“The Death of Electric Cars” — Oxford Club says you can make a fortune on “The Next Exxon”

by Travis Johnson, Stock Gumshoe | March 23, 2016 1:01 am

Oxford Club says this "little-known company" and its "miracle of science" could do away with electric cars -- what is it?

I wrote an article about a similar pitch from the Oxford Club[1] folks a couple years ago, back when it was not just the “death of electric cars” that was being promised, but a way to make gasoline “three times cheaper” without using oil[2].

But I figured that this new ad must be talking about something a little different, despite the similarities, so I thought I’d take a closer look for you. The pitch is from Sean Brodrick[3], who helms the Oxford Resource Explorer[4] newsletter, and he says this “How to Make a Fortune on ‘The Next Exxon'” report will lead you straight to profits… in his words, “getting in now could soon hand you 53% in weeks… 165% in months… 633% in years… and more….”

Man, that “Next Exxon” bit sounds very similar to the promise he made back in the Summer of 2014, too –though back then it was “Early Investors Could Make 90.5%… 281.9%… And Even 1,063% in a Few Years….” Though that stock, which was recommended almost exactly at the recent peak in oil prices back in July, 2014, is now down about 46% from where it was then.

Am I sounding mysterious enough yet?

OK, here’s the opening of the spiel…

“Maybe once every century we see a technology breakthrough that completely transforms the world…

“And I believe we’re about to witness one of these rare events right now.

“It’s an event that could completely wipe out the electric car industry…

“And, at the same time, hand a clued-in group of investors gains of up to 633% in the coming 18 months.

“Not many understand the scale of what’s about to happen…

“But it’s going to begin with a little-known energy company working deep within the Louisiana Bayou.”

Other than that “electric cars” bit, that is sounding more and more familiar.

Here’s the “sum up” of Brodrick’s tease so we can jump ahead a bit:

“In my “How to Make a Fortune on ‘The Next Exxon’” report, you’ll discover…

- The name of this little-known company that creates real gasoline from natural gas[5]… three times cheaper and 40% cleaner than the “oil to gasoline” method.

- How it could sell this gasoline for as little as $0.58 a gallon and still be profitable.

- How it’ll soon create enough gasoline to fuel 10.3 million American cars a year… and ramp up to 20 million and beyond…

- How its technology, 372 patents, 120 scientists and locked-in monopoly on the ‘natural gas to gasoline’ process will give it a competitive advantage for years to come…”

Seriously? Yes, it seems that Brodrick is still pitching this same “natural gas to gasoline” company, Sasol (SSL)[6].

So yes, this remains one of the more egregiously misleading ads around — I thought it was bad enough that they were still sending out the ad unchanged last Fall, when I re-checked that “get real gasoline without oil for $0.58 a gallon” pitch[7], because the story had changed so dramatically in the year following that ad’s introduction… but now it’s even more ridiculous.

Unless, of course, oil takes off again and natural gas stays cheap, and Sasol re-starts their big but still conceptual “gas to liquids” project in Louisiana and it goes off without a hitch and is super-profitable in four or five years. Which might be possible, but isn’t in my “likely” category at the moment.

For those of you who don’t know the full story, I should backtrack a little here. Sasol is a big South African energy company, and they have probably worked more on fine-tuning and improving the Fischer–Tropsch process for creating synthetic liquid fuel from coal[8] and natural gas than anyone else in the last 75 years — in a sense, that’s because Nazi Germany, which was the previous champion of Fischer-Tropsch, and Apartheid-era South Africa had some things in common aside from the obvious horrors: They had lots of coal; and no one wanted to sell them any oil.

The process itself is pretty well understood and has been used by lots of companies — it’s not patented (the basic process is 90 years old), though there are patents on some of the specific processes, improvements and equipment used by most of the major gas to liquids plants (including the world’s largest, which is run by Shell in Qatar using a proprietary reactor system that’s different from Sasol’s). Sasol’s uniqueness, apparently, is in their reactor design, which (this is oversimplifying, sorry) uses heat, pressure, and cobalt[9] as a catalyst to turn natural gas into liquid fuel.

And Sean Brodrick persists in telling us that this company could “hand you 53% in weeks” because of this ability to “create real gasoline from natural gas” … more from the ad:

“As you’ll read in a few moments, its American plant is already in the works…

“A plant designed from the ground up to reduce the production costs of gasoline and fuel 10 million American vehicles per year.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“I’ll get into the details on this plant and why it’s going to result in an enormous surge in share price here shortly…

“Soon, it will distribute this ultra-cheap gasoline all across America…

“As I write this, trucks are clearing land for a plant to come online just months from now.

“People driving by can’t imagine the scale of what’s going to go on here.

“Covering 650 acres… it will rise out of a Gulf Coast bayou… with direct access to the massive natural gas fields pumping out record amounts of natural gas across Texas and the rest of the U.S.”

That implies a plant that will be selling cheap gasoline (actually, diesel in this case) soon… right? And he says that “a company executive let slip in an overseas newspaper that its plant is designed to be profitable at $25 a barrel”… which also seems to indicate that it should be “full speed ahead,” right? After all, oil did dip to maybe $28 or so a few weeks ago, but bounced right back and is in the $35-40 range now.

Except… Sasol canceled work on this plant well over a year ago and said the project was “delayed” because oil had fallen from $100 to $50 or so. Delayed as in stopped, as in they’re not investing in building this $11-14 billion massive gas-to-liquids refinery on their 650 acres near the Gulf coast and cheap natural gas supplies in Louisiana.

Now, Sasol is building something in Louisiana — that gas to liquids project, which is what he’s talking about and which is designed to turn natural gas into diesel fuel and similar refined liquids, is on hold… but they are also building a large ethane cracker at the same site, and that part of the project (which is slightly less expensive, about $8 billion expected capital investment) is apparently still proceeding (though a little slower than anticipated). That cracker complex, which is part of a big chemical complex that Sasol already had in the area, won’t have anything to do with gasoline prices, this is a plant that will create ethane from natural gas, which will then be used as an ethylene feedstock for various products (detergents, synthetic fabrics, film, etc.) That cracker broke ground last Spring, and is expected to be producing in 2019 sometime (delayed from 2018) — and ethylene prices are, apparently, much more stable than diesel fuel prices.

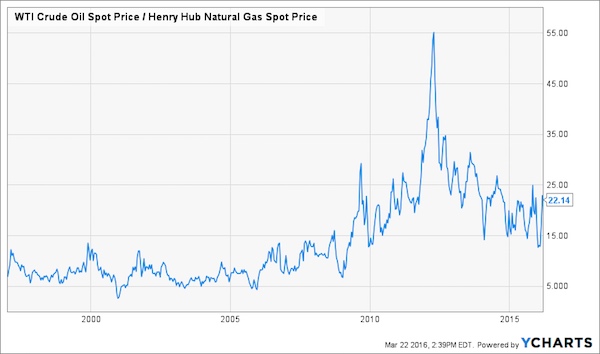

The company has been pretty consistent about saying that a oil-to-natural-gas price ratio of about 16:1 is the minimum for their gas-to-liquids (GTL) process to be cost-effective, and we’re still in that window — but when the project was first moving forward in the design phase in 2012, the ratio was more like 40:1. Here’s that ratio put on a chart, so you can see where the relative pricing has been over the last 20 or so years:

You can see that it’s been below 16 for at least as long as it’s been above it, though you can also see why the idea of investing in the differential between natural gas and oil was such a hot idea from 2009 into 2012 when that ratio was inexorably climbing… that’s also what got so many folks excited about the natural gas engine and fueling companies (Westport and Clean Energy Fuels, among others) — it seemed magical that natural gas was falling so fast but oil and gasoline prices were staying relatively higher, mostly because natural gas is so much more expensive to transport overseas than crude oil.

As an aside, that’s also when a fire was lit under the idea of liquefied natural gas (LNG) exports as a way to profit from the gap between US natural gas prices, newly cratered by explosive increases in shale gas production, and high LNG natural gas import prices in fuel-deprived areas like Europe, Japan[10] and South Korea[11]. There was a lot of money invested based on theories about where this oil/nat gas ratio or Henry Hub/LNG ratio might be in the future, and betting on broad price differentials like that is inherently risky.

Like Sasol’s mega project, LNG plants cost many billions of dollars and take forever to build — the first export facilities are finally operating now in the US, but everyone’s warily watching the price differentials there, too, as Japan’s import price for LNG has fallen by 50% since 2012, when Cheniere’s Sabine Pass LNG Export Facility broke ground (the US price, the Henry Hub nat gas price, has also fallen by about 50%). I mention that mostly because Cheniere (ticker LNG) was teased by this same newsletter about four months ago (that was a pitch from Dave Fessler which I wrote about here[12], Fessler also works on the Oxford Resource Explorer — Cheniere is down about 20% from when that pitch came out, though Chenier’s Sabine Pass MLP (CQP), which owns that first export project, is about flat)

Most of us just didn’t see, I guess, that the inexorable decline in natural gas prices following the “shale gas” revolution was going to mirrored by a similar move down in oil prices as US oil production exploded… probably because no one worried that we’d see an oil glut, because oil is so much more fungible on world markets (because of much cheaper and more available shipping infrastructure), and China[13] would keep buying more cars and surely OPEC would maintain some price controls… right?

Not so much. The Saudi’s opted not to bail US producers out, hoping that if they kept production up and drove prices down to the $30s everyone would give up and put their fracking[14] toys away and go home (driving heavy duty pickup trucks, hopefully, at high and inefficient speeds). Perhaps we’ve found some equilibrium now, with oil bouncing back a bit after a horrible few months, but I have no idea where the price is going — I am fairly confident, however, that all the oil found but not produced at $40 means we’ll see a lot more supply come online at, say, $60 or so as desperate drillers look to increase production rapidly so they can pay their bills. It seems unlikely, absent a big shock, that oil will be back at $100 anytime soon.

Which means that natural gas has to stay really, really cheap for big GTL projects to make sense — and it is, at least, awfully cheap right now. Sasol doesn’t have $14 billion to throw at a project in the hopes that they might breakeven in ten years — and they don’t necessarily own a cheap natural gas supply (like Shell reportedly does in Qatar) that can keep them going if oil prices are volatile, so their planning must depend on their guesses about future gas and oil prices… and while their recent comments about pricing are conservative, there’s no what to know how or when they’ll make a decision to go ahead with their big plant in Louisiana.

It does not appear that the WTI Crude/Henry Hub natural gas ratio of 15-25 that we’ve seen over the past year is enough to make Sasol eager to put a shovel into the ground — as far as I can tell they’ve made no decisions on the project since January of 2015, when the CEO said the delay “will allow us to evaluate the possibility of phasing in the project in the most pragmatic and effective manner.” (that CEO, David Constable, is leaving the company in May, just FYI.)

When this ad was first circulating in the Summer of 2014, I wasn’t all that worried about the price of oil having a huge impact on Sasol’s plans — I was more worried about the fact that we’re talking about a $14 billion project, and there are only a few of these facilities in the world (all of which seem to have gone way, way over budget and taken far longer than expected to build)… and the fact that even if the project works and is on schedule, it would take several years before they actually got it built and produced any diesel from natural gas. That’s still a concern, assuming that they do eventually build this thing.

And that, presumably, is what Brodrick thinks will happen soon — in a follow-up email to the original ad this is what he says:

“Remember: This ‘gasoline without oil’ company is poised to fuel 10.3 million U.S. vehicles a year…

“With $0.58 gasoline.

“I’d like to give you a quick reminder of where we stand at this very moment:

“I expect this ‘gasoline without oil’ company’s executives to make a series of announcements about their U.S. ‘gasoline without oil’ plant soon.

“The buzz from their press releases alone… not to mention the news coverage… could easily send the stock up 90.5% quickly and triple it soon after.”

So I guess he’s betting on the idea that Sasol will announce that they’re restarting development of the plant to at least some degree, and that investors will be ecstatic. If it does get built, it would presumably take at least 3-4 years, probably longer, but it appears that Brodrick thinks we’ll see the market immediately react with excitement to the plan.

I’d counter with the reminder that this is a large company, with a market cap of about $20 billion and major operations in several countries… and that the impact of the Louisiana GTL project wasn’t that obvious on the share price back when that project was expected to be built and operational in 2018 or 2019. From 2012, when they started the engineering and design work, until January 2015, when they put it on hold because of falling oil prices, the share price of SSL went from the mid-40s to a high of about $60 when oil peaked in price in the Summer of 2014, then dropped with falling oil prices and was back below $40 a share before they announced that the Louisiana project was on hold.

If the stock rose by 90%, that would put it back right around Sasol’s all-time highs in the neighborhood of $60 a share. Sasol is a little bit unusual because of its focus on alternative technologies like their GTL process, but the stock still tends to move in line with oil prices and with other big energy companies — here’s a five-year chart of Sasol and WTI crude oil:

That doesn’t mean Sasol can’t go up by 90% — it has had good runs before, though the last time it really outperformed the energy sector was in 2003-2006 or so when they were first emerging as a global player trying to grow beyond South Africa (they began to trade on the NYSE in 2003, which was part of raising their profile). But I suspect that if Sasol does go up by 90%, that means oil is going to be probably at least $70 a barrel… which means a lot of other energy stocks will also do fantastically well. I suppose it’s possible that the market would get excited about a flurry of press releases about the Louisiana GTL plant getting the green light or getting financing, and maybe the stock will soar, I don’t know… but I’m pretty skeptical on that front.

And, of course, the most recent news out of Sasol has not been about speeding their capital expenditures… but about cutting costs and delaying projects further, like the announcement a few weeks ago [15]that the ethane cracker part of the Louisiana project that is still being developed will now likely be completed in 2019 instead of 2018. Sasol is clearly planning for oil prices to be “lower for longer,” and I’d say they seem, from reading their press releases (like the recent quarterly report here from a couple weeks ago[16]) to be hunkered down in “cost containment mode”… not nearly as desperate as the midsize oil producers who are panicking and in “survival mode,” but not necessarily primed for growth, expansion and big capital projects, either.

If we ignore the possible impact of the massive on-hold capital investment in GTL expansion either in Louisiana or at their smaller Qatar plant, and just look at their current operations, Sasol has held up relatively well despite the decline in oil prices — it’s still profitable, with a trailing PE of about 14, and it’s down from its highs… but not down nearly as much as some energy companies. I see just two analyst estimates for SSL, and the average of the two has earnings falling dramatically in the current year (which ends in June) to about $1.29, then recovering a bit in FY2017 to $2.30, with earnings growth in the low single digits after that. That means the stock is trading with a forward PE (based on FY17) of about 13. Obviously, analyst estimates depend heavily on whatever that analyst thinks will happen to energy prices.

There doesn’t seem to be much enthusiasm about the shares outside of Sean Brodrick’s office, from what I can tell, so he is at least being a bit contrarian now (though his similar push for the same stock at $58 in 2014 was, of course, the very opposite of contrarian). Analysts have been downgrading Sasol in recent weeks, and their debt has come under watch for a possible downgrade (though it will still probably be pretty highly rated, they don’t have that much debt relative to their cash and assets — the balance sheet isn’t really what worries me about SSL). I guess I’d probably be inclined to consider buying Sasol over Tesla… but that’s more because of my fear of Tesla’s valuation than it is the notion that Sasol will “kill the electric car.” I’m pretty happy that I don’t have to own either at this point.

So there you have it — yes, it’s still the same old pitch for Sasol and their possible big GTL project in Louisiana, and I still think you’ll have plenty of time to digest the news if they do indeed decide to go forward with that project. And if you’re throwing around numbers like “SSL will go up by 90% this year” or “triple soon after” well, I’ll happily take the “under” on that bet, and I suspect that Sasol’s performance over the next few years will probably be good if oil goes up, and bad if oil stays flat or goes down, much like lots of other energy companies. What say you? Any interest in Sasol or the other stocks that need a big gas-to-oil price ratio to thrive? Let us know with a comment below.

- Oxford Club: https://www.stockgumshoe.com/tag/oxford-club/

- oil: https://www.stockgumshoe.com/tag/oil/

- Sean Brodrick: https://www.stockgumshoe.com/tag/sean-brodrick/

- Oxford Resource Explorer: https://www.stockgumshoe.com/tag/oxford-resource-explorer/

- natural gas: https://www.stockgumshoe.com/tag/natural-gas/

- Sasol (SSL): https://www.stockgumshoe.com/tag/ssl/

- I re-checked that “get real gasoline without oil for $0.58 a gallon” pitch: http://www.stockgumshoe.com/reviews/oxford-resource-explorer/real-gasoline-without-oil-for-90-returns/

- coal: https://www.stockgumshoe.com/tag/coal/

- cobalt: https://www.stockgumshoe.com/tag/cobalt/

- Japan: https://www.stockgumshoe.com/tag/japan/

- Korea: https://www.stockgumshoe.com/tag/korea/

- pitch from Dave Fessler which I wrote about here: http://www.stockgumshoe.com/reviews/oxford-resource-explorer/its-the-only-company-licensed-to-trade-a-product-it-buys-for-2-60-and-could-sell-for-as-much-as-15/

- China: https://www.stockgumshoe.com/tag/china/

- fracking: https://www.stockgumshoe.com/tag/fracking/

- announcement a few weeks ago : http://www.bloomberg.com/news/articles/2016-03-07/sasol-first-half-profit-falls-63-after-oil-and-chemical-decline?cmpid=yhoo.headline

- quarterly report here from a couple weeks ago: http://finance.yahoo.com/news/sasol-earnings-resilient-despite-oil-054300161.html

Source URL: https://www.stockgumshoe.com/reviews/oxford-resource-explorer/the-death-of-electric-cars-oxford-club-says-you-can-make-a-fortune-on-the-next-exxon/

Thanks for the update Travis. Some Teases refuse to die!

I love to read your reports. They give me a lot of insite. I just started to invest on my own, and what I invested in really sucks at this time. (I’m down by at least 10% from when I started). Mostly because of one stock – SUNE. I’m also invested in TSLA, TRXC and a couple more. As soon as they make a profit, I’m getting out of this time consuming losing business. Please tell me what you think of the stocks I am invested in. These were the stocks that Money Morning suggested.

canklan, welcome to the Gummunity. 🙂 I for one encourage you to not to throw in the towel on your investment journey. Travis has provided new investors and/or new members of the Gummune an excellent article and thread here: http://www.stockgumshoe.com/2014/11/first-steps-and-favorite-tools-for-new-investors/ I wish the best of the best for you.-Ben

It’s not just about what to invest in but also when to do it. Timing is important. Anyone planning to invest in the markets right now perhaps should look at a chart such as this one and consider whether it’s all about to become “3rd time unlucky”.

http://www.marketwatch.com/investing/index/spx/charts?symb=SPX&countrycode=US&time=20&startdate=1%2F4%2F1999&enddate=11%2F3%2F2014&freq=3&compidx=none&compind=none&comptemptext=Enter+Symbol%28s%29&comp=none&uf=0&ma=1&maval=12&lf=2&lf2=4&lf3=0&type=4%20&size=2&style=1013

I worked for a company owned by Sasol, and was impressed with their

shrewdness and acute business- like approach to the bottom line…..with some affection, I Iikened them to” Scottish Jews” (no offence, I am part Scottish). Their dividend is worth considering and probably very solid……john

john, I do take offence, I am Jewish, and see no reason for you or anybody to assume a person who is Jewish is mean or tight in any way.

If you know anything about human nature, you will know every person is different, each with their OWN personality. To assume that a person who is either Scottish or Jewish, or even both, is one who watches their outgoings, is to assume everybody else is a wasteful overgenerous fool.

Everybody’s a stereotype!

Yeah, but Scots are notorious for it (having been poor for so long). Luckily,

they have a sense of humour or perspective, possibly from a recent lack of persecution.

It was humor, get over it or die with it.

Stop being so sensitive that’s why these stereotypes linger on and on. Is it a bad trait to be frugal with money? No. would you want to be on the opposite end where your squander everything you get your hands on? The problem with stereotypes is people either perpetuate it or try their hardest to disprove it or complain.

You might want to check out Siluria technologies out Hayward California . Can do the same thing . 60 cents a gal when NG is $4/ gig . But they are a private company . The Saudis are involved to.

As a climate change supporter, this looks to keep us in the fossil industry; So maybe, but electic cars new battery tech is at least emotionally, much more appealing;;

Unfortunately you have two strikes against your views. Climate Change AKA, Gorebull Warbling has been dismissed by numerous Geologists, Engineers and Real Climate Scientists like Dr. Tim Ball as he writes in “The Deliberate Corruption of Climate Science”. Dr. Ball points out the theory has no basis in fact and was an invention of the UN Agenda 21, the World Global Domination Meme in the early 90s. None of the Doomsday Predictions by Climate Alarmists has happened and there has been no warming for the last 18+ years. So government apparatchiks ( NOAA ) are now fudging the climate record to disprove that. Keep track of the treachery at https://www.wattsupwiththat.com, award winning Scientific Blog three years running.

Your other fantasy about battery technology can easily be dismissed by the attached video from Mark Mills at the ICC-10 Climate Conference which I attended in June of last year, http://climateconferences.heartland.org/mark-mills-iccc10-panel-3/, Called Energy Reality. Hopefully you will be better informed in the future.

Travis! Stop this thread while you can!! I’ve seen a lot of forums blow themselves up by following this fact-free emotional indulgence! Keep us focused on the stocks, not the back and forth of whose scientists are better fabricators and dissemblers.

Very good Sir. Thank you.

yea, yea, all in “good time” any body who thinks electric cars will

be upstaged needs to reconsider…. Elon Musk is currently the

next best thing since ALBERT passed away. Paul.

Hell I’d be just as good if I had the Billions of taxpayer Dollars and tax relief Elon has extorted. Things are a bit musky in California and DC ( District of Corruption ).

Unless they can get their act together and begin producing large numbers of affordable quality cars (and trucks) the company most likely to kill electric cars is Tesla. If the present CAFE target of 54.5 mpg by year 2025 is to be met, all the major auto manufacturers may be paying you to drive an electric car off their lots by then. It’s doubtful Tesla can match that and stay in business, unless they start making and selling (gasp!) gasoline-run cars as well. As for Sasol, they should probably stick to building ethylene plants, where they can compete with the Original Exxon and other major oil/petrochemical firms who are also expanding their ethylene capacity.

Hmm, so the pitch was the usual rabid blithering. I wonder if these people have a nurse to look after them. I also wonder if they feel any shame when Travis exposes their nonsense!? As for Sasol then surely they’re better off using their LNG in power stations to supply the grid for all the electric cars. Seems simple and if they started before March 31st they could make 713 1/2% before April fools day.

The next “Exxon” ?? Was that a typo ?? I think he meant ENRON. Trav-I don’t where find the time for such insightful analysis but it is most appreciated ! God Bless and Happy Easter !!

Has anybody given thought to Solar Highways – all those acres and acres of solar energy soaked up and wasted in tarmac. Consider: one ‘converted’ moderate driveway a sufficient contender to power the accompanying house and a motorway surface area capable of powering up adjacent towns or a city. (Rule of thumb of course, or perhaps fly by wire!) Free bonus included: No need for Triffid like cable carrying pylons stretching for miles, or communication services outed due snow and wind. Who needs to go rock breaking or bleeding mother earth of her essential oils. Energy has been thrown at us free gratis (and for nothing) from the sky since day one! If nothing else maybe a solar panel nailed to the roof of a popular Hybrid -‘no further ‘plug in’ required sir’ – and 100’s to the gallon .

…Just a thought. The astrologer.

A car that runs on sunshine!

The picture you painted is not clear enough for me. If the invention was founded 75 yrs. ago why was it not put into immediate global practice? Here one is tempted to say, that’s because oil was plenty available, easy to extract and brought in higher revenue. That’s half-truth only. The oil shock of 1973 should have been sufficient enough to budge the most pig-headed oil executive to look for an alternative, all the more if it could have been cheaper as the present claim pronounces.

A more plausible explanation could be that technology is moving pretty fast and much cheaper energy sources are popping up, the hydrogen technology in particular. Sun is free of cost 3/4 th of our Globe is covered by water. With constantly improving more efficient solar cells you only need to split desalinated sea water into hydrogen and oxygen. A 1984 paper by a leading technologist Ludwig Böllkow – founder of the pedigree German company – MBB (Messerschmitt-Böllkow-Blöm) and the well-known semi-conductor physicist late H.F. Mataré proposed that an area of the size of Sahara farmed with Gallium-Arsenide-based multi-junction solar cells producing electrical energy to split desalinated sea-water into hydrogen and oxygen, could feed the entire Europe with hydrogen as prime energy. When hydrogen burns, we get water again, thus a very environment-friendly cycle completed. Hydrogen-fueled cars are already plying the streets of Californian cities.

Very possibly one could predict that by the turn of this century our world would have gone hydrogen. If fusion energy lights up too, the human kind would have in principle solved its energy problem for good. Exxon has already invested over 20 Bill. $’s on H2 research and Royal Dutch Shell years ago earmarked around 250 Bill $ for alternative energy R & D, as President-Director, Shell Netherlands, Mr. Dick Benschop told me many years ago here in Vienna. Big Oil will be the last to lose sight of the market. These are tough callings to take note of.

George Chakko, former U.N. correspondent, now retiree in Vienna, Austria.

Vienna, 24/03/2016 19:51 hrs

I think the keys are probably that the process is expensive and dirty, and therefore only viable where there is cheap gas or coal and expensive or unavailable oil. The process has also improved iteratively, I expect, over the past 30 years … But it also still costs tens of billions of dollars and many years to build a plant that is only viable in commodity pricing markets that are skewed in a particular way… Which is often not a permanent situation.

All pipe dreams. As a correspondent your knowledge of physics and thermodynamics is simplistic and so are these people you reference. Peter’s Principle stipulates that in any organization all individuals rise to their own level of incompetence.

Suggest you reference http://www.fauxscienceslayer.com for appropriate information.

How do you claim tax rebate that Oxford Club is pushing?

I think you’re taking about this one: http://www.stockgumshoe.com/reviews/oxford-club/whats-oxford-clubs-42-4-billion-consumer-rebate-program/

This battery redesign may at last make electric cars practical,,, If it pans out.

In theory, practice and theory are the same, but in practice they are not.

If it does work it may make a millionaire of Elon Musk,,,,, yes I do know he is a

billionaire now. IMHO

http://scienmag.com/superoxide-gives-lithium-air-batteries-a-jolt/