[/irregular]Yesterday I wrote to you about the Motley Fool Canada’s “death of Twitter” tease, in which they were pushing a small web publisher as a competitor who could benefit from ad weakness at Twitter (now X) and Meta… and today, down here on our side of the border, the Foolies are using the same basic spiel… to pitch a completely different company.

Don’t worry, this will be a quickie. Here’s the headline of recent ads for Motley Fool Stock Advisor…

“Elon Musk’s “cage match” challenge to Mark Zuckerberg is a smoke-screen for the real contest.

“Control of a $200+ billion social media ad industry. Discover who we think will win now.

“Get Our Top Advertising Stock”

Those who’ve been aboard the good ship Gumshoe for a few years might have a quick knee-jerk answer to that “Fool’s favorite advertising stock” … and I bet you’ll be right… but let’s see what clues they drop:

“Meta’s ad revenue, the company’s financial backbone, slipped by 4% in Q4 of 2022. And Twitter? Its U.S. advertising revenue nosedived 59% within just five weeks in April to May, as reported by The New York Times.

“This is largely due to something called ‘walled gardens.’ Essentially each company controls all user data within their platforms. This approach limits transparency for advertisers, restricts campaign integration across platforms, and curtails innovation. It also raises some privacy concerns that have seen many users leaving.”

I don’t know about that… yes, the “walled gardens” of Meta and Alphabet are a challenge, but that wasn’t the reason that ad revenue was weak in the fourth quarter. After all, ad revenue has actually started to bounce back pretty nicely in the last couple quarters, at least for the leading companies (not so much for Snap, or perhaps Twitter/X, but for Google and Facebook and Instagram), and it’s not like those “walled gardens” changed policies in the last six months.

But anyway… back to the ad:

“… you don’t need to pick a side in this Billionaire Brawl.

“There’s a third company emerging like a sunflower from the limited environment of walled gardens. This rising star is embracing the open internet, providing more precise, targeted ad solutions. And it’s setting a new paradigm even in the face of industry turbulence.

“While Meta and Twitter have seen advertising declines in the last year, this company saw YoY revenue growth of 21% in the first quarter of 2023. In fact, it already has its foot in the door of over 90 million households and growing. And this has garnered the attention of some deep-pocket investors, including Vanguard, Blackrock, JP Morgan, and T. Rowe Price.”

And they also say that this company has a 95% customer retention rate, and is “still under $100.”

So what’s the story? This is, sez the Thinkolator, yet another tease of The Trade Desk (TTD), which has been one of Motley Fool Stock Advisor’s most-teased stocks for years (it often gets pitched as a “double down” stock or an “all-in buy”, often because of their exposure to high growth in streaming video ads). Trade Desk CEO Jeff Green loves using that “walled gardens” term, mostly in reference to the controlled ad/content networks owned by Alphabet and Meta which continue to dominate global advertising spending.

If you don’t know the company, TTD is the leading buy-side platform for advertisers — that means they aggregate data and provide access to inventory, and have automated systems that help advertisers place their brands in the best places, at the best price. Their customers are all on the “buy” side, so they aren’t conflicted (unlike Alphabet, for example, which both operates a buy-side system and owns most of the inventory), and they’re by far the biggest company of their kind. If you’d like the narrative from the horse’s mouth, Patrick O’Shaughnessy did a great interview with CEO Jeff Green back in February that’s worth a listen… but in brief, here’s how they describe themselves:

“The Trade Desk™ is a technology company that empowers buyers of advertising. Through its self-service, cloud-based platform, ad buyers can create, manage, and optimize digital advertising campaigns across ad formats and devices. Integrations with major data, inventory, and publisher partners ensure maximum reach and decisioning capabilities, and enterprise APIs enable custom development on top of the platform”

And yes, TTD did post 21% earnings growth in the first quarter… though their expenses also rose more rapidly than revenue, so it wasn’t a great quarter overall, and 21% was actually their lowest year-over-year growth rate ever (well, with the exception of the second quarter of 2020, when ad budgets were slashed as the world closed down — that quarter they actually posted falling revenue, though it bounced back almost immediately). Still, that quarter was better than feared, and gave some hope about the recovery of the ad market in general after a weak fourth quarter. The estimate for the next quarter, which should be reported in about two weeks, is for 20% revenue growth and 29% (adjusted) earnings growth.

The stock, though, has been off to the races this year, rising far more dramatically than their earnings or revenue. In fact, just since that last earnings report, in early May, TTD is up by almost 30%… and at the peak a couple weeks ago, when investors got a little extra excited because TTD was about to be added to the Nasdaq 100 Index, the shares were up 100% year to date, rising almost as wildly as some of the AI names.

The Trade Desk is usually a volatile stock around earnings, so pretty much anything could happen in August, but you can find support for either an optimistic or pessimistic view among analysts — with the pessimism usually related to their valuation, and the optimism driven by their position as the largest buy-side ad platform, with particular strength in retail-focused advertising, including travel, and in streaming video, and with a massive addressable market that makes dramatic market share growth from here still quite feasible.

Here’s a recent upgrade note from Needham, as excerpted by Briefing.com:

The Trade Desk target raised to $100 at Needham on scale & tech stack (82.07)

Needham raises their TTD tgt to $100 from $80. Analyst Laura Martin said, “Qualitatively, we raise our PT for TTD because: 1. We believe that Generative AI most benefits companies that control global data and also have high-quality, tech-first FTEs. Within our media coverage, this implies that FAANGs win most, followed by the largest AdTech company we cover- TTD. 2. TTD has been growing its revs >20%/year, and we expect this to continue through 2025, despite macro ad weakness. 3. TTD’s FCF and ROIC have been improving. For example, TTD’s EBITDA margins have expanded by 1,000 basis points, from 32% in 2019 (pre-COVID) to 42% in 2022. 4. TTD’s pace of introducing new platforms and products has been rapid, launching a new platform every 2 years (eg, Solimar, Kokai) and new product lines (Retail Media Nets, OpenPath.) every year. 5. No acquisitions, so 100% of TTD’s y/y growth is organic.”Are you getting our free Daily Update

"reveal" emails? If not,

just click here...

And at the same time, the stock was downgraded in recent weeks to “sell” by Redburn ($34 target) and New Street ($69 target)… I haven’t seen those notes, but I suspect their reluctance is valuation-based, and it’s very understandable.

And what do I think? I think The Trade Desk is a great company, but I’d have a hard time paying more than $60 per share to buy it… at $80+, it’s priced for continued excellence and it wouldn’t take much of a “weak quarter” to drop the stock by 20% or more overnight.

I’ve owned The Trade Desk since October of 2017, and actually first bought the stock after researching it because of a Motley Fool teaser pitch — so yes, they’ve been riding this one, successfully, for a long time, and TTD is a “10-bagger” teaser pick, it’s now up more than 1,000% since it was first teased (it was around $6 at the time, split-adjusted). I’ve taken a lot of profits along the way, but it’s still a large position for me — I last went into detail on TTD as part of a Friday File last month (“Expensive Stocks: How Worried Should We Be?”), so I’ll just share an excerpt from that with you today… the numbers haven’t changed that much in a month (TTD is now a $41 billion company, not $37 billion, but other than that we don’t have any new data):

6/30/23: “… with everyone in Hollywood still very committed to streaming, as cable cord-cutting continues, it’s starting to look like TTD CEO Jeff Green was right: There are millions of people who aren’t going to be willing to pay full freight for all this content, the content will have to be subsidized by advertisers. And though the ad market is a little less steady than it was a couple years ago, it does seem like buying ads on premium streaming content is a big focus of most major advertisers.

TTD also introduced the latest update of its ad-buying software recently, called Kokai… and no, it’s not a coincidence that “AI” happens to be part of that name, they’ve been using some variety of machine learning and automation to help advertisers do their media buying for years, including with their previous software platform (Koa), but they do say that AI is playing a larger role in that now. We’ll see if it helps TTD continue to attract a growing stream of ad dollars, but so far that has certainly been the trend. I’ve seen the Motley Fool touting TTD as an “AI” stock these days, just to ride on that momentum, though I wouldn’t get overly excited about it at the moment.

When does the valuation get absurd for The Trade Desk? Well, absent some broader re-rating of technology growth stocks in general, or of companies that are attached to the advertising industry, that probably depends on when the growth slows down and they disappoint (I guess it’s “if,” but they’ve hit “disappointment” periods before, and gravity tends to reassert itself eventually, so I think we’re safe in saying “when”). The valuation is, well, foolish at TTD right now, they’re valued at more than 500X GAAP earnings. But that doesn’t mean the stock is going to collapse tomorrow… they were at 1,000X earnings about ten months ago, at their previous peak in August of 2022, and the stock has held its own since then, roughly matching the total return of the S&P 500 — it did fall 50% along the way, to be fair, into the ad market despair of November, so you did have to live with quite a bit of volatility to get through to today’s “OK” end result for that period of time. It’s a very high quality company… it’s just not a very profitable company right now, partly because they’re still very ambitious and see huge growth potential, particularly as streaming video ads really go mainstream and take share from the traditional TV ad market much more quickly than most people expected.

This one will give you heartburn, for sure, even if you ignore the 2020-2021 mania (the shares were as high as about $110 in late 2021, though the company was also much more profitable then — the trailing PE at the time was barely 300, he says with a straight face). If you don’t want to ride that tornado, I don’t blame you, but it’s a good reminder of how exceptional a company can be if it combines proven profitability, growing and leading market share in a key sector that itself is growing, and a relatively small size (relative to the size of the addressable market). The only thing that has so far been lacking for TTD is the ability to scale their profitability — as primarily a data and software provider they should be able to meaningfully grow their margins over time, the business ought to be inherently scalable, but it hasn’t happened. They have maintained their very high gross margins (over 80% most of the time), but other than the windfall of late 2020 they’ve been spending so much that their actual net profit margins have declined pretty markedly over time (from 9-11% at IPO time in 2016, to the mid-teens in 2019, and now the net profit margin is under 5%). That got much worse when they were overspending and the ad market went into a bit of turmoil last year, so it might well be that they recover from that margin compression fairly quickly, but it’s been moving in the wrong direction of late.

Just imagine what they could do if those profit margins came back to their 2019 levels of about 16% — with about $1.9 billion of revenue likely this year, that would be net income of over $300 million.

Oh, crap, the market cap is something like $37 billion now… so that would mean we’re still paying well over 100X earnings.

Jeez, I guess investors are expecting margins to come back, and the revenue to keep growing quickly.

And to be fair, they probably will. The company keeps moving forward and announcing great partnerships (the Warner streaming platforms signed on to use UID2, their cookie replacement, just recently)… but boy, I can’t help but admit that things are looking pricey. At this kind of valuation, you’re always walking a bit of a tightrope….

What keeps me sane, as a TTD shareholder, is that The Trade Desk has a much more consistent business than some other highfliers like NVIDIA, with revenue and profits that are generally a lot smoother and more predictable. Predictability is valuable.

Still, TTD needs to continue their recent trend of getting a little bit more disciplined with the stock issuance. That “100X hypothetical earnings” number I threw together above, assuming a return to past profit margins, is from using GAAP earnings, not their preferred adjusted earnings (the 2024 estimate from analysts is that TTD will earn $1.48 per share, adjusted… but just 63 cents under GAAP accounting, so if you pretend that paying employees in shares is free they’re trading at about 50X next year’s earnings… if you think it should be accounted for the same way paying them in cash would be, it’s 125X).

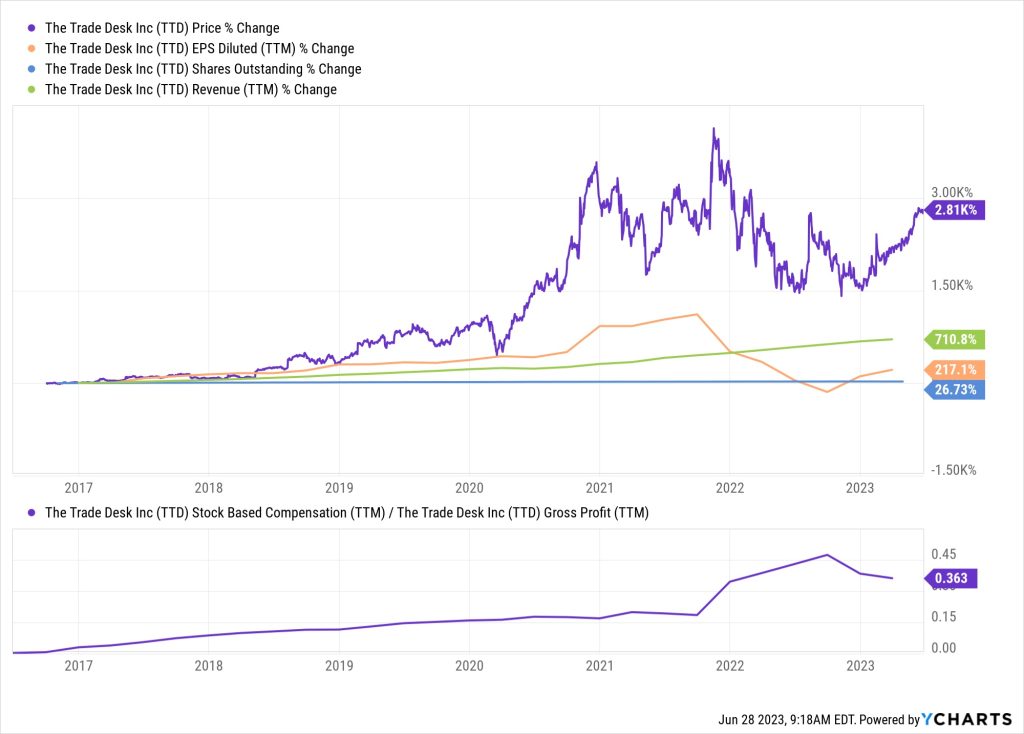

TTD got to be one of the worst offenders of the stock-based compensation excess during the pandemic, at the high point their stock-based compensation reached 43% of their gross profit. Even they knew that was nutty, and it was partially caused by the stock price craziness during 2021, but I find it at least slightly reassuring that the number has been coming back down — this is what that looks like on a chart, the bottom is stock based compensation for the trailing year as a percentage of the company’s gross profit, since the IPO, and the top shows the growth in trailing annual GAAP earnings per share (orange), the number of shares outstanding (blue) and the price performance (purple). TTD has grown, but it also trades at a dramatically richer multiple than it did in the past, when it was growing faster, and it hasn’t gotten more efficient or more profitable. And the employees have been more amply rewarded than the shareholders, as a group — maybe that’s justified, but it’s not necessarily what shareholders want to see.

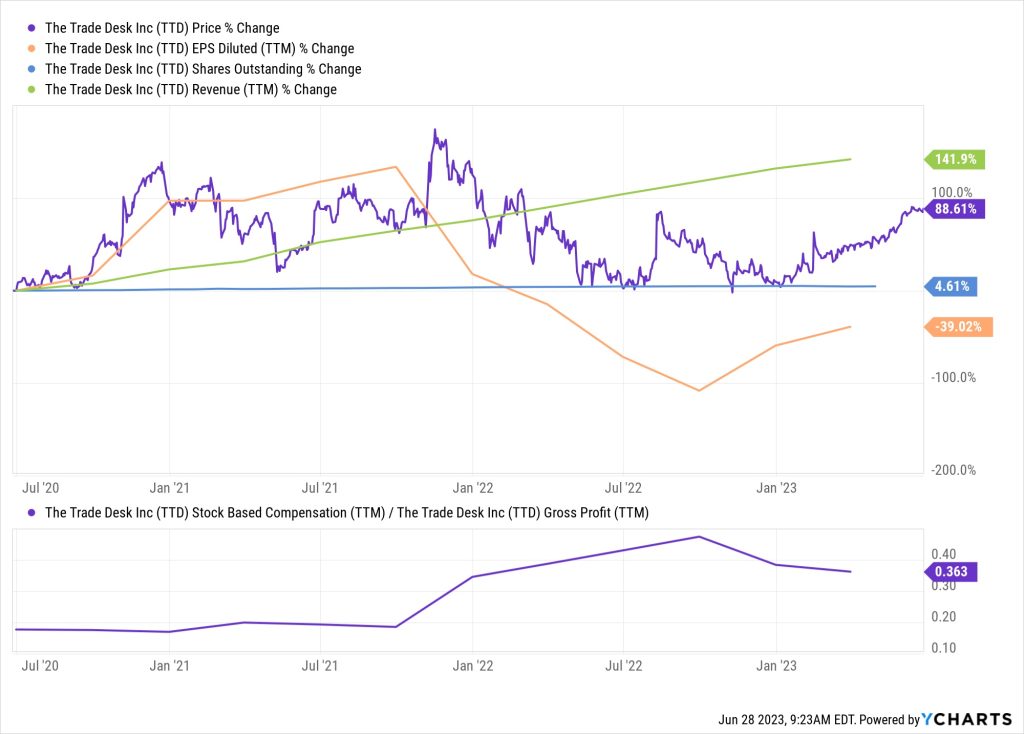

That really incorporates the initial surge that TTD made from the IPO into the 2019 highs, though, which emphasizes that share price growth from a low starting point. Here’s what the same chart looks like over just the past three years — at least revenue growth is outpacing share price growth, even though the GAAP earnings have disappointed and the weight of stock-based compensation has roughly doubled.

The last couple quarters indicate to me that TTD management is moving in the right direction, gradually, on cutting costs and establishing some discipline after the wild surge of 2021… but they certainly need to keep the growth going to keep investors happy with this valuation…. They ought to report in the second week of August.

My opinion hasn’t changed… I still think TTD is a great company that’s too rich to buy these days, but I also haven’t sold any shares in the past couple years. Re-recommending it certainly fits with the Motley Fool ethos of “double down on your winners”, and that can keep working for a long time if companies continue to post strong “beat and raise” quarters that keep investors enthused. Alphabet’s solid report yesterday offers a bit of reassurance that ad revenue is continuing to grow, in general, so that’s one good sign for TTD’s results when they report in a couple weeks, but expectations are also pretty high. Be ready for a bumpy road.

Disclosure: Of the companies mentioned above, I own shares of The Trade Desk and Alphabet. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

I nibbled in 2018 and am up 632% so I’m happy. Pricy to be sure, but like the Fool, unless something fundamentally changes, I’m in for at least 5-10 years.

I would not touch this stock at any price under any cirumstances. I’m no Fool. #TTD

The top chart looks like a roller coaster ride come unglued from the rails. You have to think there would be a time where gravity takes over. I wonder what TTD’s price chart would look like if it were never a MF pick.

There aren’t many large companies that can grow at 30%+ for years and years while being consistently profitable. They always attract attention somehow 🙂

I agree, it seems like gravity should hit at some point… but stocks don’t usually fall just because they’re popular, it usually takes some bad news (or a broad market crash). TTD has never been a cheap stock, it has felt like “gravity is coming” most of the time over the past six years (even if, yes, the valuation is unusually extreme now)

Surely agreed. I did some follow-up research and actually turned up a “Buy” from CFRA, who thinks they are fairly valued at current prices and customer base growing. They also suggest their suit against Google may come out favorable for them, which would give them another boost. I’m still not buying, but nor would I sell if owned already.

Motley Fool has a recent report on how Apple will benefit from AI, but they are touting 5 small companies that will benefit more from supplying their products to Apple. Have you researched this report?

I enjoy your website, has given me many good ideas!!

Best, Vermonter.

Haven’t seen that, do you have a link?

https://www.fool.com/order/applepay/e8ba983c-7d20-4438-8e13-c4fdd6e045ac?c=mpappl-2308-hc&apikey=5c8e52dd-1bea-455e-87f5-d5506e590f21&idh=e41d827a-04a6-48c9-9da5-4364a7dcb96d&lid=0hy4ugnv858x&mailing_id=edd5c7c4-19ca-4aa4-b9dc-c5084e701b03&mailing_name=Variant+1&source=im1xsleml0000499&u=2050001956&utm_campaign=mm-mp-aug2023&utm_content=sales13&utm_medium=email&utm_sd=20230829&utm_se=annual&utm_source=sales&testId=Splitter11518&cellId=13129&pid=13129&did=7114

Adding that to the pile, thanks!