The Motley Fool’s Market Pass service offered up a teaser pitch over the weekend about a new stock that is being recommended by Rich Greifner… here’s how the email got everyone excited:

“It’s less than 24 hours until the market opens, so I’ll get straight to the most exciting story I’ve ever shared in Investor Digest

“MICROCAP STOCK TARGETS 865X POTENTIAL”

What’s with this Market Pass service, you ask? It’s sort of a “best of” service, here’s how they describe it in the promo:

“Each year, the Market Pass team reviews all the picks in Stock Advisor and Rule Breakers…

“Picks what they believe to be the very best stocks – both individually, and as part of a team…

“Sprinkles in a few ETFs as needed…

“And designs what we consider the ‘ultimate portfolio.’

“It’s meant to be THE one-stop shop for investors looking to take advantage of what Rich and the Market Pass team believe to be the VERY BEST stocks in Stock Advisor and Rule Breakers to build a potentially market-beating portfolio.”

So mostly it’s trying to winnow out some winners from among the Fool’s most popular newsletters, and throw in some other stuff — including the “best small caps for 2021” special report that they’re pitching here, including that “865X Microcap” they hint at… and, of course, it’s a pricey offering, $999 a year with no refunds (the Fool’s “entry level” letters are often sold at $49/yr and typically offer free trials and easy refunds, but, like most publishers, they design their marketing funnel primarily to feed subscribers into much more expensive services that do not offer refunds).

What hints do we get about this latest microcap? Not much, here are the clues…

“… hasn’t been recommended anywhere else at The Motley Fool…”

“This stock’s market cap is under $250 million….

“This company made $19.5 million last year…in a fast-growing online market management believes will grow to an estimated $16.9 billion by 2025. Potential 865x growth?”

And they make some claims about the very profitable business…

“800% ROI per client. That’s right – for every dollar this company spends acquiring new clients, on average they make $8. That’s a simply massive reinvestment opportunity for the company to rapidly scale up in the coming months. (And that’s with this company already being the lowest-cost competitor in its market. If they raise prices, could that ROI grow to 1,000%+ per client?)”

So which little company are we being teased with here?

No definitive answer today, but the closest match we have from the Thinkolator is IZEA (IZEA), which is a small company that has gradually rolled up a bunch of online influencer marketing agencies and providers and software tools over the past 15 years.

How do we match? Well, IZEA had total revenue 19.4 million a year as of the third quarter of 2019, so as of the last quarterly update that would have been “last year.” That was before COVID began to really depress results (though it’s down to $17.6 million as of the most recent four quarters — and, to be fair, it had been flat-to-declining for a couple years pre-COVID), and it is an online “marketplace” model company — offering both a SaaS product in its marketing software and a marketplace in which social media influencers and brands can connect.

They have been gradually trying to improve the business by making it more of a SaaS platform and bringing on new customers, and the transition to SaaS can cause a decline in top-line revenue even if you’re not in a pandemic or recession, but their revenue is still mostly really from the “agency” business where they manage influencer campaigns directly for advertisers. Maybe this is IZEA’s time to shine, perhaps they’ve finally become a real business after a “failure to launch” decade, but that’s a qualitative assessment you’ll have to make for yourself.

Certainly investors are more enthused about the stock right now than they’ve been for a few years… and the stock has gotten some attention from other newsletter pundits (Luke Lango over at Investorplace submitted it as his top pick for 2021, for example, calling their new Shake marketplace platform a “game changer”). And, of course, it’s got a good following on Twitter, and there are certainly other folks who believe that the “influencer” marketplace will be huge, and that IZEA will be a leader in the market… all of which has helped drive the stock higher, up a few hundred percent in the last several weeks (which was met by a shelf filing to raise perhaps another $35 million by selling more shares — though that’s not necessarily imminent). The fact that the shares jumped 30% this morning is perhaps some confirmation that the Motley Fool was touting this particular name, but it could also just be other folks jumping to the same guesstimate as the Thinkolator. It doesn’t take much attention to make a small cap stock go bonkers.

"reveal" emails? If not,

just click here...

Will influencer marketing be with us forever? Kinda seems that way, regardless of how silly it seems to so many of us. And IZEA has consolidated a fair amount of that business, particularly among the “regular” consumer brands (they’re not a fashion/luxury group, think more “hiring some TikTok stars to do a dance about Campbell’s Soup”), with a good roster of clients and a solid-sounding business model (SaaS subscription fees for the platform, plus add-on service sales and a piece of all deals made in their marketplace).

My other hesitancy about calling this out as a match is that I don’t know if they are really generating an 800% ROI for their new customer acquisition, I haven’t seen that claim anywhere and it’s certainly not reflected in their financials (their “sales and marketing expense” has pretty consistently been in the range of 30-40% of revenues — meaning that each dollar of marketing spending, which presumably is largely customer acquisition, brings in about $3 in revenue, not $8 — and selling and marketing expenses have risen more than revenues every quarter for more than a year). I also have not seen a specific claim that they believe their “online market” will reach $16.9 billion by 2025, though that forecast is in the ballpark with what I’ve seen some other folks estimate for “influencer marketing” in general.

Here’s how IZEA describes their “core revenue streams”…

“Managed Services” is a project management business, they actually manage a campaign and pay the creators.

“Software licensing” is a high-margin SaaS business, licensing the use of their platforms (mostly IZEAx for self-managed programs and BrandGraph for data and reporting)

And “Marketplace fees”, which is probably self-explanatory — they host a marketplace for “influencers” and service providers (photographers, etc.), and collect 12-15% of any transaction that takes place on that platform. The latest version of this platform is called “Shake” and is available for everyone as a self-serve platform, which might finally help the business to get some scale, though listings are curated to some degree and they also have a legacy enterprise platform (IZEAx) that’s more closed, and it is indeed lower-cost than Fiverr (FVRR) in terms of marketplace transaction fees… whether it’s the “lowest cost” platform, I don’t know.

They have reported some customer wins recently, from the government (both military advertising and COVID “wear a mask” marketing) to some large consumer brands, and said that their managed service bookings, which tend to gradually hit actual revenues over 3-6 months, have surged in recent months (up 48% in the fourth quarter, helping 2020 to recover to 12% growth on the year after a terrible period during the pandemic shutdowns)… so that’s a sign of some hope for the next few quarters… but this is a wildly volatile one, the shares surged as much as 30% this morning, perhaps from that Motley Fool attention if this is indeed the stock being teased, and it’s well over $5…. pretty impressive, given that just a few months ago the company was worried about maintaining its Nasdaq compliance as the shares dipped below a dollar (and after there was a teensy bit of insider buying at 75 cents in November).

As a business, it sounds attractive in the abstract, particularly because of the large store of data they have about influencers and celebrities and social media campaigns and the possibility that they can turn that into a larger platform with their self-serve Shake business. Beyond that, well, you’ll have to make your own call — the numbers are not there yet, their SaaS revenue is less than $2 million a year as of last quarter and their managed services revenue is by far the biggest part of their business, so there’s no really obvious reason for it to trade at a “SaaS multiple” since it has none of that subscription stability, and they’re not currently growing so you have to have a little faith about growth resuming before committing to buy the shares at a “growth multiple.” Of course, everything that has a more obvious SaaS connection is already trading at 30X revenue, it seems, so perhaps you have to stretch a little to find such names in this market.

They do have a decent amount of cash, and after their shelf registration they’ll presumably be selling a bit more now that the stock is at multi-year highs, but the story is entirely about their optimism about their new products and recovery in enterprise influencer spending that could spur growth as those products gain traction or as the economy recovers — as of last quarter, they were getting some recovery in bookings but the actual financials showed decline, not growth, with marketing spending from their clients lower and their fees pressured, presumably due to competition.

While 2020 was a rough year, they did say the right things back in the summer about investing to try to lead in their sector, this is from the Q2 conference call:

“While others in our category might be struggling to survive for various reasons, we believe it’s the ideal time to focus on segment domination and scale. To that end, with the capital we’ve recently raised, we plan on deliberately increasing our cost basis and net loss over the coming quarters to promote investments in key areas around our business that we believe are long-term game changers, from hiring and launching our first ever wholly virtual professional selling program this fall to develop up and coming in-house sales talent to adopting a virtual first human capital stance across all company departments.”

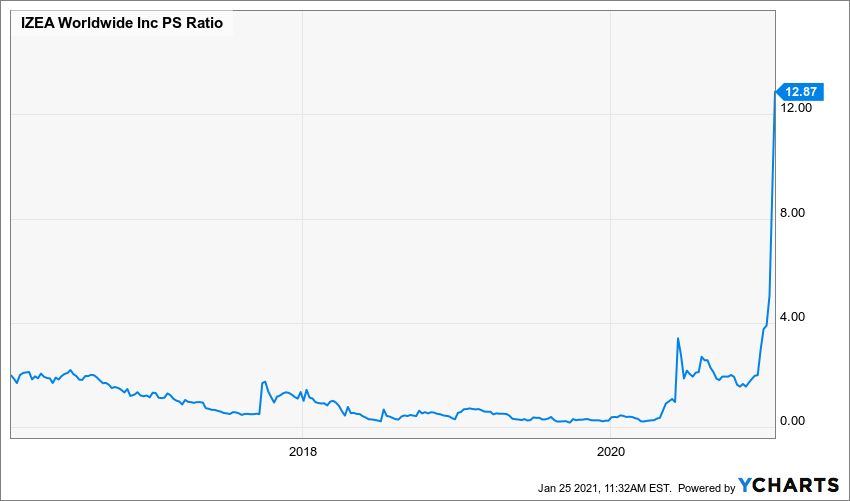

So I can see why you’d look at this one and find it interesting, but do note that the valuation is at a historic extreme — maybe it’s justified because of the improved product suite and the rollout of Shake, or just because the overall market is trading at such high multiples and people do love a SaaS/marketplace story, but the company has been around for quite some time and, as an investment, has generally been a disappointment so far (unless you bought in the past couple months), so part of your assessment, if buying shares, would have to be “ah, NOW things are finally lined up, and they’re about to get it right.” Here’s what revenue and the stock price have looked like over the past five years:

And here’s what the price/sales ratio has done over that time period, the amount investors have been willing to pay for each dollar of IZEA revenue:

So it’s certainly more popular, investors are optimistic, and the company thinks it is well positioned. Whether or not you agree, well, that will have to be your call — so read your tea leaves, dear readers, and tell us what you think the future holds for IZEA.

And, of course, feel free to chime in if you think there’s a better answer to that Motley Fool microcap tease… just use our happy little comment box below. Don’t worry, we don’t bite.

It looks like the market is expecting the earnings report due on March 11th to be good.

When a market maker puts a price target it’s to influence selling at that price. SLGG his 7.6 in after market trading so far, and we know how well small caps do when a catalyst is anticipated. Vol + earnings + big influencer could spell out a bigger move then just a 100% gain. PLL had a price target of 60 and went to 90 shortly after. These companies issue estimates for the purpose of influencing a stock. You just need to figure out what their agenda is. Maxam Group is a market maker.

Thank you

Just heard on Motley Fool Inflection Point Event that this is driverless or autonomous cars.

Another bleeder for the 100x/secret portfolios…Getting hard *diamond hands*.

One 100x can cover for many losers. But this one is definitely bleeding in the meantime. I still believe in it though. Have not sold any shares. Holding for at least 3 years.

Well, the bleeding is about to stop – permanently. SHSP board has agreed to buyout at $17.10, subject to SH approval. Sell or hold ?