The intro from today’s teaser ad sounds pretty similar to lots of other ads we’ve seen with a commodity or gold focus…

“URGENT INVESTMENT ALERT:

“Miss this chance to buy these resource stocks now, while they’re dirt cheap, and you’ll regret it for years…

“Three ‘Bounce-Back Mining Belters’ to Buy NOW”

But today the big promises are coming not from one of our typical newsletter publisher foils, but from Down Under — this is an ad for Resource Speculator, which is a mining and energy-focused entry-level newsletter in the Australian market.

So the stocks they’re teasing are probably listed on the Australian Stock Exchange, though sometimes such stocks are also available to be traded either as ADRs or OTC in the US… so let’s see what he’s pitching.

There are three stocks to identify today, so we won’t get too much into the “big picture” claims — it basically mimics any other natural resources newsletter you might be familiar with: gold is soaring, natural resources are priced below what it costs to produce them, we’re near the bottom for mining and energy stocks, and we’ll all get rich when the prices inevitably rise. It may or may not be accurate, but it’s familiar.

So we’ll get right into the individual stocks — and unlike some natural resources newsletters these days, who are hiding in gold and scared (perhaps rightly so) of base metals and energy, these aren’t just gold stocks. Here’s what we get about the first one by way of clues for the Thinkolator:

“Bounce-Back Belter #1

“1.66 million tonnes of nickel in the middle of the South Pacific…and this ASX digger is about to claim every scrap of it for themselves!

“This is my favourite speculative resource stock story on my buy list right now.

“This company has uncovered a major nickel deposit in the Pacific…and you can buy in today for under 13 cents.

“If I’m right, you could see this stock bounce-back in a big way over the next 18–24 months.

“And I mean BIG. According to my analysis, shares could be swapping hands for nearly $2.00. That’s a potential 13-fold gain in the months ahead.”

So what is this major nickel deposit? More clues…

“The firm I’d like to show you is on track to break ground on what could be an enormous nickel reserve in the Solomon Islands.

“This deposit is rich, shallow, and big. Historical drill results by Kaiser Engineers show as much as 1.66 million tonnes of high-grade nickel buried just metres below ground.

“That’s by FAR the biggest nickel resource in the Pacific and — all going well — may be among the largest nickel deposits on the planet!”

And apparently there’s been some fighting or controversy regarding the deposit… here are some more hints:

“In March, after working on the lease for more than five years, they ended a long-running court battle with a Japanese outfit vying for the right to mine this nickel deposit. Subsequently, the Solomon Islands government ruled the Japanese state-owned firm didn’t have rights to the lease.

“A decision that leaves this ASX-listed miner as the favoured company with a claim on this multi-million tonne nickel mine.

“I’m convinced the Solomon Islands government will give them the go-ahead to begin mining this area very soon.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“If they get the green light, you could see shares jump 50% within seconds…then DOUBLE inside a couple days….

“Of course, there’s still a chance the lease won’t be granted, in which case the share price could fall.

“But if they’re awarded the lease — and I’m convinced they will be — you could see the stock price soar 13 times over by 2018.”

This is Axiom Mining (AVQ.AX, AXNNF OTC in the US — extremely illiquid in the US, so be careful… the stock is volatile, and even if you can buy it OTC in the US for close to the fair value set in the Aussie market, it may not be possible to sell an OTC position at a reasonable price in the future… buying illiquid stocks is far, far easier than selling them).

Axiom got one of those “why is your stock going up so fast?” notices from the Australian regulators last week, which might have had something to do with newsletter attention but is probably mostly speculation on that pending decision from the Solomon Islands. This is what they said in response to the query:

“The Company expects official information from the Solomon Islands Government shortly as to the process and/or repermitting of the Kolosori tenement on Isabel Island.

“The Company continues to work with it current strategic partners as to the development of the Isabel Nickel Deposits which includes the San Jorge tenement and other potential development partners and during the normal course of business it continues discussions with other potential development partners.

“There has also been political and media speculation that with the new government in the Philippines, it may introduce a ban on the shipping of nickel ore, further limiting the supply available to China, the world’s largest consumer of nickel ore.”

I’ve never heard of this one, and haven’t looked into the background of this dispute over the Isabel nickel project, but there’s an article here that provides part of the story, and Axiom’s website gives some of the history as well.

So the two catalysts are that potential mining license, and the price of nickel.

Axiom is hoping that they have the inside track on getting the license thanks to the work they’ve done on the site to date, but I have no idea what the probabilities or politics might be… the stock fell 50% after their previous license to mine was thrown out by the courts in late March, and it has started to recover a little bit on that optimism about being able to get the license back, so perhaps it could trade as high as the A$0.40 neighborhood if they do get a new license to mine (that’s about the high of the past year, investors expected production to be imminent before the court negated their license so presumably much of the other prep work for mining is done). That would be roughly a double from here… and I don’t know what the downside is if someone else wins the license to mine that project, Axiom does have some other assets, mostly copper/gold/zinc projects that are still in the exploration stage in Australia, but I don’t know what they might be worth (Axiom’s market cap right now is about A$67 million, which is about US$50 million).

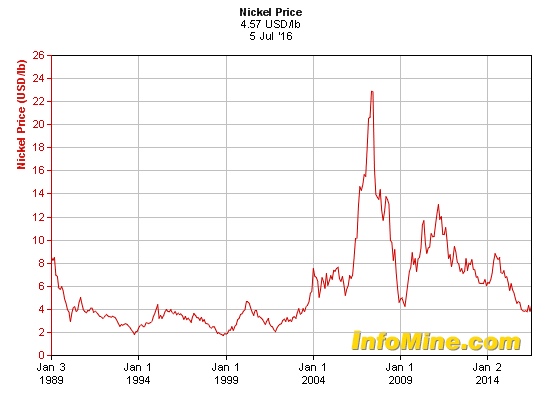

As to whether nickel is going to surge higher, well, on that your guess is at least as good as mine. As with iron ore (which, like nickel, is driven largely be steelmaking demand), we have to make educated guesses about whether the huge China-driven cyclical peaks of the last ten years are the norm and we’re going to have one again, or whether the norm is more like the 15 or 20 years before that, with much less dramatic swings in price. Here’s the nickel price for the past 27 years from Infomine, just to give you a picture to go with the sentiment:

So… that should be enough to get you started on researching Axiom if you’re interested, we’ve got other stocks to find. Moving on!

“Bounce-Back Belter #2

“Hot Aussie oiler sitting on a potential multi-billion barrel crude ocean… and the market doesn’t have a clue! Since January, shares in this tiny energy firm have near-doubled. An impressive ‘bounce’ for a speculative, small-cap oil play…

“But the way I see it, the share price run hasn’t even started yet.

“Right now they sit on three prime oil targets.

“The first is a well in the Gulf of Mexico, which should pump out 2,000 barrels of crude by this time next year. Another high-potential prospect in Tanzania holds 170 million barrels.

“But these two don’t come close to the potential of the third oil lease…and it’s this third multi-well target that has me REALLY excited about this little Aussie driller.

“3D seismic data shows that, beneath this firm’s 558,195 acres of ice-swept Alaskan coast, lies not one but TWO potential ‘elephant’ oil fields.

“Each oil field could bubble with as much as 600 million barrels of crude.”

It’s a bit refreshing to hear some enthusiasm about a little oil company, right? A nice change from all the talk about US shale producers being on the verge of declaring bankruptcy. So which stock is this? A few more clues:

“The company’s Managing Director recently confirmed the spectacular potential of the Alaskan oil field (emphasis mine): ‘These are mega plays that form the source intervals for multi-billion barrel conventional fields….’

“Today you can pick up shares for under 4 cents. That’s incredibly cheap considering the company is sitting on oil reserves totalling 1.4 billion barrels. Enough to fuel Australia for the next four years.

“In my view, if all goes to plan, and they tap this oil bounty, you could see each 4 cent share hit 30 cents in a matter of months…maybe weeks!”

This is Otto Energy (OEL in Australia, OTTEF OTC in the US… like Axiom, extremely illiquid in the US so the same warnings apply). They were very focused on deepwater offshore oil in the Philippines until a year or so ago, when they had some disappointing drilling results and abandoned that project to focus on what they call “lower risk” assets in Alaska and in the Gulf of Mexico, both of which are joint ventures, and in Tanzania, where they also have a partner. There’s a good article here that sums up their current status and plans, and they also detail recent progress in their latest quarterly update here. The Gulf of Mexico project hit a snag with one failed drill that couldn’t penetrate a shale layer to reach the expected reservoir, but they are continuing with other drilling and they have enough cash to keep participating in their exploration projects until at least the end of the year if the spending continues at the current pace.

They make no bones about the fact that they are focused on “high impact exploration,” which should make for a volatile stock — good results could certainly send the shares soaring, bad results could mean they have to pack up their toys and go home. Last summer the shares peaked at about 12 cents before drilling results from the Philippines disappointed, and they dropped by about 75% over the course of a few weeks when they abandoned that project and moved on… these stocks often tend to rise in the weeks and months before meaningful exploration results are expected, though that may not be as true if we’re in a generally pessimistic oil market.

The Alaska drilling is probably the biggest longer-term catalyst, even though they have only an 8-10% working interest, because that’s near the massive Prudhoe Bay fields so they’re hoping that their 3D Seismic now underway gets them closer to identifying some genuinely massive oil reservoirs. I have no idea whether they’ll succeed or not.

Next?

“Bounce-Back Belter #3 Tiny Angolan gem miner on track to uncover the world’s greatest mineral discovery of the last decade ‘

“This ASX mineral miner is on the verge of a sharp and imminent price lift.

“At a market cap of just $106 million, this stock is tiny for now.

“Today, shares are priced at just 40 cents.

“If my analysis proves correct, you could see the same shares sell for 10 times that in the next 18 months….

“Your third ‘belter’ tip is an Aussie-based diamond miner operating out of Angola in southern Africa.

“Diamond mining is notoriously hard work.

“The majority of companies who attempt to become commercially viable never do.

“That’s why I tend to stay away from diamond stocks altogether.

“But this diamond miner is different.

“On 15 February they uncovered an enormous 404 carat diamond… the largest diamond find in Angolan history. But it’s also a ‘Type 11a D’ colour gem…this is the rarest and most expensive of all diamond types. Many of the most famous diamonds throughout history are Type 11a D….

“This 404 gem… sold at auction for $22.5 million….

“This firm is picking up huge, quality gems every single day. In the eight months since mining began they’ve uncovered 60 large, special stones, including the gigantic 404 carat diamond

“The sheer number of large diamonds is the strongest sign yet a huge underground diamond cluster is nearby….

“… this Aussie firm is tantalisingly close to what could be the first largescale diamond mine in more than 10 years.

“And if they find it…you could see shares in this company EXPLODE higher.”

This one you might have heard of, because it’s been in the news quite a bit in recent weeks thanks to that 404 carat diamond that they sold at auction… here Resource Speculator is teasing: Lucapa (LOM in Australia, LCPDF OTC in the US), which is the operator of the Lulo diamond concession in Angola (not to be confused with Lucara, another diamond miner which has been mentioned by our junior miner columnist Myron Martin a few times).

Lucapa has been finding huge diamonds, which is why they’re in the news, and that’s been going on for a while — according to their presentation at a February investor conference, 25% of the carats they’re producing at Lulo are in 10+ carat diamonds (which also account for 86% of revenue). So they do have a record of finding these “special” diamonds, particularly the truly massive ones of greater than 50 carats, but these are essentially being “sifted” out of the alluvial plains in Angola… the goal is to use the presence of these alluvial diamonds to find the deeper underground kimberlite source where they think there will be a great concentration of diamonds.

More recently, they also gave a presentation in London last month, perhaps in connection with their possible listing on the AIM in the UK that would also probably make the shares considerably easier for most US investors to trade — that presentation incorporated their 404 carat monster, which changes the price per carat for the project pretty considerably. I don’t know what it will cost them to continue exploring for the “source” of diamonds there, or what the world’s appetite is for big new capital projects to build diamond mines — the only diamond miner that gets much attention here in the US is Dominion Diamonds (DDC), which is part owner of the Ekati and Diavik mines in Canada, and their shares have been weak over the past year.

Will any of these “Bounce-Back Belters” teased by Resource Speculator actually bounce back? Thinking of taking on some risk and excitement in mining and energy outside of the gold market? Let us know with a comment below.

I gained and lost plenty on a nickel miner with a very similar profile (right down to the geography). Their prices are very explosive. I believe I’m right in saying that one problem is those clever Chinese finding alloys which don’t use nickel when the price gets too high.

If you’re buying any of these companies sell on a spike. In one position I got out at a profit on a mid-morning spike after waiting in loss for a couple of years. They really are pass-the-parcel (in search of the bigger fool) stocks.

Thanks for sharing your experience, good to hear from folks who’ve been through the wringer with such “can’t miss” miners.

Thanks Travis for looking at ASX

I like to spread it out a little when I can… It’s a big world out there past the Statue of Liberty 🙂

I have been caught in PNG, agreement with traditional owners, access roads built, village built, declines started, and then along comes another “owner”.

Resource Speculator is written by Jason Stevenson who is the resource analyst for Port Phillip Publishing (Australia’s Agora). As a former subscriber to Resource Speculator (formerly ‘Diggers and Drillers’) I can say Jason researches thoroughly and really sucks you in with his writing style – he’s confident with definite views. For example, in his Google+ posts he’s still adamant that spot gold is following a trendline down to US$931 per ounce and only then will he recommend the ‘best gold stocks in the world’ to Resource Speculator readers. Hey, he may be right in the long run but he’s certainly missed a lot of opportunities in gold stocks this year. I remember with Port Phillip Publishing’s subscription services round up he received a D+ for his stock picks but to be fair to Jason resources was not the easiest sector to be making money in 2015 especially in a small Exchange like the ASX.

It was actually an advertisement of Jason’s about Otto Energy “The New Oil Gusher of the Orient” that first got me interested in the share market. OEL was his stock pick for May 2014. I sold OEL at 0.105 for a small profit. Fast track since the oil price downturn OEL has pretty much gone backwards but it’s share price has picked up a bit since February ‘16.

Axiom Mining was Jason’s stock pick for May 2015 and again I was sucked in that time as well. I sold at a loss when the Solomon Islands High Court ruled on 21 March ‘16 that the land in question was ‘customary land’ and Axioms lease and prospecting licence were set aside. Well Axiom has since reapplied for a prospecting licence and when I read Jason’s recent article about Axiom I thought ‘here we go again’. This time around I’m wiser! I would recommend anyone considering Axiom to hold back buying until their court case is successful and they have the licence. I’ve learnt it’s OK to buy high and sell higher, especially when AVQ’s share price is only .245 and potentially going to $2 as Jason anticipates. Either that or buy AVQ now and have a tight stop loss. Interesting to note Axiom said after their initial March court ruling it ‘expects delays to first exports of up to 4 months’….that ends 21 July this month which may be the reason why Jason’s recommending it again now and why the share price has been quietly accumulating by the big players…the court decision may be getting close.

The pick of the three for me is Lucapa Diamond with a market cap of 122 million and some OK fundamentals although no revenue in the last 12 months. I’ve got a minimum positon in LOM (on the ASX we have to take a minimum order size of AUD$500 (about US$380) for ordinary stock…the reason I prefer trading CFD’s which don’t have that restriction). The regularity of large finds of good quality diamonds and gems, well…it’s got me sucked in again!

Quick thanks to Travis for his previous gold recommendation of Sandstorm Gold, I bought some last month and although I’m late to the party it seems to have further to run. Thanks!

I have followed AXIOM as I previously did some work way back on this nickel prospect. I felt then that the nickel grades were not great, but OK. More recently with high grade nickel ore being in short supply and Indonesia and possibly the Philippines halting direct ore shipments, AXIOM could be an attractive speculation. But the Solomon Islands could also halt the shipment of nickel ore to China and force AXIOM to do on site processing. AXIOM has access to the so called “starved acid leach technology” whereby some easy nickel is solubilized with a reasonable amount of sulfuric acid. This technology is however unproven on a large scale. Finally: don’t underestimate Sumitomo!

I tend to think Port Phillip Publishing and Resource Speculator tend to follow a scatter-gun approach. Pick enough companies and you’ll soon have a few that have gone onto to make big gains in the share price. But they are quite happy to ignore and forget the losers. Just a few months back they were pitching Kingsrose Mining (ASX: KRM). It went to 26 cents on the hype and is currently back at 14.5 cents.

Hi Travis, his most recent article is entitled 3 ASX gigastocks set to conquer the world … have you done any analysis of this teaser?