This is not a heavily hyped stock sent out in lots of ads — I should make that clear up front.

But it’s a puzzle, and I like to solve puzzles… so I thought I’d sniff it out for you.

The tease was part of a Stansberry letter that seems to have gone just to their existing subscribers in the Stansberry Digest, which I think is the basic daily letter that goes to everyone who pays for any Stansberry subscription. I don’t get this letter, but several readers forwarded it along.

Porter Stansberry introduces his idea as follows:

“It’s an idea I call the ‘magic’ portfolio because it combines buying the highest-quality businesses with extremely stable stocks. When used to build whole portfolios, this combination produces market-beating results with about half the volatility of the stock market as a whole.”

There are lots of ideas that are pitched as “Magic” ideas or strategies or strategies that beat the market, of course, so you’d be forgiven for running and hiding when you hear the “M” word… but this one is, at least, based on rational analysis — here’s more from the Digest that some readers forwarded to me:

“last April I introduced the idea of trying to build a “magic” portfolio. I knew from my experience recommending chocolate maker Hershey (HSY) back in December 2007 (right before the worst bear market of our lifetimes) that certain stocks can produce outstanding long-term results with shockingly little volatility.

“These ‘magic’ stocks tend to have similar characteristics: They produce good profits (a 15%-plus operating margin). They are far less volatile than the S&P 500 (their “beta” is 20% lower than the market’s, meaning their moves up and down are less severe). And they own well-known brands. To produce good investment results, it’s also important to buy them at a reasonable price. We consider great companies trading for less than 12 years’ worth of cash profits to be ‘reasonably priced.’

“None of these ideas is revolutionary. We’ve just put hard numbers behind the kinds of businesses every investor should want to buy: Highly profitable, well-known (more than $1 billion in market cap), reliable, and fairly priced.”

He says that they’ve been backtesting these strategies and screens using data from the past 15 years, and that you end up with a portfolio that beats the market by a bit, but with much less volatility. “Volatility” isn’t risk, really, but investors think of it that way — it’s a measure of how much a stock moves relative to the market, so it tells you whether the stock jumps up and down more than the market, with greater amplitude in that price chart, or whether it is more stable than the market.

“Less stable” equals “more risky” in the Wall Street consensus definition (others think about risk differently — you’ll often see value investors note that the risk that matters is the likelihood/probability of a permanent loss of capital, which is a definition that makes more sense to me… but high volatility certainly makes investors feel like their stocks are “risky”). And there’s something to be said for stable stocks, for sure.

He goes on to explain some more about this “magic” stock strategy, which over three year periods would have beaten the market most of the time (well over half the time), with substantially less volatility even though the 15 year period includes two pretty cataclysmic market crashes, and then to say that he thinks the “magic” performance can be improved by doing two things: Only choosing those stocks that meet the numerical criteria and that have strong brands…

“We started with ‘magic’ stocks – again, companies with great businesses, low volatility, and reasonable valuations. Then we eliminated about 80% of these names, leaving only those companies that own one of the world’s great brands.

“As a final hurdle, we demanded that all of these firms display excellent capital efficiency of at least 10%. So to qualify for our highest-caliber portfolio, a firm had to be a “magic” stock, PLUS it had to own one of the world’s greatest brands, PLUS it had to demonstrate high levels of capital efficiency.”

And he says they found this to provide “stupendous” results — and he even went further and noted that you could scale it up using leverage (options) to essentially invest in those stocks that pass his screens and criteria, but then use leverage to artificially bring the “beta” (volatility level) up to market average, which would have turned $100,000 into $1.1 million over 15 years. (Yes, for those doing the calculations in your head that’s compounding $100,000 at about 17% a year.)

Not a lot to argue with there — you might note that proving something works over a 15 year backtested period is not proof that it will work in the future, and that’s certainly true, maybe the kinds of stocks that were successful over the last decade will be quite different than those that will be successful in the next ten years, or simply worry that the time period isn’t long enough or the resultant portfolios are not diversified enough. But it’s a reasonable way to build a portfolio, and the criteria make sense, and it’s not designed to double your money every year or be a short-term trading portfolio or identify the hottest “story” or momentum stocks in any given week, so it’s far more reasonable than a lot of the foofaraw we have pitched to us every day.

And then comes the sales pitch… for information that’s apparently coming out today:

“Here’s the most interesting fact of all. Right now, only one stock qualifies across all three criteria. In theory, you could have all of the advantages of this portfolio approach by buying just one stock.

“If you’d like to learn all of the details about our ‘magic’ portfolio, all you have to do is read the next issue of Stansberry Data, out on Tuesday.

“As you may know, Stansberry Data is available only to lifetime subscribers of my newsletter, Stansberry’s Investment Advisory.”

So that’s what I’m curious about: What’s that one stock that “qualifies across all three criteria” as “the only ‘Magic’ stock today” — can the Thinkolator ID it for us? That “lifetime subscription” would cost you $750 at the current “sale” price

“This company was built by one of the world’s best investors. It serves a huge group of customers in North America. It has extraordinarily reliable results. And the stock continues to be one of the best performers in the entire world. Just look at the chart over the last 10 years…”

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...

That stock chart illustrates a share price that has risen by about 700% over the past decade, and that’s our only definitive clue other than the fact that it matches all the criteria Stansberry lays out.

So who is it? Thankfully the Thinkolator is on your side, so we can tell you that this is: AutoZone (AZO)

Which, before you start complaining, is indeed one of those “high priced” stocks — they don’t split the shares, so it’s trading at about $700 a share right now. Some of my best investments over the years have been in those seemingly “expensive” ideas that trade for more than several hundred dollars per share (AAPL, MKL, BRK-B, etc.), so I don’t shy away from them, but some folks find a $700 stock unpalatable.

I’d urge you, if you’re in that camp, to think not about stock price but about total valuation — if you look at the stock and you’d be happy buying 100 shares for $7 each, buying one share for $700 is exactly the same. There’s only one real exception to that, and that’s for those who depend on options trading — if you do want to leverage with options, sell puts, or sell covered calls as part of your investment strategy you have to own 100 shares, and that’s not feasible for a lot of small investors when you’re talking about a $700/share stock. And if you can’t buy a single share of a $700 stock without it being too big a part of your portfolio, or you simply don’t have an account big enough to spend $700 on an individual stock, then I suppose you’re off the hook too, but in that case you’re almost certainly better off diversifying through index fund than buying just a few tiny positions in some favored stocks.

I don’t like to think about investors buying individual stocks before they have at least $10,000 or so saved up to trade with as money that they can afford to risk (ie, not your 401(k) or the college fund), because either losing or winning big on an individual pick when you’re just starting out as an individual stock investor is likely to poison your thinking for a long time (“I’ve lost too much, I’m never investing again” or “I’m brilliant! Roll the dice, baby, I can’t lose!”).

But in all other ways, the actual price per share is meaningless: What matters is the company’s performance and the value and the valuation, and the total capital you commit to the investment as a percentage of your portfolio.

Sorry, got on my high horse for a moment there — so what do we know about AutoZone?

Well, they do have a strong brand — they are a leading distributor and retailer of auto parts and accessories in the US, and have an important brand and 5,000 or so outlets. There are several competitors who are publicly traded, including smaller players like Pep Boys (PBY, which is currently being acquired by Carl Icahn in a tender offer at $18.50, to combine with an auto parts company he already owns) and Advance Auto Parts (AAP), but the big name that should come to mind for you as the largest competitor is O’Reilly (ORLY).

O’Reilly Automotive is a slightly bigger company and is very similar on a lot of the metrics — compared to AZO, ORLY is slightly more volatile, has free cash flow generation that has been a bit less steady, has a slightly better balance sheet, and is more expensive on a PE basis, but also has been growing faster in recent years. That has allowed ORLY to “catch up” with AZO when it comes to long term performance, after lagging for a while — over ten years the two have been nearly identical and have similar charts, with ORLY up about 650% now and AZO currently at a 670% gain. But it’s AZO that exactly matches the “clue” of the chart in Stansberry’s letter.

AutoZone is quite capital efficient, which in Stansberry’s parlance means that it has plenty of cash flow and can use it for either buybacks or dividends because it doesn’t need more capital in order to keep growing. That’s also a complaint of some investors, some of whom see it as “financial engineering” that the company is using buybacks to make it look like it’s growing earnings more quickly.

I like buybacks, with the possible exceptions of buybacks at growth companies that are done solely to keep a lid on the growth in the share base due to too-generous employee stock options — a company that doesn’t need cash for great growth investments should gradually, if the shares are not overvalued, use excess cash to shrink the share count so that each remaining shareholder owns more of the company in the future. And, to be fair, ORLY has also been buying back a lot of stock — like AZO, ORLY’s share count is down roughly 10% over the last two years.

I might be inclined to look at ORLY a little bit more favorably because of their lower debt burden and better recent performance, but that’s splitting hairs a bit and is balanced somewhat by the fact that AZO has more value in their buildings and land on the balance sheet than does ORLY. AZO is certainly cheaper, both on a PE basis (19 vs. 27 for the trailing year) and on a price/free cash flow basis (23 vs. 28). With similar growth rates for the two, I can see why you’d want to go with a somewhat cheaper way to get that growth.

But that’s not the idea of having a “Magic” formula or screen, of course — the idea is that you have solid metrics on which you screen, and if the stock matches them then you buy it… you don’t sniff around and see if there’s a competitor who you might like a little more, or if there’s a different catalyst that might move a similar stock, you follow the rules.

AZO does have a low beta of 0.75 (lower than ORLY’s 0.84), it is measurably cheaper right now (Stansberry cites Enterprise Value/Earnings before interest, depreciation and amortization, and AZO’s EV/EBITDA of 11.6 is substantially lower than ORLY’s 14.5… competitor AAP is way down at 9, but falls way short in other areas), it is a “great underlying business”, a metric Stansberry measures using operating margin (AZO’s operating margin is 19%, essentially the same as ORLY’s and well above the 10% of AAP), and it has a solid and established brand and has demonstrated its capital efficiency by consistently buying back stock (both have similar buyback levels in recent years, but AZO’s “tradition” of buying back stock goes back more than 15 years, ORLY is much newer to that game). So there are real reasons to like AZO as a stock, whether you think it’s magical or not.

And with that, I’ll leave you to it — do you like this magic formula? Feel positive about AutoZone or any of its competitors? Think this is a worthwhile screening approach to use in general? Let us know with a comment below.

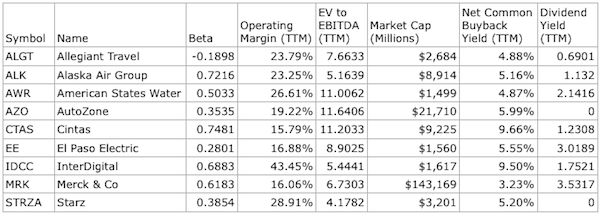

P.S. In case you’re looking at ways to use these ideas to search for “Magic” stocks, here’s one of the screens I tried that ended up having a small collection of interesting ideas… my universe was only the stocks listed on major US exchanges:

- Beta less than 0.8 (at least 20% less volatile than the broad market)

- Operating margin of greater than 15% (that’s Stansberry’s “excellent underlying business” — has to have potential for excellent profitability)

- EV/EBITDA less than 12

- Market cap of at least $1 billion (stability is more likely in larger companies)

- Net common buyback yield plus dividend yield (both TTM) of at least 5% combined as a proxy for capital efficiency/capital return to shareholders.

These are the stocks that match those criteria — haven’t looked into them or played with the screen much, but I thought you might find it interesting:

Lets have a discussion of stock screeners. What are the best free stock screeners available in your opinion?

I am fond of investment tools and have shared many here: http://www.stockgumshoe.com/2014/11/first-steps-and-favorite-tools-for-new-investors/ Best2AlandAll-Ben

Hmmmmmm, I’ve followed Stanberry’s take since Porter was the “Pirate Investor” before the beginning of the century. From what I remember he never owned or reco’d AZO. If I’m wrong pls. call me out & when was he in the stock too if you don’t mind?

Recently he become very bearish on auto loans being given to sub-prime customers. If he’s right about that, shouldn’t he be bearish on AZO?

Just wondering!

This is not a recommendation from his newsletter, as far as I can tell from the ad — it’s a match/recommendation from the Stansberry Data service that he says will be covered in the latest Data release today. For what it’s worth, the auto parts stores have often been touted as a beneficiary of people owning cars longer… which might be the result if auto loans crash and it becomes harder to finance a new car. I suspect he’s mostly bearish on the debt itself and on the lenders who hold the debt on car loans, which doesn’t really have a direct logical connection to auto parts.

Hmmmmmm, when houses went the “foreclosed route” those not bought soon after turned into garbage. Who fixes up auto garbage if cars are repossessed & stored in a dump, here, or in So. America, Africa, Mid-East, etc,? Most of the older cars you speak of are already paid for Travis, or am I wrong there? 🙂

We overthink this kind of thing a lot. Home Depot dropped 30-40 percent from 2007-2009, but that was less than most stocks in the housing crash and market crash, and since then it is up maybe 400 percent.

Travis

Once again your sleuthing is excellent. Magic stock was just released and it is as you described. Again it is not a purchase recommendation, just the only one that passes its screen.

And, it was. AZO.

During the Great Depression, auto mechanic and appliance repairman were two of the top ten most secure livelihoods, for exactly the reason Travis mentioned: when people can’t afford to buy new, they must maintain what they have, or buy used. I’m sorry I don’t have the reference for this, I just remember being surprised by that fact when doing some library research back in the 1970s – which was the last time, pre-2008, that I was this concerned about the possibility of a deep depression in the U.S. – the other jobs and professions in the top ten were more expected, so not surprising: doctors, nurses, teachers, lawyers among them.

One thing I don’t think is considered…with all the “tech” being introduced in new cars…which can only be repaired by “tech machines”….only much older cars can still be repaired by the independent or owner mechanics…

I am amiliar with Stansberry Research…generally speaking, find them to be upfront and fairly easy to understand…I would think just the opposite would be the case on sub-prime loan issues, and by the way, I agree with him that we do have an issue with people being given the okay to buy vehicles they really should not be buying, and those buyers will be the first to have to let the cars go back at any significant downturn in the economy…regardless, I think AZO would benefit, because there would be less ‘new car’ purchasing and more ‘repairs’ needed for older cars…I believe I read that Americans are holding on to cars at the tune of 11 – 13 years on average these days…I know in my case, one car is 10 years old and the other one will be 10 years old in July…can’t say you are wrong, just giving an alternate viewpoint.

People are holding on to their cars much longer because they are so much better than they used to be and the styles don’t change much. Years ago there was a cartoon with a guy tied up and he was telling a cop ” They got away in a ’51,’52, ’53, ’54, ’55, ’56, ’57, ’58’ ’59, ’60, or ”61 VW” Now days that could be almost any car.

Stansberry is a scam artist. He puts out thousands of recommendations most based on “inside” information he says. That got him convicted of fraud in the past. The few times he is correct he trumpets those results to no end.

If you ever somehow fall for his newsletter you are then bombarded with even special “better” deals if you pay more. He then sells your name to every other crappy newsletter out there.

His latest scam is the stansberry vip website. It must be great if he overnighted the invite to join! It only costs $15k per year. Step right up.

Blah Blah Blah Blah. I have done very well with Stansberry. And I was a novice.

Porter S is indeed a relentless marketer, but so is Weiss, Casey and all the others. I have subscribed to his letter in past, did not find his reco’s made money any more frequently than any of the others I’ve tried (worst being Byron King & Teka Tawari {sp?}).

However, being accused of fraud and convicted of it are very different. To my knowledge, he was never convicted due to lack of evidence of wrong doing. I do believe him to be an honorable man who sincerely tries to educate his readers to be better investors.

JKC might want to read http://stansberrysecfraud.com/

…who knows, he may even change his mind

For what it’s worth, I work on my cars a lot and buy my own parts when I pay someone else to. If I buy locally, I shop Advance first, then OReilly, NAPA or other local parts stores. AutoZone doesn’t stock enough name brand parts. For oil I shop local discount stores, and when I can plan ahead (brakes, shocks, wheel bearings), I buy parts at Amazon or elsewhere online. AdvanceAuto’s recent acquisition of CARQUEST took some wind out of their sails, but I think it was a great way into the professional repair shop market. I believe it could ultimately compel someone to buy or merge with GPC, to get NAPA which is a great name in parts.

I would love to know what you are driving that needs so much work.

$700 a share… To expensive.. I’d buy Appl if I could before something like this!

me to

Try reading the entire article. You seem to have missed the point of price versus value entirely.

While a find your argument for considering a high priced per share stock compelling, I personally find the case for investing in AZO considerably less so. AZO does not meet my personal initial screens –the P/E is higher than 15 and they pay no dividend. Occasionally volatile my P/E rule for an otherwise attractive stock, but never the dividend rule. Using initial screening rule on, other stocks listed on your table, the only stocks that I would find attractive enough to look into further would be ALK and MRK. While Warren Buffet and company are quite successful and have never paid dividends, I personally find that unsatisfactory as one must sell at least part of the holding to realize any tangible profit.

It’s good to live by a set of rules when investing — especially if those rules can help you avoid making speculative mistakes. I’m not as committed to dividends, but I understand why many people are.

OK, YOU RIPPED UP THE MESSAGE. IS IT TRUE THE MESSENGER WAS CONVICTED OF FRAUD? THAT WAY WE WON’T HAVE TO BOTHER WITH HIS OTHER MESSAGES. CAPISCE!

PPM

Stansberry and his previous publishing company were found guilty of securities fraud, and that held up on appeal. Further appeal to the Supreme Court was rejected. I have certainly criticized lots of things he has done, and I definitely didn’t like the ad campaign that the SEC found to be part of the fraudulent action, but I also think the ad was fairly typical of those sent by other publishers then and now and I actually think the courts took it too far and pushed the boundary against the First Amendment and extending the reach of the SEC into the non-fiduciary media with their decision in that case. The amicus brief from a bunch of First Amendment advocates (reporters and news organizations, mostly) here is pretty compelling: http://graphics8.nytimes.com/packages/pdf/opinion/RCFP.pdf (a shorter NY Times editorial on that is here: http://www.nytimes.com/2010/07/04/opinion/04sun3.html?src=tp&_r=4&)

In general, my goal is to identify the real investments being discussed and think about them as independently as possible — I don’t ignore all Business Insider articles just because they were founded and are run by Henry Blodget, for example, though that does cross my mind when I read the articles.

I subscribe to some of Stansberry’s products – a couple very cheap ones, plus his daily Digest – even after having followed his court case very closely (I testified in a Baltimore courtroom on behalf of the SEC on an issue related not to Porter directly but to Agora companies and their “questionable” advertising practices). In my humble opinion, Porter is sometimes as much a “journalist” as an ‘ole West snake-oil salesman was a doctor. Bottom line, he’s trying to sell products, not “inform” the public. His subsequent description of his case is just pure, unadulterated b.s. One point: he must be the only one in the entire Western world who would claim that merely sending an e-mail to someone (supposedly a company “insider”) is documented evidence/proof that that person not only received the e-mail but opened it and read it, and must have agreed with its contents just because that person did not send any response to Porter. (Court rulings said the company person testified that he did not provide Porter with the information Porter claimed he did – and there was a witness who heard their discussion, I believe.)

Another point: Porter’s “recommendation” piece (which I never saw, except parts quoted in court rulings) sold for $1,000; it told buyers exactly when to buy the stock and exactly when to sell it (in May). And not that much later, Porter advised his readers that the stock was no longer a good investment. So, one would have had to take Porter’s advice to buy the stock and ignore his specific advice to sell it in order to benefit three years later, as he claims. Can’t have it both ways…well, most people.

Porter and his company Pirate Investors were fined $1.5 million; as Travis noted, he lost on appeal and the Supreme Court declined to review the case. Incredibly, not too much later, Porter used his court case – which he lost – to tout a new “service” (selling put options, as I recall) as if his recommendation piece for which he was fined $1.5 million was a “highlight” of his work. I told Porter in a message that I thought his court case was a very appropriate “shot across the bows” for those in his “business” who go way “beyond the bounds” in their hype. Unfortunately (to me), it almost never happens. Travis is of course right: they “all” do it, though I’m not sure that excuses the practice. Problem is, I think, this “business” is not regulated by the Federal Trade Commission – there are definite limits to what companies can say in advertising their products in most fields.

So, I have mixed feelings about Stansberry. His daily Digest can be interesting to read, but from what I’ve seen Porter (and Steve Sjuggerud) are wrong more than right.

Per Gov’t posting: 63% of Americans say; “can not handle (cope) or pay a $500 dollar surprise auto repair if necessary and needed. That is some sad commentary and that is probably one reason Stansberry is thinking debt will be the down fall? With excessive student debt, vehicle debt, mortgage debt, sovereign debt, etc I believe and agree with Dent, Stansberry and Weiss etc. that debt will be the economic downfall. One best prepare accordingly as old Joe sixpack is in very bad financial condition and imploding.

My question then becomes where and what do you invest in if you expect this pending and inevitable debt implosion?

See: Martin Armstrong | Armstrong Economics

http://www.armstrongeconomics.com/archives/author/romulusaugustuscaesar

2 days ago – Author Archives: Martin Armstrong. Post navigation. ← Older posts · Let The Bail-Ins Begin. Posted on January 16, 2016 by Martin Armstrong.

Blog | Armstrong Economics | Forecasting the World

http://www.armstrongeconomics.com/armstrong_economics_blog

Posted on January 17, 2016 by Martin Armstrong · GoldmanSachs-Bldg-NJ. Goldman Sachs is finally paying a price (money) for the role it played in 2007 …

Older posts – Global Market Watch – Writings – Services Best2You-Ben

I just noticed this ad on craigslist. If I had another $5Gs I would be in to it too!

http://sfbay.craigslist.org/sby/fns/5606279434.html

As of 29 Oct 2016 AZO is starting on a trek downwards

I’d post a Chart if I could.

$AZO chart http://finviz.com/quote.ashx?t=AZO via finviz Best2You georai & welcome to the Gummunity ~ Ben