Everyone has an AI-related teaser circulating this year, and we can’t get to them all… but we’re trying!

And today we’ve got a new one — the folks at TradeSmith are selling a service called LikeFolio Investor, which is run by the LikeFolio founders (Landon and Andy Swan) under a separate business they call Derby City Insights. This looks like a way to turn their longstanding LikeFolio service, which is a social media tracker used by investors and brands, into an entry-level investment newsletter that picks stocks whose brands or products are getting a “surge” in social media attention.

(By “entry level,” I mean it’s selling for $49 right now, renews at $79, which means it’s the “top end” of the marketing funnel, designed to bring people in who can be upgraded to pricier services in the future — TradeSmith is yet another MarketWise imprint, and the MarketWise companies all use the same marketing and upsell system pioneered by Agora and Stansberry… they even use the same actors as their “infommercial” hosts).

I have no idea how effective LikeFolio might be as an investing tool, it essentially tracks social media mentions of brands and products and similar trends and tries to identify when consumers are getting revved up about something, which is obviously valuable information for those who produce and market products and services… but can also be valuable for investors if they can catch a “viral” sensation or a big shift in consumer behavior. The examples they give in the pitch are mostly either viral brands, like Crocs, or products that had big shifts in behavior during COVID (remember Peloton?), and the timeline between the surge in social media mention “bubbles” and the surge in the stock price doesn’t seem particularly consistent, which makes me suspect that the universe in which this kind of data is valuable to individual investors is pretty limited… but maybe that’s just my inner skepticism.

With all the massive data mining efforts underway by all the quant investors and hedge funds, I would hesitate to assume that this particular service is going to be better at pinpointing stock price moves than the next guy… but who knows. We’ve seen dozens of different services that try to push investing strategies that are based on data mining of social media posts over the years, and I’ve never really tried one out — but most of them didn’t last very long. I’ve never looked at LikeFolio at all before.

But what I can do is ID the “AI Moonshot” idea they’re dangling as bait to lure investors… here’s some of that hinting in the ad, which starts with the FOMO admonition, “Missed NVIDIA? Don’t Miss This ‘Great $2 AI Moonshot'”:

“Two Math Geniuses ‘Crack the Code’ on a Secret Algorithm Showing Which Stocks Could Soon Take Off by 100% to 500% or More – IN ADVANCE!

“Now they say a small, sub-$5 stock is ready for takeoff. Find out about it BEFORE everyone else….

“You could earn tens of thousands of dollars if you choose to invest…

“Perhaps even millions, if you get the timing right and everything plays out as the Swan brothers expect.”

So what is it that they call, “The No. 1 AI Small-Cap Stock Opportunity of the Decade?” Let’s check the other clues…

“What if you could combine a live-streaming TV platform with the best in sports, news, and entertainment? That’s what we’re talking about here.

“You might think of Netflix. But you’d be wrong.

“That’s like comparing a minnow with a blue whale…

“Whereas Netflix has close to a $150 billion market cap, and shares going for over $300 each…

“Our AI moonshot’s market cap is 99% smaller.

“That’s a mouth-watering prospect when more consumers than ever are bypassing traditional media platforms for online content.

“And guess what…

“Our Social Heat Score is picking up unusual online activity for this tiny Moonshot…

“Online mentions of streaming live sports have jumped 33% from last year — which is excellent news for this tiny firm…”

And apparently there’s something company-specific going on, not just “streaming live sports” in general…

“Purchase Intent (PI) mentions are currently pacing 59% higher year-over-year as the company expands its coverage and programming….

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“these secretive online surges are often the PRECURSORS to a major price rise.”

Along with, of course, that “AI” connection…

“… we discovered that the company is tapping into artificial intelligence (AI) thanks to a blockbuster acquisition.

“It gives them access to computer vision technology that can track and identify specific athletes.

“As far as I know, not even NBC, Netflix or ESPN can do that.”

To be fair, this is probably an “all or nothing” idea, that’s what a “moonshot” generally means… and they are honest about that…

“We see this as an all-or-nothing wager. If this tiny company continues to hook into powerful consumer trends, as it’s now doing, and engineer a successful business-model transition, it could deliver a moonshot payoff.”

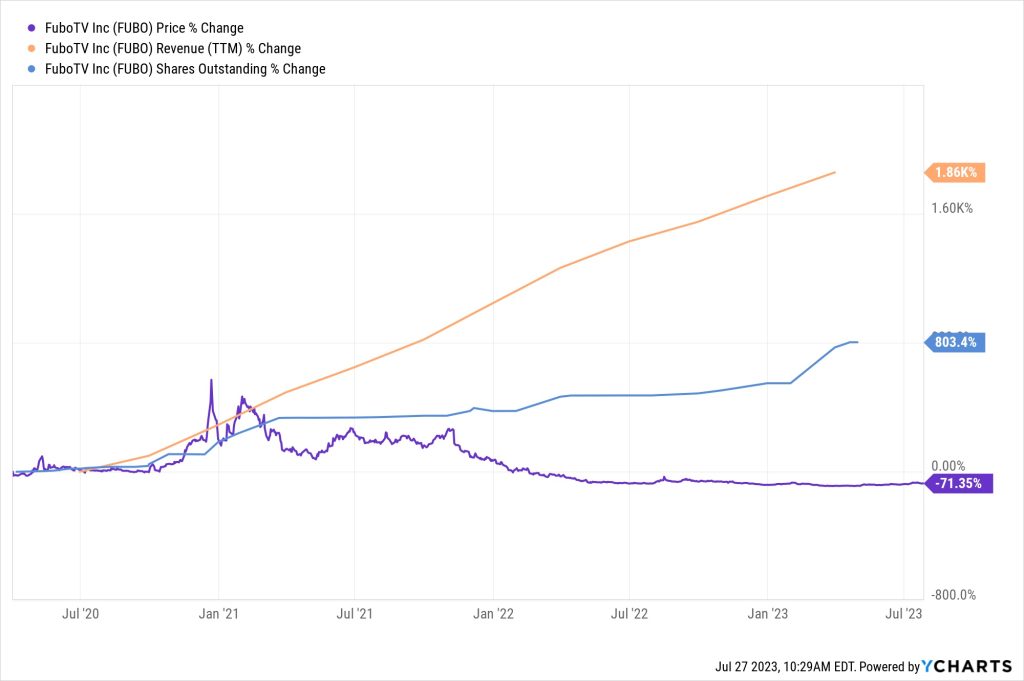

So what are we dealing with here? This is the tiny sports-focused live TV streaming company Fubo (FUBO), formerly known as FuboTV, which went public through a merger in April of 2020 and enjoyed a wild surge in the manic markets of 2020-2021, partly driven by the hopes that they would be able to tap into the huge excitement for legalized sports betting by integrating betting with their streaming video content… but the stock has, like so many others, fallen on hard times. Here’s what their chart looks like since they came public through that merger (with a company that was previously called FaceBank) — they have grown their revenue pretty dramatically, but that hasn’t been enough to give the stock any sustained life, partly because they’ve also had to raise tons of money, increasing their share count by 800%:

It’s been a tough run, for sure — FUBO was even the runner-up in our Turkey of the Year contest last Thanksgiving. But that’s the past… what might happen in the future?

I find the Fubo story quite fascinating, and I have often wanted to like it, but I haven’t come up with any rationale for the company that makes sense — it just doesn’t seem like they have the ability (or the financing) to scale up anywhere near fast enough to compete with the similar streaming options from much larger companies (including YouTubeTV). Here’s an excerpt from what I wrote about the stock two years ago, a few weeks before it was teased by one of the Oxford Club newsletters:

8/27/2021: FuboTV is a streaming service that focuses on sports and live events, relieving some of the cord-cutting anxiety that many sports-loving cable customers might otherwise feel at giving up their live access to the offerings from Comcast, Charter and the other traditional video distributors. In effect, really, they offer essentially the same thing that SlingTV or YouTubeTV or Hulu+Live do, a pretty full slate of broadcast networks that covers most of the live sports available on television, and most of the live offerings of the popular basic cable networks, and at a pretty similar cost, so a lot of the sports focus is just marketing — but, of course, marketing is a big deal.

These kinds of services are really “cord cutting” in name only, in many cases you’re still paying close to as much for live TV as you did to Comcast or Charter, you just get an (arguably) higher quality experience, depending on the customer interface and add-on services you might prefer (and, of course, on the quality of your internet connection)… but you don’t have to have the big clunky box, the cable interface, or a long-term contract, you can swap in and out of all these services from month to month, maybe sign up for FuboTV or YouTubeTV during the parts of the year when you want to watch live sports, and otherwise cycle through HBOMax or Netflix or Hulu depending on which shows you want to watch at that time, and that is certainly attractive to a lot of people, even if the typical savings might be minimal in any given month….

Last quarter, FuboTV had 685,000 paid subscribers, with the company guiding that they will top 910,000 by the end of the year. With an enterprise value of $3.8 billion, they’d better grow at least like that — they’re being valued at something like $4,000 per subscriber, and each subscriber currently contributes nothing to the bottom line (just like Comcast, FuboTV has to pay the cable channels they carry a big chunk of those monthly subscription fees — one way Fubo is growing is by subsidizing that cost a little, so even their gross margin is negative (meaning they pay more for the content and distribution then they can charge their customers). It is possible to grow into this business, but it’s not easy for a small player because they don’t have much power over the content creators, and until you can get your gross margin to be consistently positive there’s no real opportunity for “economies of scale” to kick in and give you some visibility on possible profits someday in the future.

There’s some good potential to grow this business as a sports-focused streaming services, but given the cost of sports content and the highly competitive environment, it won’t be cheap and it’s hard to justify the investment they’re making unless you have some great confidence that they’ll end up being a market leader (and they’re competing both with the big cable systems and with Alphabet’s YouTubeTV and Disney’s Hulu+Live among many others, so that confidence might be hard to come by unless you’re a FuboTV customer and are convinced that their product is a dramatic improvement). If you want to buy FUBO here, I think you either have to really embrace the vision of them becoming a major provider in five years and building enough scale to become sustainable, with the increasing size of the business either giving them some pricing power or making their platform more attractive to advertisers… or you have to believe that their so-far-very-early plans to become a player in the sports betting business will bear fruit. That’s two different high-growth businesses they’re competing in, and both of those businesses are so competitive that they’re very low-margin right now, so it’s not going to be easy, but I’ll admit I’m impressed with their growth rate as they’ve come out of nowhere to maybe hit close to a million subscribers by the end of this year, but if they can really define their sports niche in cord cutting and establish a brand, maybe it will work out….

You have to have something in the numbers that helps you to see where profitability could emerge, and i don’t see that with FUBO yet. Perhaps it’s a failure of imagination on my part, if you want to make the case for FUBO I’d love to hear it.

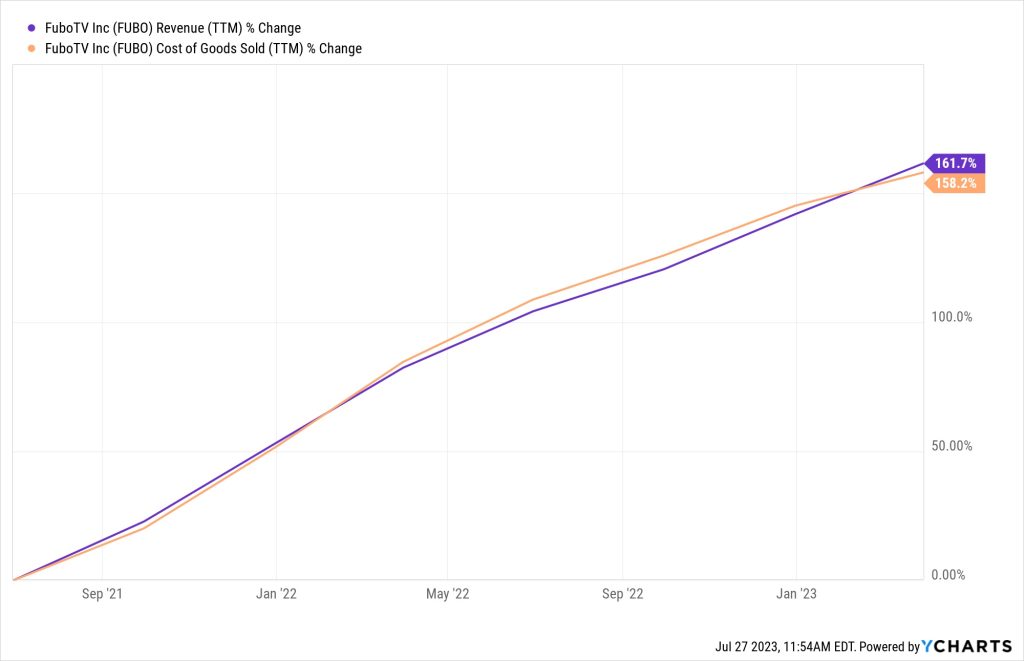

So… what’s been happening since then? They’ve been selling shares pretty much every quarter to keep reinvesting in the business, so that’s been tough on shareholders, but they have actually finally gotten to the point where they can sell their product for a hair less than it costs them. That’s the one bit of clearly happy shiny news I see in their financials: Their gross margin (which is revenue minus their cost of goods — mostly the fees they have to pay for video content) has now been positive for two quarters in a row, right at 1%. Scaling up a business in this sector is really hard when the cost of content is extremely close to what you can charge subscribers — there’s just not a lot of margin room in there for companies who don’t have unique content assets or some other cost advantage (that 1% positive gross margin means that last quarter they had revenue of $324 million and their cost of goods was $321 million… so that $3 million is all that’s left over to cover $57 million in SG&A expenses, $18 million in R&D, etc.). They can control some of their costs, but I can’t imagine that they’re a big enough player to really have any influence over their cost of goods (mostly content costs). Here’s what that looks like on a chart over the past couple years, that little blip at the end, when trailing revenue (purple) crosses over and grows a hair faster than the trailing cost of goods (orange), is what hope is made of:

They’re still losing tons of money, of course, they have other costs aside from their cost of goods, so they’re still spending $125 for each $100 in subscriptions they sell… but that’s much better than the $172 they were spending a couple years ago. On that front, they’re moving in the right direction. The challenge is that they really need to grow that 1% gross margin into something meaningful if that “gross profit” is ever going to be enough to absorb their corporate costs (sales, marketing, overhead, etc.)… and they don’t get any better deal on the content costs than giants like YouTubeTV, I would imagine, so they really need to be able to differentiate themselves in a meaningful way to convince sports fans and others to pay slightly more for their live TV than YouTubeTV charges. I haven’t used Fubo, so I don’t know if they’re getting to that point or not — but most of the live streaming services look very, very similar to me.

Live sports is the saving grace of cable TV and of the “cable replacement” streaming bundles, and live sports are therefore still a major driving force for advertising money, advertisers really want large, live audiences, but sports are also expensive. With YouTubeTV getting the rights to the NFL Sunday Ticket this year, and Amazon Prime adding NFL games, in addition to all the other premium streaming sports deals (like NBC’s Peacock holding most of the Premier League rights in the US), I don’t see many ways for Fubo to differentiate itself on content without losing even more money… and they no longer even really talk about the sports betting business that many folks hoped would be their core cash generator a couple years ago (that’s not completely fair, they have actually launched their sportsbook in a couple states, but it hasn’t had any impact on their income statements)… so maybe it will be personalized or AI experiences that make Fubo stand out?

They did buy an AI company a couple years ago, Edisn.ai, which does specialize on video recognition, so maybe those features will drive more subscriber growth. I don’t know if that’s a particularly momentous piece of software, or if it’s fair to call it an “AI blockbuster” deal, but that must be what they’re talking about in the tease (from the income statements, it looks like FUBO probably paid $21.5 million for Edisn.ai in December of 2021).

Operationally, they’re growing — they have 1.66 million streaming subscribers now and are guiding investors to expect 1.97 million at the end of this year. So they’re still small, but not microscopic (YouTubeTV is the most steadily growing “over the internet” cable replacement services, and they had 6.3 million subscribers last quarter), and Fubo has grown that subscriber count by better than 40% a year since 2021. They expect to have $1.28 billion in revenue from that subscriber base this year, which would be about 25% revenue growth from last year’s $1b… and given the trajectory of their earnings to this point, assuming no unusually dramatic improvement in margins, that probably means they’ll lose something like $400 million in 2023, but probably only about $250 million of that will be actual “cash burned.” So that means they should easily have enough cash (about $340 million as of March) to at least get through this year.

They also carry some debt, most of which matures in 2026, but it’s pretty cheap (3.25% coupon) and convertible, so they may not have to repay the principal in cash, which would mean the bondholders are screwed because the stock would have to go up about 2,000% for them to make money (I haven’t looked at the terms, but the press release says it’s “at FuboTV’s election” to convert or pay in cash). So there doesn’t look to be an immediate cash crunch, but this is not a company that is very close to becoming a sustainable cash-generating business, and competition in their space is fierce and does not seem to be getting easier, so they will almost certainly keep selling shares. That’s just my opinion, though, and the company says no, they won’t need to sell more shares — this is their quote from the last quarterly update:

“We are confident that our current cash balance is sufficient to achieve positive cash flow in 2025 based on our current operating plan. Accordingly, we have no further plans to utilize the at-the-market (ATM) program based on our current outlook.”

The big content news at FuboTV of late has been their partnership with Ryan Reynolds and his Maximum Effort channel, and he’s a social marketing genius so that might be enough to have gotten FuboTV’s social media mentions soaring, so perhaps that’s what’s sparking the green lights at LikeFolio… and they’re also spending on partnership deals with sports teams to try to get their name out there with sports fans, including some local exclusive deals for specific teams, so they may be able to build on their pockets of strength.

I’d still say it’s a stretch to call Fubo an “AI” company in any meaningful way, though they are certainly using machine learning for some of their offerings, including personalized video feeds. It’s really still a “cable replacement” streaming product that is mostly being marketed to sports fans, and has some unique interfaces and maybe even some unique content, at least at the margins. Will that be enough to get them to profitability in a couple years?

They think so, and the LikeFolio folks apparently think they’re due for a surge as social media mentions of Fubo are climbing, but I’ll reserve judgement, personally. Video carriage is a tough business, with huge competitors who have no qualms about losing billions of dollars to take market share, and I don’t have enough insight into Fubo to guess at whether they can take enough share from those competitors to build something meaningful.

But sure, there’s a chance. And they look a lot better than they did a couple years ago — being able to charge more for subscriptions than the content costs them, even if it’s only a 1% margin, is a big deal, and a “grown up” moment that they reached just in the last six months or so. It’s nowhere near good enough yet, but that’s the number that makes it rational to pay attention.

It’s your money on the line, though, so you get to make the call — see a future where Fubo can be the next social media viral sensation like Crocs, or grow subscriptions dramatically and become the next Netflix? Let us know with a comment below.

Disclosure: Of the companies mentioned above, I own shares of NVIDIA, Alphabet and Amazon. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

Quick take???

Sorry, coding hiccup — fixed now.

It’s been out a while and almost doubled… as always it could it could go higher.

I have heard that SOUN is the new darling of the AI investment strategists.

I bought some SOUN at $4.43 and am down 50% on my position….hoping it will rebound but not overly confident

I don’t know why, but for some reason I have a good feeling about SoundHound (for one thing, I like the name 🙂 – I just bought some a few days ago.

But trying to pick a penny stock winner in the AI race is definitely a difficult challenge.

Anyway, best wishes with it.

That’s been teased a few times, too — not so appealing to me, but everyone’s looking for something that could become an AI story.

We selected FUBO in 2021 because they were the only vendor carrying all the Olympics and the Olympic trials. They sort of operate like a normal channel provider, but frequently the news on some channels is replaced by some event that is “finishing” that day. FUBO is easy to use, but rather expensive. Never thought of it as an investment. Hoping that another vendor, with more programing reliability, will pick up the Olympics for less money if they somehow have a different set of financial basics.

I tried out Fubo, but, ultimately wasn’t satisfied with what it offered for the money. But, who knows? – If they made some significant additions to their channel lineup, without increasing the cost substantially, they might be a winner in the streaming race. In contrast to just 3 or 4 years ago, I DO see lots of evidence now that streaming services are steadily pushing cable TV into oblivion. But the list of providers is a long one (I think the list of pre-loaded streaming apps on the Sony TV I just bought is about three dozen), and it’s difficult for other streamers to compete with Amazon Prime Video and YouTubeTV.

Travis: Thank you for the financial analysis on FUBO. Watched the stock for a while, no bids. Currently, I have zero interest in streaming media investments of any kind.

Two phrases come to front of mind about video streaming: Joseph Schumpeter’s idea of Creative Destruction in Free Market Capitalism and the military analogy of trench warfare or war of attrition. Almost all the players are losers. The casualty rate will be high. Not willing to bet on who will survive. Especially not a small vulnerable player with zero moat.

Frankly I find modern video media has little real meaning or much entertainment value with rare exceptions. It is painful to watch cultural rot offered as art by Hollywood studios or the partisan corruption of news coverage by MSM.

Angel Studio’s production of Sound of Freedom is a powerful movie about international child sex trafficking that Hollywood turned down and suppressed for 5 yrs. It fills a need for real stories and heroic content that transcends the Endless sequels of Comic book heroes. It has done extremely well at the box office.

I’d rather listen to an intelligent blog interview or read a great book than be subjected to the latest ESG/DIE propaganda narrative portrayed on the big and little screens.

Shoot your television!

(Mine doesn’t bother me anymore)…

Good analysis, Gerard – yes, definitely likely to be a pile of casualties in the streaming business. From where I sit, YouTube TV and Amazon Prime Video look like the strongest players at the moment.

And I agree with your observation about the dearth of good movies or TV shows to watch. An indication of how ridiculously far Hollywood has gone down the path of political correctness is that one of the factors that can lead to your movie getting an “R” rating is if it contains…SMOKING (horrified gasp) – and I wouldn’t be surprised to see added to the warnings characters being shown “eating meat”. 🙂

Getard, your last paragraph caused me to actually understand why I watch very little television over the last few years, only an occasional documentary and more often Jeopardy. that’s about it.

Not sure if we’re talking about the same $49 special but after listening to “The 2023 AI Race”webinar with Marc Chaikin and Doc Eifrig and learning about TradeSmith’s forward looking projection software AN-e (and their other offerings) I received a $49 offer which caught my interest. Bottom line on this thought… this offer buys only ONE search per week or Month? They also toss in two “tips” each month. Either way, not much time to test it. The full program costs $1700/year.

FUBO is in a pretty bad spot. Last I listened to management; they don’t have a content strategy – they say it’s just “opportunistic” based on what they can afford. You can tell from some of the comments below that there might be an opportunity as a niche live sports provider – either because they are less popular or like the Olympics are hard to watch/navigate. The content game increasingly requires capital. As you can tell by every company launching an “AI” capability, it’s not hard or expensive to add this kind of technology to the recommendation engine or access it directly or via API from another AI service. I’d like to see it run, it could become a profitable short.

STEM new uses for AI energy savings

I bought FUBO in 2020 and 2021 and sold it both times for a loss. Is there anything anyone can say to make me look foolish a third time? Buy BBAI, RGTI, IONQ, SYM, FLNC and STEM and in five years you’ll have a hefty return.

Blessings

PS: Big AI predictions on OPRA, PERI and EXTR. Highly recommended by Louis Navellier & Luke Lango.

Luke Lango has pushing FUBO big time for years. I’ve lost money on that stock twice and I am done with entertainment stocks.

I have come to the conclusion that it would be easier for a camel to pass through the eye of a needle then for me to make any money with FUBO!

Luke Lango was pushing FUBO in 2020 when it was in the $30+ range. I’ve lost too much on this company to ever trust it again…no matter how “cheap” it gets. I also lost a little chunk on SOUN which hasn’t lived up to its hype either. Too many people buying anything with “AI” in its name. Blessings.