This is an ad that has circulated off and on for about 18 months now. It’s making the rounds again as we begin the year, and as “tech stocks” are in vogue (and as perhaps the upcoming Apple Vision Pro gives the “metaverse” and gaming another shot at an investor mania). I’ve updated our thoughts on the stock and the metaverse below, but this article is quite similar to the one I shared a year ago.

The pitch is from Ross Givens, who is selling his Stealth Trading GOLD service ($89/yr), and the primary bait he’s dangling is the special report about his “#1 Tech Stock of the Decade” … so that’s what we’ll focus on here. We’ve been getting similar ads from Givens since last Summer, though the pitches heated up again through December and into January, with the content of the ad unchanged, and I actually just got the ad in my inbox again this morning.

What clues can we feed to the Thinkolator to get our answer? Here’s how Givens sums up the appeal of this particular stock:

“Like Getting Netflix, Facebook, Apple, Amazon & YouTube — Rolled into 1 Stock….

“The 5 ‘Tech Catalysts’ that guaranteed these companies would change the world

“For Netflix, it was recurring revenue

“For Apple, it was the App Store and iTunes

“For YouTube, it was the ‘freemium’ model

“For Amazon, it was online shopping

“And for Facebook, it was the ‘network effect’….

“The same ‘catalysts” that helped explode those 5 great tech stocks into the mainstream — and make investors true generational wealth…

“Are ALL built into the stock I’ll detail in The #1 Tech Stock of the Decade.”

Other hints?

“Andreeson Horowitz, America’s #1 tech hedge fund & early investor in Facebook, Instagram & Twitter suggested it could be ‘the next social network’… one that’s ‘bigger than anything we’ve seen yet.’

“Investing legend David Sze who made his first billion investing in LinkedIn believes this will become ‘the largest social experience in the world.'”

This is a firm that he calls a “genius Tech/Gaming/Metaverse company”… and from those clues and the rest of the presentation the Thinkolator quickly spit out our answer: He’s been talking up the gaming platform Roblox (RBLX)

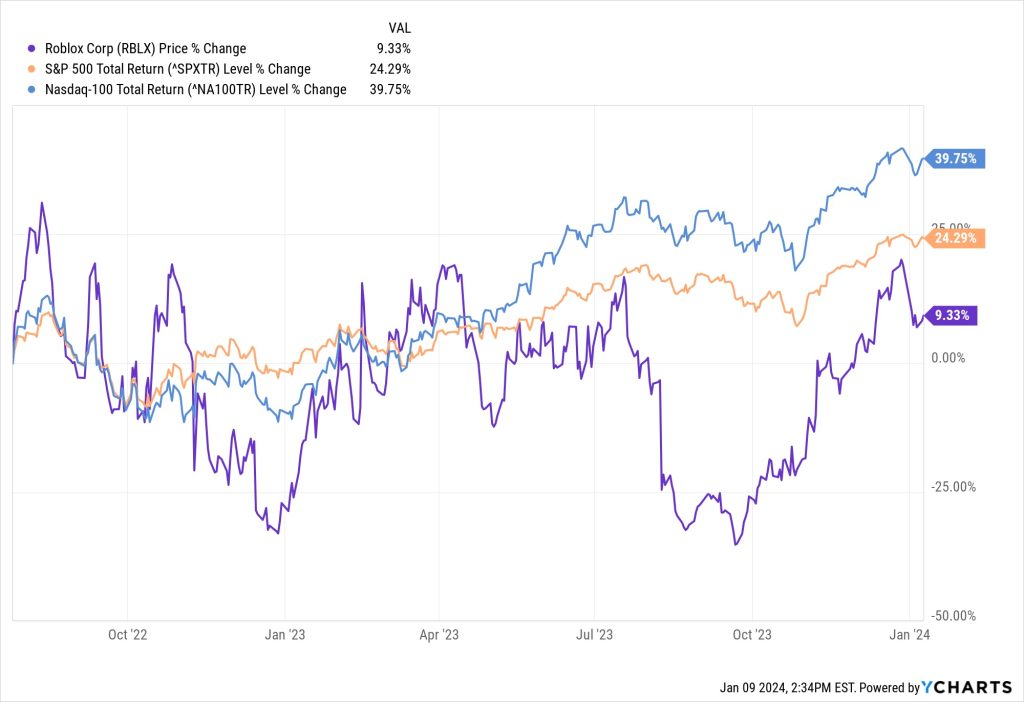

Givens pitched Roblox as a “breakout” idea back in July of 2022, but then this particular ad with the “Apple, Facebook, Youtube, Netflix and Amazon all in one” idea really started pounding our inboxes in August and September of that year, then was repeated a year ago. The actual video “presentation” and the pitch haven’t changed, only the lead-in emails and the headlines have changed a few times, though the Roblox share price has certainly moved around a lot… we know, of course, that Roblox was a hot “story” tech stock after its IPO in 2021 and has come down sharply since those days, like just about every other tech stock, but here’s what RBLX has looked like (in purple), with the Nasdaq 100 (blue) and S&P 500 (orange) for comparison, since that first ad of his, roughly 18 months ago:

No surprise that it’s more volatile, but the stock did bounced back a little in 2023 as the tech sector has recovered, even if it has lagged the Nasdaq recently… it’s done better than I would have guessed this year, given that they haven’t been a part of the “AI” story that is driving so much of the market.

What is Roblox, you ask? Well, if you’re a teen or have children you’ve probably had some interaction with Roblox… if you’re an adult, maybe not. It’s a gaming and entertainment platform that leverages user-created content, mostly fairly simple games, to build community among the younger set. It’s a simple-to-use gaming engine on which they’re trying to build what is essentially a “metaverse for kids.”

Here’s how they describe themselves:

"reveal" emails? If not,

just click here...

“Roblox’s mission is to build a human co-experience platform that enables billions of users to come together to play, learn, communicate, explore and expand their friendships.

Roblox is powered by a global community of millions of developers who produce their own immersive multiplayer experiences using Roblox Studio, our intuitive desktop design tool.

Roblox is ranked as one of the top online entertainment platforms for audiences under the age of 18 based on average monthly visits and time spent (Comscore). Our popularity is driven purely by our community of users and developers.”

Roblox has been growing quickly for many years, but really exploded in popularity during the pandemic, when kids were stuck at home and gaming became even more primary as their social outlet and entertainment. The user base is massive, as of December 2022 they had 61.5 million daily active users (18% growth in a year), but the financial strength of those users had begun to moderate a bit.

Since then, the user base has grown a bit — as of the September quarter they averaged 70.2 million daily active users, with that number currently growing at roughly 20%/year. The monetization has been flat-to-down for most of the past year, last quarter they had about $11.96 in average bookings per daily active user (ABPDAU), which is the same as it was a year ago (there’s always a lot of seasonality in Roblox usage — their fourth quarter is typically much higher than other times of the year and we won’t get those numbers for at least another week or two). The top line bookings and revenue were up big, thanks to that jump in users, with revenue up 38% year over year. They continued to lose money (net loss of $277 million, about the same as the year-ago quarter), but because of the prepaid “Robux” sold and a huge stock-based compensation expense ($220 million last quarter, a number that has generally been growing faster than revenue), they did have positive operating cash flow of $112 million (that’s not unusual — and it’s down 30% or so from last year, but still, positive is good).

We’ll see how the next few quarters go, but it’s good that they’ve corrected for their slowing revenue growth, at least for now — this is a potentially very valuable platform, IF they can continue to recruit each new generation of kids and/or build an adult experience into the platform that can keep kids engaged as they “age out” of what has been the traditional age group for Roblox, but if they’re going to grow more slowly then it’s hard to make a good argument for the valuation.

Right now, analysts are forecasting that Roblox will grow its sales to $3.4 billion for full-year 2023 and $3.9 billion in 2024, which is 15-18% annual top-line growth, pretty steady following a “reset” year in 2022 (2022 ended up with 15% revenue growth, after massive growth of 96% in 2020 and 108% in 2021). They see the losses compounding, though, with no real improvement in margins, so that would mean they’re still going to keep losing $1.50-2.00 per share per year, twice what the loss was in 2021. As we’ve seen from all the non-AI tech companies who are announcing layoffs in the last year or two, and reporting disappointing results, it’s been a challenging post-COVID time for some of the firms who had a windfall of new customers flooding their business and are trying to reset for a more “normal” world. Roblox is just now getting to that reset on the expenses side, they kept building the workforce throughout 2022 but they think they’re done with that effort now.

If you want to have an optimistic bent, the number to look at is bookings, not revenue — that’s because a lot of what Roblox (and its developers) sell is what they call “durable virtual items,” add-on virtual things that are used in the games on the platform, and the revenue for those is recognized over the average lifetime for a paying user (as of last quarter, that was 28 months — so a $28 purchase would be recognized as “revenue” at a pace of $1 per month, even though Roblox already has all $28 in cash, which is why their operating cash flow is pretty good, and why they had positive free cash flow this quarter for the first time since the first quarter a year ago). Bookings had been falling for the first half of 2022, but started to go up again late last year and was quite good this last quarter (up 20%). That’s the fuel for future revenue growth, even though it’s not really “per user” growth right now (they grew daily active users over the past year, so 20% bookings growth still means bookings per user is just treading water).

Right now, with 70 million daily active users, you’re effectively paying about $375 per daily active user when you buy RBLX shares at a $26 billion valuation. If that user base keeps growing and they are able to grow the revenue per user, and get some scalability by slowing the expense growth, then that can multiply nicely and it can certainly work out, platforms that become dominant can eventually grow into even steep valuations… but if growth slows down and it takes a long time to reach some profitable plateau (or they never reach it), it can be very challenging to get new investors excited about buying shares.

The real challenge for me, when trying to get interested in Roblox, is that each user only sticks around for an average of 28 months, so at something like $50-55 in bookings per year, per daily user, that means the average user might be expected to generate ~$120 in lifetime bookings at Roblox. Developers get a bunch of that money, and Roblox of course has high operating expenses for R&D and selling and administrative costs, so you can see why paying almost 3X the lifetime revenue (not profit) value of their current users is still pretty lofty. It can work, but you’re still really betting on growth. They’d need a lot more users spending a lot more money to scale this to profitability unless they can really slash their operating costs. There are enough people in the world to imagine a very bright future, I suppose, roughly a third of the global population is under 20 years of age, but I think Roblox needs to both double its user base and double its per-user bookings to start to make financial sense. They were doing that during the height of the pandemic, but I’m skeptical that they can grow at that pace again. We’ll see.

To be fair, I should note that these are just the DAILY active users — there are a lot more casual Roblox users, too, and those folks have value and might be convinced to become more active or to spend money on the platform (the “freemium” part, which Givens compares to YouTube, is that you can play a lot of Roblox games without spending money). They provide some other key metrics in their quarterly supplemental presentation, if you’d like to get a sense of the trajectory.

There aren’t a lot of easy comparisons, but one that comes to mind because of its similar scale is Roku (ROKU), which sells streaming TV hardware and earns “platform” revenue by selling ads on streaming content and collecting commissions for selling streaming services. Roku seems to have almost the same number of active users (about 76 million active accounts, in their case), a lower user growth rate at the moment (16% last quarter) and a similar annual per-user revenue number (lately about $40 in annual revenue per user (ARPU), a number that has declined a bit over the past year). They also grew more quickly during the pandemic but are still growing, albeit more slowly, post-pandemic, and they’re likely to have a longer customer “life” (they don’t report their churn, but households don’t age out of watching streaming television). Roku is also losing money over the past year, mostly because they subsidize their hardware to build the user base and support the ad revenue, and their stock-based compensation is similar, but they’ve also recovered to be “Adjusted EBITDA” positive last quarter, for the first time in over a year.

Streaming TV and “metaverse” gaming are obviously not the same business, and Roblox probably has more potential to be explosively different in ten years than Roku, but you pay a lot for that difference — Roku is valued at about $180 per account now (up from $120 six months ago, since the stock price has surged), and is profitable if you ignore the customer-acquisition cost of the hardware side, Roblox is valued at about $375 per daily active user, and it’s harder to see how that can be recouped given the average revenue per user. I own Roku, so I’m certainly biased, but I thought I’d just throw that in for some context.

On the balance sheet side, Roblox has been steadily issuing new shares pretty much every quarter since they went public (they went public with a direct listing, not an IPO, so there wasn’t a big influx of IPO cash, but they have sold both preferred shares and regular shares since then), so although their losses are substantial they haven’t burned through all that much cash — they’ve also borrowed a billion dollars, but are also still sitting on about $2 billion in cash. They can afford to keep losing money for quite a while, though, as with other tech companies with depressed share prices, they might find their employees chafing a bit at the falling value of their stock.

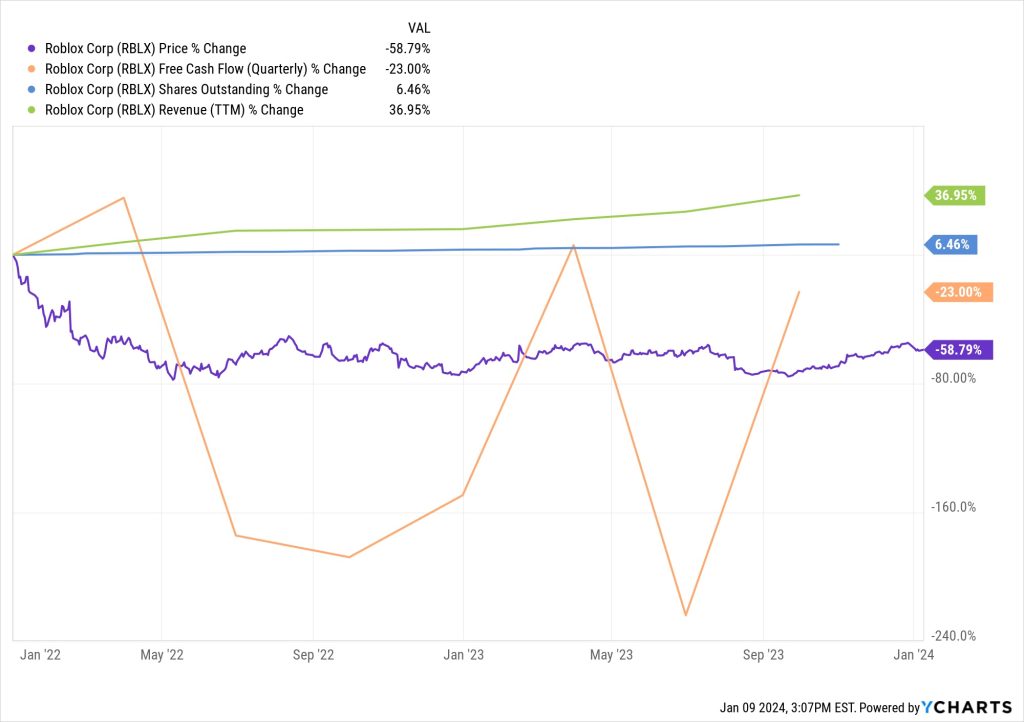

Over the past four quarters, Roblox has issued about $50 million worth of stock and paid out $787 million in stock-based compensation (they use stock-based compensation to cover roughly 25% of their operating costs, it appears), so that’s why they still have some cash left. Over the last two years, revenues have grown about 37% (green line), the share count has increased by about 6% (blue), and the share price has fallen about 60% (purple). They enjoyed the boom year of 2021, for sure, so that was an elevated starting point, and for a while looked like a strong cash flow generator that year (largely because of stock-based compensation, but still), but the dip in free cash flow late in 2022 (the orange line) really started the decline for the stock price. Now that free cash flow is is recovering a little bit, at least for now, might we hope for something better? Hard to say, given the strong seasonality they usually have in the fourth quarter, but maybe.

To like the stock, you probably have to buy into the story that their growth will re-ignite, as new creators add more new content for this immersive platform, and keep the user base happy and growing and spending. I’m not terribly confident that will happen, not with the dramatic growth slowdown they saw last year, but it’s within the realm of possibilities. And the Apple Vision Pro headset will come out next month, so may well kick up interest in the metaverse and virtual reality in general, which could help (though since Roblox is mostly aimed at kids, and the first Apple headset is going to start at $3,499, the impact won’t be direct). Roblox is available on the current market leader in VR, Meta’s Quest headset, though we don’t hear much about what usage is like on that platform… who knows, maybe the Apple Vision Pro will be a little kick start to helping Roblox increase their average user age, though, like I said, at $3,499 at launch you’d have to imagine the impact will be marginal at first. Even if everyone loves and wants the Vision Pro, there won’t be millions of pre-teens who own one for quite a while.

Still, the feedback on the new Apple headset from the first wave of reviewers has been impressive, and it sounds pretty incredible, (far more interesting than the Meta headsets we still have rattling around our house, mostly unused). I probably won’t ever use Apple Vision Pro, because I don’t really like that augmented reality immersion, but who knows, maybe it will even suck me in someday — I didn’t think I’d need a camera on my mobile phone in 2002, either, despite the fact that camera phones had been available for five years (the first iPhone was still five years away). I did like this Twitter post on the “Apple hype cycle,” and it’s always possible that the cycle will create another wave of interest in the metaverse and suck in Roblox and others, and I wouldn’t be at all surprised if there are a bunch of newsletter teaser pitches about augmented reality again, that was a hot story about five years ago that fizzled out with the lack of a really compelling product or user experience.

Apple product hype cycle, explained pic.twitter.com/yOBOx97V6A

— Trung Phan (@TrungTPhan) June 5, 2023

Roblox stock is volatile, and the platform certainly has a lot of fans… though we also don’t really know how it will perform in an economic downturn — will parents keep buying “Robux” for their kids to spend on Roblox (that’s the currency that powers their ecosystem, the way that users pay game developers), or will that be a discretionary item that gets cut back? Will the next generation of kids find fascination with something entirely different, or will the teens who we think will age out actually stay with Roblox and become stickier or more valuable customers? My kids played some Roblox games for a little while when they were in elementary school, but never really got into it in a big way, so I haven’t been caught in that particular money trap, and they and their friends certainly have no interest in these “kid games” now… but they’re also 17 and 20, so they are no longer really in the target market, which means I can’t leverage any personal expertise as a user.

Analysts are feeling better about RBLX these days than they did a year ago, the average rating is a mild “buy” and the average price target is about $44, roughly 10-15% above where it was in January (but also very close to the current $42 share price).

So there you have it… a wild valuation, but with some signs of growth recovery this year, for a company that is nowhere near profitability, but has a solid cash foundation that can keep them going for quite some time. That can give investors a bit of hope that the business will begin to make financial sense at some point in the future, and that they’ve got enough cash to survive until then. I wouldn’t bet on this being the #1 tech stock for 2024, and didn’t see the sense in making that claim in 2023, either, and I don’t see enough reason to put real money at risk in this company, but, well, it could work out great. 70 million addicted kids daily active users is a nice market to start with, and it’s encouraging that the user base continues to grow… even if it takes some imagination to believe that those power users are worth $375 each.

That’s what I think, at least… but when it comes to your money, it’s your thinking that matters. See great things ahead as Roblox builds out the metaverse for the elementary school set, or convinces more of their casual users to spend money and buy some Robux? Think it’s a fad that will fade away, or the monster that will dominate the kids entertainment world in the 2020s? Let us know with a comment below (I added the comments on my original January article below, too, just in case that provides some perspective).

Disclosure: Of the companies mentioned above, I own shares of and/or call options on Roku, Amazon, Unity Software and YouTube owner Alphabet. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules .

As my good friend, The Sultan of Snark likes to say,

“Yessiree … what always happens when too many people start taking a Lifetime Supply of Stupid Pills EVERY MORNING when they get up.”

This was also a Paul Mampilly pick before he went off into the wild blue yonder. I have a very good friend who years ago got involved with a program called Second Life. Roblox is very similar and in my opinion psychologically unhealthy especially for children who can use it to escape from reality. In my friend’s case it was a fad and he’s beyond it which is the risk Roblox hopefully has!

Most people don’t know this, or care, but there are literally millions of “kids”, who are probably adults by now, in Japan who have never left their homes and live entirely on the WWW. This is truly a generation raised completely by what they clicked to on their screen. Very sad. They have zero social skills because they never were made to develop them. This was something I read about at least 15-20 years ago.

I got rid of Roblox over a month ago. I think that picking up the Vision Pro and holding it for a couple of decades in its box might be more worthwhile.

Easiest and cheapest way to invest in the Metaverse….check out Tokens.com