Today, for your holiday reading pleasure, we’re re-sharing a teaser solution that’s still being asked about (and apparently still being heavily promoted by the Sovereign Society folks).

The original solution to this teaser appeared in a Friday File commentary, so some of you may not have seen it. I’ve excerpted most of the teaser solution from that Friday File below, and then added an update on the company to the end of today’s article. The ad started running about four months ago, and my teaser solution first appeared on June 3 — the ad has not changed significantly as far as I can tell, but it is running heavily enough again to send questions my way… and what follows is mostly unchanged as well (except for the update at the bottom).

And yes, this is an instance where my curmudgeonliness would have resulted in a missed opportunity, at least at the moment — I wasn’t very enthusiastic about the pick, but as of today the stock is up pretty big since the teaser started running (more on that in a minute).

This pitch, which a few of you have asked about already, is from Paul Mampilly in an ad for a service called Profits Unlimited — and it’s another “Internet of Things” spiel… which is actually a little bit refreshing. The internet of things is a big deal, it is important, and it will have a substantial economic impact over the next decade even if the consumer part of it (the smart home, wearables, etc.) doesn’t take off as much as we expect or in the precise way that we expect. The increasing “sensorization” of the world, with remote monitoring and sensor networks checking on bridge integrity and jet engine performance and traffic and everything else you can imagine is going to proceed apace.

So it’s nice to be able to look at something like this with a genuine and powerful business trend behind it, instead of something like virtual reality that I think is much more uncertain, and much further from widespread deployment (outside of video gaming, at least). Whether that means there’s a great stock idea coming from Mampilly, well, that’s another question entirely — the newsletter marketing industry thrives on the power of big ideas, and on the ability of a crafty copywriter to go from that big idea to the “one stock that will rule the day” without stopping in the middle to consider competition, margins or other boring and distracting things like that.

Or as I like to put it, the promises are often akin to “Rain coming, you will get rich by buying stock in Acme Umbrella.” There’s an appealing logic that rings true, but when you think it through things are rarely that simple. There are other umbrella companies, to say nothing of ponchos and raincoats, and maybe it won’t rain for as long as you thought, or new umbrella companies will cut their prices and try to take share once they realize it’s going to rain for years.

But anyway, at least it’s a real trend that’s already pretty well established, and there’s little that’s faddish or particularly speculative about a lot of the projections of growth. More stuff is getting connected to the internet, we’re collecting more important data about more stuff in the real world, and that is going to continue.

Paul Mampilly has been a newsletter guy for at least several years — he started out at Palm Beach Letter, I think, and pretty quickly moved over to run the FDA Trader for Agora Financial, then ran Professional Speculator for Stansberry during that letter’s very short life… and now he’s running this Profits Unlimited service, which appears to be a new “entry level” newsletter for the Sovereign Society. That’s a lot of moving around, which typically seems to happen when newsletters are unsuccessful at quickly building a sustaining level of readership (which is not necessarily the same thing as having an unsuccessful investing record).

So what’s Paul Mampilly’s stock now?

Here’s a bit of the ad, to give you a taste:

“The Greatest Innovation In History… 7-Times Bigger Than Computers, Tablets And Smartphones … COMBINED!

“Experts Predict 50 Billion Devices Will Utilize This New Technology By 2020. Early Investors Stand To Reap Tremendous Rewards As Its Growth Surges 8,000%…”

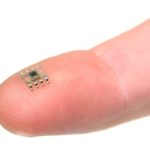

And he repeatedly shows the photo of a tiny little doohickey on top of a dime, to emphasize the teensiness. That little doohickey is some sort of sensor, though it’s not particularly specific about what kind — and, as you can imagine just by thinking about the number of chips and sensors that are in your phone, or in smaller stuff like a fitbit or Apple Watch, being tiny enough to fit dozens of them on a dime is not that shocking and doesn’t really narrow it down.

The pitch is, of course, hot and heavy:

“Insiders are calling the science behind it ‘the greatest innovation in history,’ ;the future of technology’ and the breakthrough that will ignite the ‘second Industrial Revolution.’

“That’s because this tiny invention is predicted to ‘rival past technological marvels, such as the printing press, the steam engine, and electricity’…

“Ushering in ‘a period of economic nirvana.'”

I don’t know about that “economic nirvana” bit, but otherwise I generally agree — with the caveat that the world has grown far more complex, and this is far more complex a budding network than was the internet or the railroad int early days, and could be far more distributed and chaotic in its development, so I think there’s a huge amount of guessing that’s taking place about exactly how it will evolve and who will benefit most.

I’ve already gone on for probably too long in chattering to you today, so you can check out his ad if you want to see the rest of the breathless lead-in, but let’s just jump to the specific clues about Mampilly’s current favored stock:

“In a moment, I’ll tell you about the one little device that’s at the forefront of this technological revolution, and who makes it.

“Most importantly, I’ll give you specifics on how you can personally profit from it. In fact, if my analysis is correct, you could potentially see thousands of dollars turn into hundreds of thousands of dollars in a short amount of time…..

“It reminds me of one of the biggest stock market successes in modern history … Microsoft.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“If you were to invest in Microsoft back on March 13, 1986 – the day Microsoft went public – a $1,000 investment would be worth $838,833.

“I think this opportunity could do the same for you … without having to invest in an IPO or take on unnecessary risk….

“On the cutting-edge of this breakthrough technology from a well-positioned company that’s begun massive production of this little device….”

OK, so that gives us some idea… a company that’s already producing these little sensor chips, or something similar that’s an important part of the evolving “internet of things” ecosystem. But which one?

OK, so that gives us some idea… a company that’s already producing these little sensor chips, or something similar that’s an important part of the evolving “internet of things” ecosystem. But which one?

More clues:

“The Internet of Things is the future of ALL technology.

“The time to take action is NOW.

“And at the epicenter of it all is a tiny device made by a cutting-edge company that could hand early investors 5, 10, 20, even 50 times their money….

“… a remarkable – yet overlooked – company is at the forefront.

“This company is literally at the pulse of everything shaping the new Internet.

“If you were to make only one technology investment in the next decade, this should be the one.

“I have absolutely no doubt.

“Here are the details…

“As I mentioned, the Internet of Things is going to connect 50 billion devices by 2020.

“And the absolute best way to capitalize on this phenomenal opportunity is to invest in the one component that makes this technology possible…

“It’s the same component that’s behind the biggest tech stocks in history.

“I’m talking about software.

“Software is the secret to technology riches.”

Huh? I thought he was talking about those little sensor chips, and the company that makes them. Do they also make software? Maybe. Perhaps some more hints will clear things up….

“You see, in order for the Internet of Things to work – every device must have one piece of software.

“A tiny piece of technology called MEMS, which is short for microelectromechanical systems.

“MEMS are tiny low-power sensors … so tiny that 100 of them can fit on a dime … some versions are just a thousandth of an inch in size.

“The Internet of Things will be able to sense, think and act, but only with these sensors. They are, quite literally, the eyes and ears of the Internet of Things.

“That’s why investing in the right sensor company could mean life-changing profits in the next year.”

And yes, he is talking up a sensor company, not a software company (though obviously data collected by sensors is worthless without software of some kind)… he gets more specific and actually does talk about some of the competitors, which is admirable:

“So, to get in on the action, you will want to own a company that makes these sensors.

“A few leading sensor producers are Texas Instruments, Hewlett Packard and Bosch.

“Each company has strong profit margins … and when demand surges, profits will skyrocket….

“I’m not recommending you buy shares in any of these companies.

“For the folks who follow my research, I prefer recommending smaller companies that are well-positioned for this type of growth and that have less exposure to other risks….

“Formed in the mid-‘90s, this European-based company’s CEO is a 40-year high-tech pioneer, and he’s using his industry contacts to lock in some stellar contracts…

“Investing in this corporate pioneer today will position you perfectly to enjoy a ride on the greatest technological wave history has ever seen.

“In the last few months, Apple, Samsung and Bosch have already signed on to his firm’s sensors.

“Fact is, even if only a small portion of the $19 trillion flows toward this $5 billion firm, the growth will be through the roof.

“8,000% growth is being conservative.”

Ugh. Know who this is? He’s hinting about STMicroelectronics (STM), which has been a slow-motion train wreck of a company for most of the past 20 years. Here’s their chart since the 1994 IPO:

The CEO, Carlo Bozotti, is indeed a 40-year veteran of the chip business (I don’t know if he’s a “high-tech pioneer”), and his entire career has been at STMicro and, before that, SGS Microelettronica, which was one of the companies that merged to create STMicroelectronics — an intentional creation, with government backing, of a “European Champion” in the semiconductor business (the other was Thomson Semiconducteurs).

And yes, the company has a market cap of about $5 billion (according to YCharts, it was a $25 billion company at the IPO in 1994… over the past five years it has fluctuated between $4-9 billion). And it is trying to reorganize and restructure (as it has seemingly done almost continually over the past decade) to focus on some growth areas in chips, including their strong MEMS division and other “internet of things”-related chips (you can see how they describe themselves here).

And I’m not kidding when I use the phrase “trainwreck” — that doesn’t mean the company can’t get growth going, but it means it hasn’t done so for a very long time. The last time they posted sequential revenue growth on a trailing twelve month basis (as in, the revenue for the past twelve months in the March quarter was higher than the revenue for the past twelve months in the December quarter) was 2011. That’s a long time to have gradually stagnating revenues in an industry like semiconductors, where price competition on margins is relentlessly painful for even the strongest and most innovative companies.

As you might guess, given the slow collapse in the share price over the past decade or so, it’s not just revenues that have been falling — profits have been weak as well. They have been reducing costs along the way, on R&D as well as general operating costs, and they’ve shed divisions and sold stuff, but it hasn’t been enough. In five of the past ten years, they have lost money — they have also bought back some shares, and some years they have made a profit, but there’s been no particular trend of improving performance that I’ve seen (other, arguably, than the gradually “less bad” years of 2012-2014, when revenues declined but they were gradually improving the bottom line… that string of small hopes stopped in 2015).

If you try to take any near term impact out and guess at the long-term earnings power, making no assumptions about booming growth in their sensor business, then the average adjusted net income per year for STMicro is about $230 million (“adjusted” mostly takes out one-time costs like restructuring, which they’ve done a lot of). The company has a market cap today of $5.3 billion, so it’s trading at 23X their average adjusted earnings over the past decade.

That’s not completely wild, though I think it’s an awfully high number for a company that’s not growing. So… will they grow?

Analysts are ready to be optimistic about STM — they expect that the company will have revenue growth next year for the first time in six years, and that this will turn into earnings growth and bring 41 cents (a number that’s come down slightly in recent months) in earnings per share in 2017, and that they will then post 50% annual earnings growth for five years after that. Which is a pretty remarkable turnaround after average annual declines of 20% for the previous five years.

I’ve written about STM a few times over the years — it was very aggressively teased as the maker of the “one device to end all disease” by Michael Robinson back in 2013, and before that it was pitched as far back as 2007 as the company of “Geneva tech wizards” who would dominate the next tech boom (chips that would enable smart houses, the Wii, the first iPhone).

At both of those times, Wall Street analysts were just about as optimistic as they are today. In 2007 STM had a forward PE of 15 and expected growth in the 20% range, and those forecasts turned out to be way too high (to be fair, 2008 wasn’t a great year for anyone, but most of the other years weren’t so hot, either)… in 2013 analysts were expecting about 38-40 cents per share in earnings by 2015 (STM actually earned 12 cents, or 17.5 cents in “normalized” earnings last year) and about 60 cents in earnings per share by 2016. 2016 forecasts today are for 16 cents a share, and even in 2017 analysts are now expecting just 41 cents… and, obviously, we should have learned by now not to put much faith in those analyst estimates.

So… will STMicroelectronics turn around? It’s not going to be easy — partly because the “activist investors” they’ve had to deal with are the French and Italian governments, which together still own large stakes as far as I can tell (Italy was planning to sell some in their debt crisis, but the last news I saw was that France and Italy combined still owned 27% of the shares). Those “activists” don’t much like restructuring or layoffs, and they definitely don’t like the continued poor performance.

The CEO has been in place for 11 years, presiding over many of the strategic errors and bad luck and weak sales and losses, so it’s hard to see why he still has a job, frankly — let alone why we should be convinced of his ability to turn the ship around. Maybe he can, and maybe the weakness has nothing to do with him (I’ve heard many folks blame the mismanagement on government interference, though I don’t know the details). Recovery is far from being impossible, and STM does have an admirable manufacturing capacity in MEMS chips, as well as a large amount of probably valuable intellectual property regarding those sensors and the other broad areas of business STM participates in within the semiconductor industry… but I have a hard time considering it to be likely without becoming an expert on the company and their strategy. Maybe Mampilly is an expert and has some insight that I don’t — but, as he also notes, there are several much larger companies who also make a lot of MEMS chips… and lots of smaller ones as well, many of which have also been struggling in this hypercompetitive environment.

Few of those companies have numbers that look as weak as STMicro’s if you just skim through the top-level financials. NXP (NXPI), which I wrote about last week and which focuses on a lot of the same end markets with somewhat similar product offerings, has gross margins of 45%, Texas Instruments (TXN) has gross margins in the mid-50s, even little Invensense, which itself has struggled thanks to overreliance on Apple and Samsung, has gross margins above 40% (their performance over the past three years has been even worse than STM’s). STM has gross margins of about 34%.

So believing in STM, even at what looks like a horribly depressed price compared to their 20 year history, means believing that they have some way of fixing things and righting the ship, and that they really can get to revenue growth and earnings growth again, perhaps on the strength of their focus on MEMS chips that will be used in the internet of things, self-driving cars, etc. The problem with that picture, as I see it, is that all the other strong companies in the space know about these trends, too, and they’re all working toward dominating those same markets. I’m a lot happier betting on a strong, profitable company going into a competitive growth phase than I am betting on a company that’s counting on external growth to help them fix problems they’ve had for more than a decade.

I might be overly critical because of STM’s history, so in that case the possibility is that STM isn’t getting enough credit for the potential of their turnaround, and for the rising tide that might lift all ships. In that case, I can live with being wrong and missing that opportunity, partly because I don’t think STM will do dramatically better than the companies I’d feel more comfortable buying. STM might work as a turnaround, and the assets are valuable and they do arguably have a leadership position in some MEMS chips… but I’d much rather go with NXPI, TXN or other somewhat related stocks like Broadcom (AVGO) that are showing some underlying business strength. It’s possible that I’d pick STM over Invensense (INVN) or Qorvo (QRVO), two other relatively weak competitors who are suffering some in comparison with the leaders, but I haven’t looked at those in detail of late… and, thankfully, I’m not forced to pick one of the laggards today. I have a lot more faith in NXPI’s growth potential as an internet of things play, despite its larger size, than I do in the perennially disappointing STM.

UPDATE: STM last released earnings about two months ago, and the stock had a nice rise following that — it’s now up about 30% since I first covered this teaser pitch on June 3, which erased the swoon of the first half of this year (the stock is now up almost 14% over the past 12 months). That’s certainly a more positive couple months than my favored big chip stock (NXPI) has had, even with the latest surge from NXPI’s takeover rumors… though I’m still more comfortable personally with NXP Semiconductor than I am with STMicro.

The company’s quarterly earnings were right in line with expectations, thanks to some strength in autos and “internet of things” networking applications, but the company issued optimistic guidance about the third quarter that was rosier than analysts had expected (much better revenue growth, and a forecast that gross margins will be well over 35% — Bloomberg story here), and the stock popped by something like 10% on the news almost immediately.

That’s impressive, to be sure… but I’m not jumping on board this one. That optimism means that there will be a lot of eyes watching STM’s next quarterly release on October 27, and with this surge over the past few months has built expectations up pretty substantially. The estimate right now is for eight cents per share in earnings — and for what it’s worth, the third quarter of last year was the most recent quarter when the company actually beat earnings (the last three quarters have been weak), so perhaps Q3 is just a good time for them (though eight cents in earnings would still mean that they’re not growing year over year). Both the results and the forward commentary about the end of the year are likely to have a big impact on the stock price.

As I noted above when I originally wrote this piece in early June, I may be feeling too pessimistic about STM because of its long and disappointing history, so your opinion may certainly differ from mine. If you’ve thoughts to share on STM or their competitors, please feel free to toss them on the pile with a comment below — thanks!

One of the best IOT plays out there, only concern is will their SOC implementation will be embraced or go wayside of competitors i say they will do fine and prosper

I think the ST of the company will go up, but the LT will go down, down…. as it has so many times before.

I am confused. My handle is rernst and I did not post this, Travis, is there 2 rernst’s in the database and if so I think that I will need to change my online name to something different as not to confuse people. This is strange to me and I hope this other rernst has not hacked into my database. Thanks Travis!

Only an 8,000% projected gain? I’m only interested in stocks that will gain over 10,000% : )

Now that’s funny!

That is hilarious!

That brings to mind the people that only play the lottery if it is a very large jackpot.

Funny!

I’d love to know a particular stock with potential gains of 10,000%.

If you people want to contribute then please do so properly and not assume that everyone knows the abbreviations that you are using…you might- but it’s big-headed to assume everyone else does eg Dean: what (TF) is lOT and SOC and then RERNST with :ST up and poor LT down !!! don’t be so ffen lazzzzzzzy.

IOT is Internet of Things. SOC is System On a Chip. ST is Short Term. LT is Long Term.

Ask nicely. Manners are key to people being kind to your request. 🙂

What does ffen mean?

Ya kno…ffen you don’t obey you will pay. jst sayin

Locker room talk

Travis,

I cannot help but notice that in all your articles and solutions to same, they are all punctuated with the very Adverts eg “Two Best Biotechs”,

“7 Greatest Dividend Stocks” to buy etc,etc.

Would it not be a service to immediately solve those Puzzles before waiting for someone to request your service ?…will this comment get through this time!!?

If you mean the ads that appear next to articles, those are different for everyone — I often do write about the ads that appear either on the site or in the newsletter, but I keep the editorial separate from the advertising so any day’s ad is likely to be different than that day’s article.

I actually think it’s cool that a free service, which I personally think is my most honest Stock Chat read is blatant enough to be supported by the enemy.

I’m only disappointed there’s not a UK version.

Good guess. STM is the teaser stock but it’s NOT in his portfolio. This does not make any sense to me. I cancelled FDA Trader and am still sitting on some losses and will probably cancel this one too.

I don’t subscribe to his letter so I don’t know how he’s treating this stock — two possibilities that are pretty common in newsletterland: 1, he had the stock in his portfolio but sold it and the publisher is still using it in ads because the ads worked well last time; 2, he never had the stock in his actual portfolio but it’s a “special report” idea that gets treated separately from whatever the running “portfolio” of picks might be.

I wonder why he is not teasing INVN, which specializes in sensors. STM is a broad line semiconductor company with sensors probably a very small percentage of its total revenue.

INVN specializes in a pretty narrow line of sensors, mostly gyroscopes and multi-axis accelerometers as I recall, and is much more reliant on a couple big customers (Apple and Samsung). STM is a much bigger and broader player with exposure to more industries and end products, and makes more sensors (MEMS) than anyone else… and arguably has the best patent portfolio in MEMS. I have trouble getting excited about either at this point, but That’s the basic argument for STM over INVN.

Also INVN was one Of Motley Fools great picks which seems to have gone in the opposite direction of what they claimed.

Yes, I liked it (and owned it) for awhile as well — that stock was a lesson in who has the pricing power in semiconductors… it ain’t companies who make gyroscopes that are slightly better than other companies. As long as there’s a relatively small technical difference (like a “six month head start” on competitive products), and no overwhelming reason to go with an existing provider for reliability or compatibility reasons (like there is with automobiles, for example), it’s a buyers market where huge customers like Apple and Samsung have sometimes overwhelming power.

It’s not motleyfool’s first backwards recommended stocks that go backwards. They are a ripoff. I subscribe to Rule Breakers and it lags as in staying updated. They use to give their 10 picks on Rule Breakers but now you have to join Stock Advisor to get them. This year I have to join Stock Advisor. I’m Locked in to Rule Breakers until 2019. So to get their stock picks this year I have to join Stock Advisor.Just beware to just sign up to them for just one year. Because next year they will create new different issues to get their new picks for 2017 teasers.

Looks as though David and Tom read Gumshoe. LOL

THANKS TRAVIS !!!

What happens to the IOT when a killer solar flare hits the earth?

Probably the same thing that happens to all other small electronics and communications systems.

One reason I find it not to good of an Ideal beginning to launch so many satellites to use as wireless. We as a world are relying to much on electronics and wireless.

One reason I like the Trans Atlantic optical fiber using optical amplifiers connecting one side of the Atlantic to the other. Another downside to satellites is trashing up the upper atmosphere. Broadband relays is the way to go.

They will burn and fry. That will double the market for replacement IOT’s. Win!

We’ll instantly revisit the late 1800s.

What’s the difference? We will never know, because we rely on electricity to know, and 95% of us would be dead in six months anyway since civilization as we know it would collapse, we’d starve, die of thirst or exposure (primarily exposure to other humans trying not to die of starvation or thirst). If coronal mass ejections worry you, sell everything you have and try to start a self-sustaining farm that relies only on animal power; i.e. a pre electric lifestyle circa 1850. And, um, no medicines, those pills and potions take electricity to produce. Also stock up on guns, and while the electricity is still on, build a deep moat and some very tall rock walls. Proven solution.

My fleet of one thousand solar powered drones will sweep in and swipe your crops.

Damn. A friend’s son started working at Bosch (post grad engineer) about 2 years ago and is absolutely full of praise. I started looking into it and the more I discovered the more I like BUT my new 11 year old stockbroker told me it’s a family owned business and you can’t buy shares in it. Now I read ‘Bosch (BSWQY)’!!!!

I’ve actually bought a lot of product since then, full solar water heating system, super efficient oil boiler, white goods for a new kitchen and I read they’re well involved with compndnts for driverless cars…that’s for me so thanks for this write up even though the usefulness was in another direction.

BSWQY – Does it actually exist?

Seems to exist but not a lot of action: http://web.tmxmoney.com/charting.php?qm_symbol=BSWQY:US

Your stockbroker is only 11 years old?

http://economictimes.indiatimes.com/bosch-ltd/stocks/companyid-11911.cms Found this link. Live right down the road from a “Robert” BOSCH plant that makes braking components for cars. They are heavily into Internet Of Things( acronym= IOT) The link has their stock price from NewYork Stock Exchange (NYSE) The price is super high really hard to tell what market has ET Markets also, Travis if you could just click link at start and see. Posted for because of Karl’s post.FYI (For Your Information). thinairmony

Doesn’t Bosch make all those European dishwashers and washing machines that take 2 1?2 hours to clean anything because they are ever so eco-friendly?

What happened to my comment about Bosch? I posted it an hour ago.

I only see 2 posts Karl; Good morning:

https://twitter.com/Gardener_John/status/765790784167645184

In /most-recent-comments/ Best2All-Ben

It’s up, Karl — comments get flagged by the system and held for human moderation for a variety of reasons that aren’t always intuitive, not sure what tripped that one.

My guess ii was BS as part of BSWQY

Nope, BS posts immediately

So glad I found Stock Gumshoe. Thanks for the awesome explanation on Paul Mampilly’s greatest stock known to mankind. (STM) STMicroelectronics. My question is this. Paul also talks a lot about Apple, IBM, Cisco, Google, Amazon, Skyworks Solutions and Iridium Communications. What say you?

Ever heard of Rolm? Bought a small mems manufacturer Kionix out of Ithaca NY a few years ago. Kionix got their first big customer Apple approximately 10 years ago. They have been a pioneer in accelerometer and gyro technology along with asic design for awhile now. The brains behind this operation mostly come from Cornell.

That ROHM trades in Yen

You may have seen this. SHANGHAI, China, Aug. 1, 2016 (GLOBE NEWSWIRE) — STMicroelectronics (STM.PA), a global semiconductor leader serving customers across the spectrum of electronics applications, has been named the MEMS Manufacturer of the Year at the MEMS World Summit, a leading MEMS Manufacturing Conference gathering the top executives in the Worldwide MEMS Manufacturing Industry. The event took place in Shanghai on July 25-26, 2016.

Nice annual analysis of MEMS over at Yole: http://www.yole.fr/2015_TOP30_MEMS_Players.aspx#.V8NNZpgrIdU

Was thinking PM teaser was Infineon till I looked at Yole reports.

2015 Top 25 #MEMS mfgs via Yole: http://www.yole.fr/iso_album/illus_2015_top30_memsmanufacturers_yole_april2016_vertical_350x3508.jpg Thank you Keith.

In the PM teaser he specifically talks about Software and Systems – the MEMS fabs seem to provide just a component of the whole. That’s why like curiousjoe I am looking into the fabless InvenSense INVN:

http://electronics360.globalspec.com/article/6039/the-internet-of-things-needs-mems-and-sensors-plus-more-security-and-better-software

which curiously is also a seven dollar a share affair.

I’m out of investing and likely it will be a long time before I ever get back in. But I continue to subscribe to SG because you expose these modern versions of the miraculous snake-oil salesmen and their lies.

Thanks virgo! And we have fun doing it…

As usual, Travis Johnson gives us the info Straight, no chaser. And that’s what I call “Good Business.”

Do the same people write all these pitches for miracle stocks? There is a sameness to them. This one reminds me a lot for some reason of Kent Moors’ SUNE pitches, and we see where those went.

Yes, there is a marked sameness—kinda like the nearly identical structure of all TV shows, so there has to be a template that they all use. Sooo tiresome.

After receiving an email from Mampilly about getting involved in Profits Unlimited, I Googled as to whether Profits Unlimited and Mampilly was legit or a scam. As you can see, I’ve been reading your input (as well as other sites) to learn the truth. I’m a novice but gather from your article this is worth serious but guarded consideration and research.

It is, as mentioned in a previous comment further down that I read, more helpful to those of us reading your article if you would include complete terms along with abbreviations – I’m guessing STM = Short Term Margin for example. I realize this may be an inconvenience to those of you familiar with the terminology; however, it will be of great benefit to those of us trying to navigate and learn more about investing.

You are doing a great free service informing us with your articles and I thank you. I feel, with this upcoming general election and the many uncertainties our country is facing, the way we have invested in the stock market could possibly change according to how we’re used to.

STM is the ticker symbol, for STMicroelectronics.

What holiday is that? Just a few of your paying members, over the pond, have been at work all day!! Me included.

Columbus Day/Indigenous Peoples Day/Casimir Pulaski Day… take your pick! Kids out of school = an absence of clear thinking for your friendly neighborhood Gumshoe 🙂

Thanksgiving Day in Canada.

Tomorrow is our annual Indian Displacement Day. We celebrate when your nutty puritan Protestants came over and mowed down those Indians who did not first die from exposure to small pox and measles. Nasty guerrilla warfare with a lot of scalping and that sort of thing, but settled down after about 350 years. Officially known as Thanksgiving, just like the Canadians have, only they do it in Oct. and we do it in Nov. They have to do it sooner because it’s colder up there, at least in the East and MidWest.

If Paul Mampilly really means what he is saying why don’t he corner the stock for himself and get the 8,000% gains when it happens instead of pandering to the people to subscribe to his news letter. A Trumpeteer, maybe? Huh?