I’ve had quite a few readers write in to ask me about silver lately — there was a spurt of “silver will be better than gold” newsletter teasers over the Summer, and this latest pitch from the Insiders Strategy Group folks for their Macro Trader newsletter has been filling up the inbox …

… so let’s have a look and see what Sara Nunnally says we should do to invest in the shiny stuff.

And just up front, I should also let you know that I don’t follow silver slavishly, so I’ll tell you what I can but I don’t follow the conspiracies or the silver production numbers every day.

Here’s the hook that they use to get you on the line:

“Why This Historic “Price Glitch” Could Force Silver to Jump From $33.50 to $208 in the Next Six Months…

“Did BIG BANK CHEATING Create This Glitch?

“Here’s How You Can Take Advantage of It Today.”

Which pretty well sums up the big picture argument they’re making for silver having a big run — the “price glitch” is a reference to the fact that the silver/gold ratio is out of wack and a return to the “average” would mean a huge silver spike (or a huge fall in the gold price, naturally); and the “big bank cheating” stuff is a reference to the manipulation of the silver futures markets by JP Morgan and others.

The silver manipulation conspiracies basically revolve around a few large banks dominating the futures markets in silver, and holding huge short positions which they use their trading to buttress, trying to keep prices down whenever they show signs of taking off. I don’t know or care much about the mechanics of this, but there have been plenty of very detailed articles about it and plenty of things to make the conspiracy story seem like it’s ripe for a TV movie — including the (loose) connection to the downfall of Bear Stearns, and the fact that the prime whistleblower in this case was injured by a hit and run driver just as his testimony was getting attention. There was a good blog post at the NY Times on the whole conspiracy/price manipulation foofaraw last year, it’s dated now but he explains it all much better than I can so you can check that out if you don’t know the basic story.

I know many people feel strongly about this silver manipulation story — I’ll leave it to you to go read up on it and decide what you think. Certainly silver has been manipulated before, most famously when the Hunt brothers tried to corner the silver market (which in turn led to some of the futures trading position/leverage limits) about 30 years ago, back when silver had its all time nominal peak near $50 an ounce … whether it’s being actively manipulated now, the nature of that manipulation, and whether that manipulation will stop, is an open question.

The other part of the argument put forth here for silver is that the manipulation has kept the lid on a per-ounce price that should be dramatically higher because of the gold/silver ratio. Here’s a longer excerpt from the ad explaining (or selling, at least) that basic point:

“The value of silver throughout history has been tied directly to gold.

“As far back as the Roman Empire, the value of silver was set at 12 ounces for every ounce of gold.

“And when the U.S. fixed its own gold standard in 1792, that ratio was set at 15 to 1.

“Silver is often referred to as “poor man’s gold” for that reason.

“You see, it has intrinsic value like any other precious metal. That’s what makes it a reliable store of wealth…

“But you can get it at a fraction of the cost of gold.

“That means it’s much easier to build a position in silver without having to come up with $1,730 or more just to buy a single ounce of gold.

“Part of the reason it’s so much easier to get into silver is the silver glitch I talked about earlier.

“The silver glitch is pushing the price of silver down way below where it belongs.

“Silver should track gold’s performance… for example, let’s use the Roman standard of 12-to-1…

“At $1,730 per ounce of gold, history tells us that we should be seeing silver prices at $144 per ounce.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“But today, the historic silver/gold ratio is wildly out of control.

“The gold market has rocketed to historic highs in the past 10 years, but silver hasn’t risen at the same pace.

“That’s the glitch I’m talking about. Silver is wildly underpriced on a historic basis.

“Currently, you would need 52-53 ounces of silver to buy just one ounce of gold.

“That’s because the big bank market manipulation buries the price of silver… and stops it from reaching the natural historic 12-to-1 ratio.

“Now, with the CFTC breathing down their necks, JP Morgan and HSBC won’t be able to blatantly control the silver market.

“And without any interference, the silver glitch could move quickly to correct… driving the price of silver all the way up to its historic 12-to-1 ratio with gold…”

The gold/silver ratio is not magic — the ratio of gold reserves to silver reserves is probably in the neighborhood of 10:1, and the ratio of gold to silver in the earth’s crust has been estimated at 20:1, so the number of something like 12 or 15 makes some intuitive sense and helps to bolster the argument … but as with anything else, it’s not just the supply that determines the price. It’s the demand.

Gold has fluctuated over the years as jewelry demand has waxed and waned, but in the last decade or two it’s been almost entirely a “store of value” play as folks look for something to hold value during inflation or currency manipulation. Silver has become a “store of value” play more recently, too, with investors looking to get in on something that’s cheaper and easier to acquire in small quantities, but it is also an industrial metal that is consumed in massive quantities, so industrial demand has driven the price through some big fluctuations — particularly with the abrupt demise of film photography, a major silver use. Still, you can probably argue that silver should be more valuable than gold — it gets used up, it’s an important industrial metal (for lots of reasons — antibacterial qualities, highly reflective, highly conductive and non-resistive — silver is in tiny quantities in millions of products), and it is just as shiny. Still, human culture puts gold at the top of the list — you don’t see Indian brides collecting trunks of heavy silver necklaces, or nervous young men getting down on one knee in unaffordable New York restaurants with silver rings in pale blue boxes.

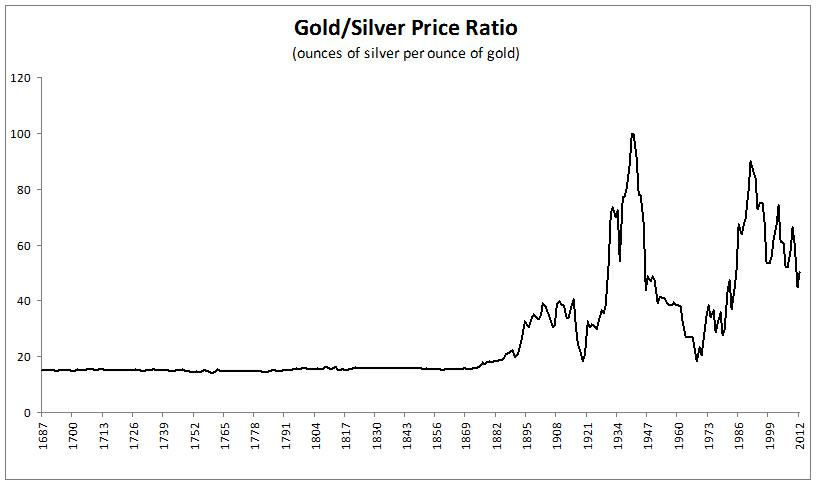

So the short answer from me is: I have no idea where the gold/silver ratio might head, but the craziness of the chart during the post-industrial era and the “fiat currency” era doesn’t indicate to me that there’s any “stickiness” of any particular magical ratio in the prices of these two metals in modern society. I’ll borrow a couple versions of the gold/silver ratio chart here so you can see what I mean:

So what is one to do? Beats me. I own some physical silver and some exposure to silver through ETFs and the like, but not because I think that we’re going to see the gold/silver ratio return to Roman or even 19th century levels. The average for the last 40 years or so, since we officially lost the “silver standard” for US currency, has been a gold/silver ratio of something in the neighborhood of 50 … but we also had perhaps 20-25 years or so in there when silver did almost nothing at all, when the big moves in the gold/silver ratio were largely due to changes in the price of gold, before the last decade when both gold and silver have made tremendous runs. I actually think silver will do pretty well over the long run as industrial demand continues to emerge and the fiat currencies of the major financial powers continue to depreciate, but it’s just part of the “hard assets” part of my portfolio that includes some gold, some silver, some mining-related stocks and some other “real” stuff like real estate or other hard-to-replace assets that should hold value despite long-term currency weakness. I do not think that we’ll return to a real silver standard or a gold standard on either a US or international level, where currency is again backed with precious metals … but if we do then all bets are off — and perhaps in a bad way relative to purchasing power, if government sets the value of something it rarely sets it just where you’d like it to be.

But that’s not the real point of the teaser ad, as you’ve probably guessed by now — we’ve seen people predicting outsize gains for silver for many years now, and though the silver price targets fluctuate depending on what measure they use ($134! $208! $155! $62!), they all, of course, promise not only that silver is going to go up, and dramatically so, but that they have the best secret way to invest in silver that you haven’t thought of yet.

And Nunnally is no different. She’s looking at $208 silver when the “price glitch” of the last 100 years corrects … and she’s got some special ways for you to invest to profit from that correction. So even if we consider it a bit absurd that silver might “correct” to $144 “within days” we might still be interested in her silver ideas (we’re glossing over some of her argument, you can see the whole ad here if you want) … so what are they? Here’s how she puts it:

“Will You Be Ready When the Price Glitch Corrects and Silver Shoots Toward $208?

“Today, you can get in on the ground floor of a historic move in silver prices that could hand you huge gains.

“This move has nothing to do with coins or bars of silver.

“It doesn’t involve old-school silver miners. It’s not about groveling for ‘junk silver’ at your local bank.”

That last bit is a nice little elbow in the ribs for Dr. David Eifrig and his two coin silver pitches, the half-dollar-focused “five magic words to say to your bank” pitch and the long-running junk silver “buy silver for under $3” pitch. So what is she talking about as a way to play silver?

Well, the first one is some kind of fund … here’s how she teases it:

“I’m happy to report I’ve discovered an opportunity that makes it easy to own physical silver.

“The silver you own is stored for you in a secure vault where it stays safe until you decide to cash in on a big market swing.

“This special vault is not owned by a bank… so there is no danger to your silver from bank failures or government appropriation.

“As you may have already guessed, it’s an exchange traded fund (ETF).

“No, I’m not talking about the hugely popular silver ETF trading under the symbol ‘SLV.’

“This is a special ETF. As you’ll see, it’s far better than SLV.

“This special ETF gives you a way to buy safely stored silver bullion… and you can do it right on the stock exchange.

“Better yet, if you choose… your shares of this ETF can actually be cashed in for bullion.

“That’s right, real physical silver available to you on demand.

“And because of a special designation this fund carries, you could even qualify for a lower tax rate on your gains when you decide to cash in!”

There are a couple of silver-backed exchange traded funds, but I think with this one they’re teasing the Sprott Physical Silver Trust (PSLV in NY, PHS in Canada). This is actually a closed-end fund (meaning they have to have follow-on offerings to create more shares, they don’t just create new shares as they’re needed), but it’s quite liquid and is an investor favorite. The shares are technically redeemable on a monthly basis, though you have to redeem a minimum of 10 “London good delivery” bars, which in practice means the minimum redemption is somewhere in the neighborhood of $250,000. So it’s real, and it should provide a base for the share price if they ever traded at a substantial discount to the silver net asset value in the fund, since institutions could redeem and close that discount … but PSLV hasn’t traded at a discount and has usually, in fact, traded at a pretty stiff premium to their net asset value. Which would make it foolish to redeem the shares (“Excuse me, can I please have $12 of silver in exchange for my $13 shares? Yes, charge me the redemption and shipping fees too, please!”).

Interestingly, PSLV has finally closed the massive premium gap to a large degree — for most of last year some folks were paying absurd premiums of 10 or 20% just to get shares of this fund, even more than you’d pay to buy Silver Eagle coins and have them stored for you, and over the winter that premium even spiked to 30%+ for a few weeks, but it has steadily dropped this year and the premium is now down to less than 2%. You can see the historical premium/discount chart and the current calculation here.

And yes, if we assume that there will continue to be a discounted tax rate for capital gains next year, then US shareholders might be able to get that discounted rate (currently 15%) instead of paying the higher capital gains tax that’s generally due on collectibles. Most ETFs, like the big gold (GLD) or silver (SLV) funds, warn that investors will be subject to the higher 28% collectibles rate, but since PSLV is classified as a passive foreign investment company you apparently can, with a bit of work, get the lower rate. You can read about that on PSLV’s website here, and for God’s sake don’t rely on me for any kind of tax opinion or advice.

So that’s the exchange-traded fund option from Nunnally, I expect. What else is she touting?

“Did you know that there’s a way to profit from silver mining, without ever owning a single mine?

“Let me explain…

“I’ve found a way you can profit from what’s called “silver streaming.”

“Silver streaming happens when a company pays a premium to a miner and then has the option to buy all of the miner’s silver production at a low fixed price in the future.

“The miner gets some capital upfront. It can use this money to expand operations, acquire new assets or just guarantee more time to bring its find to the market.

“The silver streaming company gets cheap silver they can turn around and sell at market prices, sometimes booking big profits.

“Having sources of silver that won’t be affected by market changes helps them to have a more stable flow of income, as well….

“What makes this play truly unique is that this top performer has made deals with massive mines that produce silver as a byproduct of other mining efforts.

“Essentially, the miners get silver when they’re looking for other metals like gold, copper and zinc. It wasn’t their intention to be silver miners.

“Silver’s just an added benefit to their main mining concerns.

“So they’re happy to sell the rights to it upfront and get more cash to build their mines.

“And because this silver streaming company is paying upfront, it can buy the silver at a tiny fraction of the market price.

“The best part is, this is a long-term deal… the price the silver streaming company pays for the silver isn’t going to change.”

Well, that’s quite clearly referring to the world’s largest streaming/royalty company, Silver Wheaton (SLW). Which is also the only one of the major royalty/streaming companies that’s looking relatively inexpensive if you look at their current financials (the gold-focused ones are substantially more expensive on a PE or cash flow basis), and arguably trades at a discount to their expected growth rate. But I’ve written about Silver Wheaton many, many times so if you want more details on that you can check out my most recent piece, when I unearthed them as the solution to Matt Badiali’s “Canadian Silver” teaser. I would buy SLW before I bought any silver miner, but I don’t own shares now.

And our last tip from Nunnally?

“I also want you to know about a company that’s set to become one of the largest silver miners in the world.

“It estimates its 2012 production at nearly 20 million ounces.

“And their operating costs are less than $8 for each ounce of silver it pulls out of the ground.

“With silver selling for $32 per ounce, you can see how this company is already making big profits.

“But when the market corrects the silver glitch, this miner could see even more amazing profits than ever.

“Just imagine what its balance sheet would look like with silver at $208…

“That would be an additional profit of $3.4 billion per year!

“That could add another $37 per share to the stock price.

“This silver miner is strong and stable today, with the potential to hand you years of impressive returns as silver snaps upward over time.”

This one isn’t a 100% certain solution, but the best answer provided by the Thinkolator for those clues is … Coeur d’Alene Mines (CDE).

CDE does expect to produce “nearly 20 million ounces” in 2012, though they bumped the “nearly” part down by a million or so ounces when they announced earnings and some disappointing production numbers a couple weeks ago. So you can, if you like, buy the shares for a lot less now — they dropped from about $30 pre-earnings to $23 and change today. Prior guidance had been for 18.5-20 million ounces on the year, but it will now be 18.5-19 million ounces — most of the drop is due to a relatively small problem area at their largest project, the Palmarejo mine in Mexico that they say is “short term” and impacted only production, not reserves (my dumb guy interpretation: the silver is there, they just couldn’t get at it as easily as they planned).

CDE is one of the top ten or so silver producers in the world, and the largest US company in that category, though they do also have a gold mine or two — their big silver mines are in Bolivia, Mexico and Nevada. And yes, they do expect cash costs to remain low, at about $7.50 for this year. So if silver prices skyrocket, they should be quite leveraged to that price … and they do expect 2013 to come in right about the same, with similar production in the 20 million ounce neighborhood. CDE was down substantially earlier in the year, too, and over the past year, two years or five years you’d have been better off owning just silver, but with low cash costs and a rising silver price logic would tell you that CDE should be able to dramatically increase margins, and therefore get a higher valuation. Logic doesn’t always work with miners, unfortunately — I don’t know what CDE’s issues have been specifically this year, other than this quarter’s production shortfall, but miners almost always have some kind of issue … Pan American Silver (PAAS), for example, is often touted as another massive silver producer with great potential but has had headline trouble with their Argentinean mines (don’t want to invest too much if the gummint is going to take them away), and stories of cost overruns, production problems, permitting delays, etc. are legion in the mining business.

Which doesn’t keep people away for long, since there’s always money to be made if you can turn dirt and rock into gold or silver, but it does mean that yes, miners come by their leverage honestly — they should generally do better than the underlying metal price when the silver price is rising, but not all of them will, and they can do far worse when the silver price falls, as it has for long stretches. There is an ETF of silver miners, ticker SIL, and that has tracked pretty closely to silver this year — but lately the leverage has only been on the downside, when silver goes up the SIL recovers along with it, but when silver drops the SIL ETF drops harder (like in the Spring, when silver dropped about 10-12% and SIL dropped 20-25%). There’s fortunes in them thar hills, but sometimes it’s easier just to buy the fortunes that someone already dug up or — as mentioned above — to diversify with something like Silver Wheaton, which has recently shown a leveraged response to the price of silver on both the upside and the downside and ha done better than both the metal and the miners over the past year. Not dramatically better, but better.

So there you have it — some thoughts on silver from Sara Nunnally and the Insiders Strategy Group people, and a few ideas they’re pitching for profiting as the “glitch” in silver prices disappears. What that means for your portfolio? Well, it’s your money so that’s your call — I do have some small speculative call option positions in both SLV to PAAS, largely because of the occasional tendency for silver to make large moves, and I do hold some physical silver, but I really don’t think silver will hit $208 anytime soon. And if it does, I may be too busy stockpiling Twinkies to care.

I know that many, many, many Gumshoe readers are avid precious metals investors and speculators, so if you’d like to toss your two cents on the pile as it relates to the gold/silver ratio, or the best way to invest in silver, or your own price target for the shiny stuff, well, what are you waiting for? That’s why we have that friendly little comment box below. Thanks!

The group Sara works for has three people left. They’re a sinking ship after letting so many people go.

Interesting to hear, I haven’t followed them closely but was disappointed when they dropped the “Taipan” name to go bland and forgettable with “Insiders Strategy Group.” Mostly because I have to look up the name every time. As you say, looks like the only names they’re boasting about now are Andrew Snyder, Sara Nunnally and Sandy Franks, though I think all three have been active in newsletters for at least as long as Stock Gumshoe has existed (six years now).

They have actually been rolled into Agora Financial from what I can tell – Lots more stuff coming from/about Bill Bonner.

Boy, that was a lot of new information…NOT!

I own all three of those and could have guessed them pretty well. Is that all these newsletters have to tease us with? No hidden gem of a junior miner about to burst on the scene? No insider information? But then, Stansberry keeps rolling out the same teaser for the bank junk silver and Silver Wheaton over and over again like a fishing line hoping to catch complete newbies. Sigh.

I feel your pain, Paul. Though I confess that I had written off Sprott Physical Silver as ridiculous last year with their massive premium, so I appreciated the nudge to notice that the premium has evaporated.

I used to own shares of (Arcana) aunff, which was hyped by a geologist friend. I learned an expensive lesson after taking a bath with another ‘sure thing’ of his, an oil company that went belly-up (sng). In both cases, the product was good and the find was legitimate. Sadly, management was crooked. I owned Arcana until a few months ago when an announcement was made about gold being discovered there. It smelled to high heaven. Salting the mine; such an old ploy. The price shot up, as predicted, and I sold my shares and made a small profit. There has been no further news of gold. I own a little Golden Predator, but am very wary of ore, and own no physical silver or gold. Sold my unwanted jewelry for $2,000.

Sorry, it’s Aurcana (forgot the ‘U’ as in Silver).

I like SLV and made quite a score in the last run-up. PSLV does not track the discounted price of silver so how does one value the ETF? Additionally they are issuing a bunch of instruments ( $200MM ) is that dilutive of the ETF? How do it know?

I follow about 75 gold/silver producers. Calculate a couple of ratios to find better values. In my opinion, the articles Hamilton of Zeal research wrote about the gold/silver ratios are FAR better than what the folks have written. He says to buy silver when the ratio gets above 55 and to sell when it drops to less than 45. Easy enough.

it’s going to happen soon and it will be so fast It may be un- catchable without tremendous risk for average players or novices “Like” the ETF for the general but if patient and one would have margin times $x 2 pretty safe risk vs, reward scenario the problem with most in this theory however most folk’s do not know how to add to a position or they take profits way to early for the move to mature fully,it’going to happen and soon. at aprox. 50/1 I like it on the stretch run.

frank x.

.

Owning physical silver couldn’t be easier or more anonymous just by using ebay. I regularly buy junk US coins for ‘spot’ pricing all the time. Delivery is very inexpensive and most importantly, it is blind to everyone. AND, if you buy US coins, you get 2% bqack in ebay bucks. It’s a piece of cake. Of course, this shouldn’t be your only play in the metals market but one you should consider for diversity. JYD

Silver runs through most things even some clothing. Take silver out of your life and its

like going without food and drink. You would not have much of a life, no car, no remote

for the TV, no toaster, medical uses, no microwave etc., etc., Only something like 8yrs

supply left above ground. Its a nil-brainer.

If you want to know about Gold and Silver investing and manipulation look for TED BUTLER he is very good excellent report by STOCK GUMSHOE.

http://www.kingsgate.com.au/newsdesk/

Stockpiling Twinkies? If you hope to do that you better do it now. Hostess, the maker of Twinkies, is shutting down. Many stores are out and hoarders are offering Twinkies on Ebay auctions. No doubt some other plastics manufacturer will come along to Twinkle On…

The “SLV” silver EFT has been a great stock equity fund that tracks silver very well. As noted in your article you do not own the physical metal with this fund but this is of not of any concern to me since I trade the option market and not for ownership. Because SLV has a very liquid market option prices for the bid and ask prices are normally only a few pennies apart making it ideal for option trading. When Volatility is high this allows a decent premium for debit spreads for ATM (at the money) or slightly OTM (out of the money) positions so a monthly return on capital has the potential to be great (over 100% yearly return). My favorite strategy is to create a diagonal spread with deep In-the -Money (ITM with option delta value > .90) long positions a few months out and selling short term premiums (closest month) for capturing time premium. When the long option is within a month or so from expiration I roll my long position to a further out month for pennies to continue this strategy. I have done this for years even though silver has had dynamic moves so I do not win each month but enough wins to stay in the game. This approach is similar to buying covered calls but with significantly less capital.

So the historic ratio in price between gold and silver is because the ratio was set up governments. In what way is that relevant when gold and and silver prices are no longer set by governments but by the market? As our favourite Gumshoe has pointed out, the ratio might be relatively equivalent if you look at the volumes of the metal available but unless you factor in demand, just looking at supply is not very meaningful in determining price.

As far as I am concerned own physical metals and the streamers, such as SAND and STTYF.

PSLV LOL!. Here’s Kid Dynamite’s analysis of Sprott’s “fund.”

http://kiddynamitesworld.com/

It’s the 26.11.12 post/rebuttal. He’s archived other posts on Silver, eg. hypothecation on the Comex. Bullion? What staid and true Central Fund of Canada, CEF.A:TSX.

SouthernX

PS Thanks Patty for the heads up on Aurcana.

Follow the golfing buddy tour with the Ministry of Minerals seems like all the boys tee it up with Mr. Luna somewhere down the line, politics and a language barrier is a good thing to have down south , to many bushes to fall down and never be seen again, when the guide tells you not to say a word you better listen . There are many good plays down there but don’t go there on vacation anymore, just ask the new MAG episode of CSI I am sure the Federals will find there man or two, nothing like a cold Tecate and a dirt floor bar but there is gold and silver in those hills but you should let the locals do the digging and stay up north and have MOLSONS AND PLAY THE MARKET FROM THERE. The new sign that was put up by Luna says you are in SAND AND SPROTT COUNTY NOW THE GG’S LET THEM BID IT UP you can not really go wrong with any of them , it is not what is on the table it is what is underneath and that creates value as long as you keep your distance, you are in pay to play land ,people think of the third world but the is a fourth world, and now the new Gold is water and the locals control that always look at the directors of the companies that used to work for the govt. it will help with your due diligence. A miners best friend is the local cartel and they use different kind of ounces now that is streaming wait for that new mining novel without an author’s name. Beautiful countries all have there borders . That news letter they never talk about but it is there they have a special mining union and it is fast and furious how much does that geologist weigh, they are worth there weight in more ways than one. There is a lot of cash to be made and a lot of it never hits the market, that is in the stat of the cost of doing business and that is the biggest stat of them all but of coarse the insurance man always gets his premium, LYODS OF LONDON has a great policy, Gumshoe put this in the thinkmachine ,who is the biggest mining insurer for the junior miners all the big miners are self insured, that would be a good stock for a nice hedge because even if you don’t reach your output in production you still have to make that insurance premium. I will bet the answer will surprise many an investor or are they all in good hands, and if that is not a good lead what public company handles the security , there are two good leads right there and is there any publicly traded lab that stands above the rest. Good questions for SAND and SPROTT and a couple others who do not get there hands dirty but they all have to turn in the paper work for there exchange, is that all in house or is there a main player in that price water house field, or are they all painting there books the same color. Some Govt’s don’t care but the stock exchanges try to make it some what fair. It is a little different doing business in Nevada or Canada , I am just curios who is the best at the south of the border express , like they all say about the forward looking statements who controls the ink in that pen. I am a happy Gumshoe subscriber and these questions are no teaser news letter thing I am just interested in how what comes out of the ground, really what is the ROI in the whole picture and I am sure all countries are different like it takes about 2 years to get a permit in a lot of counties even in CANADA and AUSTRALIA but the good old USA takes 7 years will that time frame come down or will the other time frames go up. Maybe they all use LEGAL ZOOM just kidding but I thought you could put some behind the scene’s things that a miner owner has to go through especially when there bank says we can not borrow or front you ant more money which is where the Sprott’s and the Sand’s come in, they hold the cards and the banker gets his free lunch but the miner has to bend and let the Streamers call the shots with out getting there hands dirty. Nolan is young and very sharp and Rick is a little older and also very sharp, who outbids who if the mine has potential all I can think of would be what a perfect merger Sand and Sprott but that will never happen but if it did that would be a stock to own and then they could really play with the big boys you should do a hypothetical theory on that, what a finders fee would that be, they could really step on some toes then. I know a long comment but there joint venture would change the game with there competition. They would go from small billion market cap to get out of my war SPROTT AND SAND are coming your way. Just a thought but it would be a game changer if the ego’s could hold hands S&S could move the market and the institutions would be in line.