The first version of this article was published on July 20, 2023, as I investigated the ads scaring us with their “dollar recall coming as soon as July 26” headline… but we’re getting yet more questions about this Teeka Tiwari “Biden Shock” ad with a “December 13” panic moment now, so we’re re-publishing it, with a few mild updates noted below, to answer reader questions. The first phase of FedNow has now launched, thought he ads haven’t really changed at all, and Teeka’s ad is still teasing the same “protect yourself” investments that I discuss below.

There have been a half-dozen or so highly agitated teaser ads about the “recall of the US$” this year, from many of the usual suspects in the fearmongering world, and they’re all essentially making the same pitch: The launch of the FedNow money transfer system (which happened about six months ago now) will be the “trojan horse” for a central bank digital currency (CBDC) in the US (often called “FedCoin”), which would be a digital version of the dollar that eventually replaces the current dollar, so… PANIC!

There are a few variations on the “panic now” ads, depending on which pundit is trying to stir us up, but they mostly tell us that you’ll lose all financial privacy because the Fed is suddenly going to swap out the dollar for a cryptocurrency version of the dollar (usually referred to as “FedCoin”), and then they’ll attach “smart contracts” to the dollar and therefore control how you can spend your money… or, worse, with this particular Teeka Tiwari ad, that your dollars will “become worthless” and will be “recalled” by the government. Or more specifically, by Joe Biden personally.

These ads then generally pitch an investment that will benefit from this transition to a digital dollar, of course, with the idea that you can “win” through this chaos by owning gold (or gold miners), owning the right digital currencies that will become more widely used (or in the most bizarre claims, will ‘replace’ the dollar and force a ‘recall’ of your money), or just by buying the technology companies or payments/fintech companies who will benefit from money going even more “digital.”

It’s a hard tightrope to walk, frankly, promising both that the financial world will come to an end and you should be really worried… but also that owning the right stocks or cryptocurrencies will save you. Judging by the questions I’m getting from readers, though, it seems some people really believe the extreme end of this hype, that somehow their money is going to be “recalled” by the government on July 26 September 20 November 1 December 13 and they have to ACT NOW to save themselves.

Quick answer? That’s not going to happen.

There are risks in the market, there is a chance we’ll see a real central bank digital currency be launched in the US and go into meaningful use over the next few years, and there’s also the theoretical possibility that some future US government will push beyond that, and be unable to resist the temptation to use a central bank digital currency to enforce the law more stringently, or even, though this veers more into conspiracy theory and speculation, pass new laws to exert more authoritarian control over what people can and can’t buy.

I can’t say that this will never happen. You can’t prove a negative, and the world is strange and unpredictable.

But I can say it didn’t happen on July 26, or September 20 or November 1 or December 13, and there won’t be a “flip the switch” moment when cash is banned and dollars are “recalled” in the foreseeable future.

Anything the government does with a digital currency in the next few years will be an experiment, and logic (and Congress, and the Fed) insists that if some kind of “FedCoin” central bank digital currency goes forward, it will be seamlessly exchangeable for “regular” dollars — and it will be argued about in Congress, and will move very slowly. The government, we should recall, has been spending the past 50 years trying to convince voters that they can give away money and spend it on everything that voters like, without raising more tax money. No matter which side of the aisle you drift toward, it should be clear to you that cutting taxes and increasing spending are how politicians win votes, giving people money or benefits, not taking it away or scaring the hell out of people for no reason.

And it’s the government, so whatever evolves as a central bank digital currency in this country is going to take a while, and people are going to fight about it. Heck, given how cranky and dysfunctional Congress has been in recent years, they might even block or hobble any CBDC project that gets to the “testing” stage. After all, politicians are essentially social media influencers now — they see that “FedCoin” fear is stirring up good results for investment newsletters and conspiracy theorists, and many of them will take the baton and try to lead the parade if it gets them airtime. The current Fed leadership has made it clear that they don’t believe they have the authority to launch a new digital currency without Congressional approval, and it would be shocking if the courts disagreed with that.

If you’re afraid of the government acting quickly to take away all the paper currency and make cash illegal (which you would have to do, of course, to get rid of the dollar and replace it with something that’s not just another variety of a fully fungible dollar), let alone “take away” any digital dollars that are in your checking account right now, I’ll just remind you that the United States Congress has been trying, and failing, to eliminate the now-completely-irrelevant penny for the last 35 years (slowed down by the zinc lobby, and by the fear that it would look bad to voters or punish the poor in some special way… though that’s quite silly from any objective perspective, most other countries have gotten rid of their similarly worthless coins, and most Americans support getting rid of the penny).

Sure, there are things that are worth worrying about if you’re concerned about government overreach, and reasons you might want to protect your financial privacy a bit or hedge against some kind of currency disaster, but I don’t think a big change to US currency is anywhere near the top of the list of things that investors ought to be worried about. As an investor, I’m a lot more worried about the valuation of the stock market, and about finding the next great company, and about saving enough for retirement than I am about the possibility of a so-called “digital dollar” eventually replacing the dollar. (In every real way, of course, the dollar is almost entirely “digital” already).

The likelihood is that financial privacy (and all privacy) will continue to erode in my lifetime, as it has for a century or more — we’ve pretty consistently chosen convenience over privacy, as a people, and that’s been the trend for both society and technological progress to this point. And that’s at least somewhat worrisome, but it’s not going to change the way I save or invest in any real way — I already own a little Bitcoin, hedge with a little gold and gold royalty companies, and spread the risk around a little bit, and the way I see it, there isn’t really any magical way to go further than that (unless you’re at the point where you wish to move out of the US$ entirely, move your savings and your person to another country that you think will protect your financial privacy better, sew diamonds into your pant cuffs, or go entirely “off the grid” and keep your wealth all in cryptocurrencies and gold… and remember, all of that stuff is difficult and time-consuming and expensive, and the opportunity cost is even greater than the obvious cost, because it will take you away from the stock and bond markets, which have historically been the best places for long-term investors to build and preserve wealth).

But that’s just me — I hear from many of you who are very worried about the potential loss of privacy, partly because these ads seem so convincing as they try to raise your blood pressure and spur you to emergency action (“emergency action” meaning “pull out your credit card and subscribe”), and I know many people are angry about the idea of a “creeping State” or the possibility that a central bank digital currency in the US in the next few years will mean that eventually the government will automatically be able to prohibit you from buying a gun, or an abortion, or aspartame, or foie gras, or whatever it is that you worry the State will try to take away from you.

I’m an optimist, but maybe your worst fears will eventually be realized, I don’t know the future and can’t tell you what role the government will play in our lives in 2050 — but be careful not to let that political fear and anger disrupt your investing plan. Marketers are very skilled at manipulating political emotions, and that’s much more to their benefit than yours.

But enough of my blather on that… we should at least take a gander at one of the actual ads — let’s look at Teeka Tiwari’s pitch for the Palm Beach Letter ($49 for the first year), which starts out this way:

“Wall Street Legend Warns: Take action BEFORE December 13th!

“The ‘Biden Shock’ of 2023

“‘Just days from now, President Biden could go on TV and announce a national recall on the U.S. dollar. If you have any U.S. dollars in your bank account, you must prepare now… or risk losing everything.’ – Former Investment Bank VP Teeka Tiwari”

No matter how much you might hate, love, or fear President Biden, he’s not going to announce a “national recall on the U.S. dollar,” let alone “just days from now” (or tomorrow). Please don’t do anything rash because of that immediate fear.

"reveal" emails? If not,

just click here...

But Tiwari later “doubles down” on this July 26M September 20 November 1 December 13 scare…

“Our financial authorities already scheduled an official announcement for July 26 September 20 December 13.

“Friends, this is a screenshot of their website.

“So this is an official date.

“That’s just a few days away.

“And that’s when I believe they could begin this dollar recall.”

Teeka forgot to update his graphic in the latest revision of this teaser ad, so he’s still got a screenshot of an earlier Fed meeting on the schedule, September 19-20, as the moment when he thought they’d begin this “dollar recall” (as he was previously promising they’d do at the July 25-26 meeting), but yes, there were Federal Reserve Open Market Committee meetings on July 25-26 and September 19-20 and October 31-November 1, and there is one starting tomorrow, December 12-13. Those Federal Reserve meetings are scheduled at regular intervals, every six weeks, and are closely watched (though not because of some “dollar recall” — they’re watched because we’re all obsessed with the Fed Chair’s announcement about any changes to the interest rate or to their thinking about future interest rate changes).

And the FedNow system was expected to go live in “late July” and did so, though they didn’t talk about that at the Federal Reserve meeting in July or in September or November, and they probably won’t talk about it on Wednesday when they conclude their meeting, either. FedNow is being rolled out to participating financial services companies, but it is not Chair Jerome Powell’s primary concern.

And, to be clear, the FedNow system is not changing the dollar, it is effectively an upgrade for the current Fed-managed interbank transfer system. They’re not even trying to replace the current private-market money transfer systems (PayPal, Zelle, etc.), let alone “replace the dollar.” And none of this is at all secret.

FedNow launched with 41 banks and 15 service providers “certified” to use the system immediately, and at least a handful of banks planned to begin using it immediately. I don’t know what the usage has been like, but the number of participating banks and other companies has grown (the last update is here, I haven’t counted them to see if it matches Teeka Tiwari’s “110 Banks Are About to Recall Your Money” pitch, but it’s probably pretty close… the number changes every couple weeks).

What is FedNow? Here’s an excerpt of a post from the New York Federal Reserve Bank explaining it…

“At its core, FedNow is an interbank instant payment infrastructure. Banks, credit unions, and other eligible institutions have accounts at the Federal Reserve. These Fed accounts allow institutions to hold reserves. Banks pay each other by transferring reserves from the paying bank’s Fed account to the receiving bank’s Fed account using several interbank payment options. FedNow is a new addition to the suite of options to make such transfers….

“FedNow is a new interbank RTGS payment system that will support instant clearing and settling of retail transactions. Individuals will not have access to FedNow directly, but instead will have access to the instant payment services offered by their financial institutions. FedNow will allow participating institutions to transfer funds between their customers and provide immediate availability without incurring credit exposures. Because of their speed and convenience, instant payments, whether between individuals or between a business and a customer, are expected to grow in the United States, as they have grown abroad. With FedNow, the Federal Reserve is supporting the growth of this segment of the payment industry.”

Basically, that means FedNow offers a modern instant payment system to financial institutions, potentially replacing the antiquated ACH systems and other payment “rails” that most of us rely on now for transferring money, perhaps including the core credit card networks (many transfer systems still, in the background, take 1-3 days to settle, or cost a ton of money). I expect this will actually be bad for many banks and financial services companies, in general, since it will mean that banks and service providers no longer get to sit on money for a day or two and earn interest on it while it’s “clearing,” but there are obvious benefits to go along with that lost income, too. The retail financial world should get a little faster and cheaper and more convenient, catching up with similar official instant payment systems in other countries. The US systems for moving money around are still pretty antiquated, so this is mostly an attempt to improve that, to offer a system instant money transfer that doesn’t come with big fees or overdraft costs.

Teeka says this is somehow giving the Fed “direct access to your bank account,” which doesn’t seem to be at all true, this is a system for banks to move money back and forth to each other on behalf of their customers, not for individuals to have “Fed” accounts.

The part where this becomes a “what if” nightmare is that some people are connecting dots, often imaginary dots that they see because of how they feel about the government, and saying that the FedNow money transfer rails will become that platform on which a “FedCoin” central bank digital currency (CBDC) might be built and operate, and that it’s this “FedCoin” CBDC that will “replace the dollar.”

Well, maybe that’s possible… but the two projects (FedNow and “FedCoin”) are not at all connected now, and don’t even seem like they’re based on the same kind of technology in any way, so it seems a very big conspiratorial stretch to me, more of a disembodied fear of what’s coming than a logical step forward in financial authoritarianism.

As I said above, though, I can’t prove a negative, and lots of folks are freaking out about what might happen someday, and are primed to see threats everywhere. Frankly, I think it’s more likely that the FedNow system takes some of the wind out of the sails of FedCoin development, since it brings some of the benefits of a digital currency to the current dollar and banking system (instant payments, reduced need for intermediaries, etc.).

We’ll see… but either way, many who fear government overreach, or believe that we’re on our way to a totalitarian society (it’s always whichever politician we disagree with that’s trying to lead the authoritarian regime, of course), are convinced that FedNow is a “stalking horse” or “trojan horse” (some kind of horse, anyway) for “FedCoin,” based on not much more than “you should be worried about what the government might do.”

Maybe you should be worried, and express that worry with some portion of your assets, but that’s not much of an investment plan or strategy if you’re someone who needs to grow a portfolio to meet future needs. Being afraid only works out for you if the absolute worst happens, and investing and saving from a perspective of maximum fear is expensive.

Here’s what the Fed says about it:

“Is the FedNow Service replacing cash? Is it a central bank digital currency?

“No. The FedNow Service is not related to a digital currency. The FedNow Service is a payment service the Federal Reserve is making available for banks and credit unions to transfer funds for their customers. It is like other Federal Reserve payment services, such as Fedwire and FedACH. The FedNow Service is neither a form of currency nor a step toward eliminating any form of payment, including cash.

“The Federal Reserve has made no decision on issuing a central bank digital currency (CBDC) and would only proceed with the issuance of a CBDC with an authorizing law. Testifying before the House Financial Services Committee in March 2023, Chair Powell said a CBDC is, ‘something we would certainly need Congressional approval for.'”

Maybe they’re lying, maybe they’re desperate to take control of your bank account and tell you what you can spend your money on, and that belief is an article of faith for some people (which doesn’t mean they’re wrong)… or maybe it’s just an inevitable evolution, that more technology means surveillance grows and privacy shrinks, which is more how I feel, personally… but remember, everyone in Congress is trying to get your vote, too, and they know that people would rather not have anything scary and new happen to their money. If you’re so worried about a potential FedCoin launch someday that you’re panicking about the next Fed meeting, then whether or not you’re right about that, your time is probably better spent calling your Senator or organizing a political response than signing up for an investment newsletter or shaking your fist at black helicopters.

Back to Teeka Tiwari…

“The U.S. dollar is already in free fall…

“And all over the media, all you see are headlines about the end of the U.S. dollar….

“I could go on and on…

“But the bottom line is the U.S. dollar is in big trouble.

“And I believe the U.S. government will soon announce a radical plan to stop this bleeding.

“They’ll announce a mandatory national recall on the U.S. dollar…

“And replace it with a new digital version that will be radically different from what you have in your bank account right now.

“And you need to prepare now because they could officially announce this recall as soon as July 26 September 20 November 1 December 13″

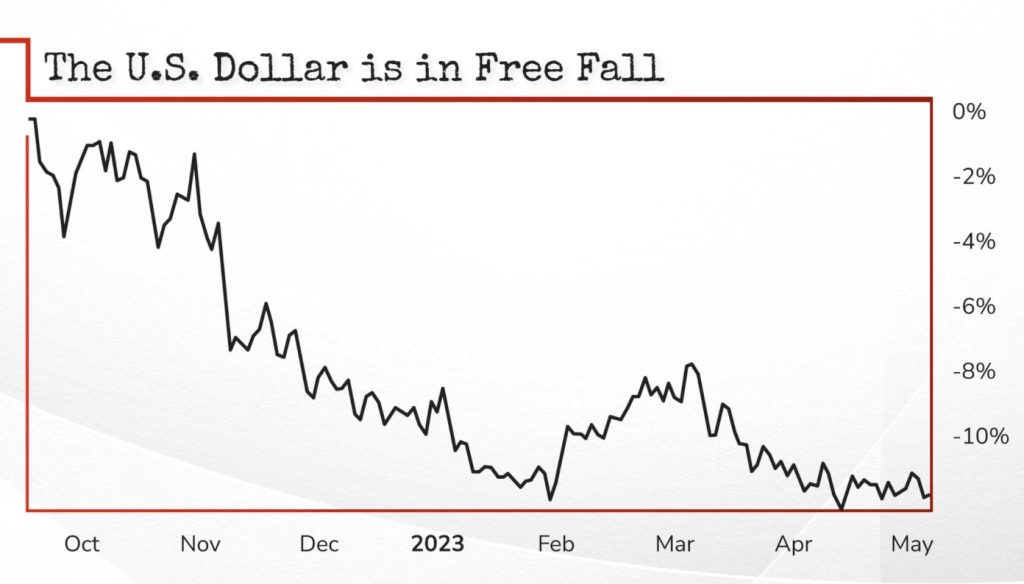

He also includes a chart for that “Dollar is in free fall” notion, which shows the dollar falling in value by about 10% from last October until May of 2023…

To which I’ll respond just by saying that when a marketer uses a chart in an ad, the intent is to make you feel a certain way. And you can make a chart convey just about any feeling you want, just by manipulating the scale or the time period.

What he’s talking about is the value of the US$ versus the basket of other major global currencies, commonly called the “dollar index” — and that did indeed peak in October of 2022, because interest rates started going up quickly in the US way before other countries started aggressively raising rates, and money goes to where it’s treated best. When US rates are higher, more money flows into the US$. Here’s what the dollar index looks like if we go back a bit further, to cover the last five years — it has been more volatile than average during the COVID and post-COVID drama, largely because of the tendency of US Treasuries to be a “flight to safety” trade and because of shifting interest rates among the large currencies:

There IS a push for de-dollarization in parts of the world, mostly because the US has used its sanctions regime to scare or control some other countries over the past 40 years, and because a couple of those recent targets have been big countries (we might think Russia deserves to be cut off from financial networks or even have it’s own overseas sovereign reserves frozen after invading Ukraine, but we can’t expect the Russians to agree with us)… and sure, a lot of people think the US has overreached and taken too much advantage of being the world’s reserve currency, which has helped to give US consumers a lot more purchasing power than anyone else in the world (and, of course, helped finance the world’s largest military spending boom, which is an indirect benefit to many and a threat to others).

So yes, many parts of the world are trying to move out from under the hegemonic control of the US$, particularly China and Russia as they face sanctions that restrict their trade, or chafe against having to use US$ to buy oil from the Saudis… but that hasn’t yet had much of an impact on global trade, which is still overwhelmingly in US dollars. No other currency, with the possible exception of the euro, if you’re feeling optimistic, is anywhere close to being able to handle all of the transactions that take place in US dollars every day. And since the EU almost imploded seven or eight years ago, the euro has a lot of “brand building” to do to build that kind of trust.

The reign of the US$ won’t last forever, no global reserve currency has lasted forever yet, and there’s been a shakeup every couple hundred years, on average, as empires rise and fall, but there isn’t any reasonable alternative available today.

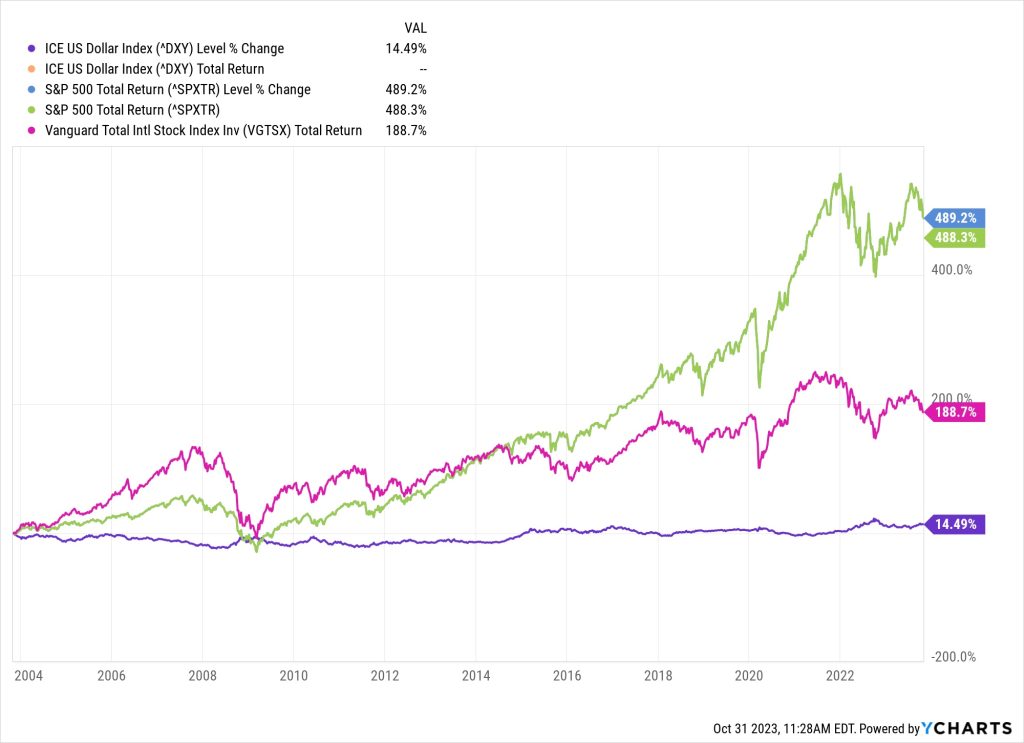

And not to put too fine a point on it, but though we see some fluctuation in currency exchange over time, with big currencies down 20% sometimes and up 20% sometimes, and interest rate shocks have brought a little more volatility, it generally evens out for businesses. The fluctuating value of the dollar has not been a primary driver of investment success over the past 20 years. Here’s that same dollar index compared to the S&P 500 (green) and the Vanguard Total International Stock Index (pink) over the past 20 years or so, just to provide some context:

Not that this has any impact on whether the US$ is managed by the computers of the Federal Reserve and the banking system, as it is now, or is replaced by a differently structured “FedCoin” digital dollar someday — in international terms, as far as we can imagine at this point, the dollar would probably remain essentially the same as it is now even if it’s replaced with a “CBDC.”

Yes, the dollar will probably gradually lose value over time, like all currencies, and it might even lose value to other major currencies over the next decade, as it sometimes does, particularly if China opens up further or the Euro Zone grows nicely and becomes more consistent. No other country wants to be totally reliant on the US currency… but that doesn’t mean the dollar is “in free fall” or is about to become extinct or get “recalled.”

Financial innovation and evolution are continuing to move around the world, of course, and it is widely argued that the US needs a central bank digital currency to keep the US$ at the top of the global heap, since other countries are pushing forward with their own CBDCs and money will probably continue to drift to where it moves most easily. Digital currencies are easier, cheaper and faster to move across borders, and they generally are centrally controlled, not dependent on a commercial bank’s intermediation (which adds the credit risk of that bank to the equation), so that’s another likely reason for the development of a “FedCoin” in the US… but Teeka, like many people, believes that the “crisis” of a dollar that is falling in value will give the Fed room to overreach:

“I believe they’re going to use this NEW dollar crisis to implement what they’ve been planning for months now:

“A new digital dollar that will give them complete control over your money.

“And they’re going to tell you they’re doing that for your own good… to save the U.S. dollar.”

We’ll see. “Them” of course, is the government, which always means, “the bad guys in government who you disagree with” (and that means the marketing works for everyone!)

Teeka also implies that this “recall” is a real thing that banks are talking about…

“Bank of America is already warning its clients that ALL checking accounts are likely to be replaced with digital dollars.

“And it’s not just Bank of America.

“More than 110 banks have already enrolled in a pilot program that I believe is the trojan horse for the digital dollar.”

To be clear, checking accounts are already “digital dollars.” That cash is not sitting in the vault at your local branch. It’s not like you mail your landlord a paper check and he takes it to his bank, and the bank then puts that check in a satchel and carries it to your bank, which takes the cash out of the vault and puts it on the Wells Fargo Stagecoach, which drives it to your landlord’s bank, which puts it in their vault until your landlord can come over and pick up the cash. Most “money” is created digitally, moves digitally, and is recorded digitally, most money does not ever exist in physical cash form, and that’s been true for a very long time.

And no, Bank of America is not “warning” clients that their checking accounts will be “replaced.” I’ve got a Bank of America checking account, and they’ve not told me a thing… though they have cut their fees for bouncing a check, and they are a participant in FedNow, so perhaps they’re letting people know that some of their money might move faster as that system launches, that payments they make might clear instantly instead of in two days, but they haven’t “warned” me about that, either. And my money transfers haven’t gotten any faster since FedNow launched, frankly, nor have they cut their fees that they charge for moving money around.

Teeka says…

“Once they make the official announcement….

“Most Americans will be caught completely off guard…

“And they could end up holding a bunch of worthless U.S. dollars.”

Again, there is no real basis for this “your dollars will become worthless” pitch, that’s just fear marketing to get your attention. There isn’t even a “FedCoin” digital dollar available to use right now, they’re still testing different technologies and ways to integrate that potential crypto-dollar with the banking system, and if it does move forward, and if Congress approves such a move, the only way I can fathom a transition to a fully digital currency happening, with no paper cash in existence at all, is very gradually… which means that yes, any theoretical future “FedCoin” dollar would function exactly the same as the current US$, they would exist together and be indistinguishable from each other in your account, and the paper currency you carry around would likewise be worth exactly the same amount as your digital dollars. Unless you literally recall paper currency, that’s the only way it could possibly work.

And remember, we have yet to stop minting pennies.

And the shift in logic comes next, as Teeka says you can avoid “holding a bunch of worthless U.S. dollars” if you follow his advice…

“… it doesn’t have to be like that for you and your family.

“You see, the bureaucrats who run our government don’t know much about digital currencies.

“They wouldn’t know how to pull this off.

“That’s why the U.S. government is turning to the private sector to help them implement this massive change to our financial system….

“And that’s where the opportunity comes in.

“There are potentially trillions of dollars involved in the development of these digital currencies.

“And if you know which companies are working on these CBDCs projects…

“And which assets would benefit from a digital dollar….

“You could come out of this U.S. dollar recall wealthier than you ever thought possible…”

So what are those investments? This is what he says…

“I’ll give you the names and ticker symbols of three companies that are already involved in this potential dollar recall, completely free of charge.

“These are companies that you can buy directly from your brokerage account.

“I even found a company that’s working directly with our central bank to launch the U.S. digital dollar.

“Plus, I’ll discuss the $0.25 alternative investment that could skyrocket in the coming days… no matter what’s happening with our economy.”

Here’s where he talks up that opportunity and those “free ideas”:

“This new digital dollar will also create incredible opportunities…

“Because I believe it will send a few stocks higher than anyone can imagine.

“For example, Big Tech is all over this trend because they know these central banks control trillions of dollars.

“According to my research…

“These central banks will likely end up hosting at least part of their new currency systems with major cloud providers like Microsoft, Google, and Amazon.

“Google has already made inroads in the Caribbean.

“Microsoft helped Bahamas launch its digital currency.

“And Amazon is testing several CBDC pilot programs and experiments.

“For example, they’re already working with the European Central Bank to launch the digital euro.

“So these three companies will certainly benefit from this trend.

“But I believe there are better opportunities than Microsoft, Google or Amazon.”

You don’t need me to tell you whether or not to buy Alphabet (GOOG) or Amazon (AMZN) or Microsoft (MSFT), of course, those are among the most-followed stocks in the world, and the most widely-held. I wrote some about Microsoft a few days ago when Luke Lango was teasing it as a “back door loophole” way to buy ChatGPT, and I’ve owned Alphabet and Amazon for years, and they still trade at justifiable valuations today, in my book… but I agree, central bank digital currencies are not likely to be a major driver for any of those three companies, they’re just too massive and profitable for that type of new business to generate any “surprise” revenue or income growth at this point. Maybe it will help a little, maybe it won’t make any difference at all, but they’re obviously very strong and very profitable companies, with or without CBDC’s.

So… what’s the “secret” stock?

“I found a smaller, little-known stock that I believe has much more upside potential.

“It’s a company you’ve probably never heard of.

“But it’s working directly with central banks around the world to help them launch their digital currencies.

“This company already helped our central bank develop its real-time payments network called FedNow.

“Maybe you’ve heard about it.

“But that’s basically the infrastructure that would be required for a future transition to a U.S. digital dollar.”

And more clues…

“… it’s not just the Fed.

“They already signed a deal with five central banks from other countries.

“And with more and more countries rolling out their own digital currencies…

“There’s a good chance they will sign many more deals in the coming months.

“That’s why I believe that once they officially announce the U.S. dollar recall…

“Shares of this company could skyrocket.

“That’s why the world’s largest asset manager BlackRock already invested $3.3 billion in this company.

“Vanguard, another Wall Street giant, has invested more than $3 billion.

“And Bank of America has invested more than $500 million in this single stock.”

Time for another pet peeve of mine: No, Vanguard and Blackrock didn’t invest $3 billion “because they think the U.S. dollar recall will make shares skyrocket” — they invested ~$3 billion because they are primarily managers of index funds, and they buy something like 5-10% of just about every company that’s in a major index. Very little of the money they manage is actively managed, by people who choose this stock over other stocks for any fundamental or strategic reason.

And given the size of those positions, and the fact that they’re working with at least five central banks on CBDC projects, Thinkolator sez that Teeka Tiwari special report, “My #1 Stock for the Coming Digital Dollar,” is almost certainly pitching FIS Global, formerly known as Fidelity National Information Services (FIS). The stock price has moved around a little, it dropped about 10-15% after Teeka’s initial tease back in July, and then recovered to be largely unchanged for the past six months or so (this part of the ad has not changed at all), but back then Blackrock held about $3.3 billion worth of FIS shares, and Vanguard $3 billion… and FIS has been talking up their work in helping governments build CBDC platforms and instant payment/settlement systems.

I’ve never followed FIS very closely, but they’ve had a couple tough years coming out of the pandemic — the stock is back down to where it was in 2014, and it’s trading at a pretty low valuation now if the analysts are at all correct in their forecasts (they’re estimating about $3.40 in earnings per share in 2023, which would be nearly a 50% drop from 2022… so the shares are trading at about 8X trailing earnings, quite inexpensive compared to most “fintech” stocks, though a lot of stocks in the financial services area are quite beaten-down at the moment), but at pretty close to the average S&P 500 multiple on 2023 earnings (current-year PE of about 18). Analysts expect earnings growth to pick up after this down year, growing roughly 50% between now and 2025, and if that’s how the future rolls out the stock might work out just fine from here… just note that expectations have changed dramatically for both 2023 (much worse) and 2024 (better) since Teeka’s ad began back in July.

And yes, FIS has been actively involved in FedNow, they announced early on that they were one of the first companies to complete their testing and get certified to accept FedNow payments. That’s pretty much “table stakes” for a major financial services company, all of the major payment networks and banks are likely to adopt FedNow pretty quickly if it ends up working well, and most of them are already working on it or certified to participate, but yes, FIS is an active participant.

The big drive for FIS and the reason for the big shift in earnings forecasts, however, is not CBDCs… it’s their ongoing strategic reorganization — which apparently investors have not been all that enthusiastic about for the past couple years, but which got a little kick start in early July, when they “accelerated” their plan to separate into two companies. They’re effectively selling a controlling stake in Worldpay, which is their merchant solutions business (handling credit card payments) to help them delever the balance sheet and focus on their core financial software businesses, where they expect to have better and more sustainable margins. You can check out the presentation slides here (or the actual webcast) if you’d like more detail on the plan. They seem pretty excited about it, though it’s not necessarily going to boost earnings growth immediately.

So… reasonable idea at first glance, it’s one of the bigger players in global payments and financial technology, and it’s inexpensive and not particularly beloved at the moment. That’s about where my knowledge of FIS drops off, but analysts have generally had nice things to say about the reorganization… and Seth Klarman at Baupost, one of the most-respected value investors around, made it one of his largest holdings earlier this year and has kept adding to it each quarter so far, so that’s saying something (it was 4.5% or so of Baupost’s fund as of the March quarter, and he probably paid something in the mid-$60s… and Klarman bought more FIS in the second quarter, increasing Baupost’s position by about 40%, and a few other big name investors bought some FIS too, including Dan Loeb and Paul Singer… as of the September 30 13F, FIS is the fourth largest position at Baupost, about 7.4% of Klarman’s portfolio.

And on that cryptocurrency that he also pitches? These are the clues:

“I’ll also give you details on the $0.25 alternative investment that could skyrocket when this dollar recall begins.

“Most people don’t even know this exists because it has nothing to do with precious metals or commodities.

“But it’s the same type of investment that’s already attracting the attention of legendary investors and billionaires like …

“The founder of Tesla, Elon Musk…

“Shark Tank star Mark Cuban…

“Legendary hedge fund manager Paul Tudor Jones…

“And the co-founder of Apple, Steve Wozniak.

“Even though these billionaires are all in…

“This isn’t reserved for rich people only.

“In fact, you can get started with this alternative investment with less than $0.25…”

Notice that he said “same type of investment?” That basically just means, “those famous people bought cryptocurrencies, too” — which is true, I’m sure, pretty much every famous investor other than Warren Buffett has at least tinkered around a bit with cryptocurrencies, though there are thousands of different cryptocurrencies out there.

Which one does Teeka like here? Not much in the way of other clues…

“… this single investment would give you DIRECT exposure to the blockchain technology that was designed for central bank digital currencies…

“And you can get started with less than a quarter.”

So… I’ve mostly got to shrug my shoulders at that, but it’s probably one of the cryptos that was designed to make money transfer easier. Readers have posted in other discussions here that it’s Stellar Lumens (XLM), and that would be a fine fit for Teeka’s argument… though we should also note that an effective FedNow will be a strong competitor for a cryptocurrency whose raison d’être is to make moving money faster and cheaper. At least in the US.

Stellar is trading at about 12 cents these days, it surged higher for a while in July on high trading volume, so perhaps that’s partly Teeka’s doing, but it mostly drifted back down over the past few months and currently trades right around where it was in September. No idea where it goes next, the price has participated in both of the major crypto peaks and collapses over the past six years, so it’s a good bet that they’ll continue to be driven by the same trading urges as all the other pretty big cryptos… but feel free to discuss it amongst yourselves. This one sticks in my mind mostly because it has been teased in the past, by Jim Rickards back in 2018, and it has been mentioned in connection with other crypto-curious newsletter folks recently as well.

Beyond those investment/speculation pitches, Tiwari also offers up a “special report” that he says is called, “The 3 Simple Steps to Opt Out of the Digital Dollar” … and that’s something he has talked up in free commentary in the past. So, not to spoil the surprise, it’s basically “buy Bitcoin” — here’s an excerpt from one of his previous posts on that topic:

“I know it sounds outrageous. But nobody can stop this trend. If you look at history, leaders have always tried to have more control over our wealth.

“But there are simple moves you can make today to opt out of this digital dollar….

“There are three simple steps to take right now…

- Open a crypto account

- Buy Bitcoin on an exchange

- Store it securely in a wallet

“You may have heard me sermonize on Bitcoin (BTC) before. But with the possible move to a new dollar regime, it’s now more urgent than ever that you move a portion of your wealth to alternative assets like Bitcoin.

“The beauty of Bitcoin is you hold it. Nobody can take it from you. You’re essentially your own bank.”

I won’t argue with that, Bitcoin has clearly reached a point of pretty broad global acceptance as an asset, kind of like a new version of gold. There’s obviously risk, Bitcoin has only been around for 15 years or so, whereas human culture has had a couple thousand years to develop the consensus that gold has persistent value, and Bitcoin does depend on the internet (and electricity)… but really, if the internet and electricity fail us, then probably gold won’t do us all that much good, either. Maybe whisky and bullets will be the new currency then, but there’s a limit to how much “disaster prep” I want to do… and I can’t fill my basement with whisky, because I’d just end up drinking it all.

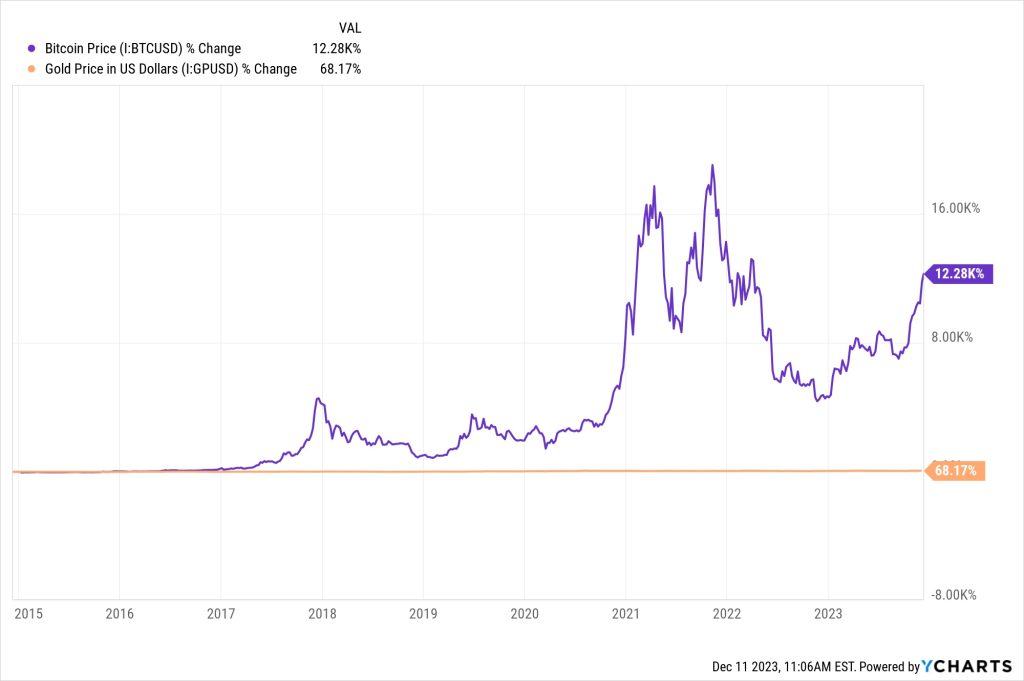

I’m more confident in gold than I am in Bitcoin as a store of value, if only because Bitcoin is so much more volatile, but I do hold a bit of Bitcoin (and Ethereum). You’ll have to make your own call about how much of your wealth you want to have in these kinds of “core” digital assets, but it seems reasonable to me to have “some.” Bitcoin has certainly been more fun and exciting than gold, but sometimes that’s the opposite of what you’re looking for in a “store of value” or a “currency” — this is the chart of Bitcoin and Gold since 2014, just to illustrate that point:

Pretty cool, right? Anyone who bought Bitcoin five or ten years ago certainly made a lot of money on it… but when people think “store of value” they’re probably nervous about “assets” that can drop dramatically in value without much warning, this is that same chart going back just to April of 2021, the first time Bitcoin went above $60,000. It seems safe to assume that assets which can rise 1,000% in value must also be able to fall 90% in value — there is no such thing as a risk-free speculation:

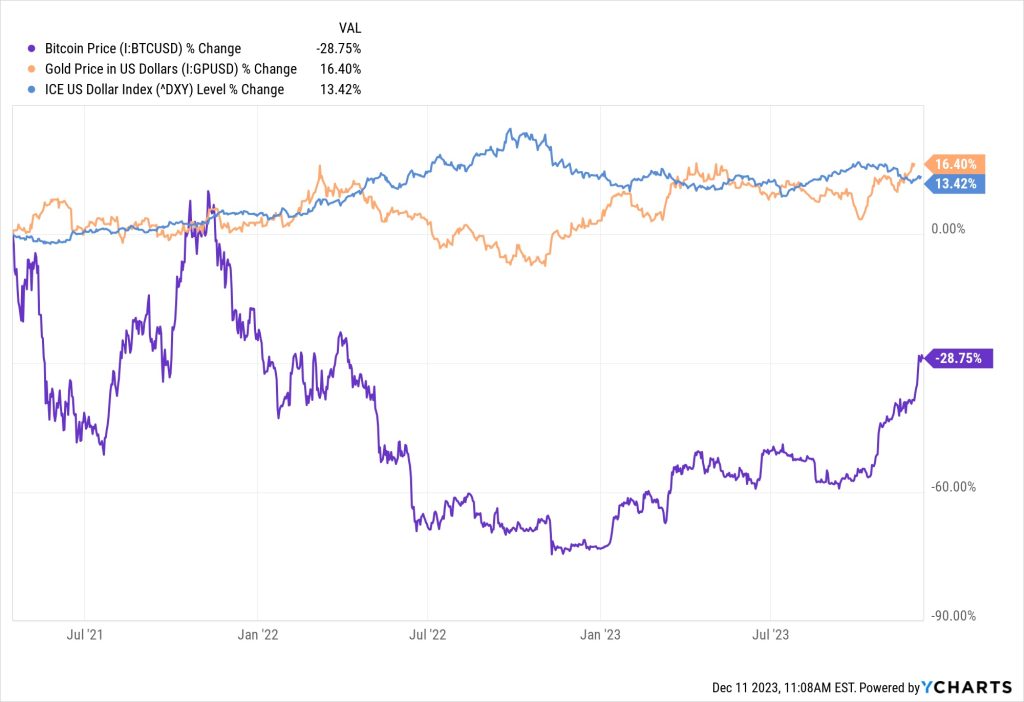

Remember, Teeka said one reason we have to get out of the dollar is that it’s in “freefall”… so here’s what the dollar looks like over that same time period (that’s Bitcoin in purple, gold in orange, the US Dollar Index in blue):

Bitcoin may end up being the safest investment over the next 20 years, I certainly don’t know how money will evolve in the future… but volatility can be scary. Owning bitcoin over the past few months has been fun, but you wouldn’t have wanted to have to sell your bitcoin to pay college tuition or property taxes back in January.

And Teeka also throws in yet one more pitch for a gold investment — so he’s running the whole gamut of “FedCoin” fear response today: Buy the tech company that might profit from more CBDC development (FIS and the three big cloud titans), buy some cryptocurrencies that might benefit if people want to move away from the dollar (Bitcoin, maybe Stellar Lumens), and buy some gold. Those are the three somewhat logical ways to cope with this kind of monetary fear, and he’s ticking all the boxes.

So what’s the gold one? Here’s what he says…

“… nations across the globe are not only dumping the U.S. dollar…

“But they’re also buying gold at a record pace.

“In the first quarter of 2023 alone, central banks added 228 tons to global reserves.

“That’s the highest rate of purchases seen in a first quarter since the data series began in 2000.”

That’s true, though there are usually some sellers, too — most recently China and Poland have been increasing their official gold reserves, for example, while folks like Turkey have been selling off reserves to fund other priorities. Central banks were net sellers of gold for a very long time, but in recent years there has been some meaningful net buying. They aren’t necessarily great at timing those purchases, of course, they’re buying for strategic reasons, not immediate price reasons, but it does create more demand in the gold market.

And he has a specific way to “play” gold that he calls “The 10X Gold Secret”…

“I found a little-known gold investment that could return up to 1,000 times more money than gold….

“The last time gold had a big bull market was in 2007, in the midst of the global financial crisis.

“Gold jumped as high as 162%.

“That’s not bad.

“But it’s nothing compared to my #1 gold investment.

“It skyrocketed as high as 2,100%….

“I believe we could see similar gains in this new gold bull market.

“Unfortunately, most people don’t know about this secret because I’m not talking about collectibles, gold coins or even a gold miner.

“And it doesn’t involve options, futures or anything extra risky.

“But you can buy it from your computer with just a few clicks.”

And Teeka includes a chart, too, so we can actually see that big move of 2,000% or so from 2007 to 2012… and that lets me give you a certain answer, because that’s one of the charts that scorched into my brain, largely because I owned the stock for most of that time and still own it today, I didn’t sell the stock near that 2012 speculative peak, and it later gave up most of those gains (not that I’m bitter or anything).

Here Teeka is teasing Sandstorm Gold (SAND, SSL.TO). Here’s what that chart looks like, I can’t quite get to 2,000%, but that depends largely on your starting point — the company was founded in 2007 and had its IPO on the venture exchange at about 20 cents per share in August of that year, so from that IPO price the gain at the 2012 peak was actually close to 7,000%, but if you look at most stock charts that average out that initial activity, those early gains show up as more like 1,000%. It was, as you might imagine, an extremely volatile penny stock in those early years, and it also had a fairly major spinoff early on.

That kind of gain is probably not going to happen again. At that time, gold was surging in the years after the global financial crisis, and Sandstorm Gold was also one of the first viable new gold royalty companies to emerge, with a fair amount of attention, and it also just happened be a tiny company — it had a market cap around $9 million back in 2009, and was up to $500 million or so as gold soared and they planned their uplist to the New York Stock Exchange in the Summer of 2012. The timing was perfect.

If gold does surge in the next few years, the gold royalty companies will have a lot of leverage to that surge and will probably outpace the price of gold (though they won’t go up as much as the best miners will — and they don’t fall as much as the miners do in bad markets, either). But Sandstorm Gold is harder to move now, they dod some big acquisitions last year that were pretty dilutive, which angered investors and brought the shares down, and some of their major projects have been delayed (several times, in some cases), which has pushed their anticipated revenue growth from those royalties further into the future.

On the plus side, I think it’s still the most value-priced of the large gold royalty companies, and they have a lot of future potential growth in the form of hundreds of royalties that could turn into something someday, in addition to the dozens of solid royalties that are paying them cash right now, so I’m happy to hold, but I do want to make it clear that CEO Nolan Watson is under some pressure to stop being an acquisitive cowboy. He has made a lot of “transformative” acquisitions that may well pay out someday, but his push to make big growth strides, quickly, has also really cut into the per-share cash flow at Sandstorm, mostly just because he has had to issue a lot of shares to make those acquisitions.

If you’re looking for other options in the royalty space, Wheaton Precious Metals (WPM), Franco-Nevada (FNV) and Royal Gold (RGLD) are the biggest players, and Osisko Gold Royalties (OR) and Triple Flag Precious Metals (TFPM) are the recently more successful mid-tier competitors for Sandstorm. Among the big ones you’d probably go with WPM if you want more silver exposure, FNV if you’re willing to pay blue-chip prices for blue chip brand names, RGLD if you want something closer to cheap that has some meaningful exposure to other metals. Among the mid-tier names I continue to think Sandstorm has the best combination of potential growth and reasonable current valuation, but that’s been true for a while and they’ve underperformed because of those delays from major assets (Hod Maden, Oyu Tolgoi) and because of their eagerness to dilute shareholders in search of transformative portfolio growth. That might work in their favor if gold really spikes again, so it’s quite possible that they’ll be the fastest mover if gold moves dramatically, like it did from 2010-2013, but I wouldn’t get your heart set on a 2,000% return. They’re never going to be a little $10 million startup again.

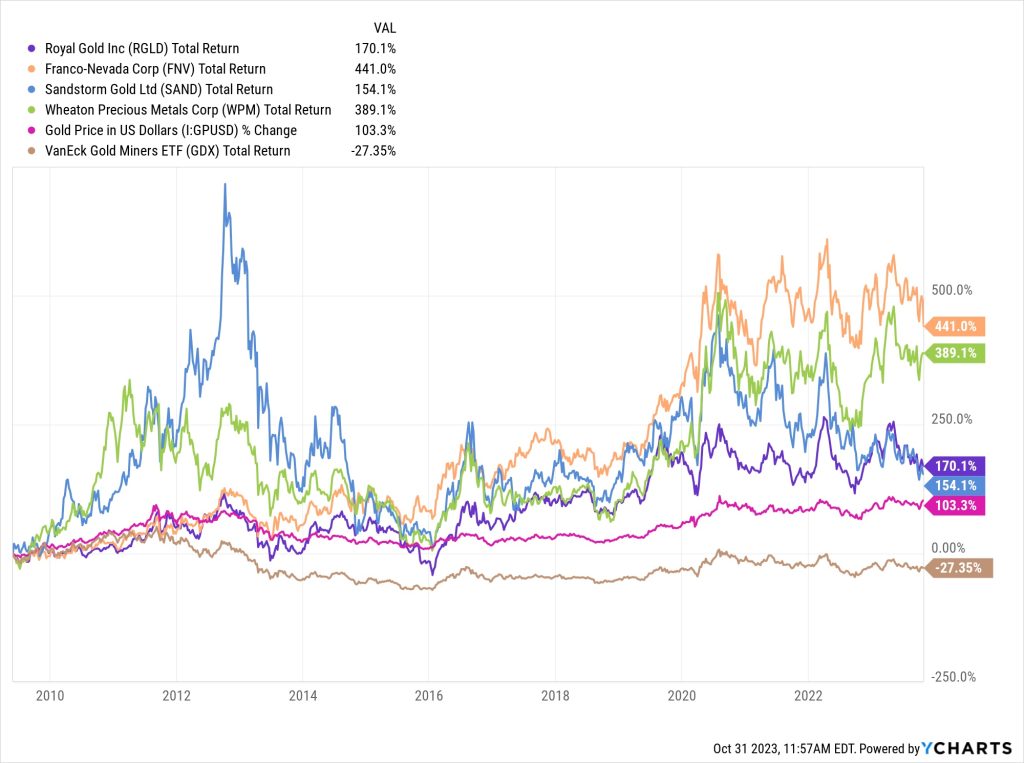

I own Sandstorm Gold and Royal Gold, personally, mostly just because I can’t stomach the valuation at Franco-Nevada… but at this point, I’d have to acknowledge that “paying for quality” would have been the better call in the gold royalty space over the past decade. Still, in general, owning royalty companies provides good leverage to gold with a downside risk that is much lower than gold miners. This is the chart of performance for Sandstorm (in blue) from 2009 through a few months ago, compared to WPM, (green) FNV (orange) and RGLD (purple), with the gold price (pink) and the “big gold miners” ETF (brown) for comparison (the others royalty companies didn’t exist back then):

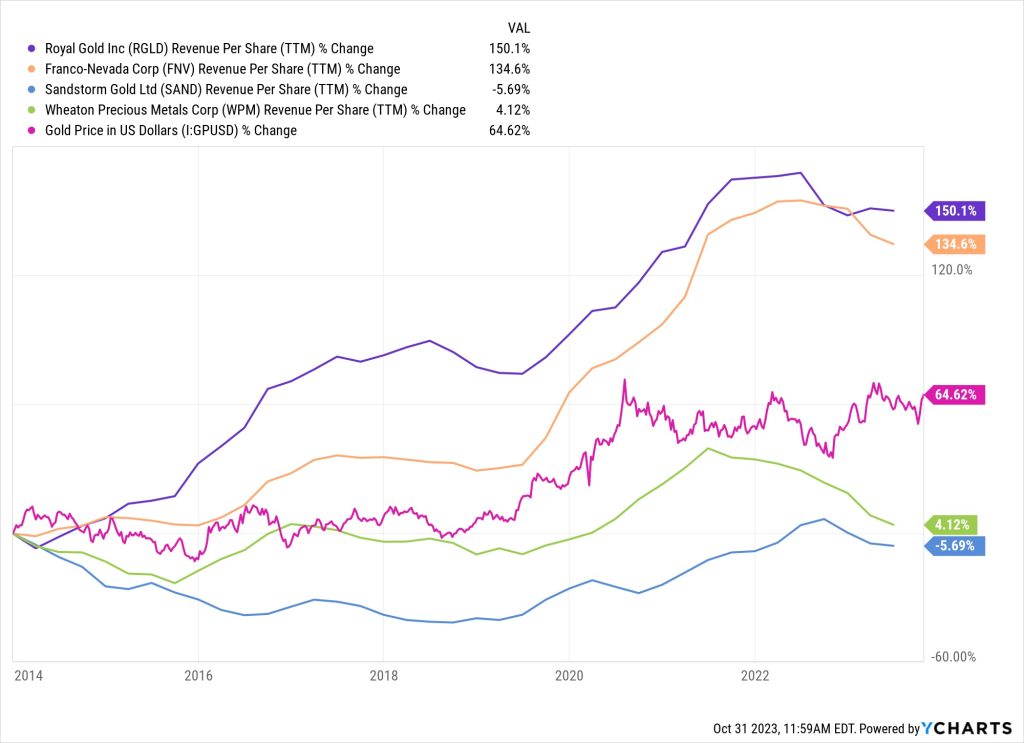

Sandstorm’s revenue-per-share growth has lagged over the past decade, largely because of dilution and the delays in the startup of some of their hoped-for major growth drivers (like Hod Maden), this is what that looks like compared to some peers (that’s SAND at the bottom, in blue):

Though over the past few years, things have actually started to look better, even with the dilution that dropped their per-share revenue over the past year…

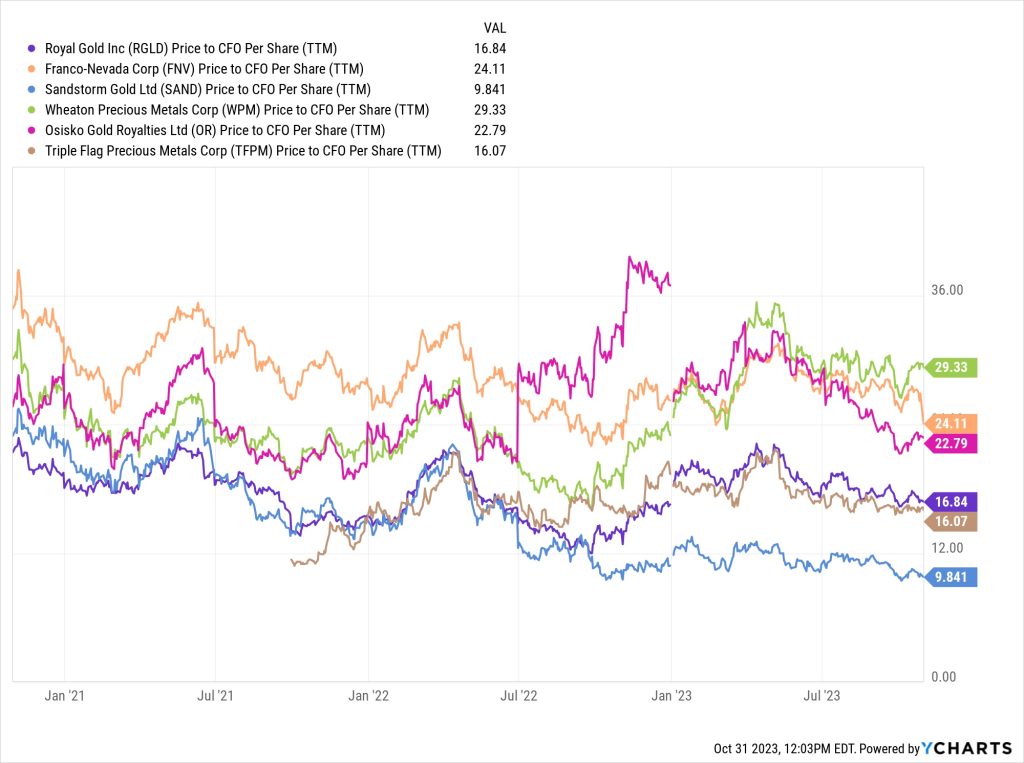

But, like I said, it’s also the cheapest of the big players, by a pretty big margin — this is the valuation as of a few months ago, using cash flow from operations per share (this is the Price/CFO per Share multiple). This isn’t a perfect measure, partly because it doesn’t include debt and Sandstorm does have some debt, but I use it because earnings are a tough measure for these companies, since “depletion” of mines is a major writeoff, sort of like depreciation, and revenue growth is misleading because some do more streaming deals, which have much lower gross margins, and others do exclusively royalties that have essentially 100% gross margins:

My “line in the sand” is that I tend to balk at paying more than 20X cash flow from operations for a royalty company, and it’s mostly that valuation stubbornness, along with portfolios of impressive projects that have future growth potential, that has kept me buying Sandstorm Gold and Royal Gold over the years. If you chose instead to buy the company with the best reputation and the real “blue chip” status (FNV), that would likely have worked out better for you, I might just be too stubborn in sticking with Sandstorm after all these years… but we’ll see how the future plays out. If gold spikes, they’ll all make investors pretty happy.

So… will the Fed “End the Dollar” or “Recall your bank account” or “destroy your financial privacy?” I don’t spend much time worrying about that as I plan my finances and manage my portfolio, but I guess we have to say “maybe”, though they’d need Congress and the courts to go along for some of that… and it’s not going to happen this week, or anytime soon. January 31, 2024, will be the first FOMC meeting next year, in case you want to get a jump on what Teeka and others are likely to use as the “panic” deadline once December 13 has passed.

Maybe those things become pivotal issues in our country at some point in the not-too-distant future, but that’s a fight for philosophers and politicians — I think it’s essentially irrelevant for investors. Maybe folks can find the stocks that will “win” because the government is investing in building a new FedCoin currency system, maybe gold or Bitcoin will rise as people begin to worry about a new digital currency in the US, but to my mind, those are things that happen around the edges of a portfolio. Neither the still-hypothetical “FedCoin” nor the notion of government encroachment on financial privacy is likely to mean nearly as much for the next 10 years of stock market returns as the fact that we’re still near an extreme valuation level in the stock market.

But the fear and the anger certainly get the attention of potential newsletter subscribers, so the ads are going to keep rolling. If you wish to indulge in some worry, I’d just urge you to worry about “FedCoin” as a political issue, not as a financial or investment issue. FedCoin is not going to impact your bank account next month (though the FedNow system might mean you can transfer money instantly, instead of in two or three days, and the costs might go down, if your bank is kind enough to pass through savings to you), there’s not going to be a “dollar recall” at all, I’m quite sure, and as an investor, there’s nothing to really win or lose at this moment from the scary concept of a purely digital dollar, or the potential future loss of financial privacy.

You can worry about it or prepare for it, if you have surplus cash and want to buy something that feels a bit like insurance. Having some gold or Bitcoin is a pretty easy and “consensus” way to hedge against the decline in purchasing power of all currencies over time (including the US$), and perhaps those “store of value” kinds of assets could serve the same kind of protection against future forms of “privacy overreach” by the government… but I wouldn’t let it drive you into a panic, or prevent you from planning for more important things, like whether you’re saving enough for retirement or have your investment portfolio set up to generate enough income for you, or whether you’re prepared if the market provides a below-average return for the next five or ten years. Those things don’t have anything to do with “FedCoin,” but I bet they’ll go a long way in determining how comfortable you feel in 2030 or 2040.

Really, a lot of how you feel right now probably depends on whether you spend a lot of your time worried or angry about a disembodied “them,” whether it’s the black helicopters or the “global elite” or the aspiring authoritarians or the progressive or regressive “thought police” or whoever else (everyone has a “them” in mind to fear or hate, it seems) — if that’s what’s filling your head or becoming a personal priority, then sure, worry away… citizens and voters should pay some attention and participate more actively in the political system if the government is moving in a direction they believe to be worrisome. Just try not to mix that up with your investment strategy.

And as you might imagine, there are plenty of very strong feelings about this stuff in the Stock Gumshoe readership — so I’ve left the comments from the past versions of this article below, and you’re welcome to add your two cents as well… as long as we keep our comments thoughtful and respectful, we can all learn from each other. Thanks for reading!

P.S. If you’re looking for coverage of Teeka’s “Man Gets into a Self-Driving Tesla in Arizona” story, that’s a semiconductor manufacturing tale — click here for my story on that (and the answers to the teaser clues, of course).

Disclosure: Of the investments mentioned above, I own shares of Alphabet, Amazon, Sandstorm Gold and Royal Gold, and I own some Bitcoin and Ethereum and gold and silver coins. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

Tiwari is nothing more than the “old traveling snake oil salesman ” you see in a multitude of old Western movies. He constantly promotes fear among the less fortunate folks who happen upon his “tall tales of foreboding doom” in the financial system. Too bad he isn’t blackballed by the financial system. He has nothing to brag about — just that his ‘snake oil’ will never take hold of smart, sensible people.

He isn’t a part of the financial system, which is regulated — from my understanding he is not allowed to work as a broker or with a regulated firm, due to past settlement agreements with FINRA, but that sure doesn’t stop him from being a pundit.

He’s not a snake oil salesman , I remember years ago he was saying buy ETH crypto when it was about $10, make the reckoning its over $2000 now, not all of his recs went ballistic but overall he nailed it.

With + 33 trillion debt the US is virtually bankrupt and its better to be too early to adapt than being one day too late ,fiat is inflating away parts of this huge debt but will eventually become about worthles at the same time.

Gold/ silver is part of the protection and some crypto’s will be an option too ,but most of these crypto’s will vanish,most stocks are still in a bubble mode and are only interesting when cheap as protection when the whole thing of massive debt will be managed.

$49 for his letter is dirt cheap with the recs he’s touting ,you don’t need to buy everything he says ,make up your own choice, overall he”s right once cbdc “s will be there yhey will take more freedom from us to enslave society in favor of the elites .

While I agree that no one should take investment advice from this TEEKA person (or anyone else) and the Fed may not have a set a date, I do think a retail version of a “digital dollar/CBDC in the U.S. is only a matter of when – not if.

Actually, the government would likely not need to “make cash illegal”. They would only need to stop issuing new paper dollars. The “cash” in your bank account is not cash at all; it’s already just digits on a screen, no?

I’m also not sure that it would take an act of Congress to allow the Fed to issue a CBDC – maybe to fund the rollout? As it stands now, the Fed has the authority to issue currency. Did Congress specify whether it could be paper or digital or some other form?? I’m honestly not sure about that.

The Fed could simply do a slow multi-year rollout of a retail CBDC, gradually decreasing the amount of paper bills in circulation (I think is more likely than doing away with cash all at once). In this scenario there would be early adopters, and over time, the masses would be lured in by the perceived convenience.

I’m not saying everyone should panic. But technically, a CBDC would enable surveillance and a level of control over individuals that was previously not possible. And as you point out, the rights & privacy of citizens tend to erode slowly over the generations. Once gone, they don’t tend to come back easily.

This is a tricky one. Thanks for the article though. Keep up the good work.

I’m no legal expert, but Jerome Powell has made it clear that he believes only Congress could authorize a change to the way US currency is created and managed, and that congressional approval would be needed for a CBDC, assuming such a currency ever becomes technically viable and the Fed decides they want it.

Guessing about what future governments might do is a worthy area of debate, but I don’t think it provides us much investment clarity.

I learned the hard way about Teeka, Rickards, Nomi, Altucher and others. I see these names and just hit “DELETE.”

I do the same, however I do read, or actually scan them and then delete, and, yes, I learned the hard way as well.

Thanks for the detailed explanation!

You saved me from getting sucked into the unpleasant fearmongering of TT in a former warning and also by association, from several other pundits predicting the same or other secret prophesy countless times i.e.LL. I pay them no mind as soon as I see that cookie format they use over and over again. They’re like widgets. I wonder if they all use the same video production company because their videos seem so similar.

Most of them use the same corps of copywriters, who are descendants of the original group trained by the Agora folks in Baltimore… and a lot of the publishers are now conglomerated into one ownership group under the public company Marketwise (MKTW), so they also cross-market like mad among themselves. And newsletter pundits who fail to either perform well or attract subscribers typically just move on to the next publisher and try to get going again with a clean slate. If you have some celebrity, at least among certain niches of potential subscribers, publishers are happy to throw together a newsletter with your face and your macro ideas. My general observation is that for most of these publishers, priority one is to sell, priority two is to quickly upsell to a higher-priced letter, while you’re still flush with the excitement of joining the “secret club,” priority three is to have some meat on the bones in the form of a newsletter that people like to read and/or that makes good stock picks sometimes, so that those folks ultimately decide to renew.

Nobody wants to have a lousy newsletter, and everyone makes mistakes in picking stocks, but the only thing that’s unforgivable in newsletter world is failing to sell yourself hard enough.

I have a BOA account and have not been notified. I guess I should be worried but I’m not.

PANIC!!! 🙂

Thanks, as always, for this thoughtful, thorough, helpful analysis.

I’ve been a customer of BOA for 10 years now and they have never sent me any type of warning about money in my accounts. Scare tactics.

Exactly. Thanks for the confirmation, Gary.

The top 5 AI stocks that will make us all billionaires is really getting old. I don’t even care what they are anymore. I remember when it used to be the top 3 AI stocks. Why is this even published. Show me the money or show me the stocks or just hit delete.

Explosive investor interest,

But very few “pure plays” and nowhere near enough stocks to sustain it outside of the biggies that everyone knows (NVDA, GOOG, MSFT, META, AMZN, etc)

Which probably means there’s more to come, as the avalanche of venture funding over the past decade leads to some IPOs that keep the excitement level high. That’s what happened in 1999, we’ll see if history rhymes… and as we know, of course, buying into that frenzy only worked if you picked the best few stocks AND were super patient as they fell 70% and took years to recover.

Ignoring the Economic and Dollar Value Issues temporarily to focus ONLY on FedCoin…

First the reality is that Crypto currencies are based on nothing, but the hype has created a genuine challenge for global fiat or fiat “light” currencies. Because of this many nations have started rolling out digital money to begin to shut down the Crypto bus. For the US to maintain its reserve currency status, whether the Fed wants it or not it is being forced into the digital currency market.

That is a short summary of the current situation. This is also why the hype is ridiculous. However, it does not foreclose the reality of governments, even the US Government, are obsessed with controlling their populations and this could be abused in the future. In spite of the likelihood or possibility of abuse it isn’t really an option for the US to enter the digital currency market. If it does not, the very nature of digital currency makes bi-lateral and multi-lateral direct exchanges simpler and more possible than ever. As a result, for the US to even retain a strong hand as the global medium of exchange there is no other option. Without entering the digital currency space every other country in the world who have rolled out, or are in the process of rolling out, digital currencies will simply eliminate the US dollar as an intermediary. The status is not at serious risk yet, but could easily be there within 5 years.

That is the background on the FedCoin issue and US digital currency. If past is prologue to the future, will it be abused by the Federal government? YES! But is that the reason for the FedCoin? No! It is just an eventual outcome from power crazed politicians and government bureaucrats.

Well put!

This posting depressed me. It is disheartening to think that some people will fall for this ridiculous prediction whose arrival date keeps getting pushed further into the future when SURPRISE, it does not materialize. It’s disheartening that some people still pay for these expensive, non-credible tip sheets that are not going to make subscribers rich. It is also disheartening that the very sagacious Travis J. feels it necessary to again write extensively to downgrade the latest iteration of the Fed-coin. (Suggestion to TJ: in the future, simply provide a link to this excellent analysis, and then use the time saved to go have some fun.) To share my disdain for the idea of a sudden shift to a digital currency via a total dollar recall, let share my version of the conclusions that would be reached at a possible secret meeting of the Board of Governors of the Federal Reserve System that was convened to consider this unprecedented money shift. “We are agreed on the following: there is no compelling reason to go all-digital; there is insufficient data to think it would be successful in curing whatever it is supposed to cure; Congress will go ballistic at being bypassed and will legislate a diminution of the Fed’s powers; the idea is probably illegal, and maybe unconstitutional, so we will be tied up in litigation for many years; we will encounter enormous political and practical problems in dealing with the trillions of dollars held abroad by governments and private citizens; and last but not least, we don’t know how we can gobble up in one fell swoop the entire M-2 money supply of $20.7 trillion. So this awful idea is dead and buried (unless we are ordered to implement it by a second Trump administration).”

Thanks for taking the time to dissect this stupid, and frankly fraudulent, pitch about the the world coming to the end (oh yeah, you were only talking about a slightly less likely possibility, but they are both about equally likely). I’ve spent the last 6 months trying, fruitlessly, to get unsubscribed from every “newsletter” that touts this coming to the end of the world bulls#@t. They seem to unsubscribe e, but then they resubscribe me a short time later.

One more thought. Other commenters have talked about the possibility of the Fed issuing a digital dollar and the possibility of losing personal confidentiality. My thoughts on this are that most of us use credit cards and rarely use cash. Our spending habits are already available in the electronic world. Unless you need privacy for illegal transactions, the Fed replacing paper money with digital should be a concern.

Thanks for the detailed explanation! Even after this, I’m still interested in getting a hold of TT’s most recent crypto reports. Does anyone know I can get those aside from subscribing to their newsletters?

Anyone have access to Messari’s Crypto Theses for 2024?

I’m following, thanks.