Here’s the lead-in for the latest ad from Tim Melvin, which I started to see lots of questions about starting this week (looks like it started running on April 3):

“This $5 mattress stock has bounced triple digits after every major bear market since 1972.

“Guys, they’ve come back from 7 recessions with a vengeance.

“And the stock’s about to go nuts again as it bottoms near 14 year lows.

“(Plus they will pay you a 9% dividend kicker)”

Sounds impressive, right? People always love low share prices and high dividends. Let’s dig in and see what the real story is.

Melvin is using this pitch to sell his Momentum & Value Portfolio Letter, which he abbreviates as The M.V.P. Letter ($1,497/yr), from publisher Investing Daily. Strangely, I don’t see that letter listed on their website — so it might also be that they’re selling the same thing as his “2023 Turnaround Project” (which has the same price, and sounds like a similar strategy).

His other newsletters at Investing Daily are mostly about bank and real estate stocks, though he does often push the dividend yield story… we’ve covered some of those teases in the past, and I still think he’s being too optimistic about TFS Financial (TFSL), for example, given the current gulf between what they earn on their mortgage portfolio and what they have to pay out to keep depositors happy. (I mention that mostly because the ad for that one looked kind of similar, with a photo of a rundown depression era building at the top and a promise of a high dividend – the ad pitching TFSL as the “Perfect Dividend Stock ran for about six months, from late last Summer at least through January, my take on that and some follow-up comments are here.)

But back to today’s ad… the spiel is really mostly about “small cap value. As he describes it in the ad, “M.V.P. Letter is about buying the deepest value plays on the market to generate triple digit gains in 9-12 months.” Though he also does say that he has a 50/50 strategy that he thinks will work in all markets, putting half of his positions in small “value” stocks and the other half into small “momentum” growth stocks.

Will he succeed? No idea, I don’t think he has much track record with this particular letter yet, whether he’s changing its name or not, and we haven’t heard much from subscribers so far… but hope springs eternal.

And he has five reports to dangle as bait for new subscribers — this is the shorthand pitch for the one we’re covering today (I’ll try to get to the others tomorrow):

“The $5 Small-Cap Stock set to 5X. — My top small-cap to buy that’s paying a crazy 9% dividend with triple-digit upside.

“I’m about to show you a small company that’s hitting March 2009 lows TODAY.

“That’s despite 14 years after those ’09 lows, this mattress co. has gone global with manufacturing plants in America, Canada, China, Turkey and other countries…

… It pays a 9% dividend…

… Insiders are buying up thousands of shares this year…

… The company has zero debt…

… Has been around since 1972 lasting through 7 recessions…

… And it’s still growing with free cash flow reported.

“Yet, the stock trades for just $5… “

So what’s the stock? One more bit of clues for you…

“Right now, my #1 $5 small cap stock is trading around 2009 lows.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“Comparing 2009 to today…

“Their revenue is 45% higher

“Income is 10X higher

“8% less shares outstanding (making 1 share more valuable)

“Executives bought thousands of shares March 2023

“The last time it bounced from 2009 lows… the stock shot up 1,123%.”

Thinkolator sez that’s Culp (CULP), a North Carolina textile manufacturer. It’s tiny, with a market cap around $65 million at $5 per share (about the same value it carried back in 1987 — it peaked around $450 million back in 2017 or so). They have been around since 1972, though the company has evolved a bit over the years.

Those financial clues really point to mid-2022, however, not today — as of last July, they had revenue that was about 45% higher than during the 2009 recession, the share count had shrunk a bit (roughly 8%, depending on what point you start with in 2009), though to get to some “income is 10X higher” assessment you’d have to cherry pick their worst quarter from 2008 or 2009 and top-tick a period sometime a year or two ago… there were some good years in the interim, mostly six or seven years ago, but they haven’t actually had a profitable quarter since late 2021.

And they did have a dividend of about 48 cents per share, which would indeed by about a 9% yield… but they last paid that dividend in the first quarter of 2022, about a year ago, and the business has had a rough year (remember all the people that moved, bought new mattresses, and upgraded their furniture when they were stuck at home in 2020? Yeah, a lot of them were done with that by mid-2022… many furniture stores now have inventory gluts, not nine-month lead times).

Here’s Culp’s outlook from the January quarterly earnings press release (which came out about a month ago, in early March):

“The company continues to navigate a difficult demand environment as a result of elevated inventory levels at manufacturers and retailers, as well as shifting consumer spending trends and weakening consumer confidence. The company is also experiencing operating inefficiencies due to this reduced demand as well as an improving but still inexperienced labor force. Although CULP remains well-positioned over the long term with its product-driven strategy and flexible global platform, current conditions are likely to continue pressuring results through at least the end of fiscal 2023.

“Due to the continued volatility in the macro environment, the company is providing only limited sequential financial guidance for the fourth quarter of fiscal 2023. The company’s consolidated net sales for the fourth quarter are expected to be moderately higher as compared to the $52.5 million in net sales for the third quarter of fiscal 2023, driven largely by strong improvement in the mattress fabrics segment and comparable performance in the upholstery fabrics segment. The company expects a consolidated operating loss (loss from operations) for the fourth quarter of fiscal 2023 that is meaningfully lower than the $(7.8) million operating loss for the third quarter of fiscal 2023. The company also expects its cash position as of the end of the fourth quarter of fiscal 2023 to remain comparable to the $14.6 million at the end of fiscal 2022.”

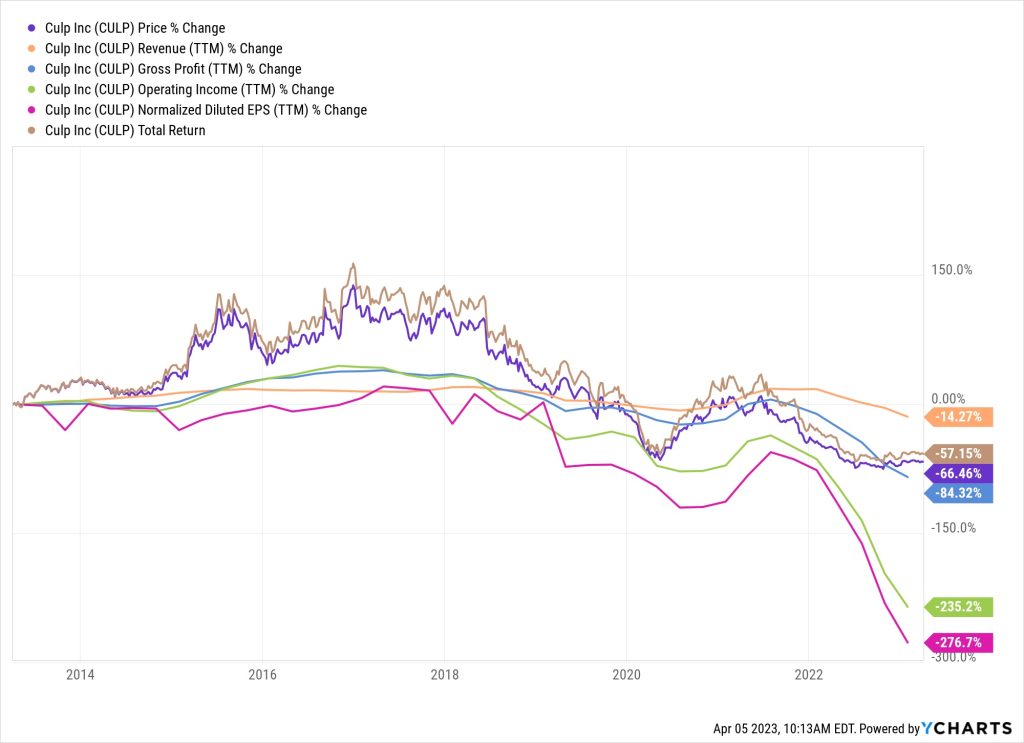

2022 was their worst year in a long time, after a boom in 2021, and it looks like 2023 will be even worse than that. This chart shows ten years of their revenue (orange), gross profit (revenue minus cost of goods, blue), operating income (gross profit minus overhead, generally speaking, in green), and earnings per share (pink), with the share price in purple (and total return, including dividends, in brown).

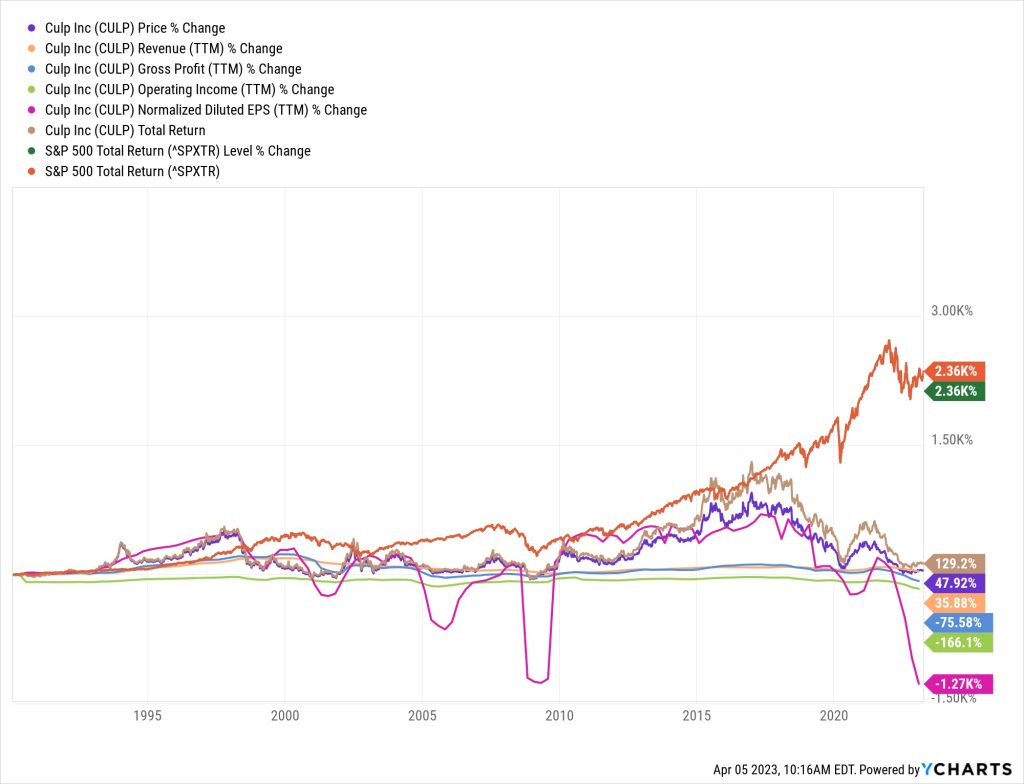

They’ve been around for a long time… but it’s also been a long time since the business was on the right trajectory. This is that same chart, adding in the S&P 500 for comparison and going back to the IPO in the late 1980s…

So to be extra clear, when it comes to the dividend that Melvin is so excited about and pitching in the headlines of his ad…

“To preserve liquidity and support future growth opportunities, the company’s Board of Directors suspended the company’s quarterly cash dividend on its common stock in June of 2022.

“The company did not repurchase any shares during the third quarter of fiscal 2023, leaving approximately $3.2 million available under the current share repurchase program as of January 29, 2023. Despite the current share repurchase authorization, the company does not expect to repurchase any shares during the fourth quarter of fiscal 2023.”

Which means this ad is really dirty pool, frankly — he even said, in the P.S. of his email that circulated on April 4 (yesterday), that “the company is cash flow positive and growing so that dividend is likely safe.” In my judgement, none of those three things is true today (not cash flow positive, not growing, dividend obviously not safe). Perhaps we can give him the benefit of the doubt and guess that maybe his publisher sent out a teaser pitch based on some old commentary he shared a year ago, perhaps, but that doesn’t smell great — you shouldn’t entice someone with a 9% dividend, and then pitch them a stock that suspended the dividend a year ago. Hopefully this is a marketing screwup, and if people actually pony up $1,497 and subscribe, he provides something more timely and truthful for his paid subscribers.

Culp is a very small company (market cap $65 million) that has paid a dividend for most of its history as a public company, and for many years either grew the dividend or paid out big special divdiends… but according to Ycharts, at least, the last time they suspended the dividend, in 2001, they didn’t resume paying it until 2012. Who knows how long the gap will be this time, all they’ve been saying is that they will “reassess the dividend each quarter,” but they also don’t expect to be back to sustainable profitability for a year or so (and may need some economic tailwinds to get there that fast). The saving grace for Melvin is that this ad at least offers a 60-day money-back guarantee, so he’s not locking you in with “no refunds” on this particular bait and switch.

To be clear, there may be reasons to buy this company during a down cycle, they have survived bad times before, and had some good times, and the founding Culp family is still exerting its influence… and yes, there are some signs of potential, particularly in the commentary from executives and the insider buying. Melvin was right in saying that insiders are buying shares, there has been a fair amount of insider buying over the past year, mostly by members of the Board of Directors, so that’s good to see, and that has continued even this week, with Directors Jonathan Kelly and Perry Davis buying recently in the $4.50-$5.50 range. I don’t know anything about those two or the other board members, and in general we’d slightly prefer to see officers buying, not just directors, but that’s still a positive, and Kelly in particular has been a steady buyer (there was only one officer purchase in the past few years, by my count).

And I do like long-lived companies with family leadership. The letter from Robert G. Culp IV that was released on their 50th anniversary last year is reassuring, and makes you want to like them.

This is the kind of business Warren Buffett might have bought 30 or 40 years ago, a family business with a long history but a (perhaps temporarily) bad market, an established operation that has evolved and been (mostly) profitable for a long time… in fact, it is kind of like one of the companies he did buy, a textile mill called Berkshire Hathaway, which itself was a terrible business because it was losing out to lower-cost operators in other places… maybe even specifically including Culp in North Carolina (though Buffett bought Berkshire in the mid-1960s, a few years before Culp was founded, and closed the mills in 1985… unlike the Berkshire Hathaway mills, Culp also outsources a lot of its textile work, to Haiti, Canada, Vietnam and China).

And yes, despite the fact that they DON’T currently pay a dividend, and haven’t for about a year (the last one was paid on April 19, 2022), we can confirm that there’s no mistake here, Melvin is definitely pushing CULP and has been including some more recent info in his ads (including the March 2023 insider buying) — he even lifted the photo of one of Culp’s headquarters locations from Google Maps to use in his pitch.

Not sure CULP would choose to use the photo of the loading dock and the dumpster, but it’s still their headquarters building in High Point, NC. Here’s the front of it, in case you want a different perspective:

Here are some of the other things Melvin says about Culp, when he goes through the criteria he uses for picking these small cap stocks:

“Find companies trading for less than what they’re worth. The #1 company I share is trading for the cash, inventory, and real estate they own. There’s zero value given to the cashflow it generates and has generated for over 50 years. That’s an opportunity.”

They have invested pretty heavily into property, plant and equipment over the years, though that seems to be a requirement for a manufacturing company (from what I can tell they essentially buy raw fabric and finish it, preparing it for mattress and furniture manufacturers). And they do own a lot of real estate, and have a few long-term leases but no long-term debt (though they did announce a new credit line in January, so that could change).

So that’s pretty good… though the current challenges in the industry have led them to build up a lot of inventory — before the pandemic they had $75 million in cash and $48 million in inventory, now it’s $17 million in cash and $47 million in inventory, so it looks like they’ve gradually been eating their retained earnings to keep the business afloat over the past year or so… the retained earnings line in the balance sheet has dropped from a high of about $115 million pre-COVID to about $49 million today. The company has was built on $43 million in capital that they raised over their first 20 years or so in the public markets, plus some debt that they’ve paid off, they’ve not ever had to raise more capital… but they also haven’t been able to turn that capital into any sustained earnings power.

To me, they seem like they’re kind of stuck — Culp is sustainable and they employ a lot of people and they’re not going out of business, partly because they’ve been smart about outsourcing and diversifying and have been a design leader and kept on top of trends in home goods fashions, but they also haven’t really been able to compound any value over time. Maybe I’m too pessimistic here because they’re in a down cycle, but it looks like a company that has to fight just to survive, and has admirably done so, but doesn’t have a lot of opportunity to grow. I could be wrong about that — they are introducing new products, and on the last conference call they said plenty of optimistic things about being able to improve margins, now that inflation has moderated for their raw materials and China has reopened and they’re able to push out new products at solid prices.

Melvin also says he wants to…

“Eliminate overleveraged companies: High interest rates break companies. The famous quote, ‘When the tide goes out, you’ll see who’s swimming naked’ applies to companies too. It applied to Silicon Valley Bank and undid them as high interest rates killed their portfolio. My #1 stock has zero debt on the books.”

That’s true, they are a “survivor” company and they don’t look like they’re in any financial trouble… though they have spent down their cash surplus, which is why they halted the dividend a year ago, and that shrinking cash might become worrisome if they can’t offload inventory fast enough for a few quarters. They won’t report again until the end of June, which will be their fiscal 2023 annual report, so we’ll probably learn a lot more then.

And he closes his list of criteria with this:

“Avoid companies with potential financial distress in the future: Only buy companies that are cash flowing like mad. If they have toxic assets on the books, fancy accounting tricks, companies robbing Peter to pay Paul to cover bills… these are poorly run companies no matter how well the stock does. My #1 small cap generates cash and does it in an industry that’s not going anywhere anytime soon (furniture)… with customers that are massive i.e. Ashley Furniture, Serta, and others.”

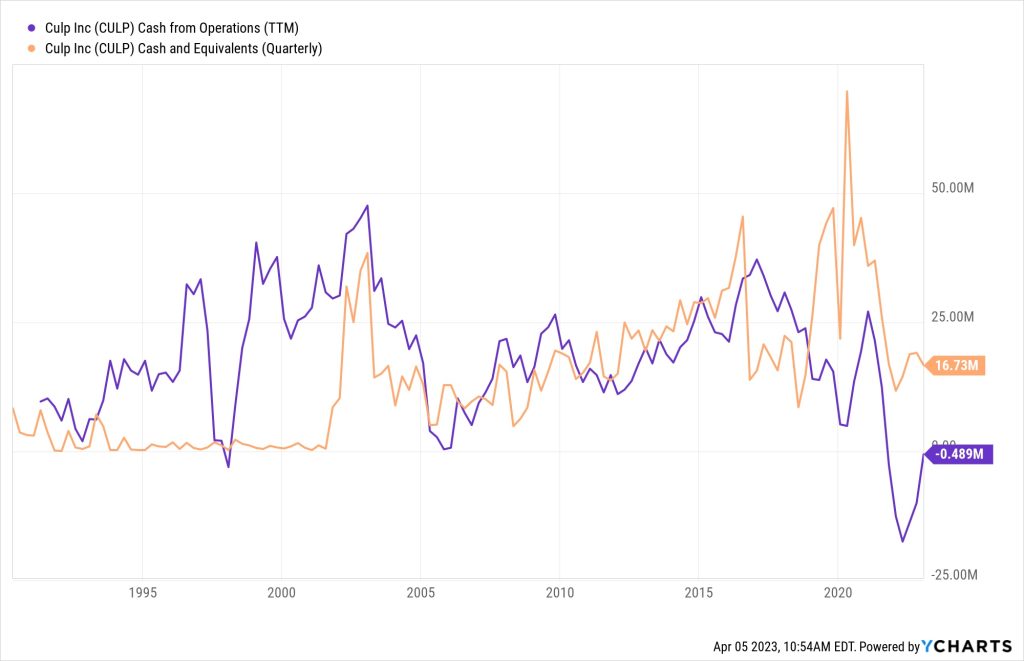

That’s a reasonable stance, Culp does not appear to be doing anything wacky with its accounting, and they did an admirable job of “protecting” their balance sheet during a terrible year… though I wouldn’t say they’re “cash flowing like mad.” They have mostly kept their cash flow from operations positive for a very long time, even through the recessions in 2008 and in the early 1990s (with a brief dip into negative territory in 1998 that was quickly repaired, presumably from some kind of one-time event)… but that actually stopped last year, 2022 was their first year of negative cash flow from operations since going public, though there is some indication that it’s bouncing back.

Let’s visualize that… this purple line is the ~30-year chart of cash from operations for CULP, the reason for hope is that little bounce-back to almost break-even in cash flow in the past few quarters, so 2023 may end up being positive when they report their next quarter (the orange line is the “cash and cash equivalents” on the books, so you can kind of see how it helps tell the story losing cash in operations quickly ate up all that surplus cash they built up in 2020):

It seems like I’m overloading you with charts here, but for a company that has been around for an extremely long time but never really built any value, probably mostly because of the pressure of competition that keeps their margins down and sometimes seems to require them to keep investing in the business just to tread water, I think the charts can tell an interesting story.

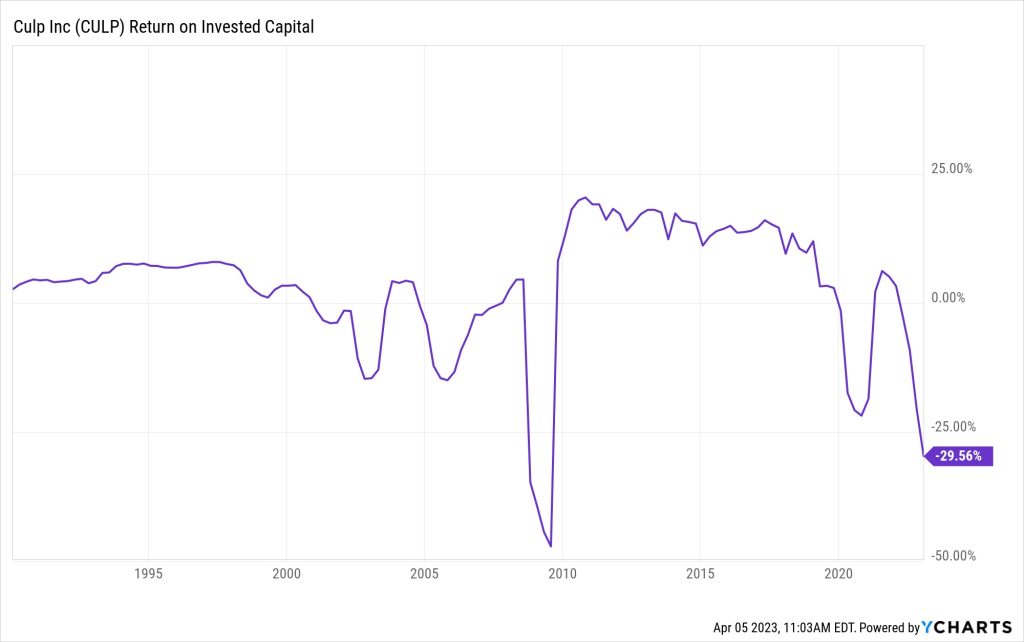

And let’s do one more. Here’s the chart that a lot of new-age value investors would focus on, this is their Return on Invested Capital through their history — that’s a measure of the efficiency of a business, which a lot of people think of as the quality of the business, it measures how much of a return the company makes from the investments it has made… and therefore, it measures how good the company is at making capital allocation decisions — sometimes it has been good, as during the low-interest years from 2010-2019, recently it has been not good:

That may well obscure things, they’ve also had some temporary issues (including COVID shutdowns, which extended for a particularly long time in their operations in China), but for me it mostly paints a picture of a company that is surviving a bad patch, but hasn’t really been able to become more efficient over time. Maybe that pays off in the long term, and they have been long-term survivors so that’s certainly not impossible, maybe they’re just setting the stage for their next great cycle of profitability… but I can’t say that I’m particularly interested. Love the survival, and I admire the company, but I don’t want to own it.

If you want a more optimistic take, I’d check out their last quarterly conference call (transcript here, presentation here)— it has been a tough patch, but they do see brighter things on the horizon coming out of the January reset from their industries (mattresses and furniture), with good takeup of their new products and recovery from some sectors, particularly in the hospitality business, though retail furniture and mattresses are not yet recovered from their inventory overload. Management believes that they will continue to steadily improve in the next few quarters, and may reach break-even or start to report a profit by the end of their 2024 fiscal year (which starts on May 1).

What about you, dear friends? Interested in CULP without a 9% dividend? See them coming out ahead in the next cycle, as the inventory is worked through and the furniture and mattress businesses normalize? Think it’s worth sticking with this family-run business and buying shares, as Directors have been doing? Let us know with a comment below.

P.S. This pitch was awfully misleading… but he does also hint at four other small-cap dividend payers or value opportunities, and I’m always curious to learn about new little companies, so I’ll probably dig into those tomorrow. Stay tuned…

Disclosure: I am not invested in any of the companies mentioned above, and will not trade in any covered stocks for at least three days after publication, per Stock Gumshoe’s trading rules.

What about the 8% dividend canadian stock that pays dividend monthly – latest MF’s teaser? Any thought which stock this is and whether it is worries buying at its current price?

Haven’t looked into that one… there are a number of stocks, including quite a few Canadian ones, who pay monthly dividends, and several pay close to 8% these days — if you want to get sucked into that particular niche, the folks at Sure Dividend follow the monthly payers pretty closely and have a good list here.

I am 84, retired and have a small (about $41000) ROTH IRA that I play with. If it wasn’t for AAPL, FCX and maybe 3 other stocks the IRA would be worth about $2000 REMAINING out of $15000 invested! My stock picking was BAAAD!

I recall when I had foreign stocks in it a tax on dividends was always withheld. It was too complicated for me to deal with the taxes so I sold all my foreign stocks. Are taxes still taken out or is my memory faulty?

HOWEVER, 8% dividend paid monthly sounds pretty good! i WILL look into those!

I would have no worries buying this stock if the price was worth it.

So he recommended a dividend play stock that no longer has a dividend? Seems beyond bad even for an “investment” newsletter!

I worked at CULP’s Upholstery Prints back in the late 90s, too much family for my liking. There is management and then there are the workers. Back then it was a stable place to work but I believe globalization has put heavy pressure on their future. They did have a good design group but that just gives the foreign mills some great designs to knock off. US fabric manufacturing is a dinosaur who’s days are numbered IMO. I would be a gambler in the $2.50 – $3 range but see no reason to get in any higher.

I wonder if/how reshoring might affect them?

Can’t imagine anyone’s going to push that hard to bring a lot of textile factories back to the US, but they are certainly getting more automated and computerized, so I guess one never knows. Culp is trying to sustain itself as a design/pattern/texture leader, it seems, not really the low cost manufacturer, but costs are obviously a huge deal for everyone in textiles… probably why they’ve done at least reasonably well with production in Haiti and Vietnam, I imagine a lot of the folks they competed with in the southern US in the 1970s and 80s are probably gone.

Thank you, Travis. This is why I love the service you provide. The second one he mentions is a small oil company in Louisiana with a 24% yield. I’m pretty sure that one is not as good as it sounds either.

You da Man.

It does at least pay a dividend still… though it’s not Louisiana, it’s further west (his Louisiana reference was to something else, an old Warren Buffett investment) — all shall be revealed tomorrow, I’m almost done with that article.

I was reading this and thinking to myself ‘ wow I wish there was a way we could report these cowboys for fraudulent / misleading representations and then it dawned on me ” if there was truth and absolute transparency in the publishing / spruiking industry then we wouldn’t need Stock Gumshoe…. thus in order to keep Travis off the streets and the Thinkolater rusting over I think I will avoid commencing a class action against these charlatans….. ha ha…..

Phew! Thanks 🙂

Travis you really must do something about google adds. Articles are unreadable on mobile devices and they only get bigger as you try to get rid of them.

Thanks for the feedback… we don’t get a lot of control over the Google ads and how they appear for different readers, but we are looking into offering a “no ads” option.