is undated, but they didn’t even bother to update the “in the first half of 2023” clue, though the plant is actually not online yet.

Might it make investors 100X their money? I guess anything is possible, we can’t prove a negative and they might actually build this mine and produce their uranium and make a nice profit someday. The stock has risen a bit since Del Real teased it in January, and it’s around the same level as it was the first time I looked at it, back in August of 2022, but the company is significantly larger because they’ve issued another $25 million worth of shares so far this year, which was used to pay back some of the debt they used to buy the Alta Mesa project from Energy Fuels late last year (the total cost was $120 million, part of it was initially debt, and they’ve raised capital a couple times to help cover that acquisition and get production started).

enCore is expecting to begin production at their past-producing Rosita plant in Texas late this year, starting in November, and to expand that to Alta Mesa next year and to other of their Texas ISR properties in the next few years, though their larger potential projects, like the one under that photo above, in South Dakota, are many more years away from possibly being built or producing (they currently say those projects represent a million pounds a year of proposed capacity and have it penciled in for mid-2026, but the potential resource is much larger, with projected life of mine production of 14 million pounds of uranium).

You can check out their investor presentation here if you’d like a little more of an overview, but the situation at enCore is similar to most other uranium juniors — if uranium prices go up, and there’s really increased demand for US production because of this latest hoped-for nuclear renaissance, it will do well. The benefit is really that since they probably can produce a meaningful amount of uranium within the next 2-4 years, they’re far more ‘real’ than many of the uranium juniors who are just “discovered a deposit” stories and might never build a mine.

If uranium prices fall again, though, perhaps because of abundant supply hitting the market from Cameco or Kazatomprom, the two largest producers (Kazatomprom has been keeping production artificially low for ~5 years, to try to support the uranium price, but they said they’ll be back at 100% production soon, which means they’ll grow production by about 50% from this year to 2025), and there’s no sustained strategic push for US production in future years, then probably these ISR producers will all shut down again, that’s what happened after the Fukushima tsunami destroyed demand for nuclear power in several countries for a decade, slowing development and closing down a lot of existing power plants. (ISR is in situ recovery, in case that term is new to you — it’s actually more like oil production than like hard rock mining, they pump water into uranium-hosting sandstone deposits, extract that water, and remove the uranium from it).

I’ll stick with roughly the same mildly informed enCore opinion I shared with you back in January, to wit…

Going by the somewhat rosy projections of net present value for the Azarga projects that enCore bought, which probably need to be discounted further because of inflation, my initial judgement is that enCore’s share price is in the “fair” range as a speculation on rising uranium prices. Not wildly cheap, so get daydreams of 100,000% returns out of your head, but probably justifiable if uranium stays steady. It could be that Alta Mesa significantly boosts the future potential… but it also cost them a lot of money, and there’s every chance that they’ll have to keep raising capital to keep the lights on until they establish a profitable level of production. There’s no real forecast from the company about what their cash flow will look like with this first year of production at Rosita, nor of what a restart at Alta Mesa will cost next year, but they’re essentially out of cash now so whatever they don’t earn from this initial production, they’ll have to raise.

That’s probably not telling you anything you don’t know, and Del Real doesn’t try to hide the fact that his recommendation is based on the idea that uranium prices will hit new highs sometime soon — after all, the title of his “special report” is “$200 URANIUM! – And Three Uranium Stocks That Could Generate Extreme Fortunes For Investors” (the peak price, in case you’re curious, was about $140 during the 2007 uranium spike).

So what are those other two “extreme fortunes” uranium stocks?

“Uranium Extreme Fortune Stock #2: An Unhedged & Production-Ready Uranium Rocket Ship

“In the last uranium boom, this stock went from 16-cents… to nearly $7.50 — for a gain of 4,587% in only two years….

“The company has a suite of production-ready assets in the US.

“It’s also been on an acquisition spree — adding assets in the US and Canada that give it millions of uranium pounds in the ground.

“The company has nearly 300 million pounds of uranium across all of its projects. At my predicted price of $200 per pound, that has an in-situ value of $60 billion dollars.”

OK, so this is one of our old friends again — Uranium Energy Corp (UEC), which did indeed go from about 16 cents at the bottom of the market in 2008 to about $7.50 at the peak in the previous uranium surge, in late 2010. It’s a volatile one, it was also under a dollar in early 2020, but has been spiking higher as uranium prices rose this year, and it’s always a very promotional company, CEO Amir Adnani has a lot of friends in the investment newsletter world.

I don’t have any big recent insight into UEC, and there’s been no news from the company in the few weeks since I last mentioned them, so I’ll just re-share what I wrote about them when Whitney Tilson also included the company in his “Seven Nuclear Power Stocks” Promo:

There are two conventional uranium mills in the US, though only one is in operation right now. They’re both in Utah — White Mesa, which is owned by Energy Fuels (EFR.TO, UUUU) and is in operation now, and Ticaboo, owned by Uranium One but currently not operating (it’s been on “care and maintenance” standby, I guess waiting to see if other mines restart in the area as uranium prices rise, for more than 40 years). The two companies who own uranium mills in Canada are Cameco and the French company Orano, but almost all of the uranium production and million in Canada is done by Cameco (CCJ) at its McArthur River mine, the largest single uranium mine in the world. You can’t own part of Uranium One these days, at least not the part that still owns the Ticaboo property, that was sold to Rosatom and remains tied to the good ol’ Russia/Uranium scandal of the Clinton years, though some of the other uranium projects owned by Uranium One have been sold back to a North American company, Uranium Energy Corp (UEC) bought a bunch of their in-situ projects in Wyoming back in 2021.

Uranium Energy Corp (UEC) likes to brag about both its permitted projects and it’s stake in the pre-revenue royalty startup Uranium Royalty (UROY, URC.TO) (which Marin Katusa, incidentally, has been paid to tout in promotions recently). UEC owns a portfolio of uranium ISR projects, and has been trying to sell itself to investors, and effectively waiting for another uranium bull market, for more than 15 years.

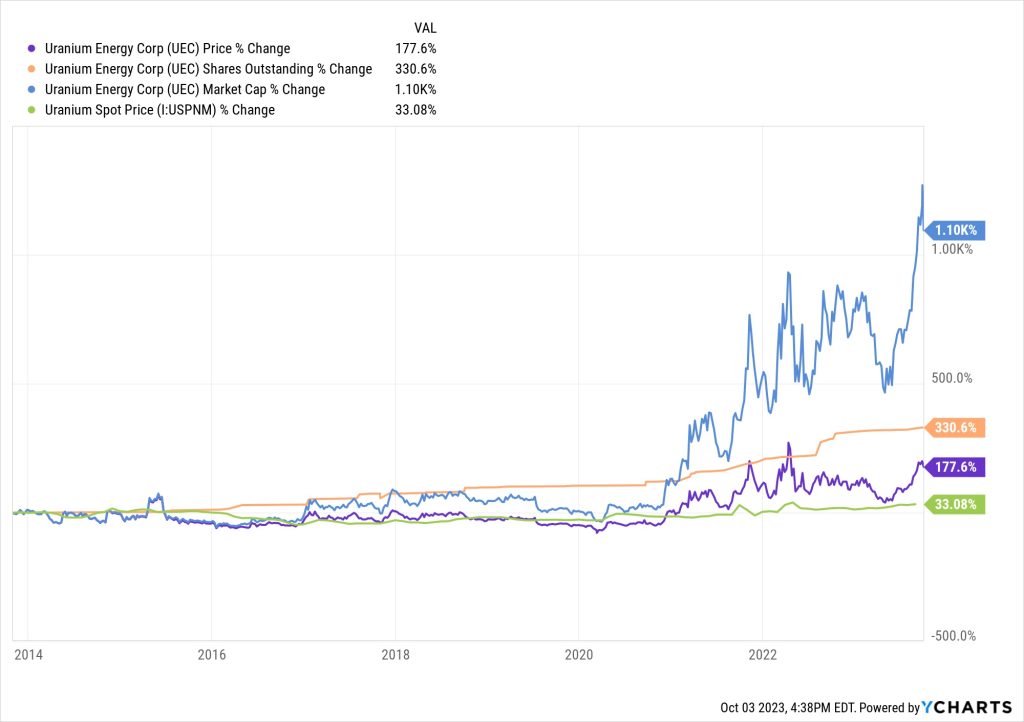

I’ve got a little built-in skepticism about Amir Adnani and his Uranium Energy Corp, since I wrote about it a few times during a previous frenzy of uranium speculation seven or eight years ago (and even got spuriously sued for doing so, though the case was dropped when the lawyers finally noticed that Stock Gumshoe wasn’t part of the stock promotion scheme they thought UEC was ginning up with Dr. Kent Moors). The thing that really stands out about that company is the fact that they’ve been building up this portfolio of permitted projects for decades, including some that are operational, but over the past decade or so they have issued more shares than they have brought in dollars in revenue… which you can see in the booming market cap and the relatively placid share price. This is the chart of UEC over the past ten years, that green line at the bottom is the uranium spot price, which may or may not be all that reliable (uranium is mostly sold on long-term contracts, the spot market is small), the purple line is the UEC share price, orange is the number of UEC shares, and blue is the market cap.

And here’s what that looks like since the Russian invasion of Ukraine back in February of 2022, since that invasion, and the possible cutoff of Kazakh/Russian uranium supplies to the West, has been a key story driver for North American uranium production…

Maybe it works out, I have no idea, but UEC is certainly going to keep promoting itself during a bull market, and they’ve designed their portfolio and their asset base to be appealing when prices are high and US production is needed. Here’s their latest investor presentation, in case you want to dig a little deeper. It hasn’t been at $1.4 billion in a few months, the stock has spiked almost 50% to get it to $2+ billion as uranium interest has grown, and it’s also not quite “under $5” as teased, it’s at about $5.50 today, but most of that climb took place in August and early September, it’s been relatively stable lately.

Next? Sounds like the last one is a much more speculative exploration company…

“Uranium Extreme Fortune Stock #3: The Stock That Could Deliver 30x Your Money In Just Weeks

“While I’m excited about the previous two uranium extreme fortune companies, this one here could quickly turn $1,000 into $30,000 or more in just a matter of weeks.

“Why?

“Because it’s currently exploring a massive, underexplored land package.

“Originally, the area was known for its copper deposits. And the land position was owned by over a dozen companies.

“But today — for the first time ever — in anticipation of the coming uranium peak cycle this company has consolidated the land.

“It’s now the sole owner of an entire district that hasn’t seen a modern mining approach in over 50 years.”

We’re told that it’s near infrastructure (rail, ports, power, empoloyees, etc.) in Canada, and whenever Del Real penned his words it was trading below 50 cents.

So… hoodat? Well, given the squishiness of the clues we can’t be 100% certain, but the Thinkolator’s best match is a little explorer called Latitude Uranium (LUR on the CSE in Canada, LURAF OTC in the US), which was spun out of Consolidated Uranium (CUR.V, CURUF) last year. Originally, their most exciting (and only) prospect was in the Central Mineral Belt in Labrador, and they were called Labrador Uranium until a few months ago, and that’s where the reference to past-producing copper and great infrastructure comes in, but they acquired a more advanced project in Nunavut from ValOre in June (for cash and shares), and that has shifted the focus. Labrador is still an exploration target, but it’s much earlier stage, doing airborne gravity surveys this year and compiling old data, Angilak, in Nunavut, is where they’ve been actually drilling.

Will they find something that’s exciting enough to get folks excited if this uranium bull market continues to run? I dunno, maybe. They’re certainly optimistic, but optimism is a job requirement for mineral exploration companies — you can check out their latest investor presentation here and see if you agree that there’s “100X” potential.

So far, they’re early enough in their exploration work that they haven’t really enjoyed the rise in uranium prices — the stock was “under 50 cents” earlier this year, whether you’re talking US or Canadian cents, and it’s now further under, at about US$0.13. It’s a real teensy one, with a market cap of only about $25 million, so it’s at least in the “anything can happen” category. They seem to have finished most of their work for 2023 at this point, but they haven’t filed their third quarter finances yet (probably next week), so we don’t know what their cash situation looks like after the Angilak acquisition. They did raise C$12 million in a private placement that came out of escrow once the acquisition closed, so that should have covered the cash portion of the acquisition cost plus their drilling expenses this year, but we don’t know what’s left — like any good junior explorer, I imagine they’re hoping for some good drilling results that coincide with strength in commodity prices so they can get folks excited before they have to raise money by selling more shares.

Like I said, not enough clues to be certain of the match here, but this is a pretty typical early mineral explorer — they won’t be building any mines anytime soon, but sure, sometimes they can really take off if the commodity price goes crazy at the same time that they’re reporting good drilling results. Might want to do some finger-crossing if you’re interested in this one, but that’s always true of a junior explorer.

Sound like fun uranium stories for you? Have others that you prefer? Do let us know with a comment below… and thanks, as always, for reading!

Besides kazatprom kazakstan there is still a lot of uranium to be exploited in uzbekistan.

Quiensroad finance has interesting convertible debts on some promising uranium Junior miners.

I got involved with nuclear power after Three Mile Island.

First on the safety analysis side. Then, ran some small scale experiments to try

to understand what happened. Then, larger scale ones. Worked with a lot of experts.

You opened this segment with the statement that nuclear power is cleaner than coal.

If you do a lifetime, full system analysis with an open mind, you’ll find that nuclear is the cleanest way.

It’s also the safest. Next cleanest are the gas fired hybrid power plants.

Your comment about BWXT being one of the SMR leaders is spot on.

I would add GE / Hitachi is a co-leader.

Thanks! It is a shame that fear and inept waste planning have kept us from doing a better job building a modern nuclear generation fleet.

Thanks for posting a picture of the Dewey-Burdock area. As a summer hire I began my career as a geologist there in `1969. At the time uranium was being mined from an open pit there and the ore was being milled at Edgemont, SD. The mill produced both uranium and vanadium. In situ leaching was in its infancy then, but had been tried in the area. The first successful in situ leach mine was started much later by Cameco at Crow Butte, NE. It may have been their lowest cost mine.

I am invested in EU, but they are concentrating getting into production on their Texas properties. I have also invested in a company that is currently producing uranium in Wyoming (do your own research). I don’t work for them but have advised that they look at other opportunities in WY, NE and SD.

My investing philosophy for uranium and other elements has been to buy a large producer such as CCJ and other low cost small producers. I do buy speculative positions, but in that area it’s even more critical to know the territory.

PS: My best performing stock this year is a coal producer.

I think the plan to focus on big producers and low-cost producers makes a lot of sense, but there’s always the temptation of those “lottery ticket” explorers. Can’t tell you how many newsletter teaser ads I’ve seen bragging about Rick Rule and Doug Casey buying into paladin for a penny before the mid-2000s spike, that kind of investing pornography really gets people riled up.

From a supplier reliability perspective, Australian uranium stocks are a much safer bet than Kazakhstan.

I agree… not quite as big yet, though.

I don’t expect to see either crude oil or uranium fetch $200 in my lifetime, unless I manage to make it to 120 years old or so. But if any of my children had to bet on which would come first, I’d tell them to choose oil. The reason? Crude consumption is once-through (too much of it becoming CO2). Spent uranium fuel can be stored and recycled to the enrichment process, a practice which heretofore has helped keep a lid on prices.

How does LEU centrus fit into this conversation? If you have talked about LEU would you please link me to it?