Um, no.

That’s just stupid.

But it is the subject line of the latest teaser pitch from the Oxford Club for their membership and their Communique newsletter — the subject reads, “The One Stock Obama Doesn’t Want You to Know About.”

Why? Well, it’s not even really implied in the ad message that follows — which is about the banning of incandescent light bulbs as a national energy-saving plan.

But they’re teasing a company that they say has the manufacturing chops to manufacture the new, more efficient light bulbs that will be needed more inexpensively. Is that what’s supposed to make President Obama want you to be “in the dark” about the name of the company? I don’t get it.

OK, fine, I do get it: The folks at the Oxford Club are no dummies, and if you say something inflammatory about President Obama in your subject line it means there’s a better chance that your email will be opened — particularly by the grouchy, older, relatively well-off white men who tend to be Republican, and who are the core readership for all investment newsletters.

It’s not just Obama, of course — they did the same thing with George Bush before him, and Bill Clinton before that. Apparently polarizing political figures make people want to open their email.

Does the President want the maker of efficient light bulbs to be secret? Don’t be stupid. If he thinks about them at all (I’m guessing he’s a bit too busy, frankly), he’s wanting the free market to do what the free market does: Allow room for innovation within a regulatory framework, and use regulations to spur demand for more energy efficient products (like tax breaks for Energy Star appliances, or auto fuel efficiency standards), which tends to help increase efficiency and lower prices as volumes climb.

But that’s beside the point — I just can’t resist a little blather. And yes, I know, you have strong feelings about Obama, or Bush, or light bulbs. If you insist on sharing those feelings, you can do so in the comment box below. Those feelings are irrelevant to the current teaser that I will get to starting … now:

“You may have heard that the government is banning the 100-watt light bulb… And very soon the 75-, 60- and 40-watt bulbs as well.

“Now, some people think that a light bulb is trivial, but we believe Americans can decide how to light our homes just fine on our own.

“And now the government is trying to take away our choices.

“But one small company is saving Americans from the dreaded ‘light bulb law’

“While competitors are lobbying to force Americans to buy their bulbs, this company has instead created a better bulb that consumers will want anyway.

“It’s competing its way to bigger profits, instead of lobbying for them.”

So who is this light bulb innovator? Apparently they’ve developed a product that is …

“… 78% more efficient than an ordinary bulb and lasts 25 times longer… Saving the average homeowner about $6,975.”

And it’s making the bulbs cheaper, we’re told:

“this company is changing the game…

“It’s developed a way to mass-produce the product and sell it much cheaper than anything on the market.

“Yet most American’s have never heard of the company… It’s a small manufacturer that’s seemingly coming out of nowhere.

“Though this company is less than 3% of the size of General Electric, its sales are growing seven times faster.”

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...

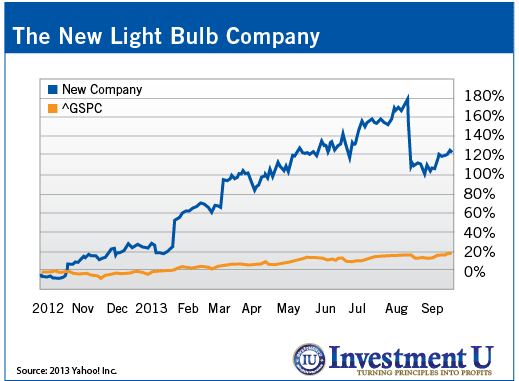

Not a lot of clues, right? I can guess at the name just from the gist of the ad … but since they also include a chart showing how spectacularly this stock has done already, we can use that as a clue as well — here’s a clip of the chart:

Which means, sez the Thinkolator, this “secret” stock is … Cree (CREE).

Which, if you’ll notice that recent dip in the chart, scared the heck out of its investors on August 13 — not because the earnings were bad, they weren’t, but because it’s a pricey stock that’s been driven by the hot story of LED lighting, and the CEO gave what most are interpreting as lowball guidance.

And … well, that’s about all I know about CREE — this is the kind of company that often does well, with a huge market opportunity as lighting becomes more efficient and their LED bulbs achieve greater economics of scale and get more cost-competitive with fluorescent or halogen bulbs even before energy savings, but I don’t know much about the specifics of the market right now, the speed of the changeover, or the business itself.

They are trading at about 25X next year’s expected earnings, and analysts think their earnings will climb by 15-20% this year and next, so that’s reasonable — I guess the reason to buy this one is if you think the analysts are underestimating the growth potential and believe that their earnings growth will stay on the same torrid pace of the last year, if that’s how it works out then CREE is cheap. If the earnings growth slows down as is expected, it’s probably a little expensive.

I clearly don’t know enough about this one to buy or sell it, so I’ll toss it out to the great Gumshoe Faithful — what do you think? Did we get a buying opportunity when the stock fell 20% in August, or is it still too expensive? Let us know with a comment below.

I HAVE OWNED CREE FOR SEVERAL YEARS. THIS PAST YEAR ITS PRICE HAS GONE FROM A LOW OF 24.50 TO A HIGH OF 76 AND IS NOW 60.19. THERE WAS A SELL-OFF THIS PAST AUGUST DUE TO THE COMPANY’S FIRST QUARTER EARNINGS GUIDANCE CAME IN ..BELOW ANALYSTS’ CONCENSUS ESTIMATES. IT IS A DECENT ENOUGH COMPANY WITH GOOD GROWTH PROSPECTS, NO LONG-TERM DEBT AND 82% OF ITS STOCK IS HELD BY INSTITUTIONS. IT PAYS NO DIVIDEND, HAS A HIGH TRAILING 12 MONTH’S P/E RATIO AND IS NOT RATED A BUY AT ITS CURRENT PRICE. I AM HOLDING ON TO MY STOCK AS I BELIEVE CREE HAS A BRIGHT FUTURE.

yes keep buying the LED as its good for the rare earths market

thank you all

ROE 3.1%, PE 81.7 – Forget it

A note from England where I am currently visiting. One thing you notice on the highways here is that there are solar panels over the lights and lit direction indicators–in rainy Britain. This eliminates the need to run wires alongside the road to light them. If the US ever gets out of its excessive and politicized fear of deficit spending and we start upgrading our infrastructure we might learn from the Brits about how to light the new roads we desperately need.

But first we have to resolve the sequester.

from a grumpy left-leaning senior female

In this discussion about LED lights I’d like to add a bit about things that are not commonly understood about them. And also other lighting options.

1) The LEDs them selves do not burn out. The power supply devices do. The power supply devices can be an issue. The LEDs that you simply screw into a socket, have a built-in power supply.

2) the LEDs do not fail like a incadecent bulb or flourecent, they get dimmer with time. So you have to replace them when they are only 90% or 80%, or 70% or some other % of their intial brightness.

3) I have had a very high % of the CFLs burnout much earlier than the normal life of an incandecent bulb. LIke 20 to 25%. Factor that in and they aren’t as inexpensve as they would seem at first.

4) CFLs are affected by low temerature. They sure would not work on our outside lights during the winter.

5) LEDs are not approtiate were the heating factor of the light is important, like traffic lights in the north, whcih rely on the heat from the lights to melt snow and ice and prevent condensation. But with the current legislation, someplaces may save to buy LEDs with supplemental heaters!!!!

And in the Middle Atalntic States, there are quite a few solar panel powered devices along non-urban stretches of Interstate Highways. A simple case of economics. In fact that is were Photo-electric solar powere actually makes sense almost always: Remote locations, even in the north. .

wouldn’t a equipment maker for LEDS and solar be a better play,such as vecco instructments (veco)/

Cree was founded by the same guy (recently deceased) who also founded the long gone and failed company, World Com.

It was CREE. Great timing. Too bad I didn’t buy, the way it goes

L can’t handle the spectral content of LED’s, Florescence’s, or Halogen lamps. So, I am on a buying spree of incandescent bulbs. Figure I have enough to last till I can’t remember what the problem was all about….

So Travis, Have you seen the Oxford Club’s latest teaser from ALEXANDER GREEN regarding the TRADE of theCENTURY? Dear Oxford Communiqué Subscriber,

The gains are, in a word, staggering.

In late March 2009, at the depths of the global credit crisis, one man and his wife made a special kind of stock purchase.

To say they knew what they were doing would be a ridiculous understatement.

Because they’ve since made an average profit of $412,569 a day on that trade… every day, for the past four years! All told, their purchase is now worth over $600 million.

Some are calling it (not surprisingly) “The Trade of the Century.” Yet this man and his wife were not the only ones getting rich…

Just days after their transaction, Oxford Club Chief Investment Strategist Alexander Green urged his readers to make similar trades in their own accounts.

And if you had known how to complete this particular trade, you could have tripled your money in 28 days.

For Alex’s readers, this was no one-time fluke. Since Alex first started tracking these special kinds of trades in 2003, he’s averaged a 44% gain on all closed positions.

And if you’d started following Alex’s advice earlier this year, to date you could have seen overall gains of up to 2,318%. That’s enough to turn a stake of just $2,500 into a $60,450 windfall.

Start making these trades today, and we believe you could make up to $15,735 every month – for the rest of your life.

To find out what’s behind Alexander’s “Trade of the Century” strategy, and what makes it so successful, just go here.

Could this be another plug for the put selling strategy?

botton line LET THERE BE LIGHT

CREE has been a leader in LED technology for a very long time, but I have been disappointed in the company’s inability to convert its technological advantages into a business model that works. Look at the smallest typical lightbulbs… those used for flashlights. Look into the specs for those super high tech and incredibly expensive “tactical” flashlights, including those that attach to the barrel of a gun, and you will probably find a Cree LED as the source of light. High efficiency, high durability, low power consumption, and rendering of precise spectra combine into one brand,,, Cree. I fianally found a superb D cell (3) flashlight for 25 bucks at Autozone (the “Max”) that is the best bang for anyone’s buck out there. Fantastic power and perfect light pattern etc. What matters here is that it uses a Cree 5 watt LED. I only mention it here, because if you check this out you will quickly see what is important about Cree – it makes the best LEDs. HOWEVER, it does not make the best investment. Too bad, because the world would benefit from a flood of superior products from Cree.

Tom

PS: If you are into short term (weeklies) covered call writing, as in an IRA, CREE can be a good vehicle. Just need to watch the trend closely and don’t be tempted by long term call options using CREE.

I made two purchases of this stock (5/7/13 and 8/27/13) with an average cost of $58.08 per share. With the current price as of 10/4/13 of 72.71, I have a nice short term gain. I like the stock’s potential.

I recently bought a few lots of CREE, but hedged my bets by selling near the money and short in time call options against them. Also, I echo the comments of others who have noted that CREE appears to be a or the technical leader in LEDs at present. I thought it very interesting when a couple of years ago Festool introduced a new and quite expensive battery powered light at $175 when I learned that Festool chose CREE LEDs for that product given that Germany has its own world class lighting companies. I, too, long for the soon to be gone incandescent bulbs and have been disappointed with the single LED lamp [made by Phillips] that I purchased about one year ago due to its extremely poor light distribution pattern that is much worse than the equivalent CFL. I’ve found CFLs don’t last as long as manufacturers and our government claims, and that many of them [all made in China] give off very noticeable audio noise continuously when in operation, take a while to warm up and produce decent light and thus are not very practical in a basement or other area that you intend to enter periodically, look for some item and then leave, and that a few have burned up producing an acrid smell as their circuitry self-fries. Fortunately those failures occurred while someone was at home and in or near the room in which the CFL failed. Others have produced so much RFI noise they interfere with TVs and radios using antennas; these, too, are made in China and carry USA FCC approval markings. Fraud, anyone? But our politicians are determined to force these lighting alternatives upon us, and ignore the hazards associated with their use, accidental breakage and disposal.

Does anyone know where Audi and other automotive manufacturers are sourcing their LED headlamp units? If anyone has watched the recent 24 hrs of Le Mans races, they may have seen those extremely high light output LED headlamps on the Audis which make all others seem dim by comparison.

Color spectrum of LED light output and capability of use with standard [existing] dimmers, service life and cost are all important factors to me.

Maybe this will label me as a “conspiracy theorist” but really , all I do is think outside the box.

Has anybody considered the fact that our fractional reserve banking system requires a constant stream of new borrowing to keep that Ponzi scheme alive? After all, “every bank loan is a new creation of money and when it is paid back it ceases too exist” Sworn testimony of Canada’s Central Bank Governor Graham Towers before Parliament in 1939 and the result should be obvious? NEW LOANS have to be contracted constantly to provide liquidity to the system as old ones are paid back, but what is not as obvious is the mathematical fact that the payment of INTEREST is not possible long term because it is never created, except in the sense of a “pyramid of debt” that eventually can not be serviced. Originally banks would not make loans unless they could get very strong collateral to confiscate if the loan was not paid back, but since virtually everything of value on a world scale has been pledged to the banking system, having to “loan or die” they have in recent years used “teaser rates” to get people to borrow, later raising the interest rates, but most of these loans are UNSECURED and mathematically un-payable. Ditto student loans, corporate bonds are simply a form of “debt roll-over” and sovereign debt is in effect secured by governments power to tax, but eventually even that reaches a practical limit.

Bottom line, government enforced new lines of business and standards are simply another form of “feeding the debt monster” new businesses generally have to borrow for plants and machinery, old established businesses not so much. Innovation is good if it is “market driven” demand based on a superior and/or money saving product or service, but a centrally planned or “command economy” is a nightmare. You can rightfully ask, what has all that got to do with the “price of putty” or in this case, LED lighting, and the answer is, FREE CHOICE, if the product is superior, longer lasting and price competitive then it will survive, otherwise it should die and go out of business, isn’t that the way capitalism is supposed to work? My experience has been that the highly touted “LONG LIFE BULBS” DO NOT last as long as incandescents in many cases, and the quality of light is inferior, and cost more. Just as the European debt problems have not been resolved and Porter Stansberry has recently written a brilliant piece saying GM is on track to possibly go bankrupt AGAIN in 5-10 years because the fundamental and foundational problems have not been resolved, so I say the fractional reserve banking system is also in its death throes.

WOW Myron!!

I am greatly relieved to learn that the fractional reserve/federal reserve system is on the brink of collapse by natural causes! For years now – decades really – I’ve been fretting that we would somehow have to extricate OURSELVES from their death-grip and after the roundup/execution of most peaceful anti-tax activists in the previous century, I seriously feared that militancy was the only remaining option and not a good one at that…more like a martyrdom really! So, please DO enlighten us as to how this natural demise of the tax-backed, government-supported, police-state bankers’ control of world economics will play out!!

It may still take awhile for the whole scenario to play out, but it is a mathematical certainty that the debt pyramid created by the Ponzi scheme known as fractional reserve banking will eventually collapse of its own flaws as pyramids always do. Eventually you run out of people, corporations and governments able to provide collateral for additional loans. The easiest way I know to follow the systemic collapse of the system is to read all the daily interviews posted on KING WORLD NEWS with some of the top financial minds in the world with impeccable credentials. Unfortunately the most likely outcome is a dictatorship and loss of personal freedom, particularly for those who are unprepared and oblivious to the malfunction of the DEBT BASED fiat (read counterfeit) paper currency system. Nothing wrong with paper money per say, but it needs to be backed by something tangible, not just the “hot air” coming from politicians. If you trust the “full faith and credit” of the U.S. government and its 17 Trillion in debt that can never be repaid in sound money then there are some painful lessons yet to be learned.

Since the Oxford letter was pushing CREE I have been checking in to the charts to see if there is a correlation of price movement off the Bollinger Bands that would help predict any change of direction. The only excitement I have seen, the waves look like a Hawaiian surfers dream in which a few have been know to die. GLTA who can trade this stock. I chose to pass on selling puts for a more predictable trend.