Certainly all the investment newsletters have been a-titter over the fortunes to be made with 5G… but now Jeff Brown is upping the ante a bit with his teased bet on 6G, and that surely caught the eye of many a Gumshoe reader in recent days. So that’s where we’re targeting the Thinkolator’s work today: What’s this 6G business, and who’s Brown teasing?

Here’s a little lead-in from the ad

“5G has barely hit the market…

“And already there is something more powerful.

“A combination of technologies that takes regular 5G – and turbocharges it.

“In fact, the new technology is so superior to consumer 5G…

“I believe we are looking at what I call an “early version” of the 6G network…

“The next level up in speed, processing, and computing power.

“And right now, the biggest companies in America are paying a king’s ransom to get access.”

He even lists some of the companies who are spending big for access to this “6G” network…

McDonald’s

Disney

Johnson and Johnson

BMW

ESPN

Zillow

Pfizer

Airbnb

Sony

General Electric

Capital One

And gives a couple examples of the huge cost of access…

“Apple is paying $30 million every month to use this early 6G network.

“Facebook forks over $11 million per month for private access.

“And Netflix spent $19 million a month during the pandemic.

“The list of groups paying for 6G access doesn’t stop in the corporate world.

“NASA, the US Department of State, the USDA…”

And he calls this “6G pioneer” the “Most important tech company in the world”…

What’s talking up there, he later reveals, is, of course, Amazon (AMZN), which has soared to dominance on the back of its Amazon Web Services division, born years ago from the brainstorm that they could take the huge and responsive global network they built to support their e-commerce empire and rent it out to all comers. AWS is now the real profit engine for Amazon, though it certainly faces real competition from other cloud computing providers, particularly Microsoft’s Azure but also a host of other smaller players.

So he does recommend Amazon, which is hard to argue with, but that’s not the “teased” investment for his 6G pitch… that’s just the free appetizer. As he puts it…

“… if you want to multiply your money even quicker…

“There’s another, backdoor way to play the rise of Amazon Web Services.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“And it could dwarf Amazon’s gains.”

So what is that “backdoor play?”

First I should include his explanation of what “6G” is — he’s not talking about the next generation of wireless technology (it’s still on the drawing board and 5G mass adoption is going to take several years, so that’s good), he’s talking about improvements in processing power and computing speed… here’s a little bit from Brown:

“I call it 6G because when you combine 5G’s speed with an extraordinary set of brand-new technologies…

“You can launch your network into hyper speed.

“Maybe a better way to describe it is 5 ½G or 5G+.

“This is a far more powerful network than what you and I will have….

“When 5G’s latency is combined with what’s called edge computing, it makes the network capable of thousands – even millions – more applications.

“And it gives the network the ability to process exponentially larger amounts of data.

“That’s why I call it 6G.”

So what’s the “backdoor” way to play this “6G” idea?

Here are our clues…

“In order for Amazon Web Services to power all of these cloud computing, artificial intelligence, and machine learning applications, they need to have the most advanced hardware in the world.

“One company makes the key components that run Amazon Web Services.

“Without this technology, as much as 100,000 of the biggest companies in the world would go dark.

“But unlike Amazon or other high-profile Silicon Valley companies, very few Americans know this company’s name.

“Yet they have the most advanced AI and deep learning processors available on the market.”

And it’s not just Amazon…

“Microsoft’s Azure is one part of the overall Office 365 business, which generated $13.3 billion combined last quarter.

“Google Cloud is currently on track to make $10 billion this year.

“And guess who makes the advanced hardware that powers Google’s and Microsoft’s cloud operations?

“The same company critical to Amazon.

“In fact, they make 97% of the pertinent hardware for three of the four largest companies in the world.”

And, interestingly enough, we’re also told that he has pitched this stock before:

“Way back in 2016 – light years ago in tech terms – I pounded the table on this company, then barely bigger than a microcap.

“I told a small, private group of individuals, this company would be the top tech stock of 2016.

“And I was right…

“Shares gained 1,048% in just over two years.

“At the time, they were mostly a gaming company.

“But that was just the beginning…

“This was before the rise of cloud computing and artificial intelligence….

“I think this company is a screaming buy right now.”

So what’s the stock? Thinkolator says we’re again being teased about NVIDIA (NVDA), the pioneering GPU company which Brown has indeed touted before, and whose high-end chipsets designed for better graphics processing have not only revolutionized video gaming, but have turned out to be fantastically well-suited to the huge processing demands of “artificial intelligence” work. Brown did call it the #1 tech stock in 2016 and I think also 2017, as I recall (before shifting to Skyworks last year), and it has been a good ride for quite some time now (for me, too, I must confess, and for many others — NVDA was everyone’s favorite for a few years, and was among the top performing stocks in the S&P for some of that time, though 2018 and 2019 were not as pleasant because the cryptocurrency boom and bust led to a surprise inventory glut).

NVIDIA has recovered nicely from that cryptocurrency glut, when they benefitted hugely from crypto miners using their gaming chipsets for high-power mining rigs but didn’t realize the extent, and were shocked with the inventory crisis they had when cryptocurrencies collapsed — revenues have turned up again in recent quarters, and should continue to rise as new products are introduced. Here’s what the revenue (orange) and the share price (blue) look like over the past five years:

One of the main reasons that I bought and still hold NVIDIA is that they’ve got the inside track when it comes to AI processors — anyone developing AI projects over the past decade or so was almost certainly using NVIDIA’s chips and probably their operating systems, and I’ve always expected that to build on itself with a bit of a network effect from their “first mover” work. Getting the early innovators and experts onto your platform can create a bit of a “moat,” particularly if competitors aren’t building anything that’s dramatically better enough that it forces you to learn a new system (see Intuitive Surgical (ISRG), for example).

I don’t know whether the 97% market share is still a fair thing to claim, but it was reported last year that NVIDIA had 97% of the cloud AI GPU market share, meaning those who use GPUs for AI processing through a big cloud provider like AWS or Google instead of hosting the GPUs on their own servers or in-house.

And NVIDIA is at a pretty key inflection point here — it’s priced at a rich premium again (forward PE is up to 45 or so), and they report earnings in a week and will introduce the next iteration of their GeForce gaming GPUs in a splashy event on September 1 (CEO Jensen Huang channels Steve Jobs a bit whenever you let him onto a stage). Earnings estimates have come up a bit in hte past few months, but certainly the stock price has outpaced those estimate increases (and the stock, at $450, is about 10% above the average analyst target… so the earnings report and any forecast NVIDIA gives will be hugely important to the share price next week).

More on NVDA in a minute, but I do want to first find the third stock Brown is recommending — he teases it thusly:

“Data centers require powerful processors to store all of that data.

“One company is producing the bulk of these processors for AWS.

“In the fourth quarter of 2019, sales were over $2 billion…

“A 49% increase from the year before.

“As 5G and edge computing drastically increase the amount of data being collected and stored, these processors will become even more popular.”

OK, so there’s a third stock — here’s how Brown sums up his ad:

“I believe there are three ways to play the rise of AWS and advanced computing:

1) Buy Amazon

2) Buy the company whose hardware powers AWS technoloeis

3) Buy the company whose processors sever AWS’s rapidly-growing data centers”

And that last one, Thinkolator sez, is NVIDIA’s arch enemy, AMD (AMD). Though it seems that AMD has so far failed to surpass NVDA in the GPU business, which was the initial focus of investors, they have begun to take a bite out of Intel (INTC) in the server processor business and regain their years-ago prominence in the data center.

I confess to having been caught off guard by AMD, it was so terrible and such an also-ran in each of its businesses for so long that their improvement really jumped up and bit me on the butt a little bit… and I still didn’t believe it, having seen their weakness and their near-death years before that. But they are the real deal now, churning out 7nm server chips and taking meaningful market share at a time when Intel has been embarrassed by its own inability to get their 7nm architecture to work.

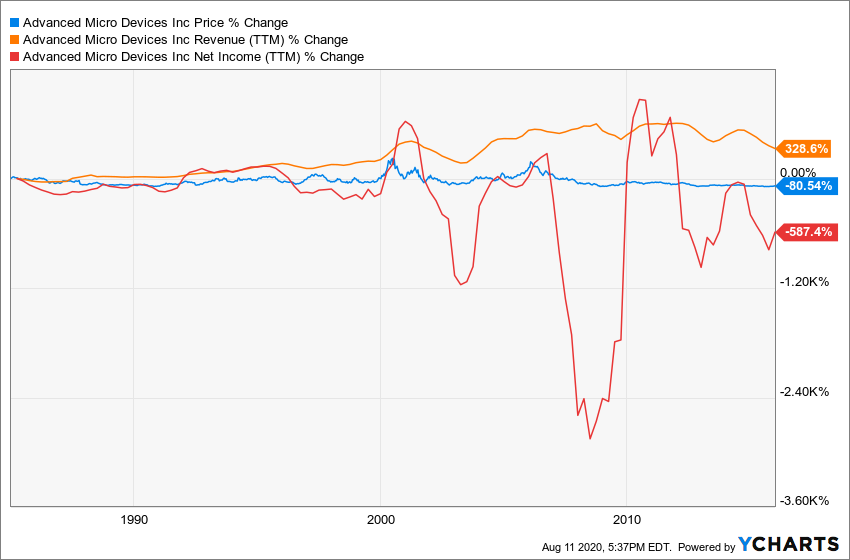

Here’s what I kept looking back at when I considered AMD in recent years, just to give you an idea of where my perspective was coming from — this is AMD’s share price (blue), revenue (orange) and earnings (red) from 1985 to 2015:

NVIDIA wasn’t public for all of that time, but here’s their history, for comparison’s sake:

And here’s Intel, to whom AMD was hardly even a splinter in the toe for most of that time:

There’s a really interesting piece here from March about AMD’s resurrection, and their ambitions in taking on both Intel in server processors and NVIDIA in GPU/AI processors. And morem recently, just yesterday, there was a good Fool article about the gains AMD is making in AWS with its Epyc server chips.

AMD’s share price is up almost 50% in a month, partly because of their very strong quarterly report a couple weeks ago, so it’s not exactly an easy time to jump aboard when some of the growth stocks are seemingly fizzling a little bit… but it’s a very impressive growth story. Right now, they’re growing revenue at 26%, with a 23% return on equity (ROE), and they’re trading at about 12X sales, with a forward PE of 47 — and with earnings that are expected to triple from 2019 to 2022 as revenue roughly doubles. Expensive, but perhaps worth it.

NVIDIA, by contrast, has a bit stronger growth (39%) recently, a higher ROE of 29% thanks to much higher margins, but they trade at 23X sales — and growth expectations are a little lower, with revenue almost doubling from 2019 to 2023 (they use different fiscal years) and earnings expected to double in that time. They trade at about 44X next year’s earnings, so on that comparison you’d probably want to edge a bit to AMD — they are riskier, and they don’t have that embedded GPU user base in AI that NVDA does so I’d say NVDA still has an advantage, but in the server chipset business AMD is clearly biting big chunks off of Intel’s hide right now, and savoring every bite… and processors are a huge business, far larger than GPUs, so you can imagine some very long-term growth if they can take even more market share from Intel.

Intel (INTC), if you’re curious, is now smaller than NVIDIA ($205 billion market cap to $270 billion) — I confess I never thought that day would come (and AMD is catching up, too, just cresting $100 billion). And if you want to further consider how much the market obsesses about growth, Intel, once again decried as a has-been dinosaur, is cheap again, with revenue growth still coming in at 20% last quarter and ROE at 30%, but they trade at 2.6X sales because everyone thinks the growth is over, forever. Analysts expect three-year revenue growth for Intel to be about 5% (total, not per year), and that earnings will only be about 10% above current levels in 2022. So it shouldn’t be surprising, I guess, that Intel is trading now at a forward PE of 10… though frankly, it’s getting pretty tempting now, if only because it’s hard to imagine Intel really losing as badly as the stock market tells us they’re losing. Intel’s net profit of $24 billion over the past year still makes NVIDIA (at $3.3 billion) and AMD ($609 million) look downright puny.

Kind of like IBM, for that matter, another stodgy old dinosaur whose growth dreams may have gone away, but who still puts together tens of billions of dollars in EBITDA every year, buys back stock, and keeps on chugging along with a strong dividend (now 2.7% for Intel, 5% for IBM… which, unlike Intel, is actually shrinking).

So that’s the sum-up of Brown’s teased ideas, at least — buy Amazon, buy NVIDA, buy AMD. That would have worked out almost unimaginably well over the past few years… but those are certainly all very expensive stocks now, pricing in continued rapid growth and market share gains from AMD and continued dominance from NVDA and Amazon. That might be what happens, and it might even be the highest-probability forecast give the strength of all three, but if you’re someone who likes to buy with a “margin of safety,” well, the market doesn’t give you that in these kinds of stocks right now. The market is telling you that these companies are going to be even-more-powerful market-dominating giants five years from now, and you have to pay a premium price for that anticipated dominance if you want to own a piece today. Fair, perhaps, but that doesn’t make it easy to buy.

The factor that has jumped out as interesting for me lately is Arm Holdings — about two weeks ago the rumors started to firm up that NVIDIA was the leading company in negotiations to acquire UK chip design giant Arm from troubled Softbank (SFTBY), which bought Arm Holdings for $32 billion four years ago. If that happens, NVIDIA suddenly becomes the most feared company in the tech world, as Arm’s basic chip architecture designs are used by everybody from Apple to Qualcomm, but, partly because of that widespread fear of this combination, it’s hard to see a purchase being approved by regulators… even if it’s fun to imagine.

That would give NVIDIA a clear runway into other chip markets outside of the GPU business that they still dominate (though Intel and AMD are fighting them there), including into CPU chips with products that could perhaps take the competition back to Intel and AMD. The UK government might well fight such a move, too, since Arm Holdings is one of their real homegrown tech success stories and the only real UK tech giant… it’s probably more likely that Arm goes back to the public markets in a spinoff or IPO, but you never know. That link above is to a Bloomberg story, the take from the UK’s FT is worth reading as well… I haven’t seen any meaningful updates in the last ten days or so.

Personally, I have owned Amazon and NVIDIA for many years… and I’ve been slowly adding to Amazon because, absent strong regulatory action, it’s hard to see anyone beating Amazon in a meaningful way as they are increasingly woven into all of our lives… but I haven’t bought any NVIDA in a long time (in fact, I stopped out of a third of my position about a year and a half ago, during the crypto crisis). They’re great companies, but grouping Amazon with NVIDIA and AMD is enough to make Amazon look cheap, with 40% revenue growth and nearly 100% earnings growth recently off of a massive revenue base (nobody has used a PE ratio with Amazon with any success over the past couple decades, but now that they almost can’t help but be profitable it might become relevant — AMZN is trading at about 70X forward earnings).

I expect all three of these companies will shoot the lights out in terms of their operational performance over the next couple years, with new products and growing revenue and strong margins, but when it comes to which ones investors will love or pay a premium for, well, that’s your call to make. I wouldn’t sell any of the three, but wouldn’t bet the college fund on them at this valuation either — if I were to buy any of them at these valuations today (as I’ve done with Amazon several times recently), it would be a small nibble.

But I’d love to hear what you think — ready to buy AMD, NVIDIA or Amazon for this “6G” growth that Brown advertises? Would you prefer the stodgier dividend-paying tech stocks that the market has given up on, like Intel or IBM? Want to go smaller with the manic cloud stocks, or just wait for the dark days (if they come) to do your buying? Let us know with a comment below. Thanks for reading!

P.S. Our readers always want to know what subscribers think about these heavily advertised newsletters — so if you’ve ever tried out Brown’s Near Future Report, please click here to share your experience with your fellow subscribers. Thanks!

Disclosure: I own shares of and/or call options on Amazon, NVIDIA, Intel, Alphabet and Apple among the companies mentioned above. I will not trade in any covered stock for at least three days, per Stock Gumshoe’s trading rules.

Why do I SEEM TO THINK that GOOD OLE JEFFY, the canny BROWN guy may be SALTING the IMMEDIATE PRESENT with ALREADY SCORED ideas, so when we (STOCK GURU) GETS IT, when we yank the CHAIN, all we get is A FLUSHING of the WATER IN THE OVERHEAD TOILET TANK!

I SINCERELY DO THINK SOFT SPOKEN, NICE GUY JEFFY B. HAS ENOUGH SMARTS TO HOSE US DOWN WITH ALREADY PULLED TRADES!

NOW WHAT AM I GOING TO DO WITH ALL THESE UNDERWATER TRADES OF “JEFFY” THAT I BOUGHT TO LATE TO CASH IN?

DO I NEED TO EDIT IT OUT?

You need to quit “YELLING”.

Calm down, have faith in Jeff and your decisions. Anyway, I guess if you’ve stuck to your plays, you could be smiling from one ear to the other by now.

Very interesting Travis thanks. You sum up the dilemma nicely! I have some Amazon and Nvidia which have done very well. I have added small amounts of Amazon along the way. Basically I wish I had had more courage along the way and bought more because valuations have always seemed stretching but I am reluctant to add too much more. I am thinking still of adding Amazon in small amounts because I think they are going to dominate for years to come.

Good analysis Travis. I agree that the current valuations for these three are too high. But I would certainly nibble on all three, IF we ever get a significant correction in this market. But with all the “heroin”, I mean “new funds” that the Fed keeps injecting into the “patient”, I mean the economy, a market correction may be a ways off.

Yes Intel is the least overbought here, but they’ve been making a lot of significant mistakes for a year or two, and they certainly deserve a lower valuation. I wouldn’t buy it either.

Travis, I look forward to your next comments on purchasing another small “insurance policy” in the form of QQQ or SPY put options.

Thank for your great work.

Thanks derek. I’ve been gradually buying new tranches of put options every six months or so for a couple years now, some of those have thankfully paid for themselves but in general it has been a drag on the portfolio — much of it is psychological, having those put options in place gives me the stomach to hold on to some of these growth stocks that trade at nutty valuations.

I’m from the UK. ARM was a brilliant company. Then it was sold off. Brits would sell their own mother for the right price. If Nvda gets ARM it will be a brilliant move IMO. I hold NVDA and I hope that they do buy it.

Travis,

Thanks for your great, brutally honest discussion of your past skeptical views on AMD which, like you, has kept so many of us out of that stock. It is so danged expensive, and so erratic, that it remains difficult to become comfortable to buy it. Also remains difficult to believe they will actually make any huge inroads on NVDA

Meanwhile, I remain comfortable in NVDA and INTC, although INTC no longer does much to make me proud, but with hopes it will once again.

FRiepen

I’m long Nvidia (up today nicely), and enjoy following Jeff Brown’s work. I’m not saying he has a perfect record, or that his timing is great; but he follows many companies/technologies before they go public. I agree with the other commentors, Travis does a great job at analysis, turning the pie in the sky numbers to conservative estimates that we can use to make informed decisions. Thanks

To me you have to own Nvidia -The trends are just so strong in their favor. Sure buy some AMD but only if you believe own enough NVIDEA first. Who would have believed a year ago. that intel. would become a speculative play. U like the rise. reward on it playing the long game the they can reinvent. Collect the dividend along the way. Take a half position and forget about it. Wake up 2 years from now on a 3 bagger.

I’ve been in/out of AMD for the past 5 years since they traded at $3.15. My current holding is at $11, and even though the valuation is a bit crazy right now, if they were to come down into the $60’s I’d buy more. This isn’t about momentum its about a continuous series of tragic missteps at Intel and the opposite…flawless execution at AMD. More important to me is the corporate leadership at AMD and the lack of that at Intel. Right now, AMD has the more compelling products for the Datacenter, for the consumer Desktop and finally, their new Laptop CPUs for the very first time beat Intel’s in every important metric. Intel’s issues are serious ones. Even though they recently introduced their 10nm portfolio, its too late and its still broken. This is why you don’t see any 10mn consumer Desktop or Datacenter CPU’s. The yields are terrible and they simply do not perform as intended. 10mn’s release was more for optics and to ensure they don’t get sued by shareholders for lies told in previous quarters. They have all but admitted their 7nm progress is having issues as well. If they didn’t master 10nm I don’t know how anyone could think they could jump to 7nm. Now Intel is looking to move more projects to either TSMC and/or Samsung where they will have to get in line with other customers for wafer supply and also erode their profits. Intel is literally a disaster right now. I would not by them anywhere in the $40’s. Starting next quarter they will slowly start their bleeding. They will be bleeding for the next 2 years at least and that assume they can get their process technology back on track. It’s been broken for a loooong time now. If you see a tech market correction buy AMD for their leadership, the current market leading product portfolio, their excellent product roadmap, and their consistent execution. Their valuation is high but they also have massive opportunity in all their segments.

Instead of 6G or 5+, I would suggest calling it G 5.1, assuming it would supplant G 5.0 (the zero signifying the benefit I personally expect to see from it) and continue with the decimal system upon further improvements. If we keep adding whole numbers every time someone tweaks something, we may eventually run out of meaningful digits. Or I suppose we could use Roman numerals like we do to keep track of Super Bowls. Anyway, as I prefer value investing, my money, if anywhere among the chip makers, would still go to Intel. This is on the assumption that, from what I read, their upcoming Tiger Lake is expected to regain some market share from AMD. I’m sure someone much more knowledgeable than myself might weigh in on this thought.

I think Intel will farm out thrir cpu manufacturing to TSMC, if htey cannot solve their problems themselves. 7nm is very soon obsolete, the new norm is 3nm technology. As far as I know only TSMC is capable to produce, so far! So at the price I think Intel will be the winner in this “6G” lottery.

I’m long AMZN, NVDA, and INTC but not AMD.

I read an interesting piece on INTC that they don’t have a design problem, they have a manufacturing problem. All those other chip makers contract out production, but INTC makes 80% of that they sell. One delay does not the future tell!

I set up a synthetic on INTC, using the put revenue to buy the calls. Time will tell, but that;s also how I got my positions in both NVDA and AMZN.

That can sometimes be a nice way to ease into positions.

If anyone has a MASSIVE BUCKET from a MODERN-DAY BUCYRUS ERIE full of NVDA, AMD, or even a “PARTIAL SCOOP” of INTEL INTERLACED, I would be WILLING to ACCEPT A CHARITAL TRANSFER for some BOGUS GARBAGE SOLD ME by a FEW OF THE SLIME I ACTUALLY LISTENED TO DURING MY APPRENTICE!

I am NOT greatly concerned, however, as I could DROP OVER DEAD tomorrow without notice!

I sure APPRECIATE TRAVIS and the DISCUSSIONS some of you bring up!

You should probably stop with the Caps Locks, it makes you sound unintelligent.

Hi Tom I am not too familiar with synthetics but it sounds like your technique uses options only. This is slightly different than the information given on Investopedia. A synthetic put occurs when you are short the stock and buy an ‘in the money’ long term expiration call option on the same stock.

https://www.investopedia.com/articles/optioninvestor/08/synthetic-options.asp

I would just caution on the thought that Intel can fix their process manufacturing issues anytime soon. The 10nm issues have been ongoing for 5 years and it is still broken, which is why you only see 4 core laptop CPUs in 10mn, and not the high core count datacenter CPUs(their most profitable). Right now they are not capable of producing a competitive 8 core Desktop CPU in 10mn never mind a 28 core Datacenter cpu. They recently announced they are pushing 10nm desktop CPU’s to mid-2021. Based on how I’ve seen them operate, that means a paper launch and product in the 2nd half of 2021, and that’s if they don’t push again. They admitted on their latest earnings call that 7nm has been delayed as well. If you go back to prior quarters and listen to how they talked about 10mn, you’d almost think there was never any issue, only minor hiccups/delays. One of my biggest gripes with Intel right now is they have lost all credibility. The only reason they have held up as well as they have financially is 3 fold:

1) The lucrative datacenter market moves at a turtle pace when it comes to change. By change I mean purchasing shifts to AMD. New systems have to go through long validation cycles and even then you have to get past the inertia of Intel’s prior dominance of that segment. That inertia has been slowing and each quarter that passes AMD is seeing more grow here at Intel’s expense. This is why I say the next couple of years are not going to be good for Intel as this shift continues.

2) In the past 12-18 months datacenter customer were forced to add more Intel datacenter cpus/systems to make up for lost performance due to the overwhelming number of recent security flaws in Intel chip architecture that needed to be patched(to be sure some issues plagued all the major chip designs not just Intel’s, but the majority still fell on Intel). For several reasons its not that simple to slip in an AMD based system to an overall datacenter design on an Intel platform. So ironically, due to Intel flaws customers had to buy more Intel.

3) Until the very recent release of AMD’s new Ryzen 4000 laptop line up, AMD really didn’t give you any reason to buy an AMD laptop, so similar to the datacenter Intel has owned this market, and its another lucrative one. Intel should be very scared on this front as the new AMD cpus outperform them not only in general cpu performance but also in battery life and we are now starting to seem more AMD laptop designs than ever before even though there is a long road head. Fortunately this road won’t take as long to penetrate as the datacenter.

I know I sound like an AMD shill. I’m not. My house is full of a mix of PC’s running Intel and AMD. The reason I get so worked up on Intel vs. AMD is that I feel the financial analysts(not you Travis) that cover the chip sector have continued to give Intel a hall pass and drink their marketing spin on all their issues for the past several years. It’s not until their most recent earnings call that some of them have finally awoke to the obvious,…they have had serous issues for years and they are no where near solving them. They were just lucky that AMD didn’t have competitive products until roughly 2018, and more realistically 2019 for the datacenter and just the past couple months on the laptop cpu front. Right now AMD has a more compelling CPU offering for the Datacenter, Desktop and Laptop. Think about that.

Travis, I thought NVDA, but later thought, hmmmmm…… Applied Materials , AMAT ! It fits Jeff’s tease as well or better as AMAT was , as well chosen as arguably the best tech stock for 2016. More notably, was Jeff’s tease about AMAT soon becoming a better and more well known stock. (in his latest tease, August, 2020) NVDA and AMD are already household names so, IMO, AMAT might actually be the third stock tease if not the one assumed to be NVDA…. what do you think, Travis ? …. cheers and thanks for all the great gimshoe tips over the years

Mike

Nope, it’s definitely NVDA for those clues — though Brown may well recommend AMAT for other reasons. AMAT is an interesting “bet on all semis” stock in some ways, though Lam Research and others in similar businesses have done much better Than AMAT recently.

It’s 100% Nvidia – I have the report. You’re right on all 3 (technically 2 since Brown admitted Amazon in the pitch)

Jeff Brown is now published by Brownstoneresearch.com

I’m at a crossroads with NVDA. I bought 600 shares about 12 years ago, at $24 and every time I think I should sell a few it gets upgraded and the price keeps going up, any thoughts? It has now grown to my biggest holding. If there’s still a lot of upside to come I can hold it, I don’t need the money for quite some time. Thanks Bob

Distributed Cloud Processing – Edge@Computing —> FSLY ?

Some connection, I suppose, and I do like the potential of Fastly, even at this nutty valution… though here Brown is just teasing hardware makers.

Travis, as an elderly investor with a fairly short time horizon, I have come to focus on sector ETFs, always looking at the top 10 holdings of each, before buying. That, and position sizing limits, seems a much better way to “indulge” some of my retirement funds in the high growth opportunities out there these days. I leave it up to all your “senior” readers to decide which ETFs strike their fancy, but it works for me. There is such a rich reservoir of high performing sector ETF categories to choose from. Nevertheless, thanks for all your due diligence and insights. They are very helpful.

Thanks Travis for all your thoughts. Can you take a look at Brown’s tease on a cure for blindness?

That’s a long-running tease of Editas (EDIT) — fair on the revolutionary aspect, perhaps, but ludicrous when it comes to the promise of “tomorrow at 9am” timing and immediate riches.

Is Brown’s latest “Project Xi” just a repackaging of this 5G/6G plug for NVDA?