Everyone’s climbing aboard the AI bandwagon — this latest teaser pitch is from Jim Pearce in ads for his Personal Finance ($39/first year, renews at ?), which has been around for decades, under several different editors, and tends to be a pretty conservative entry-level newsletter… and he’s talking up a “weird AI enabler” that pays big dividends and has given shareholders fantastic returns over the past 20 or so years.

So what’s the story? First we get the pitch about the power of AI, which probably most of you have heard several times… here’s a little excerpt:

“The AI program – ChatGPT – eclipsed the million-user milestone in a blistering 5-day stretch.

“… research firm Statista… estimates the AI market will explode to over $1.84 trillion in only a few years…

“McKinsey… pegs AI’s potential at $13 trillion…

“…billionaire tech veteran, Tej Kohli… believes everyone is shooting low…. And that AI’s financial impact could be as high as $150 trillion by the end of 2025…”

And some bait dangled in the form of nice, fat payouts…

“The massive AI megatrend…

“Is quickly becoming the greatest…

“Most controversial…

“And possibly most profitable opportunity of our lifetime.

“One that could allow you to stuff AI payouts of up to $854… $1,034… $3,226… and even $5,861…

“Into your pockets.

“Over and over again.”

So this is very much NOT a pitch that we should buy into NVIDIA or the hot AI startups, or even longtime AI players like Microsoft or Alphabet or Meta Platforms, his idea is couched as being much more conservative than that… here’s a bit more from Pearce…

“I’m utterly convinced AI has shed its skin as a “cool” technology you use to turn on the lights in your house…

“Or get directions to the new restaurant that just opened across town…

“And has become…

“The biggest profit opportunity since the invention of the internet….

“The problem with that from an investing standpoint is that we’re in the first inning of a long game…

“Which means there’s going to be a lot of companies that, just like the dotcom crash, simply won’t survive….

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“I’ve found a better way to cash in on the explosive AI superboom…

“One that doesn’t require you pick which companies are going to come out on top of the AI arms race…

“One that you can get the ball rolling with for around $100…

“And one that allows you to collect regular cash payouts of up to $5,397…”

See how he put those two numbers right next to each other? That’s not an accident… that’s a copywriter who knows that he’s giving us the impression that we can invest $100 and get $5,000 payouts, triggering a little subliminal greed impulse without quite making that a real promise.

Actually, the Investing Daily folks have gotten a little more honest in their marketing over the years — I like to think we had something to do with that here at Stock Gumshoe, so they’re now more specifically disclosing that of course the amount you make in dividends from these kinds of companies depends on how much you invest. As long as I give them a hard time for using marketing tricks to make us daydream about riches, I should give them a little credit for being a bit more obviously truthful these days.

And this newsletter is marketed mostly at folks who’ve never really thought much about investing, so they make it sound like they’ve opened up the investing world to everybody…

“Even though the big boys like Vanguard, Fidelity, and Blackrock hold millions of shares…

“The rock-solid AI income opportunity I’m about to lay out for you is available to EVERYONE.

“In fact, while the AI megatrend is still in its infancy…

“My research shows that…

“100% of the people who put their name on this company’s income distribution list were approved.

“It didn’t matter how old they were…

“Where they worked…

“If they had a few hundred bucks to invest…

“Or a few hundred thousand…

“Every single person who joined forces with the ‘weird AI enabler’ that I’m about to reveal to you…

Had the chance to collect money.”

So what does this company do? How is it connected to AI? We do finally get a few specific clues to feed to the Thinkolator…

“… it supports a market niche that’s experiencing what I can only describe as a modern-day gold rush…

“One that has grown by leaps and bounds over the past 20 years…

“And one in the midst of shifting into hyperdrive thanks to the rise – and mass adoption – of artificial intelligence.

“I’m talking about the foundation of AI – data.

“If there’s one thing I’m certain about…

“It’s the fact that we will never use less data.”

And other clues…

“It took me months of intensive research. And an untold sum of my company’s money.

“But I finally found it…

“The perfect AI business….

“the U.S. Federal Government insists it share 90% of profits with investors….”

That just means it’s almost certainly a real estate investment trust (REIT), which indeed must distribute at least 90% of its taxable earnings to shareholders to maintain its tax-free REIT status (the idea being, shareholders pay the taxes on their dividends… instead of the company paying taxes on their profits). In practice, most REITs pay out substantially more than what would be their taxable income, mostly because they can deduct for depreciation on their property, so the shareholders don’t pay tax on all of it (some of the dividend is often “return of capital,” which means part of the dividend is like a return of your money, not income, so it reduces your cost basis and you only pay taxes on the profit when you sell your shares).

But anyway, when a teaser ad says the company is required to pay out 90% of its income, or that the Feds require them to pay dividends, or they throw in a photo of President Eisenhower, it’s pretty much always a REIT (Eisenhower signed into law the REIT Act in 1960, as part of a bigger piece of legislation, though it took a long time for companies and investors to really begin to take advantage of that tax structure in a major way… and the sector changed quite a bit when the 1986 tax reforms freed REITs up to be more active managers of real property).

Other clues?

“… you can get started for around $100….”

OK, so you can buy partial shares of almost anything these days, brokers have come a long way, but that probably means the share price is in the $100 neighborhood.

So we’re being teased about a REIT that deals with data in some way, and that trades right around $100. That’s actually enough to narrow it down an make a good guess at the answer, partly because the number of REITs has shrunk dramatically over the years (many of the data center REITs have been taken private, or consolidated into larger REITs), but let’s double check the more specific clues he gives, too, just to be sure… more from Pearce…

“I’m so excited to share the details behind this weird “AI enabler” I’ve discovered…

“Because it hasn’t just sent payouts like clockwork.

“It’s increased the size of the payments too.

“21 times in the past 19 years.

“To the tune of 682%….

“Since 2004 this company has grown its share price from $12 to $94…

“That’s a 685% gain!

“And its enough to turn $500 into $3,925….”

OK, so that gets us a confirmation on the Thinkolator’s answer… this is Digital Realty (DLR), one of two very large REITs who primarily own data centers, the massive buildings that house the servers and drives and, yes, the AI processing chips that many of us now think of as being in “the cloud.” The cloud = thousands of large warehouse-looking buildings that are wired in to major data networks and consumer huge amounts of electricity to make data and processing power available for everyone, everywhere, all at once.

A lot of data centers are owned by major technology companies, like Alphabet and Meta Platforms, who build their own infrastructure… but some are also owned by pure-play developers and operators of these data centers, and the largest of those have often opted to operate as REITs to get some of the same tax benefits as other owners of commercial real estate. It’s been a nice high-growth area, partly because data consumption just keeps growing, and data storage needs just keep growing, and we all want everything faster and better, which means that owning facilities that are well-connected with all the major networks and have abundant power available is very profitable, particularly when construction of new data center facilities doesn’t increase competition too much.

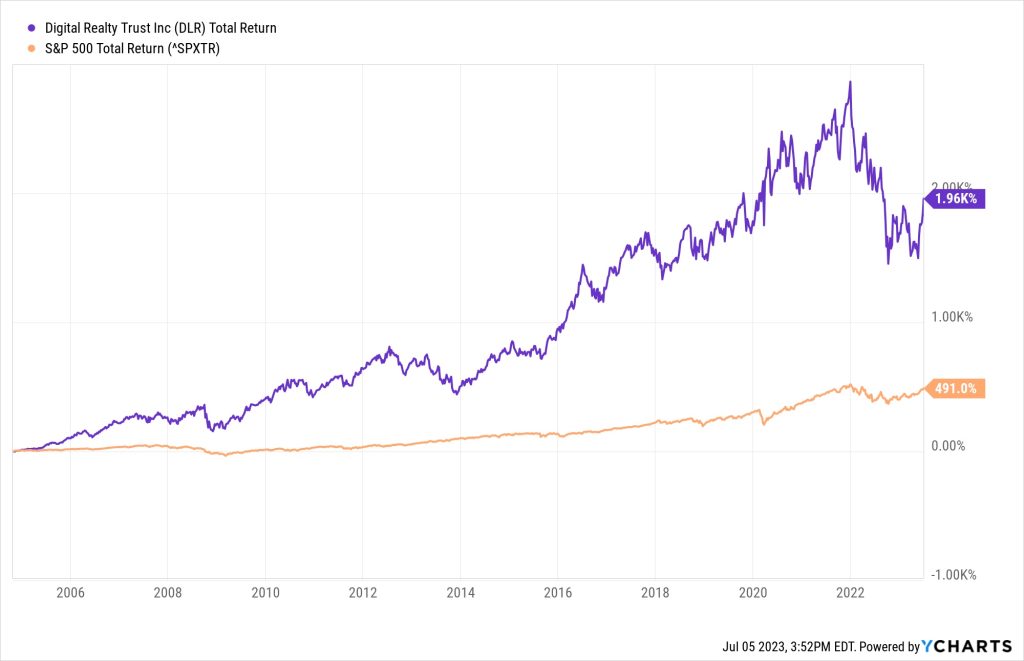

But yes, Digital Realty is the oldest surviving stand-alone data center REIT, and now the second-largest behind giant Equinix (EQIX), and it has indeed been public since 2004, when it had its IPO at $12 a share. They’ve issued tons of shares since then, which is typical of growth REITs, but have also grown both the top and bottom line of the company nicely since those early days… here’s what the total return (dividends plus share price) looks like in chart form — that’s DLR in purple, and the S&P 500 in orange:

Though we should note, of course, that you can make a chart tell pretty much any story you like — a lot of that growth came early on in DLR’s life as a public company, this is what the past five years look like, including the ugly reaction to both falling technology stocks and rising interest rates in 2022:

Digital Realty shares have recovered a little bit recently, so they’re no longer at $94, though the stock was in that general neighborhood for a couple months until everything heated up again in June. Today, DLR is a $33 billion company at $115 per share, and currently pays out a dividend of $1.22 per quarter, so that’s a dividend yield of about 4.25%.

The challenge, in recent years, is that the dividend growth for Digital Realty has slowed down quite a bit — it’s rising dividends that generally push up the share price, assuming that other interest rates are relatively stable, and DLR has not been boosting the dividend very quickly of late — the dividend was $1.01 per share five years ago, and is $1.22 today, so that’s dividend growth of a little under 4% per year. It’s better than nothing, but it’s not currently keeping up with inflation, and the dividend hasn’t been increased in the past six quarters. I think that’s the longest they’ve ever gone without a dividend increase, which has investors a little bit nervous.

And it means Pearce is being a little disingenuous in saying that the company “Just Boosted Its Dividend for the 21st Time in 19 Years” — that’s a fair representation of the history going back to the IPO, and they’ve sometimes increased the dividend more than once a year, but it doesn’t really tell the current story — the last dividend increase was in March of 2022, and they’ve now “boosted” the dividend four times in the last five years. Some short-focused analysts have been speculating that they might need to cut the dividend this year, which I’d say is not terribly likely in the near future but is certainly possible… their next dividend declaration isn’t expected until mid-August, for the payment which will be made in September, so there’s no urgency either way, you’ve got plenty of time to think it over.

Like most REITs, Digital Realty reports its “FFO” more prominently than other measures of profitability or cash flow — FFO stands for Funds From Operations, and is generally considered to represent the cash flow that the company has available to pay dividends — and on that front, the way they adjust their numbers, they think they’ve got plenty of cash to keep paying the dividend… they’ve told investors to expect “core FFO” of $6.70 in 2023, so that would mean the annual dividend right now consumes only about 73% of that adjusted FFO number, which sounds like a pretty sustainable number for a REIT… they just haven’t backed up that confidence with a dividend increase recently. Maybe it’s because some of the “nonrecurring” charges are left out of core FFO, or maybe they’re just being cautious because they are widely seen as having to manage their liquidity these days.

Note that when we talk about REIT’s being legally obligated to distribute 90% of their income to shareholders, that means real net income, not FFO or EBITDA or any adjusted numbers. As of last year, about 75% of the DLR dividend counted as some kind of taxable income, either regular income or capital gains — so if the REIT rule that they must pay out 90% of their taxable income provides you some confidence, that would mean that DLR was probably only legally required to pay a dividend of about $3.30 in 2022 (they paid $4.88). All of those numbers change quite a bit year to year, especially when the company is selling assets (like DLR has been), so 2023 might well be much different than that.

As Pearce pretty fairly implies, this is not likely to be a nosebleed growth story — Digital Realty won’t “win” the AI race, but if Artificial Intelligence leads to substantially more investment in data center space, in part so that more of those high-end NVIDIA chips can be put to work “thinking” for us, then perhaps that will increase demand for racks and interconnections and power in Digital Realty’s big data center campuses around the world… hopefully faster than new capacity is being built. So far they just list AI as one of the “high potential” growth areas, and talk positively about AI bringing some more “additive demand” to their market, but it’s not like flipping the switch for ChatGPT really had an immediate impact on the income statement for Digital Realty or the other big data center owners. This AI boom is likely to help them, but it won’t necessarily be fast or revolutionary for DLR.

And they are currently raising prices, they say that last quarter they were able to raise prices on renewals at something in the 5-6% range, so there is some growth potential, even if that means their prices aren’t necessarily keeping up with inflation (many of their contracts run 3-5 years, so that might mean they’re getting a 5% price increase over several years, not annually). You can check out their June investor presentation if you’d like to get their optimistic take, or read the transcript from their last earnings call to get an understanding of what analysts have been worried about on the financing front… and to what extent management sounds excited about the potential demand from AI or other growth drivers.

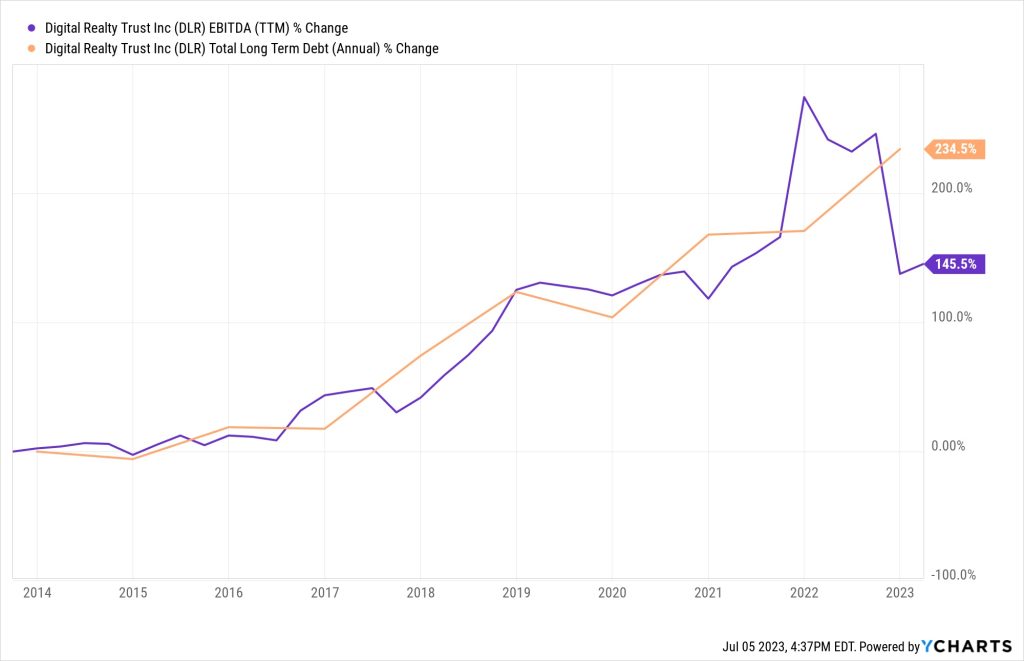

The challenge for a lot of these technology REITs is whether they can raise their prices fast enough, in a competitive market, to keep up with inflation and with the quickly rising cost of debt — big REITs like DLR tend to be pretty good at managing their debt maturities, but they have certainly grown their overall debt pretty dramatically, and we should expect that debt, which was a tailwind over the past decade as debt kept getting cheaper, to be a little more of a headwind in the future. Their reliance on debt has grown gradually over the years, so even though they don’t have a lot of unhedged floating rate debt, and their interest charges have not yet grown meaningfully, they will eventually have to deal with gradual refinancings at (probably) higher rates — their net debt is now 7.1X the size of their annual adjusted EBITDA, which is the way they measure their balance sheet, so they’re riding with more leverage today than they did five years ago, when it was 6.2X. That essentially just means it would take longer to repay the debt, if they ever have to do that. If you don’t use adjusted numbers, and just go with EBITDA and total debt, you can see that both numbers have climbed pretty substantially over the past decade… but debt is currently growing faster than that particular cash flow metric.

That doesn’t mean they’re doomed, it just means that the business gets tougher when interest rates are higher. They’ve got about $5 billion worth of debt that is scheduled to mature over the next three years, so investors will be paying attention as those maturities hit (and the following year is then a big lunker, with $4 billion of mortgage debt maturing in 2027), and I expect they will be able to refinance that debt… but it will probably cost them — their average cost of debt right now is only 2.8%, and I don’t think I’m drifting outside of consensus here in guessing that their refinancings in the next few years will probably cost them at least twice that much, even though the impact will be gradual. They also are continuing to sell shares, they’ve raised another billion or so by selling more stock just since the end of the first quarter, and they’re also selling off some “core” properties to focus on “growth” locations, as part of that effort to improve liquidity, so I guess they have plenty of options… it’s just that most of those options mean the cash flow per share will struggle to grow in the near term.

Thus, investors demand a higher dividend yield, and DLR has a harder time increasing the dividend at a reasonable rate, at the same time that it’s selling more shares.

Thus, the share price weakens.

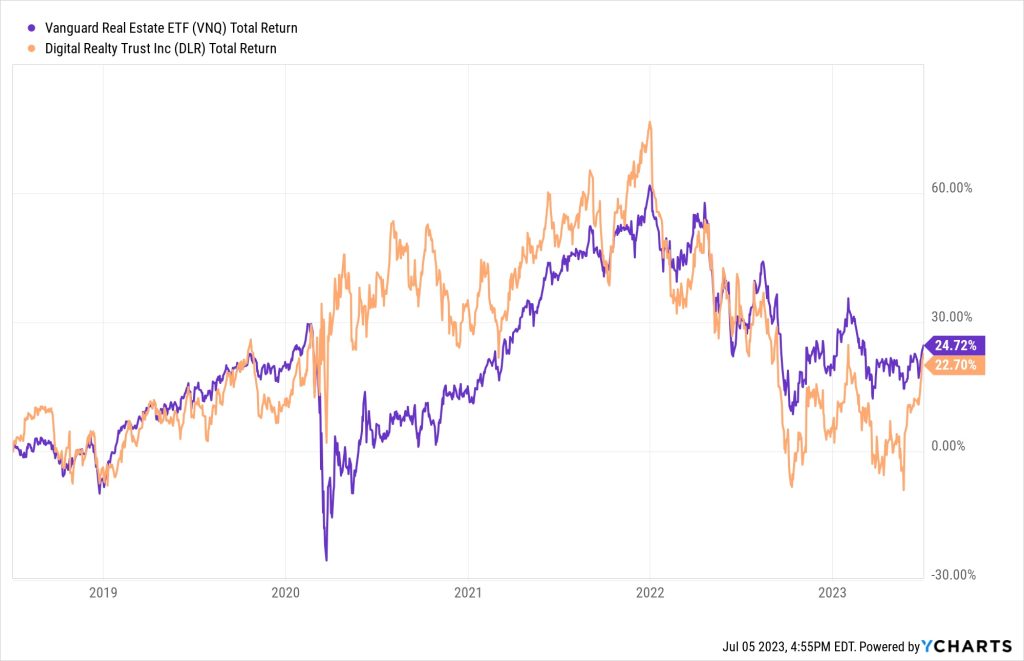

Maybe it has now fallen “enough,” I guess we’ll find out — this is a big company, with some valuable properties and a global footprint, so it’s not likely to collapse or disappear, but it is likely, unless there’s a real acceleration in demand for data center space that boosts the prices they can charge, to be a fairly slow grower with interest rates at these higher levels. It might work out to be a fine investment for some folks, particularly if interest rates do end up dropping back down in the next year or so, as many investors expect, and it looks a bit better today at $115 than it did at $175 during the last gasp of the manic market in late 2021, before inflation pulled the rug out from under tech stocks and income stocks… but it’s not obviously an easy “buy” to me if you’re getting a 4% yield and the dividend is growing only about 4% per year (and so far this year, not growing at all). That’s pretty close to being “average” in the REIT world — and over the past five years, even with the collapse in REITs during COVID and the current panic about office real estate, DLR has roughly the same total return as the broad REIT ETFs — this is the five-year total return for DLR compared to the Vanguard Real Estate ETF (VNQ)

Of course, DLR is also a meaningful component in any US REIT ETF — it’s not as huge as fellow data center REIT Equinix (EQIX) or the big cell tower REITs, but it’s still the ninth or tenth biggest REIT in the country, and it’s about 2% of most REIT index ETFs. And the ETFs adjust as prices rise and fall, of course, so there isn’t really a traditional “urban office towers” REIT in the top 25 holdings of VNQ any more, the office REITs have mostly shrunk into irrelevancy now, and the top 10 largest REITs are in businesses like logistics warehouses, cell towers, self-storage, shopping centers and fast food restaurants, senior living and medical offices, high-end shopping malls, and casinos, with the REITs who own apartments and single family homes starting to climb up but not yet in the top ten.

REITs have changed quite a bit over the past decade, but the lure for investors is still high current dividends and good dividend growth, and DLR is too close to “average” in both of those metrics to really grab my attention. I don’t think the cell tower REITs are in great condition either, frankly, given the contractual limits on their rent increases and their own rising debt costs, but among the big “technology infrastructure” REITs I do think the towers own more irreplaceable assets, and I would have an easier time buying either American Tower (AMT) or Crown Castle (CCI) over Digital Realty (DLR) today, though I don’t think we’re currently at a compelling buy level for any of the big REITs.

Your mileage may vary, of course, and many people are far more optimistic than I am about DLR and the other “technology REITs” at this level — these are companies who own important assets, they just can’t grow their earnings very much at the moment, so, the way I see it, their future is more dependent on what happens to interest rates in the next couple years than on their own plans and strategies, which makes me cautious (I own AMT, but have sold more than I’ve bought in this general area over the past year). Your thinking is what matters when it comes to your money, though, so please do let us know what you think with a comment below.

P.S. I do always like to point a little math at the “payout” numbers cited in the most promotional parts of these ads… so the number that comes up a few times in the ad is “AI payouts up to $5,397” from this “weird AI enabler” — if we charitably assume that he means $5,397 annually, then at $4.88 per share in annual dividends per share you’d need to own 1,106 shares to earn $5,397 in annual income from DLR at the current rate. At today’s price of about $115 per share, that would require an initial investment of about $127,000. The lowest number he cites as an example for these “AI Payouts” is $854, and to earn $854 in annual dividend income from Digital Realty right now you’d only need to buy 175 shares, so that would cost you a mere $20,000 or so. Of course, putting $20,000 into a one-year T-Bill right now will earn you about $1,080 in “payouts” — and you know you’ll get exactly your 20,000 back at the end, so there’s no risk of loss like there could be of DLR shares falling, or potential gain from DLR shares rising over the coming year… and you also know that your T-Bill payout is not going to increase during the year, as Digital Realty’s might.

Disclosure: Of the companies mentioned above, I own shares of American Tower and Brookfield Asset Management. I will not trade in any covered stock for at least three days, per Stock Gumshoe’s trading rules.

Anytime I see “payouts” I immediately think REITS and I’m not buying REITS these days, especially at $114/share.

Travis, thank you for sharing your analysis. I heard Jim Chanos express his view which echoes some of your points.

Yes, I found his argument pretty compelling — he’s been short the data center REITs and similar businesses since last year, and I don’t know whether he’ll end up being right. They did a good Business Breakdowns podcast episode with him a few months ago that summarizes his short thesis on data center REITs (and commercial real estate in general). He’s worth listening to, if only because he’s one of the few to have thrived for decades as primarily a short seller.

In a report released yesterday, Brendan Lynch from Barclays maintained a Sell rating on Digital Realty (DLR – Research Report), with a price target of $80.00. The company’s shares closed yesterday at $114.49. https://www.tipranks.com/news/blurbs/barclays-remains-a-sell-on-digital-realty-dlr

Off-topic, but did anyone else read this as “Weird Al” ie. Weird Al Yankovic?

Has anyone heard about the under $3 stock associated with the FED COIN……for instant world wide banking transactions and replacing paper currency by the FED?

Who’s pitching that particular one? Lots of wild fearmongering pitches about FedCoin of late, mostly (misleadingly) tied to the FedNow launch later this month, but I don’t recall a “$3 stock” one

Andrew Zatlin….Moneyball Economics I can send you the link Travis