I’ve gotten a bunch of questions about Teeka Tiwari’s “Trump Tower” teaser pitch recently, so although the ad is actually very old now (it’s still got a January 29, 2020 date under the signature) I thought I’d re-share our solution. It is still circulating heavily, and it’s an ad for Palm Beach’s “entry level” newsletter called The Palm Beach Letter ($49, renews at $129).

What follows was last updated on April 6, 2020, in the throes of the Pandemic Panic, so the story for all of these stocks has obviously changed dramatically… as have prices for cryptocurrencies, with Bitcoin now up about 650% since then… but the actual ad and the stocks he’s teasing remain largely unchanged. I have kept my notes unchanged as well, though they may now sound foolish given the year we’ve had, so be gentle :).

The basic pitch is that blockchain is going to revolutionize the world, and that all the big guys are invested in it and we’re just getting started, with 295,000% gains coming (that comes from the World Economic Forum’s assessment that the blockchain ecosystem will store 10% of the world’s GDP by 2027, which might as well be a made-up number — there’s a free Palm Beach note about that here).

Tiwari even throws Warren Buffett in there as being part of this “investment of the decade” in blockchain technology, though that’s a pretty spurious name-drop (he implies that Buffett is “all in” because 21 of Berkshire’s 25 largest holdings have “invested in Genesis technology” — meaning they’ve done some kind of work with blockchain or cryptocurrencies… since I expect that almost every large company has done some work exploring or researching blockchain, that’s probably pretty meaningless).

But anyway, yes, his basic argument is that “Genesis Technology” is about to go mainstream and reach heavy adoption, and that as it becomes a huge part of the global economy you’ll get rich if you own the right stocks. Which, of course, he can tell you about for $49.

To be fair, Teeka Tiwari was one of the early mainstream newsletter guys who was recommending cryptocurrencies early on, back in the Summer of 2016, and particularly got into Ethereum before most pundits, so he’s not making up those historically excellent returns he probably had at that time. I would imagine that Ethereum pick in 2016 is probably what boosts the high average return that he brags about for his newsletter portfolio, much like the early picks of Netflix or Amazon fuel David Gardner’s average performance at the Motley Fool, and Tiwari these days is probably recommending little tiny cryptocurrencies right and left to try to replicate that 1,000% return magic.

But this one’s about stocks — so let’s find out what he’s pitching, shall we?

Before we get started, though, I should note that the “Trump Tower” part of this tease seems to be just name-dropping — he uses it as an example of a property evolving to “highest and best use”, as happens with lots of real estate eventually (a long spiel about a vacant lot becoming townhouses becoming a department store tower becoming Trump Tower, and adding value along the way). Somehow he applies this to blockchain, but mostly it’s just a way to drop the Trump name for attention… here’s how the connection is drawn…

What is blockchain’s “highest and best” use? More from the ad…

“Well, here’s the thing…

“At its core, blockchain is really just a very secure way to store information…

“It is the safest way to store information that has ever been devised. Because you can’t ‘hack’ the system.

“So, blockchain’s potential uses are wide and varied—I can’t possibly go into all of them in detail.

“But, to give you a taste, blockchain is being used today…

* To help modernize the $217 trillion real estate industry…

* To combat the $1.7 trillion in counterfeit goods sold each year…

* To improve the electoral voting system, making illegal votes a thing of the past…

* To help greatly reduce healthcare costs….

* And, also, to secure the food supply.”

But the big market, no surprise, is “money”…

“You see, while I was in Manhattan, I discovered something major going on right now…

“And that is this:

“The finance industry is ALL OVER blockchain!

“We talked about the “adoption curve” earlier.

“Well, we’re right at the “take off” point.

“Mass adoption has started…

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“Have you ever heard of the DTCC, the “Depository Trust Clearing Corporation”?

“That’s the major organization that clears more than $54 trillion in stock, mutual fund, and other financial trades each year…

“Well, get this…

“The DTCC just announced they’re moving $10 trillion onto the blockchain!”

OK, so that’s the basic background to his pitch — that blockchain is going mainstream. And while he does tease and tout some specific cryptocurrencies in his other pitches for higher-priced newsletters, in this ad he’s pitching stocks that are connected to blockchain. So what are they?

Let’s get into the clues… here’s the talk about number one:

“Well, soon, we’re going to see a brand new blockchain exchange hit the markets.

“And one company has positioned itself as the sole ‘gatekeeper.’

“You see, it’s the only company cleared by the SEC to trade blockchain investments…

“That means, as blockchain goes mainstream…

“And more and more investors rush in, and new financial blockchain products are introduced…

“This company will make a cut on every transaction.”

Other hints about this one? This is what we get…

“It’s got a huge competitive advantage—a ‘moat,’ as Buffett would put it.

“Insiders LOVE it. They own 93% of the company…

“Vanguard, Blackrock, State Street. They’ve all scooped up a ton of shares.

“But—today—you can still buy cheap shares while it’s flying under the radar.”

Not much certainty here, there are lots of companies setting up to try to become the toll-taking “exchanges” of the blockchain world, but my first thought was that this is very likely Overstock.com (OSTK), which has been investing in building a blockchain-focused venture capital arm for a few years. That division is called Medici Ventures, and the star of the portfolio is tZero, which is indeed trying to become a big exchange for security tokens.

I don’t know where they get the “insiders own 93% business,” though — there are essentially no publicly traded companies where insiders own that large a percentage. Yes, Vanguard, Blackrock and State Street all own “a ton” of shares of Overstock, but that’s not really useful informaion — that’s true of pretty much every single stock of any size in the public markets, if you’re in any of the indices, from the S&P 500 to the Russell 2000 to any major sector index, then a large number of your shares will be held by index ETFs, and those are the three big managers of those index ETFs so they’ll always show up as major owners of any nontrivial company.

Readers called to my attention, though, that Intercontinental Exchange (ICE) is a much better match. ICE is a great company, they own a couple dozen exchanges and really benefit from market volatility so it’s probably a good idea here (better at the trough, of course, then in January or now, but one never gets timing perfect), but I’d be very surprised if it ends up being dramatically impacted by trading in cryptocurrencies or security tokens. They do have an interesting business in BAKKT that might turn into something big as this evolves, but I would be surprised if that makes a financial impact on the company in the next five years — the NYSE and their commodity trading exchanges are far, far larger than the bitcoin/altcoin trading opportunity right now. Energy futures trading is by far their largest market — energy, agricultural commodities and metals make up about half of their actual trading and clearing revenue, which is their highest margin business and is pretty volatile, but their data and analytics products and services provide a pretty steady revenue foundation. I do like ICE a lot more than OSTK, so that’s good, but wouldn’t base my valuation on their potential in cryptocurrency trading.

Here are the notes I shared on Overstock, before shifting my focus, in case you’d like to see them…

Sadly, Overstock still owns its disappointing ecommerce division, Overstock.com, and they’ve probably missed the opportunity to sell it and get out of their own way in that division. It was an exciting e-commerce growth story 15-20 years ago, but they lost that battle to better-capitalized unicorns and Amazon, to say nothing of the improving ecommerce offerings from Target and Walmart, and it strikes me that they have been trying to create a survivable niche ever since. Faced with the pressure from giant money-losers like Wayfair, they decided about two years ago to ramp up their investments in advertising instead and try to lose money as fast as the other guys to grow the business, promising that they could grow even better and more efficiently than their new competitors. Then they kept losing even more money, and realized it might not be easy to get more, so they pulled back on that (this is my perception, at least, it might be unfair).

And through the past decade of ups and downs they’ve essentially been riding the waves generated by their unpredictable (now ex) CEO, Patrick Byrne, who has spent 20 years angering regulators and espousing conspiracy theories and fighting against the insular Wall Street titans (not an unreasonable thing to do all the time, of course, but it rarely ends well for public company CEOs to tilt at windmills — Patrick Byrne has often been compared to John McAfee in the past year, which is fun but probably not healthy), then got caught canoodling with an accused Russian spy, and finally stepped down from his position and sold his Overstock shares late last summer (selling a huge stake right before Overstock announced disastrous results and saw the share price drop, coincidentally enough).

Byrne’s story is a fantastic one, you’d have a hard time believing it if it were a novel — there’s a good summary here following his resignation if you’re curious, and a longer Forbes piece here.

On the plus side, the stock has certainly come way down in price now, and they are still trying to build up their tZero and other blockchain-related investments that have been Byrne’s focus since 2016 or 2017, though it’s going to become a bit more financially precarious unless they start getting some revenue fairly soon. They aren’t going broke immediately, they did sell some equity late last year so they have more than $100 million in cash still, and they borrowed money against their Peace Coliseum headquarters and are having their Medici companies raise third-party capital where feasible, but cash is likely to be spent pretty quickly — the actual ecommerce business performs best in the fourth quarter, as you’d expect for a retail operation, but they always burn cash the rest of the year and this year will probably be unusually bad in that regard.

Still, if you have a lot of confidence about tZero then maybe it’s worthwhile to you that you are getting that and the other Medici Ventures investments “on the cheap” here by buying Overstock shares.

Their big push now at tZero is to open the first regulated national exchange for trading security tokens, the Boston Securities Exchange (BSTX), but they don’t yet have regulatory approval in hand (tZero does have one SEC-registered broker dealer in its portfolio, tZERO ATS, which facilitates trades of equities and digital securities, so that technically matches the clues but the trading volume is minuscule so far). My guess would be that having Byrne involved as a major Medici shareholder (I don’t think he sold his separate shares of Medici Ventures, just his OSTK shares) is still a substantial negative, since nobody knows what he might do next, but some of those businesses, including tZero, do look appealing. They’re also issuing a “digital dividend” using the tZero platform at some point soon, though the details of that (it gets the designation OSTKO) are still seemingly uncertain.

The big push is in “tokenization”, which is different from the first wave of cryptocurrencies — most cryptocurrencies were designed (if any thought went into an end market at all) to serve as “utility tokens” to help with the exchange of money or establish platforms for exchanging or authenticating other assets, but the “security tokens” being issued more often now are often much more like regular financial assets — they’re often “securitized” real assets, like pieces of real estate, or pieces of ownership in a company. Instead of chopping your company up into pieces and selling those pieces on the NYSE, then, you might chop them into pieces, create a blockchain “token” for each piece, and let people trade those tokens through an exchange like tZero. It’s not really any different, except that the infrastructure and regulatory overhang are much lighter, so the costs are much lower. At least theoretically. That tokenization is what Patrick Byrne has long called the “killer app” for blockchain, and he’s not the only one who believes that… though what it might be worth, who might “own” it, if anyone, and how money will be made are all open questions.

Will security tokens take off as a way to sell and exchange assets, in place of stock markets or bond markets? I have no idea. Maybe. And tZero and Overstock are an early mover in this space, though the idea that they’ll be able to “disrupt” the big exchanges and create a meaningful-sized business still seems a little optimistic to me.

At this price, With Overstock.com now trading at a market cap of just about $200 million, it may be worth considering and it might be that they’ll get beyond the collapsing e-commerce business and that the departure of Byrne will let Wall Street take them seriously again someday… but be careful — at this point, I think, you’re catching the falling retail knife of what I’d guess is a dying ecommerce business and hoping that tZero and the other Medici Ventures companies can grow up fast enough for it to be worthwhile. The e-commerce business is cheap, and they still say optimistic things about it in their presentations, but revenue is still falling pretty sharply so I’d hesitate to bet a lot on their survival in that business. If you want to start digging into where they stand now, you can see their last quarterly presentation here (transcript here).

And what’s the next stock? Let’s check our clues…

“The Next Visa: The Blockchain ‘Payment Stock’ I Predict Will Go Up 16x! ….

“As I mentioned earlier, I believe our current debit and credit cards will soon disappear…

“They’ll be replaced by better, much safer ‘blockchain-backed’ cards….

“One payment company right now has already implemented blockchain into its system!

“It’s not Visa. Mastercard. American Express. Discover. Or PayPal, either.

“And, already, this company’s revenue has skyrocketed 16-fold…

“That’s eight times faster than Visa. And six times better than PayPal!

“And the number of payments processed is blowing up…

“But it’s not done yet…

“In fact, I predict blockchain stock #2 will become ‘the next Visa’… meaning it could still climb 16x from here… turning every five grand into $80,000!”

And a couple other clues…

“… the company has attracted Goldman Sachs’s former CFO to its board of directors. As well as former secretary of the Treasury, Larry Summers….

“Vanguard, Blackrock, and Morgan Stanley have already stockpiled 51 million shares between them…

“Goldman Sachs was also an early investor, participating in a $150 million round of funding…

“And billionaire hedge fund managers Andreas Halvorsen and Stephen Mandel have taken positions.”

That’s Square (SQ), and yes, that stock has been tied to the blockchain story since the emergence of bitcoin as a big deal a few years ago — partly because the Square Cash app was one of the first mainstream ways that regular people could easily buy bitcoin. And this one is nice and definite, since we can confirm the match with some numbers — the tease indicates that this “secret” company had $3,298 million in revenue in 2018, and that’s exactly what Square reported.

The bigger story for Square, though, is their actual business — providing point of sale hardware and cloud payment processing services for retailers. They are indeed pushing bitcoin as a payments solution, including accelerating their development of the Lightning Network that is intended to make bitcoin more scalable, so there is a real connection there still (I’m not an expert on this, but here’s how I think about it: bitcoin processes transactions very slowly compared to conventional payment networks, way too slowly for it to be useful for everyday commerce, so there are a lot of “speed it up” networks that try to build on that with a second layer, processing payments much more quickly and then communicating those transactions back to the base bitcoin network… somehow).

Whether they’ll become the “next Visa,” though, I have no idea — certainly they have pretty good economies of scale to invest in blockchain, but it’s also true that Visa and Mastercard and everyone else in the fintech or payments space is also investing in blockchain projects. Nobody wants to be beholden to a network they have to pay for in the future, partly because everyone’s pretty grumpy about the fact that in so many ways we’re all beholden to the expensive Mastercard and Visa networks now.

Square gets teased pretty regularly, and I’ve invested in it in the past though I don’t currently own shares, so I’ll just leave you with what I wrote when Christian DeHaemer included Square as one of his “MVPS” stocks to lead the next payment revolution:

Square is in a more competitive situation [than Paypal, Mastercard or Visa] and is less established, and that’s reflected in the volatility of the stock, but it is a strong emerging brand for retailers, and as more small retailers during the coronavirus panic start to rethink how important it is to have an online retail option and be able to easily take card payments it’s probably doing OK (our local shops have long had the little signs up saying “please pay cash to keep it local” for small purchases — but when they had to shift to delivery or online orders, those with Square or a similar product had a head start). I’d guess it will probably make more incremental progress in building its customer base, but we shouldn’t discount the competitive pressure of so many terminal companies trying to acquire customers… payment system customers are hugely lucrative over the long term, because they’re sticky and you therefore get the inside edge on a little share of the payment processing fees for a long time, but everybody knows that so acquiring customers is probably going to continue to be very expensive….

Square (SQ) had a nice bounce recently because they’ve announced that the COVID-19 impact will not be as dramatic as some might have feared — but that’s because the stock fell by more than 50% in the initial panic. Part of that is some relief that their Cash app for transferring money between people is still growing and doing well even as the merchant network is taking a hit, and part of it is their guidance for the first quarter, updated on March 24th, that has shrunk by less than 10% since their last update, with revenue guidance still close to what analysts are expecting. That’s just one quarter, and we don’t really know how long this retail “pause” will last or how customers will behave in the recovery from this “stay at home” period, so things are very fluid still — but any numbers or reassurance from companies these days is so far being taken very well. Guidance and updated numbers make things seem manageable, and predictable, and that’s really all that investors want these days.

Next?

“The Modern-Day ‘Cisco’…

“When most people think about the big Internet winners… they think of the Amazons, Googles, and Facebooks.

“But, for every Amazon, there’s a secret ‘behind the scene’ company like Cisco that returned a lot more!

“You see, back in the 1990s… Cisco was the decade’s 5th best stock… and returned a whopping 67,491%.

“It almost seems like a conspiracy… but the truth is, the “boring” companies like Cisco and Qualcomm get ignored….

“… behind the scenes, these companies provided the hardware that was needed to power the internet’s big boom….

“Now, it’s set to happen again…

“One company has brilliantly positioned itself to scoop up billions in revenue by supplying the hardware needed to power the blockchain boom.”

OK, so some kind of blockchain-enabling hardware company. Any other clues?

“Honda has already started working with this company.

“And, again, the big institutions are lining up…

“JP Morgan. Blackrock. Vanguard…

“Fidelity, in fact, loves this stock so much, it’s already scooped up 7.5% of ALL available shares!

“You can buy it straight from your brokerage account, too.

“And I recommend you do so soon.

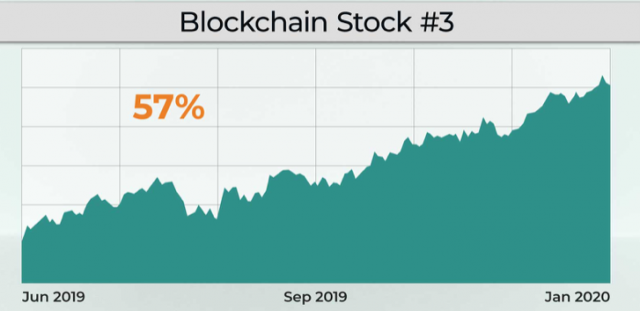

“See, this stock has already started a big move… shooting up 57% in the last 6 months alone.”

This one is a bit odder, since there are quite a few possible matches — and I’ve got one that matches the stock pattern they show precisely… but the percentage gain cited does not match.

Here’s what I mean — this is the image from the ad of “Blockchain Stock #3” for the “last 6 months” of this stock’s price movement…

And here’s the price chart for NVIDIA for roughly six months from late June into January…

So the stock chart is an exact match, down to each little dip and jump, so this must be our match… but it rose more than 80% while following that chart pattern, not 57%.

And yes, NVIDIA (NVDA) is one of the chipmakers that has been closely tied to the blockchain revolution since the beginning — which became a problem when bitcoin collapsed, because that exposed the fact that the marginal retail demand for NVIDIA’s higher-end GPUs, which were mostly designed for high end video game systems, was actually coming from cryptocurrency miners. That ensuing inventory crisis has now abated, for both NVIDIA and its major GPU competitor Advanced Micro Devices (AMD, which apparently remains the pick of the decade for fellow Agora affiliate Paul Mampilly).

I suppose that NVIDIA might get some boost from a more blockchain-heavy world, because one aspect common to a lot of blockchain projects is the concept of “mining” — mining basically means that computers which participate in the network, racing to complete computations in order to earn the right to validate transactions, will get rewards for that work… so the fastest processors earn the highest rewards. That’s becoming less of a driver for the GPU makers, since those chips weren’t really designed for cryptocurrency mining or blockchain specifically and a lot of specialized chips (ASICs) have been developed in the last couple years for bitcoin and other mining, but “need more high-throughput computing” is probably another part of the reason to consider buying AMD or NVIDIA.

And yes, to circle those clues, NVIDIA does work with Honda and lots of other carmakers — though as far as I know, not on blockchain projects, the more important work for NVDA in the automotive space, by far, is their work in designing self-driving car AI systems for those vehicles. Speeding up artificial intelligence both in cars and in data centers are key areas of growth for NVIDIA, though visual processing chips are still the largest part of their revenue, and still largely because they continue to push the envelope with faster and better chips to support high-end computer gaming, with that technology then gradually trickling down to cheaper GPUs for everybody else. I own shares of NVIDIA, but more because I think gaming will continue to be surprisingly profitable and because they have the lead in establishing the most accepted AI operating system than because of any benefit they’re still getting from blockchain.

And in case you want a little perspective, we can look back since we know that the ad was first sent around in late January — here’s how those stocks have done since the ad was created (that’s NVDA in orange, SQ in blue, and OSTK in red… with the S&P 500 in green for comparison):

And as for blockchain itself? It seems really interesting, though it will have to get more efficient as it grows (checking each entry or transaction against lots of computers around the world, and making “miners” fight for the privilege, consumes a lot of electricity and time), but I’m sure it’s already made a lot of progress in that area.

The key, for me, is to think about it as a foundational idea for developing next-generation internet technologies and platforms — which means that it might be huge and we might not really know until years later who, if anyone, “won” blockchain… nobody owns the http protocol, nobody owns the basic technology of blockchain, or became the only company who could sell database or spreadsheet technology, and everybody is trying to figure out how to build better technologies that use blockchain but also might be proprietary enough to make them some money. But it’s still very early, so don’t bang your head too hard on the table trying to find the one “winner” for this next evolution, you can probably stick with actually watching the financials and identifying obviously profitable businesses run by managers who are pushing growth in the right direction, and trying to buy those when the price gets relatively appealing.

I feel pretty good about NVIDIA still in this neighborhood, though not because of blockchain, (and the stock has perhaps recovered too quickly for my taste of late), and Square looks more appealing than it has in the past year because of the coronavirus drop but could have a truly incredibly awful year with retail stores closing down right and left and might find it hard to dig out of that to resume growth if this “pause” extends beyond the spring… so I could perhaps talk myself into either of those positions over time, and have owned both (I own NVIDIA today, but not Square currently), but I really can’t talk myself into owning Overstock just yet, there’s just too much baggage to carry and I am probably a little too cynical after hearing huge promises about tZero for the past couple years.

So there’s my take, at least… but with your money, of course, it’s your take that will matter — have a hankering to add any of these blockchain stories to your stock portfolio? Prefer to dabble in the actual cryptocurrencies, or have different favorites? Let us know with a comment below. Thanks for reading!

Disclosure: Of the companies mentioned above, I currently own shares of and/or call options on NVIDIA, Google parent Alphabet, Berkshire Hathaway, and Amazon. I will not trade in any covered stock for at least three days, per Stock Gumshoe’s trading rules.

If you are new to crypto I would stick to Coinbase and if you decide to buy Cardano (ADA) and altcoins I Would recommend investing in a hardware wallet like Ledger Nano X or Trezor hardware wallet both very good I Use Ledger, you can also look up hardware wallet on Youtube and you will get good information on both, hope this helps.

ledger also

coinbase ipo>?

Travis or others what do you think of Coinbase? Mine is just a feeling [no technical or knowledge] I have used coinbase since 2016. But I feel it is hyped and over priced from the start.

Also I feel people will be moving away from these centralized exchanges more and more. The biggest advantage is getting money to/from crypto easily and that is suppose to change “soon” (I am thinking within 6 months). Binances CEO CZ, has mentioned this also (binance is on of the largest exchanges)

Voyager isn’t a bad option to buy crypto from. It’s publicly traded. The CEO is a former high-level executive at Etrade. The best part is you earn monthly interest on many of the cryptocurrencies including 9.50% on USDC stable coins compared to the measly .4% or less from banks.

I think the one thing holding Voyager back is several recent negative ratings on Google PlayStore. Great management team and solid fundamentals. People don’t like the waiting period apparently and its a busy field. To wit, crypto.com is coming.

Despite that, it has made a pretty swing this week with some 50% profit here but I think it’s near cap.

I use Voyager, but they have a huge spread between bid and ask. Cheaper to buy on Binance U.S. Also, they have a disclaimer that will curl your hair and put you into FUD. Yes, they do offer great interest, but if anything goes wrong, they cannot be held responsible for your losses. They loan out money and crypto, that is why they can pay high dividends on some of them.

Any Canadians out there? It is insanely difficult to buy Crypto up here…all the platforms verify you only to have our banks and CC’s decline to work with the platforms. I’d recommended KuCoin as a work around using Interact transfers from your mobile but not ipad….from there you can transfer Bitcoin…took me quite a while to figure this out! Now to research the hardware wallet…thanks for the tip.

What about funds like ETHE or ARKKK? Both have Crypto exposure though the ARK family of funds are more diverse. Your thoughts Travis?

ARKK has some GBTC(Grayscale trust for bitcoin) ETHE(Grayscale trust for Ethereum). Beware of their new one for lite coin (LTC). As much as I have liked having GBTC so I could get exposure to Bitcoin in my 401k. I am not happy with the past premiums, the SEC for again hurting retail investors by not allowing direct access via 401k or at least approving a ETF (Lower fees). The other issue is Grayscale Trusts besides higher fees also does not follow the REAL market 1:1 (it seems to follow the feelings of people about the real price) I am afraid of GBTC and ETHE crashing some once the ETF is available. (My guess on ETF is around August to Feb 2022 however that is right before we anticipate the crypto correction down based on the 4 year cycle. Of course it could be different this time, but be aware. As it could just be self fulfilling action based on assumptions. Also March is normally a slow month for crypto)

American Green seems like a well run company yet it’s been relegated to penny stock status with 40-50% short interest for the last 3 years! The company was the 2nd cannabis outfit to become publicly traded in the U.S. and has expanded over 300%. Why do you think they continue to languish?

Any comments on Joshua Martinez, Destination Trader of Traders Agency ?

I wanted to che k first before I pay $1497 membership

“45 equities research analysts have issued 12-month price objectives for Square’s stock. Their forecasts range from $44.00 to $380.00. On average, they anticipate Square’s stock price to reach $203.56 in the next twelve months. This suggests that the stock has a possible downside of 13.1%.”

Tangent, on the Trump name used for pitching: https://www.nytimes.com/2021/02/17/nyregion/atlantic-city-trump-plaza-implosion.html

LiDARar Dudes, to the tune of “All The Young Dudes” 😉

“and that NVIDIA will be the hardware that enables the blockchain revolution”

Nvidia just announced that they will be putting protocols into their newest GPU’s that make it harder for

cryptominers to mine Ethereum by a factor of 50% or more. Nvidia isn’t looking to invest in blockchain. They are interested in gaming. Unless some smart cookie comes along who can over-ride the “blockage” that Nvidia has put on their new graphics cards I see Nvidia sales of their product dropping drastically

They’re planning to release some crypto-specific GPUs.

Nvidia is trying to protect itself from the crypto volatility by releasing a GPU for miners without an actual display output, so the next crypto deepdive would not affect their new device sells via a second-hand market flood of the no-more-used mining GPU’s.

I am well invested in defi/crypto and have been diversifying in other systems that provide public good. For example:

After conducting the research, I invested in and made over 200% on (XTLB) & (EYES), short % of float has been reduced to less than 1% of outstanding shares short currently.

Now investing in (XENT), has a short % of float of 6x larger (6.25%), total of 1,050,000 shares short, so may see an even lager gain.

Ears, Nose, Throat Devices Market to reach $26BB, with cumulative impact of COVID-19 SARS CoV2 variants, bio-absorbable therapies such as Propel & Sinuva fastest growing segment.

https://www.acumenresearchandconsulting.com/ear-nose-throat-ent-devices-market

(XENT) capturing 5% of market realize $1.3BB in revenues/ 32MM Shares = 40$ per share in Revenue, at comp. 10X Sales= $200 per share

(XENT) Intersect ENT Inc.

– Positive 10 day & 50 day Moving Average

– Current Assets to Liabilities ratio attractive

– Enterprise Value is undervalued compared to peer group

– 5 Day Rounding Bottom chart + (Cup & Handle)

– Moving Average Convergence Divergence crossing higher.

Christopher Michael Lim, MSc. Health Sciences

Western Medical School

Mr. Lim,

like the idea of XENT and appreciate your comment above. Will investigate a bit more before I invest but am interested in the sector. Thanks for sharing your idea.

another very interesting company called abaxx is creating a commodities futures exchange using smart contracts, which actually solves a real world problem, discarding the old paper warehouse receipts which are easily lost and replacing them with digital receipts. Founder was a goldman sachs commodities strategist and minerals economist. market cap is 200 million.

What are Teska Tiwari’s “My top 3 small cryptos for 2021”?

I don’t buy stocks, I buy crypto tokens. I would go into detail but always end up with essays. Here are some coins/tokens to research, be sure to start with “The Chainlink / SWIFT connection part 1” on youtube, be sure to watch the other one too

ALBT LINK OCEAN ADA ETH DOT

and I have one that is very very unknown, contact me if you want to bribe me this one will absolutely melt people’s brains when they see it all over the news day after day in a few years

As for fiat and the seemingly impossible to deny DOLLARIZATION medium term future.. where are the fx experts and quants ? pls do the analysis and good luck. A new “DEFI monetary system” GAUGECASH looks very promising and is targeting any % of the EUR/USD forex market which is apparently 6 TRILLION a day wtf ?? lol silly competitive species we are missing the biggest gift Satoshi left, the key to why “trustless” decentralization is so important and useful, code vs ego.. anyway.. if you do go for this one be aware the prices of things have changed but the ICO price is not adjusted ! so I got over 2x as much as most buyers, only a few of us have noticed this.. by buying GAUF with LINK you get a way better deal than buying GAUF with ETH ! its a fixed ratio

If you ever needed proof there it is.. a) API is the enabler, the first huge breakthrough.. hence the wisdom of the early LINK adopters.. and 2) things priced in FIAT are very distorted and why such huge opportunity exists in this the 4IR the fourth industrial revolution or INDUSTRY 4.0 the new easy label.

I have TEN DOLLARS FIAT and haven’t had more than a couple of thousand, for longer than a few days.. in a long time ! life has never been better..

Finally.. if LINK as the god protocol “ORACLE” standard excites you anywhere as much as it should, look up the XY company and look at the chart of XYO, find an entry ! I buy this on KuCoin any time it is not in a local top. The app they make has made me so much off a small investment because it runs 24/7 and I was lucky enough to get it over a year ago. Some got in year or more before me, one guy even made enough to pay off his house if he wanted by not selling just collecting XYO for the app coin each time he could, and never selling. You will see LINK and now ALBT users say this, and its one of my fav things to make ppl think hard about this ORACLE secure information technology. DR;NS

Didn’t read, never selling. If you watch the ALLIANCE BLOCK videos “explainer” “data tunnel” etc on YouTube you will see why the data economy is actually something the public should be so grateful for, and stop hating the people trying to manage the world and massive complexity/entropy

Teeka tech royalty

I would much rather just buy the crptos. Much better than trying to make profits from companies that use them. ADA and VET are two of the best right now.

Let’s catch up on what’s happening with this.

In the latest email update/revision, Teeka mentions a 4th bonus stock. I haven’t subscribed yet, so I don’t know what this is about.

Crypto investment has been a real hassle for me, after a failed investment during the pandemic, I decided to take the back seat and focus on increasing my knowledge about bitcoin and the crypto investments.

After consulting with marketplus247 . com, I got investment networking I could leverage on and my patience and knowledge has paid off greatly.