“I’ve found the next stock that I believe has just as much potential as (perhaps more than) Berkshire Hathaway, Apple, Netflix or Amazon.

“In fact, it could be even bigger than any of those when all is said and done.”

That’s from Alexander Green’s most recent pitch for the Oxford Club’s Communique, their entry-level newsletter ($49 first year, renews at $79). The lead-in to this “Tek Talk” is all about “How an Unknown Kansas Welder Ended Up on the Forbes Richest List,” which is just one of the many stories you’ll hear from time to time about folks who bought shares of Berkshire Hathaway (BRK-A) 40-50 or more years ago (in this case, he’s talking about Stewart Horejsi, who was indeed working for his family’s welding business when he bought his first Berkshire shares at around $265 each back in 1980). That is similar to the oft-told story of “Forty Dollar Frank,” who bought his BRK shares a few years earlier, in the mid-70s, and similarly created a fortune… there are quite a few billionaire or near-billionaire families who were lucky enough to bet on Buffett early on, and, probably at least as importantly, wise enough and patient enough to hold on to their Berkshire shares for decades.

Interestingly, Horejsi, according to Forbes, has seen his net worth climb by only about 150% since 2014, while Berkshire shares are up by more than 200%, so hopefully he’s giving away his money or having some fun with it — he managed the Boulder Growth & Income Fund until he retired from that in 2022, which for a while was a way for small investors to get exposure to Berkshire before the B shares were created (and then split) to make Buffett’s brilliance more accessible, and that fund kept up with Buffett for a while but has lagged Berkshire pretty dramatically since Horejsi retired and a new management firm took over the closed-end fund (it also changed names, it’s now the SRH Total Return Fund (STEW), in case you’re curious).

But I digress… Green’s point, which he has also made at some points in the past when he boasts of having bought Netflix and Apple early on (and still holding them), is that the potential exists for one stock to completely change your life… you just have to believe in the right disruptive stock, buy it early, and hold on for a long time — very similar to the Motley Fool’s strategy of letting both the losers and winners run, almost no matter what, because all it takes is one or two real mega-winners to create a fortune. As long as at least one or two of the stocks you happen to buy turn out to be those mega winners.

And we’d all like to believe that, of course, so that makes us want to pony up fifty bucks to find out which one it might be, right?

Except, retirement-plan/">Alexander Green has also been making the same “this stock could be your one-stock retirement, and could change your life” pitch about Hon Hai/Foxconn for at least five years now, and that has so far been a lousy and lagging investment… so maybe he doesn’t always know which stock is most likely to win?

A better idea: shall we find out what the stock is without sending Oxford Club any money? That might help us to think for ourselves a bit, no? After all, once you pay for something, you tend to become quite biased about how awesome it is, if only to justify your investment.

So we won’t subscribe… instead, we’ll go in with a clear mind and an open heart, and figure out what the company is… then we can decide if we’re interested.

Ready?

Here’s a little more hype, referencing another of Green’s favorite past picks, Intuitive Surgical (ISRG)…

“The company I’m going to tell you about today I believe will become the most important AI company in the world over the coming years.

“Intuitive reminds me more of the company I’m recommending today than any other.

“Back when it was trading for less than $25 per share in 2004, I wrote this:

‘It holds a monopoly position in surgical robots. As a result, sales and earnings are making a dramatic turn northward. Gross profits are a whopping 63.2% of sales. And recurring revenues are already more than doubling. Clearly, this is a stock with a great deal of upside potential.’

“Not every subscriber hung on for the whole ride… Some surely sold along the way when we recommended taking profits.

“But the message is clear…

“If you want the true dream retirement… and you’re worried that you haven’t saved enough… it’s not all about diversification.

“It’s about finding that one stock that’s created a new cutting-edge technology or product that is now set to change the world.

“And today, I’ve found what I’m convinced is the next great breakthrough company.”

So who is that “next great breakthrough” company? Here’s when we get into some more specific hints….

“The Medical Company Using AI to Radically Speed Up the Discovery of Breakthrough Treatments

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“It is also a medical technology company… founded in England by a doctor in biophysics from the University of Oxford.

“And like Intuitive, this company is set to revolutionize medicine.

“The founder of the company spent a decade at Pfizer learning the inner workings of the pharmaceutical industry before coming up with a brilliant idea.

“What if he could use artificial intelligence to create more effective drugs… with less side effects… and bring them to market faster than ever?

“AI enables computers, robots and other connected devices to mimic the perception, learning, problem-solving and decision making of the human mind.”

OK, so it’s an AI-powered “drug discovery” company — there are a ton of those which have sprung up over the past few years, and even more startups raking in cash to join the fray this year, so which one does Green think has the inside lane?

The basic idea of “AI drug discovery” is that machines are a lot better than humans at sifting data about drug interactions and biological processes and chemicals and assessing which molecules are more likely to fight specific diseases, or less likely to cause bad side effects — it takes out some of the “trial and error” phase, or at least speeds it up a bit, and it might also help to identify drugs that nobody would otherwise have thought to test… or pair existing drugs to diseases they haven’t been tried on before. Here’s how Green puts it in the ad:

“AI can now take massive datasets of potential molecules and then analyze them to find the ones most perfectly matched to fight a disease.

“And the speed and accuracy are breathtaking….

“According to one report in The Independent…

“MIT’s artificial intelligence can identify effective drug possibilities 1,000 times faster than the traditional method.

“The Wall Street Journal reports that…

‘The time required for the early stages of drug discovery could shrink from years to months.'”

That MIT reference is to a study that came out about a year ago, before ChatGPT really captured everyone’s imagination when it comes to AI, so that’s a good reminder that AI has been a focus in biotech and technology for more than a decade now — it wasn’t “invented” this year, but investors small and large (and public and private) have suddenly recognized some maturation in the sector, thanks to the mass-market appeal of ChatGPT, so stories that have seemed interesting but maybe not ready for prime time in recent years, have suddenly jumped to the front of the line.

So… what clues do we get about this particular stock from the Oxford Club folks?

“… there is one company in particular set to dominate this new AI approach to medicine.

“The company I’m telling you about today is the first AI platform to improve treatment outcomes for cancer patients.

“It is the inventor of the world’s first AI-designed drug to enter clinical trials.”

There is some dispute about who has that “first” title, but that definitely narrows down the list… what else are we told?

We get a patient story…

“Paul, an 82-Year-Old Cancer Patient, Thought He Was Finished… Until He Was Cured Using AI

“Paul had a form of blood cancer that was aggressive and difficult to treat.

“He went through six rounds of chemotherapy.

“They tried an assortment of cancer drugs one by one, but with no luck.

“Much of this harmed Paul’s healthy cells, and he became more and more frail.

“All six rounds of treatment failed.

“That’s when doctors turned to the company I’m telling you about today.

“They used AI to analyze Paul’s disease for the best possible available treatment.

“The system combed the data and shot out an answer… a drug doctors hadn’t considered at all.

“And it worked.

“Within two years, Paul’s cancer was completely gone.”

And then we get some hints about the specific deals that this firm has made with other pharma companies — since pretty much all the “AI drug discovery” stocks are built not to produce their own drugs, but to partner with big pharmaceutical companies who will both pay the AI firm for technology services and, eventually, provide milestone payments and royalties if a drug advances to the clinic or to commercial production….

“Now That the Technology Is Working, the Biggest Companies in the World Are Lining Up to Work With This New AI Company

“For example, the French drug giant Sanofi entered into a $283 million partnership with the company a few years ago.

“But now they are going bigger…

“Sanofi recently agreed to pay the company up to $5.2 billion to develop 15 experimental oncology and immunology drugs.

“The company will receive $100 million upfront as well as milestone payments from successful treatments.

“And that’s just one of many projects in the works. The latest is a collaboration with Merck on three potential best-in-class drug targets. The deal could be worth up to $674 million.

“It’s also signed a major $1.2 billion partnership with Bristol Myers Squibb, one of the biggest pharmaceutical companies in the world.

“The company has a partnership with Japan’s huge pharma company Sumitomo Dainippon Pharma.

“Together they brought an AI-designed drug to clinical trials in one year… compared with the five it normally takes.”

This is getting to be an embarrassing wash of clueiness, I might not even need to haul the Thinkolator out of the garage to get our answer… but just to dot our i’s and cross our t’s, here are a few other hints they drop:

“It completed the acquisition of Allcyte, integrating that company’s tissue platform into its own drug discovery operations….

“It launched its third collaboration – worth $70 million – with the Bill & Melinda Gates Foundation to create a portfolio of up to five antiviral drugs….

“Its strong balance sheet is in a great position to fund AI-designed molecules going forward, with over $600 million in cash in the bank….

“It opened a 21,000-square-foot expansion of facilities at The Oxford Science Park, expanding its capacity and efficiency for developing new AI drugs.”

And your last bit of hype before we spit out some answers, leavened with a wee bit of sobriety from Alex Green:

“With all the potential uses of this technology, the company I’m recommending now could become one of the most important companies in the world.

“It’s that big an opportunity.

“But now is the time, as the stock is trading for less than $10.

“This is one of those ‘Stewart from Kansas’ moments… when buying just one stock could ultimately secure your financial future forever.

“And let me be clear about something important. I am NOT suggesting that you put your retirement money into this stock.

“There are no guarantees that this tiny stock will turn into the next legendary winner.

“It has that kind of potential, but there are always risks with investing.

“I never recommend anyone invest more than they can afford to lose.

“That’s why… what I’m recommending is that you put a MODEST amount of money in this stock and then sit back, leave it alone and let it compound in value for years and years. That is how real fortunes are made.”

So…. hoodat? The Thinkolator was a little offended to even be asked about this one, given the shovels full of clues provided… but that’s OK, we can still tell you that this is Exscientia (EXAI), a company we also looked at a few weeks ago because Keith Kohl over at Angel Publishing was pitching the same idea (he called it “Algo Meds”).

And as a reminder, in case you’re curious, Alexander Green has also touted a different “AI drug discovery” company in the past — he pitched Absci (ABSI) as his #1 Stock for 2023 back in December of last year, though that was for his Oxford Microcap Trader newsletter.

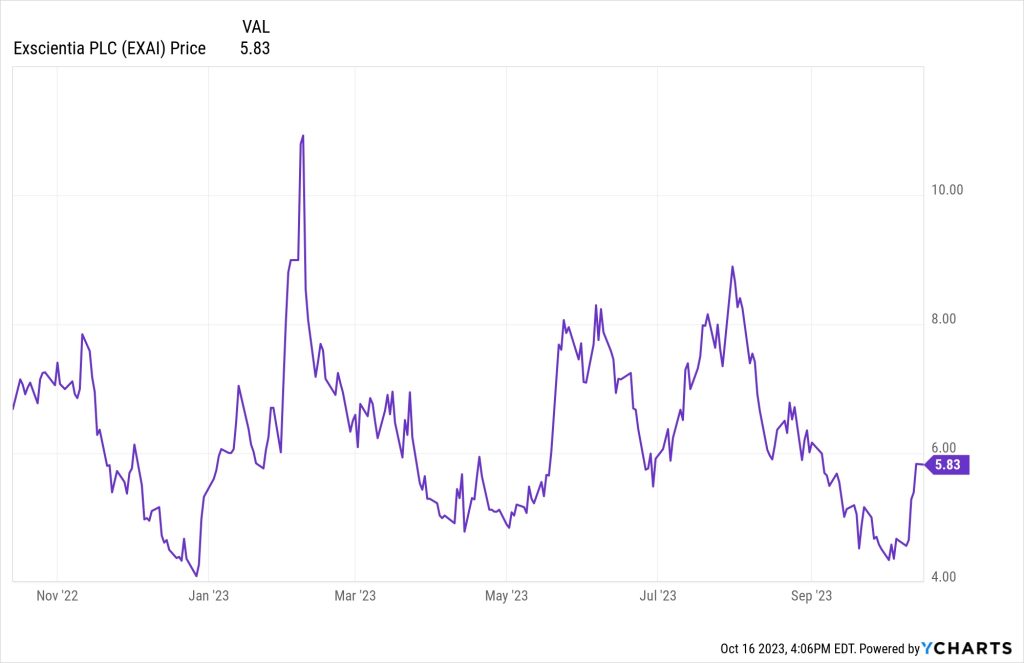

When it comes to EXAI, Green’s ad is dated “September 2023”, and Kohl’s ad also first caught our eye in September, so I don’t know which of them might have been “first” on this idea… but it was a stock that had been coming close to new lows until last week, when it bounced back a bit.

Though if I show you that choppy chart for the past year, I should also pull back a bit and show you the fully history — this cover the two years since Exscientia went public:

The good news in that second chart, if you’re looking for good news, is that their IPO took place at that upper left, which means they raised money at prices far higher than where they stand today… which is why they have enough cash to keep pushing the business forward. At least for now.

So what’s the story with this stock? Well, to be honest, it hasn’t really changed dramatically since I last wrote about it three weeks ago… so I’ll mostly repeat what I said in that article about Keith Kohl’s “Algo Meds” tease…

Exscientia is a UK-based drug discovery firm that has indeed gotten a lot of funding from the Gates Foundation… and also managed to go public near the peak of the market, in late 2021, so they got a nice cash infusion to launch as a public company. They’ve been burning through that cash, but also making pretty big deals with pharmaceutical companies that include some milestone payments that have slowed the cash burn slightly, so they’re still in pretty good shape, with about $500 million in cash on the books — a big number for a company with a market capitalization of just $725 million, even if, of course, they’re likely to spend that $500 million, and perhaps more, before they have much of a chance of becoming sustainably profitable.

Exscientia is a pioneer, they say they were the designers of the first AI-discovered drugs to enter clinical trials (though some others make similar claims — there’s no real referee on this playing field, especially because not everyone agrees on exactly what qualifies as “AI”) — it looks like their first AI-discovered drug candidate was a flop in the clinic, that was many years ago in Japan (that’s the one that went quickly into clinical trials in 2020, as teased), but they do have four drugs in the clinic right now (two where they maintain some ownership, two partnered off for milestones and royalties), and two in “IND enabling” trials (meaning, getting the last data to justify an application to the FDA to start testing in humans). In total, they say that they have identified eight drugs that are either in trials or likely to be in clinical trials soon. And there have definitely been some successes in the cancer fight coming from Exscientia’s work, at least early on, according to this story from MIT Technology Review that provides a nice overview. (That’s where the story of Paul from Alex Green’s tease comes from, too.)

Exscientia widely distributes the claim that they “reduce drug development time by 70%”, and their earlier work with Sumitomo let them make an “80% cheaper” claim, too, though it’s awfully early, with a small data set, to be certain about that kind of advantage for AI.

And they have both a good history of grants from the Gates Foundation, as well as equity ownership by that foundation (about 1.3%). Many of Exscientia’s shareholders, in fact, are still the fairly early venture investors from before they went public a little two years ago (including Softbank, which owns about 5%).

Alex Green also says there is a “HUGE lineup of catalysts coming,” and that’s really what biotech investors want — they want results from clinical trials that shock investors with how good they are, and they want big milestone achievements, and new clinical trial launches, and, eventually, news that the FDA has approved their drug. We’re not all that far along on that front, but things are percolating.

Here’s how Green puts it:

“The company has drugs in their pipeline to treat head and neck cancers, colorectal cancer, and breast, ovarian, and pancreatic cancer.

“One of their AI-designed compounds just hit the clinical development stage… plus two more are coming right behind it.

“The company recently announced a brand-new potentially first-ever immunology and inflammation candidate in partnership with Bristol Myers Squibb.

“A month later, there was another announcement of a collaboration with the University of Medicine in Berlin to predict hematological cancers.

“As the chief executive and founder of the company says…

“Their ‘pipeline of wholly owned and partnered drug candidates is progressing rapidly.'”

That CEO quote is from their first quarter earnings report press release (well, they call it a “business update” since, you know, they don’t have earnings, and people care more about clinical and partnership progress, but you get the idea).

More recently, they shook things up a bit with their announcement, about two weeks ago, that they’re simplifying their own drug development pipeline on the non-partnered side, dropping one of their lead drug candidates that was in Phase 1/2 clinical trials and refocusing their own efforts on a few specific cancer targets, while they also continue to sign new pharma partners for other work, and make gradual progress with partners like Sanofi, Bristol-Myers and others (Sanofi is the biggest partner at this point, their deal is to identify 15 drug candidates in immunology and oncology for Sanofi to develop, with the potential for up to $5.2 billion in milestone payments plus royalties if all the candidates do very well in the clinic and get commercialized, presumably over many years). This “reprioritisation” seems to be a sign that they recognize how valuable it is that they have a nice cash pile right now, and they know that these programs will not necessarily be easy or fast, so they need to make the cash last — the goal, per that press release, is to “support continued investment into market-leading technology while maintaining cash runway well into 2026.”

Right now, they have three partnered drugs in Phase 1 trials with Sumitomo and Bristol Myers, and one drug they co-own in the clinic (CDK7, in Phase 1 trials for advanced solid tumors)… and any data released from those trials, or any new Phase 1 trials that get approved to begin, would probably be seen as important by the market, though that CDK7 trial is still enrolling. They probably won’t have definitive results for a while, and the company doesn’t specifically note any timeline for expecting results, but the first patients were dosed this summer. This isn’t shocking, nobody else running clinical trials on “AI discovered drugs” can really claim to have Phase 2 results anytime soon, there’s been a lot of work in this area, over the past decade or so, but not many actual drugs have gotten far enough that they’re being tested in a lot of human beings.

There may be catalysts coming if good news is released from these early-stage clinical trials over the coming year or so, or even if a preclinical candidate has spectacular numbers that get everyone’s attention, but the best guess is that the big milestone payments and any drug approvals are (at best) several years away. Exscientia does say that they use their AI systems in the clinical trial design and implementation, too, with “simulation guided trial design,” and that this leads to an adaptive trial in which they can evaluate results while the trial is running, including the precision systems that match patients to drugs, and maybe make the trials move faster… but it was also implied in the last conference call that the earliest they’ll have a “readout” from even these very early-stage clinical trials is probably the first half of next year. Maybe news squeaks out before that, I have no idea, but usually things don’t happen much faster than expected when you’re talking about biotech and trial enrollment and data releases.

Will Exscientia work out? That depends on the results of all these clinical trials, and on how the early milestone payments go, particularly with their larger and relatively new collaborations with Bristol Myers and Sanofi. The company says that although 2023 will be pretty light when it comes to milestone payments, which are the fees they earn when a partnered drug makes it through a big step (into clinical trials, good results, more clinical trials, approval, etc.), they “still see several hundred million of potential milestones over the next handful of years” (I’d say a handful, assuming we’re counting fingers, is five, but it’s obviously intentionally non-specific).

We’ll close with one last bit of hyperbole from Alexander Green…

“I believe the under-$10 AI stock I’ve described will be the next big winner in the Oxford Club hall of fame.

“This company is set to become one of the most profitable in the world. The number of drugs in development and giant partnerships is off the charts.

“If there was ever a chance to retire on just one stock, I truly believe this is it.

“I don’t want anything holding you back….

“I expect its sales to increase 111% by the end of the year.

“And they could jump by billions of dollars in the years ahead.”

That’s a bit above what analysts currently predict (they’re estimating $74 million in revenue in 2024, which doesn’t mean much, but there could be additional milestone payments, or new partners coming on board — the operating expenses presumably won’t drop much from the current level of a little over $200 million/year). And they could “jump by billions” in theory, eventually, but since milestone payments are back-loaded (they’re almost always much higher for Phase 3 and FDA approval than they are for Phase 1 or 2 or “IND-enabling” studies), I’d guess that any hint of “billions of dollars” in revenue is probably at least five years away. But you never know, sometimes biotech surprise us.

Exscientia is one of several AI biotech stocks that are encouraging high hopes among some investors, so one never knows if they’ll ignite during another manic phase for AI stocks in general, but they will probably also require a meaningful amount of patience when it comes to stuff like revenue and earnings. I covered the first 25 AI stocks we saw teased this year (including EXAI) in a sum-up article last week, in case you want to hear about what other folks are promoting.

Love EXAI’s potential? See great things for this one, or for any of the handful of other “AI drug discovery” stocks that have gone public and are trying to make similar progress? Let us know with a comment below. Thanks for reading!

Disclosure: of the companies mentioned above, I own shares of Berkshire Hathaway, Schrodinger, Amazon and Intuitive Surgical. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

I’ve been burned several times by Alex’s stock picks use caution and better yet trade the crap out of what he recommends if you intend to hold .. example ABSi and FLNG

Yep, ABSI and FLNG were both pretty heavily promoted teaser stocks from Green over the past year or so. They may end up doing well eventually, I guess we’ll find out in the course of time, but they have certainly failed to match the urgency of the promotions at this point.

ABST is defunct since August 1, 2023.

It is, the software company ABST was taken private over the Summer at about $11.50, and that was teased by some folks along the way (the Motley Fool, if memory serves) — but in this case we’re talking about Absci (ABSI), a slightly different ticker — ABSI was an earlier “AI drug discovery” tease by Alexander Green, for his more expensive microcap newsletter at the Oxford Club.

look at BFLY he recommended did a whole video with on how it was taking the world by storm the normal hype to get subscribers its almost worth nothing today! Anything that is get rich quick is a mistake they prey on your greed and desperation with a since of urgency to instill FOMO ! If you really want to get rich quick create a wolf of wall street type business like them and take unsuspecting peoples money from them!

True, he pitched BFLY back in April of 2022 as the next 10-bagger… so far, it’s down about 80% or so since then. (covered here: https://www.stockgumshoe.com/reviews/oxford-club/whats-oxfords-the-next-ten-bagger-handheld-ultrasound-stock/)

Alex Green has been a high flying ‘fiction’ writer. He has tremendous belief in his recommendation power. And so are coterie of minions. To save the organisation, his colleague Marc Lichenfeld most of the time dishes good recommendations. However, any recommendation (belonging to other outfits as well) you must vet. Important parameters are MC, EPS and minimum financial metrics. If EPS is in negative territory, you have to think twice.

I have been a lifelong member of Director Circle since 2006.

I’ve been an Oxford Club Chairman’s Circle member for a number of years, and view Marc Lichtenfeld as the worst – think he’s easily had the most “services” cancelled or renamed (a sure sign of “failure”) of any Oxford Club “analyst” in recent years. Huge drawback to me that he has pretty much become Oxford Club’s most prominent analyst after the departure of people like Matt Carr, whom I trusted a whole lot more. Alex Green maybe has a little higher (residual) status in the Club, but Marc runs more “services” now and is highlighted a lot – way too much for my taste. I discount ‘any’ recommendation from Marc.

I agree, Marc Lichtenfeld is loosing all credibility. He should have stayed put pitching his value stocks and fixed income.

ABSI finally made a big move. I had 20,000 shares that I bought at 1.77 and sold at 3.30. It is now 4.65.

Timing is everything. Recently bought ABSI just over $2 and I’m up 71%

I gave up on the Oxford Club years and years ago. Lost more than I made with their hyped recommendations. Thanks for cutting through all of the BS Travis!

Thanks John!

Thank you for all you do for us Travis, your info is vital to us small guys!

Thanks for the kind words, Rick, glad to help!

I heard that #RXRX Recursion Pharma was supposed to be the hot AI play for new drugs. Seems like there are a lot of players in this field.

That’s been one of the more high-profile ones, largely because they got a $50 million investment from NVIDIA a few months ago. They’re also in the very early stages, a couple rare disease treatments in Phase 2, a couple drugs in Phase 1, lots of preclinical work.

What is the company?

The one I mentioned in the comment above? RXRX

The one featured in this article? EXAI

are there other great AI medical companies that are highly recommended?

Not by me, AI Drug Discovery is a super speculative long-term bet — the stocks I see mentioned with some regularity are ABSI, EXAI, SDGR and RXRX, but the hopefuls are coming out of the woodwork, too.

RXRX was being pushed by Luke Lango at Investor Place, along with ADPT. ASRT, MAIA and IMGN were also some of Louis Navellier’s picks. I did really well with ASRT which dropped when they bought out another pharm company. I still think it could be a great buy especially at their current artificially low price of $2.34. I had a chunk at $1.35 and sold most of it when they went over $8 in May of this year. Pharm stocks can be dangerous, but they are also the easiest way to make big hits. Small pharm is well known to be the largest category of biggest gainers. Don’t forget to blow on those dice! Blessings.