The first version of this article was published on May 4, 2023, but the ad is circulating very heavily again so we’re updating it here to help answer questions. The ad is unchanged from May of 2023… but the latest version of the pitch calls it a “$6 wonder stock” and has the introduction, “While the stock is no longer trading at $3, it’s not too late… Ross believes this ‘AI Wonder Stock’ still has a lot more profit potential built in.”

Here’s the intro to an ad that folks have been asking about this week:

“Forget ChatGPT… This ‘$3 AI Wonder Stock’ Could Be a Financial Lifesaver in 2023!

** URGENT **

“A tiny company trading at under $3 a share just got the keys to a virtually UNTAPPED $15.7 TRILLION Market

“That would be BIGGER than 5G… Electric Cars… and Cryptocurrency… COMBINED!”

It’s a pitch for a trading service of some kind from Ross Givens, he calls it the Live Action War Room, and it’s very cheap, just $5 (though I confess I haven’t read the fine print), which, in the newsletter world, generally means this is a “front end” service, designed to fill the top end of the funnel with new customers and their credit card numbers so you can try to pitch them on value-added services and upgrades (free subscribers are valuable for use as sales prospects, but folks who have shown a willingness to pay something, even a trivial amount like five bucks, are much more valuable).

He runs through a bunch of the hot-button stories in AI recently, most of which were fueled by the rapid rise of ChatGPT as the first really visible “killer app” in the AI wars, and then says this…

“Who’s gonna come out on top in the AI war?

“Will it be a big tech titan like Microsoft and Google…

“Or another big player with substantial bets on the technology, like International Business Machines (IBM), Nvidia (NVDA), and Advanced Micro Devices (AMD)?

“NOPE. I believe none of the above!

“You see, these companies are giants…

“Their stock prices are already in the stratosphere.

“Worse still, AI is only a tiny portion of their business.”

Could be, I still expect the long-term winners to be the giants like Alphabet, Microsoft and Amazon who have poured so much into AI for the past decade… but there’s no guarantee, and you don’t have to be the “one big winner” to do very well, especially if you’re staring out small.

And, yes, Givens is teasing a smallish company… here are the clues he drops:

“If you want a shot to get FABULOUSLY RICH from the AI war…

“Make sure you grab my No. 1 AI recommendation today.

“No, it’s not these tech giants…

“I’ve uncovered an obscure $3-per share (as of today) company that is about to alter the generative AI landscape for good.

“Founded in 2005 by a Canadian computer scientist…

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“It’s moving fast…

“By leveraging 98 registered patents for cutting-edge voice and sound recognition technology… It’s already lined up a slew of major partnerships with Hyundai, Mercedes Benz, Honda, Pandora, Netflix, and many others.

“And recently, I noticed some suspicious buying activity…

“Causing the price to skyrocket by 260% in just 19 days!

“Right now, the price is hovering around $3…

“Giving us a great buying opportunity.”

And he talks up some insider buying (from January of 2023):

“This is your chance to get ‘skin in the game’ before the wider world sees what’s happening.

“Especially because I spotted some unusual activity taking place just beneath the surface.

“Here’s what I’m seeing…

“Two insiders of a tiny $3 AI Wonder company, the CFO and a prominent board member, both bought stock on January 20.

“CRUCIAL: According to my proprietary indicators, these are the first insider buys at the company since it went public.

Even the people who work there are buzzing!“This is one of the ‘breakout triggers’ I’m always on the lookout for.

“Damn, did they time that well!

“The stock shot up 260% over the next 19 days.”

So what’s the story? Thinkolator sez the stock Givens is pitching here is SoundHound AI (SOUN), which went public in a 2022 SPAC merger and, like a lot of SPACs, fell in value pretty quickly as the SPAC mania receded and people started looking at the actual financials fo the company.

Late in 2022, SOUN was down around $1 per share, representing about a 90% loss for anyone who was unfortunate enough to buy into that SPAC in late 2021 and hold on through the business combination (not many did), but the AI mania and some new partnership deals reignited investor optimism and drove the shares back above $4 for a little while, at the same time that they were raising yet more capital (about $25 million, in preferred shares and convertible debt), and laying off 40% of their staff. It was those sales of preferred shares that the tease refers to, some of them were bought by insiders as part of their “rescue” recapitalization of the business, just a month or two before ChatGPT and NVIDIA really lit the fuse for the AI mania. From what I can tell in scouring their SEC filings, there has never been an open-market insider purchase of common stock at SOUN by anybody, ever (there’s been a LOT of selling, however, up to and including last month — and insiders haven’t been price-sensitive, they’ve sold at both $2 and $6 over the past six months or so).

SOUN did end up netting something like $65 million out of the SPAC deal in 2022, but that was far short of the $220+ million they were hoping for, and almost all of it came from the $113 million of PIPE private funding provided in conjunction with the merger, some of which was used to let SOUN’s private owners cash out part of their ownership. 96% of the SPAC shareholders redeemed their shares for cash, which turned out to be a wise move, and SOUN was down to less than $10 million in cash at the end of that year, so they probably needed to raise money just to fund their severance deals with that huge chunk of the employee base — thus the convertible preferred PIPE financing.

Things have improved a little bit on that front, over the past year or so, with a $100 million loan from Atlas Credit Partners that was announced in mid-April of 2023, extending their debt financing through 2027, so they have some time to work through their current cash burn and find a way to build a profitable company. As you might imagine, the terms of the loan were pretty rough on the borrower — they’re paying something like 13-14%, and have to pay fees and hold some of their interest payments in escrow in addition to using part of it to repay another existing loan ($30 million, I think), but they did end up with enough cash to get through 2023, and they’re still in decent shape on that front, with close to $100 million in cash on their balance sheet at the end of the year (they had losses of about $83 million last year, but they issued a lot of shares for cash to absorb operating costs, and also used stock-based compensation liberally — stock-based compensation has been about half of revenue — so they still have most of that cash). They’ve already had their big layoffs, so the cash burn got a little slower last year.

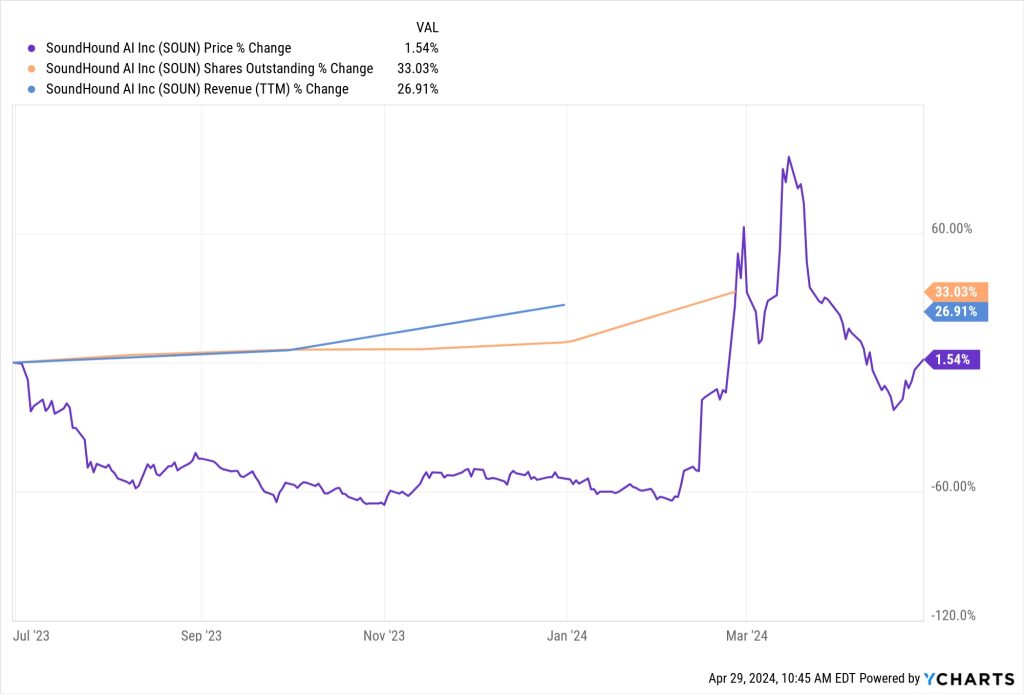

SoundHound AI shares were around $4 when we initially covered this teaser ad, almost a year ago, riding that enthusiasm for anything with “AI” in its name (they were around $1 when it looked like the business might fold quickly, in January of 2023), but have been very volatile — they’ve seen both $1.50 and $8 in the past six months or so. Today the company has a market cap of about $1.4 billion, at $4.60 (the “implied valuation” of the original SPAC deal was about $2 billion, so we’re closing in on that value… even if that’s partly because the number of shares has increased by 50% or so since the SPAC merger). Here’s the chart since we first write about SOUN on May 4, 2023 — that’s revenue (blue), share count (orange) and share price (purple)…

They’re still very clearly in growth mode, with no clear scalability of the business yet — but it does look a little better now than it did a year ago. Here’s the chart of their gross profit and major expenses (SG&A and R&D) since they went public — both SG&A and R&D have go come out of gross profit if you’re going to have an actual operating profit, so there’s clearly a long way to go… but the curve of those charts has turned more positive over the past year, with gross profit growing and their operating costs coming down.

They might be able to build up to a sustainable business over time, but they’re certainly not there yet — they continue to announce deals for their AI voice processing software to be used by customers, mostly automakers and drive-through restaurant chains, and maybe they can reignite optimism again before they burn through their current balance sheet. Right now, they’re valued at about 23X their 2023 revenue, or about 20X the estimated $70 million or so that analysts believe they’ll report for 2024 revenue (just as an FYI, back in late 2021, when they released their projections as part of the announced SPAC deal, they were expecting $297 million in revenue in 2024).

They have offered preliminary 2025 guidance, too, of “more than $100 million” in revenue, which is also roughly where analysts already were with their estimates, and analysts have actually penciled in a positive EBITDA number for that year, on average (adjusted, I presume, since they certainly won’t be profitable if you include stock-based compensation as a cost)… so that’s the hope, that they can stop bleeding cash within 18 months or so, and become a self-sustaining company. They are, at least, growing their revenue, and that gives them a chance… they haven’t had the exponential increase in revenue growth they projected back in 2021, but they have pretty consistently grown revenue at about 50% per year.

Before going public in the SPAC deal, SoundHound was one of the “unicorns” of the venture world, though that term doesn’t really apply so well to companies that were getting venture funding from 2016-2021 (earlier venture capitalists called a company that reached a billion-dollar valuation before going public a “unicorn,” but venture funding grew so generous and competitive that companies started staying private for much longer, so unicorns became about as common as squirrels).

I remember stories about their Houndify service being a better voice assistant, like an improved Alexa, and also that their products were superior to Shazam, the popular music-identifying service (now owned by Apple), but the stories have moved on and the market has shifted a bit. This is now SoundHound describes itself now:

“SoundHound (Nasdaq: SOUN), a global leader in conversational intelligence, offers voice AI solutions that let businesses offer incredible conversational experiences to their customers. Built on proprietary technology, SoundHound’s voice AI delivers best-in-class speed and accuracy in numerous languages to product creators across automotive, TV, and IoT, and to customer service industries via groundbreaking AI-driven products like Smart Answering, Smart Ordering, and Dynamic Interaction™, a real-time, multimodal customer service interface. Along with SoundHound Chat AI, a powerful voice assistant with integrated Generative AI, SoundHound powers millions of products and services, and processes billions of interactions each year for world class businesses.

That new “Dynamic Interaction” product does sound impressive in the demo, and it seems like the automotive and quick-service restaurant markets are where SoundHound is pointing much of their ambition right now.

Others are also working at this, of course, including companies who similarly have deals with auto makers, like Apple CarPlay or Amazon’s Alexa, though CarPlay and the Android equivalent are the easy ones… Amazon’s Echo Auto device seems underwhelming and hasn’t made much traction, it appears you really need to be built into the smartphone or the car itself to really reach any mass usage. Perhaps SoundHound will be able to squeeze in among the giants as auto makers improve their voice features — one other challenge there, of course, is that turnover of automobiles is extremely slow, so getting built in to the latest Hyundai or Mercedes doesn’t do nearly as much for you as getting built in to the iPhone, which means distribution could be a challenge even if SoundHound is genuinely much better than the existing options (in which case, I would think, somebody would buy them — assuming that the Department of Justice will allow big tech companies to buy anyone these days, an open question given Amazon’s failed attempt to even “rescue” a small firm — iRobot — through acquisition).

And this is how a TechCrunch article described their position in the market last year:

“SoundHound has inked a lot of big partnerships over the years, including deals with Mercedes-Benz, Kia and Hyundai in its extensive automotive efforts and more recently Toast in the hospitality sector, as well as a deal with Qualcomm to integrate SoundHound voice AI into Snapdragon, work with Snap and more. But how much all of that has played out in products — and specifically products that are generating revenue right now — is not so clear.”

That’s still more or less true, revenue has picked up notably over the past year, and they’ve moved ahead in restaurants with some recent deals (including the acquisition of SYNQ3), so they say they now have more than 100 restaurant customers, and Soundhound has attracted a few more analysts and certainly gotten more investor attention over the past year — though almost all of those analysts also all work for investment banks that were either involved in the original SPAC deal or are helping to raise money for SOUN more recently (companies who need to raise money tend to attract more analysts, since they also attract investment bankers in general).

They continue to sign customers and publicize those deals, like a plan to use AI to handle drive-thru orders at White Castle and several other fast food voice AI deals (partnering with both Olo and Oracle’s restaurant POS systems, in addition to Toast), along with deals with a bunch of car companies to include voice assistants in new models, but I don’t get any sense of what the revenue from those still-early deals might be. Insiders have continued to be very steady sellers of shares, as has been the case for over a year, and, as I noted above, they’ve been as willing to sell at $1 as they were at $5 — that’s not necessarily a negative, newly public “growth” stocks pay employees with shares, and those employees are often net sellers because you can’t buy a boat or a house or pay tuition bills with shares, and stocks with insider selling don’t perform a lot differently than stocks without insider selling, on average… but it is at least the absence of a positive, there’s no real “ownership culture” or buy in from employees evident, and none of the executives or board members are celebrating this low share price by buying a bigger position.

The biggest surge for the stock started in mid-February this year, when the stock surged dramatically… and that was caused not by their earnings update (which came a couple weeks later), but by the disclosure than NVIDIA owns some shares of SOUN.

So to be clear on that front: NVIDIA has owned a (very) small slice of SoundHound since it was a venture investment a long time ago, they probably bought the shares six or seven years ago, this was not a new investment by NVIDIA. There was a flurry of interest in mid-February because of NVIDIA’s disclosures about a handful of small venture investments it owns… but none of those were new, it’s just that NVIDIA didn’t previously have enough value in outside investments that it was required to file those quarterly 13F disclosures. That changed when ARM Holdings (ARM) went public, because that’s NVIDIA’s biggest outside investment by far (a remnant of when they tried and failed to acquire Arm Holdings from Softbank a couple years ago). That brought their total investment portfolio in publicly-traded stocks above the $100 million threshold to require disclosure, which means their investment in SOUN suddenly became public (joining their much larger known ownership of Recursion Pharma (RXRX) and ARM, as well as a couple other little companies). NVIDIA is partnered with SOUN to a limited degree, SOUN is using NVIDIA’s DRIVE system for its voice assistants in the automotive world, but that’s not exclusive to either company, and it’s still a tiny business at this point.

Soundhound plans to issue their next quarterly financial report on May 9, so the story could change.

So whaddya think? Is Soundhound going to make the turn from cash-guzzling SPAC failure to profitable software firm over the next couple years? Odds good enough to risk money on them at a valuation of about 20X their expected 2023 revenue? Let us know with a comment below… I’ve left the original comments from our first article attached below, to give some perspective.

Disclosure: Of the companies mentioned above, I am invested in NVIDIA, Amazon and Google/Android parent Alphabet. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

No HOUN at AMTD ?

Ooops, sorry — had a typo in the Quick Take. Fixed now, yes, it’s SOUN.

Try SOUN

Yes Thx ! from $ 18 to 2.4 ..

It is SOUN now is ,$3.75

I think the stock symbol is SOUN, not HOUN.

After checking out their financials, it sounds like a BB stock…buyout or bankruptcy… which I suppose would put them in the same class as some of our regional banks.

there is a lot of insider sales

AI….I read somewhere that it is the next .com bubble. That ended badly for many.

I put some shares in my hand, then I laughed no more.

Is this the company that has “98 US patents crucial to AI?…

That’s what Givens says about them in the ad, their actual number of patents applied for plus granted globally is more like 250-300, but presumably at one point they had “98 patents” … as far as whether those patents are particularly meaningful or valuable or essential, I have no idea.

I have been reading these stories for more than 10 years and learn new things all the time.

SoundHound AI, Inc. offers an independent voice artificial intelligence (AI) platform that enables businesses across industries to deliver conversational experiences to their customers. The Company’s Houndify platform is a Voice AI platform that combines advanced AI with engineering expertise to help brands build conversational voice assistants. The suite of Houndify tools includes application programming interfaces (API) for text and voice queries, support for custom commands, an extensive library of content domains, inclusive Software Development Kit platforms, collaboration capabilities, diagnostic tools, and built-in analytics. Houndify provides a Web API that takes in text queries or audio and returns actionable JavaScript Object Notation to anyone with an Internet connection wanting to add Voice AI to any product or application.

5400 BETSY ROSS DRIVE SANTA CLARA CALIFORNIA

Best $3.00 stock that is so hot today.

So I looked up SOUN which is Sound Hound AI Inc. The chart looks like typical pump and dump. If you bought day one and sold the next day you made a good profit. The rest of the time a bit of up and downs since between $1-$4 quite a bit so buy at around $1 and sell at around $3.75 is a possible, but now its down trending so the big move was missed by most right when it launched and selling the next day! Pump and dumps happen constantly. Hit market at $6.50 first day april 29th and peaked by May 6th at $13.49. So good to buy at $6.50 or $7 on day one and then sell several days later for say $13. Most missed that boat. That ship sailed and never came back lol. Seen in many times. Sometimes and rarely the company will regain traction and popularity and do a big move, but thats super rare. Most die and just sit in the little ups and down, or flatlines and downs until not worth much and stay never worth much. Unless you know the company is going to truly be a long growth player, then that’s all you need to know to trade the fluctuations, or just that you missed the boat.

I think SOUNDHOUND (SOUN), is on the right track but it may take some time to increase their revenue, that however should not discourage people from buying the stock.

Saw SoundHound AI touched on by Travis in December 23, if my memory serves me right, so as a Xmas punt I bought a few shares at around $2 ish. This week wham, they shot up by 70%, I wondered why this “pump up” happened and read that Nvidia had revealed it has put a few million into the company. The market certainly reacted well to that news by the look of it. Is it a classic pump and dump though? I’m on the right side for once, at least I am right now

NVIDIA has owned a little slice of SoundHound since it was a venture investment a long time ago — maybe 2017? Would have to check. There was a flurry of interest this week because of NVIDIA’s disclosures about a handful of small venture investments it owns… but I believe none of those are new, it’s just that NVIDIA didn’t previously have enough value in outside investments that it was required to file a 13F.

What changed? ARM Holdings went public, and that’s NVIDIA’s biggest investment by far (a remnant of when they tried and failed to acquire Arm Holdings from Softbank a couple years ago). I’m guessing that since the IPO was in the last days of the third quarter, NVIDIA probably was supposed to file a 13-F in mid-November to acknowledge that holding as of the third quarter, because their total investment portfolio was probably worth more than $100 million at that time, for the first time (I think “managing $100 million” is the cutoff for being required to file a quarterly 13-F of your US equity holdings, but the number could have changed since I last checked), but there may be technical reasons why they didn’t have to do so at that point. Now they do have to file the 13F, though, because of their positions in ARM and RXRX, which now add up to a bit over $300 million.

I would not buy anything just because NVIDIA was forced to file the details of their ownership stakes in five companies that they’ve invested in on a venture level or have ownership stakes with due to a partnership (like Recursion (RXRX), which is their second-largest investment after ARM, and the only other one of meaningful size). NVIDIA’s holdings in ARM are currently worth a little over $200 million, and in RXRX just under $100 million, so those are barely rounding errors for a massive firm like NVIDIA… but NVIDIA’s stakes in Soundhound, TuSimple (which is delisting and on its way to becoming even more irrelevant, most likely), and Nano X Imaging, the only other three publicly traded companies they hold some shares in, are all lint on the shoulder of the rounding error.

More importantly, I’d say that none of those represent a new commitment of capital by NVIDIA this quarter, or a strategic endorsement of those firms by the leading AI chipmaker. If I were trading Soundhound, I’d consider this a gift horse worth selling after that surge, though if you have reasons you want to own it for the long term (I don’t), this surge might be irrelevant in a decade.

Okay everyone who is subscribed to this thread, I’m going to offer a different opinion on this guy Ross Givens. He is absolutely frickin’ smart. I’ve been trading in markets for 20 years with limited success, and from what I can see, nearly every time this guy opens his mouth, he does something right. This ticker, SOUN, came up one day as just a side comment in a webinar I watched of his. I looked at the stock and it looked like a good time to get in. I did it with an option trade to lower my risk, and I’m up 4 x in days!

The first service of his I signed up for was called Stealth Trades, where he gives one idea a month, and it costs a whopping $5 bucks! I can’t get the latte I want for 5 bucks anymore!

There’s so much education and other info included for that 5 bucks that I haven’t even had time to go thru all of the website yet. The first trade I encountered as a member was on NET, or Cloudflare. I was being picky and couldn’t get in at my price on the option I wanted. While I was messing around getting my price, he closed a 700% win on that stock! Now I see him offering a one day a week subscription to his “war room” with a free report on what I assume is this SOUN stock, again now this ad says for another 5 bucks!

We better all hope this guy is a good trader, because he certainly isn’t making money off of all of us!

It appears to me that this guy has a good heart, and is trying to get info into the hands of traders who maybe need a few wins. From what I see, he seems to specialize in BIG wins. There are tons of people out there advertising what turns out to be totally untrue claims about services that they charge $995 to $1499 or more for.

And Ross wants 5 bucks for me to listen to his great ideas for an hour once a week?

Sign me up, Ross! I’m all in.

I googled Ross Givens and found his website. It offers 6 advisories, four of which cost $4,000 and the other two just $300. I didn’t see anything about $5. Is there more than one Ross Givens?

Based on Ross Given’s analysis of SoundHound, I bought at $1.5 and cashed in a large chunk of it when they hit $6. I’d say his analysis defintely was a solid one. Also, following many of hiis different strategies, my own portfolio has been plus 40% overall counting both the profits and losses. I trust him way more than any of the other supposed experts.

Promises promises promises. Sounds like a great deal, especially with it’s massive daily volume. Still losing over 40 cents a share though. Check out what it was trading at a few months ago. It seems like the recent raise in share price is based only on promises, lots of talk.

Jason Bodner and TradeSmith are talking about a cash bubble happening May 1st due to the FOMC. Does anyone have any clues about the recommended investment strategy? It sounds like options to me. The newsletter gurus are either talking about a crash because the Fed won’t lower rates, or talking about a boom because the Fed is going to lower rates.

A recent (4/10) news item from “Barrons ” indicated SOUN has an agreement for an at-the-market equity offering thru which it can sell up to $150M of stock from time to time. Given their $1.4B market cap, that doesn’t seem like a big deal to me, but it might keep a lid on the price at least up until their next earnings report. CFRA rates them as SELL, based on valuation and squishy (my word) financials. I’m sticking with Alphabet, Microsoft and Amazon, eagerly scooping up all 3 of them right after the META earnings-related crash.