This article was originally sent out as a bonus note for the Irregulars on Friday, February 2… but people are still asking about it two weeks later, so we’re now releasing it for anyone to read. What follows has not been updated since it was originally published.

Altucher is pitching his Paradigm Mastermind Group ($5,000/year), which is basically just an AI-focused publication that’s combining the work of the three Paradigm editors, Altucher, Ray Blanco and James Rickards. All of whom have apparently become leading AI experts in the last year.

But this spiel from Altucher is all about the latest product launch from Apple, their Vision Pro augmented reality headset… and about a tiny supplier. Here’s the summary that a reader sent last night…

“In case you missed it, James Altucher spent close to two hours in a video this evening hyping Apple’s biggest new product launch since the iPhone.

“With good reasoning, he believes this will do to META and other mixed reality headsets (AR/VR) what the iPhone did to the Blackberry.

“But, he’s not recommending Apple; he’s recommending what he calls a $2.00 supplier with 200 patents on a required display technology (light weight, spherical plastic lens) which is apparently an essential component of Apples big new launch, Vision Pro.

“Altucher says this tiny company is already a supplier to Google, 3M, Garmin, Lockheed Martin, General Dynamics and others. He’s betting that with the launch of Vision Pro the stock will soar10x near future, and 100x over time; that the stock will either increase in price very quickly or that Apple will buy them out, either way at huge gains to investors.

“Of course, he is revealing this to a limited number of people at a huge price through a subscription to a new service, Paradigm Mastermind Group and its free newsletter, My Second Apple Prediction.

“Apparently Apple’s Tim Cook will make the announcement of the launch tomorrow morning (Feb 2) at 10.00 AM (Eastern ?).

“Any idea what company he’s talking about?”

And yesterday, I got some similar questions:

“i assume you are already on top of what James Altucher is pushing on his $2 stock the owns all the patents that Apple is ready to jump on & buy for $1-3B once they release their Vision Pro system Friday morning, so are you going to come out with your report to beat Jamnes to the punch?

“Btw, my wealthy friend who used to follow you religiously just told me he tried out a prototype VP about year ago & owns Zuck’s Oculus & agreed with James that there is no comparison between the e goggles, so the $64 thou or billion question is what is that $2 stock James is promoting for $2497 as of tonight!?”

And yes, it’s true that the Apple Vision Pro did go on sale today, and there was sort of an “event” as the sales started, with Apple CEO Tim Cook in New York and making the media rounds to show off the new gadget, though most of the details about the Vision Pro, short of a real teardown, have been available for months.

Altucher is essentially arguing that there’s a component supplier for the Vision Pro that either is supplying parts for the headset or owns patents on the technology the headset needs, and that this supplier will boom in value as the Vision Pro sales take off… or maybe get acquired, if Apple turns out to really need the technology.

That reader’s description above, about the plastic lens and display technology, and the hint about “200 patents” and the $2 share price, mean that this is almost certainly a tease of one of the two perennial “smart glasses” and “augmented reality display” hopefuls Vuzix (VUZI) or Kopin (KOPN). Both have been teased for years as potential linchpin technology owners in virtual and augmented reality hardware, going all the way back to the days of the original Google Glass failure.

Over the past three years, VUZI has been more consistently teased by a few of the technology-focused newsletter pitchmen as the “iPhone killer” — I got awfully tired of re-hiking that same trail, so I last posted a similar article about a Michael Robinson tease of Vuzix, which had a similar theme, about a year ago, but the pitch has been pretty constant since 2021 (partly because this Vision Pro project has been hinted at and leaked by Apple for a couple years, before becoming “real” last year and actually getting sold starting now).

Here’s what I said in the Quick Take from that year-ago article:

Vuzix (VUZI), which makes smart glasses and is sometimes rumored to be selling components for larger “smart glasses” projects from Apple or Google, is the match for this tease about an “iPhone Killer” that Robinson says will be announced on January 25. And yes, it’s a repeat of ads that Lou Basenese ran over the past couple years before he turned over his newsletters to Michael Robinson a few months ago, predicting the same ‘iPhone Killer’ event off and on since mid-2021. Apple is developing a smart glasses AR/VR product, and they’re getting close, but the tech journalists don’t expect to see anything real until later this year, and we have no indication that Vuzix is at all involved with Apple as a supplier or partner (all things are possible, and Apple rarely talks about suppliers, but there would probably at least be rumors). I don’t think the odds are very good that Apple will be working with Vuzix, or that Vuzix will otherwise make any explosive progress as a small hardware company, it’s tough to break into the market against such gigantic and well-funded leaders, but there is a little dollop of hope in VUZI’s recent attempts (so far nothing big) to sell parts to other OEM headset manufacturers. It’s possible that Google or Apple could buy more control of the category by purchasing VUZI and controlling its patents or designs. The fact that they haven’t, and that VUZI has been selling smart glasses mostly for industrial applications for years, with limited success, is an indicator for me that the big guys don’t see VUZI as a threat or an innovator or an owner of patents that will slow the development of either tech giant’s progress. I do know a lot of folks are VUZI fans, and it certainly might work out, the stock has had surges in the past because they’ve gotten attention as the only real “smart glasses” pure play stock, and they’re very small, so the stock sometimes reacts quickly to extra attention, but I remain very skeptical.

The latest word from VUZI has not been much more encouraging, frankly, though I guess there’s still hope. They preannounced their fourth quarter numbers in mid-January, and that the bump up in engineering work they did for AR projects earlier in 2023 had died down, at least for the moment, but that their sales of their own smart glasses had risen in the fourth quarter… but the total impact was pretty dismal, with fourth quarter revenue down to $2.1 million (their lowest sales quarter since 2020), and with an announcement that they’re streamlining the business by focusing on their OEM projects and the most popular smart glasses products they sell (mostly into healthcare and manufacturing working environments), which will mean reductions across all major areas of their business to reduce cash losses.

Perhaps this doesn’t need to be said, but a company that’s about to get windfall orders from Apple isn’t very likely to implement major cost-cutting initiatives and streamline operations to slow their cash burn. Nor does it seem likely that they would see a major decline in engineering services work in the quarter before Apple’s product goes on sale.

It’s true that Apple is very secretive about suppliers, and it’s possible that maybe they are using Vuzix’ waveguides lenses and optical micro displays in the Vision Pro, or are infringing on Vuzix patents and will end up having to buy the company or license the tech. But I have to say, it doesn’t seem probable. Apple has been working on this Vision Pro headset for years, and just their R&D budget would have allowed them to buy Vuzix 1,000 times over if they believed it was critical to their product or their technology.

"reveal" emails? If not,

just click here...

Never say never, but I don’t think I’ve ever felt compelled to buy Vuzix, and that remains the case today. It is probably getting to be a better company, with some production capacity for components for augmented reality glasses and similar display technology, and they do say they have a lot of OEM partners with whom they’re working on possible products, but it seems more likely that they’ll be focused on industrial and defense niches with those customers, for the most part, as they have been for their smart glasses products over the past few years, and nothing the company is doing today indicates that massive volume orders for components are on their way.

Will the Apple Vision Pro be a real “game changer” for augmented reality? No idea. The press coverage I’ve seen from the initial test users makes it sound interesting, and clearly a huge leap forward from the Oculus headsets by Meta, but this is also just the first iteration, and it’s heavy and inconvenient and very expensive, so I expect this is more of a test case for the technology, a toy for early adopters and enthusiasts… and we’ll see how it evolves to meet some real consumer wants and needs in the years to come. If anyone can turn this cumbersome technology that doesn’t really have a “killer app” into a “must have” consumer product, it’s Apple, but my guess is that will take a few years.

Vuzix won’t report their full fourth quarter numbers for about a month, most likely, but their third quarter investor presentation is here, and that press release pre-announcement about the weak fourth quarter and the cost cutting plan is here.

This has been a ‘story stock’ for its entire existence, and has been burning cash for 15 years. Here’s a little chart summing up the company, and reminding me that there’s not much point in chasing these kinds of early-stage stories unless you’re a nimble trader — that’s the share price in purple, it was around $6 nine years ago and did hit $30 for a moment during the meme stock mania of 2021, but is now around $1.70… and the cash flow from operations, which has been negative every year but has tended to get worse over time, not better (other than a little improvement in 2020)… and perhaps the most important measure for perennial R&D startups, the share count, which has gone from about 15 million in 2015 to well over 60 million today. The good thing is that they raised money while the shares were surging in 2021, so that gave them a bit of a cushion, but the cushion is wearing thin — they were down to about $38 million in cash last quarter, and have been burning about $10 million per quarter, so you can see why they need to cut costs and “streamline” this year.

Is it possible that Vuxiz will finally have its day in the sun, and become a real operating business that can generate cash instead of consuming it? Sure, lots of things are possible I haven’t seen anything in the last ten years that makes me think it’s likely, and it also doesn’t seem likely that they’re working with Apple at all… but I certainly can’t prove a negative. I’ll just continue to not invest in VUZI.

Kopin (KOPN) is somewhat more appealing than Vuzi, but that’s mostly because this company has built itself a pretty nice position as a supplier of high-tech displays for the military over the years, including a key position in the F-35 pilot’s helmet as well as some weapons sights and similar stuff. One reason they’ve survived this long, I would guess, and have a chance to eventually become profitable, is that they’ve mostly eschewed the consumer market, where high volumes are critical for suppliers, and focused on the defense business.

As with Vuzix, I don’t see any sign that Kopin is on the verge of getting big Apple orders, and it’s unlikely that they’re supplying components for the Vision Pro… but, again, we can’t really prove a negative — now that the first sales are happening, we should see some hardware teardowns of the Vision Pro pretty soon, so that might reveal who is supplying many of the key components… but, again, it’s not necessarily going to be a high-volume device with millions of units sold, so it might not be a huge boon for any suppliers. Kopin has been teased a number of times as a play on virtual/augmented reality, starting back in 2016, but the most recent article I wrote about it was back in 2022, updated in early 2023, and that was (more appropriately) a pitch from a military-focused newsletter… here’s what I wrote at the time:

This is a pitch about secret government research and funding leading to the development of “retinal matrix” tech, with one company owning tons of patents and supplying key tech to AR helmets for fighter pilots and next-generation weapons sights, and turning that into leadership in the “metaverse” as augmented reality goes mainstream. That’s a pitch for Kopin (KOPN), which has been similarly teased as a VR/AR leader in the past, though they remain a small R&D focused company, with roughly half of their revenue from defense contracts, and they have never built to sustainable profitability in thirty years as a public company — it’s always hard, and a little dangerous, to trust in a public company that has been around for decades but still has to sell stock every couple years to make payroll, and remains extremely small (KOPN’s market cap is about $100 million at this point). Maybe this time will be different, and the stock has had good runs in the past as the story has gotten attention (Google Glass in 2013, Virtual Reality in 2016, the Metaverse in early 2021), but it hasn’t ever really turned into sustainable revenue growth or profits, so it might require nimble timing to ride whatever the next wave might be and jump off at the right time… or serious patience to wait out the rise of AR, maybe following the next Apple device, and hope that Kopin catches some of that rise and turns into a sustainable business someday. They raised some more cash in January at low prices, and also reported a very weak fourth quarter as their new CEO tries to get the company turned around and focused on profitability, so it looks like they’re trying to do the right things but aren’t likely to see a surge of growth anytime soon. I’ll pass, personally, I’m a little jaded after seeing this story fail to turn into profits after so many years, but I do expect the Kopin story, like the Vuzix story, to keep coming around whenever there are a lot of AR or metaverse headlines.

Things are a little better than that for Kopin now, the stock was down around $1-1.50 back then, as they were selling yet more shares, and the cash burn slowed a little in the past few quarters, so it has gotten off the mat a bit but is not exactly booming right now — they do have some orders, but they’re kind of “between orders” at the moment for big stuff, so their last quarter was a little weak and we probably won’t get more detail on the end of 2023 until mid-March.

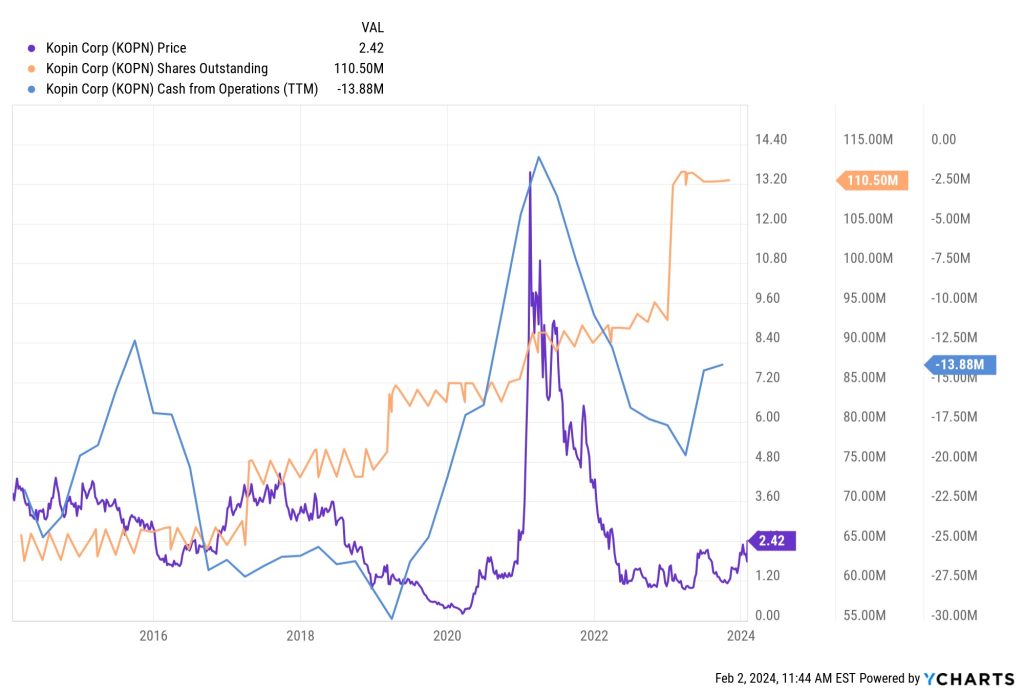

And they don’t burn as much cash as Vuzix, but they are still losing money. Here’s a chart of those same metrics for Kopin over the past decade or so — you can see that the dynamics have been awfully similar, including that surge of attention in 2021 (though KOPN didn’t raise funds as aggressively during that meme-stock surge), and that the overall performance has been a little less bad… but they’ve still been selling shares to keep the lights on for years, and have consistently burned cash each year for a very long time:

Given the surge in Kopin’s share price this morning, with no real news, I imagine that’s probably the stock Altucher actually talked up in his special presentation. I’d prefer Kopin over Vuzix, I suppose, given the likelihood that their growing military business will be fairly steady and might grow enough to give them a chance at profitability, while Vuzix is in somewhat worse shape on the balance sheet… but that’s like saying I’d rather jump off a ten foot wall than a 20-foot wall, I’m pretty happy not being forced to do either. If Kopin is going to become a fantastic and profitable company someday, the signs are not obvious just yet… you’ve probably got time to think it over, and there’s not likely to be any Apple-specific news that supports this 30% jump this morning, a jump that was presumably caused by Altucher’s pitch. When tiny stocks soar because of full-throated hype from a newsletter about an urgent announcement, and that announcement doesn’t actually have a financial impact on the company being teased, the share price usually comes right back down. We’ll see if history rhymes again this time.

Disagree? Agree? See signs of hope that I’m not aware of? Think Altucher has ginned up some different little AR supplier company instead, and that he’s not teasing Vuzix or Kopin? Feel free to let us know with a comment below. Thanks for reading!

Thank You Travis. I have been researching for 2 days and I think you came up the best guess, KOPN.

It can’t hurt to buy some just in case.

It is KOPN..

Thank you, TRAVIS!!!

What about Unity? symbol U. I read in a new flash that they were Apple’s missing software link

I own Unity, which has been a trainwreck of a company over the past 18 months and is probably a long way from a turnaround, despite the continued popularity of their platform for content creation. They were one of the first video/game engines to support the Vision Pro, and that may matter at some point in the future, but it’s not likely to make any difference to Unity over the next couple years, there would need to be a huge amount of content production driven by Vision Pro for that to bleed through into any real revenue for Unity from that platform and it’s unlikely that there will be enough users in the near term that the production activity will be dramatic. That’s my thinking, anywa.

It is KOPN…buy upto $2.25. Was at $1.83 Thursday and up 38% today — $2.53

I’d be really surprised if we don’t see the price back down around $2 within a week or two, as attention fades… but we’ll see. Maybe the teasing and promotion will continue.

He just raised the buy upto $2.50

🙂

“This is a LONG TERM buy and hold position, and patience is key. As with most companies this size, any of the capital you put into this position should be considered a “lotto ticket” and can move fast in both directions from day to day.

Never put more money into a speculation like this than you can afford to lose.

And make sure you use a strict limit order.

Don’t worry if you don’t immediately get in, keep your limit order open and your order will likely be filled.”

Might have to be VERY long term… this is the 30-year chart for Kopin, which got briefly popular during the dot-com mania (I believe they were making viewfinders for camcorders at that time, but I might be misremembering), and again during the 2021 goofiness, but has only had a few profitable years in its history, none of which were in the last decade:

KOPN data by YCharts

Maybe it works out this time, we’ll see — companies have emerged from darker and colder ashes in the past, I’m sure, I just don’t like counting on companies that have burned money for decades and never really found a way to scale up to profitability. I’ll keep my fingers crossed they’ve found their path.

I’ve been watching quite a few of these low floaters and notice the price fluculations can be wide within seconds

Wow so much for spell check!

Lol!

Unity (U) is actually a Ray Blanco buy upto $40 recommendation under the umbrella of the others.

Based on price movements today it most likely KOPN is the stock

It is….I get their recommendations.

James Alt…. Tried to sell his guesses a few years ago. I only lost money on every single recommendation.

This time around he is just picking obvious plays that will also be losers!

Stay away!

I agree; Altucher has consistently been a vulgar little shill for Paradigm. Rickards should send him packing. I remember Altucher proclaiming riches to be had on Hertz several years ago-shortly before the company went into Chapter 11! LOL. Stay far away from this clown.

Laughing, laughing,

His cryto picks have done extremely well…5+ are up over 500% in the last year.

True – I made about 15x on his Solana recommendation in ’21. Had a few losers on his stock picks though.

I’m skeptical of a guy that looks in a mirror and doesn’t realize he needs a haircut.

I believe Microvision MVIS is a better match. It is closer to the $500 M market cap. It has business with all the organizations he mentioned such as 3M, Google, General Dynamics, Lockheed Martin

Hi Travis,

Thank you as always for the great analysis, I ‘ve seen a ad many months ago but can’t recall about a similar story but for a Canadian company, do you have any take away about Nextech 3D AI (NTAR)is the ticker name?.

Thank you

Never heard of that one, but the chart and market cap indicate it’s probably promoted penny stock junk.

Thank you I appreciate it.

Here is a Quote from Bing- – The plastic lenses for the Apple Vision Pro are made by ZEISS, a renowned German manufacturer of optical products.

Could be I just don’t know enough, but it seems reasonable that Apple would rather trust a more established company.

I’m sure they’re not

Dependent on Kopin or any other microcap supplier.

From what I’ve read and followed over the past few weeks, I’m 90% sure Altucher was (and is) pitching Kopin (KOPN) as one of his picks for the Vision Pro, but also 99% sure that Kopin actually has nothing to do with this latest Apple product.

https://www.stockgumshoe.com/reviews/paradigm-mastermind-group/friday-bonus-altuchers-apple-market-disruption-event-today/

I heard an ad from him pop-up on my kids Instagram scroll… something about “AI 2.0” and the Magnificent 7 are not part of the AI 2.0 companies…wonder if Kopin (KOPN) and Vuzix (VUZI) are part of the #AI2.0 companies he was alluding too?

It felt worth stating that when Stephen Colbert in his monologue says something like “I’ve gotta have these” (Apple Vision Pro) it stands to reason the stock of whatever is attached would get a huge boost. However this wasn’t true when I looked at VUZI, KOPN, and Apple a minute ago.

This is referring to last night night, not the Feb 2 bump.

RAY BLANCO-STAKED HIS REPUTATION-(LOL) ON LAST TWO RECOMMENDATIONS-BOTH CRAP-NEED I SAY MORE

This is response to the Texas Ranger from his comment to Felden who considered KOPN to be the stock teased by Altucher;

Felden February 2, 2024 4:25 pm – Based on price movements today it most likely KOPN is the stock Kopin (KOPN)

2 – Reply by texasranger 279 February 2, 2024 5:36 pm – Reply to Felden

“It is….I get their recommendations.”

Hello;

I’ve been intrigued by your statement since reading it Friday in my research on the candidates. Would you please clarify the source of your mentioned recommendations, and whether you have evidence that KOPN is verified to be the candidate-stock that Altucher is charging $2500 to reveal?

Consider: the three stocks garnering the most attention are KOPN (Kopin), VUZI (Vuzix Corporation), and MVIS (MicroVision, Inc, of which Blackrock reportedly owns 114.7 M shares ($38M).

Yet a leading expert in MicroLED technology, in numerous recent articles (such as the one available at https://kguttag.com/2023/03/12/microleds-with-waveguides-ces-ar-vr-mr-2023-pt-7/) has this list of companies involved in MicroLED-related display research, only some entries of which I’ve determined to not be candidates:

MICLEDI MICRODISPLAY(S)

OSTENDO

INNOVATION SEMICONDUCTOR

POLYCHROME

MicroLED Pion

JBD (Jade Bird Display) (Apparently privately held)

Lumens LED (of Korea)

MojoVision (very small emitter)

Meta (Plessey, InfiniLED)

Snap (Compound Photonics)

Google (Raxium)

Apple (LuxVue)

Innovation Semi (drive in GaS)*

VueReal

MIT (Stacked pixel – recently announced)

Aledia (nanorod)

IpiPix (diodes)

LGD

BOE

Lumiode (TFT with Quantum Dots?)

NS Nanotech (nanorod) (Allied with McGill University, and probably privately held)

Raysolve (LEDs on backplane – no transfer)

Oppo

TCL

Dispelix

Waveoptics (acquired by Snap)

Playnitride (Stock price about $91)

Oorym

Lumus

Plessey

Compound Photonics

Atomistic

KGOnTech

Porotech (…has only one granted patent)

Applied Materials (Stock price about $186)

…and after listing those, the author states, “…more extensive list of companies involved in MicroLED development can be found at microled-info.com (https://www.microled-info.com/companies) – – Microled-info’s parent company, Metalgrass, also organized the MicroLED Association (https://www.microledassociation.com/).”

Other distractions found:

From: https://www.thelec.net/news/articleView.html?idxno=4172

Ghosh’s said eMagin’s technology will be more efficient than using white OLED with red, green and blue color filters __ a technology that is expected to be used on the microOLED on Apple’s mixed reality device launching next year. BUT, eMagin was purchased by Samsung.

From: https://en.wikipedia.org/wiki/Apple_Vision_Pro

Users see two 3660×3200 pixel[4] 1.41-inch (3.6 cm) micro-OLED displays with a total of 23 megapixels usually running at 90 FPS through the lens but can automatically adjust to 96 or 100 FPS based on the content being shown… the three priciest components in the Vision Pro are its camera and sensor array, its dual Apple silicon chips, and the twin 4K micro-OLED virtual reality displays.

Tear-down: https://www.ifixit.com/Device/Apple_Vision_Pro

Search terms that have been linked to the Apple Vision Pro, some of which may not be correctly attributed to the device, include “microOLED panels”; “microOLED panels”; “twin 4K micro-OLED virtual reality displays”; “3660×3200 pixel”; “Dual micro-OLED displays”; “92% DCI-P3”; “triangular corner”; “23,000,000 pixels”; Dual micro-OLED displays, 23 total megapixels, 92% DCI-P3, 100 Hz; Curved front-facing OLED display (such as by the person in this tear-down video, https://www.youtube.com/watch?v=JVJPAYwY8Us.

So, it would certainly be helpful if you could provide the conclusive evidence that KOPN is the stock to buy.

Thank you.

From what I’ve read and followed over the past few weeks, I’m 90% sure Altucher was (and is) pitching Kopin (KOPN) as one of his picks for the Vision Pro, but also 99% sure that Kopin actually has nothing to do with this latest Apple product.

Per Altucher:

Given all the positive news and the price action I’m seeing on Kopin Corporation (KOPN), I want to update our limit order so we can get in with the most optimal entry.

Remember, make sure you DO NOT use a market order for this trade.

Given how small the company is, the only way I recommend trading this name is by keeping a strict limit order at the price I provide. That way, you can be sure you’re getting in at a price where you can see the best returns.

Now, in the interest of keeping this email short so you can get your trade entered, I’ll get right to what we’re going to do.

Shares of KOPN look to be higher, trading around $2.40. So I’m updating our buy up to price to make sure you have a good shot at getting in at a respectable price.

Action to take: Buy shares of Kopin Corporation (KOPN) up to $2.50 per share.

Yes, it’s KOPN (I’m a subscriber to Altucher’s “Mastermind Group”). His reco was to buy up to $2.50.

With respect to Atlucher’s secret supplier to Apple, I suggest you research the company whose symbol GIST and report any findings.

Do you mean GSI Technologies (GSIT)? Wrote about them last month here: https://www.stockgumshoe.com/reviews/technology-opportunity/answers-kohls-nvidia-killer-could-make-you-120x-teaser/

That’s an old memory chipmaker that used to mostly sell to the govt, now trying to commercialize a design for AI processing chips. Not much financial progress so far, tiny company, no connection to any commercial products to speak of so far.

Oh man…I’m getting so tired of hearing the name Altucher. Am I the only one who thinks that the SEC should take a closer look at this guy? This ‘iconoclast’ ( to put it generously), reeks of a ‘pump and dump’ pro. I won’t be surprised to see his name on the ten most wanted list along with Mikula and Tiwari et al. Travis, let’s not give this guy too much of a runway.

While KOPN is likely the stock that Altuchee was pumping, the more-critical aspect of the AR/VR design problem is one of weight, power use, and heat output. The AR/VR helmet is, first snd foremost, a computer. Unless the user wants a cable tying the helmet to a box on a desktop, the device needs battery power, WiFi or Bluetooth connectivity, and considerable graphics power on board.

It just so happens that Advanced Micro Devices (AMD) launched a graphics processing unit (GPU), the V2718, that has amazing energy efficiency compared to the other members of AMD’s Ryzen line of CPUs and GPUs. Generative AI, the stuff that Altucher’s new service is reviewing, generates imagery and requires an output device, preferably with 3D capabilities, that the user can use to view the generated imagery.

What’s very curious about the V2718 is that AMD designed it, hired TSMC to build some of them on their Taiwan 7-nanometer line, and offered them for sale to buyers, but furnished a very limited amount of support to buyers. For example, if one writes code in C++ or C#, one needs a function library for the chip executing the code. AMD never published one for the V2718…a strong hint that the main buyer developed their own function library from scratch. There’s a better chance AAPL did that, than a cash-burning optics company who do no computer building. Even more intriguing: AMDs chief technology officer, who brought out the Zen series chipsets, is a transplant from Apple who reported to the late Steve Jobs a dozen years ago.

It would not shock me if Altucher’s first tease is a disappointment. Commodity optics priced cheap enough for Apple probably are not going to be much of a boom, particularly if there are Apple patents involved in the present or next version of their VR helmet and the best either possible optics supplier can hope to win with 200 existing patents, is cross-licensing. We could easily see a shoving match between Kupin and Vuzix over who supplies which parts of the optics system for Apple and Apple ends up buying them both at par value.

Meanwhile AMD suffers the prejudice from old-timers who remember them as a big deal in the 1990s who put emitter-coupled logic in their chipsets for Dell PCs, and by modifying the power supply to support emitter-coupled logic, a PC builder could get new life out of older foundry technology that made bigger transistors and used more silicon. AMD gave Intel quite a race for the Moore’s Law finishing line, but it’s been crossed. TSMCs move from 7 nanometers to 3 nanometers burned nearly a decade. Processor power is no longer doubling every 6 months. In the absence of news, many pundits think of AMD as a has-been and trumpet nVidia as the new star of the AI world. But if AMD bites off a chunk of Apple business inside those AR/VR helmets with a V2718 GPU that’s downright miserly on power consumption, what’s to stop them from tapping the broader AI market and putting those same chips into server boards for 4U enclosures and AI mainframe equipment? nVidia has had a nice run for several years supplying GPUs and video cards for desktop PCs and gaming machines. AI developers used nVidia GPUs because they were plentiful and well-documented. Heck, even cryptocurrency miners started using nVidia GPUs for the same reason. Will that abruptly change in AMD’s favor?

It might set up an interesting pairs trade between NVDA and AMD shares as they move in response to sales. Eventually they will reach parity as each company has unique features to offer the AI market. Initially the profitable move will likely be long AMD and short NVDA.

Meanwhile, I think Alticher’s newsletter is overpriced at $2700 and change.

Really interesting perspective, thanks for sharing!

There is a long history of Apple suppliers getting teased and promoted and soaring higher, so I imagine the newsletter salesmen will always find that theme attractive… but not so much room for excitement when you’re supplying low-volume products like the Vision Pro and Apple is presumably just as tough on suppliers as they’ve always been. Not as much investor magic in the Apple “teardowns” as there was 10-15 years ago.

AMD is a fascinating story, curious to see how it plays out.

Travis, I’m inclined to think that when Weiss and Paradigm both start trumpeting loudly about AI but know very little about it, we’re going to see a lot of pets.com fluff on the pump-and-fail, and then the hardware makers will start to cash in on enabling the transitional industry to develop. Ultimately the biggest issue was to make audio output standard on PC hardware in the 1990s, and that was what made videotext/multimedia a feature that distinguished the PC from the fax machine. (Yes, Ben Bernanke once challenged people to show what a PC could do on the web, that a fax machine could not accomplish over phone lines). So the ignoramuses might catch a break from the FTC and SEC as AI transitions into a consumer product. I just don’t see the defense budget funding all the AI development it may need, because too many avenues must be explored. Hence, regulators will back off, pump and dump scams will abound, and the market will charge a gullibility tax that never shows up on the DoD’s books.

Altucher still promoting the idea today in his early stage crypto investor group using subject line: The Apple Vision Pro just changed everything

Did it happen as he predicted? He said it did but I wonder?

KOPN did go up a bit, though I’d say that was because of Altucher, not because of Apple — looks to me like he told everybody it would rain while he was turning on the sprinklers.