Teeka Tiwari’s basic pitch for his “Genesis” idea has not changed dramatically in the last year or two, he spent a long time pushing previous ads with headlines that he had “just returned from Trump Tower” during the election campaign, since that got plenty of attention, but of late he’s launched a new “presentation” about this same blockchain topic… and he continues to tease the idea that he has three stocks to recommend in this space.

So are they the same as before? The offer is still the same, a subscription to Palm Beach Letter for $49 (renews at $129), but let’s dig in and see how the details might have changed in the past 18 months…

The basic pitch is that blockchain is going to revolutionize the world, and that all the big guys are invested in it and we’re just getting started, with massive gains coming… and that Tiwari’s average gain of 281% indicates he’s the guy to make you rich on this trend.

The argument is that this blockchain “Genesis Technology” is about to go mainstream and reach heavy adoption, and that as it becomes a huge part of the global economy you’ll get rich if you own the right stocks. Which, of course, he can tell you about, for $49.

To be fair, Teeka Tiwari was one of the early mainstream newsletter guys who was recommending cryptocurrencies early on, back in the Summer of 2016, and particularly got into Ethereum before most pundits, so he’s not making up those historically excellent returns he probably had at that time.

I would imagine that Ethereum pick in 2016 is probably a big part of what boosts the high average return that he brags about for his newsletter portfolio, much like the early picks of Netflix or Amazon fuel David Gardner’s average performance at the Motley Fool, and Tiwari these days is probably recommending little tiny cryptocurrencies right and left to try to replicate that 1,000%+ return magic. If he just bought Ethereum when he teased it back in 2016, as I recall it was in the $25 neighborhood (I bought a little at the time myself), then he would be sitting on roughly 15,000% gains from that position today (and it would have been closer to 25,000% a month ago).

He says he has made 63 recommendations over those years, so if you keep it simple and just use division, if all of the other recommendations averaged out to zero he’d have an average return per recommendation of about 240% right now (or 396% at Ethereum’s high last month). So the 281% number he claims may well be true, even though those are annualized gains and not total five-year returns, partly because he recommended some even more speculative tiny cryptocurrencies that also soared much higher, and partly because he’s also been recommending tech stocks for the past few years and that whole market, as you’re well aware, has soared… whether that’s likely to be predictive of his future returns is another question entirely.

But this tease is about blockchain-related stocks, not buying cryptocurrencies directly — so let’s find out what he’s pitching, shall we? From the ad:

“Bitcoin is not my #1 pick for the 2020s. What I’m recommending today is something different and something much bigger than Bitcoin….

“In total, car manufacturers are spending at least $30 billion right now to implement this technology …

“Shipping…

“FedEx, UPS, Penske… they’re all changing the way they ship products because of “Genesis”…

“Biotech…

“Moderna just announced they will use the tech to open up the country even faster… and it should help greatly slow down the spread of deadly viruses in the future.”

And Tiwari does make the point that he’s using somewhat of a “shotgun” approach in hot trends…

“… just one Microsoft or one Amazon in your portfolio can make up for a string of duds.

“Which is why I never recommend putting all your eggs in one basket.

“You want to talk about secrets?

“Everybody should write this down…

“One of my biggest secrets to the outlandish performance I’ve been able to show is that by taking small, smart positions in the significant trend of the decade…

“You greatly increase your odds of landing a whopper of a winner.”

That’s not always easy to manage, at least on an emotional level, but it’s true that those huge winners make up for a lot of stinkers — thanks mostly to the simple math that your biggest loss for any position will be only 100%, and if you’re fortunate enough to get a few 1,000% or 10,000% gains easily swallow up those losers. You don’t need a good batting average, but you do have to hit some home runs. And you have to resist selling them after a 100% or 200% gain — rising 100% to gain 100% is not good enough math when you’re dealing with speculative growth stocks, because over time you’re probably going to pick bad stocks, or buy at a bad time, at least half the time.

"reveal" emails? If not,

just click here...

And, as he did a couple years ago, Tiwari implies that Warren Buffett is big into blockchain…

“My team and I looked at all of Berkshire Hathaway’s holdings.

“And out of the 49 total holdings, take a guess how many have now allocated resources to Genesis?

“39.

“That’s 80% of his investment book.”

Those Berkshire holdings he shows are slightly out of date, but only by a quarter or two.

And then, finally, we get down to some of the detailed hinting about what they call “Teeka’s Top 3 Blockchain Stocks”… here’s what we get for clues with number one:

“Soon, we’re going to see a slew of new financial blockchain products… like ETFs… options… and futures…

“And each of these assets will need to trade on a specific, unique exchange….

“… a brand new “blockchain exchange” is planning to go public soon…

“And it’s 50 times smaller than Coinbase….

“Microsoft’s venture capital arm has already put money in it…

“Paul Tudor Jones… the famous billionaire… he bought some Bitcoin using this exchange…

“Chase, Chipotle, JetBlue and American Express—they’ve all partnered with this new exchange.

“In fact, The Wall Street Journal estimates this stock will soon go public with a value in the $2.1 billion range.”

OK, so a “soon to IPO” idea? Which one might it be?

“Here’s what’s exciting about this…

“I found a way people can take a position in this exchange now… before it goes public.

“Without having to wait….

“… this new blockchain exchange is owned (in majority) by a ‘parent’ company that is already public.

“So, anyone with a standard brokerage account can get ‘ownership’ of this blockchain exchange… just by buying shares in a normal stock.”

Any other hints?

“So, my research suggests the upside is huge. And I think that’s why Wall Street has been piling in the stock of the “parent” company that owns this new exchange….

“Vanguard… BlackRock… State Street… Some of the smartest money people around…

“They’ve scooped up 100 MILLION shares between them.”

So that’s still Intercontinental Exchange (ICE), the behemoth behind some of the major commodity and futures trading exchanges and owner of the New York Stock Exchange… and, yes, also the controlling shareholder of Bakkt, the cryptocurrency exchange that they’re taking public through a SPAC merger with VPC Impact Acquisition Holdings (VIH). So if you do want exposure particularly to Bakkt because of its crypto trading platform, you could buy ICE to get a little exposure (ICE is a $65 billion company, so crypto trading doesn’t move the needle for them yet), or you could go in directly and buy VIH to get a piece of Bakkt directly once the SPAC merger closes (assuming it does… it appears on track, but one never knows until the deal is done).

ICE is certainly the safer choice, they’re huge and profitable and effectively have near-monopolies on some major trading markets, which leads to steady returns from trading fees. They pay a small dividend, trade at about 30X earnings and are likely to grow earnings by probably about 10% a year, and aren’t cheap, but it’s a solid company. And if you’re worried about inflation, they’re likely to be well-protected from that — they benefit from the volume of trading that happens in stocks and commodities, and probably in stuff like cryptocurrencies and carbon credits in the future, it doesn’t much matter what the prices are. If you want to think over the appeal of the Bakkt deal specifically, the presentation about the SPAC deal details is here — I did also write some about that Bakkt deal for a different teaser pitch a few weeks ago if you’re curious.

Next? Stock #2 is teased this way…

“The ‘Next Visa’ ….

“there’s one specific payment company I’m recommending to my readers right now…

“And it’s not Mastercard, PayPal, or Visa…..

“This was the first to add blockchain to its payment system….

“… their revenues have spiked recently…

“They’re up 12-fold since 2015.”

So yep, that’s still the same as his pitch a year and a half ago as well, Teeka’s “next Visa” is still Square (SQ). Which I still think of as one of my “one that got away” stocks — a great company that I owned early on, but sold way too early and have been too stubborn to re-buy. And it’s probably still a decent idea even now, at 9X sales and 300X earnings, if you can wait — if they can hold onto their market share and keep growing with more merchants (a big if, since competition is fierce in payment processing and people are willing to lose a lot of money to break into that market now), then their huge processing volume can eventually catch up with their valuation… particularly if they are able to cross-sell other financial products to their merchants. Analysts think they’ll double revenues again this year, though I’m sure it will be volatile as the world re-opens and as smaller merchants live or die on the pace of reopening and how that meshes with the end of stimulus payments, so it will probably be an interesting ride.

I’ll be curious to see how the dynamics evolve between PayPal (PYPL), Square (SQ), Shopify (SHOP), Stripe and others over the next few years, and eventually it’s likely that blockchain will begin to play a meaningful role in these payment networks, but for now it’s really just a spending story… how much are consumers spending with their credit cards, with the processor getting a teensy cut of each transaction, and how can these and other payment processors build their merchant base to keep getting more of that spending volume? I do own Shopify, and expect that the giants Mastercard (MA) and Visa (V) will also remain strong, but I can’t talk myself into chasing any of them at these valuations.

And one more? Are we in for a full repeat of 2020’s pitch?

“Stock #3

“You know, I call this… and anyone who was around in the early days of the internet will have a chuckle at this… I call this my ‘Cisco’ play….

“So, for every Amazon… there’s a secret ‘behind the scene’ company like Cisco that actually returned a lot more.

“In the ‘90s, Cisco returned 67,491%.

“That was actually 15 times better than Amazon.”

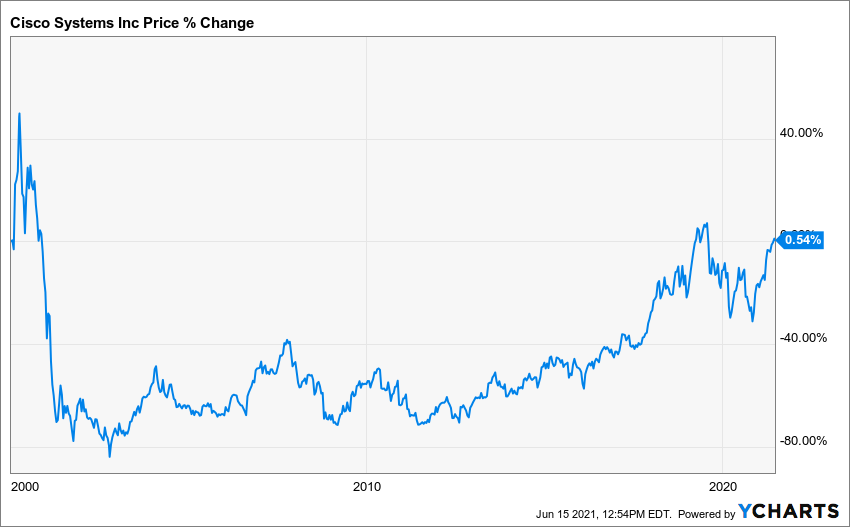

OK, so I have to insert my cautionary tale there, just as a public service announcement for those of you who missed the crazy world of the late 1990s — yes, Cisco Systems (CSCO) did have an insane surge in the dot-com boom, and it ended that decade actually even a little better than that, with a 69,000% return. Amazon’s return in that decade was indeed “only” 3,800%, though they didn’t go public until 1997… but the cautionary tale is about buying these stocks while they’re popular. Here’s what Cisco looks like if you bought near that height of popularity, on New Year’s Eve, 1999… the stock is now up 0.5% in 21 years. Total, not annualized (OK, fine, CSCO would be up about 36% if you reinvested the dividends they began to pay in 2012 or so).

And everything looked ugly for a while after the dot-com bubble burst, but here’s what happened with AMZN if you bought it on that same fateful day…

If you want to be really fair, include dividends, and compare it to the S&P 500 or even a non-tech stalwart, here’s that chart — Cisco in blue, Amazon in orange, the S&P 500 in red, and Berkshire Hathaway in green:

OK, PSA over… what’s this third “background” stock? More clues…

“… there’s one company that has brilliantly positioned itself to scoop up billions of dollars in revenue by supplying the key hardware needed to power this blockchain boom….

“Subaru has already signed a contract with blockchain stock #3 to use their hardware…

“And it’s rumored… Let me be clear, it’s just rumored….

“It’s rumored Tesla is about to start working with this company as well…..

“Google, Microsoft, Twitter, IBM, Apple, Amazon…

“They’re all clients. And that’s why revenues for this company are starting to explode…”

And we get a little bar chart to that effect, showing revenue growing from about $1.4 billion in Q1 of 2019 to almost $3.5 billion in Q1 of 2021. So they’re at least updating the charts and the hints, and presumably thinking about the changing stories of all of these stocks. Did they shift their actual pick?

Indeed they did, last time around Teeka was teasing GPU chip pioneer NVIDIA (NVDA)… this time, he’s teasing their largest and fastest-growing competitor, AMD (AMD).

AMD is tougher to trust, they effectively came out of nowhere a couple years ago to become relevant again, after decades of fruitless competition with Intel in CPU chips and also-ran status behind NVIDIA in graphics chips, and they spent on R&D and made huge inroads in both of those markets. That doesn’t match the Subara tease, as far as I know, but AMD has a few times been rumored to be getting some Tesla business (Tesla dropped NVIDIA in favor of its own chipsets for autonomous driving a few years ago), and the revenue numbers Teeka hints at are an exact match for AMD.

I still prefer and own NVIDIA, largely because of their better brand and technological lead in gaming chips and their huge lead in building a user base for their AI operating systems and chips, which I expect to be very sticky, but both certainly get some business from crypto miners and are growing nicely right now — and AMD is trading at a somewhat easier-to-stomach valuation. I think NVDA is buyable up to about 40X forward earnings, which is only about $635 now, and even if you use next year’s estimates that’s only $690. If you gave AMD that same benefit of the doubt, with their faster earnings growth rate but much lower margins and smaller size, that same valuation of 40X earnings would justify the low $80s using this year’s forecasts and a little over $100 based on next year. I’d rather pay a little premium for NVDA, even with its larger size and therefore theoretically inferior growth potential, but reasonable minds can differ on that.

So not a lot of huge changes from the last time we looked at Teeka’s “Genesis” idea — a swap-out of chipmakers, and a twist on the ICE recommendation since their crypto business is actually being spun out into that SPAC, but we’re generally dealing with the same idea. Sound like the kind of investments you’d like to own? Have a favorite in the bunch, or alternatives that you think are superior? Let us know with a comment below.

Disclosure: of the companies mentioned above, I own shares of Shopify, Amazon, NVIDIA and Google parent Alphabet. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

I am a subscriber to PBRG. All three of your guesses are correct.

i confirm. i have the $5 k package and you have to pick your moment to get in to have the returns they claim. Teeka is not worth investing into

What is the difference between pre-IPO stocks and stocks on the market? I’ve got two pre-IPO stocks Also if you think NDB and CLII.WS or EVGO (after CLII merges with EVgo, I think they’re going to be EVgo) are stinkers or potential winners..

Thanks, Travis, for keeping us current with the Blockchain scene. I’m invested with small companies like Mara, Riot, and GBTC. Any comments on those companies or the up-and-comers?

GALAXY DIGITAL

It’s not about the games. Take the long view. When my nephews were locked up in their homes all last year due to COVID in NY, they’d still “go out” with their friends. They’d meet via Roblox. The whole Metaverse thing, the Internet 3.0, is getting hot again. Consider UpLand and Earth 2.0. That’s what Roblox is moving toward. Virtual workspaces, virtual real estate (a booming business right now–seeing properties in the metaverse. Second Like, a decade ago, was a dud, but the young folks are adopting those kinds of platforms. There are like virtual malls on one of those metaverses, and brand name companies have bought land and set up shop… selling clothing and stuff for you avatar…. everything is an NFT. Apparently, this is the direction we’re going to go. COVID kept us remote, at our computers, an we adapted. We’re one step closer to living dualistic lives… one in reality, and the other in VR

Thanks!

Thanks. I hadn’t realized that CISCO really had a bad bad couple of decades.