Today I thought I’d answer a reader question about a teaser that’s of particular interest to me — not because it’s particularly heavily marketed, I haven’t even seen the original ad or article our reader cites, but because I like the topic.

Here’s the question posted by Irregular bunion132 recently:

In a recent piece entitled “The One Business I’ll Teach My Children”, Porter Stansberry discusses why Insurance is the world’s best business. It reads like a lecture on factors to consider when investing in insurance companies – i.e. float and underwriting profits. However, he also shows a chart of “four of the best-managed property and casualty (”P&C”) insurance companies in the United States”, providing the following descriptions:

Company No. 1 is a major global company that insures virtually anything and is worth roughly $41 billion. It has produced more than five times the S&P 500’s long-term return because, using a small equity base, the firm has profitably invested underwritten float into solid investments, year after year.

Company No. 2 started in the 1930s insuring jitney buses, and later, long-haul truckers. In 2019, it serves niche markets and underwrites specialty insurance products. The company is worth about $15 billion.

Company No. 3 got its start insuring contact lenses. In 2019, it focuses on things that other companies won’t touch, like oil rigs and summer camps. It’s a small public company worth a little more than $4 billion.

Company No. 4 was founded by a Harvard Business School graduate 50 years ago. It’s still mostly a family business (even though it has public shareholders and is worth around $13 billion). It insures almost anything commercial, from yachts to elevators.

Does the Thinkolator or its cult following (saying this in fondness) know the names of these companies?

So…. good questions, bunion132! And I do love insurance as an investment, so let’s see if we can ID these. I haven’t seen the original ad or article you reference from Porter, but he has long championed property & casualty insurance as one of his favorite long-term investment ideas and one of the best businesses on earth (and he’s not wrong). Stansberry even has an insurance data service called Insurance Data Monitor that I believe is given to all Stansberry Investment Advisory subscribers — I don’t know how successful or predictive their rankings of insurance companies are, but the criteria used seem rational and it probably does well (though it’s insurance data and these stocks tend to not be terribly sexy, so it’s probably also hard for Stansberry to sell to subscribers even if it does well — one common refrain I hear from newsletter folks in general is that individual investors are least likely to value the most valuable content or advice, partly because it’s boring, which is why they sometimes lament, perhaps over that third whisky, that they “have to” sell hyped-up junk in order to get attention).

This wasn’t a big hype-y tease, apparently, and I don’t even know which service he might have been touting, if any, or if there was more detail from him, but we do like to follow the hints and find the secrets… so I’ll see what i can do with these clues you’ve dropped…

“Company No. 1 is a major global company that insures virtually anything and is worth roughly $41 billion. It has produced more than five times the S&P 500’s long-term return because, using a small equity base, the firm has profitably invested underwritten float into solid investments, year after year”

Those clues are not terribly precise and could match a few different companies, depending on what other criteria you’re using, but since we’re sticking with just property & casualty insurance companies here and want something with a market cap near $40 billion and a long period of dramatic outperformance relative to the S&P 500, I’ll have to go with either Progressive (PGR) or Travelers (TRV).

Progressive is technically the best match on market cap and market outperformance at the moment, though I don’t know when these hints were dropped. The company seemingly took inspiration from Warren Buffett’s delight in massive marketing spending for direct insurance sales with GEICO and used that to grow at least as fast as Berkshire’s gecko-sold insurance operation. Travelers was roughly the right size before its recent drop, and is a diversified international P&C insurer so is probably a better match thematically, but has really just matched the S&P 500 for most of its history. If forced to guess, I’d say it’s probably Travelers — just because that has often come up in Stansberry’s free articles and commentary about the best insurance companies, and because Progressive really doesn’t do any business outside the US (OK, and Canada), but this is definitely a guess.

There are some other companies that might reasonably get close to matching — Tokio Marine (TKOMF) is of a similar size and is much more global, though thanks to the disastrous Japanese stock market it has not outpaced the S&P 500 over any appreciable time period… .. Chubb (CB) has been a steadier and more stable insurer and is a better match for the global reach and “insures anything” idea, but is too large at a $70 billion market cap (and has trailed the S&P over the past five years or so, since it merged with Ace). Aflac (AFL) is right up there, too, but isn’t a property & casualty company.

Progressive is an amazing company, churning out fantastic marketing-driven performance in the US auto market and (arguably) growing faster by out-advertising GEICO, which is backed by the deepest pockets in the world. I wouldn’t try to talk you out of that one, but it is expensive and it’s therefore far more speculative than your average property and casualty insurer — the shares trade at a remarkable valuation of 3X book, which really should limit future return expectations… but on the flip side, they probably are twice as good a company as Allstate (ALL) right now, and Allstate trades for 1.5X book value. Sometimes great companies are expensive for a reason and can sustain that, and Progressive does look more appealing since the shares have come down 20% or so since July, though I still can’t personally talk myself into paying this price for PGR. If we see some market weakness that brings the shares down to the low-to-mid $60s that’s when I can start really justifying the valuation, though I may, of course, be too conservative on this one — at least in part because I’ve never really looked at the financials in detail or dug deep on PGR, so I’m just doing a pretty cursory look today.

Travelers (TRV) is an impressive company that is not quite global but does cover the UK and Ireland in addition to the US and Canada, and they have put together an admirable record for a very, very long time — it’s trading right now at about 1.35X book value, which is about the middle of the range they’ve been in for the past 30 years, but looks downright cheap compared to some insurance stocks today. Their historical performance offers some comfort when compared to the jumpier and smaller insurance companies… Travelers hasn’t ever really shot out the lights and done dramatically better than the market, since to a large degree they really are the market, but they also held up really well in the financial crisis when the “hot” insurance companies and even some of their large peers were collapsing — TRV was down only about 25% peak to trough and recovered quickly in that 2007-2009 period, while some sexier specialty firms lost 40-50% or more and came back more slowly, and a few big peers like Hartford (HIG) lost 90% or so and had to be rescued. So that’s encouraging.

More recently, TRV reported a weak quarter on the back of some soft pricing that cut into earnings… so perhaps this is an opportunity, since the shares are a little more appealingly priced than they were a month ago, and the sentiment seems to be that the pricing environment is gradually improving.

Next?

“Company No. 2 started in the 1930s insuring jitney buses, and later, long-haul truckers. In 2019, it serves niche markets and underwrites specialty insurance products. The company is worth about $15 billion.”

That’s Markel (MKL), the specialty insurer and reinsurer which I’ve probably written about more than pretty much any other stock over the past dozen years. They did indeed get their start in specialty insurance, and that was their focus for decades, though they’ve now grown to the point that they do a lot of more “commoditized” insurance business and reinsurance as well. Markel first came to a lot of investors’ attention about 20 years ago, when it started to get talked up as a “kind of like Berkshire Hathaway” stock because they were doing a very good job of investing their portfolio and, thanks to the specialty nature of their insurance business, had a pretty nice and defensible profit margin.

They’ve slowly added to their “Baby Berkshire” reputation in the past decade or so by building up Markel Ventures, a portfolio of private companies they’ve invested in or acquired to put some of their excess capital to work and, hopefully, grow their cash flow over time (they started with a few small industrial-type companies near their Richmond, VA home base, but have acquired some larger ones over the years, too — most recently the dominant houseplant supplier Costa Farms)… and their latest push has been to build on their service and insurance linked securities businesses, which should also help them grow their margins over time as they use other peoples’ money (earning fees for managing insurance portfolios, essentially, instead of putting up all the capital themselves).

Markel is my second largest position — I first bought shares in 2006, and certainly overpaid for some of my shares during a time of some “this will be the next Berkshire Hathaway” enthusiasm, but when great companies are consistently able to make a profit and reinvest that profit in their own growth, overpaying by a bit is not a cardinal sin if you have the patience to wait for the business to catch up to the valuation. I was tempted to take some profits on Markel when it approached what I thought was an unsustainable valuation, around 1.8X book value for a bit in 2017 and 2018, bringing the shares to $1,200 and a premium valuation at a time when the actual performance was a little bit soft… but because I’m so confident in management and the strength of their business I just held. Which looks to be working out, since MKL has grown book value per share and therefore grown itself back into the ~$1,200 share price that seemed too high a year and a half ago.

Markel is right now just above where I’d think about nibbling on shares, at about 1.5X book value (that would be the low $1,150s), but that’s partly because it’s one of my favorite companies and I’m extremely reluctant to ever sell, so I need to have some pricing discipline or the position would have become way too large by now. They have definitely had a couple tough years in underwriting, 2017 was a record catastrophe year and 2018 not a lot better as we’ve seen so many waves of hurricanes, typhoons, ice storms and wildfires, but underwriting has been good this year and the market does seem to be “hardening” a little as expectations of future catastrophes rise (in insurance, a “hard” market is one where insurers can charge higher prices, a “soft” market is one where insurers are competing too aggressively for business and it’s harder to charge a profitable price for risk).

Next?

“Company No. 3 got its start insuring contact lenses. In 2019, it focuses on things that other companies won’t touch, like oil rigs and summer camps. It’s a small public company worth a little more than $4 billion.”

That’s RLI Corp (RLI), a fantastic company that was indeed originally built on a contact lens insurance business. Over the past 20 years, shares have grown in value by 1,000%… but if you go back to those early days in the 1960s, it’s 10,000%. Really amazing.

I’m conditioned to value insurance companies using their book value per share, and tempering that with a look at their combined ratio (lower is better) and their investment returns and their revenue (or premium) growth. Ideally you want a company that sells for less than book value, underwrites profitably, makes money on its investment portfolio, and is growing its sales steadily.

"reveal" emails? If not,

just click here...

With RLI, you definitely get the underwriting and the investing profits… and the sales growth has been solid over a long period of time, though the last three years have plateaued to some degree… but you definitely don’t get the discounted price/book valuation. They trade at a stiff premium of about 4X book value, and though that’s partially because their margins are much larger (because they insure unusual stuff) and they have a better balance sheet than most insurers (they have almost no debt), it’s still a tough valuation to swallow if you’re accustomed to buying other insurance companies. You probably really need to think of RLI as a service provider with a defensible moat, not as an insurance company, if you want to talk yourself into buying the stock today.

This idea of “specialty insurance” comes up a lot when talking about investing in insurance companies, because if you do the same thing as all the other businesses in the space you face a lot more competition and you will probably get similar results. “Specialty” is one way that insurers can stand apart — the real areas of possible advantage for an insurance company are scale and distribution, which is where Progressive and Berkshire’s GEICO shine, reducing costs and increasing efficiency; underwriting discipline and skill, which some companies do better than others but everyone screws up sometimes; and segment specialization, building up a business and an underwriting knowledge base that lets you be the “go to” insurer for a particular nonstandard kind of activity or business.

So when Markel started out by insuring Jitney buses, that was a “specialty” — it wasn’t a big enough industry for the other insurance companies to go after it, and maybe they thought it was too dangerous and not likely to generate a profit, but owners of those buses still needed insurance, so once you learned the business and the risks and priced it accordingly there was a good business there. Markel did the same with lots of other kinds of businesses, like hair dressers and summer camps, though it has now also grown far beyond those “specialty” markets. The risk of the “specialty” market is that you have to keep finding new ones, and lots of other insurers and insurance entrepreneurs have seen the success of Markel and RLI and many others and been tempted to try to carve out a niche for themselves. RLI is no longer primarily a contact lens insurer, because that market wasn’t big enough to grow the company and the falling cost of lenses made insurance less critical, so now they’re much more of a “regular” insurance company — and that’s what makes the valuation tough to swallow, even though their return on equity is quite a bit stronger than the average insurer. RLI’s latest Investor Presentation is here if you want to read up on them yourself.

Next?

“Company No. 4 was founded by a Harvard Business School graduate 50 years ago. It’s still mostly a family business (even though it has public shareholders and is worth around $13 billion). It insures almost anything commercial, from yachts to elevators.”

That’s W.R. Berkley (WRB), founded by William R. Berkley while he was getting his MBA at Harvard in the late 1960s. WRB has been a very successful specialty insurer as well, party by remaining decentralized and letting its specialty divisions write their own business, and has grown into a large player.

The stock has had an extraordinary year in 2019, as has RLI, and now trades at more than 2X book value, which is arguably defensible for a very strong business with consistently excellent underwriting (averaging about 95% over the past five years), but is still high enough that I’d hesitate to get excited at the moment. As happened with Markel a couple years ago, I think the price has gotten ahead of the stock — that doesn’t mean it’s a sell, it’s a great company and it’s making a lot of money and has established a very strong business that should endure and keep growing… but it means the stock might have a hard time posting financial results that justify the current price, so I wouldn’t be surprised to see the stock either stagnate for a while or drop.

Unlike some of these others, though, WRB does also pay a dividend — including special dividends when the business is strong, and if you include the special dividends paid and declared for 2019 (50 cents in the Summer, 75 cents payable next month) shareholders will get a total dividend yield for this year of 2.4%. That may or may no be sustainable, the “regular” dividend is only about 0.7%, but it’s a nice touch that they can keep growing while also returning capital to shareholders (Markel and Berkshire Hathaway, for example, do not pay dividends, though they do a little bit of share buybacks, and dividends place more fiscal discipline on a company). They also have been much less catastrophe-driven than most of the larger insurers most of the time, so although they certainly have losses in big catastrophe years they are not as driven by big hurricanes or storms as many insurers are (that’s probably mostly because they focus on commercial lines of insurance, not homeowners insurance or other personal lines). Great company, and it will probably work out well in the long run even if you buy it today, I just can’t really stomach paying 2X book value for the shares — hopefully I’ll be paying attention the next time WRB drops closer to a more “normal” 1.5X book.

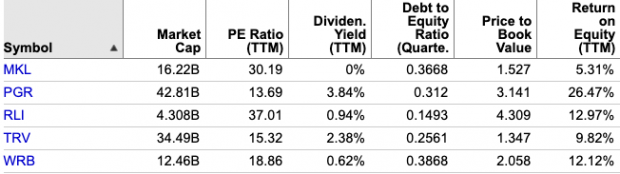

So what do we end up with? Well, it’s not terribly flattering for me — Markel (MKL), the stock I’ve been most confident in of that group, has done substantially worse than all the others over the past five and ten years, pretty much just tracking along now at about the same return as the S&P 500. That will probably continue, it’s a much less volatile stock than most of the others (except TRV) and certainly will not ever again have the aggressive growth profile of RLI, but I do continue to have confidence in MKL’s gradual wealth-building potential. Here’s a little chart of the current valuation for each of them (I’m assuming Travelers is the first one, but included Progressive just in case, and both could be wrong — the other three are certainly correct matches):

And here’s a look at what those stocks have done over the past 20 years, just to remind ourselves that this is a sector that is generally most appealing over the very long term:

And yes, in case you’re curious, there is an ETF for that — the Invesco KBW Property & Casualty Insurance ETF (KBWP) has been around for almost a decade now, and it’s worth thinking of as a benchmark… here’s what those stocks have done in the past five years compared to the ETF (in pink), you can really see that RLI and WRB have taken off dramatically this year, while TRV and MKL have lagged in 2019:

I’d guess we’ll see some “reversion to the mean” on that front, but you never know.

There is plenty of reason to look at other stocks who are trying to break into this space, too — one popular niche “insurance” sector in recent years is the extended warranty or very low-value product insurance (“ding and dent” insurance for cars, consumer debt insurance for small loans), similar in some ways to RLI’s original contact lens insurance, and I did recently buy shares of Tiptree (TIPT), a very small investment conglomerate that’s trying to build a business in that area (though there’s plenty of competition, too, both from giants like Assurant (AIZ) and Asurion and from a bunch of fintech startups). Seeing the huge success of these established “specialty” insurance companies over the long term does make you want to seek out the next generation… though, of course, even really successful and still-growing firms like RLI and WRB are not all that huge just yet, and arguably deserve their premium valuations.

So I kind of like all of these guys, probably because I’ve just got a soft spot for insurance stocks in general, but for most of them it feels like we’re overpaying right now — that doesn’t mean you can’t buy them, but it does mean that betting big on the current valuation is probably risky. The one thing we really know about stocks in general is that if we pay an above-average valuation, we should expect a below-average return — that doesn’t mean it happens that way every time, clearly some companies grow their business so fast that they can justify a very rich valuation and still outperform the broader market, but these larger insurance companies generally do not have enough top-line growth to sustain really rich valuations forever, so if you like them my advice would be to buy a tiny bit and wait for weakness to add to those positions.

There are a few things that tend to influence insurance stocks, broadly speaking, and they’re things over which they (and we) have little to no control — that’s catastrophes (hurricanes, etc.), interest rates, and stock market performance. Catastrophes are the highest profile part of that, but good insurance companies deal with catastrophes well and adjust their pricing over time… interest rates are a huge deal, because the “float” that insurers hold when waiting for possible claims to be filed has to mostly be invested in bonds, for safety’s sake, so if interest rates are low that spurs insurers to either push their investment risk a little (buy riskier bonds) or charge higher rates and “harden” the insurance market, and if interest rates jump higher then they often take a temporary hit to book value as their bonds are revalued (though rising rates in general are good for insurers int he long term)… and most insurers allocate some of their portfolio (usually not a huge amount) to equities to provide a return boost, so if the stock market crashes their book value falls as well.

If you want to have excess returns, you probably need to find solid insurance companies that can underwrite profitably almost all the time (they’ll all report their combined ratio each quarter, that’s their overhead and claims paid divided by the incoming premiums, so anything under 100 is an underwriting profit and anything over 100 means they’re losing money on their underwriting), and try to invest in them at good prices over time when they post bad results or get caught in a downdraft because of a hurricane or a bad quarter. It hasn’t generally worked well to throw your money at the best performers at high valuations and hope they maintain lofty valuations forever, unless they’re in a truly defensible niche market where there’s no price competition (like RLI was, in retrospect, though perhaps they still are)… but you have to start somewhere, and I do think it’s a good industry to count on for the long term.

That’s just my take, though, and you can see that with my money I have bet heavily over the years on the weakest of these stocks (and probably would do that again today, though I do regret not buying WRB, a stock I’ve come close to adding to my portfolio in the past). So if you’ve got thoughts on insurance stocks, I’m sure we’d all be delighted to hear them… just use the friendly little comment box below. Thanks for reading!

Disclosure: Of the stocks mentioned above, I own shares of Berkshire Hathaway, Markel and Tiptree. I will not trade in any covered stock for at least three days, per Stock Gumshoe’s trading rules.

I read the Stansberry article and Googled insurance stocks. Among the articles, I found Kinsale Capital (KNSL) rated A+ with a long-term history of remarkably steady increases. So I bought some. Within hours, it crashed 11% for the first time ever as far as I can tell.

What happened? Was it my fault? 🙁

Sounds like you bought before Nov 1st, when KNSL reported Earnings for the most recent quarter. By just looking at the chart, I’m assuming the report was really bad for the stock to plunge like that.

I don’t think I’ve ever looked at Kinsale in detail, but it’s a specialty and higher-risk insurer — they target higher risk accounts (past losses, risky locations, hazardous materials, I gather). Very high underwriting income (combined ratio of 84% for the year, great “regular” insurance companies are often in the mid-90s), but they also trade at a wildly higher valuation than most (price/book of 5X), so you pay a lot fo that high level of profitability and premium growth. Don’t know what happened to make them disappoint this quarter, but clearly something did.

Never heard of KNSL even though I’m very active investor in stock markets for decades. Before you buy any stock, please pay attention to MC and daily/monthly volume and few other crucial factors that all are available on finance.yahoo website except RSI. I suggested to exclude “1y Target Est” and include RSI.

Thanks, Travis. For those that want to diversify or balance a portfolio a little better, I thought it might pay to seriously look into one of the most (if not THE most) boring yet stable industries out there. Does the property & insurance niche hold up fairly well during a recession?

Overall, the 5 companies mentioned above have a general “Hold” rating from analysts as of now, with PGR having a slight edge and best probable upside movement from hereon. Who’d have thought that “Flo”, who resembles a housemaid for the uber-rich circa 1950’s-1960”s, would be capable of selling insurance better than the green gecko? Lol.

.

As an optometrist in the 1980’s, RLI contact lens “insurance ” was a rip off, requiring the doctor to sell the insurance to the patient, then provide the materials at a discount to the patient while the patient’s total charge was higher than I would have sold it to them, without insurance, but my profit was smaller! (So RLI collected money using eyedocs as their agents, but never had to pay any money out since the doc had to buy the cl’s at wholesale to sell to the patient at the agreed discount written by RLI.) Also patients were allowed to renew the insurance directly with RLI but couldn’t order more contacts without a new exam which was not explained to them by RLI. Because of that, we talked patients out of buying insurance from RLI and just promised a reasonable replacement price for a small pre-paid fee. I dismissed RLI as a company that had no business being in business and was surprised to see it still around today. Now I know what I missed : all those fat profits they were harvesting without any expense on their part. I assume they took that same method to other markets to make the same fat profits. How many thousand percent stock gain did I miss because I knew them “too well”? Ouch.

Thanks eyedoc, interesting perspective on that one — it’s hard to know at the time which annoying and seemingly unsustainable business will turn out to be a huge winner, and which will be competed away by someone who does the same thing on better terms. There’s a lot of fintech money flowing into making warranties and “insurance” like this more sustainable, taking away the middleman, but I’m guessing they’ll find that if there’s no middleman most of the business disappears. Sounds like RLI figured out a way to keep more of the profit, which is suprrising, but in most “extended warranty” situations the product salesman is the one making a lot of the profit (the commission on an “extended warranty” or special insurance like that is often 50% or more of the price, though that usually means the selling company is taking some of the fulfillment risk as well) and with the incentive to push the product at the point when the customer is most likely to feel inclined to buy it.

Travis, I have to say Travelers caught my eye; can’t tell you how much I appreciate todays dive into something we all have an interest in, either as a serious investment opportunity, or as plain consumers.

Another instance where the one percenters have a built-in edge. I have paid house, car, and medical insurance for 30 years and never collected a dime (I might have if it wasn’t for deductibles, which I always had the lowest deductibles possible.) Meanwhile, the ultra-rich don’t have to worry about insurance (self insured – car, house, medical, they are above the necessary cost of life paid by the vast majority of people. Right now, I use USAA; any helpful suggestions or comparisons to how insurance companies you covered?

Self-insuring is indeed a nice way to live if you can get there! I am no expert on the appeal of different insurance companies from the customer side, sorry, don’t know anything about USAA other than the many ads I see for their products.

There is something to be said for buying shares in the company that provides your insurance, assuming it’s a solid and competitively-valued company, just like there’s some rationale in buying shares of your electric or gas utility or your phone company — it just feels nice to know that a tiny sliver of those rate increases comes back into your pocket. 🙂

USAA used to be such a GREAT company. They have a new CEO. Rumer is that he is from State Farm. As a retired claims adjuster, and retired Public Adjuster, the two worst companies are State Farm and Allstate. The two companies that spend the most on marketing. But when its time to file a claim- good luck. They both have a license to steal and defraud the consumer.

Any comments on Insurance company ETFs (IAK, KIE)? At least you spread your risk with these.

Those get into the life insurance and other insurance sectors, too, I prefer KBWP for the cleaner focus on property & casualty insurance.

IMHO the only way to invest in an Insurance Company is with life insurance. Starting with basic whole life and term rider. The cash value builds over time and protects your family in the event of the insured’s death preserving family assets and continuity. Variable Life and Stock-based policies can be very effective in investing one’s money on a monthly cost averaging basis.

More importantly a disability policy is your best defense against heath issues or unfortunate accidents that will arise in one’s lifetime.

For every dollar I’ve invested in insurance over the years I have gotten $10,000 in payments for permanent disability and the riders I paid to insure life policy payments in the event of disability.

Ever looked at or heard of The Westaim Corporation WED on the TSXV Exchange

Nope, what’s to like?