This article was originally published on January 24, it has not been updated but new versions of the ad with different headlines are driving questions our way so we’re re-posting here. If you’re looking for Stansberry Innovations Report’s “#1 AI Stock for 2024” that was covered separately here.

Today I thought we’d look into a teaser pitch from Eric Wade for his Stansberry Innovations Report ($49)… Wade is better known as the “crypto guy” at Stansberry Research (his pricier “upgrade” newsletter is Crypto Capital, which is currently $5,000/yr), and Innovations Report is a more generalist “tech growth” letter, but this pitch is pretty crypto-focused.

And the big picture spiel is similar to past “world is coming to an end” spiels about FedCoin and FedNow… but instead of pushing the “fear” button on the potential move to a digital currency in the US, he pushes the “greed” button. Which is at least a little refreshing after the past year of Nomi Prins and Teeka Tiwari hype about “your dollars are about to be recalled!”

The ad does start out with a bit of the “panic” popular among pundits…

“WATCH YOUR MAILBOX FOR YOUR FEDERAL QR CODE”

“As part of the biggest shift to the financial system in decades, this Government-issued code could soon be mandatory to access your social security income, pay your taxes and cash your paycheck.

“‘Saying [it] would be a game changer is almost downplaying the potential impact’ – Forbes”

That Forbes quote, by the way, is from one of many articles about FedNow, which is the instant payment network the Fed built and launched last year, in an attempt to finally modernize the rails of the US payment system. That’s a bank-to-bank network which essentially allows for instant money transfers, which should make the economy more efficient because it should do away with all the persistent delays — like two or three days to clear a check, or transfer money via the ACH.

The ‘fear’ part is that a bunch of pundits have been speculating that this FedNow service is the “trojan horse” that will let a central bank digital currency (CBDC) eventually be developed and implemented to replace the current concept of “cash” in the US. But, thankfully, Wade sticks with the investment angle instead of the “shake your fist at the globalists” angle — and I say “thankfully” not because worries about the loss of financial privacy under a CBDC are necessarily wrong, I share some of the trepidation about how this could evolve over the next decade, but because fretting about a CBDC is essentially irrelevant to your investment portfolio. It’s just a fear marketing target that the marketers (and politicians) have learned they can push.

But like I said, Wade pretty quickly shifts to “greed” on this… here’s a bit of the ad:

“That means you have a choice to make…

“You can get angry about the idea of the new, fully digital financial system being rolled out today – and I can guarantee you, millions of ordinary folks will do exactly that…

“And look, I’m not telling you not to keep money in cash or gold… I think alternative and conservative assets are critical ways to hedge risk.

“But just as important is backing the companies making the update happen – and riding them as far and as fast as they’ll go.

“I think just a tiny investment in these companies will be the single best financial decision of your life.

“Years from now your friends and family will ask you how you saw it all happen.

“What you choose to do is entirely your call, of course.

“But just remember what history tells us…

“When Western Union launched its telegraph enabled “lightening lines,” it transformed itself into one of the biggest companies in America…

“When Paychex helped launch the credit card and bring plastic money to America, it rose 45,000%…

“And when Mastercard helped roll out chip and pin money across the country, it rose 8,873%…

“A $5,000 investment in either of those stocks would have made you hundreds of thousands of dollars richer.”

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...

So that’s the basic idea, big-picture wise: Buy the investments that will benefit from the world of money becoming even more digital than it already is, and that will benefit from the FedNow network.

But which stocks might those be?

“PLAY #1: FedNow’s Secret Partner

“My No. #1 play is already working hand in glove with the Fed.

“That’s a fact.

“It’s one of the handful of technology firms the Fed has hand chosen to be a part of the fast growing FedNow ecosystem.

“That puts it in a position most fintechs would pay a billion dollars to be in.

“It’s right at the beating heart of the build-out of the new financial system – working alongside huge financial institutions that’re part of FedNow.”

No, I wager that most fintechs would not “pay a billion dollars” to join the FedNow system and be part of the transformation. That would be dumb — pretty much any financial institution or technology company can work with FedNow. They have to jump through hoops to work with the government, as all contractors are used to doing, but most of the established financial technology companies already work with the Fed and with tons of banks, this is not some exclusive club that other people aren’t allowed to join.

What else does Wade say about this favorite pick?

“… while there are currently 41 financial institutions working as part of FedNow…

“That number is expected it explode 24,290% in the very near future.

“Soon, there’ll be 10,000 banks and credit unions nationwide incorporated into FedNow.

“And the play I’ve found for you will be right there working alongside them.”

OK… so what exactly does this “fintech” do?

“It’s built a super-secure payment network that would be a giant step forward for our current financial system.

“Consider…

“Right now, VISA can process around 1,700 transactions per second…

“Mastercard can handle 5,000.

“(For reference, bitcoin can only handle 7 transactions per second.)

“But this superfast network can process TEN THOUSAND transactions per second.

“That’s 600,000 per hour.

“And because it’s “always on”… this network runs seamlessly, 24/7.

“There are no outages at night or over the week.

“Meaning it can process 14.4 million transactions a day.

“And a hundred million transactions every single week.

“In fact, in the first quarter of 2023, this network processed SIX BILLION transactions.

“And it does it using the latest security protocols… in a completely transparent way… and with almost no latency.”

OK, so it’s some kind of payment network… which means he’s probably pitching a cryptocurrency, but it could be a “fintech” company as well. Other clues?

“… it won’t surprise you to know that this network isn’t just working with the Federal Reserve…

“It’s also partnered up with $100 billion software giant ServiceNow…

“Not-for-profit organizations like the Coupon Bureau…

“And the second largest law firm in America.

“Not only that, some seriously big corporations are directly involved in building this network out.

“Companies like Google… IBM… Boeing… LG Electronics… and Deutsche Telekom.

“But here’s the cool part…

“You can currently buy into this network for less than a dollar.

“All you need to do is grab a copy of the FedNow Investor Playbook report I’ve put together for you.”

So… hoodat? Eric Wade is very likely teasing Hedera, which you can “buy into” through the network token HBAR. And it is indeed way under a dollar, HBAR goes for about 7 cents these days. HBAR has roughly a $2.3 billion “market cap” (number of circulating tokens X token price), which puts it in the top 50 cryptos by size. The Hedera hashgraph network and technology are being used, to one degree or another, by the Coupon Bureau, mega law firm DLA Piper (on their TOKO project), and ServiceNow, and they have at least some connection to all the other specific “partners” who are involved in building out the Hedera network.

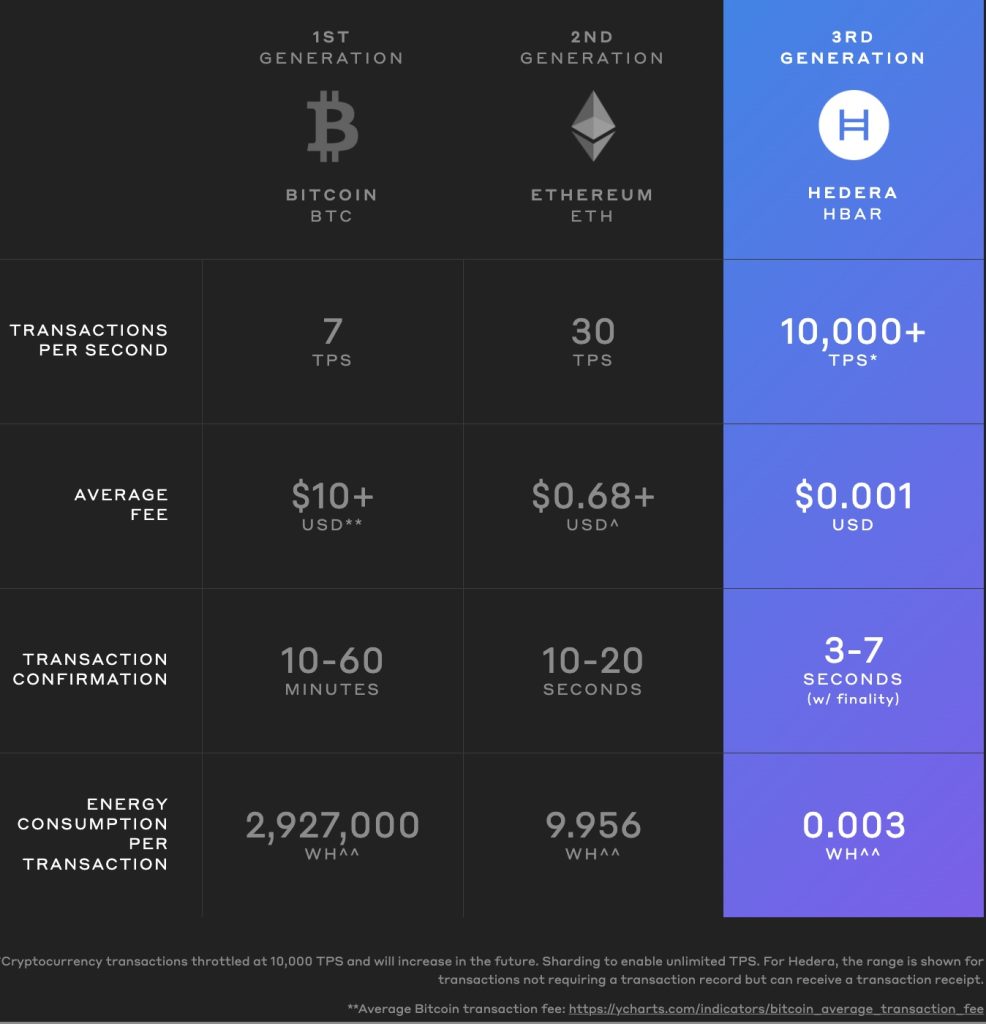

What is Hedera? It is trying, like many other crypto projects, to position itself as the rightful heir of bitcoin and ethereum as the “next generation” network. Here’s how they describe themselves:

“The 3rd generation public ledger

“Bitcoin pioneered decentralized infrastructure and Ethereum brought programmability. But earlier proof-of-work blockchains consume massive amounts of energy and process transactions slowly in order to achieve acceptable levels of security. Heavy bandwidth consumption by these technologies leads to expensive fees, even for a simple cryptocurrency transaction.

“The Hedera proof-of-stake public network, powered by hashgraph consensus, achieves the highest-grade of security possible (ABFT), with blazing-fast transaction speeds and incredibly low bandwidth consumption. By combining high-throughput, low fees, and finality in seconds, Hedera leads the way for the future of public ledgers.”

And they include this handy chart to emphasize that point:

Will Hedera’s token soar higher in the years to come? No idea. They did spike higher during the 2021 mania, when pretty much all cryptos were soaring, so they got to 50 cents or so back then, but over the past 18 months or so the price has mostly bounced around between five and ten cents. As with any network, the potential economic value should eventually be driven by how much the network is used — the “earnings” of a crypto network are the fees that are charged to move tokens around, and the tokens that are “staked” to the network are the ones who earn a share of those network fees, and tokens are fungible and limited in number so the value of any token should be some multiple of the earnings, or the potential earnings, from those staked HBAR tokens. The returns of any particular crypto token from staking can vary widely, partly because the fees vary widely, but HBAR has a fixed maximum staking reward that seems to be designed to maximize efficiency and keep costs very low. Back in August their Governing Council set the maximum staking reward at 2.5% (down from 6.5%), and also stipulated that only 13% of the tokens will be eligible for a full 2.5% staking reward (so if more than 13% of tokens are staked, the reward rate will be dropped for all of them).

That tells me this is more of a “growth” investment idea than a “yield” or “valuation” idea in the crypto space. You can’t envision a clear economic reward from being part of the network at the current yield, so you have to imagine that the network becomes vastly more popular and gets used much more in the future, which might increase the potential yield (the fees are very low, and they’re intentionally low in order to encourage the use of smart contracts and micro-transactions, but if there are 10,000X as many transactions, the fees will eventually add up and, at least theoretically, provide more potential yield for the tokens that are staked, which would make all tokens theoretically more valuable).

That’s how I see it, anyway. Buying into a token that runs a network is inherently a different kind of economic relationship than “owning a business” or “lending money to a business,” so it’s a pretty foreign concept for me, but in general the network should become more valuable if it becomes much more widely used, which means there will be more reward available for being part of the network, which means those tokens should be worth more. But there’s no really objective way to decide how much a token should be worth today, at least for me, beyond that current potential “staking yield” of something between 0 and 2.5%.

If that sounds like gobbledygook, here’s the CoinMarketCap description for a different flavor of gobbledygook:

“The HBAR token has a dual role within the Hedera public network.

“First and foremost, HBAR the fuel that powers Hedera services, such as smart contracts, file storage and regular transactions. Second, it’s used to help secure the network, since HBAR users can stake their tokens to assist with maintaining the integrity of the platform.

“Hedera (HBAR) is the native cryptocurrency of Hedera Hashgraph, a platform that is positioned as an alternative to traditional blockchain technology and aims to excel in speed, efficiency and security.

“Older blockchains tend to use a consensus mechanism like proof-of-work (PoW) to validate transactions, while younger blockchains opted for proof-of-stake (PoS). The Hedera Hashgraph system has a structure that was created from scratch particularly for the project. Hedera is based on a PoS model that is believed to increase the efficiency of transaction verification in the network, provide a high level of security, and protect the network from hacker attacks. Its ecosystem has the underlying hashgraph consensus algorithm and the global enterprise governing body.

“Hedera Hashgraph is a distributed ledger technology (DLT). According to the project website, Hedera differs from other blockchains because it uses a new consensus algorithm called hashgraph. It intends to process and execute transactions faster, eliminate delays, and smooth out the TPS (transactions per second) indicator. Hashgraph is claimed to be an upgrade in transaction speed, cost, and scalability.”

Sounds pretty cool and a little bit mysterious, like pretty much every real cryptocurrency project. And yes, Hedera does have a pretty impressive group of partners in their ecosystem… and one of their projects, a micropayments tool called Dropp, was added to the FedNow list of service providers over the Summer, which gave the HBAR token a little boost, but for the most part HBAR has acted like a lot of other cryptocurrencies, which means it moves along with bitcoin most of the time, though with more volatility. Here’s the chart of HBAR and BTC over the past six months, that little August spike of HBAR, in green on the left, was when the FedNow connection was first made and publicized.

Worth your money? That’s your call. I don’t dabble very much in cryptocurrency projects, for the most part, but I do hold a bit of Bitcoin and Ethereum, and I have put tiny amounts of money into other cryptos from time to time. I can see why folks would want to put a tiny portion of their speculative portfolio into next-generation ideas that could play out — even if the economic value of those crypto tokens or networks is quite ineffable at the moment.

I suspect the price will be driven much more by story and speculation over the next year than by anything else, and perhaps a lot of cryptos will surge higher in the wake of Bitcoin’s potential for increased demand as the bitcoin ETFs roll out and begin to gather more institutional money, but I don’t have much ability to even guess at a rational valuation for these kinds of tokens… which means I shouldn’t be putting more money in than I’d wager at the blackjack tables on a trip to Vegas. Your opinion could easily differ, and I imagine many Gumshoe readers are much more immersed in the cryptocurrency world than I am, so feel free to use the comment box at the bottom to tell me why I should invest in HBAR… or, for that matter, in whatever your favorite crypto might be.

But that’s not all we hear from Wade, he also teases two other “plays” on FedNow and the digitization of money…

“PLAY #2: The “Tollbooth” of the Next Generation Financial System

“The tollbooth is perhaps the best moneymaking idea in human history…

“You sit by the side of the road… and collect a small charge from everyone who passes by.

“There’s nothing complicated or nothing hard to understand about it…

“It’s all about being in the right place at the right time.

“So long as there’s plenty of traffic passing through your tollbooth, you’re making money.

“And that’s exactly the principle behind the second play I want to share with you.

“It’s owns a ‘tollbooth’ on the fast-changing financial system.

“In fact, it made $4.5 billion last year, simply by collecting a ‘toll’ as investors and traders move into the market.

“Even better, it passes millions of dollars of that cash back to its shareholders.

“Which makes it a great way of getting paid as traffic in the new financial system picks up.”

Will FedNow increase the velocity of money transfer enough that it actually picks up the level of investing and trading activity? That seems to be the basic pitch there, if this firm is earning $4.5 billion by “collecting a toll as investors and traders move into the market.” I’d guess that impact would be pretty muted, but let’s see what other clues we get…

“… every investor – whether you’re a private investor or a trillion dollar sovereign wealth fund – has to route their trades through a gateway into the financial system.

“And for every trade you can think of – stock, option, bond, gold, crypto – the owner of that gateway earns a fee.

“And my second play is one of the best in the business at collecting these fees.

“Not only that, it’s moving into the digital markets space as we speak… thanks to a huge acquisition it just made for a digital asset and derivative market.

“And it’s recently partnered with asset-management giants like Fidelity, WisdomTree, VanEck and Invesco to move into the digital currency space.

“That makes it a perfect way to capitalize on the shift to an all-digital financial system.”

That last bit, tying in Fidelity, WisdomTree, VanEck and Invesco, probably means that he’s talking about one of the firms that enabling the Bitcoin ETFs being launched by those firms (or back when this ad was probably written, being planned by them).

So what’s our match here? Well, there are several of the large exchanges and financial overlords who could fit this tease, but the best fit for the specific clues is the CME Group (CME), leader of the futures markets… though probably the best match conceptually is their cousin the CBOE (CBOE). Those used to be the Chicago Mercantile Exchange and the Chicago Board Options Exchange, and along with the Intercontinental Exchange (ICE), which owns the NYSE, they’re among the biggest exchange operators. Operating an exchange, which used to mean a physical trading floor but now is almost entirely digital, is one of the world’s great businesses — and it seems as though the CBOE and CME, which offer some specific proprietary products, including licensed rights to things like the S&P 500 index options for CBOE, are among the best at keeping their fees from getting competed away.

CBOE is more actively involved in the Bitcoin ETFs, they advise or work with all those named players and have been active in cryptocurrency trading, including bitcoin and ethereum futures, and they did buy a digital exchange a little while ago called ErisX (now remaned CBOE Digital). That’s very likely the match for Eric Wade’s pitch here, and my impression is that they have their fingers in more crypto projects and products than the other big exchanges, but they have never actually had $4.5 billion in revenue (they’re just shy of $4 billion right now). CME is not as good a match conceptually, but it matches that specific $4.5 billion clue… and they pay a much higher dividend as well if you’re interested in that “passes millions of dollars back to shareholders” bit.

So we’ll settle on CBOE Global Markets (CBOE) as our “best guess” here, but can’t be 100% certain. CBOE is a great company, and trades at a pretty rational valuation even after spiking much higher over the past six months — at about $190, a new record high, the stock is trading at about 28X trailing earnings and 23X their forecasted earnings of $8.35 in 2024 (which would be almost 10% earnings growth from 2023, similar to the prior year’s growth rate). They pay a dividend of about 1% these days, but have also consistently bought back stock over the years, so the share count has also shrunk about 1% per year. It’s a great business, and they essentially own some big markets, like S&P index options and VIX options, but I should note that at this point, everything related to cryptocurrencies is so tiny, in relation to the size of the index options market and the general equity options trading volume at CBOE and their other businesses, that the CBOE Digital business is really a rounding error. We may see the Bitcoin ETFs drive more trading volume on the CBOE, which could help, at least incrementally, but the big driver for CBOE is just “trading volume” in general — the more people invest and trade, the more they make by shaving off their tiny “toll” while the money flies around their exchanges. I wouldn’t talk you out of buying CBOE, even at a new all-time-high price today, it’s likely that you’ll do fine if you hold the stock for long enough, even though the earnings will almost certainly dip if trading volume collapses in a prolonged bear market… but don’t buy it because of FedNow or your sentiment about cryptocurrencies, none of that matters very much to CBOE’s bottom line at this point.

And there’s one more… what else does Wade tease?

“PLAY #3: The unknown network building the financial “KILLER APP”

“We’re in the middle of a shift not just to the way money works… but the digitisation of the entire financial system.

“Ultimately it’ll disrupt the way every stock… bond… ounce of gold… or piece of real estate… gets traded.

“Before long, it’ll all be traded digitally, using super-fast, super-secure networks like the blockchain. (It’s already happening – the Bank of America claim more than $1 billion in “tokenized” gold was traded in March 2023 alone.)

“JPMorgan analysts claim the technology that makes this possible will be the financial world’s “killer app.”

“And I think I’ve found the network that’ll make it possible.

“I’m not alone.

“The institutions this tiny company is working with right now is about as prestigious as it gets.

“Consider… it already has partnerships with Credit Suisse and Deutsche Bank…

“…the Central Bank of Italy…

“…payments firm Stripe…

“…Starbucks… Adobe… META… Adidas… Disney… the NFL… and DraftKings.”

Going by the teased partners whose names Wade drops here, that’s very likely a pitch for the crypto smart-contracts platform Polygon, which is an Ethereum “scaling system” designed to improve Ethereum by making it faster, and therefore he’s probably recommending a purchse of the Polyton network and it’s token, MATIC. Polygon says the “current reward percentage” for staking is 4.95%, though I don’t know how much of that flows through to the folks who stake their tokens to help with validation on the network. Polygon Labs has received a good chunk of venture capital funding as well, and I don’t know whether that equity investment is separate from their tokens, but it seems likely — most of the time, the token owners don’t actually “own” the business that created the technology, tokens are typically investments in the viability and trading volume and fee generation of a network, not investments in “owning” something.

Polygon is also pretty big, with a “market cap” of over $6 billion (it was around $20 billion in the 2021 heyday), and it does have a lot of big-name partners who have used their network for things like NFT development — I came across this graphic, and it seems to mesh accurately with press releases I’ve read:

Will MATIC end up being the best “scaling layer” for Ethereum? Will that lead to a higher value for MATIC tokens as they process more and more transaction volume, taking that weight from the (pretty expensive) ethereum network? I dunno. Maybe. They do have a limited number of tokens, like many crypto projects these days, so there’s some potential, and they do say that their “gas” fees are quite low, averaging about 1.5 cents, so it’s nowhere near as inexpensive as HBAR claims to be, but it’s a lot cheaper than basic ethereum transactions. Beyond that, I’m way out of my comfort zone in judging how valuable any of these specific networks or tokens should be… but it’s at least pretty clear that Wade is pitching Polygon. Do with that what you will.

That’s all I’ve got for you today on these three “FedNow Plays” from Eric Wade — a couple cryptocurrencies and one of the large financial exchanges. Think FedNow will light the candle for these rocketships? Just marketing hype? Have other favorite plays on the future of digital money? Let us know with a comment below… and thanks for reading!

Disclosure: Of the companies mentioned above I own shares of Google parent Alphabet, and I also own some Bitcoin and Ethereum. I will not trade in any covered investment for at least three days after publication, per Stock Gumshoe’s trading rules.

are you nreferring to matic-usd or matic-eth. -big difference in price !

Looks like MATIC is trading for about $0.70, or for about .00033 ETH. Which is also a little over 70 cents, if you translate Ethereum to US$. MATIC-USD and MATIC-ETH seem pretty much the same unless I’m missing something.

Travis – Is there a way to buy the MATIC concept without being involved in Crypto or ETH?

what technologies are behind the MATIC name and what companies are connected?

I’m not aware of any way to invest in Polygon’s technology or their MATIC cryptocurrency without buying the cryptocurrency itself. Almost every large bank or financial services company is using blockchain in some way, either partnering with existing crypto teams or building their own, I’m not aware of anyone in this sector that has a particular “edge” on that… and frankly, the growth of the FedNow system is probably a negative for those kinds of cryptos, since they exist largely to speed up peer-to-peer transactions, and to some degree the modernization of the interbank system in the US will take away the appeal, since it will bring the slow 2-3 day ACH clearance process up to “modern” speed, make those transactions instant without using cryptocurrencies, and take away some of that casual demand for cryptos as a tool for speeding up money transfer.

Certainly not an expert on financial technology, though, maybe there’s a leader behind the scenes that I don’t know about.

they aren’t at TD Ameritreade

The cryptocurrency ones? Yeah,

Not many brokers deal directly with those. They’re pretty big, so I imagine they’re trading on most crypto exchanges, but haven’t checked.

TD Ameritrade (at least in Canada) does have 2 listings for Ethereum and Bitcoin through 3IQ. Full disclosure, I had a position in both and did pretty well but sold in early 2022 . I wanted to sell in November 2021 but got talked out of it…trust yourself I guess or maybe its better to say, trust your conclusions.

In the digital realm of cyberspace whales, Michael Saylor may be the elephant in the room.

I have never bought into crypto coins because, customer token quantities are protected by Blockchain, however, the dollars are in wallets (accounts) in an Exchange (bank) that is NOT protected by blockchain.

How many times have off-shore hackers sucked millions of $$ from those exchanges??

About 1 year ago I got E-mailed a certificate for 100 Unicoins priced at 1 cent each. I get E-mail updates and this crypto is very different. They went on a big advertising campaign and mase massive sales at 20,000 coins at a time and made millions. Rather than putting the dollars in an exchange they bought property as in investing. A copper mine in S.A. and a Lux resort in Thailand etc. Now a Unicoin is worth 50 cents.

They are planning to be listed on the stock market in 2024. Travis have you looked into Unicoin???

Thanks for all you do, even for us retired folks.

Nope, I don’t know that story at all — thanks!

Crypto, or The Blockchain, is real and Eric is correct, a Digital Dollar is coming. I’ve been warning people since the 70’S that this is the Fifth World Empire from Daniel’s prophecy in the Bible. It will not be a Military Empire like the first four, it will be Economic.

I’ve done well with crypto. Bought INJ at $2 and it was recently up over $50! Bought ETH @ $700 and BTC at $20K. There’s still time!

Blessings

“Not your keys, not your coins”. Keeping crypto in a CEX isn’t a great idea – self storage is the way to go, preferably a cold wallet.

Hi Travis Can you do a quick review of Joe Duarte MD review of the Apple supplier of new tech? He sent out a review via email on 30 Jan 24 called Profit Catalyst Alert. ($995 pa) Apparently Apple need the small teased company’s input to make the new Vision Pro Headset work. The urgent call is to get in to this small company before Apple announces on 2nd Feb. Thanks

Dude, send Travis the link to that letter @

ILoveStockSpam@gmail.com

and he will review it.

Thanks for the overview. I just received a very long video message from Wade. He misrepresents the “new” FEDNOW program and offering the concept of an individual “code” to log onto their network. That is not the purpose of FEDNOW as you have correctly presented. It is refreshing that Stansberry has now decided to go with the GREED factor rather than play the FEAR factor.

It is interesting that this report does not include any reference to the BTC Halving event that we have all hoped Gumshoe would be all over! Just like the Solar Eclipse, there will be a lot of attention leading up to the event. Will there be any long term repercussions the BTC halving? Stay Tuned!