The talk of “Trade War” is everywhere in the financial media, as you’ve no doubt seen — the first round of “tit for tat” trade tariffs has been decided on both sides, with the US planning tariffs against Chinese steel and aluminum and the Chinese retaliating with tariffs on a variety of mostly agricultural products from the US… and no one knows how far it will go, or whether this will just end up being negotiating bluster on both sides that eases once some real negotiations take place.

But certainly it causes a lot of fear, the stock market does not like tariffs and it does not like to go to bed on Friday night wondering what the Twitterer-in-Chief is going to say next… and the market was already richly valued and worrisome when we started this year, so big moves up and down have followed each round of the bluster-and-response game.

And Steve Sjuggerud, it appears, has some way of profiting from this “Trade War” — and he’s hinting at that “favorite way to profit” in the latest ads for his True Wealth China Opportunities letter (currently $2,000 for life, no refunds… $149/year “maintenance fee”).

What is this way of benefitting? Well, it seems like… the same thing it has been over the year or two he’s been promoting this service and his China-related stock picks. The only thing that has changed, really, is that the big Chinese tech stocks who make up the majority of his recommendations (or so it seems, at least) are down sharply, in many cases 15-20%, from the peak prices we saw in late January and late March.

The reasoning seems to be that these stocks are down due to the “trade war” talk, but they are not actually directly touched by tariffs or US-China trade. Every major company is indirectly impacted by global trade, of course, since it plays a major role in economic growth in general, but at least most of these stocks won’t be reporting tariff charges on their income statements.

Here’s a taste of the ad:

“My Favorite Way to Profit from Trump’s ‘Trade War’

“A Rare Second Chance to Get In On Steve’s Favorite Government-Sheltered Investment….

“Steve Sjuggerud says – while certain industries could suffer – for investors, it’s a total distraction.

‘There’s a HUGE side of this story most people don’t understand. It’s not being told by the mainstream press – or reported widely in the financial world. But if you understand what’s likely to happen next, it could change your life.'”

This story was initially touted back in 2016 as a way of buying the Chinese equivalent of the “FANG” stocks — and the rationale was mostly that the growth potential was as good or better than the global FANG stocks (Facebook, Amazon, Alphabet, etc.), but Chinese regulations meant that these firms were spared competition. Amazon and Alphabet wouldn’t be storming across the “Great Firewall” to take share from Alibaba and Baidu, for example, so growth should be tremendous as they continue to expand and thrive in the rapidly expanding Chinese economy.

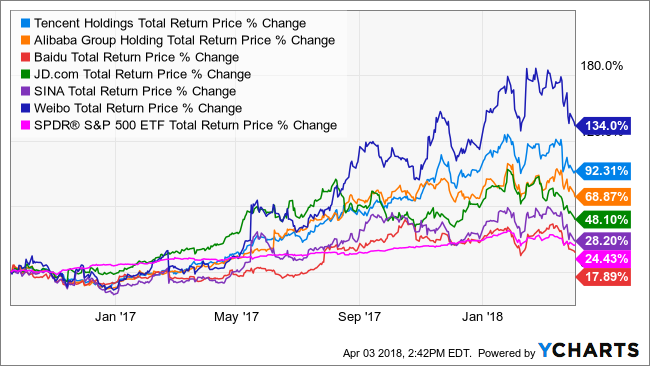

And it worked quite well, as you’ve probably noticed — those stocks were probably not all recommended by Sjuggerud on just that one day in September 2016 when we covered his earlier ad, but if we go by that date here’s the chart of the stocks we identified in that earlier pitch:

So among Tencent (the Chinese Facebook… or really the “Chinese everything”), Alibaba (Chinese Amazon), Baidu (Chinese Google), JD.com (also Chinese Amazon), Sina (Chinese Yahoo, owns much of Weibo), and Weibo (Chinese Twitter), only Baidu has done worse than the S&P 500 over the past year and a half since that article was written. Those comparisons to US companies are, of course, not very accurate — all of these firms are far more complex than their two-word description — but they give a general idea.

And it does make you think about just how important it is that China essentially held off the big US multinationals and nurtured their own competing internet companies. Other large tech companies have survived and thrived despite that global hegemony by the mighty few, of course, but you can probably count the other non-Chinese countries have their own “Google” or “Amazon” on one hand (Latin America’s MercadoLibre, Russia’s Yandex, etc.).

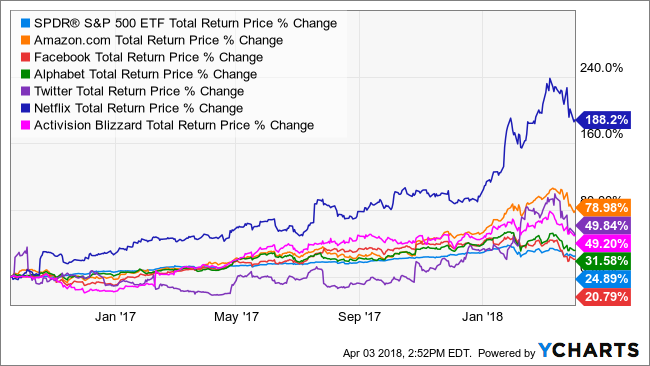

Incidentally, here’s what that chart looks like with the rough US corollaries — I threw Activision Blizzard and Netflix in with the US bunch, since gaming and video play a big role in a lot of the larger Chinese tech companies:

So yes, the Chinese stocks still win… but it’s pretty close, and “giant tech stocks” in general have certainly been a winning bet for the past year and a half. Until, of course, the February dip or the late March dip came along and created what Sjuggerud seems to be calling a “buying opportunity.”

So yes, though we’re not told to rush out and buy one big winner from Sjuggerud, he has repeatedly hinted at Tencent as his favorite in this bunch, and that’s still on the list here… as is Ctrip (CTRP), which didn’t come up in my previous article about his ad (Ctrip was an earlier strong performer, up 2,000% in 15 years and touted by pundits for years before Alibaba was even publicly traded, part of the first generation of Chinese tech stocks that took off in the mid-2000s along with Sina and Baidu, but the stock has been more or less flat for the past two years).

And… that’s about all we get by way of hints, so all we can really tell you is that Sjuggerud seems to still like most of his China tech stocks and similar investments (he has also recently touted MercadoLibre (MELI) as the “next Tencent” for his True Wealth newsletter, and that stock has dipped, too… though I don’t know if that South American company would make it into a China newsletter).

He doesn’t drop any other hints about the specific companies, but here are the ones we know that he has liked in the past — none would have triggered a 25% stop loss over the past couple years other than Ctrip, which would have stopped out using that criteria back in December:

"reveal" emails? If not,

just click here...

Alibaba (BABA)

Baidu (BIDU)

Ctrip (CTRP)

JD.com (JD)

Tencent (TCEHY)

Sina (SINA)

Weibo (WB)

He has also, over the past year or so, teased some other recommendations as plays on the increasing weight Chinese domestic shares (“A” shares) will have in global indexes, including the KraneShares ETFs KWEB (Chinese tech stocks) and KBA (China A shares)… I don’t know if those are currently in his portfolio, they’re not hinted at in this latest ad.

And yes, all those stocks are down from their January highs and/or their March highs, with drops of anywhere from 5 percent to 20 percent from those recent highs, after a couple years of mostly extremely strong performance.

Does that make them buys? Well, if they’re going down because of tariff fears… yes. If they’re going down because everyone’s worried that they were overvalued and in bubble territory and that China’s growth might slow down and provide a bit of a headwind… maybe not. Nothing is ever perfectly clear or simple, but they are, at least, cheaper than they were a few weeks ago.

For what it’s worth, (and for disclosure purposes) I’ve traded several of these in the past but currently have just long-term option positions on Alibaba and JD.com, and an indirect position in Tencent through the South African firm Naspers, which owns about 30% of Tencent shares. I also own shares of Facebook, Amazon, and Alphabet among the US companies mentioned. I’ve most recently bought some Naspers and sold some Facebook among that group… and now that I’ve mentioned them, I can’t trade those stocks for at least three days, so hopefully nothing exciting happens this week.

For your money, though, it’s your call — what do you think? Is this latest drop in the share prices of the Chinese tech giants a buying opportunity? Do they have to fall further before you’ll be interested, or resume their positive momentum before you can set aside your fears? Have other favorites that I haven’t mentioned here? Let us know with a comment below.

And, of course, we always want to know what you think about the newsletter company you keep — if you’ve subscribed to Sjuggerud’s China Opportunities letter, please click here to let your fellow investors know whether you found it worthwhile. Thanks!

” I can’t trade those stocks for at least three days……..” – well if U do, we are not going to know anyway – or care because your trade is not going to move the market.

I’ll know. And the SEC will know. Rules are important.

Don’t bet against him…he was touting the melt-up before it became popular and others started using the term…is he perfect? Of course not, but he has been accurate on the melt-up. As Travis likes to say, and for full disclosure, I own Tencent.

Fundamentally, everything could drop another 40% or so, according to the email I read just before this one, which was by Christian DeHaemer (Energy and Capital). I suspect the odds of that happening could be reduced somewhat if Trump could be kept bound and gagged for the next couple of years. Interesting that none of these investment darlings, USA or China, make anything you can hold in your hands, so it’s difficult to see how they would be affected by a trade war. I put my money down and hope for the best. And no, I’ve always resisted sending any money to Sjuggerud, and thanks to your synopsis, I wouldn’t give that a second thought.

I’m wondering if anybody viewed the The China Hustle movie?I have a friend that buys fish down there says the movie is right on.

That movie might apply to small caps, but ridiculous to compare to companies like Tencent and Ali Baba.

Good movie and story continues in China with other shams………..

http://d.muddywatersresearch.com/content/uploads/2017/12/MWR_CIFS_12202017.pdf

Just don’t know enough about the Chinese stocks to even considering investing in them. Plus it is hard to trust whatever the Chinese say they have or are doing or what is actually fact.

I dont trust the Chinese markets,not enough transparency for me. Besides this isnt reallly a trade war, more like a dust up.

I’ve followed Sjuggerud off and on since late 2016. So far as of today,

TCEHY up 47%.

PNGAY up 40% and

BABA up 36%

Haven’t reached my trailing stop yet but getting close.

Hmmmmmm, all you hear & read is that tariffs will hurt Wall St’s American stocks. Well, isn’t the China tariffs going to do the same to these Chinese stocks Steve is recommending? Looks like tariffs just hurt the instigator, right Steve?

Tariffs that have been announced so far won’t hurt the US internet stocks directly, either, they generally are aimed at trade in physical goods. Impacts the economy, but not those specific companies directly. Google, Amazon and Facebook don’t do much in China; Tencent, Baidu and the others don’t do much outside of China.

I wonder when that salacious group of scumbags dropped their stop loss to 25% when another group of scumbags Greenie & Karime used 35% in 2011.

That trading tactic, i.e., not providing realistic stock price recommendations and trying to protect against downside moves by stop loss orders is a loser method. It cost me a boat load of money in 2011. Algorithms used by arbitrage traders look for these stop loss orders and trade against you especially in tech stocks.

I don’t know if Sjuggerud uses a 25% stop loss, that was just an example.

Stop loss orders do generally work, over time, to reduce risks by a little bit and thus improve average returns… but only over a long time, on average, and only if you do something productive with the money after selling and don’t just sit on cash out of fear. I don’t like them as a firm rule, but I like to use them as a guide for when to reconsider and re-analyze a position.

No newsletter recommends, putting actual stop loss orders into your brokerage account, as far as I know. They all recommend “mental stops” to avoid showing those sale orders in the exchange order flow… but with newsletters a sell order has a similar impact to a buy order in that it means traders know there are thousands of people following that same price point, so it can be manipulated, at least for smaller capitalization stocks.

Steve S. and Porter S. have been using the new Trade Stop set-up and not using their typical 25% stop loss. Each stock now has a weighted value so it does not take you out of your position prematurely but keeps you in for better returns. There were times when you have the mental stop at 25% to sell, the stock would end up turning around at 30% and head back higher. Trad Stop kept you from that loss while providing better gains.

I encourage all would-be investors in Chinese stocks to see a movie called THE CHINA HUSTLE. It bares many of the scams going on in the Chinese stock market. Not easy to find—showing mostly in art cinema theaters. Maybe you can find it on DVD. Well worth the effort to see it. You might not put a dollar into Chinese stocks after seeing this movie

I´ve seen a few movies (with Michael Douglas, Di Caprio) about Wall Street.

Maybe they were a prequel to this China Hustle.

ITunes has The China Hustle . I haven’t rented it yet but it looks interesting.

Play it safe…Put your money in the Moscow Exchange.

Hello everyone,

As alternatives to riskier-sketchier-opaque Chinese stock picks…Please check out $XSOE crazy good returns (46+%) and focuses on Chinese companies that are not owned by the state therefore they are essentially free to compete!

Personally, too much risk in my portfolio from too many individual stocks, considering flipping to majority ETFs – anyone have experience and care to share a good service they like that recommends just ETFs? Trying to lessen trade fees and my own reckless movement in and out of positions as I focus on a job search…yuck. But also, if there is a big correction, I feel that it’s safer to be in fewer positions to get our quicker. What do you think

@travis and others?

I’ve subscribed to Ted Bauman for 5 rotating ETF picks. Any feedback on him? Part of Banyon Hill. Surprised nothing on Ted Bauman when I searched to add as a Topic Filter below…

Sjuggerud: I’ve been in and out of $KBA (dud), $BABA (modest gain), $FB (solid gain)…

ETFdb

Any True Wealth China subscribers know Steve’s two MSCI picks?

Maybe IDCBY and CICHF

3 MSCI picks: FXI, KBA, CAF

I made a good profit on Tencent months ago, and bailed while I had my 20% gain (that took only a few months to get). Lost money on Baidu; I won’t touch China stocks much. A good friend who works for a Chinese-owned tech company in North Andover, MA, a small one, please note, says he wouldn’t touch Chinese stocks mainly because if the government in Beijing wants, they can nationalize any company they please, and there goes your investment. I said as much in a comment I submitted to Stansberry, and Sjuggerud mostly poo-pooed it. I did get sucked into the Alliance pitch, and, unlike all their subscriber testimonials, I’m still trying to figure out why it’s so darn great. A lot of Sjugerrud’s Melt-Up portfolio are just doing OK; I’m pulling in more $$ by selling OTM puts on those stocks and ETFs. Dan Ferris’ portfolio is rotten, and the Stansberry Big Trade put recommendations are almost uniformly losers. GM, Conn’s and the other doomed to fail businesses are not just still open, their stocks are up. Oh well, you gotta waste money to learn how to make money.