This article was originally published on September 18, when we first saw this Teeka Tiwari ad circulating… it is still in very heavy rotation, and still has a “September 2023” date, so the ad has not been updated. What follows has also not been updated, but questions are still rolling in so hopefully this will help to answer them.

The basic spiel from Teeka Tiwari in his recent “I’m riding a self-driving Tesla to a remote and mysterious location” ad is that he’s found good investments in hot “trends” several times in the past, from Apple in 2003 to Bitcoin and NVIDIA in 2016, and that he’s got another one to sell you today.

So yes, it ends another of those “on location” teaser ads, in this case standing in front of what is obviously a big construction project… here’s how the email reads:

“My Fourth Trillion-Dollar Idea….

“Recently, I unearthed what I believe will be the fourth $1 trillion idea of my 30-year career in investing.

“According to consultant firm PwC Global, AI is the largest megatrend of our generation. It estimates it’ll create $15.7 trillion in new wealth.

“That’s why I recently booked a self-driving Tesla car to take me to Arizona’s Sonoran Desert to visit the facility I’m standing in front of…

“Moving forward, I believe this AI stock has MORE upside potential today than Nvidia.

“Based on my research, this company will end up supplying Tesla CEO Elon Musk with a key piece of technology for his new AI venture…

“And if you buy shares now, before Musk makes the official announcement…

“I believe you’ll have a chance to make incredible gains from a blue-chip stock.”

And once you click through to the ad, which is a pitch for Tiwari’s entry level Palm Beach Letter ($49 first year, renews at $129), he plays more on that Elon Musk connection…

“Elon Musk made $180 million on PayPal, $47 Billion on SpaceX, and $94.2 Billion on Tesla. He’s about to shock the world again with his new AI project. Here’s how to profit from it”

And he talks more about that mysterious building under construction in his video…

“… this facility… doesn’t belong to Nvidia, Microsoft, Google or any popular AI company you might have heard of.

“In fact, it doesn’t belong to any of the world’s Big Tech companies.

“It belongs to a company that’s supplying Elon Musk with a key piece of AI technology.”

And he drops some names of famous big investors who are putting money into the project…

“… legendary investors on Wall Street are pouring a ridiculous amount of money into the company behind this AI project.

“Billionaire Ken Griffin, the founder of the largest hedge fund in the world, Citadel, already took a stake.

“This is the man who made $16 billion in profits last year, the biggest annual windfall in the history of hedge funds. He’s now betting big on this project.

“Famous billionaire Ken Fisher has poured more than $2 billion into this project.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“Jim Simons is another one. He runs Renaissance Technologies, the best-performing hedge fund in history….

“He has put $294 million into the AI company that owns this facility….

“Ray Dalio, the founder of the world’s second-largest hedge fund Bridgewater Associates…

“Billionaire and hedge fund manager Stanley Druckenmiller…

“And Steven Cohen, another billionaire hedge fund manager and owner of the New York Mets…

“They’re all invested in this AI project.”

And Tiwari says he thinks they’re betting on Musk with their investments…

“I believe they’re doing it because they’ve figured out this project will supply Elon Musk with a key piece of advanced AI technology…

“So this is a great way to profit from Elon Musk’s new AI venture, xAI.”

And he can’t resist throwing in a Warren Buffett reference, too:

“Warren Buffett has even put more than $175 billion in AI stocks.

“Think about how crazy that is… that’s almost half of all his money.

“These are some of the best investors on the planet… and they’re all in because they know AI is a game changer.”

That’s just another reference to the fact that Berkshire is the biggest single shareholder of Apple, with a stake worth about $160 billion today (it was ~$175 billion a couple months ago, but the shares have come off their highs a bit). Berkshire didn’t buy Apple because of their various efforts to get involved with AI, of course, they bought it because everyone’s addicted to their iPhones and Warren Buffett loves strong cash-flowing brands.

But anyway, any more clues?

Tiwari goes over the top in claiming that if Elon announces he has partnered with this secret company, it will all be over and you’ll have missed your chance — which is almost certainly nonsense, but we’ll get to that in a minute, that’s just his way of trying to get you to act quickly (“act quickly” means “get out your damn credit card and buy a subscription, quick, before you start to have second thoughts!”)

He sums up the clues in his “reasons for buying…

“Reason #1… It’s a Way to Profit from Elon Musk’s New AI Venture…

“… this company produces some of the most important advanced technologies in the world.

“They’re already supplying Elon with a key piece of AI technology that makes self-driving cars possible.

“And I believe Elon will use that same supplier for this new AI venture….

“Reason #2: This company is smaller than Nvidia

“And that means there’s more upside potential….

“Reason #3: This company is Building the next generation of AI tech

“AI requires a lot of computing power.

“You can’t just use any computer chip to run Artificial Intelligence.

“It has to be a special processing unit called GPU….

“Today these chips are almost entirely made by one company: Nvidia.

“It’s estimated that Nvidia owns 95% of the GPU market.

“And that’s a big reason why shares of Nvidia have skyrocketed, just like I predicted….

“The most important and widely used AI chip in the world today is Nvidia’s A100 GPU.

“Well, Elon’s supplier is developing an AI chip that’s even more powerful than that.

“It’s a hotly anticipated next-generation AI chip that’s 25,000 times thinner than a single human hair….

“… even Nvidia’s CEO has admitted that the future of AI depends on this company that’s about to release this next-generation chip.”

OK, so a lot of you probably already have an answer percolating in your heads about this one… and Tiwari goes on to say this…

“They own that facility I showed you earlier.

“That’s where they’re going to build this chip.

“And since this is made in America, you can take a stake right from your brokerage account.”

There’s a lot of pandering and hyperbole and talking to you like you’re an idiot in Teeka’s presentation, for sure, but we can still sift through it and try to identify some of the facts.

First of all, the Thinkolator confirms that yes, this is a tease for Taiwan Semiconductor (TSM), which has been listed in the US for a long time, since well before it started planning to build more chip production capacity in Arizona.

Taiwan Semiconductor (also sometimes abbreviated TSMC) is the largest chip foundry operator in the world. Most semiconductor companies these days are “fabless,” which means they design the chips but they outsource the manufacturing to foundries run by other companies — there are a bunch of these, from Samsung to Global Foundries to a lot of smaller players, but Taiwan Semiconductor is by far the largest, and the most technologically advanced.

So, yes, if Elon Musk wants to design new GPU chips for his AI project, he’ll probably turn to Taiwan Semiconductor to build them. TSM already builds almost all the GPUs that are used for AI right now, the ones that are designed by NVIDIA, AMD and others…. though Musk might have to get in line, NVIDIA has been pushing to buy up more and more of TSM’s production capacity so they can meet the increasing demand for their H100 and A100 GPUs for data center AI processing.

And Taiwan Semiconductor has seen the writing on the wall, that the world is getting wary of being entirely reliant on Taiwan for its most advanced chips, particularly at times when the saber-rattling over the Taiwan Strait gets particularly loud… so they’re beginning to offer a little more geographic diversification. Part of that means investing in the US, thanks in part to incentives from the CHIPS Act to encourage domestic semiconductor manufacturing. Construction is underway now for their first major fab in Phoenix that should be able to produce 4nm chips, and earlier-stage development is underway for a second fab in Arizona for more advanced chips (3nm, which is the cutting edge right now).

That’s not going to mean they’ve got room for some big new Elon order just now, of course — these facilities take years to build, and Taiwan Semi also announced earlier this year that they need to push back the timeline, at least in part because of a shortage of trained employees in the US, so they’re now expecting production to start at their first Arizona fab in 2025, and maybe 2026 at the second fab.

So yes, you can buy shares of a company that’s building advanced chip manufacturing facilities in the US, and which is making most of the high-end AI chips which are in use around the world right now (mostly from NVIDIA)… but the downside is that if you do so, you’re also buying a company that’s 80%+ reliant on its facilities in Taiwan to produce this stuff, and that also produces millions of other less-advanced chips that are in somewhat less demand right now. Taiwan Semi’s largest customer is actually Apple, which designs many of its own chips for Macs and iPhones now and has TSM build them, but they build tons of lower-end chips for every product you can imagine… so there’s some weakness when those kinds of mass-market products see falling sales volumes, like Apple has in recent years.

And while Taiwan Semiconductor is not nearly as well known as NVIDIA or Apple, and is quite a bit smaller despite the fact that it is, as Tiwari rightly noted, a “blue chip” kind of stock in the eyes of many people… it certainly ain’t small. Other than NVIDIA, Taiwan Semiconductor is the largest pure-play chip company in the world right now, with a market cap just shy of $500 billion. It’s pretty reasonably valued based on its current earnings, in contrast to NVIDIA, and it’s very profitable, even though it hasn’t been enjoying much earnings growth recently, and it might be the most important manufacturing company in the world. They’ve got a good technological lead on Samsung and Intel, which are other big fabs that are building capacity (including the huge Intel projects in the US) and could maybe compete in some areas, and many of the greatest technology companies in the world, including Apple and NVIDIA, really do rely on Taiwan Semiconductor. I wouldn’t try to talk you out of buying shares.

But don’t do it because of Elon Musk, or because you hope the earnings are going to suddenly skyrocket in the next few months. Like everyone else, Elon is doing all he can to order as many GPUs from NVIDIA as they’ll sell him… and NVIDIA is working like mad to make sure they can keep growing production, which means taking up more and more of Taiwan Semi’s capacity. Sure, maybe Elon will come out with a different GPU design, though I have no idea why folks assume it would be better than NVIDIA, which has been leading in this segment for decades, (or even Intel or AMD, which are also pushing hard to compete for high-end GPU customers in the future)… but there’s very little reason why Taiwan Semiconductor, while it is trying to double their high-end capacity for things like GPU chips, should suddenly get a windfall because they get mentioned in the same breath as Elon Musk.

OK, I shouldn’t be that definitive — investors get gaga and do stupid stuff all the time when it comes to following Elon, so maybe he’ll announce that TSM is going to build some GPUs for his AI project in 2026 and that will cause people to go made for TSM shares and spike the price up. That shouldn’t happen, but I guess anything is possible.

The challenge of slowdowns in other areas of semiconductors is real for Taiwan Semi, so despite the fact that it’s the global leader and is certainly a great company, with excellent profitability, it’s almost certainly going to earn a lot less this year than it did last year (estimates for this year are currently at $4.94 in earnings per share, they earned $6.57 last year)… but analysts do think that growth will kick back in again in 2024 ($6.06) and 2025 ($7.62). That’s not anything like NVIDIA’s wild earnings growth this year, but it’s still nice growth for a monstrously huge manufacturing company. At that valuation, TSM is trading at about 15X next year’s estimated earnings and pays a dividend of about 2%. Perfectly reasonable…. maybe even cheap… but not likely to be a nosebleed growth story even if AI continues to be a hot trend.

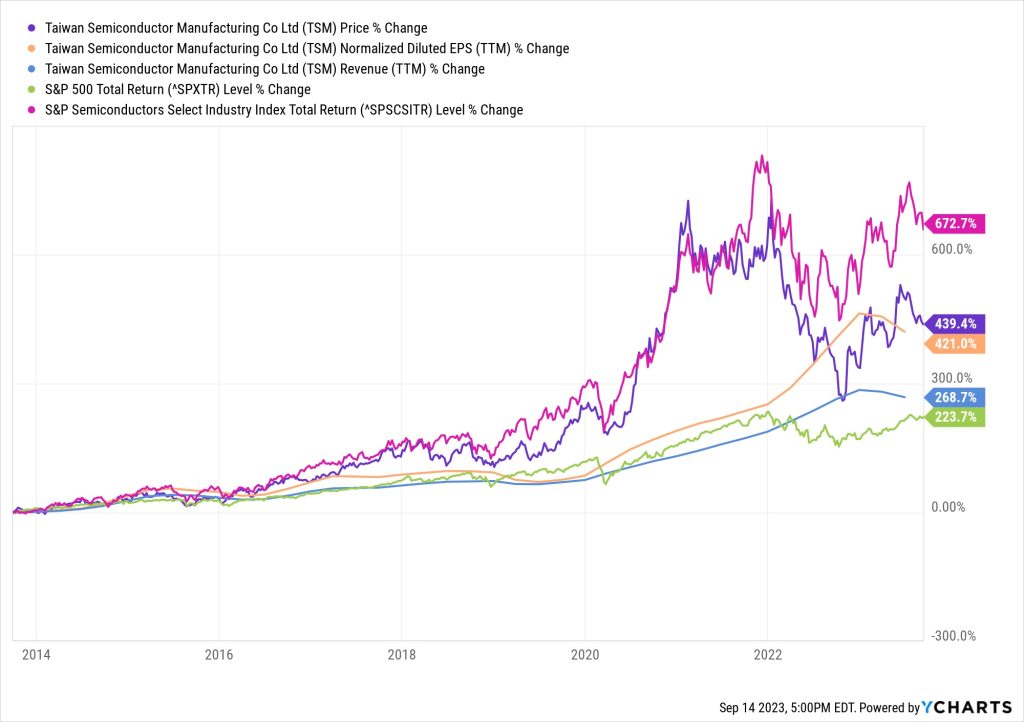

TSM has been the leading chipmaker for lots of hot trends over the years, and that has served them well, but they’re also so huge that they ride the cycles of the semiconductor business down during weaker periods, too. Here’s what their performance has been like over the past ten years, just to give a little perspective — it was the biggest foundry and arguably the technological leader ten years ago, too (Intel is the only one who might argue, really, that was right around when they started to lose the race)… thats the total return for TSM in purple, driven by their earnings growth (orange) and revenue growth (blue) over the years, compared to the S&P 500 (green) and the S&P Semiconductor Index (pink) (NVDA is up about 10,000% during that time period, which had a huge impact on the chip stock index):

So TSM has done well, and it’s not just multiple expansion — their earnings have grown, and the stock has kept up with that. There aren’t many more important companies in the world right now, so if you can accept that the biggest gains are likely to go to the companies who design hot products, not those who manufacture them, it’s probably a fine landing place for your money.

It’s just not doing great right this second. Making those high-end GPU chips for NVIDIA is a relatively small part of Taiwan Semiconductor’s business, and slowing demand elsewhere has clearly had a bigger impact on their factory utilization and revenue than NVIDIA’s rising demand. At least so far. The latest worry came out from reports over the weekend that TSM is asking suppliers to delay deliveries, because of slowing demand, but TSM management had already warned investors that the boom in AI chips was not going to be enough to offset the clear slowdown in the industry right now.

That can all change, of course. If it weren’t for the massive geopolitical risk as China continues to eye the absorption of its “renegade province” and Taiwan continues to arm itself for a Ukraine-like surprise invasion, I would probably own Taiwan Semiconductor today, I’ve looked at it many times but haven’t ever bought shares.

And there are plenty of other endorsements for this stock — Tiwari noted some famous investors who have bought TSM, and the list is even longer than that, though for most of them, of course, it’s a relatively small portion of their portfolio, and some of them have since sold down their positions (Bridgewater, for example, sold about 2/3 of its TSM position a quarter ago — but it was a trivial position for them even before that, well below 1%). Warren Buffett was probably the highest-profile investor in TSM in 2022, since he bought shares last year… but then he quickly sold them, with his rethinking of the geopolitical risk as the primary reason for selling all of Berkshire’s TSM shares within a couple quarters of buying.

I’ve admired Taiwan Semiconductor for years, and it’s hard to really imagine that China will take Taiwan by force and destroy or sequester the most advanced manufacturing facilities in the process… but the simmering standoff between the US and China, with Taiwan often in the middle, certainly increases the range of possible outcomes.

Most likely, though, the real risk is what we’re facing right now — that when Apple sells fewer iPhones, Taiwan Semiconductor sees lower demand and falling revenue. Apple accounts for something between 20-25% of TSM’s revenue in any given year and has been its largest customer for a long time (NVIDIA is probably ~6-8% of revenue, maybe a little more this year, they’re usually in the top five customers), but the roster of large customers for Taiwan Semiconductor is a who’s who of the chip and electronics world — Qualcomm, AMD, Broadcom, NVIDIA, MediaTek, Intel, Marvell, Sony, Amazon, STMicro, Infineon, and many more. TSM may build the future, but not all of their customers have strong demand growth every year.

Does it have “more potential than NVIDIA,” as Tiwari teases? Well, quite possibly… but that would be because Taiwan Semiconductor is much more conservatively valued today, not because their business is likely to grow faster than NVIDIA’s in the near future. If things take a turn for the worse for a few years, it could easily take NVDA 20 years to “grow into” their current valuation (see the history of Cisco, which we go into a bit below), and that is much less likely to be a problem for TSM.

But wait, there’s more! Teeka also teases a second stock…

“I believe I found ‘the Cisco of Artificial Intelligence.’

“It’s a company that’s essentially building the backbone of the AI industry.

“And it’s 1/10th the size of Nvidia.

“If shares rise to the same valuation of Nvidia, and I believe they will…

“You could make up to 12 times your money from this company.

“Again, most people don’t even know this company exists.

“But Wall Street is all over it.

“Vanguard Group has invested more than $7.6 billion in this company.

“BlackRock, the world’s largest asset manager, has also poured more than $7 billion into it.

“And JP Morgan has invested more than $2.2 billion.

“I believe they’re building these massive positions because they know this company will become the backbone of AI…

“Just like Cisco was the backbone of the internet.”

OK, so before we throw some guesses on the pile, we should share the public service announcement that Cisco was the backbone of the internet, and to a large degree it still is, but that sure didn’t make it a good long-term investment back when that truth was becoming clear and they were growing revenue close to 100% a year during the boom times of 1999 and 2000. This is the 25-year chart for Cisco, which was the largest and most popular company in the world in 2000… and, as we’ve noted many times, is the most frightening historical comparison available for NVIDIA shares today (thats CSCO in purple, the S&P 500 total return in orange). Be careful what you wish for…

That doesn’t look so terribly frightening, but if you switch to 24 years, starting in the Fall of 1999 instead of 1998, you see what it was like if you started buying Cisco as it was becoming very popular… and do note that this was not anywhere near “buying at the top,” CSCO more than doubled into 2000 before it began its two decades of radical underperformance.

OK, one final chart for our PSA — which reminds us that Cisco was and is a great company, the only real problems were that the demand exploded and then collapsed in a short period of time, destroying the “growth” story, and that story never came back because growth never got to those wild 1999-2000 levels again… even though, after falling in 2001 and then recovering by 2003 or so, Cisco’s earnings per share still ended up growing by close to 1,000% over the past 20 years. This is that same 24-year chart for both earnings (blue) and revenue (orange), the growth in Cisco’s real business was still quite good for a long time… it’s just that it took decades to recovery from that bubble valuation.

To be fair, CSCO’s total return is a little better than that, since they started paying a dividend a decade ago — the total 24-year return is not 52%, it’s more like 120%, so by that measure the stock has just barely topped its 2001 peak in recent years.

OK, PSA over — do we have a guess about Teeka’s “Cisco of AI?”

The only one that really fits those clues, if we’re dealing with valuations as of the last week or so, is semiconductor capital equipment maker Lam Research (LRCX)… it is roughly 1/10th the size of NVIDIA, and those are pretty exact matches for the number of shares Vanguard, Blackrock and JP Morgan owned as of the end of the last quarter.

Can’t be sure without any additional clues, but that’s our best match. Lam Research is a great company, even though it’s facing some of the same slowdown challenge as Taiwan Semiconductor right now — which makes sense, TSM is one of their customers (as are pretty much all the other big chipmakers — Samsung, Micron, Intel, etc.).

Lots of folks are quite certain the the “de-globalization” of the semiconductor industry, as the US and Western Europe and others try to ramp up their own chipmaking capacity, will create more demand for the high-end tools that go into building semiconductor fabrication lines — so that would include all the biggies, from ASML (ASML) to Lam Research, Applied Materials (AMAT), Teradyne (TER) and KLA (KLAC)… generally speaking, the ones who have grown fastest trade around 30X earnings (ASML), those who have been a little pokier are down around 18-20X earnings, like AMAT and LRCX.

The performance by LRCX over the past couple years has been middle-of-the-road in terms of earnings growth, compared to those near-peers (that’s them in the middle, in purple):

And the same has been true of the share price:

Much of the uncertainty for these companies who make capital equipment for the semiconductor industry comes from worries about how the bifurcation of the world will impact them — how much will they be blocked from selling to China is a big deal, since most of the growth in chip fabrication in the past decade has been in China. And the types of chips that their customers make is also important when guessing at their growth potential, so Lam Research has perhaps been a little weak because they depend more than most on the memory chip market, which many folks see as being more “commoditized” (though there’s also another side to that, since AI processing requires massive amounts of memory, too, so NVIDIA’s big GPUs each include a lot of memory as well).

Lam Research and ASML both tend to come up in these pitches about growing chip production in the US, so I’ve covered that story and the connection to several smaller companies when covering similarly themed teasers over the past year, if you’d like to dig a bit deeper. But with those clues, LRCX is our best guess for that second Tiwari tease. Even if the “AI” connection is pretty tenuous.

Have any thoughts on all of this? Favorite stocks in the space? Let us know with a comment below… thanks for reading!

Disclosure: Of the companies mentioned above, I own shares of NVIDIA and Warren Buffett’s Berkshire Hathaway, as well as some bitcoin. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

Hi Travis. I have the subscription to the Palm Beach Letter, and I’m confirming the LRCX is indeed Teeka’s recommendation for Elon’s Project x.ai

Kaz

Thanks Kaz… quite a stretch to try to make that connection (Elon’s hypothetical future GPU chip design to Lam Research, current manufacturer of semiconductor-making equipment), but I appreciate the confirmation.

Tesla is already producing a GPU at TSM. https://en.wikipedia.org/wiki/Tesla_Dojo

Yes, Tesla moved away from NVIDIA hardware to run its self driving quite a while ago, as I remember, that in-car hardware could easily be made by TSM too. I Wonder if they’ll want to use the same design for Elon’s earlier stage AI project. We’ll see,

For now they’re still ordering as many NVDA GPUs as they can get, like the big cloud AI providers.

You’re most welcome, Travis, and thank YOU for all your unmatchable & invaluable disections of everything in the market for us.

Kaz

Confirmed, TSM as the Elon AI Project and LRCX as the Cisco/NVIDIA.

I confirm it too.

What is the fedcoin $0.25 moonshot pick?

Teeka’s $0.25 moonshot crypto is Stellar (XLM). Current price is hovering around $0.11

Best,

Kaz

thats a 600 dollar stock. Doesnt look like a buy now.. 2019 was the time

Intc is the right play! They are going to catch and perhaps pass TSMC in manufacturing technology. Jensen Huang is speaking favorably about using Intel fabs and NVIDIA has designed in Intel’s Sapphire Rapids chip. Gelsinger has exactly the right strategy and they are executing!

True, NVIDIA is thinking about adding Intel fabs to their supplier base in the future (as well as Samsung, which they use a little bit now, for some of their products). Don’t know how fast any such change would take place over the next several years, but there’s certainly some interest in diversifying the production base so they’re not entirely dependent on TSM for their high-end products, both because that might keep pricing under control and because of the geopolitical risk in Taiwan.

Might work out well if Intel’s turnaround plan really works, but there’s a lot of weight riding on that (I haven’t really followed the story in detail, sounds like you have) — right now, Intel is valued at about 14X 2025 earnings estimates, TSM is at about 11X 2025 estimates (NVDA is at 22X, LRCX 14X, in case you’re curious — though NVIDIA analysts, I should note, have been unusually terrible at making earnings forecasts).

Warren Buffett sold all of his TSM. He said it is a great company with great leadership but a troubling location.

Indeed, and he made the about-face very quickly — the purchase was made in September or October, and Berkshire had sold most of it six months later (and shortly later sold the rest), turned out to be a very unusual quick trade for them. And it does seem, as he implied by his comments about the decision, that it must have been made entirely because of Buffett’s changing sentiment about the geopolitics, since nothing really changed about the China/Taiwan situation during those few months.

Curious how China Taiwan extreme step does not also affect Apple and other US stocks in Buffet portfolio?

If Taiwan is cut off in a shooting war, most every company will be dramatically impacted. Apple certainly relies on both China and Taiwan to a pretty extreme degree.

Not even a shooting war. A blockade would suffice. If DPP gets back in, tensions ramp up. China may go for it as US getting embroiled in too many conflicts.

Could be. Tensions have waxed and waned for decades now, and the diplomatic talk has grown more conciliatory of late, so hopefully peace will continue to prevail in the Strait… but as we saw with Russia/Ukraine, it can be very hard to predict the actions of a single person, particularly when tensions are high and a small mishap or overreach on either side could cause an eruption of conflict, and most of the political analysts believe that China is now essentially run by a single “strongman”.

I wouldn’t bet big on it either way, I think a war is unlikely but a war (or blockade) is far from impossible. For what it’s worth, “betting” on a serious conflict over Taiwan is relatively inexpensive — you can buy six-month put options on the iShares Taiwan Index ETF (EWT) for about half the price of puts on the Nasdaq 100. Of course, a collapse of Taiwan Semiconductor and the Taiwanese export economy would also probably hurt the Nasdaq 100… but I’d assume that a blockade or war would hurt Taiwanese companies more than the global tech titans.

Foxconn’s building a chip factory in India with Vedanta.

That is what has kept me out of TSM.

Recently read where TSMC fabs in Arizona have been delayed over inability to hire people.

Yep, that’s the reason for the 2025 likely start now, not 2024. They’ve been bringing more experts in from Taiwan to try to speed it up.

Something about union workers and TSM employee balance.

Hi Travis,

Kinda off topic a bit, what’s your take on India Semiconductor?

I assume you mean Indie Semiconductor (INDI) — haven’t looked at them much, but they are growing their sales nicely. My initial reaction when I first looked at the stock a while back was that it’s really hard for a little guy to break into the chip space for automotive, because of the very long lead times for design wins, the extreme reliability standards, and the established leadership of very large companies like NXP, Infineon, STMicro, Texas Instruments, Renesas, etc.

my investment advisor “brownstone research” advised selling TSM and buying it back AFTER they open U.S. plant and their tawain plant is under control of china????

That’s some awfully specific predicting.

Taiwan Semi’s US plant would be worth a tiny fraction of the value of the company, assuming it someday gets divided by politics, the VAST majority of their high-end production will always be in Taiwan, and they have more production in mainland China than they do in the US or elsewhere at the moment… but who knows what the future will hold.

Still, if US-based semi MFRs become the much preferred or only source, the AZ TSM will be in one of the main driver’s seats. If Musk bulds out his Optimus vision (see Lex Fridman interview 12/28/21), with one or more robo helper per person, and they are powered by Dojo or its sequels, then even more chips will be needed. I just wish Musk were not such a ….

Could be, but if anything happens in the next few years, South Korea will be in the driver’s seat first.

Undoubtedly Teeka Tiwari made a name for himself as a renowned entrepreneur, writer, and financial influencer. In the process from a pauper he became a wealthy person. The net worth is estimated to be around $4 million in 2023.Tiwari made the majority of his wealth from subscriptions to his publications with the Palm Beach Research Group. He has been featured by various international television networks – CNBC, FOX News etc.in 2016, he invested a small amount in Bitcoin and turned into an enormous amount. The success has gone to his head. In every Palm Beach letter, he recommended buying Bitcoins and later crypto currencies. I was a subscriber and discontinued as I considered Bitcoin and fraternity as akin to ponzi schemes which have gone mainstream.BTW, I have bought and sold LRCX several times and I hold it in the present portfolio.

Would you recommend buying LRCX at this time?

I don’t recommend stocks, I just tell folks what I buy and sell and the results of my research… so the only honest answer I can give is that I haven’t decided to buy it. Don’t have any reason to dislike the company, and the industry is generally appealing.

Thanks for your comments Travis. You certainly give me insight that I would never have had.

Interactive Teaching Ciock Teach Starter

Joined one of the the Palm BEACH Groups. It had a 90 day guarantee. Cancelled it because it did not do what it said would happen within 30 days. Turns out the the 90 day guarantee only gives you credit to join another one of their groups. In other words, they keep the subscription money.

many of these gurus have publishing groups that have those terms. Many of us reject that and only subscribe to services that have a full refund, even if it is 30-60 days. You are the customer, not a victim.

FYI, this teaser campaign abruptly disappeared over the past couple days, after MarketWise announced that they are shutting down Palm Beach Research (and the other Legacy Research imprints, Legacy and Rogue Economics and Brownstone Research)… partly because, as Porter Stansberry implied in his letter to MarketWise employees and (indirectly) shareholders, they should have fired Teeka Tiwari after the publisher learned about his conflict of interest deals that made it into Palm Beach Venture years ago.

Received an email from Palm Beach Research today indicating that Teeka has been canned. Maybe not news here, but it is now official.

I saw that email, too — didn’t mention that Palm Beach itself will be shut down, as Porter said in his letter, but that might take a few months as they figure out where to put all those subscribers and avoid having to give out too many refunds. At least they’ve given up on sweeping Teeka’s transgressions under the rug, as Porter implies that at least some of the Palm Beach folks did for the past couple years.