The Motley Fool’s Market Pass service offered up a teaser pitch over the weekend about a new stock that is being recommended by Rich Greifner… here’s how the email got everyone excited:

“It’s less than 24 hours until the market opens, so I’ll get straight to the most exciting story I’ve ever shared in Investor Digest

“MICROCAP STOCK TARGETS 865X POTENTIAL”

What’s with this Market Pass service, you ask? It’s sort of a “best of” service, here’s how they describe it in the promo:

“Each year, the Market Pass team reviews all the picks in Stock Advisor and Rule Breakers…

“Picks what they believe to be the very best stocks – both individually, and as part of a team…

“Sprinkles in a few ETFs as needed…

“And designs what we consider the ‘ultimate portfolio.’

“It’s meant to be THE one-stop shop for investors looking to take advantage of what Rich and the Market Pass team believe to be the VERY BEST stocks in Stock Advisor and Rule Breakers to build a potentially market-beating portfolio.”

So mostly it’s trying to winnow out some winners from among the Fool’s most popular newsletters, and throw in some other stuff — including the “best small caps for 2021” special report that they’re pitching here, including that “865X Microcap” they hint at… and, of course, it’s a pricey offering, $999 a year with no refunds (the Fool’s “entry level” letters are often sold at $49/yr and typically offer free trials and easy refunds, but, like most publishers, they design their marketing funnel primarily to feed subscribers into much more expensive services that do not offer refunds).

What hints do we get about this latest microcap? Not much, here are the clues…

“… hasn’t been recommended anywhere else at The Motley Fool…”

“This stock’s market cap is under $250 million….

“This company made $19.5 million last year…in a fast-growing online market management believes will grow to an estimated $16.9 billion by 2025. Potential 865x growth?”

And they make some claims about the very profitable business…

“800% ROI per client. That’s right – for every dollar this company spends acquiring new clients, on average they make $8. That’s a simply massive reinvestment opportunity for the company to rapidly scale up in the coming months. (And that’s with this company already being the lowest-cost competitor in its market. If they raise prices, could that ROI grow to 1,000%+ per client?)”

So which little company are we being teased with here?

No definitive answer today, but the closest match we have from the Thinkolator is IZEA (IZEA), which is a small company that has gradually rolled up a bunch of online influencer marketing agencies and providers and software tools over the past 15 years.

How do we match? Well, IZEA had total revenue 19.4 million a year as of the third quarter of 2019, so as of the last quarterly update that would have been “last year.” That was before COVID began to really depress results (though it’s down to $17.6 million as of the most recent four quarters — and, to be fair, it had been flat-to-declining for a couple years pre-COVID), and it is an online “marketplace” model company — offering both a SaaS product in its marketing software and a marketplace in which social media influencers and brands can connect.

They have been gradually trying to improve the business by making it more of a SaaS platform and bringing on new customers, and the transition to SaaS can cause a decline in top-line revenue even if you’re not in a pandemic or recession, but their revenue is still mostly really from the “agency” business where they manage influencer campaigns directly for advertisers. Maybe this is IZEA’s time to shine, perhaps they’ve finally become a real business after a “failure to launch” decade, but that’s a qualitative assessment you’ll have to make for yourself.

Certainly investors are more enthused about the stock right now than they’ve been for a few years… and the stock has gotten some attention from other newsletter pundits (Luke Lango over at Investorplace submitted it as his top pick for 2021, for example, calling their new Shake marketplace platform a “game changer”). And, of course, it’s got a good following on Twitter, and there are certainly other folks who believe that the “influencer” marketplace will be huge, and that IZEA will be a leader in the market… all of which has helped drive the stock higher, up a few hundred percent in the last several weeks (which was met by a shelf filing to raise perhaps another $35 million by selling more shares — though that’s not necessarily imminent). The fact that the shares jumped 30% this morning is perhaps some confirmation that the Motley Fool was touting this particular name, but it could also just be other folks jumping to the same guesstimate as the Thinkolator. It doesn’t take much attention to make a small cap stock go bonkers.

"reveal" emails? If not,

just click here...

Will influencer marketing be with us forever? Kinda seems that way, regardless of how silly it seems to so many of us. And IZEA has consolidated a fair amount of that business, particularly among the “regular” consumer brands (they’re not a fashion/luxury group, think more “hiring some TikTok stars to do a dance about Campbell’s Soup”), with a good roster of clients and a solid-sounding business model (SaaS subscription fees for the platform, plus add-on service sales and a piece of all deals made in their marketplace).

My other hesitancy about calling this out as a match is that I don’t know if they are really generating an 800% ROI for their new customer acquisition, I haven’t seen that claim anywhere and it’s certainly not reflected in their financials (their “sales and marketing expense” has pretty consistently been in the range of 30-40% of revenues — meaning that each dollar of marketing spending, which presumably is largely customer acquisition, brings in about $3 in revenue, not $8 — and selling and marketing expenses have risen more than revenues every quarter for more than a year). I also have not seen a specific claim that they believe their “online market” will reach $16.9 billion by 2025, though that forecast is in the ballpark with what I’ve seen some other folks estimate for “influencer marketing” in general.

Here’s how IZEA describes their “core revenue streams”…

“Managed Services” is a project management business, they actually manage a campaign and pay the creators.

“Software licensing” is a high-margin SaaS business, licensing the use of their platforms (mostly IZEAx for self-managed programs and BrandGraph for data and reporting)

And “Marketplace fees”, which is probably self-explanatory — they host a marketplace for “influencers” and service providers (photographers, etc.), and collect 12-15% of any transaction that takes place on that platform. The latest version of this platform is called “Shake” and is available for everyone as a self-serve platform, which might finally help the business to get some scale, though listings are curated to some degree and they also have a legacy enterprise platform (IZEAx) that’s more closed, and it is indeed lower-cost than Fiverr (FVRR) in terms of marketplace transaction fees… whether it’s the “lowest cost” platform, I don’t know.

They have reported some customer wins recently, from the government (both military advertising and COVID “wear a mask” marketing) to some large consumer brands, and said that their managed service bookings, which tend to gradually hit actual revenues over 3-6 months, have surged in recent months (up 48% in the fourth quarter, helping 2020 to recover to 12% growth on the year after a terrible period during the pandemic shutdowns)… so that’s a sign of some hope for the next few quarters… but this is a wildly volatile one, the shares surged as much as 30% this morning, perhaps from that Motley Fool attention if this is indeed the stock being teased, and it’s well over $5…. pretty impressive, given that just a few months ago the company was worried about maintaining its Nasdaq compliance as the shares dipped below a dollar (and after there was a teensy bit of insider buying at 75 cents in November).

As a business, it sounds attractive in the abstract, particularly because of the large store of data they have about influencers and celebrities and social media campaigns and the possibility that they can turn that into a larger platform with their self-serve Shake business. Beyond that, well, you’ll have to make your own call — the numbers are not there yet, their SaaS revenue is less than $2 million a year as of last quarter and their managed services revenue is by far the biggest part of their business, so there’s no really obvious reason for it to trade at a “SaaS multiple” since it has none of that subscription stability, and they’re not currently growing so you have to have a little faith about growth resuming before committing to buy the shares at a “growth multiple.” Of course, everything that has a more obvious SaaS connection is already trading at 30X revenue, it seems, so perhaps you have to stretch a little to find such names in this market.

They do have a decent amount of cash, and after their shelf registration they’ll presumably be selling a bit more now that the stock is at multi-year highs, but the story is entirely about their optimism about their new products and recovery in enterprise influencer spending that could spur growth as those products gain traction or as the economy recovers — as of last quarter, they were getting some recovery in bookings but the actual financials showed decline, not growth, with marketing spending from their clients lower and their fees pressured, presumably due to competition.

While 2020 was a rough year, they did say the right things back in the summer about investing to try to lead in their sector, this is from the Q2 conference call:

“While others in our category might be struggling to survive for various reasons, we believe it’s the ideal time to focus on segment domination and scale. To that end, with the capital we’ve recently raised, we plan on deliberately increasing our cost basis and net loss over the coming quarters to promote investments in key areas around our business that we believe are long-term game changers, from hiring and launching our first ever wholly virtual professional selling program this fall to develop up and coming in-house sales talent to adopting a virtual first human capital stance across all company departments.”

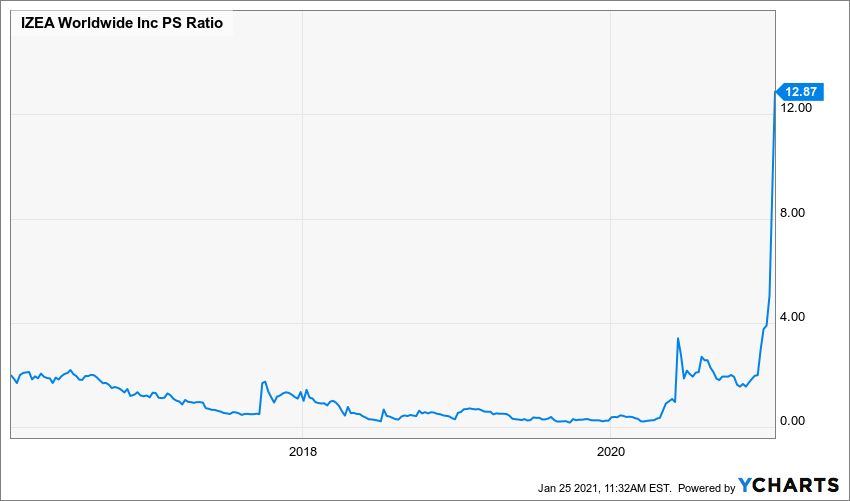

So I can see why you’d look at this one and find it interesting, but do note that the valuation is at a historic extreme — maybe it’s justified because of the improved product suite and the rollout of Shake, or just because the overall market is trading at such high multiples and people do love a SaaS/marketplace story, but the company has been around for quite some time and, as an investment, has generally been a disappointment so far (unless you bought in the past couple months), so part of your assessment, if buying shares, would have to be “ah, NOW things are finally lined up, and they’re about to get it right.” Here’s what revenue and the stock price have looked like over the past five years:

And here’s what the price/sales ratio has done over that time period, the amount investors have been willing to pay for each dollar of IZEA revenue:

So it’s certainly more popular, investors are optimistic, and the company thinks it is well positioned. Whether or not you agree, well, that will have to be your call — so read your tea leaves, dear readers, and tell us what you think the future holds for IZEA.

And, of course, feel free to chime in if you think there’s a better answer to that Motley Fool microcap tease… just use our happy little comment box below. Don’t worry, we don’t bite.

Pretty safe to assume that your IZEA sleuthing nailed it on the head. Just look at their chart for today. IZEA is up 50% overnight from yesterday’s stock price. That’s what almost always happens when Motley Fool comes out with a new recommendation. Their subscribers gobble it up on the first day like bees to honey.

I’m a subscriber, their latest recommendation is not IZEA. The pick is a new one, as a long time subscriber, they’ve never pitched this stock before.

I bought the service. The stock is SHSP. It is alot like Hubspot, which is another MF favorite. It is much smaller though. Other stocks in the MF 2021 small cap report from are as follows: API, BOMN, CWH, FLGT (which already doubled my money), INSP, MGNI, NCNO, and PAR. They are winners and will provide big returns over the next few years.

Wow, the stock surged 50% as of the post.

Would wait for it to drop from current rise of 51% as of today. Fool recommendation are crazy once publish stock sure to rise.

Thanks Travis! Great write up as always. I believe influencer are here to stay and are probably one of the best ways to reach the GenZ audience in todays crowded world. Another great company pretty similar, but with a gaming focus is EGLX/ENGMF. They have different platforms were they reach 300m users on a monthly basis. They want to become the social network for gaming, also working with the most popular gamers as influencers. You should check them out. It‘s quite impressive and they have received some stock love lately as well. https://www.enthusiastgaming.com/

Is this gaming company similar to SLGG? I have had some bad luck with that one.

Its certainly had a fool size pop today. I have both rule breakers and stock advisor and Izea isnt recommended in either of these. Maybe its in a more premium service.

They say that the stock is recommended by Market Pass, and has not ever been recommended by any other Fool service at this point.

My thought would be ZNGA

Definitely not a match for those clues, Zynga is huge in comparison ($11 billion market cap)

Zynga has previously been recommended by Motley Fool; I got into $ZNGA through a Motley Fool “5 Stocks Under $50” advert last July (it was the only one with <5% return six months later)

I bought the service. The stock is SHSP. It is alot like Hubspot, which is another MF favorite. It is much smaller though. Other stocks in the MF 2021 small cap report from are as follows: API, BOMN, CWH, FLGT (which already doubled my money), INSP, MGNI, NCNO, and PAR. They are winners and will provide big returns over the next few years.

Thanks Professor Cole for sharing. I’m especially keen on Ncino, I think banks are ripe for moving to more efficient cloud-based workflows, I like the focus on software for a specific industry. I bought on what turned out to be a market high, but I believe they’ll be a long-term win.

I started a small position in IZEA last month when it was one of the best pick 2021 stock from investorplace. There is no denying how powerful influential marketing is, they just launched a new platform for the influencers and the advertisers and I read really good reviews about the new platform. Got in at $1.84

Hi Nicepulkit, wow, your return is triple now. Congrats! Who in the InvestorPlace touted this stock?

IZEA was Luke Lango’s pick in Investor Place’s Best Stocks for 2021 Expert Contest. I, however, did not buy in. Darn it. Another low price stock on the list was Matt McCall’s pick OCX. Started the year at 2.39, closed today at 5.85.

Thank you!

Investor Place did a great job. OCX is certainly very interesting. Travis, at the current price, if you choose between IZEA and OCX to put money in, which one would you choose?

I cannot stand these people, constantly on you tube,

along with other companies, who try to get people us buy their stuff.

I bought from another company not too long ago,

Watch out ,

for ANGEL PUPLISHING!

They own or SELL pretty much all of these!

I be seen some being charged for over $1000 for their input, they say things like we would normally sell this for X amount of money,

you’re getting a deal today.

In my opinion you’re better off doing your own research,

reading about companies and not using these pretty close to scammers,

Who are making millions off of innocent people. I ordered something and learned nothing!

Then they want you to spend more money for more info. They might give you one or two stock Tickers!

They’re making so much money when you can get all the information you want to read and learn about from people on YouTube who are pretty good at what they’re doing, uncle Larry, Chris Sain they teach you

Amongst others,

these people are making so much money off of you guys buying their stuff,

Using money that you could be using to invest and make money!

I got a refund,

and it wasn’t very easy to get it either!!

so make please make sure if you do buy any of these publications that you use a credit card.

They promise A full refund on what They are giving,

so get your refund and stop giving money to them.

I’m new to trading I’ve only been doing it a Short time, I don’t buy expensive stocks that I can’t afford!

sometimes I buy fractional shares sometimes I buy penny stocks, and sometimes I buy shares in like NIO!

Companies that I know that will make money.

I’ve made my own mistakes by freaking out and seeing shares go down dramatically and then selling all, and then seeing a few days later seeing them surging.

So my advice to you or anyone who’s reading this, is to buy into what you think you like,

or what you have researched and think it’s a good Investment.

If I had started trading back in the crash in March last year,

I would be up so much money!

but I didn’t start until like October because I was scared,

I still am sometimes,

but I have not lost any of my initial outlay, I just usually buy and keep, and occasionally sell!

sometimes I still panic!

I originally invested around $35 to

$ 3800 and was up well over 6000 pre-market today,

then it went down.

I haven’t lost any money,

but I haven’t gained a lot of money either.

You should only invest in what you can afford to lose,

buying into the next best thing and buying a bunch of shares,

Then to lose all you have, can happen.

There’s one particular company, that has tanked really bad!

but I read about the company and it said in the future that they should be soaring eventually,

right now I’m at about $100

I’ve lost about 200,

but if you believe in a company stay with them,

when I first started I originally purchased , About 300 shares,

then I saw them going down and freaked out,

and now they’re up to $20 a share from like $4

Just be careful what you’re doing, and don’t buy these publications, because all you’re going to get in your email box is so much junk mail,

that I have,

that is driving me bonkers.

Don’t waste your money or your time on those out to make money from you, and give you very little in return

because that’s what they do, I am so, Fred w up hearing,

About the Motley fool, and David Gardner, and how they say if you had invested in this in the 80s or that in the 90s you would be a millionaire today. Well that’s the past and those big companies most f them are not within reach of people like me.

Like buying one share of Berkshire Hathaway, or Amazon etc..

they say buy low ,

and sell high,

but sometimes I don’t,

sometimes I buy and usually keep onto things that I think will get bigger eventually.

I would’ve had more money had I not sold those 200 shares,

when I knew this company would eventually make more.

So watch and learn.

don’t waste your money on these publications because all you’re doing is making them richer!

They don’t even need to buy stock anymore because you’re investing in them!

Invest in yourself!

not in some some company, who’s going to rob you blind, and give you no to no worthy information at all.

Start out buying penny stocks,

and go from there!

platform I’m using right now I’m kind of fed up with,

and I’m looking at another company but I’m not sure how to use it.

Because I invested in something small, and they canceled the shares that I try to invest in,

their response was that I tried to buy shares not in dollars which was not the case.

I didn’t lose anything anyway.

Just chill and be aware!

Hello My friend, next time can you please keep your comments short? Thank you!

I could agree with you more. I think we’ve all made the same mistakes that you did. That’s why we’re here. Thank you for this service! Your obervations about most being very close to scammers and selling your contact info is the most frustrating to me. Even ‘unscribing’ does ‘t help- it only gets your contact sold more so now I just bulk put them in the trash. We all live and learn.

Well said, my inbox is over 1,000 unread mails, my business mails are being lost in them, all because I subscribed to these publishers. The most helpful is Luke Largo and then Motley Fool, but stop with the junk mail, already!

Motley Fool Has a disclosure policy I checked on Rich Greifner stock portfolio and IZEA is Not in his portfolio that doesn’t mean it’s not IZEA Just means If that the stock he is pushing he’s not a buyer.When I hear one of the fools pitching a stock I like to check On there Portfolios Most of the time it’s in their portfolio if they’re pitching it and they really believe In it

MF just did a headline for “Why IZEA was soaring today….” The writer downplayed it heavily and closed with the regular closing;

Should you invest $1,000 in IZEA Worldwide, Inc. right now?

Before you consider IZEA Worldwide, Inc., you’ll want to hear this.

Investing legends and Motley Fool Co-founders David and Tom Gardner just revealed what they believe are the 10 best stocks for investors to buy right now… and IZEA Worldwide, Inc. wasn’t one of them.

Indeed, though that’s their standard boilerplate at the end of most articles.

Then according to David and Tom, what are the 10 best stocks?

The 10 best stocks in the default comment are the 10 stocks in their weekly recommendations in the basic subscription. (I subscribed a year ago)

IZEA is not the answer

Are you saying that because you know definitively, or as opinion? Just checking, thanks!

He is correct. It is not IZEA.

do let us know then. thank you!

That’s an awfully firm answer. So then… are you going to share what you feel it is?…. plz/ty

Guessing that satisfied paid Fool subscribers don’t want give up the info. I am one and IZEA has not been mentioned that I’ve seen.

A. That’s the dumbest thing I’ve heard. If you subscribe and bought the stock, then of course you want others to buy and drive price up!

B. Fool has so many services, so unless you subscribe to all you don’t know.

Re- wanting ‘others to buy and drive price up’:

I have long thought about that too. And conversely, thought that newsletter buyers may see it as a loyalty thing, to not leak the info. (Incidentally, this sounds reminiscent of those lower socio-economic folks, who sometimes do not vote in their own economic self-interest).

I’ve also speculated that the Foole might gradually degrade its high-end recommendations through their lower newsletters, so that more and more people will see and want to buy. Maybe what’s “high-end” about all this, is to get to see the recommendations FIRST. After that, trumpet them from the rooftops!

The cynical side of me thinks the same thing.

Good point!

I am a paid Fool subscriber (Cloud, Rule breakers) and I am happy to share.

please share

I have Stock Advisor and Rule breakers, would you mind sharing some stocks from cloud

IZEA up over 40% today regardless if it was the Motley Fool pick or not. Me thinks I’m not touching it after that kind of move.

Izea was recommending by Luke Lango on 21 December in his 10X as enormous ….

I recently joined stock gumshoe and want to tell you how appreciative i am about your hard work to help others to find out what stock this company is promoting. I cant understand why a company like the motley fool has to charge so much money and then refuse to return the money if a person is not happy with the service. Not everyone has so much money to buy advice and then afterwards have leftover money to buy the stocks advised. I love this website and soon i will become a paying subscriber. Thank you for all your help

Re newsletter prices:

My Granddad used to quote some one of the great Robber-Barrons of yesteryear, as saying “(they) charge what the market will bear!”

Perhaps one of the readers will remember who to attribute this to.

Is there any chance that it’s Paysign -Pays

Just had a look at the price action on this one and got to admit it’s another head scratcher. In early 2019 it went up when everything else was tanking and since gone down while everything else is going up. Thanks for your comment, I will do some dd.

Sure. That’s also a decent semi-match for the clues, though I found it a little less likely when I had to finalize a guess.

Has any newsletter recommended PAYS?

I’ve never written about a pitch for that one.

Paysign (PAYS) doesn’t meet the revenue criteria. It is at $32M in revenue.

I was about to buy TSIA but saw your email Travis. Bought IZEA instead at 6.72.

It seems that there is something very positive in the wind for this segment right now because I am enjoying a similar ride with ACUIF and it has a model much like IZEA but with a higher value. Good work Travis!

Along for the same ride. Read about it here when much cheaper and continued adding to the point I can just sit back and watch. Great fun, looking for another. Love this site. Thanks

yah, i wish i went YOLO on IZEA in december, the same way i went YOLO on ACUIF in June …lol

I was piecing SharpSpring SHSP into this puzzle.

Also a partial match. I did mention that one last

Month here, just FYI: https://www.stockgumshoe.com/2020/12/friday-file-adding-a-dividend-grower-getting-more-risk-averse/

I was very confused this morning when sharpspring popped. I don’t think I’ve ever seen it trade pre market and it was up 20+% at that point.

Izea doesn’t work on a subscription model, as mentioned in the teaser. Also, I would consider IZEA the next thing to a penny stock. Fools don’t go there. When you dig, you will see the 2025 19.6b market graphic. I did not find the 19.5 mil figure though. I think it was like 22mil.

Sorry, didn’t realize I put that as a reply to you dadpunchers. But yes, SharpSpring did have a nice little ride.

Do you know why sharpspring was up today? I picked it up based on someone’s recommendation on this site last November. It is essentially finding the next TTD trade. Sharp seems to have a bit better revenue track record than a few of these other stocks. Maybe they are all floating up together.

To find the next TTD you must go to Canada and buy AcuityAds (AT-TO). They are the next TTD. Their platform Illumin is already generating more revenue than expected.

It is $SHSP. I use Titanvest and got the notification that says motley fool suggested them.

Titanvest sends notifications of Motley Fool subscription suggestions? Or all kinds of notifications?

ED D Schmitt I’am thinking you are right with SHSP I’am member of SA and RB per motley Fool disclosure policy Rich Greifner Has SHSP in his portfolio and Tom Gardner believes in having skin in the game of stocks that analyst are pushing in there high paid subscriptions .

I am only an SA subscriber so don’t know if it’s really SHSP but I must say that it is much a more suitable pick for MF. They do not gamble on stocks just based on an idea, they usually give an explanation of why they think it is a good investment that includes a look at the numbers such as revenue and growth. They love growth. I checked out the SharpSpring investor presentation on their website and looking at the growth it is exactly the pattern they like. Constant proven growth YoY for many Qtrs/Years. I will keep my gambling money in IZEA because it still seems to me like an idea that can succeed but will probably add SHSP tomorrow morning to my portfolio.

This is what Jeremy Bowman says on MF today to explain the surge – The surge might then well be the result of 2 causes – that one plus recommendation

On a wacky day in the market, shares of IZEA Worldwide (NASDAQ: IZEA) were surging Monday as the company announced an at-the-market offering worth $35 million.

As of 2:24 p.m. EST, the stock was up 44%, an unusually large jump in the wake of news of a secondary stock offering.

So what

IZEA operates online marketplaces that connect content creators and influencers with brands looking for content, advertising, and promotion.

The stock has surged in recent weeks following the company’s November launch of online marketplace Shake — an easy-to-use platform for influencers to advertise sponsored Instagram posts and other such promotions.

That launch and business update featuring strong growth in its managed services segment have led investors to bid the stock up by more than 200% so far this year. IZEA said last month that bookings for the fourth quarter in managed services, its biggest segment, jumped 40% even as it experienced some headwinds from the pandemic. New customer counts also doubled from the third quarter to the fourth quarter.

Secondary stock offerings normally aren’t a reason for shareholders to celebrate, but investors seem to see this one as a smart way for IZEA to raise cash it can use to fund additional growth efforts, as well as a validation of the stock’s recent surge. The sale would dilute current shareholders by about 10%.

Now what

IZEA’s sudden surge is clearly turning heads as Monday’s jump indicates, but investors should be aware that historically, this company has been a poor performer, trading in the penny stock range for most of the last decade. In 2019, for example, the company’s revenue declined 6% to $19 million and it lost $7.3 million.

However, IZEA is still small, now at the bottom range of a small-cap stock , and if new products like Shake and its BrandGraph intelligence platform take off, the stock should have more room to run.

There’s a free piece on Motley Fool titled “Why IZEA Worldwide Stock Was Soaring Today” dated Jan 25, 2021. At the bottom there’s a statement that the author and The Motley Fool have no position in any stock mentioned.

I noticed that too. Also when a company is recommended they create a message board for that ticker and IZEA doesn’t have one. I’ll continue to check in the coming days.

Are you sure it’s not SharpSpring? SharpSpring was 240 million cap (before today), with similar 2019 revenue (around 19-20 million), and jumped 12-15% on Monday. Does digital marketing, like a much smaller niche version of Hubspot. I did some digging and came to SharpSpring so I was surprised you got IZEA! Let me know what you think.

Nope, as I said, not sure of this one at all.

Sharpspring and a few others are very similar on the few metrics given.

No message board for Sharpspring as of yet

The correct answer is sharp as a spring 😉

Nicely played, Ron – now THAT’s a sharp answer!

lol thanks for that but you know for fact?

SHSP. I bought it and that is what it is.

I have both Stock Advisor and Rule Breakers and it is not one of their recommendations yet. Or am I misunderstanding the post.

RB and SA can’t recommend microcaps, they’re both so huge they can barely recommend large cap stocks without jolting the share price. This pitch, whether for SHSP or IZEA or something else, is for their smaller (and pricier) Market Pass service.

Market Pass is a service that is sort of a best of SA and RB, it includes subs to them in the price. The teased stock is not even part of the regular Market Pass service but a special report on 9 small caps you get when you subscribe to Market Pass.

I first heard about this stock in Dec and could have bought it at $1.80.. Kinda kicking myself now but it had a history of poor performance so I passed. I do not think this is going to be the tease as their disclosure states they have no position in or recommend IZEA.. but they are crafty and they might not have put it out as a recommendation yet but plan on it in the next few weeks.

Unfortunately, Annalee123, that’s the story of my investing career, shoulda bought when – shouldn’t have sold then.