This update was posted on November 24, we’re re-sharing it here because of a huge number of new reader questions. It has NOT been updated or revised since we last posted an update on 11/24/2020, when Ray Blanco reporposed the ad to use the new invented target date of January 20 to replace September 22. Tesla has not confirmed the date of their next earnings report and conference call/presentation, incidentally, but it’s more likely to be a week or so after January 20, just in case you’re focused on that.

What we’re looking at today is a pretty craven repurposing of a dramatically failed teaser pitch, just to let you know that up front. Ray Blanco’s Catalyst Trader service teased this as their “Tesla Battery Day” stock pick back in September, and anyone who speculated on that happening at the last minute could have lost a lot of money as that catalyst turned out not to exist for this teased small cap stock.

Most of the ad is just a repeat of that “Battery Day Event” from Blanco, though it has been updated slightly to say that the big event is no longer Tesla’s “Battery Day,” now it’s some unnamed Tesla “investor event” that he says will come at 5:30pm on January 20, 2021… a day that seems to have been made up, though perhaps there’s some possible future event that I don’t know about (Tesla’s quarterly earnings report is likely to be about a week after that, for whatever that’s worth).

And yes, Ray Blanco is pitching a stock that he says will be the big winner of that announcement… so what’s the story? It is, no surprise, essentially the same pitch they used in September (once you have an idea that gins up excitement among potential subscribers, you keep milking it — and anything Tesla-related is exciting to people this year), but there are some minor updates, so I’ve gone through and added some additional notes to this article — though in substance it’s mostly unchanged since we first published on September 22.

What Blanco’s doing is trying to sell a new trading service — he calls it Catalyst Trader, and they say it’s Blanco’s “most premium service” at $5,000/yr. And, of course, Ray “convinced the publisher” to offer a discount — they’re selling it for $1,995 at the moment. And yes, as you might imagine, there is no possibility of a refund — even if Blanco turns out to be wildly wrong about this January “Tesla event” (just as he was in September).

Tesla’s big battery announcement in September was anticipated for months, it was originally delayed by the coronavirus pandemic… and it turned out to be a bit of a letdown in the eyes of investors. The promise from Blanco was essentially that Tesla would announce a dramatic improvement in battery technology, probably a battery with much higher storage capacity. Musk is not, of course, a subtle guy, and he’s been hinting at Tesla’s news for months, with talk about how this new battery info would impact production for Tesla’s trucks and roadster starting in 2022… while also, in Tesla’s previous earnings call, pleading the miners of the world for more nickel and dangling long-term purchase contracts for that metal for producers who can be environmentally sensitive and efficient.

There are lots of battery advancements made all the time, of course, this is not a business that is controlled by Tesla alone — nor is it one where advancements often come in surprise overnight announcements, the improvements are gradual and steady but also somewhat iterative… lithium ion batteries of the type that are currently used in Teslas, laptops, or your Black and Decker drill are heavily commoditized, production is dominated by giant companies like LG Chem, Panasonic and CATL, and my impression is that they tend to get a little cheaper and a little better every year, kind of like microchips.

A lot of that improvement is thanks to Tesla, which pushed for dramatically higher volume with the attention-getting Gigafactory — but there are a lot of huge battery plants around the world that are close to on par with the gigafactory, and there seems no end to demand increases (and, sadly, no revolutionary breakthrough that’s soon to replace lithium ion batteries — apparently and allegedly, even Nikola was just making theirs up to some degree. Trevor Milton seemed to have learned the “overpromise” tricks and the value of a tweet from Elon Musk, but apparently didn’t have the charisma to pull it off… or the ability to back it up with enough real and audacious progress on Nikola’s battery or hydrogen technology).

And now that this “Battery Day” event has passed, here’s how Blanco pitches the latest now:

“Act By January 20th For The Best Chance To Take Advantage Of A Company Set To Revolutionize The Most Explosive Industry On Earth

“On January 20th, a few minutes after 5:30 p.m. ET…

“Elon Musk will take the global stage at a Tesla investor event and what he says could shock the world.”

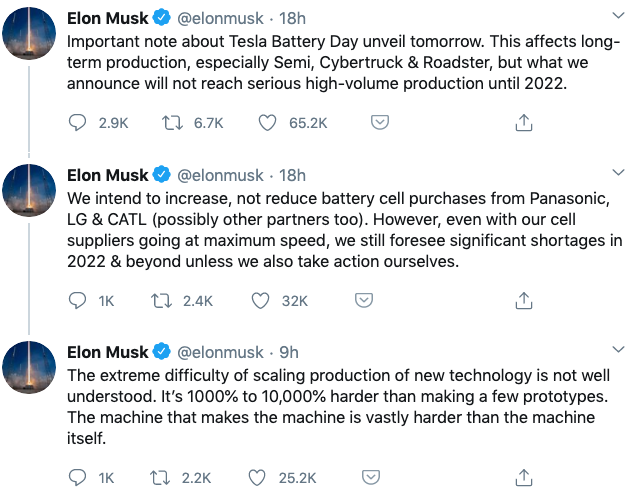

There was plenty of chatter about this “million mile battery” notion, and whether it would be surprisingly revolutionary… or will at least sound revolutionary when it comes out of Elon Musk’s mouth. The tweets leading up to Battery Day seemed somewhat tepid in comparison to his past hints about new product rollouts, but this is what he posted in mid-September:

And Blanco, of course, says that there’s “one tiny company” that will be the focus of Tesla’s announcement, and will drive shares of this little $2 stock dramatically higher tomorrow for the “biggest and fastest gain of the year.”

Here’s more of the pitch from the email…

“That’s why Elon has made it his mission to fix that problem, promising the world a million-mile battery in April 2019…

“Which would essentially make Tesla’s cars last much, much longer than their gas-guzzling competitors.

“And now, on January 20th… Elon Musk is finally prepared to make a massive announcement.

“But according to this man, the media are missing the most important part of the story…

“The story of how a tiny $2 company founded by a former senior Tesla battery engineer holds the key to the million-mile battery…

“A technology that’s already protected by patent application No. 3069168.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“According to this man, if Elon Musk mentions the name of this tiny company from the stage… there’s no saying how high its stock could go.

“If the stocks jumps by just $2, investors will double their money in a matter of minutes.”

And, of course, he ladles on that prediction of a 100% gain overnight into 1,000% in three months, and 10,000% in a few years.

The “presentation” from Ray Blanco and Aaron Gentzler comes with three “smoking guns” that Blanco says indicate this stock will be the focus of Tesla’s presentation to “all but guarantee” a major partnership is set to be announced.

And we’ll just put this quote from Blanco here for posterity, this is what he said about Tesla announcing their partnership with this little company on “Battery Day” in September:

“I’ve never been more certain of anything in my entire career.”

And, of course, he’s similarly “confident” about this next announcement too, which he now indicates will coincide with Tesla’s January earnings call…

“I’ve never been more certain of anything. Because this upcoming earnings call is when the whole world will be watching every word Elon says.”

The basis of this argument seems to be that Tesla, in the presentation (whether September’s or January’s), will announce progress toward their long-promised “Million mile battery,” and that Ray Blanco’s tiny company will be their key partner, announced at the event.

Blanco says that million mile battery is the “single linchpin” for a energy revolution, not just in electric vehicles but in energy storage for homes and businesses and all kinds of other stuff (he even hints that this company will be helping extend the battery life of the iPhone before too long), so what’s this “crucial part” of the story? What’s this $2 company? Will it “shoot up over 10X in value over the coming months?”

They use the typical marketing stagecraft of the “secret box” — though this time there are three boxes on the dais for their presentation, each one holding a “smoking gun” that Blanco says proves this company is going to be Tesla’s key partner.

Ray Blanco has had both hits and misses in his splashy presentations over the years, of course, though it’s worth noting that none of his heavily hyped stocks have come close to those kinds of dramatic 10,000% returns — like most stock pickers who talk up little “catalyst” stocks in tech and biotech, he has a lot of 80-100% losers and a few solid 100%+ winners in our tracking spreadsheets, though his best pick in my memory was a much more mainstream stock for his inexpensive “entry level” newsletter, when he teased NVIDIA back in March of 2016 as a virtual reality play (the VR stuff hasn’t really ever taken off as so many were hinting at back then, but the stock has returned about 1,300%).

The last time I remember seeing this kind of “tiny stock to get a big partner” marketing from Blanco, by the way, was when he was certain that little Energous (WATT) would be involved in a big Apple announcement, including the WattUp wireless charging technology in the iPhone back in 2016 (August 30 was when we covered it that year). That did not, of course, end up happening… and here’s what the price action has looked like for Energous over the ensuing four years, just as a cautionary tale about hype attached to “big announcements”…

So what are those “smoking guns?” That part of the ad is essentially identical to the September version…

The first one is that the founder of this company was a senior research engineer at Tesla from 2015-2017

And the ad says that back in 2015, Tesla hired the a team of engineers to lead the battery division — “Dr. D.” is what the leader gets called in the ad, and he has been referred to as “Tesla’s secret weapon”… and he also worked with the cofounder of this $2 company.

With a further connection as well — “Dr. D.” works out of a lab in Canada, and this secret company being teased today was apparently spun out of the same lab.

And Blanco says that his company is stacked with experts, including the former CEO of the largest chemical company, a retired admiral, and that Dr. D’s own son is director of engineering at this $2 company.

That Dr. D. is, of course, a reference to Jeff Dahn at Dalhousie University… so that’s all the confirmation we really need, Jeff Dahn’s son Jackson is the Director of Engineering at Novonix, the battery testing and technology company which was acquired by the Australian company GraphiteCorp about three years ago, with the new company taking the Novonix name shortly thereafter as it refocused on building its presence in the battery tech business instead of just producing commodity graphite materials for battery makers.

So yes, Blanco is teasing Novonix here — it’s a smallish Australian company, listed at NVX on the Australian Stock Exchange and trading on the pink sheets in the US at NVNXF (they’ve applied for the slightly higher listing standards of the OTCQX to try to bolster their presence with US investors, but apparently haven’t been approved yet). And the stock went bonkers in September because of Blanco’s pitch, which helped to spur several breathless rumor-mongering videos and tweets, so the shares got up over $4 at one point on the day Blanco’s ad really took hold (it was around $1.50 before that). As soon as investors realized that Blanco was wrong (along with other folks who teased similarly about Novonix becoming a publicly acknowledged key Tesla partner that day), the shares collapsed immediately, falling to the 80-cent range, where they have puttered around for the past two months.

The company is listed in Australia, so the fair price going into that September event, set in Australian trading overnight (for us in the US) would have been A$1.70, which would have been about $1.22 in the US. The average volume in Australia has been about 3.5 million shares a day, so that’s where you’d think the “real” price would be set, but once a rumor settles in for a thinly traded stock it’s hard to predict what will happen — the pink sheets volume in the US soared probably 20X the average pink sheets trading volume on this Tesla enthusiasm, before the rug was pulled out.

And from what I can tell, there has been no “new” news from the company — they did release their annual report a few days before Blanco’s original tease, so that’s probably a good place to learn about the company, but it wasn’t particularly explosive in any way I’m aware of. Their latest investor presentation is here, if you’d like that overview (it also includes most of the clues and screenshots that Blanco used in his pitch).

Tesla’s work with Dahn’s lab in Canada, by the way, is not new, and their work on new battery chemistries has already been discussed as a key part of building that million-mile battery when Elon Musk was hinting at that over a year ago. Of course, at the time Musk was also saying that it would probably be part of Tesla’s robo-taxi service by this year, perhaps even using those single crystal cathodes as part of the way they extend battery life, so it’s important to remember that “overpromising” is an important part of Tesla’s marketing.

Shall we go through the other “smoking guns,” just to be thorough? Very well…

“Smoking gun number two…

“The next clue is the list of customers from the company’s website, along with the small print notification that “for confidentiality reasons there are a number of major global automakers, battery makers, medical device and electronics companies that are customers but cannot be disclosed.”

“That’s a perfect match for the customers page on Novonix’s website.”

And yes, they do deal with most of the big battery companies I could name… though the extent of those relationships is anyone’s guess. Most of their revenue presumably comes from their battery testing business, which is what spun out of Dahn’s lab in Halifax and works with most automakers, but the future dream of large volume would come from selling PUREgraphite anode materials for ultra long life batteries. So far they’re trying to scale up to 2,000 tons per year of production for that anode material by the end of 2021, but they don’t say anything about what the revenue might look like. Their prior core business, before 2017, was the Mount Dromedary graphite project in Australia, and that’s on hold because of oversupply in the graphite market and their desire to move up the “value added” chain to higher margin businesses… and their future dream is to commercialize their DPMG technology to make “high-performance long-life single crystal cathode materials” that could be a big part of that “million mile battery” potential.

Novonix’s revenue has been largely unchanged over the past couple years, coming in at around A$5 million, though the change this year is that most of it came from customer contracts, not from “other income” (I assume that “other” is paid R&D work, but don’t really know), though their costs have also ballooned — if you ignore the one-time impairment charge in 2019, which I assume was from the graphite mine but don’t really know, then they went from a loss of about A$10 million in 2019 to A$20 million this past year (their fiscal year ends in June). They do have $40 million or so in cash thanks to their restructuring this summer and an equity offering, so that will sustain them for a few more quarters as they try to ramp up capacity for their contracts for PUREgraphite anodes, but this is not generally a high margin business and the scale of capital projects is crazy. They would like to produce 2,000 tons of their PUREgraphite anode material a year once they scale up, but, just for context, one gigafactory-size project (and there are now many of those around the world) probably uses at least 20X that much anode material in a year. Ramping up as a meaningful player in a huge, tight-margin business like batteries is a tough challenge, even if you have a unique technology that is somehow different or better.

And, also on the website, Blanco says this quote is a “smoking gun”:

“NOVONIX has customers in twelve countries including Apple, Microsoft, TESLA, 3M, GM, Bosch, Dyson, XALT Energy, Panasonic, ATL, CATL and more”

With NOVONIX blacked out, of course, since it’s “secret”

This was, Blanco implies, a “leak” — though that’s silly, it’s on the CEO’s bio page. More likely, the fact that Tesla is one of many customers for the battery test equipment sold by Novonix is not at all secret or particularly surprising… after all, Tesla has been the big funder for Dahn’s lab in Halifax for years, and the Novonix battery testing business was spun out of that lab.

And another?

“Smoking gun number three” is that they’ve got a patent, with the patent number 3069168 touted as having been filed with the world intellectual property organization, Blanco says this is the key to the whole process, and the key to what Elon Musk needs for the million-mile battery.

He shows the patent number, along with several images that are just screen grabs from Novonix’s website, showing the single-crystal cathode that they think is key to the durability of the battery. And implies that they’re already about to take over the market:

“They’re already cutting supply deals with Panasonic, Sanyo and Samsung, companies that represent 40% of the lithium ion battery market.”

With Blanco’s “interviewer,” Aaron Gentzler, saying “It’s almost like this $2 company is ‘cornering the market.'” Which is silly, of course, but hope springs eternal.

There isn’t a real way to be sure of what will happen with Tesla’s event this afternoon, and I have no particular insight. Elon Musk is always unpredictable, and I have no idea which technologies might be important that were developed in that Tesla-funded lab, or whether this spinoff from that lab a few years ago might have something even better, but I would be shocked if Tesla’s announcement involves a partnership with a little public company of any kind. Presumably this is a technological or design announcement about their battery work, and if I were to bet on today’s outcome I’d say any named suppliers are likely big companies, not small ones. That’s just a guess.

Blanco also says that…

“… this tiny company predicts they will be making 100,000 tons of battery material a year”

And that is the “back half of the decade” plan from Novonix, according to presentations they’ve made to investors, though their goal right now is still to get to 2,000 tonnes within the next couple years. Those presentations were covered by the Financial Review back in June, which also ends up summarizing some of the hope for the company.

Blanco also said that “insiders own 64% and keep buying more,” but as far as I can tell there’s been as much insider selling as buying… though some of the major shareholders did participate in the fundraising in June. I didn’t spend a ton of time sifting through the announcements on the Australian Stock Exchange, but I can’t find any indication of big individual buying — one big shareholder sold a huge chunk of shares just recently, directors like Robert Natter (that former admiral hinted at, a board member) have exercised options and then sold those shares, though St. Baker Energy holdings, an investment fund, has built up a big position at prices well below where it trades now.

What do I think? This was my immediate reaction when going through the story this morning:

If it were possible for me to sell Novonix short during the first wave of mania pre-battery day, I would have been extremely tempted to do so (it wasn’t, there have not been any shares available to short from my brokers for a long time on this one). The ideal strategy, I suppose, would have been to buy the stock in Australia before it hit the eyes of speculation-addled US investors this morning, then short the shares in the US on this crazy rumor-fueled surge, but, well, that’s just a day dream.

The original ad said this presentation was sent to as much as ten million people, which is, of course, why the stock soared on the hype — there’s no great secret here, and the stock was not hard to ID for anyone who was willing to sit through the “presentation” (which was, I admit, hard even for me to do), and several Gumshoe readers wrote in with answers to this tease, they all saw those same clues in the presentation and quite quickly found the right answer. Maybe that means I’m out of a job someday, but I’m sure the teasermeisters will keep pushing the envelope and finding new ways to pull the wool over our eyes.

The freely mentioned “other way” to play the electric vehicle boom that Blanco gives away in the end of the presentation, if you’re curious, is Fisker (FSR), which came out of a SPAC merger a little while ago in an attempt to build yet another Tesla competitor. Henrik Fisker’s baby was a bankrupt disaster seven years ago, but now the SPAC money is just sloshing around in the market and they’ve got plans to build a vegan electric car called the Fisker Ocean, so hope springs eternal in the car business. I have no idea whether or not Fisker 2.0 will work out, but I’d probably go in with some healthy skepticism.

Blanco, by the way, does also present us with a “guarantee” ….

“If the $2 Company is NOT named at the Tesla event tomorrow evening, I will upgrade your subscription to a lifetime membership.”

Which is a nice piece of marketing, right? Would you have signed up for a $2,000 lifetime membership to this new service before hearing about it today, sight unseen and with no possibility of a refund? Probably not, and yet positioning it as a discount, and as a guarantee, makes us feel like Ray Blanco has some “skin in the game” in making his guarantee because the “potential cost is in the millions” to him.

Which is, of course, not true at all — if you send him $1,995, then he’s got that money and the risk is all on you. Whether you love it and let it renew at $5,000 in a year, or just sit back and accept that you made a mistake and cancel at the end of the first year, he’s got your money and you don’t get it back. Even if you love it, and end up appreciating the lifetime subscription that will come after Novonix is (I assume) not mentioned by Elon Musk in January just as they weren’t mentioned in September, that’s still $1,995 that you’ve sent, probably irrevocably, to Ray Blanco’s publisher (I don’t know if they charge a “annual maintenance fee” for the lifetime membership like some folks do, they don’t mention it on the order form). Always remember that the price is a construct fully invented by the publisher, they can sell as many or as few subscriptions as they like, and at whatever price they like, to most efficiently extract revenue from the largest number of readers possible.

I don’t know how many other ways I can say this in response to these kinds of deals, but the primary goal of the marketing “funnel” used by newsletter publishers is to get you to buy premium-priced (usually $1,000+) research, preferably with no refund guarantees… yes, most legitimate publishers would prefer to have happy repeat customers, and some people love these publications, but the only thing the publishers “risk” in these cases is the possibility that they’ll have to give you a credit, or a future discount, or extend your subscription for free — the money at risk all comes from you, and thanks to the internet the cost of delivering a newsletter to each incremental subscriber approaches zero.

Presumably anyone who signed up back in September got switched over to a “lifetime” subscription, though it wouldn’t surprise me if they made you call and complain to get that upgrade.

But anyway, that’s my quick take on this Tesla story from Ray Blanco — sure, consider Novonix as a possible idea if you want to research their battery anode technology, or their plans to commercialize longer-lived cathodes… and yes, Novonix has been rumored for its possible connections to Tesla’s battery day since at least June, but I personally wouldn’t bet on any real boost to their plans coming from Elon Musk in January, that seems wildly speculative and not at all rooted in reality, despite Blanco’s “smoking guns,” so if I were interested in Novonix, personally, I’d evaluate them on their own merits. The share price is, at least, a lot more appealing than it was last time Blanco touted their Tesla potential.

Your mileage, of course, might vary. I’d be delighted to hear what you think will happen, either in January or in the next couple years, with Tesla or Novonix or whoever else might lead us to our next leaps forward in the battery tech world.

And I’ve left all the original comments appended below, for your edutainment — lots of folks got wrapped up in the speculative fervor of “Battery Day” and I imagine they’ll be less inclined to jump the gun again for this hastily rejiggered “January 20” event that Blanco’s now using to generate urgency, but we’ll see what the future holds when it gets here. Thanks for reading!

IBATF it is the only egg in any basket or at least the one for lithium went from .33 to now 3.90 and even had a private buyer spend 10,000,000 for shares at 3.83 when they where 3.60ish so that last pretend or just Slippy slide didn’t effect us much at all unless you waited and bought more no joke do some research and you will see this is our only way to any kind of lithium supply to come close to the demand and if we are for real and serious not just to feed our bottomless and senseless greed or envy since it usually more about what you want or don’t have but see other who do who you feel aren’t as good as you that is just how hungry and never ending it can take you control from you all for a stupid physical or expensive useless thing to show off screw that Ide like to see not 1 hungry child or worse its time to stop ignoring these problems expecting some 1 super person to come and solve for us or open your eyes and see Elon Musk is such a person but he well always save our home or planet first but as long as we keep going strong with this losing GAME of being or becoming a better so called capitalists or consumers’ we are domed to the same cycles starting to repeat so ai often that A new World Order is looked at like some kind of evil empire no idiots the US was never and could never be the 1 country for ever We will again just maybe not in our life times and so then you have all the crybabies that would rather just go now as long as we all do to like we all are when we die its sad unless you ignorant hate life or welcome death and happen t to be to afraid to be alone eventhough you will be retard So if 1st thing Putin is stopped and Trump is never aloud to spread his ingnorace and stupidity again as before and people realize just how much power they have and can be a huge help with for some real change, but if we as a whole do care where we live and how its treated and future ones if we can make it which we can but we got to stop fighting stop greed and work together and screw it if thats socialism its starting to look and feel more like survivalism and progression to a new stage of human existence or hell maybe an older beter one we have actutually been a part of i personally would rather skip the next dark age or worse mass extension and its amnesia it seems to cause. I’m sorry I was so critical but we are out of time and those who feel like I do know the only way to get anything good going is with straight positivity no negattive ideas thought actions or leaders can be allowed

Some of us are with you. Your fortitude in sticking your neck out is appreciated.