This is the intro to an ad that intrigued some Gumshoe readers yesterday:

“Imagine if you could have bought stock in Microsoft before computers took off. Or invested in Apple back in the 90s before the iPhone debuted.

“Big tech revolutions only come around every so often, and when they do, they could possibly mint the next generation of wealth.

“Yesterday, we shared with you one industry we think has the potential to do this in the 2020s— Virtual and augmented reality. One market research company predicts this industry will 10X in market size in the next 5 or so years.”

And of course, they have the “small company” that they believe will be the big winner in that space.

So who is it?

These are the clues we receive:

“… the company we’re talking about is 365X smaller than Apple….

“this small company only needs to become a $60 billion company to 10X.”

So that means, “market cap somewhere near $6 billion.”

What else?

“Apple recently invested over $400 million from its advanced manufacturing fund in this company — because they make critical components for Virtual and Augmented reality.”

That’s in the email ad’s subject line, too, specifying that it was $410 million.

And that’s it, those are the clues.

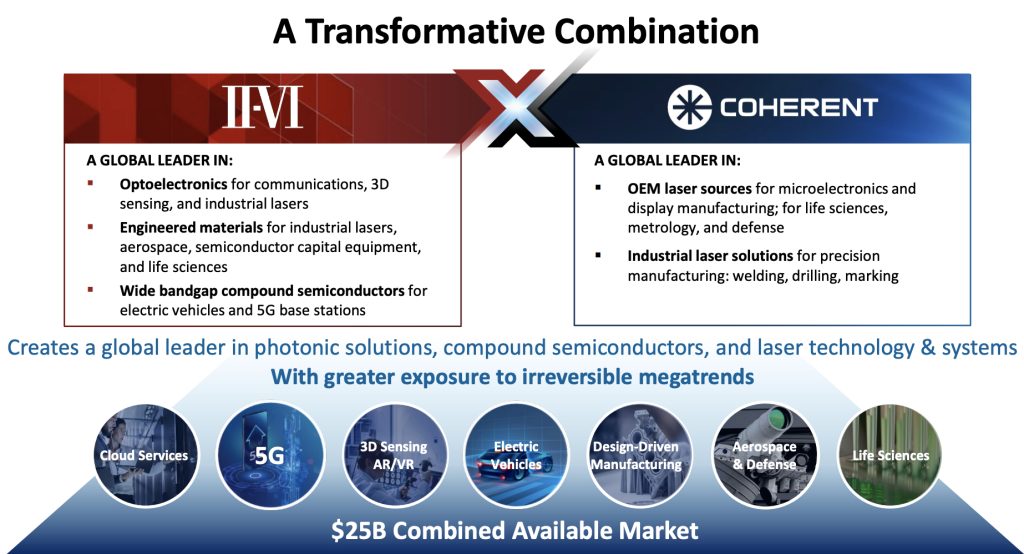

So who’s our “secret small company” here? This is almost certainly Coherent (COHR), a vertically integrated manufacturer in materials, networking and lasers… and the result of several large acquisitions in lasers and photonics over the years. The core of the company was formerly called II-VI (IIVI), but they took the Coherent name when they acquired that company last Summer. This is a slide from the announcement of that deal back in March of 2021, to give you an idea of the businesses they’re in:

There is some “augmented reality” connection, though you’d be hard-pressed to say that’s the most important part of the business. It’s true that augmented reality and virtual reality will create more demand for bandwidth and data transfer in general, which is good for optical equipment suppliers to data centers and telecom companies, but the more direct connection is from 3D sensing, the little laser chips in your phone that let it read the contours of your face for Face ID, and the outward-facing laser scanners that can help map a room for an augmented reality experience. Those are real products, they are growing in demand now that they’re ubiquitous in phones and in augmented reality devices, and Coherent and competitor Lumentum (LITE) are the most likely suppliers for consumer products in those areas.

That Apple connection we’re teased about? II-VI acquired Finisar back in 2019, which was an Apple supplier… and before II-VI changed its name to Coherent, it did indeed get a $410 million award from Apple’s Advanced Manufacturing Fund (that was back in the Spring of 2021, though they also got a similar award several years before that) — here’s what Apple noted in its press release at the time:

“II-VI manufactures vertical-cavity surface-emitting lasers (VCSELs) that help power Face ID, Memoji, Animoji, and Portrait mode selfies. Apple also works with II-VI to manufacture lasers used in the LiDAR Scanner — technology that helps deliver faster, more realistic augmented reality experiences and improves autofocus in low-light scenes in photos and videos.”

If you’re interested in the business of lasers and communications equipment, Coherent actually has an unusually readable and interesting 10-K (that’s the official SEC name for “Annual Report,” I use 10-K in hopes that you’ll think I’m extra smart). They go further than most companies in really describing their product lines and outlining who their customers and competitors are — and there are a lot of big names on that “representative customers” list, including ASML, Ford, Lockheed Martin, Infineon, Alibaba, Cisco, Corning, and many more. Unlike a lot of suppliers who depend on Apple, they are not just selling parts into consumer electronics, and they are not overly dependent on Apple (as of last Summer, they say that “A small number of customers have consistently accounted for a significant portion of our revenues, although none individually represent greater than 10% of total revenues.”)

It’s been a wild few years for the companies who specialize in lasers and photonics, including the laser systems that make fiber-optic communications work. Parts of the business have looked like an oligopoly for a long time, with companies like II-VI, Lumentum, Finisar and IPG Photonics… but now II-VI has acquired Coherent and Finisar, (and taken Coherent’s name going forward), and Lumentum has acquired Neophotonics and the telecom products division from IPG Photonics. Suddently, Coherent is the leading player, and the business is probably getting more oligopolistic… which tends to be good for investors, if not customers.

The cost of all that empire building in the sector is debt, they paid a stiff price for Finisar in 2019, and borrowed more heavily to acquire Coherent, so the “new Coherent” is now sitting on over $4 billion in net debt and a pretty big chunk of new preferred shares (mostly sold to Bain Capital to finance the deal). The good news? It looks like those preferred shares are convertible at $85/share, which was pretty close to the average analyst target price last summer when the deal was finalized, and COHR has fallen to about $42. The Coherent deal came after a bidding war with Lumentum that II-VI won on March 25, 2021, back when the market was still at the “giddy” stage, so they probably overpaid, and it may not exactly feel like a victory today — the shares were down about 50% from that level at the end of 2022, though they have bounced back with the tech/semiconductor market in early 2023, so they’re currently down 36% since the deal was announced.

"reveal" emails? If not,

just click here...

And in the six months since the Coherent deal was finalized, the business is improving, and paying down debt… though it’s early. They just reported their second quarter as a combined company this morning, announcing that they posted organic revenue growth of 23%, and, thanks to the acquisition, grew their top-line revenue and their backlog by about 70% (and retired $133 million of that debt).

The merger/acquisition is going to make their GAAP numbers look pretty messy for a while (amortization, transaction costs, and restructuring costs can’t be ignored in GAAP, even if they’re net positives in the longer term), but they report their non-GAAP adjusted earnings per share as being 95 cents this quarter, so that’s a little better than analysts had been hoping… though who knows whether COHR and the analysts are using the same adjustments.

They say the integration is working well, with $30 million in “synergies” achieved from the merger, halfway to their target of $65 million (they’re also halfway through their fiscal year)… and that they expect adjusted earnings per share of between 75-90 cents during this current quarter (their fiscal third quarter ending in March, what the rest of us think of as the first quarter). That’s just about what analysts had penciled in (83 cents was the average estimate), so the stock didn’t react particularly violently… it was down a little bit yesterday, but not much more than the Nasdaq 100 was down.

Coherent is a supplier to telecommunications companies, aerospace, automotive and other manufacturing, semiconductor foundries, and lots of other cyclical businesses, in addition to being an Apple supplier, so they are almost certain to have a cyclical business themselves… though the diversification across industries should help, as should the fact that they sell into businesses that have different cycles. Selling everything from small chips for consumer products to advanced industrial lasers provides some different waves of business (“cyclical” is just a term we use to say a company’s revenues tend to ride with the economic cycle, going up when the economy is growing and down when the economy is shrinking).

I followed IIVI off and on for a long time, and owned a small position for a while (I was stopped out of that during the COVID downturn in early 2020, which was a mistake — it soared on investors enthusiasm for all “picks and shovels” tech plays in 2021), so I can see myself actually getting interested in this one again, now that it’s mired in the costs of an acquisition that they probably overpaid for and looks a little messy… and, importantly, now that we can argue, with a straight face, that the stock is cheap.

The debt is a little challenging, but it should be manageable — right now the $4.4 billion of debt and the $2 billion in preferred shares are costing them about $400 million/yr. (interest payments and preferred dividends), and they can easily cover that with their $1.5 billion or so of EBITDA.

It’s not easy to be highly confident, thanks to the potential fragility introduced by their debt and mezzanine equity from these big acquisitions, but in exchange for living with that, you get to buy a strong and growing company that’s well-positioned for a lot of pretty solid technological and industrial trends, and has more pricing power and a more diversified product offering thanks to the Finisar and Coherent/IIVI deals of the past few years… and you only have to pay about 10X adjusted earnings (analysts think they’ll earn $4.50 in adjusted EPS next fiscal year, starting in July, and that doesn’t seem overly optimistic — it would be in line with the $2 they earned in the last six months).

So I’m getting a bit tempted by COHR again, even if I am also tempted to keep calling it IIVI.

There is a publicly traded preferred share if you’d like a somewhat more complicated way to play COHR shares with a little bit of a different risk/reward setup — those are not the $1.8 billion of Series B convertibles that Bain bought to finance the Coherent deal, but an older tranche, the Mandatory Convertible Preferred Series A (ticker IIVIP), that was used to refinance some of the debt from the Finisar deal a few years earlier. IIVIP trades at $187 right now, and should pay a $3 dividend on April 1, then convert on July 1 to shares of COHR. The key to whether this is worthwhile, then, is the conversion rate — this is how QuantumOnline describes it:

The conversion settlement rate will be 3.8760 shares per unit if the then current market price is equal to or greater than $51.5996 and 4.6512 shares per unit if the market price is equal to or less than $42.9997. For market prices between those values the settlement rate will be $200 divided by the market value.

So here’s some math: If the shares of Coherent do very well from here, and go to, say, $55 in June, then the IIVIP preferreds will convert to 3.876 shares of COHR. That would mean each IIVIP is worth $213.18, plus the $3 dividend, so that’s a gain of 15-16% from the $187 that you paid. Buying just COHR would work out much better, it’s at $42 right now so $55 would represent a 31% gain.

If the shares of COHR keep falling, and drop back to their November lows (about $30), then that would be a 29% loss for COHR shares. For IIVIP, $187 would turn into $142.50 (including the dividend), a loss of about 24%. Cushions the blow a little.

If they’re somewhere in the middle of that range in June and close to where we are now, let’s say $45, then the IIVIP shareholders would get 4.44 shares, roughly $200, plus the $3 dividend, and that would be a gain of 8.5%. A little better than the 7% gain for the stock, mostly because of that dividend.

If you think COHR shares will keep falling into June, then the preferreds are a little safer, you’ll still lose but you’re likely to lose a little less than common shareholders. If you think COHR will do well or even be steady, the shares will work out a little better than those Series A Preferreds.

And, of course, if you think they’ll keep falling, why buy the shares today at all? Maybe you can get them cheaper, later, or buy over time to average it out.

I expect the Bain Series-B preferreds (which are not publicly traded) might be at risk of losing money unless there’s some meaningful improvement in COHR shares in the next few years, I don’t know what the redemption terms are but the conversion price is high, so that may result in a major shareholder putting pressure on the board to realize more efficiencies from this deal and start to goose growth again (Bain’s Series B preferreds do get a shareholder vote, unlike some). That could provide a little extra tailwind, assuming that investment in semiconductors and in industrial and communication laser systems remains relatively strong. If the economy gets really ugly and industrial capital investment pulls way back, of course, it could be a very different story.

Coherent carries quite a bit of debt, but it does not appear to be worrying bond investors. The most liquid IIVI bond I found is maturing in 2029 and has a 5% coupon, and it has a “non-investment grade” rating (B+ from S&P, B1 from Moody’s), but it’s not really a “high yield” bond — investors are still buying it with a yield of 6.4%, which indicates to me that COHR will get reasonable terms when they need to refinance their debt. They’re a levered company, thanks to two big acquisitions, but those companies were both nicely profitable when they bought them, they can pay the debt service, and unlike some, they don’t seem dependent on free money.

So we’ve got an interesting valuation here, even cheaper than a lot of the big semiconductor capital equipment names that they’re sometimes lumped in with, and we are still quite early in the transition to next-generation fiber-optic communications both for longer-distance data transmission and for speeding up data centers themselves… I can’t say that I know what the investment outlook looks like on the industrial side, but when it comes to communications and semiconductor capital investment we should be in a pretty strong growth trend, pushed both by onshoring/reshoring (taking back some of the supply chain from China) and by ramped-up investment in digital infrastructure (both to meet rising demand, and to put the massive infrastructure spending incentives from world governments to work).

On the other hand, Lumentum, their closest competitor, is also pretty cheap (about 11X forward earnings, with a slightly better balance sheet). I’d probably give the edge to Coherent, which is now substantially larger and more diversified… but if we happen upon a debt crisis in the next year or two, LITE might end up getting through it more cleanly.

Color me tempted by Coherent, but I haven’t bought shares. I’ll keep researching, and will let the Irregulars know if COHR makes it back into the Real Money Portfolio.

That’s just what I’m doing with my money, though — with your money, you get to make the call. Whaddya think? Ready to bet on a company that’s pushing through its second major acquisition in four years? Think they’ve risked too much or overpaid to build? Let us know with a comment below.

Nice article but APPL is not my speed. I am very interested in the speel for the Electric Axle by A ngel crowd. Could you sleuth this out. Thanks….

Any comments on Graphene manufacture and battery use??

An interesting speculation. I like the fact that it’s a pick and shovels play. Someone has to provide the hardware to make VR a reality; but I think the other markets for their products will pay off far more than VR. At 10x earnings the stock is just one multiple above the average traditional market value. Maybe worth dipping a toe in if it drops another 10%?

BofA, Morgan Stanley and CFRA all have “buys” on COHR, with debt load being the only yellow flag. The fact that the MF folks also like it, worries me a bit.

Why does it worry you?

superbonds