This is the email from Jim Pearce that caught my attention recently:

“Last year, at the annual Berkshire Hathaway shareholders meeting, Warren Buffett made a shocking statement:

‘If you offered me 1% of all the ███████ in America, I’ll write you a check for $25 billion this afternoon.’

“Good for him… but I don’t exactly have that much pocket change stuffed in my couch cushions… can normal investors who don’t have billions take advantage of this deep-pocketed advice?

“Short answer, Yes!”

That led into the tease…

“And if you’ve got 7 minutes, a brokerage account… and as little as $30 to invest, you could find yourself on the path to collecting $1,452 per month from the exact same Buffett-backed asset.”

So what the heck is he talking about?

Well, it’s an ad for Jim Pearce’s Personal Finance newsletter ($39 first year, renews at ?), which is one of the oldest newsletters in the investing world but has been through a ton of different editors over the years, and now serves as the “entry level” newsletter at Investing Daily (‘entry level’ just means ‘get ready to be hit with a lot of upsell offers for more expensive newsletters’). Given our history of covering Personal Finance teasers from Pearce, we can guess that his promises of large amounts of monthly income are (at least) a bit exaggerated for an average person… but let’s dig into the clues and see what he’s recommending. Here’s the headline:

“The #1 Income Investment For Uncertain Times

“Now, thanks to a little-known loophole — everyday investors can tap into this easy strategy of the mega-rich for $1,452 (or more) in reliable monthly cash”

Notice how that impacts your thinking? They didn’t lie, really, but they did leave out two words that would make the promise more realistic. Instead of “or more” they could just as easily have said “or less.” The wording implies that $1,452 is the minimum, which is obviously not a legal claim — but those are the little tweaks that influence us subconsciously when we’re exposed to advertising.

And the ad continues on that vein as they try to get you engrossed enough to read the details (the longer you read, the more committed to the idea you become, and therefore the more likely you are to pull out your credit card)…

“If you make one simple move today…

“Fresh monthly payouts could start flowing directly into your account…

“In as little as 30 days.

“Just how much income are we talking about?

“According to a recent data survey…

“James B. from Frankford, DE collects monthly payments to the tune of $1,225 with this investment asset…

“Jessica Z. from North Stonington, CT is averaging $2,154 per month in extra income…

“And Maurice S. from Riverside, IA is raking in a whopping $6,506 each month from this incredible strategy.

“For most folks, that kind of money would be life-changing.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“So it’s no wonder people from across the country are rushing to lock-in a special type of investment previously reserved for insiders and the ultra-wealthy…”

But what is the actual investment he’s touting? He implies that it’s far safer than all the stuff that got crushed in 2022, or the “blue chip” stocks that let investors down by cutting their dividends in recent years…

“… if you’re relying on your investments for income to provide life’s essentials…

“A slashed or suspended dividend is a real punch in the gut.

“And if you already earmarked that income to pay for prescriptions, medical bills, or groceries…

“Then dividend cuts and suspensions are out-and-out unacceptable.

“You need something more reliable…

“More assured…

“Something where it is LEGALLY REQUIRED that you get your money.

“Most regular investors don’t know where to go for that kind of assurance.”

So what to do? In Pearce’s words…

“An income strategy where companies are REQUIRED BY FEDERAL LAW to put 90% of the money they make right back into the hands of investors…

“Which after today could be YOU.”

Sound familiar? Yes, Pearce is almost certainly talking about Real Estate Investment Trusts (REITs), an asset class he has teased plenty of times before for income investors (like when he teased a data center REIT as providing “AI Payouts” a couple months ago).

And he drops some more clues to further cement that answer, though he calls them “Equalizers” instead of “REITs” — gotta make up a secretive name, otherwise people can do the research on their own and you won’t seem like the gatekeeper at the palace of income.

“… for too long, this kind of income stability was restricted to those at the very top of the food chain…

“Those who could afford to invest millions upfront to guarantee a lifetime of payouts later.

“Hardly fair, really.

“And so Congress stepped in.

“Now, as usual, their intervention was loaded with bureaucratic restrictions and pages of tax carve-outs guaranteed to confuse all but the savviest accountants.

“They created a new investment that aims to even the playing field by giving regular Americans access to the same income opportunities once reserved solely for use by the ultra-rich…

“But then they masked these new ‘Equalizer’ opportunities behind language that left most Americans completely in the dark about what had just happened.”

So yes, this is nothing new, but Congress did create the REIT structure, and it was signed into law by President Eisenhower 60+ years ago. It took them a while to catch on, and there have been regulatory changes over the years, but the model has also spread… there are about 200 listed REITs in the US now, plenty that are also “unlisted” private REITs, and something like 900 publicly-listed REITs globally.

This is what Pearce says about them…

“… Equalizer investments are full of income potential for those in the know.

“Because they come with a mandate to pay out at least 90% of their taxable income to investors.

“You see, there’s a little-known tax law that allows these Equalizers to pay ZERO corporate taxes…

“But in order to qualify…

“And trust me, with hundreds of millions or sometimes billions of dollars in the IRS’s crosshairs — they REALLY want to qualify…

“Federal Law requires 90% of what an Equalizer brings in to flow right back out again to everyday investors like YOU.”

So what kind of REIT is Pearce talking up today?

Farmland.

Real Estate Investment Trusts own properties, in order to qualify for this tax status you need to be primarily a real estate business — and that gets stretched sometimes, since digital assets like cell towers can be considered real estate, but REITs primarily own commercial, industrial or residential properties that are leased out to tenants, and then they pass through most of the net lease payments, after operating expenses, to their shareholders in the form of dividends. By law, they have to pass through 90% of their taxable income as dividends to keep their tax pass-through status (and then you pay taxes on that income, since the trust doesn’t — REIT dividends do not qualify for the discounted dividend tax rate), but in practice they typically pay out much more in dividends than they would otherwise make in taxable income (mostly just because depreciation counts as a huge expense for real estate companies, but does not reduce their cash flow).

So yes, there’s a legal requirement to pay out most of their taxable income as dividends… but most of them pay out much more than is required, which means the dividend can be cut and sometimes canceled, which typically happens when business gets worse (cost of borrowing rises too much, tenants default on their rent, vacancies rise, etc.). REITs are pretty reliable income investments over long periods of time, as an asset class, but individual REITs fall apart all the time, these dividends are not “legally required” in the same way that bond interest is “legally required,” they are much more variable and unpredictable, and if your business is in trouble you can cancel a dividend long before you default on your bond or loan payments and go bankrupt.

So Pearce is putting this pitch together not just by promising dividends and yields and the promise of “legally required” dividends in REITs, but also tying his idea to “rich people seeking safe income” by buying productive farmland, including a reference to the huge tracts of North Dakota farmland that Bill Gates had to fight in court to be able to buy a while back.

So that’s the basic idea here, buy shares of REITs that own farmland.

And that loosely fits with Buffett’s quote about farmland from last year’s Berkshire Hathaway Annual Meeting… though he was just making an example of how he figures out the price and value of an investment, not specifically saying that he’s offering to buy a bunch of farmland. It was more of a reaction to a question about Bitcoin and cryptocurrencies, making the point that he doesn’t like cryptocurrencies because he can’t value them, and that’s because they are not a productive asset. Here’s the quote:

“If you said … for a 1% interest in all the farmland in the United States, pay our group $25 billion, I’ll write you a check this afternoon… $25 billion, I now own 1% of the farmland… you offer me 1% of all the apartment houses in the country and you want another $25 billion, I’ll write you a check, it’s very simple.

“Now if you told me you own all of the Bitcoin in the world and you offered it to me for $25 I wouldn’t take it because what would I do with it? I’d have to sell it back to you one way or another. It isn’t going to do anything. The apartments are going to produce rent and the farms are going to produce food.”

But yes, buying farmland is widely regarded as one of the safest investments through generations, through thick and thin — it started to get a lot more attention when Barton Biggs published his Wealth, War & Wisdom in 2008, people really highlighted his findings from studying markets and wealth through the runup tp and aftermath of World War II, and particularly settled on this quote in the introduction, on page 4 (most people, after all, don’t make it very far through such books) — the line that we see repeated everywhere, whenever there’s any panic in the air, is in bold below:

“… what happened to wealth before and after the war, and what insurance steps should a wealthy individual take to protect his or her fortune from the Black Swan-like appearance of the apocalypse…. I found that equities generally did preserve wealth — over the course of the century, and particularly if you owned the right stocks in the right country. However, stocks (and bonds…) had substantially higher returns if their country of residence was on the winning side.

“Asset diversification helped. Real assets such as land, property, gold or a business were somewhat better than stocks but far from perfect. A working farm protected both your wealth and your life.“

So following that book, since it happened to come out during the Great Financial Crisis (he wrote the introduction in October of 2007, just as the wheels were coming off the bus), we saw lots and lots of newsletter folks talk about farmland as “the one asset that never loses value,” or words to that effect.

Which we certainly know isn’t true for every specific farm and every specific time period, in part because of all the debt that farmers often have to carry to get through a harvest, and the fact that harvests sometimes fail… but it’s widely reported to be true in the aggregate. Farms, in general, have been reliable long-term investments that hold their value, even if they rarely make anyone rich in the short term.

Here’s how Pearce puts it further down the ad…

“Imagine looking at everything that grows and knowing that each and every seed, leaf, bud, or berry could put money directly into your pocket…

“Up to $1,452 per month or more…

“In as little as 30 days…

“… my recent research combining U.S. Department of Agriculture data with annual farmland returns reported to the National Council of Real Estate Investment Fiduciaries (NCREIF)…

“Shows that owners of even the tiniest farms are raking in anywhere from $2,168 right up to $17,350+ per month.

“All from humble little patches of land — many of which are smaller than some Walmart stores.

“Which helps explain why, for decades, farmland has been hands-down one of the best places to put your money…

“IF you could afford it.

“So it should come as no shock that Warren Buffett — arguably the greatest investor of all time — has been buying up farmland since 1986.

“More recently, rich celebrities like Chris Pratt and even NFL stars Josh Allen and Joe Burrow are following Buffett’s lead by investing in farmland….

“Farmland even outperforms the stock market.

“Delivering an average annual return of 12.1% over the last 20 years, compared to the S&P 500 which averaged just 9.2% during the same time period.”

OK, so that’s pretty good. Most real estate funds have done a little less well than that, though they have often outperformed the S&P 500 over 10-20 year periods… particularly over the 40 years into 2022, when interest rates were generally falling (which tends to increase the perceived value of real estate, and of all yield-based income investments). Farmland hasn’t been a particularly liquid or investable asset for most folks during that time period, though, most people would have had to actually buy a farm on their own, which brings in all kinds of other risks (farmland has generally been a good investment and good store of wealth, but not every farm… just like most real estate has done well over time, but not everywhere… and the S&P 500 has provided a good long-term return averaging close to 10%, but many individual stocks have not done anywhere near that well)…

… so what’s Pearce recommending? Here’s how he describes the idea of farmland REITs…

“… even though farmland was where the money was…

“It was simply out of reach for most people.

“Until Equalizers came around, that is.

“Equalizers are all about making very large real estate investments financially accessible to regular people like you and me.

“And a farm certainly qualifies as a large real estate investment.

“A single acre of farmland goes for more than $3,800 these days… and many farms are several hundred to several thousand acres each.

“That means just to buy an average sized farm would cost you almost $1.7 MILLION.

“Which simply isn’t an option for most folks.

“But the beautiful thing about these Equalizers…

“Is just how well they level the playing field.”

And that’s how he gets to the “$1,452 per month” number…

“If you were to invest a mere 1/100th of the average farm investment registered on the NCREIF Farmland Property Index, into each of the 3 Equalizers I’m about to show you…

“You could stake your claim to enough high-profit farmland to generate consistent income of up to $1,452 per month….

“Just over 21,000 total shares of these 3 Equalizers could pay you as much as $1,452 per month…”

The NCREIF Farmland Property Index, by the way, is an index created by institutions who own large tracts of farmland — like big endowment funds, insurance companies, etc. — which means their average farm investment is probably pretty big, as you might have guessed by the “21,000 total shares” comment, obscuring what it might cost you to get that “consistent $1,452 per month.” But we’ll get to that in a minute.

So… what are those three “equalizers?” He starts teasing the specific investments next…

“Income Harvest Opportunity #1:

“Sweet Treats For Your Wallet

“Our first income opportunity comes from the expensive side of the grocery store… fruits, nuts, and berries.

“These crops — known as ‘permanent crops’ in the industry — are time and water intensive to produce, especially if they’re organic.

“Farmers spend time with them, nurturing groves and acres of berry bushes on rental arrangements that are a minimum of 5-to-10-year deals.”

And then…

“… the one I’ve singled out makes a point of delivering income each and every month.

“For 10 straight years, it’s delivered cash payouts every 30 days without exception.

“Even better? The company is committed to raising its payouts each year at a rate higher than inflation, ensuring that your cash goes just as far as you need it to go….

“Although the company’s core business model didn’t change, and it delivered earnings and revenue beats while boosting its payouts, Mr. Market absolutely took it to the cleaners.

“That means today…

“You can snap up shares at 50% off the all-time highs.”

Well, this stock wouldn’t be alone in that “50% off highs” status, similar things happened to almost all REITs over the past couple years, that’s what happens when your share price is determined largely by the dividend yield that investors will demand — if inflation and higher interest rates mean they will expect and demand a higher yield from their investment, and the company isn’t increasing its cash flow enough to pay that higher yield right away, then that means the per-share value of the investment has to fall. That’s the cruel math of investing in bonds or other income-focused investments in a rising yield environment. The rapid move from 0% short-term interest rates to 5% rates clobbered a lot of “income” investments.

This particular one, sez the Thinkolator, must be Gladstone Land (LAND), which just celebrated its tenth birthday as a public company and is the oldest of the (very small group of) publicly traded farmland REITs, externally managed by the Gladstone folks (who also manage Gladstone Capital (GLAD), Gladstone Investment (GAIN) and Gladstone Commercial (GOOD)). That REIT currently owns 169 farms around the country, mostly in California, along with some water rights in California which could be a hidden asset whose value gets realized dramatically some day, and they do indeed focus on “high value” crops, which have dramatically higher revenue per acre (like fresh vegetables, fruits, and “permanent” orchard crops), which also means the land itself is likely to be more valuable than commodity cropland (in part because orchards and vegetable farms are much more likely to be close to urban areas). They generally lease out their farms on a triple net basis (which means it’s just rent for land, they don’t provide other services or cover other costs — tenants cover insurance, taxes, and property maintenance). Their biggest concentration of property value is in California and Florida, but they have a meaningful presence in a dozen other states, too.

The company has made pretty steady progress, leasing revenue and cash flows and their AFFO (adjusted funds from operations) per share have generally climbed over time… but the growth has been slow of late, and over the last year their AFFO, which is basically their assessment of how much cash flow they have available to pay dividends, actually shrunk a little bit. Which means, as you’ve probably noticed, that they’re not coming anywhere close to keeping up with inflation — they have increased the cash distribution per share (basically like a dividend) every year since going public, but over the past five years the increases have ranged from 0.7% to 1.5%. This year’s increase was 1.2%. Their per-share payouts have not come close to keeping up with inflation since at least 2017.

So the business should be pretty steady, their lease terms are long and only 5-10% of their leases expire and have to be renewed each year, and they also don’t have any major debt due to be refinanced over the next five years, so there’s no obvious risk of upcoming stress… but they are having trouble rewarding shareholders at a high enough level to make this a particularly exciting investment, and that’s been true since their inception (other than a brief mania which drove their shares up in 2021 and into early 2022, before inflation and rising rates exacted their toll).

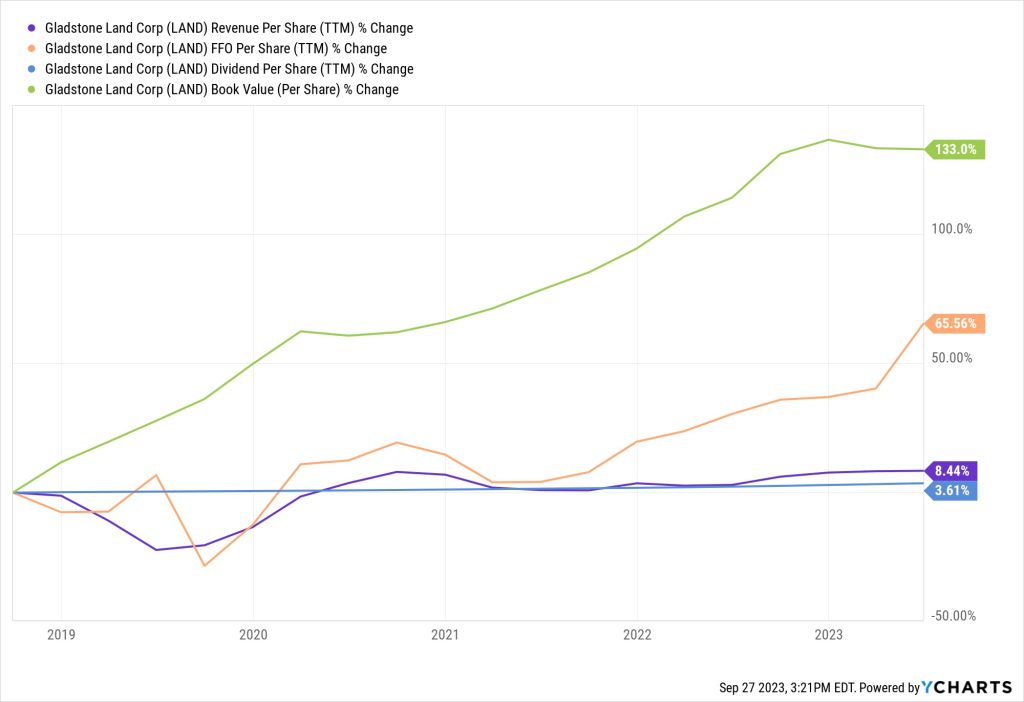

Here’s what the business looks like on a per-share basis over the past five years — that’s the funds from operations (FFO) per share in orange, which has gotten a boost recently, and that seems like a little bit of reason for optimism, but the real driver of returns for a REIT is the dividend yield, and the dividend has now grown 3.6% over five years (blue). Not every year, over FIVE years, fueled mostly by total revenue growth of 8.4% (purple). That’s not great, even though Gladstone Land has continued to report higher and higher book value per share most years (that’s the green number, as the assessed value of their land and water rights rises).

Today, Gladstone Land trades at about $14 per share, and they declare their dividends quarterly but actually pay them out monthly, so the 4.6 cent monthly dividend tallies up to about 55 cents per year. That number might rise a little in future quarters, and that gives them a current dividend yield of just under 4%. That’s back to where it has been most of the time, other than during the manic period in 2021-2022… and that means LAND is back to having an almost exactly average dividend yield, compared to other REITs (the average REIT, at least going by the Vanguard Real Estate ETF (VNQ), yields 3.8% today).

The good news? LAND is valued at a big discount to their assessment of the value of their farmland and their water rights, and it has been a stable dividend payer, the dividend wasn’t cut in 2020 like it was for many commercial and office REITs who lost tenants.

The bad news? It grows like, well, a tree — it takes them forever to yield anything, so during times when REITs are generally raising dividends and providing stronger compounding returns, it looks pretty weak. And that’s a challenge in this environment, because a 4% yield that doesn’t go up very much doesn’t look all that great compared to lending the government money, at (supposedly) no risk at all, and getting 4-5% returns per year.

So yes, it’s a way of owning farmland, and that should maintain its value over generations, and be pretty stable in terms of the rents they can charge and the income they can generate… but that doesn’t necessarily mean it’s a winning investment, it’s power might be more in providing stability and diversification to your dividend income or your portfolio value. Here’s what LAND has looked like, from an investor’s perspective, over the past ten years, dividends included (in purple), compared to the REIT index (VNQ, in blue) and the S&P 500 (orange)… stable, if we ignore the crazy anomaly of 18 months ago, but not so rewarding on an absolute basis.

Interesting factoid for you? LAND’s total return, as of today, has almost exactly kept up with inflation over the past ten years — back in 2013, it was trading at about $16.32, and if you adjust for the CPI inflation over that decade it would take you $21.45 to get the same purchasing power today as $16.32 provided in 2013. LAND is not at $21.45, not even close, but IF you add the current share price ($14) and all the dividends paid over the past ten years, you’d get a total of about $22 (the dividend has mostly been 50-55 cents/year over the past decade, but they also paid a huge dividend in their first year of $1.30, which skews that number a little).

So the dividend hasn’t come close to keeping up with inflation, but the total shareholder return has almost exactly tracked with inflation if you bought a decade ago. Maybe it will do better than that in the future if people assign more value to farmland, or want to get involved in this sector during the next era of financial turmoil, particularly because there aren’t many accessible public REITs that own farmland… but if you’re interested in this story I’d start out with very modest expectations.

And what’s that you say about “not many farmland REITs?” It’s true, it’s a tiny sub-sector of the markets… but let’s see who else Pearce teases…

“Income Harvest Opportunity #2:

“Staple Crops You Can Count On For Cash

“After indulging in the fancy foods that come with a fresh infusion of monthly cash, it’s time to get back to basics.

“Staple crops — corn, wheat, soybeans — are a food foundation all over the world. They’re always in demand, and farmers clamor for additional ground to grow more.

“That clamor for “more, more, more” has helped this Equalizer maintain a steady stock price even as our broader economy struggles.

“Stability like that is important… especially when you can get it ON TOP of consistent quarterly income payouts….

“In 2022 they posted RECORD annual revenues — the highest in company history — while increasing profits by a whopping 16.5% year-over-year…

“Profits that get paid out to investors like you.

“And with this Equalizer already reporting another incredible 54% jump in profits, it’s clear that the money train has continued into 2023….”

So this is when we confess that our job wasn’t too hard today… in the United States, there are really only two publicly traded farmland REITs… so, duh, this is the other one, Farmland Partners (FPI). They came public in 2014 and own 159,000 acres of farmland, mostly for row crops, across 20 states, and manage another 31,000 acres for other owners (they do own some higher-value specialized farms, like orchards, but that’s only 10% of the acreage and 30% of the value). They also paid a higher dividend when they came public close to a decade ago, and slashed the dividend a bit later, but since 2018 the dividend has been growing, albeit extremely slowly, and the current yield, with a 6-cent quarterly dividend and a $10.25 share price, is about 2.4%. Farmland Partners has made the total return of LAND look good — here’s how they compare since FPI’s 2014 IPO (yes, that’s FPI at the bottom, with a 9% total return over nine years — not 9% per year, 9% total, so that’s roughly 1% per year… including the dividend):

So again, this is the kind of investment that sounds good when you’re talking about generational wealth preservation, and maybe it will hold up during whatever the next crisis might be and provide some good diversification… but so far, in their relatively short history as public investments, the two current farmland REITs have been underwhelming.

I actually think Farmland Partners (FPI) makes a better case for itself in its investor presentations, I generally prefer when REITs are self-managed like FPI, instead of being run by an outside investor like the Gladstone REITs, and FPI has been more active at selling farmland during high-value times to try to recognize some of that value… but it’s still pretty tough to justify these investments given their track record to date.

Farms are consistent in generating income, over time, but even FPI says they’re aiming for only a 4% gross yield from their property acquisitions, which doesn’t leave much room for paying interest on corporate level debt and covering FPI’s overhead, particularly at a time when it’s easy to get a 4% gross yield from a savings account. It seems like you really need to count on farmland values rising substantially over long periods of time to get good earnings out of these companies… but we should also note that farmland has reportedly increased in value by an average of 5-10% per year over the past ten years, and neither FPI nor LAND has provided returns that high to their own shareholders.

But wait, there’s more! Even though there are only two real “pure play” farmland REITs available in the US markets, Jim Pearce teases a third investment… so what is it?

Timber. The slowest-moving crops of them all, but trees are probably also the most reliable “agricultural” land investments. Here’s his tease…

“Income Harvest Opportunity #3:

“Towers of Cash Whenever You Look Up

“Along with staple ingredients and snacking fruits, America’s rich soils are also ideal for growing the raw materials needed to power the world’s construction and manufacturing industries.

“The Pacific Northwest, in particular, is home to unparalleled stretches of well-tended timber ground that have been intentionally cultivated for more than 100 years.

“Not expecting to hear about trees as a “farmed” crop? You wouldn’t be the first to overlook the incredible value of a well-managed forest. And yet, out in nature, those tall trees are literal towers of money rising up from the ground.”

Timber has arguably been an even more popular institutional “alternative investment” than agricultural land over the past couple decades, so I guess we shouldn’t be surprised by its inclusion here. And there have been quite a few timber REITs over the years, though their ranks have thinned a bit over time.

Which one is Pearce a fan of? Our clues:

“Their roots are more than 100 years old — and still growing! This is a company that understands how to stand strong in tough times.

“In 2022, while other market sectors like tech & automotive fell, this firm expanded its U.S. operations by acquiring additional timber ground in the southwest. That boosted cash flows and allowed it to raise its quarterly dividend payouts for the second time in just five years..

“With a 30-year history of non-stop payouts, this is a cash income play you’ll want to seriously consider making ASAP.”

Those clues actually come pretty close to matching both of the US-listed timber REITs which you could reasonably consider today — that’s Weyerhauser (WY), the dominant player in this space, and Rayonier (RYN), a somewhat smaller timber and forest products company. Weyerhauser is the one which technically has a “more than 100 years” history, dating back to 1900, while Rayonier’s roots didn’t really begin growing until 1926, so I suspect he’s teasing WY… though on the dividend front, it’s definitely been the more unpredictable of the two. Both have raised dividends (only) twice in the past five years, but Weyerhauser also cut its dividend aggressively in 2020, and its dividend payouts over the past couple years were dominated by special dividends, not regular, predictable dividends.

Still, timber is the ultimate “store of value” in the agricultural world, in part because you’re not stuck with an annual harvest that’s always at the same time… you can always just let the trees keep growing if lumber prices aren’t high enough to justify a harvest. And wood is still in high demand for residential and other construction, in addition to the pulp demand for all those cardboard boxes jostling around in the UPS truck in your neighborhood, even if it’s true that we might use a bit less regular ol’ office paper these days.

Endowments are quite in love with buying tracts of timber land, and it has also worked out reasonably well for the timber REITs over time, partly because they’ve sometimes been able to sell off land for “higher and better use” in some areas of the country (for example, St. Joe (JOE), which used to be a paper-and-timber company, is now seen mostly as a real estate developer and land bank in the Florida panhandle, something Rayonier has also done to a more limited extent… and it’s not just timber companies who do that, Limoneira (LMNR), a long-time citrus grower, is transitioning to selling off lots of its land in Southern California for housing developments).

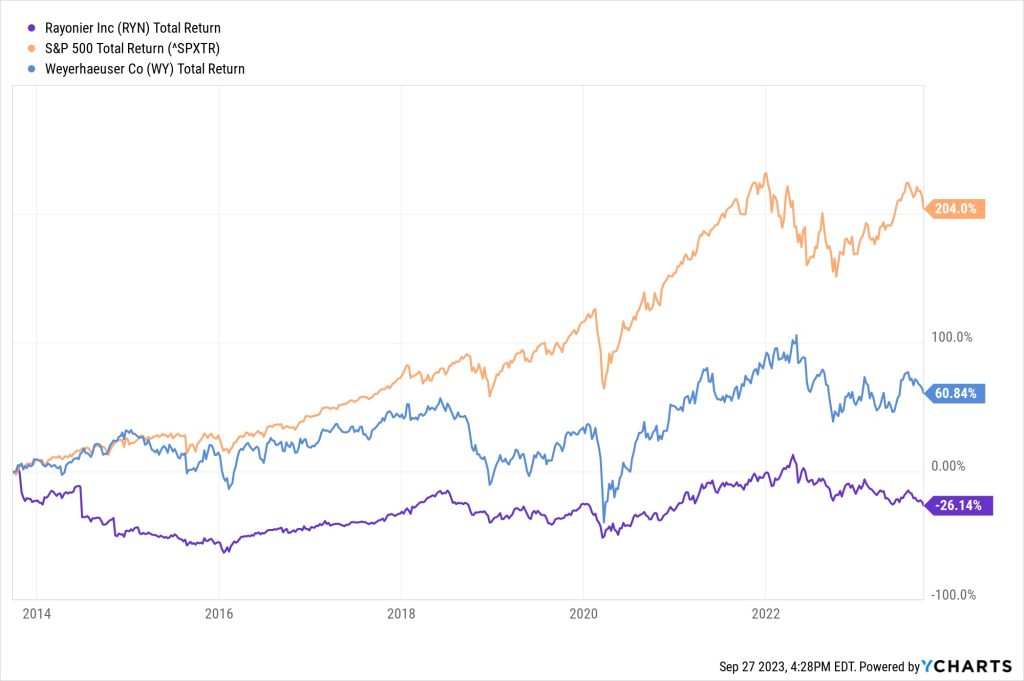

Here’s what the total return looks like for both Rayonier and Weyerhauser over the past decade, just to provide some context with those farmland REITs above — you can see that they’re also not great short-term performers:

But since these companies have been around much longer, we can also give the longer view — which is a little more encouraging, that’s still the S&P 500 in orange, so they’re not keeping up with bull markets, but Rayonier (RYN) and, to a lesser extent, Weyerhause (WY) have at least generated positive returns, without always being totally correlated to the stock market.

Right now, Rayonier has a dividend yield of almost exactly 4%, so, like LAND, awfully average. Growth has not been great of late, and the last dividend increase was in May of 2022, but they haven’t cut the dividend since they separated out their advanced materials division in 2014. Weyerhauser (WY) slashed its dividend in half in 2020, but has raised it twice since then… and they’ve also paid a bonus dividend in each of the last three years, with the last one being 90 cents in January of this year. Their official dividend yield is 2.5%, at 19 cents per quarter, but if you include the special dividend their trailing yield for the past year is actually 5.4%. Don’t know whether we’ll see another special dividend this winter, or what it might be, the payouts have varied widely since 2020.

And that “southwest” comment? Both Weyerhause and Rayonier bought timberland in 2022, but the “southwest” reference doesn’t make much sense — Weyerhauser’s meaningful acquisition was in the Carolinas, and Rayonier bought timberland scattered across the south, which might technically include the “southwest” because some of that land was in Texas, but that’s a bit of a stretch, the core operations for both these companies are in the Pacific Northwest and the Southeast, the two real centers of US timber production.

So you can flip your own coin on this one, I suppose, I’d guess Weyerhauser is the pick.

Which leads us, finally, to figuring out how we’re going to get that $1,452 in monthly income, which would be $17,424 per year. If we’re assuming that it’s some combination of shares in FPI, LAND and WY, and we give Weyerhauser credit for the special dividends they’ve paid over the past year, then the average dividend yield on those three, if you buy them in equal amounts, is 3.9% (2.4% for FPI, 4% for LAND, 5.4% for WY). To generate $17,424 in annual income from an investment that yields 3.9%, you would have to invest a total of $447,000 — so, roughly $150,000 each into those three REITs… which would tally up to about 4,800 shares of WY, 10,700 shares of LAND and 14,600 shares of FPI. Pearce mentioned buying a total of 21,000 shares, which doesn’t quite match up, so that probably means he was tallying up his numbers when those stocks were at higher prices a few months ago… so my guess would be that he based this on a $500,000 total investment, but the specifics don’t matter so much. You get the idea.

There are lots of ways to generate a pretty steady income of $1,452 per month if you’re starting with a willingness to put $450,000 at risk in search of that income — heck, if you just put that amount into high-yield savings and money market accounts it would get you a little over $2,000 per month right now, though regular ol’ cash certainly has different investment characteristics than an indirect investment in agricultural real estate, and might perform quite differently in the future. I guess timber REITs and farmland REITs are pretty far from being the riskiest way to try to get that income, so there may be some value in including these asset classes in your portfolio, particularly because those asset classes tend not to be directly correlated with the stock market… but they’re also far from being the safest way to get that kind of income. And relative to more conventional stuff, the very small number of “pure play” REITs in these sectors have certainly been disappointing investments in recent history.

There are also lots of private investments in this space — private REITs and marketplaces for buying and selling timber land and farmland. I’ve looked at some of those in the past, including in a 2021 piece I wrote back when David Eifrig at Stansberry was touting farmland as “The Only Asset With No Down Years” (that was unfortunate timing, since those two public owners of these “never go down” assets are down 18% and 41% since then), but I haven’t ever owned farmland, directly or indirectly, and I don’t think I’ve invested in timber over the past decade or so. It will be interesting to see how these “enduring value” assets hold up in an era when “safe” bonds provide a real return, which is something we haven’t really seen for more than a decade. We’re still adjusting to this new reality, it seems, with some folks expecting that we’ll go back to the “good ol’ days” of rate cuts and Federal Reserve “stimulus” as soon as next year, so this adjustment period is clearly making these kinds of low-growth income investments a bit unpredictable.

I gotta say, I like the idea of owning farmland or timber land as a “store of value” a lot more than I like the publicly traded and easily available investments in this space, at least at current valuations and with their current cash yields.

So… ready to follow the rich guys and jump into timber or farmland investing? Think these few publicly traded REITs are the best way to do that? Let us know with a comment below.

Disclosure: of the companies mentioned above, I own shares of Warren Buffett’s Berkshire Hathaway. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

Thank You Travis for your Thoughtfull and Honest commentary on these stocks. It truely simplifies the decision

I recall many years ago, the legendary Jeremy Grantham was promoting managed timber as an investment. I bought one of his recommendations, Plum Creek Timber, which languished, so I sold it…too soon, as it was later bought out by Weyerhauser. Last time I checked his GMO portfolio, it was headed by stocks that looked more like today’s “Magnificent 7” with no land REITs. Anyone have any thoughts about our other former fav “growth crop” REIT IIPR?. I’ve noted the price plunge has the dividend up over 9%. Time to get back in?

Wow, Travis, that was a LOT of writing. Thanks much for the effort, but I really don’t think we’re paying you enough to do that much work on one article. 🙂

Which brings me back to the question I raised yesterday, Travis: what size is your staff who help you churn out such detailed, incisive analyses day in and day out?

It’s a cast of thousands of voices, but I’m told that most of them are in my head. 🙂

Markets have been crazy lately , but a new service called Profit Surge with Nate Bear One Ticket Payouts for $249 you can have a year’s access with 365 day money back guarantee. Before I decide , has anyone had success with this service! I am sure others have seen this service advertised , and would like to have comments . Thank You All and Travis !

I’m looking at the service. Founders can get in cheap as Nate seems to beginning his advisory. Compared to other offers its relatively cheap. It makes sense but what do I know until I try it. As long as losses are cut fast and let winners run for a week, begin trade near Monday after a great report of earnings with other indicators that select 1 stock to trade that’s best of all. Seems simple and easy to understand. All I can do is try it since there is no history. Its a gamble at $249.00. We will know in a a few months. Maybe report good or bad news.