Yesterday we dug into Luke Lango’s pitch about a synthetic biology stock that he’s calling “the next Microsoft,” but I also promised to cover Lango’s second pitch in that ad… so that’s today’s fuel for the Thinkolator.

The urgency of both of these pitches is about the same — the idea is that Lango thinks we’re at a critical point in the growth of DNA analysis and tinkering as those become huge growth industries… or as he puts it, “DNA Sequencing Will Only Hit the Sudden Phase Once… Don’t Be Left Behind.”

And this specific pitch, about “the Next DNA Sequencing Giant,” is summed up like this:

“I’m convinced this company’s patented technology will revolutionize the industry – and put you in front of my #1 pure play for the $80 trillion megatrend happening right now.”

Presumably “next” would mean, “next up after Illumina (ILMN),” which is the pure-play giant in DNA sequencing machines, though there are several other meaningful players in that market too, including the much more diversified Thermo Fisher Scientific (TMO), and plenty of competitors have come and gone over the past decade or so.

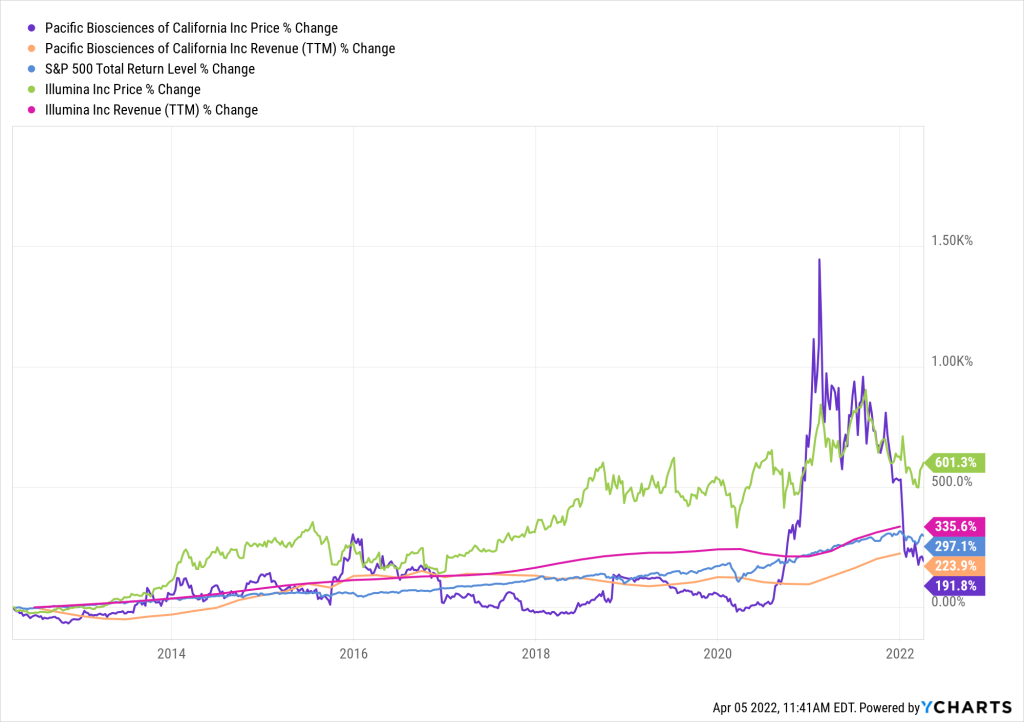

Probably the highest profile “next generation” DNA sequencing company in the past decade or so has been Pacific Biosciences (PACB), which has been teased by many newsletters over the years. PACB planned a merger with Illumina that fell apart a couple years ago, and it’s probably not the stock being teased, but their performance vs. the industry leader has been a bit of a cautionary tale, so I’ll throw that chart up for you just to help counter Lango’s hype a little. Best to go in with a little balance in our minds – that’s PACB in purple, up about 193% in a decade while their revenues grew 224% (orange), and ILMN in green, up 602% on revenue growth of 335% (pink) — that blue line of 297% growth is the total return from the S&P 500 for that same decade. Sometimes the big guys keep winning.

So yes, this pitch is for a “next generation” sequencing machine, and the company who makes it — he includes several images in the pitch as well, including a little DNA sequencer that looks smaller than a cell phone, and starts to drop some hints about it…

“First, I want to tell you about another game-changing opportunity flying under most people’s radars right now…

“You remember this DNA sequencer I showed you earlier?

“There is a good reason why I chose THIS one for today’s presentation.

“Because this piece of tech is on the bleeding edge of the newest sequencing breakthrough.

“It’s called a ‘Third Generation Sequencer.’

“You see, since scientists completed the first human genome in 2003, DNA sequencing technology has continued to evolve.

“The first-generation sequencers were incredibly expensive and were nearly the size of a fax machine…”

So getting down to pocket size seems like a pretty big deal. What else does Lango tell us about this stock?

“This company has patented its technology so NONE of their competitors can steal it!

“This method allows them to read longer sequences of DNA at incredible speed.

“In fact, it can cut sequencing time from a full day to just a few hours, or even minutes.

“Plus, this sequencer is the first one that can be used outside of a laboratory.

“It has already been used to sequence DNA on the International Space Station.

“Simply put, THIS is the sequencer of the future.”

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...

So… hoodat?

Well, the Space Station reference and the image of the small third-generation sequencer conform that he’s teasing a company I’ve written a little bit about in the past, this is Oxford Nanopore (ONT.L in London, ONTTF OTC in the US).

And what’s new? Well, from my perspective it’s new that Oxford Nanopore went public — I hadn’t actually noticed that — they had their IPO in London right as the tech market was surging higher last Fall, which was a little surprising, and it flew under my radar (it wasn’t the timing that surprised, but the location — biotechs are a rarity in London, most such companies try to go public in New York, where there’s a much larger community of investors primed to pay attention to the sector). They raised about £350 million in the IPO, and hit a valuation of almost £5 billion in trading that first day, so it was a bit of a hit — they peaked about 20% higher than that at the turn of the year, but, not surprisingly, the downdraft that has hit all richly-valued tech and biotech names was also felt by Oxford Nanopore, so they’re down to about £3 billion today. In US$ terms, they started trading at about $8.50 a share last September, briefly hit $10, and are now down to about $5.

The US shares trade closely in line with the London-listed shares, but, as is always the case with UK-listed stocks that trade OTC in the US, you’re likely to get the best price if you buy when London and New York are both open at the same time and set your limit price (never use “market” orders with OTC stocks) right around the current trading price on the London Stock Exchange (remember to convert the currency… and move the decimal point, London shares trade in pence, not Pounds).

What stands out for Oxford Nanopore? Mostly, it’s what looks like a big leap forward in the processing speed of their tests and the physical limitations of the sequencers — the standard sequencers that are used by most researchers and practitioners in “field” settings are benchtop machines — like the size of a microwave oven or coffeemaker, but Oxford uses a different technology that has allowed them to press forward with much smaller devices, often linking up to a laptop computer to do the thinking — they also have some benchtop-size machines for higher-throughput or more efficiency, but this image from their website shows the size range…

And yes, Oxford Nanopore has developed a third generation technology that’s quite different from Illumina’s second-generation sequencing tools — if you want to dig into the differences, I found this article from the Journal of Molecular Diagnostics from this week surprisingly understandable and helpful (“Comparison of Illumina and Oxford Nanopore Sequencing Technologies for Pathogen Detection from Clinical Matrices Using Molecular Inversion Probes“, https://doi.org/10.1016/j.jmoldx.2021.12.005). That’s not a full comparison that would be applicable to all purposes, but here’s an excerpt that helped clarify things for me a little bit:

“Next-generation sequencing (NGS), as a technique for clinical diagnostics and biosurveillance efforts, continues to progress toward functional realization.1,2 Currently, second-generation sequencing technologies, such as the Illumina platform, benefit from locked down reagents, protocols, and systems coupled with decades of research evaluating clinical metrics. US Food and Drug Administration approval of the MiSeqDx (Illumina, San Diego, CA) for clinical in vitro testing provided a regulatory precursor for diagnostic panels targeting genetic aberrations.3 Part of the rationale for US Food and Drug Administration approval of the MiSeqDx was low error rates,4 thus ensuring confidence for making diagnostic decisions. Unlike approved genetic screening that requires high-confidence calls for genetic variants, infectious disease diagnosis is often a binary determination of the presence or absence of foreign genetic material in a clinical sample. Consequently, these factors are the reason molecular techniques such as real-time PCR remain firmly ahead of sequencing in the infectious disease diagnostic space. Third-generation sequencing platforms, such as those from Oxford Nanopore Technologies (ONT; Oxford, United Kingdom), offer a potential bridge between current real-time PCR applications and the depth of information sequencing can provide. In this context, ONT represents a paradigm shift measuring changes in ionic current across a membrane as single-stranded DNA passes through a nanopore to determine nucleotide composition.5 The technology is small and portable, especially compared with the complex optics required for second-generation sequencers, and shows functionality in austere or resource-limited environments.6, 7, 8 ONT sequencing can also detect base pair modifications during regular sequencing runs as well as sequence RNA directly, thus offering additional information beyond the capabilities of real-time PCR, which may provide further diagnostic insights.”

And sliding over to the investment side, with something a bit less technical, a cautionary article from Evaluate Vantage that came out around the time of the IPO is also worth a read (“The Heat is on for Oxford Nanopore”) — highlighting the very high valuation at which Oxford Nanopore started trading, and the challenges it still faces with its new products in a competitive market, where Illumina and Pacific Biosciences and others are, of course, also not sitting still. That article’s cautions are that Oxford Nanopore’s product is still a little less accurate than the current standard (Illumina et al), still a bit more expensive, and, in many fields, that one of the primary advantages of Oxford Nanopore’s tech, that it offers much longer reads of DNA sequences, is overkill.

How do the finances look today? Well, Oxford Nanopore has reported early financial results that are meaningfully stronger than was being estimated at the time of the IPO six months ago — beating those initial expectations by something in the range of 20-30% so far, and with future expectations now also bumped up by about that amount. As with all the DNA sequencing and diagnostic equipment stocks, they “enjoyed” a boom from COVID-19 testing and research work, and that probably means the next couple years will be slower than 2020 and early 2021 when it comes to sales growth, but they reported revenue of £133 million in 2021, growth of 17% from 2020, and today analysts are forecasting £156 million in 2022 (17% growth), and £206 million in 2023 (32% growth). And like many of the companies in this space, they ramped up their spending to meet that surge in demand in 2020 and 2021, so their losses also ballooned, and it’s quite possible that their spending will slow down a little. They’re not at risk of being profitable anytime soon, but at current “cash burn” rates they do have plenty of cash, thanks to the IPO, so they should be in good shape on that front for at least a year or two. Analysts have generally penciled in 2025 or 2026 as a likely “break even” point for Oxford Nanopore, but that’s pretty much wild guessing at this point.

The good news? They really got the core growth rolling last year — if you ignore the big bolus of COVID spending, which was mostly in 2020, their research tools business grew 94% in 2021, and the consumables, which is the part of the business that has the potential to drive profitability at some point, grew by 116%, so that core business had both much stronger growth and much stronger gross margins than the income statement indicated for 2021 (the core business model is essentially the “razor and blade,” the profit is really in the consumable blades, not the razor itself — that’s not revolutionary, most diagnostics and testing equipment companies have a similar strategy, but it’s good to see it working here, at least in the early stages). You can get a taste of the optimism they’re feeling from the Investor Presentation of their 2021 results, posted about two weeks ago.

The way I see it, they’ve been through a wild surge in business from COVID, and there’s a wide range of possible outcomes as they return to something more “normal” in the next couple years… at the same time that their core business is changing rapidly, with substantial but uneven growth of the whole DNA sequencing industry as a tailwind, and as their new products are being introduced to try to further push the envelope. To me, that reads “buckle up” — it will probably be a very bumpy ride. They are, however, much cheaper than they were on IPO day — with a current market cap of just about £3 billion (at $5 a share), Oxford Nanopore is currently valued at roughly 20X expected 2022 revenues. That’s not a comfortable number, but it’s well within the range that next-gen biotech equipment stocks have traded at during the past few years, at least, and it’s better than the ~50X sales multile the stock briefly carried last Fall.

Illumina, by comparison, is roughly 10X the size of Oxford Nanopore, and is expected to have revenue growth of about 18% in 2022 and 2023, and is currently valued at about 12X forward revenues… though they are also profitable (earnings are likely to drop this year before growth resumes, and they’re not cheap on an earnings basis at about 70X earnings, but profitability certainly gives you some stability that the purely growth-focused money-burners like Oxford Nanopore can’t match). Pacific Biosciences is now only about half the size of Oxford Nanopore, and is similarly unprofitable, growing at a similar pace, and valued at about 13X forward revenues. When Illumina was the size that Oxford Nanopore is today, and was growing at a similar 20%ish rate, they were valued at only about 6X sales… but, to be fair, that was a decade ago, and the market was very different in 2012.

There are several other companies in this space — a lot of the “next gen” competitors are private and some, like Singular Genomics (OMIC) are public but much smaller than Oxford Nanopore (OMIC is just beginning to have revenue for the first time), and I do not understand enough to have any confidence about one emerging next-gen technology being meaningfully better than the others… but I have been watching Oxford Nanopore as a high-profile and meaningfully different competitor for Illumina for six or seven years, and I am impressed with their focus on utility and doing “on location” scans (and yes, it was their sequencer that was tested on the International Space Station — though, to be fair, that was way back in 2016).

And who knows, perhaps this technology will also become interesting as a tool for the next-gen “synthetic bio” companies, because those firms, like Twist and Ginkgo, are likely to demand faster and smaller tools if they’re going to reach their goals — particularly the goal of using DNA as a machine language for storing data (for that to work, we’d have to be able to read and write it a LOT faster than is even imaginable today).

So no, I don’t know who’s going to win — but this industry is almost certainly going to continue to grow, and probably very quickly. That doesn’t even mean there will be a winner, it could certainly be that strong competition drives DNA sequencing to new heights but also chews up all the potential profits, but it’s a tempting area in which to place speculative bets… as long as you can tolerate the high risk of loss and wait out what will almost certainly be a slow evolution. After all, people were predicting that Oxford Nanopore was about to eat Illumina’s lunch several years ago, and PACB before that, and so far the leader is holding up just fine.

It does seem logical that there will be “winner take most” leaders who emerge in this space as it grows, not unlike most areas of technology, where scale and a real or perceived technological advantage can quickly create near-monopolies. Personally, the two that I find most appealing in this space are the established pure-play leader and the next-gen company that leader seems likely to be most afraid of — so that would be Illumina (ILMN) and Oxford Nanopore (ONT.L, ONTTF). I haven’t invested in either, but Illumina has been on my watch list for a long time and has almost dipped to my “buy” level a couple times, and I’ll keep an eye on Oxford Nanopore as well.

I’m sure many of you out there in the great Gumshoe readership will have looked at these and other players in the space, and I’m equally sure that some of you have a better grasp of the technology differences and market opportunity than I do — so if you’ve got a favorite sequencer stock, or see reasons to pick or pan one of the names I’ve mentioned above, please do share your thoughts with a comment below. Thanks for reading!

Disclosure: Of the companies mentioned above, I own call options on Ginkgo Bioworks. I do not own any other stock covered in this piece, and will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

Great find Travis! Speculating few shares on DNA and watching ONTTF.

Hmmmm….$397 a share on London EX. but only 5 dollars and change on the OTC….why the big disperity in price….

Pence in London, dollars in the US.

Sounds like a good buy, bought ILMN at $300. and sold at around the $500’s was higher but I waited to long. I bought because of your article on ILMN. Thank you Travis !

Genomics in the field of biology just may be the wave of the future. Having researched it and looked them all over, I chose to take a small stake in (PACB) Pacific Biosciences mainly because Kathy Woods of ARK investments is a very large holder. And she has had a pretty good track record. However, she also took a large stake in (QSI) Quantum-Si and it’s down over 50% from her entry. Then she doubled down on that, which is when I decided to get in. Still a good buy. Also took a small stake in (TXG) 10x Genomics, as Vanguard is it’s large investment holder. In any case, I expect these to be a long term investment with opportunities along the way, calling for some years of patience.

I considered microdosing on ONTTF. Unfortunately, my brokerage firm does not accept orders for this particular Pink Sheet item, to quote: “Opening transactions in Pink No Information, Grey Market and Expert Market securities are not permitted due to the inherent risk associated with these products.”

… and ONTTF requires a foreign investment fee/commission of $50. 🙁

Depends on the broker, but yes, I know Fidelity often charges that fee for trading in OTC tickers — it’s basically the commission for them hiring a market maker to buy shares for you in London.

For all such restrictions and fees, if you find it important to get access to international markets you can shop around, the fees and access vary quite a bit even among the big discount brokers. I like Interactive Brokers for overseas trading, personally.

Thanks Travis, I appreciate you sharing your experiences and stock wisdom. Switching gears a little, Jeff Brown has yet another event tonight to address the Biotech resurgence of being the next bull run. I did find the ticker to be a good spread… “XDNA”

Haven’t looked at that one before, though it is heavy into the four or five real “CRISPR” stocks and those are all still mired in long-running patent litigation to some degree (though Editas won another battle in the war just recently) — I can see how it would make sense to buy that ETF rather than try to pick out whether EDIT or CRSP or NTLA or whoever else has the best chance of being the biggest winner from CRISPR-driven drug development someday.

It’s an amazing field, and it’s easy to imagine the potential returns if there are some big winners, but it’s also a field that’s filled with lots of companies who are setting gigantic truckloads of money on fire right now.

I’m curious and perhaps suffering from some age related memory issues but has Doc Gumshoe weighed in on this sector? If no, I’d love to hear his take and if yes, is there a link? Thanks for all your work.

Luke Lango inherited Investment Opportunities, of which I was a paid subscriber since it was edited by MattMcCall (I suppose this name is correct) last year. Luke’s recommendations were so outlandish, I surrendered and closed the file.

Any opinions on BGI Genomics in this space?

How do we purchase this on the OTC as a US tax resident? What platforms. Keep getting a “risk is too high” message.

I love Luke but am surprised he recommended a scam stock that does not sell on OTC as the company has not given financials to US officials. Granted it is a foreign based stock but very fishy. Avoid buying for now. Gingko is a better bet.

Ginko (DNA) is the stock he was teasing.