I got a question from several readers about this fairly quiet pitch from Eric Fry over the weekend, and it rang a little bell so I thought it was worth a little check-in… this is what Fry says about the business of asset management…

“‘Gather assets under management… and bill them.’ That’s how a money manager from Greenwich, Connecticut, once described his business plan to me.

“A nearly identical strategy drives the success of the money management firm that specializes in precious metals investments that I recommended to members of my elite trading service, The Speculator, earlier this week. This firm manages several precious metals exchange-traded funds (ETFs), as well as funds dedicated to stocks in the precious metals sector.”

I’ve never looked at a pitch for The Speculator before, but it seems to be a relatively high risk trading letter… so what is it that Fry is hinting at?

Most of his ads are about the “Technocasm” and the big accelerating technology trends, but this appears to be much more of a bet on precious metals… with the timeliness of this story hitting last week being that a week ago, we were all wondering whether the Reddit crowd would find any success in causing a “short squeeze” in silver futures.

Silver popped 15% or so on that excitement, though it has come back down a little, and I imagine the short squeeze story will be short-lived on that front… but silver is certainly the most volatile of the precious metals, and we’ve seen big spikes before. So you never know.

And here’s how he sees that turning into profit:

“If investors expect precious metals prices to rise, they will commit capital to them. Then this firm will collect its management fees on those investments… no matter what gold and silver actually do.

“This attribute makes it a unique play on precious metals.”

Other hints? This is a “Toronto-based firm,” and we get these tidbits:

“The Toronto-based investment firm serves more than 200,000 global clients and manages approximately $17 billion. Most of that capital resides in the company’s four physical bullion ETFs. Unlike many competing precious metals ETFs, this company holds physical bullion, not simply paper claims on the metal.

“In addition to these physical bullion trusts, it manages four other publicly traded investment vehicles: two gold stock ETFs, a value-focused closed-end fund, and a resources-focused investment company.”

And apparently they did well last year, with assets under management rising 73% in the first nine months of 2020, and Fry sees another surge in the final numbers for the fourth quarter… which he says will come out on March 1.

The bet, then, is apparently both that silver and gold will rise… and that investor enthusiasm for these metals will spike higher, driving funds into this firms ETFs and sending assets under management higher. Owning an asset manager in a hot area is certainly a nice way to get some levered returns, so what’s the stock?

Well, maybe Eric Fry has been chatting with his colleague Dan Ferris over at Stansberry (which owns Investorplace now), because the Thinkolator sez this is clearly a pitch for the Canadian natural resources-focused asset manager Sprott (SII). Ferris has been pitching Sprott as a levered gold play for a few years now… and it has done pretty well, particularly getting a little burst of attention as it uplisted to the New York Stock Exchange just when gold was hitting new highs last summer.

The last time I wrote about Sprott was back when it was applying for that NYSE listing last Summer and Ferris pitched it again. So what’s the best way to think about this one?

I think of Sprott as essentially a levered play on gold (and to a lesser extent, silver). That means it’s primarily in competition with other levered plays on precious metals, primarily the mining stocks and royalty companies. It’s not as operationally risk as those firms, since the majority of their assets under management are in ETFs that primarily just hold physical metals… but nor is it as levered on the upside unless they’re able to attract a lot of new dollars into their ETFs when prices rise. Which maybe they can, but that isn’t at all a certainty.

The New York listing could certainly help in the long run, particularly if we see an extended bull market for gold and silver — Toronto is the center of natural resources investing, and Sprott is a much stronger brand name north of the border, but there’s so much money sloshing around on the NYSE that almost any decent company that gets listed in the US and can get “discovered” with any kind of story that appeals to investors (and “leverage to gold or silver” counts as a story) can certainly get a lift from being included in that much larger market — especially if they’re a fairly unique story.

Sprott is the only real “pure play” asset manager in precious metals, so there’s certainly some chance the stock could take off if people are excited about gold — I imagine there’s a limit to that, but I don’t know what the limit is.

The optimistic case is that a NY listing lets Sprott also raise more capital at a higher valuation, and invest more heavily in the business to acquire more assets, and that creates a flywheel of returns because of the inherent efficiencies of scale that an asset management company enjoys as it grows (the same team can manage $500 million or $5 billion without a big difference in costs, especially if it’s mostly just in bullion). That’s certainly possible, though I don’t know what their plans are — if gold is on a strong rise for a few years that would provide a nice tailwind, and if gold falls again it’s possible that they’ll be able to acquire more assets, like the Tocqueville mutual fund they bought a couple years ago, at relatively appealing prices.

And in the short term, if silver really takes off because of this newfound Reddit-linked enthusiasm or for whatever other reason, the hope is that they’ll be able to boost their assets under management further as they can argue that buying their ETFs is more efficient than buying coins (which are temporarily at a stiff premium and in relatively short supply).

The pessimistic case is that they’re competing against much larger organizations for investor and institutional funds, and they might lose that competition. Particularly in the ETF world, they have had trouble attracting new funds to their mining ETFs or their precious metals ETFs, despite the “twist” they put on the metals ETFs (that they are redeemable for gold for some large investors, which lets them argue that they are not “paper gold” like the much larger ETFs). I don’t know if that’s just a brand and marketing edge that the bigger ETF managers have, or if folks are rationally choosing the lower-fee ETFs over Sprott’s offerings.

"reveal" emails? If not,

just click here...

That was starting to hit last year, the ETF I usually watch for this is the Sprott Physical Gold Trust (PHYS), and that did finally see assets under management climb with gold’s surge last year to finally show some of that leverage — it was not taking share from the much larger gold ETFs like the iShares Gold Trust (IAU) or SPDR Gold Shares (GLD), but it was at least attracting some new money, and that’s potentially a big deal. It didn’t really stick for long, but they did enjoy a little increase in assets when gold surged higher.

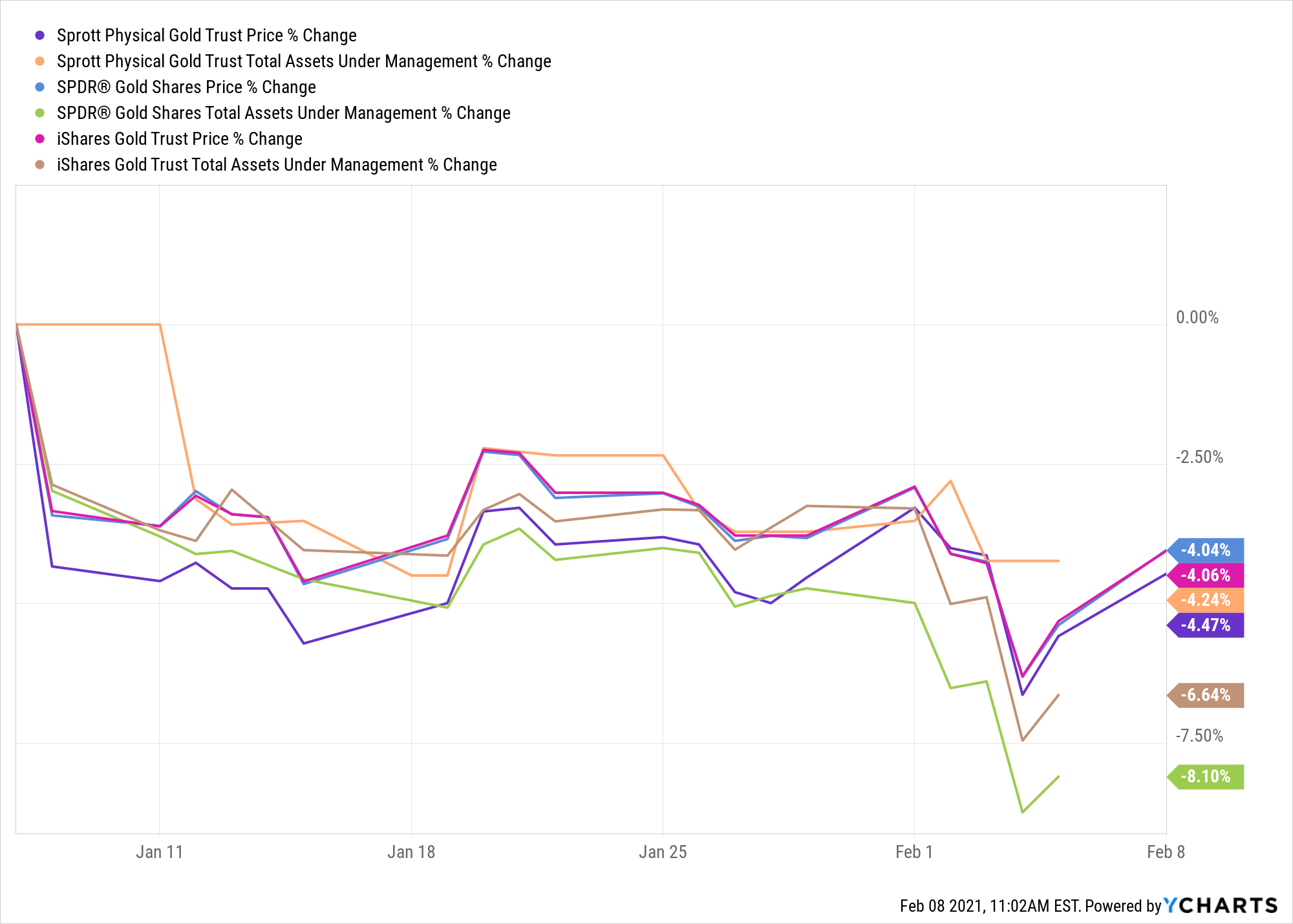

The way you can watch this dynamic is by charting the assets under management for the ETFs against their actual share price — the assets are just bullion, either gold or silver, so if gold rises or falls then the assets under management should rise by exactly the same percentage… if there’s any leverage, it’s because assets under management are either rising because more people are buying the ETF shares than selling (which means new shares are formed, and the assets they manage rise), or falling because there’s net selling of those ETF shares (with net selling, shares are destroyed and assets under management falls).

So what’s happening on that front right now? In just the past month, gold has fallen and that has clearly impacted the ETFs… here’s a little chart showing that the major gold ETFs, IAU and GLD, have both lost assets, showing negative leverage… with the slight positive glimmer being that Sprott Physical Gold (PHYS) has not shown any negative leverage. Assets under management at PHYS have fallen exactly as much as the gold price has fallen, which indicates that perhaps people are holding the shares instead of trading it as a proxy for gold — you can’t really tell much from a month, but perhaps that’s a small marketing victory for a company trying to establish itself as a way to hold precious metals.

But that same tendency also means they’re not nearly as likely to enjoy big spikes from rising metals interest. That seems to be hitting the silver version of the fund, the Sprott Physical Silver Trust (PSLV). You can see that when people got excited about silver and wanted to quickly buy it a couple weeks ago, they bought the iShares Silver Trust (SLV), which had a huge spike in assets under management, not the Sprott Physical Silver Trust (PSLV), whose assets actually fell slightly while the price of silver was rising (some of that could be from the fact that the Sprott ETFs don’t have options trading, and options seem to be a huge part of the speculative market right now).

The risk, and the opportunity, is that Sprott is a minnow — iShares and State Street (which runs the GLD ETF) are two of the most institutionally connected ETF managers in the world, and those ETFs are the brand names. If a hedge fund wants to put $100 million into gold in a week, they’ll use the GLD ETF because that’s the name they know and that’s where the liquidity is. Sprott has some brand value among real gold enthusiasts, but still seems to be an afterthought when it comes to ETFs… and their effective management costs have typically been substantially higher, which means they probably won’t “catch up” (Sprott’s PHYS ETF has about $3 billion under management, iShares Gold $30 billion and the GLD ETF over $65 billion)… but there is certainly room for them to grow if they can build their brand awareness beyond the current crop of real gold and silver fans, who already follow Eric Sprott and Rick Rule and for whom the promise of allocated bullion bars and theoretical redemption rights provides some extra confidence.

Sprott has done a good job of restructuring the business to focus more on gold and mining over the past few years, which gives them a chance to hold their niche and not have their brand competed away in the world of indexes and falling fees, as is happening for so many other relatively small asset managers. It’s a solid company, they are profitable and they also pay a nice dividend that has been growing (the forward dividend yield is over 3% now)… my expectation is that it will continue to be levered to gold and silver prices, but that in a very challenged asset management industry, it probably won’t end up taking much market share, and it won’t necessarily be any better as a levered play on precious metals than the more direct plays like royalty companies and mining stocks.

The advantage is that it might be a little bit safer than those kinds of companies, primarily because some of those assets under management are likely to be at least a little bit sticky (with “buy and hold” metals owners instead of just traders). Here’s the total return of Sprott shares over the past three years, charted against some of the other levered plays on precious metals, to give you a little context… We’ve got Sprott (SII) in light blue, gold royalty firms Sandstorm Gold (SAND, orange), Franco-Nevada (FNV, red), Royal Gold (RGLD, green), gold/silver royalty firm Wheaton Precious Metals (WPM, purple), the Van Eck Gold Miners ETF that represents the average large gold mining stock (GDX), and the proxies for gold (GLD, pink) and silver (SLV, brown). Sprott is right in the middle of the pack.

Odds are pretty good that will continue to be the case — so if gold and silver rise, SII will probably rise with them, a little less than the most exciting precious metals stocks… if prices fall, SII will probably fall, too, also a little less than the miners and royalty companies. Maybe they’ll shake up that dynamic if they can really attract a larger influx of assets under management, maybe they’ll just keep chugging along — I don’t own this one personally (I have in the past), but it’s not a terrible idea…. and while Sprott was a very different company a decade ago — it went public in 2008 — it’s worth noting that the stock did enjoy a huge surge during the big run that gold had coming out of the 2009 crash… but it was as short lived as the commodity price surge. Here’s what those few years looked like for SII shares (SII in blue, compared to gold, silver and the GDX):

If you’ve got a take on Sprott as a play on gold or silver, well, feel free to shout it out with a comment below. I don’t know whether or not Sprott will be reporting on March 1, as teased, I don’t see any confirmation of that date, but that would match last year’s schedule. Thanks for reading!

Disclosure: of the companies mentioned above, I own shares of Royal Gold and Sandstorm Gold, and also hold some gold and silver bullion. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

The Best play for Silver is SLVTF Silver TIger, Sprott just invested 20 million in this undiscovered stock.

THANKS. THE BEST SPROTT PLAYS ARE OFTEN 5X OR BETTER.

I purchased SI a few weeks ago and it’s doing very well.

Silvergate Capital? Yes, they’re really enjoying the resurgent price of bitcoin.

One of the reasons I bought SII was because Ferris was teasing something about them owning a gold-backed cryptocurrency, and that fact alone could cause the price to “double any day now.” I haven’t heard anything since, but the stock certainly hasn’t doubled.

They have made some relative small investments/partnership deals in that area with Tradewind, OneGold and most recently Glint. I wouldn’t ascribe much value to them, but you never know.

I finally sold my Sprott (SII) stock a couple weeks ago at minimal loss (9%) because I was sick of looking at it do absolutely nothing and figured my $$ would do much better invested elsewhere!!

As far as Sprott funds Stansberry’s Bill Shaw recommends CEF, as does the forever portfolio. Their income portfolio recommends SII. FYI

I’ve been in and out of Sprott products for a few years now. The only one who seems to make money is Eric Sprott himself (and pal Rick Rule). For “legends” in the precious metals industry, their products are usually laggards and don’t perform like one assumes they will when one purchases them.

I certainly agree with cyfie52. I bought into the Sprott propaganda many, many years ago with his highly touted Canadian stock fund (I forget the exact name), and today after it has been sold multiple times to various outfits, it is worth zilch. I wouldn’t touch anything having to do with this clown if it was offered for free.

I’ve had the same experience.

I’m in SLVO and GLDI, for the metals but especially the dividends.

As for gold and silver, it’s a great speculation. Done in a timely manner, it can and has for me been insanely profitable. But for now, that ship has long sailed. Today’s play, just to name one, is in Lithium mining stocks. With one’s due-diligence, it’s that which should have been pick up cheap years ago. I began picking up Lithium America, LAC back before 2011 when it was an OTC penny stock. Even in 2019, after going to the big board, it was still cheap as compared to today. Another rare gem, only now beginning to get some attention, but still on the pink sheets is Graphite One, GPHOF. Dirt cheap when I began loading up on it in 2016. As for Sprott. Had them once. They spin a good yard, but I never made a dime. As for gold. My principle speculation was with Vista (VGZ) and they don’t even produce an ounce. Figure that!

Wait a minute, are you suggesting the whole Graphite “thing” is back?

In all seriousness, I would love it if it finally came through. The whole graphite (rare earth elements) thing lost me my shirt and any sense of confidence in what I was doing and my ability to be a decent trader…but in my defense the argument is perfectly sound. Does anyone else think the underlying fundamentals will finally overcome the sentiment?

Years ago, I also lost on a play with Graphene while then a member of The Oxford Club. They never followed up on their recommendation. Suddenly, the company changed their name and left for Germany. Today’s Graphite One, which is for now, the only possible U.S. source for the ore, is without a doubt a long term play. Suddenly, it now fits well into the so-called green new deal. This I can say, -as I now approach 90 yrs, looking back I see that where I had plenty of time, -I lacked patience, having once had some of the markets best stocks. I think I might now be a fairly seasoned investor. I no longer buy into any newsletters. Yet they do provide an extra pair of eyes on the broader spectrum. Travis’ reports are invaluable in that respect.

$CHGI https://twitter.com/yatesinvesting/status/1359026997679304706?s=20 Best!

$COUV merger see the battery link: https://www.stockgumshoe.com/2016/07/microblog-storage-of-electricity-batteries-big-image/comment-page-58/#comment-5024875 Best!

Holding few and down 87%, any positive news if they will be recovering

lithium Im up 336% on spearment SPMTF , great drill results just in

Check out WPM. I have been selling puts and covered calls on WPM successfully for awhile now.

Ferris HAS HYPED THS FOR A COUPLE OF YEARS. IT RAN UP FROM ABOUT $30. TO ABOUT $39 CONCURENT WITH NYSE LISTING. IT HAS NOT PERFORMED ALL THAT WELL,, I CONCUR THAT WELLSELECTED MINERS OR ROYALTY PLAYS ARE LIKELY TO BE MORE REWARDING.

Fry’s pick of this year is Osisko Gold Royalties. He has a buy up to $13 and it’s currently well under. Set to double this year like Wheaton did last year

Fry’s portfolio pick of this year is Osisko Gold Royalties. He has a buy up to $13-14 and it’s currently well under ($11.50). It’s set to double in value this year like Wheaton did last year. As Eric says: “The company’s recent restructuring makes it pure-play royalty company, and it could get “re-rated” with a value in line with other stocks in the gold royalty and streaming sector. Buy up to $13-14″ Eric has been spot on with most of his portfolio so far (for me anyway) and his research is top class – not a pump and dumper!.

significant insider selling during the last 3 month

Gold and Silver is something I always keep a watch on. I’m a buyer only when it’s in the dumps and nobody wants it. My favorite silver play was First Majestic Silver (AG) whenever it was less then $5. As for Gold miner’s in general, I’ve done well with and keep a watch on the Midas Gold Fund (MIDSX).

I will never touch silver again after “the bypass shooting”. It is the most manipulated market that exists

Looking for a ETF that holds both precious metals and mining companies (Used to own RBC precious metals mutual fund but MER is high) WPM looks goo even though not an ETF. I am looking to see what percentage SII has toward gold vs other metals and mines.