Here’s the lead-in for Alexander Green’s latest ad for his Oxford Club Communique ($49 for the basic sub, renews at $79)…

“The expert who picked Amazon, Netflix and Apple before they soared 6,300%… 20,400%… and 94,000%…

“Says THIS little-known $8 stock could follow in their footsteps.”

And here’s how Green starts his “presentation”…

“I’m here, today, because I’ve discovered a single low-priced “Super Stock” that I believe will soon skyrocket like legendary stocks of the past.

“In fact, it’s already started.

“It’s a tiny company valued at just $1 billion.

“I would guess not 1 in 100,000 people have ever heard of it.

“But I believe that’s about to change.

“Because it’s overhauling a niche medical market that’s projected to grow from $86 billion in 2020 to $140 billion by 2028.”

So what’s the stock? These are the other clues that he drops on the order form:

“It’s disrupting a niche medical market with 118 million workers that has seen ZERO innovation for 100 years.

“That’s why this company’s revenues are already growing exponentially.

“10,000% between 2014 and 2017.

“2,000% between 2017 and the end of 2022.

“No wonder its gross margins are bursting at the seams at over 70%.”

Here’s how he describes the company’s products:

“It’s reinventing a necessity for healthcare workers that hasn’t been modernized in more than 100 years.

“It’s the most universal piece of medical gear…

“Used more often than thermometers or stethoscopes.

“And this is important for you to know.

“This product has to be replaced a lot.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“Often, doctors and nurses are required to change this item several times a day to prevent spreading disease.

“For medical professionals it’s nonnegotiable.

“People’s lives literally depend on it.

“And because of the high use, this product needs to be replaced every three to five months.”

And there’s something proprietary about the products, which investors always love to hear…

“this company’s products are so innovative…

“It’s filed 12 patents, along with 92 national and international trademark registrations…”

And some speculation about the growth potential:

“They’ve hit $505 million in sales while capturing only a tiny fraction of the worldwide market, just 2%.

“If the company jumped to, say, 15% of its niche market with 118 million potential customers, we’d be looking at $3.7 billion in annual sales.”

That would mean the average customer spends about $210 a year on this product, just FYI.

And finally, there’s the nice signal of “skin in the game” from some folks who should know…

“…insiders are loading up on shares…

“The CEO just scooped up about $5 million worth.

“One billionaire investor purchased $7.2 million more.

“And another billionaire fund manager just invested a whopping $144 million in this stock.”

So what’s the product, and what’s the stock?

Well, what Alexander Green is talking about are medical scrubs, the uniform that essentially all healthcare workers have to wear on the job… and the company he’s hinting at is one of the fallen angels of the 2021 IPO class, the high-end scrubs maker FIGS (FIGS).

FIGS has seen its net profit margins come down pretty sharply since the COVID highs of 2020 and 2021, but they are still profitable, and the gross margins have remained high (so the issue isn’t material cost inflation)… the challenge has mostly just been that their operating costs have kept growing by 25-30%, almost as fast they did in the boom years… but their revenue growth slowed from 40%ish to about 9% over the past year. That means they’ve swung from an exciting emerging profit growth company, to a company that’s barely clinging on to profitability, with earnings shrinking almost to zero last quarter.

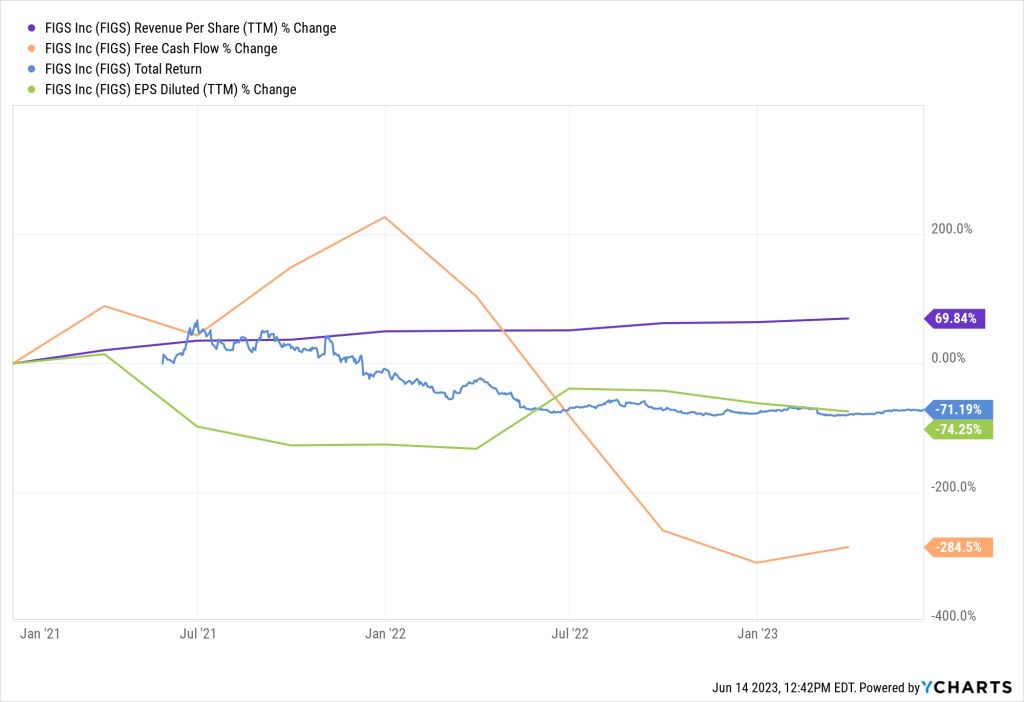

This is what their first couple years of life as a public company have looked like — yes, they had explosive growth before they went public, and that helped fuel the excitement about their 2021 IPO, but since then it’s been a bit more placid — revenue per share (purple) has kept chugging along, but not at the kind of pace people originally expected, and the earnings (green) and free cash flow (orange) lost their sex appeal pretty quickly as 2021 turned into 2022, leading to that 70% decline in the share price (blue — as is so of then the case, earnings and share price “growth” tend to go hand in hand… and that works on the negative side of the graph as well as the positive):

But that’s why it’s a mostly-ignored $1.4 billion company today, not the lusted-after $8 billion 2021 IPO that was going to be the lululemon of the medical world. And there’s something to be said for revenue that continues to grow, even if that growth slows down for a bit…. Maybe FIGS is ready for a fresh start?

There is that insider buying, though it’s not exactly overwhelming — the CEO and co-founder, Catherine (Trina) Spear, did buy about $5 million worth of shares in the low-$6 range in March… though she had the cash to do that because she sold about $65 million worth of shares back in 2021, in the $30-40 range. Maybe she’s got good timing. No other executives have been buying at these lows, and most of them have continued to gradually sell as they exercise their stock options… including some larger sales registered just yesterday by the other co-founder, Heather Hasson, who is currently executive chair and has been a persistent seller.

The other real buyers over the past year or so has been major investor Thomas Tull, who bought about $7 million worth of shares last year in the $15-20 range (his VC fund also sold about $250 million worth after the IPO lockup expired, and he’s the largest FIGS shareholder, with a 15%+ stake), though there’s also been a fair amount of buying over the past couple quarters by small cap mutual funds and hedge funds, presumably looking to buy the big dip in the shares.

I skimmed through the recent financials for FIGS, including the transcript of their last earnings call, and it sounds like things are stabilizing a bit — they seemed to go through an inventory glut last year that is smoothing out, they grew their active customer base last quarter, though revenue was still down per customer (their LTM revenue per customer is about $216, so that tracks with some of the aspirational growth numbers that Green cited in the ad), and their international growth was quite strong (45%), so the brand seems to be holding up pretty well at home and expanding internationally.

I don’t know to what extent they have real brand power among medical professionals, their scrubs certainly sell at a premium prices compared to the basic semi-disposable scrubs, but the company says they continue to have industry-leading customer loyalty and “brand sentiment,” and they get about 70% of their sales from repeat customers, which sounds impressive to me. They’re also (again, according to them), designed for specific needs of the customers, including innovative styles and functions (stretch, pockets, etc.), they use better materials, and their scrubs will last longer. Brand power will be important if they’re going to get back to a strong growth profile, because, as we’ve seen with pretty much every niche clothing company, it’s pretty easy to copy products in this space.

The company is being pretty cautious with guidance, but they do say that they think they’ll begin to improve profit margins and get some operating leverage from their work with institutional sales and improved fulfillment networks, helping to ease out of some of the cost pressures they’re seeing on shipping, but they see that improvement as being pretty gradual… they won’t be back at the huge margins they enjoyed in 2021 anytime soon (20%+ EBITDA margins), but they think that they’re on a good improvement path and should be back to a “high teens” adjusted EBITDA margin eventually, but the implication seems to be that we should expect that to be a 2024 or 2025 story, at best, it won’t happen this year.

If they do reach that goal, then they might be making $100 million or so in adjusted EBITDA in 2025, which would mean that the stock is trading at about 14X their potential 2025 EBITDA — that’s great if they are really going to get the company growing again, they’ll be able to self-finance that growth and compound the value of the business (and they traded at a ludicrous 500X EBITDA when they were a hot ticket two years ago), but it doesn’t exactly mean they’re down in “value stock” territory.

FIGS also trades at about 3X sales, which we can pretty easily rationalize for a growing clothing company that’s earning a 70% gross margin for their direct-to-consumer sales (ie, no lower-margin wholesaling, though also no distribution boost by being in Walmart or other major retailers) — that’s about the price/sales valuation where lululemon (LULU) shares bottomed out six or seven years ago, and also happens to be about where Cintas (CTAS) trades (that’s the leader in the “uniforms” space, though they’re mostly a rental/service company). Both LULU and CTAS are massive, 50X the size of FIGS, so that may not mean much, but there aren’t really any good publicly-traded competitors that I can think of for comparison.

Green also implies that there’s a change coming…

“This firm is about to make a big move that I believe will help it to explode out of the medical space and grab a larger piece of a $1.5 trillion market.”

And I don’t know what that might be — they do offer some non-scrubs items that are designed to go with the scrubs, they call this a “layering system” to include things like jackets and other outerwear, and they offer “officewear” for those who don’t wear traditional scrubs but work in medical settings. Presumably they’ll keep up the innovation and new product releases, but I don’t know if anything is likely to really shake them out of the core “scrubs for doctors and nurses” market. I’d guess that the international expansion will be more important than the non-scrubs products, but I don’t really know.

Financially, they’re not currently showing great growth but they do have a solid foundation — they are (just barely) profitable, they have no debt, and they say they’ll generate positive free cash flow this year, so they’re not in any danger from rising rates or needing to finance growth (they do still have about $155 million in cash). The stock-based compensation is meaningful, but not necessarily egregious (about $40 million worth over the last year, which is a little more than their operating income, but the number also came down dramatically as the stock price declined).

Analysts think FIGS will earn about 8 cents per share this year, growing to 14 and 20 cents in the next couple years as revenue continues to grow at a 10-15% annual rate, so if they can boost that growth rate, particularly overseas, they might be able to surprise investors… and those same analysts are pretty much on the fence about whether the share are a buy here in the $8.50 range, it’s roughly a half-hold, half-buy sentiment among the pros, with most of them having a price target in the $8-10 range.

So… FIGS isn’t cheap, and I’d want to know a lot more about how medical professionals see the brand before considering a purchase here at about 100X earnings… but the steady gross margin tells us they have at least some pricing power still, at least with a niche group of customers, and that means there’s at least a possibility that they could make that niche much bigger. If the brand is anywhere near as valuable as folks thought it was two years ago, it still might have some real growth potential. We do know, at least, that the market should be fairly steady — medical workers will be needing a few new sets of scrubs a year for the foreseeable future, and that won’t be disrupted by augmented reality or artificial intelligence or the next Apple device.

That’s what I think, though, and when it comes to your money, well, you get to make the call. Think FIGS is ready for a renaissance that leads them to world domination or a fashion cross-over into the non-scrubs world? Or was it just a COVID-driven fad, now that other cheap makers of scrubs might be copying their products, and they’ll struggle to keep their heads above water? Something in between? Let us know with a comment below (hint, since we’re starting out with the bombastic promises of an ad pitch, the best answer is almost always “something in between”).

Disclosure: Of the companies mentioned above, I own shares of Amazon. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

The apparel business is a tough one….cheaper pricing from knock-off companies in the middle east….Vietnam, China etc. I’ll watch this one but not buying yet.

I gave my wife Figs for Christmas 2 years ago. She loves them and now has the entire collection. Great product but the company is only a 10% grower so on the sidelines.

Nice analysis, Travis.

FIGS is certainly a decent company, with reasonably decent prospects; but I simply do not see exponential (AAPL/NFLX) growth potential.

Very interesting. Revenue is growing though at a slower pace. The company is profitable though SBC is still quite high. Ron Baron, the growth investor is loading up on the stock.

According to Alex Green, Figs Inc. (NYSE: FIGS) meets all of my criteria for becoming a 10-bagger. This recommendation is from a special report and is not currently in his active ten bagger portfolio

Ditto observation. Subscribe and don’t receive teases and in this case it’s not in the portfolio and has never been mentioned to subscribers. A special report that subscribers don’t know about. Odd.

Yep, sometimes the stories they sell the hardest aren’t in their “real” portfolio — though I think Green said he put $100K into this one personally (I may be misremembering, that might be a different microcap pitch).

Same with the ongoing pitch from Green for Hon Hai/Foxconn — he’s been touting that as the “single stock retirement” and the “must own patent champion” since mid-2018, we’re just about to hit the five-year anniversary of the first time I covered that ad, without the ad changing very much… and people often tell me it’s not in his “regular” portfolio at the Oxford Club. Sometimes the stock story that works really well to sell newsletters is not the same as the stock you want to commit to owning for a long time, or that you want to have on your “permanent record.” The stock has done almost nothing in those five years, despite, yes, being one of the most important parts of the global technology supply chain… but it’s still a story that he can sell, and it apparently still brings in subscribers who love that “the stock trades under a secret name” bit.

Here’s the chart I posted last month for the five years or so since the Oxford Club folks started pitching Hon Hai as a “single stock retirement plan”, just FYI — Hon Hai (in purple) was trailing the broader market’s returns (orange) by “only” about 40 percentage points (I added Apple (AAPL, blue) and Taiwan Semiconductor (TSM, green) for a little context):

I’m a traveling nurse who likes to observe scrub fashion. FIGS are well known for being a quality and expensive brand, the material is noticably thicker. Recently I learned of Mandala scrubs which are comparible in quality and reasonably priced. The FIGS fad is fading.

Thanks for the feedback!

My wife started wearing FIGS at work which got me watching the company after it’s IPO, but nosebleed valuations kept me from buying. Eventually started selling puts and got assigned some shares at the $7.5 strike, which I’m holding now. I love investing in companies where I see product adoption and enthusiastic users around me, as opposed to primarily learning about the company from financial media.

A good reminder that there are ardent fans as well as people who think it’s a fad.

I bought some $5 calls back in April and they are up 61% so I will cash out before they expire – not really interested in owning the stock.

Did anyone here ever checked LUNR? A very interesting “space shot” suppliar?

Special report is under Oxford Communique section of Website.

Clear as daylight!

Male ER Doc perspective. Most guys don’t care all that much about color or style. Give us black, grey or a few shades of blue. What we really want is as many pickets as humanly possible. There is a 5 pocket scrub pants option that is REALLY handy for men and women to carry everything you will need during a shift. No one wants to run around during a big trauma trying to find their vital difficult airway card, list of pressor meds etc. They want it ON THEIR BODY.But Figs website is nearly impossible to find mens 5 pocket cargo scrub pants using any of their filters. Using the men’s filter first, picking several options somehow mysteriously brings you back to women’s scrubs. Each time I have used it I end up quitting and buying someplace else. Combine that with its most recent financials is a hard pass for me

Good feedback, thanks — I love hearing from people who actually use the products.

An earlier negative feedback message was erroneously attributed to Stock Gumshoe. I sincerely apologize for the error. It was intended for another site.

Sounded interesting, so I looked up their stats, looks like they have been earning and not losing the last few years , but… not that much, and at $8.63 a share they are trading with a P/E ratio of 119 . Wow! I think I will follow a little and wait a lot.