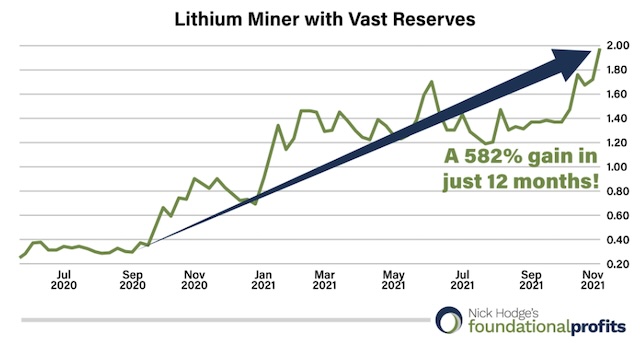

Here’s the lead-in from an ad for Nick Hodge’s Foundational Profits ($199/yr) that a few readers asked me about this week, his latest subject line for these ads was, “The Little-Known Mining Stock Everyone Wants”:

“The ‘King-Maker’ of Lithium Has Already Made Me and My Readers 582% Gains

“Now It’s Time to Think Even Bigger….

“I recently sat down with the ‘Kingmaker’ of lithium… and I’ve concluded this could be the biggest opportunity I’ve seen in lithium yet.

“I explain what’s at stake in my new report, ‘Why Tesla, Ford, and GM Want a Piece of This $2 Mining Stock.'”

And a little more background, though it’s an admirably brief ad:

“As places like California – the world’s 4th-biggest economy, if it were its own country – move to all but ban gas-powered cars, manufacturers around the world are begging for more lithium.

“And as the ‘Inflation Reduction Act’ showers tax credits on EV manufacturers who mine materials for their cars in North America, junior mining companies face multibillion-dollar incentives and potential windfalls.

“The ‘King-maker’ of lithium isn’t sitting on his hands – and neither should regular investors.

“I’ve interviewed him extensively about this opportunity… and I’d love to rush you my new report on how you could potentially profit from this $2 lithium stock.”

So what’s the story? Well, strange though it seems for a new email promo that just started running yesterday, this is almost identical to a pitch Hodge made for this “King-Maker of Lithium” exactly a year ago, when the stock was around $2… and when he said he had recommended it before the wild move the stock made from 20 cents during the COVID collapse to $2.00 in late 2021. He even uses the same chart showing the progress of that “kingmaker” stock back then. Here’s the chart for this stock that Hodge uses in his ad…

… compared with the chart I pulled up.

Which means, yes, that this must be the same stock… Nick Hodge is recommending Critical Elements Corp. (CRE.V, CRECF), which is the owner of the potential Rose Lithium/Tantalum mine in Quebec. And just to be clear, those charts are in Canadian dollars.

But it’s not a C$2 “little-known mining stock” anymore, it’s been a rough year or so for Critical Elements. Here’s the chart since that late 2021 high, which includes the height of optimism, about a year ago, when we last saw Hodge touting this stock…

This is now a 70-cent stock (90 cents Canadian) that has had to revamp its feasibility study to deal with a higher cost to build the mine, and has suffered while lithium prices have come off the boil this year. It actually seemed a reasonably appealing speculation last year, given the good potential of the project and the fairly advanced stage they were at, mostly waiting for financing… and here, a year later, they’ve gotten more approvals and a lease to operate the project and have updated their numbers, which are still quite appealing on paper (giving them a $2.2 billion net present value, as long as you use their low 8% discount rate, and a 1.8 year after-tax payback period for the inital capital expense of building the mine), but they still haven’t come to any financing agreements.

That means the timeline is pushed back further (a year ago they were saying production could begin 2024, now they say 2026), and, of course, the speculative fervor for new lithium mining projects has lightened with increases in global production and with falling lithium prices, and that has put a lid on excitement both for investors in the stock and, presumably, for the banks which might lend them money to build the project (last year they were looking to borrow money for their estimated $357 million initial CapEx, now that number is $471 million).

Which might make the project more appealing today, of course, if lithium prices go up and the demand for North American lithium really does rise with the local-content requirements of the Inflation Reduction Act… and interest rates are moderating now, so it might be easier to raise startup capital than it was a year ago, with rates rising and uncertain.

But it’s also a reminder of the speculative nature of junior mining. These projects are extremely expensive, even the smaller-scale ones like the Rose Project, and the lenders who fund mine development take a meaningful risk in funding mines, and that financing is critical. It doesn’t take much of a change in assumptions about future commodity prices or mine operating costs to move a feasibility study from “pretty attractive” to “no thanks.”

What Critical Elements is planning to mine today is spodumene, which can be refined into Lithium Hydroxide, which is expected to be in high demand for EV batteries. This is a hard rock mine, like the big lithium mines in Australia, not a pumping/evaporation operation like the lithium that’s produced in the salt flats of of Andes. And the news out of Australia is not good, that country’s government is forecasting that the spot price of spodumene will fall to $2,200/tonne in 2025, a ~40% drop from the average price in 2023, with lithium hydroxide falling a similar amount. Everyone seems to be forecasting a surplus in supply for the next couple years, as new projects finally come online and as demand for electric vehicles in the United States is a little lower than anticipated. The big lithium mines in Australia will still be profitable at those lower prices, and Critical Elements could be as well, at least if we go by their feasibility report (given their assumptions as of October, when prices were similar to where they are now, they expected gross margins of 79% and an internal rate of return of 66%, so there’s room for profitability even if prices do fall… though prices falling by 40% would obviously reduce the profitability dramatically and, as we’ve seen over the past year, make it harder to raise construction financing).

"reveal" emails? If not,

just click here...

Here’s what they say most recently, in the highlights of their December update for shareholders:

- “Critical Elements confirms ongoing interest and progress in the Rose Project financing negotiations with potential strategic partners.

- Critical Elements continues to work towards a Rose Project timeline that targets commencement of production of high quality spodumene concentrate in 2026.

- Management continues its procurement program to purchase long lead time items to protect the Rose Project timeline.

- Detailed engineering continues to advance with a high degree of confidence consistent with the Rose Project timeline.

- Programs to meet extensive pre-construction requirements under governmental authorizations and the 2019 Pihkuutaau Agreement are on-target.

- An initial drill program to test the new Rose West discovery and other targets is expected to commence in early 2024.

- While the market for lithium and lithium equities has corrected over the past year, management views the future positively.”

Interestingly, when this share price decline was really dramatic in the first part of this year, the Chairman of the Board at Critial Elements actually addressed the share price and the reasons for the decline and explained away the concerns quite specifically… which was somewhat encouraging, and unusual in the specificity with which the Chair talked about the stock price and what investors are worried about, but it didn’t do much good in the face of falling lithium prices and a continuing lack of financing from either banks or strategic partners to move the project forward. The stock price has fallen another 50% or so since then.

What’s going to happen next? I don’t know. I expect that their success might truly hinge on any push for “North American content” in batteries, and whether that means they can make a deal with a strategic buyer at premium lithium prices to move this project forward. The challenge might be that the Inflation Reduction Act incentives for EVs don’t actually require “North American content” — it’s content from the United States or from countries with which the US has a free trade agreement. So this really just excludes a few major processors of lithium, notably China, and a few of the big mineral producers, like Russia and Argentina — the US does have free trade agreements with both Australia and Chile, the largest and second largest producers of lithium in the world.

It is an article of faith that there’s a lithium shortage because of all the electric vehicles that are on the road and coming soon… but that’s the nature of capitalism and economics, the shortage that everyone saw coming became a surplus as the production grew faster than the demand. It might swing back the other way, certainly it seems logical that lithium demand will keep rising, as almost everyone predicts, but rising demand that’s accompanied by rising supply doesn’t necessarily mean that there are higher prices or huge profits ahead.

Still seems like a reasonable speculation to me within this space, certainly much more reasonable than the tiny junior explorers who are nowhere near production, and we’ve seen from the wild moves in the share price over the past couple years that Critical Elements might soar if there’s good news or another spike in lithium prices, but I’ll shy away from betting my money on the future price of lithium. I would expect that the next piece of important news will be the announcement of a strategic funding partner of some sort, probably an offtake agreement, but any deal like that will probably also have to come either with a lot of construction capital, or some kind of guaranteed pricing to attract bank financing, if it’s going to “de-risk” the project and give investors confidence that the Rose Mine will get built.

That’s my thinking, at least… but with your money, you get to make the call. Think Critical Elements is destined to grow into a large and profitable miner? Think the project is too small to attract big money or will face further delays? See great hope or despair in lithium pricing? Let us know with a comment below… thanks for reading!

Many new pumping evaporation Lith mines are on track to production, including the Salton Sea (CA), Great Salt Lake (UT), Dead Sea (Israel), and in Nevada’s Tonopa Mining District (spodium). Increase in price questionable.

I’ve lived in Nevada for nearly 50 years and have not yet heard of spodium. Also, the district is Tonopah. Blackrock Gold Corp. found lithium on some of their claims and farmed them out to a lithium company. Blackrock is exploring for gold and silver in the district. As far as I know the only operating lithium mine in the U.S. is Albemarle’s property near Silver Peak Nevada. It pumps brine out of an old dry lake bed and puts it in evaporation ponds. The lithium is then separated from the other salts. I think a mine in North Carolina may be nearing or in production of spodumene (a lithium mineral) from a large pegmatite body. This mine is a fairly typical hardrock open pit mine. Brine evaporation mines are the cheapest source of lithium minerals. Most of that production is from South America. Yes, I’m a geologist. BTW. Israel doesn’t look like a good place to invest money right now.

Sorry, speculators, the blush is off the Rose. The EV rush is over, and as usual efficiency, safety and reliability trump government handouts. I don’t know if they are planning it, but China is producing useless high teck green stuff (solar,wind and EVs) and taking what money the can from the West and investing it in fossil fuels and nuclear for themselves. They are not on the save the planet bandwagon. I think it’s very telling that these companies can’t get financing for their projects. The air is being sucked out of the room by government. Government doesn’t know anything but mal-investment.

Been holding this for a while, and I’m down quite a bit, as I am in other Li stocks. I don’t find much to criticize with the company–it has a great project, very experienced management who don’t over promote and spew out PRs whenever they turn over a rock, and they’re in a great location with lots of nearby infrastructure. Their problem, as with all the others in this arena, is the current and hopefully temporary lull in interest in Lithium due to the fall off in EV interest. There are a lot of explorers who will disappear soon, but I think this one will survive and either become a producer or be bought out. I’m averaging down a bit.

Will have to look at this one again if there is ever an increase in demand. Thanks again Travis

I think if you want an under $1 lithium play, look into BRGC. Also hard rock lithium, some great results from field tests — worth a look

You may want to take a squint at an Alberta company that has developed a lithium extraction process

that utilizes the readily available saline solutions which are left-overs from exhausted oil wells.

Sixty million tonnes are available and they just received more financing.

I wrote about a few of those DLE companies last summer here: https://www.stockgumshoe.com/reviews/penny-stock-millionaire/whats-black-lithium-and-can-it-save-the-ev-industry/

There are actually 2 companies in Alberta and Saskatchewan I believe doing DLE from oil wells–E3 Lithium and Volt Lithium. Both claim large resources and exclusive tech.

What is Dylan Jovine’s AI medical stock pick he’s reading?

Some recent articles of interest regarding lithium and the potential for shortages, not withstanding larger supplies.

https://mail.google.com/mail/u/0/#label/Katusa+Research/FMfcgzGwJclNjtHRxZrxLvlgbCthwBrP

https://mail.google.com/mail/u/0/#label/Katusa+Research/FMfcgzGwJchvfldHpQCVdKRjBkrqgPlg

Have you looked at Mark Skouse 3 … 10 bagger stock option , Enegy, Chip, crisis ???????

Demand for Lithium is lower than expected. I still think it will ramp up within 4-5 years, but there is no urgency to buy now. The Lith. will fall even more in 2024. So to get projects financed will be even harder until demand goes up again.. Maybe it will be replaced by sodium?

CRE.V closed at $.78 CDN today, with a volume of 144,000. I was thinking that if it just took 4

minutes to “fill up” an EV and it would last about 500 kms before another “fill up” I might be interested. But then again, in Canada, and all of the Northern U.S. states, the cold autumn winter and early spring weather and temperatures would shorten that by quite a bit. I could always carry a gas can in my trunk, but there is no such thing available for ETs.

Bought 1800 shares of CRECF in early 2023, between $1.70 and $2.00. And promptly sold most as it began a long, drawn-out plummet to where it is now–below 60 cents. Glad I got out when I did.

Commercial use of storage batteries will increase dramatically