Several readers are asking about a new video that Whitney Tilson is circulating, he calls it “TaaS 3.0” — he says that this investing idea is thematically in line with his previous pitches. This is the intro:

“TaaS 3.0: The Final Chapter?

“We could be just days away from a radical new development to my TaaS thesis… act now, and you could position yourself to grab a piece of what the Wall Street Journal calls a ‘$7 Trillion Technology.'”

Tilson started touting “TaaS” just at the beginning of the COVID shutdowns, in April of 2020, touting Alphabet (GOOG), Aptiv (APTV) and NVIDIA (NVDA) for their role in building “Transportation as a Service,” profiting from the confluence of electric vehicles and autonomous driving technologies. Those did quite well, all beating the S&P 500 since early April of 2020 when the ad ran:

About a year later, he pitched his colleague Enrique Abeyta’s pricier Empire Elite Growth newsletter with a “TaaS 2.0” spiel, the Thinkolator id’d those targets as Arrival (ARVL), Luminar (LAZR) and EVBox. That was a disaster, with much more speculative stocks that flew higher in a manic market and since collapsed — EVBox never actually went through with its SPAC merger, so I guess that was the good one, you would have at least gotten the $10 back when the deal fell apart, but the other two have performed terribly (I threw another EV charging SPAC merger hopeful in this chart, EVgo (EVGO), just to give you some idea of how EVBox might have performed if it went public)… and yes, that orange line that just about broke even over the past two years is the S&P 500…

So what’s “TaaS 3.0” going to offer? Better than the first TaaS? Worse than the Second? Somewhere in between?

Well, it’s really only a five-minute introduction from Whitney Tilson that pegs this as a “TaaS” idea… in reality, he’s just introducing a pitch video from Matt Milner at Crowdability, who does not use the “TaaS” term. Presumably Tilson’s Empire Financial is either bartering mailing lists or getting a commission on sales, since Empire Financial and Crowdability don’t seem to have the same parent company, or maybe he’s just doing Matt Milner a favor.

Crowdability has tried to position itself as a provider of information about all kinds of private investments (and they have some good basic investor education materials about the private markets)… but which also sells analysis of some of its favorite deals through a newsletter called Private Market Profits ($3,000/yr), which basically just selects one favorite private investment each month and “pitches” it to you, with a more thorough analysis, and tries to help investors build up a diversified portfolio of private investments. A very similar ad was running in January, though without Tilson’s introduction, so some of what follows is a repeat of what you might have read back then.

We’ve covered a couple of their pitches in past years…. 20/20 GeneSystems has had some good years of operations thanks to using their lab capacity to jump on the COVID testing bandwagon, and they say they’re “close to breakeven,” though they’re still a tiny player in the cancer detection market and there’s no indication that they’re on their way to “Unicorn” status or are close to an “exit” (unicorn is the term people used to use for private companies that reach a billion-dollar valuation, though unicorns got to be very common for a while), particularly because COVID testing has now all but disappeared as a business driver…. and SolStar Space is the “wifi for astronauts” company that has made some progress, raising a couple million dollars and getting their hardware selected for a couple space projects to provide internet access, but is, of course, not even trying to be the “universal internet access” company that Crowdability pitched us about for a year or two (it was their “#1 Trade of 2021”).

It’s not necessarily the fault of these private companies that they’re being “oversold” by a pitch, no more than it’s the fault of Aeva (AEVA) that Luke Lango is telling everyone that they’ll be built into the hypothetical Apple Car, but it’s a reminder that yes, the disease of wildly overhyped overpromising is at least as rampant in the private world as it is in the world of publicly traded companies.

This latest pitch from Crowdability, which was introduced by Whitney Tilson this time for some reason, is all about “Neural Vision” — and we saw that ad a few months ago. We’ll jump right to the bottom of the ad to get you started, this is the P.S. that follows editor Matt Milner’s signature:

“P.S. The Wall Street Journal reported that autonomous vehicles could become a $7 trillion industry over the coming years. And I’ve shown you how this industry has a HUGE “vision” problem. But one tiny startup aims to solve that problem once and for all. This company could potentially be bought out for billions of dollars any day now — leading to potential “blue-sky” profits of 51,624%. That’s enough to turn every $200 into $103,248! Click here now to see how to claim all the details on this opportunity!

“P.P.S. Even if this ‘Neural Vision’ company doesn’t get scooped up tomorrow, it could very well go public in 2023. And, the company executives also decided to close the current “funding round” on February 1st, 2023. Meaning, you’ll want to jump on this opportunity ASAP.”

That “close the funding round” on February 1 was just the default selection for StartEngine, in case you’re curious — StartEngine funding rounds default to 60 days, but the deadlines can always be extended if they’re not meeting their funding goals — with this latest version of the ad, they’re highlighting that the “deadline” is now April 4, 2023. I’ll be surprised if they don’t extend it again, but one never knows. And no, there’s no way that they’re “going public” in 2023, that would be ludicrous.

But I’m getting ahead of myself, let’s finish covering the basic idea that Milner has been pitching…

So what is that “Neural Vision” idea? It’s basically an assertion that self-driving cars right now are using an “outdated and inaccurate” view of the world (“blurry” is the metaphor they use), and that a new technology is going to give these cars better “vision” — here’s a little excerpt:

“… because of a new technology being pioneered by an under-the-radar company based in Silicon Valley , a solution for this industry might be just around the corner…

“In fact, thanks to the [neural vision device], the promise of self-driving cars may finally be realized…”

And Milner sums up the opportunity here:

“According to my research, ‘Neural Vision’ could…

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“Save over 1.2 MILLION lives worldwide…

“Be the ‘missing piece’ that the $7 trillion autonomous vehicle trend NEEDS to blast off…

“Help turn your existing car into a driverless car — for 1/200th the price you could pay for a new self-driving vehicle!

“And potentially hand early investors up to 59 times their money as this story unfolds!”

So we’ve got both the big picture spiel, which is that autonomous vehicles will dominate the $7 trillion automotive business and the trucking business, and that sounds very familiar — that’s the pitch we’ve heard for more than a decade now about self-driving cars and their inevitable rise. It’s probably even true, to at least some extent… though, like so many technological changes, it’s happening gradually (adaptive cruise control and lane-watching sensors in most new cars, for example, instead of fully self-driving capabilities). Humans are such terrible drivers that it seems inevitable that safety and driver assist technologies will keep pushing forward, helping to save lives, and the line between that and a robot driving your car for you gradually begins to blur.

And we’ve also got the “this company does it better” spiel, with the heart of that argument being that this company uses a clearer view of the road to issue driving instructions to your car… which is a little odd. The argument is that your car’s computer somehow needs the view of the road to look cinematic, instead of the machine-readable LiDAR or radar or other 3D mapping technologies that are used by many cars today — that drivers don’t feel safe with self-driving cars because the cars are using something that our human eyes don’t appreciate.

Here’s how he puts it:

“Neural Vision gives your car a crystal-clear view — not only of what’s right in front of you, but also what’s waaaaay ahead of you, too!

“It can identify everything from other cars and pedestrians, to street signs and traffic lights.

“And the image comes through in crystal clear 8K technology.

“To put that into perspective, today’s flat screen TVs have 4k technology…

“Which means this Neural Vision technology is TWICE as clear as today’s highest-quality TVs!

“Simply put, this solution blows the other self-driving ‘vision’ companies out of the water…”

And he says that “the company behind this breakthrough believes that current self-driving cameras will only provide 6% of the resolution that its ‘neural vision’ tech does.”

OK. So mostly it’s “higher quality cameras?” That will also create more challenges, of course, because a big part of the work of an autonomous vehicle is in quickly assessing and reacting to the world around you — and I would assume it’s much faster to interpret a machine-readable LiDAR map of the outside world than it is the input of a high-definition camera. But I’m not at all an expert on this stuff, to be clear, that’s just my skepticism coming through.

What, then, is our new special secret private company that sells a self-driving system for current cars, and which is 10X more powerful but costs 200X less? We’re also told that this company has a patent on its “vision” system, which turns out to be a patent that’s titled “Super Resolution Binary Imaging and Tracking System”… so we can be definitive in telling you that company being pitched by Crowdability is Epilog AI… which, until the AI craze re-ignited a couple months ago, called itself Epilog Imaging Systems.

And yes, Epilog is raising money on StartEngine right now, with the goal of manufacturing their first 1,000 self-driving “units” in 2023. That initial product is called “SideCar”, and it’s really more of a “addressable market” story than it is a “better technology” story — the goal is to retrofit existing cars for self-driving, using their vision system and design to build “boxes” that can be added to cars to provide a self-driving capability. It’s likely to be limited to cars that already have a lot of driver-assist features that they can plug into, like lane-keeping assist and adaptive cruise control, since the SideCar is meant to be installed in place of the cameras you probably already have behind your rearview mirror (so far, they say their test models will be compatible with most Toyota and Honda models).

They’ve raised money in the past, too, and the story has morphed a bit as they’ve raised money and tried to push forward with their first release of the SideCar project — they got distracted for a while with a different product they were calling Tempo, which was a fever-detection system inspired by COVID, also using AI processing of video signals, but that has now been dropped and they’re “all in” on SideCar again.

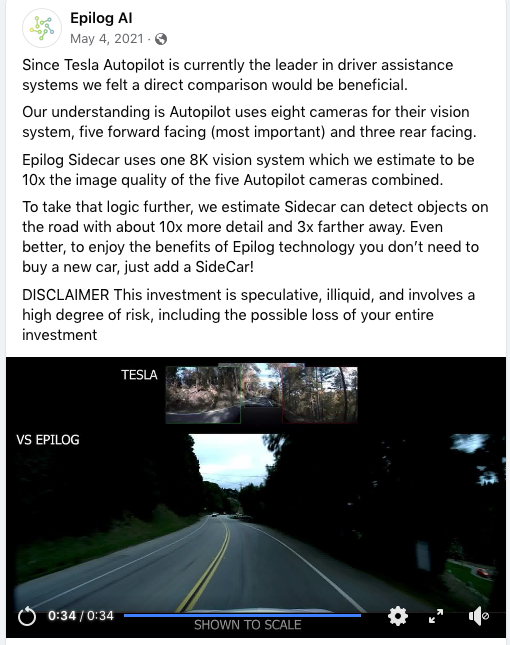

And yes, they do make the pitch that their “higher image quality” is going to make their driver assistance system better — last year they offered a head-to-head comparison to the Tesla Autopilot (this is from a May 2021 Facebook post):

Right now, Epilog’s pitch is that they’re currently manufacturing the first 1,000 SideCar modules, so they will soon generate some revenue — assuming they can sell all of those modules that they build, for their planned $999 price, that would be just shy of a million dollars in revenue. They’ve raised $4.5 million in the past, mostly through other crowdfunding efforts, and have so far raised about $230,000 in this particular campaign, which started in December and was supposed to end on February 1, but was extended to April 3 (as I said, they may well extend the deadline again, they’re falling well short of their funding goals so far).

The latest note from Epilog in their StartEngine postings is that they “expect all the parts by the end of March,” and the latest estimate of the cost for each module is ~$575, so there is at least the potential for a profitable business if they can scale up dramatically with their next iteration of the device. Assuming there’s demand. That’s all awfully hypothetical, though, since it has taken them about a year to even find the parts, I imagine the costs have changed in the last six months, and scaling up in any meaningful way would require partnering with some kind of contract manufacturer (which would probably mean having a lot of cash to put on the table to get moving).

When I review their test videos and marketing materials, it seems like they’re effectively swapping out the module that most modern cars have behind the rearview mirror — replacing that camera and sensor with the SideCar assembly, and thus connecting to the car’s computer to effectively offer a “juiced up” version of adaptive cruise control that will stop and start the car, and hopefully react to obstacles and traffic signals. I’m not sure how much “thinking” the SideCar does in analyzing the world, or whether it’s actually an AI system that is capable of “learning” or getting over-the-air updates, and it does not appear to connect to GPS, so it won’t be making any turns for you. I have no idea whether there’s any regulatory oversight for this add-on product, but it looks to me like it’s at least far short of the “full self driving” that Tesla always claims is right around the corner (and even probably short of the “Autopilot” they now offer). Which is good, because if their cost per unit is $575 that probably means they don’t have any high-end AI processing hardware in that box, you’re not getting a NVIDIA self-driving brain for that kind of money. So it’s probably safer to say that they’re offering “super duper cruise control” than “self driving.” I may be misinterpreting what the product is, but that’s how it appears to me. They use some of the open-source openpilot software from Comma.ai, which offers a somewhat similar bolt-on product called the Comma Three (more mature and expensive, with the first version hyped up seven or eight years ago… but not installed as permanently as the SideCar, and includes a display).

That patent that Crowdability cites in some of their ads, incidentally, is available here — perhaps you’ll be able to judge whether or not it’s uniquely valuable. I started drifting off halfway through the abstract, so you’re on your own with that.

Like other crowdfunding projects, there are “rewards” for buying in early — the minimum investment is 68 shares, which at $2.83 per share is $192.44, but larger investments get a bonus… $350 will earn you a T-shirt, and if you pony up $5,000+ you can get a SideCar “free” (assuming they can actually start delivering their first planned run of 1,000 test models — they’re now saying “April” for deliveries, but that has been pushed back before and could be again.)

So there you have it, dear friends — a small company believes it has a better high-definition camera-based self-driving system, and plans to start selling their first batch of those products in a couple months. You can invest in the company if you like, and can either daydream about them being taken over by someone big and becoming the next MobilEye, or hope that the SideCar is a big hit and they’re able to raise more money to build more units, cutting their costs and streamlining the product, and maybe someday earn a profit if they can sell hundreds of thousands of units or convince some automaker to partner with them. Or maybe even go public, if things work out spectacularly well in a few years. If you want to see some less sales-pitchy and more sober commentary from the company, you can also check out their limited filings with the SEC — even Crowdfunded companies have to file some regular reports with regulators.

For some perspective, buying into the wildly overvalued shares of Tesla (TSLA) right now would be a dramatically safer bet on camera-powered self-driving than speculating on the launch of SideCar. (I’ve never bought Tesla, to be clear, though the price of that stock did get closer to “rational” with the collapse in January — it has since bounced back quite a bit.)

As you might imagine, I’m the grumpy curmudgeon over here, and I won’t be holding my breath — but sometimes it’s fun to dabble in venture capital and enjoy a little of that entrepreneurial optimism. Feel like putting on your Peter Thiel mask and trying to figure out whether Epilog founders Michael and Lance Mojaver might be the next Austin Russell? Let us know with a comment below.

Disclaimer: Of the companies mentioned above, I own shares of NVIDIA and Alphabet. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

so what stock is being recommended?

Couldn’t stand to read the whole thing, eh? Sorry about that. Epilog is the name of the company.

Well, I surely wish Epilog every success in their startup, which they will have to achieve without any funding from me. On the other hand, if there is a glitch in their device that causes some crashes on the road, they may have to change their name to “Epitaph”.

Hahaha clever

I got the answer in about 15 seconds. But then I have no problem paying $49 a year for the quicktake, I strongly recommend it.

The offering for Epilog is closed

Says on StartEngine that it is currently open, end date is in a couple weeks unless they extend it again.

Just looked at Epilog offering it is open still but they have only raised 244,000. ?? Can this be right, is the financing a flop?

Looks quite floppy to me.