This is an ad I actually haven’t seen, but a couple readers have sent in questions that include some clues, so we’ll try to solve them for you.

That means, by the way, that we’re being a little bit unfair — since I haven’t reviewed this full ad, what we’re quoting from is hearsay… it definitely won’t hold up in court 🙂

But I know that a lot of folks love hearing about Motley Fool ideas… and the last time we looked at a Motley Fool IPO Trailblazers ad, back when they were touting “FAZER” stocks as the “next FAANG,” their timing turned out to be exceptional… that was back in early March, and they teased Fastly (FSLY), Appian (APPN), Zoom Video (ZM), Elastic (ESTC), and Roku (ROKU), and most of those dropped by nearly 50% in the few weeks after the pitch — but bounced back insanely quickly, and the WORST of those is now up 40% in the six months since I wrote that piece…

So I imagine that’s why folks want to know more — what else is being recommended in this “IPO Trailblazers” service?

Again, we’re dealing with some secondhand teasing here… but these are the clues dropped in our lap by readers:

“Here’s just a quick taste of a few recommendations you’ll find in the IPO Trailblazers service:

“The ‘Proprietary Algorithm Powerhouse’ – Shareholders have barely had a second to catch their breath (or count their profits) since this algorithm-based company had its IPO in 2016 and soared by more than 750% in the years that followed.

Here’s why: This tiny West Coast company’s proprietary platform has empowered it to rapidly grab market share and skyrocket revenue at a staggering +50% rate for the past two years in a row.“Despite the sensational run this stock has already taken investors on, we’re convinced this is just the beginning. Because this upstart looks like it’s got a vice grip on a fast-growing industry that’s expected to nearly DOUBLE in size by 2022, and we can’t wait to take the ride with them.”

That’s very likely, sez the Thinkolator, to be Twilio (TWLO), which has had some ups and downs in its four-year life as a public company… but has re-accelerated the growth recently, to the delight of investors, with revenue growing 77% in 2018 and 62% in 2019 (after “only” 45% in 2017, when they disappointed a bit — it took the stock two years to surpass those immediate post-IPO highs of 2016).

And the stock was also a little depressed going into COVID, with some disappointment as the revenue growth slowed again for a couple quarters… but the COVID boost of “work from home” helped to restore faith in all the cloud stocks, pretty much, and Twilio has been riding that excitement, with its share price up 75% this year so far.

Twilio is not perhaps as outlandish and direct a beneficiary of the “remote work” world as Zoom Video, but it’s definitely helping to increase the demand for their communication tools — and some parts of the business, like their support of telemedicine, were really given a chance to boom when they probably would have fizzled in a 2019 world. If you don’t know the company, they basically provide an API platform for designing communication apps, including those that are algorithmic in nature (think “chat bots”) — this is how they describe themselves:

“Twilio’s mission is to fuel the future of communications.

“Millions of developers around the world have used Twilio to unlock the magic of communications to improve any human experience. Twilio has democratized communications channels like voice, text, chat, video, and email by virtualizing the world’s communications infrastructure through APIs that are simple enough for any developer to use, yet robust enough to power the world’s most demanding applications. By making communications a part of every software developer’s toolkit, Twilio is enabling innovators across every industry — from emerging leaders to the world’s largest organizations — to reinvent how companies engage with their customers.”

Their basic investor presentation from the second quarter results is here, and the press release is here. They have had solid growth in accounts, with customer growth of 24% over last year, and customers are spending more than that did last year (though growing that spend at a slightly slower rate), and they’re still losing money — but they also offered up another $1.25 billion of shares last month, taking advantage of higher share price, so they are certainly in fine shape, cash-wise, for their trajectory to profitability.

And that trajectory is a little wobbly of late, actually, they will probably actually earn less this year than they did last year… but analysts do see growth picking up, with 20 cents in earnings per share next year and 64 cents in 2022. That’s not a lot for a company priced at $273 a share, of course, so to buy TWLO you have to really buy into that mission and the long-term future. The price looks fairly rational next to Zoom Video, at “only” 27X sales, backed up by revenue growth that is expected to be in the 35-40% range next quarter, but that’s not exactly like comparing it to AT&T or Bank of America. (ZM, which just posted its ludicrous growth quarter and jumped up 40%, with revenue growth last quarter of 355%, is now at about 50X expected 2020 sales, TWLO posted growth last quarter of 45% and trades at 24X expected 2020 sales).

So it’s not quite as nutty as Zoom, but this is rarefied air TWLO is in, and the stock is expensive… and pretty big, with a market cap of about $40 billion. But in a world that gives us Tesla and Zoom Video and Shopify, who’s to say when big becomes “too big to grow,” or when what used to be a ludicrous price/sales ratio becomes “normal?”

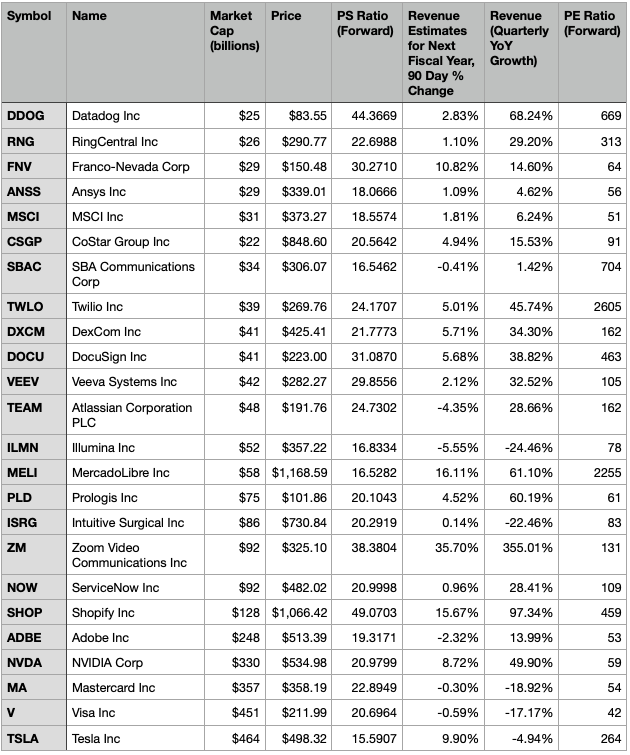

History tells us that most of these richly valued stocks will have a comeuppance at some point, but history is only a loose guide, not a crystal ball — here’s the list I pulled of companies that have a market cap above $25 billion and trade at a forward Price/Sales ratio of 15 or higher… none of them, not even well-established stalwarts like Visa, is cheap or easy to buy using most traditional valuation metrics, but most of them have pretty good momentum, so who knows, maybe someone will pay you twice the price to buy those shares from you a year from now:

It’s probably not crazy to own some of these companies, many of them will be leaders of the economy in a decade (I have exposure to five of them myself at the moment, Ansys, DocuSign, Intuitive Surgical, Shopify and NVIDIA, and have certainly considered and owned some of the others in the past, they’re all real companies with amazing businesses)… but it’s crazy to own all of them and nothing else, because if investors suddenly come to their senses change their mind and decide that 20X revenues is a wildly optimistic ceiling for valuations, they could come crashing down all together.

For those who haven’t been investing for a long time, a little history might help give perspective: Five years ago, ServiceNow (NOW) was growing its revenues at about the same pace it is now, but it traded at 13X sales… which at the time seemed insanely high, though it’s well over 20X now… and when I bought Shopify (SHOP) in the spring of 2017, I didn’t commit a huge amount of capital to it because it was trading at a very lofty valuation of 15X trailing sales, almost unheard of at that time… and it’s valued at 60X trailing sales now. All of these companies are doing fantastically well, they have great businesses and it’s quite possible that they’ve gotten a multi-year growth burst from the pandemic that will set a new “floor” for their revenues, but the unknown factor of how much are investors willing to pay for that growth is what will define their future returns from this point.

"reveal" emails? If not,

just click here...

These businesses might have had a sea change, but any kind of “floor” that might theoretically be provided for these stock prices because of a “too cheap” valuation or a dividend is likely to be really, really far below where the prices are now — this isn’t 1999, the companies are far better and they have real businesses so they won’t disappear overnight in a cloud of smoke… but most of them would still look historically expensive on most valuation metrics even after they fell by 50% or more. Partake if you like, I do to some degree and nobody likes to miss a bull market… but be mindful of the risk. As the old traders will tell you, nobody rings a bell at the top to let you know it’s time to sell.

I’m not likely to buy this particular stock, but I also opted not to buy Twilio when David Gardner’s Rule Breakers service at the Motley Fool teased it a year ago as their “hidden 5G superstar,” and it has almost doubled since then… so what do I know?

And on to stock number two teased by the IPO Trailblazers folks?

“The ‘Data Science Dynamo’ – Our analysts spy a second wave of e-commerce disruption on the horizon, and one little-known trailblazer is leading the way. This grassroots tech dynamo has taken a service that used to be exclusively for the super-rich and made it accessible for the everyday consumer by using data science.

“That innovative idea has helped them snatch a $1.5 billion piece of an estimated $350 billion industry, but we expect this founder-led disruptor to carve out a much bigger chunk of this market over the next decade as they prepare to expand overseas and increase their product offering.

“For this “Data Science Dynamo,” the question on our mind isn’t so much when it’ll 4X – but rather, how quickly it could tear through that ceiling on its way to potentially becoming a 10-bagger.”

Interestingly enough, I’m pretty sure that the Thinkolator is correct at pegging this one as Stitch Fix (SFIX), and that happens to be a stock I bought recently and have been writing about for the Irregulars in recent weeks. Their revenue is just above $1.5 billion (it was $1.58 billion last year, the trailing four quarters come in at $1.7 billion now), and they are certainly an e-commerce company — they offer up something like a “personal shopper” service for fashion, with an AI driven recommendation engine that is filtered through “stylists” who choose outfits to send you for approval. And yes, it is still “founder-led” by CEO Katrina Lake, who impresses me with her vision and persistence… it is just beginning to expand internationally (they launched in the UK last year), and they’ve recently expanded their product offering to men and children. Here’s a little excerpt of what I wrote for the Irregulars about this one on Friday (I just finished some “real world” research, my family tried out Stitch Fix over the past couple weeks — and I liked the service a lot):

“There’s a lot riding on this next quarter, to be reported on September 22, given how weak revenues were through the COVID collapse, but I’m really impressed with the service initially. Not a lot of clothes fit me very well, and I don’t usually like shopping for clothes — maybe my interest in SFIX is based too much on that narrow perspective, but so far so good. If you’d like to join me in my “real world research” as a Stitch Fix customer, my referral link is here and we’ll each get $25 if you try it out.

“I do think that Stitch Fix has to engage in some higher-volume business to make this work — but curation and style matching is a huge capability in an oversupplied and silo’d world, and should be very scalable, which keeps me coming back to look at just how tiny Stitch Fix is. Macy’s had revenue of almost $30 billion last year, the Gap was at $15 billion… Stitch Fix at under $2 billion clearly has a lot of room to grow in the clothing retail market if they can get it right, but they’re also in a bit of a ‘sweet spot’ where they’re big enough and established enough to be an important partner for clothing designers and manufacturers. That doesn’t mean magic is inevitable, but there’s a lot of potential. I put on my first little equity stake today as a ‘I’m partly convinced’ buy after this consumer experience. I expect I’ll have to be patient with this one, but the valuation is low enough, and the revenue high enough, that they have plenty of levers they can pull to improve the company in the coming years… we’ll see if they can pull it off.”

SFIX is not currently profitable, though they have had several “barely profitable” years since going public, and they really took a hit from COVID — both because “stuck at home” meant less demand for fresh new outfits for both fun and work, and because some of their supply chain froze up for a little while and their fulfillment slowed down as they adjusted (picking and packing clothes is not something workers can do remotely, so there was an adjustment period for new COVID precautions and rules). They’ve been buffetted by possible threats in the past, including Amazon’s personal shopper service for fashion, but have so far continued to do reasonably well operationally… the big question, I think, is how much they can ramp up the use of AI-powered recommendations to increase sales per customer, with add-on buys beyond the “Fixes” they ship out. If you want to see my much longer piece about Stitch Fix, that posted in the Friday File on August 21.

And if you want to hear it in someone else’s words, this is a little take from a Benzinga article that posted today:

“Stitch Fix’s business model mitigates inventory buildup as the data predicts the customer will want. Over time with more items being kept or returned, the predictive algorithms improve and provide the company with valuable knowledge with which it knows exactly when it needs to have items in stock. The good news is that despite the damage from the pandemic, the company is still enjoying robust engagement levels, which adds weight to management’s explanation that the recent slowdown was a result of supply challenges rather than demand issues.”

And no, I have no idea why SFIX was up 10% yesterday… other than the “everything is up 10%” feel of the market as we begin September in the wake of the wild Zoom news. I do think they’re in a good spot, with folks going back to work and play but maybe not so interested in returning to crowded shopping malls… or, in some cases, with local fashion retailers having closed up shop during the pandemic. And, of course, those of us (your author hangs his head in shame) who put on 15 pounds as the home delivery of beer and Doritos persisted during the pandemic, and as we ate our feelings and anxieties, are going to need some new clothes. You can see the company’s June investor presentation here if you’d like to see how they frame their strategy and potential — right now, they think they have just about 1% of the online apparel market in the US and the UK.

Both Twilio and Stitch Fix have been covered heavily by the Motley Fool in the past, though not teased in any big way this year (until now, perhaps)… but how about number three? The clues are not as helpful with this one…

“The “Booming Niche Navigator” – By targeting an unorthodox niche within an oft-considered traditional industry, this recent IPO has been able to carve out a profitable chunk for itself that has been growing at a ridiculous 36% annualized rate for the past five years.

“That’s incredible in its own right… but not as incredible as the fact that revenue growth appears to actually be accelerating.

“If this growth keeps up the way it is (and we have reason to expect it will), we could be looking at a business FIVE TIMES its current size in the next decade – and a stock that could easily return 4X or more to investors.”

I’ll throw out a wild guess for you on this one, speculating that this might be the Fool again targeting the e-commerce pet store Chewy (CHWY), but that’s just a guess — a surprisingly large number of companies have been growing at “ridiculous” annualized rates over the past five years.

And Chewy, in fact, is almost certainly not the right match because their compound annual growth rate for revenues is closer to 50% since 2016… though they are growing revenue at about 36% this year, analysts expect, and almost certainly accelerating that growth this quarter. In case you’re curious, “36% annualized for five years” would be roughly a 5X increase (a hair under).

I don’t really know what they mean by “niche navigator” or “traditional industry,” but there are some other companies it probably could be, too — if you look for at least mild growth acceleration (ie, revenue growing faster last quarter than it did last year), and stocks that IPO’d less than 7 years ago (“recent IPO”, of course, is also very non-specific), with revenue in the 30-40% range over the past five years, the list is pretty short — you have Etsy (ETSY), Genmab (GMAB), GrubHub (GRUB), JD.com (JD), Kinsale Capital (KNSL) and Wix.com (WIX), that’s pretty much it. The Fool has certainly recommended WIX, ETSY and JD in the past, but as far as I can tell it has never recommended the others.

Or you could loosen those restrictions a bit and add in some other strong growers who are pretty young and also have been recommended by the Motley Fool, like AppFolio (APPF) or Atlassian (TEAM). I can’t be sure, given those limited clues, so I’ll have to throw myself on the mercy of the court for item number three… most of those stocks (though certainly not all) have made investors very happy over the past few years. And Chewy is one of the pretty recent IPOs that I like a lot, though I haven’t convinced myself to buy it yet, so I’ll re-share some more thoughts on that one, even though it’s almost certainly not the answer to today’s tease.

This is what I said about Chewy when I covered it for a different Fool teaser recently, by the way (and yes, I wish I had nibbled on the stock at the time, but I didn’t):

Why Chewy? Well, it’s certainly a fast grower, and it has a strong niche business with better than 40% growth in the last quarter… but it’s also on an odd fiscal year with the last quarter ending in April, so although that incorporates six weeks of the pandemic shutdowns and did show some big acceleration, from 20% and 33% in the previous two quarters, I think it’s likely that their next quarter will provide accelerating growth beyond that. They report that next quarter in mid-September….

Chewy looks downright cheap compared to some of the hot cloud computing growth stocks that have given everyone sweaty palms over the past few months, it trades at a price/sales ratio of only about 4 [now 5, I wrote those words three weeks ago and the stock has gone up by more than 25% — mostly thanks to the Zoom enthusiasm yesterday], a lower valuation than even Amazon, but we should remember, of course, that it’s still a retailer… which means it has fairly tight gross margins (they have to pay for the pet food they sell, and shipping big bags of dog food is expensive).

The business should be pretty scalable if e-commerce continues to grow market share, so it’s possible that they’ll begin to turn a profit in the next few years — though with this ramp-up in sales, we’re all really guessing. Right now, analysts expect CHWY’s revenue to accelerate further to nearly 50% in the next quarter, but then de-accelerate and grow by roughly 50% over the next two years to a total of almost $10 billion a year… and that they’ll begin to post a profit sometime in 2022 (which will mostly be their fiscal 2023). They still have a pretty small market share, so there’s certainly potential for growth — they had about $4.3 billion in revenue last year, and estimates are that US spending on just pet food and treats (which is presumably most of they sell, though they also handle pet prescription medications) was a little under $40 billion that year.

With people treating their pets like family, a trend that has been in place for a long time, and focusing even more on them in this pandemic (including a big boom in “pandemic puppies” being adopted by folks who suddenly have time for training and socializing a pup), I can see how this might be a compelling “trend” pick… and their spending per customer is pretty strong, at $357/year as of their last shareholder letter, so it’s worthwhile for them to spend heavily on marketing to acquire those customers and tempt them with “subscription” plans for pet food that make it easy to lock those “pet parents” in to a long relationship (according to that Fool article today, Chewy gets 2/3 of its revenue from those subscription/autoship sales — which could be hugely important as they grow). I’ve certainly seen plenty of Chewy boxes on porches around my neighborhood, though I confess that I’ve never yet been a customer (and yes, Gumshoe Castle is practically bursting with pets).

Not a bad idea, but, of course, it’s also a company that has to compete directly with giants like Amazon and Walmart, so you never know when a competition might further pressure their margins. I haven’t bought Chewy, but I’d color myself somewhat tempted. If they can inspire loyalty in their customers, it might be worth looking at — they seem to also have some leverage with manufacturers, because it looks like they’re selling a lot of their products to consumers before they’ve even paid their wholesalers (payables are very high, receivables almost nonexistent, and that autoship/renewal feature probably means they don’t need to hold a ton of unnecessary inventory), which certainly helps with cash flow in the short term. That’s somewhat reminiscent of what Amazon did in the 1990s when they were getting started, selling books and essentially having them shipped directly from the publisher, without holding a lot of inventory… and probably paying the publishers several weeks after the consumers had paid them, giving an unprofitable retailer some room to breathe.

And a reason for patience? Well, if I were Chewy management I would be raising a lot of money right now, to build a war chest at a strong valuation and let them further build the business without worrying about near-term profitability — so although they don’t technically need cash right now, I’d be a little surprised if they don’t do a substantial secondary offering at some point in the next few months. Of course, they could post a huge beat and raise quarter in September and pop the shares up another 40% before that happens, I certainly don’t have any certainty about what the near future holds for Chewy (or anyone else, for that matter).

So that’s all I’ve got for you today — according to the hints dropped by our readers, we’ve got two solid answers for you in Twilio and Stitch Fix… and a third that’s almost certainly wrong in Chewy, but strikes me as a decent thematic match for the “recent IPO, accelerating growth” that they’re talking about.

And that means I can now hand it back to you, dear readers — a few stocks for you to chew on, which one might you like? See great things in the future for any of these folks? Are those valuations keeping you scared away? Have other favorites you’d recommend as “IPO Trailblazers?” Let us know with a comment below.

Disclosure: Among the companies mentioned above, I own shares of and/or options on Amazon, Ansys, DocuSign, Fastly, Intuitive Surgical, Roku, Shopify, Stitch Fix and NVIDIA. I did just take a partial profit on DocuSign and on my Ansys call options this morning with small sales, but will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

I like the spreadsheet of companies that have a market cap above $25 billion and accompanying info. Thanks for your good work Thinkolator.

I’ve owned TWLO and CHWY for a while. I did own SFIX but was disappointed by their execution. I haven’t looked at it in a long time but I note that the stock has basically been flat for a long time despite their continued growth. So maybe it is more “grown into” the market value at this point. At first I figured nobody wants clothes anymore but if they do, they may prefer to have them shipped rather than shop for them. I’ll give it another look.

Hmm. What happened to the dividend.com article?

It seems to have happened to the last few articles. Usually comes up mid morning the next day.

Sorry about that, I guess early drafts are popping in for some reason. Will look into it.

It only happens once you log in.

If you look it is dated for tomorrow, Sep 3. For some reason the headers for the articles have been showing up a day early.

I did watch the new video presentation for it. The only free pick they gave out was for Fulgent(and sometimes their free pick for watching the presentation isn’t actually part of the services portfolio.) They did say that recent IPO was within 4 years time frame. There are already 49 recommendations in it and they dropped a few really vague hints for a 50th one being released this week. So you would need quite a bit of money to cover all of the recommendations and make the cost of the service worthwhile. This is what MF advises:

“How much capital do I need to take advantage of this offer?

The advisors working on Discovery: IPO Trailblazers recommend that participating members invest a minimum of $100,000 in the stocks within this service to take full advantage.

While members are always welcome to participate in our services with any amount they wish, our analysts generally recommend that the purchase amount of any Motley Fool subscription (and any additional investing expenses) amount to no more than 1 -2% of a member’s overall portfolio. It is also worth noting that the analysts who designed this strategy created it as an aggressive addition to a larger portfolio.”

Speaking of the “A” in the Motley Fool’s FAZER stocks, my guess is that APPN will be Tom’s new Stock Advisor pick tomorrow.

APPN has never been able to break out above $65. It’s failed the last 3 times it was within range. And now it’s sitting just below that price once again.

So the typical MF Stock Advisor Surge of 5-10% around 1:oo p.m. Eastern Time that happens after every recommendation just might propel APPN to break out above $65 tomorrow for the first time ever.

And that, of course, would make everyone at the Motley Fool extremely happy because they really seem to love APPN stock like you would love a pet or even a child. Then again, maybe it’s just me. But they seem to push APPN every chance they get. They’ve covered APPN in 6 free articles in the last month alone on their website, including one yesterday and one today.

No other stock service or analyst gives APPN this kind of attention.

Wow! A Motley Fool shocker! It wasn’t APPN or another recycled pick.

It was FVRR, a brand new recommendation in their Stock Advisor service. And with the Motley Fool Herd Surge that started around 1:00 p.m. EDT, FVRR was only down 0.38% at market close . . . which was 25.4% better than PagerDuty (PD) today.

Hilarious reading your comment on 12/4/2020. LOL. APPN has been up over $150 and you’re probably up 100%.

Have a little faith, my friend. 🙂

Happy APPN owner.

Travis if you have time, I would like to see a screen of stocks with a market cap of greater than $25 billion and negative EBITDA. If that returns too many results, bump up the market cap to $40 billion.

You can use a stock screener to accomplish this. A free and simple one is Yahoo Finance.

Forgot to convert that last column to percentages, so it doesn’t look as impressive as it is — Moderna should appear as 400%, etc.

Thanks Travis, that was quick! I created a watch list portfolio on Yahoo of the first set (24 stocks)and assigned an equal weight investment of $100K to each in order to determine performance. Will let you know how it goes. Poppy; I use Yahoo finance for my own portfolios. I wish it had a roll up feature for multiple accounts. I do that manually but you have to enter trades and cash adjustments twice. I didn’t know that it had a screening feature.

And the short candidates are those stocks that appear on both screens. That would be #DOCU, #RNG,#SHOP, #TEAM and #TWLO

Maybe so, but be careful — Shopify has looked like a reasonable short on valuation since it was just cracking $200 for the first time. Even if you’re right and stocks with these valuations have to fall someday, and you probably will be right, on average, Predicting WHEN the clock strikes midnight is the hard part.

What is the motet fool teaser next iPhone super cycle? I’m sick of paying them for their tips (although good). I paid $1000 for the 5G Next Gen and all stock picks were obvious and already blew up

That has usually been about OLED, they’ve been running essentially the same as for several years.

As someone that has used both Shopify is easier for users to get started but it’s a lot harder to make money (especially for beginners) than Etsy is…