There’s been quite a bit of buzz about the rumored “Apple Car” over the last year or so — with some folks getting ahead of themselves and anticipating an Apple buyout of Tesla, or a new Apple car on the road within this decade… but even if we aren’t going to see an iCar on the roads over the next couple years, it is true that the increasing “computerization” of the car is moving forward at a pretty fast pace, whether it’s increasing automation on the way to self-driving cars or even just better integration of next-generation “infotainment” systems.

And the Motley Fool folks have been pitching this basic idea, the trend of the “driverless car,” for over a year — their most over-the-top teaser pitch about this trend, in ads for their Rule Breakers service, has been the “Warren Buffett’s worst nightmare” ad that implies the power of self-driving cars will destroy Berkshire Hathaway’s GEICO insurance business. The stock hinted at and teased in that ad was Nvidia (NVDA) because of the power of their chips that some automakers, including Tesla, are using in new vehicles — if you find that compelling, NVDA is right back to about where it was when that ad campaign started in the Spring of 2014 so you haven’t missed anything… you can see the article here.

But today we’re on to something a bit different, though loosely based on the same trend — today we’ve got a tease from Stock Advisor Canada, the north-of-the-border version of the Motley Fool’s flagship newsletter, and they’re touting the natural outsourcing partner that Apple (and maybe Google and others) would use if they wanted to take the next step and build their own car.

Interesting idea… certainly Google and Apple are not inclined to get their hands dirty (or shrink their margins) by doing their own manufacturing. So shall we check out the clues and see what they’re teasing?

I thought you’d never ask.

Here’s how the ad gets us started:

“Apple is poised to disrupt the 100-year-old auto industry, calling the car ‘the ultimate mobile device.’ And investors in the Canadian company that can make Apple’s vision a reality could reap huge rewards….

“The birth of autonomous driving technology and the rise of the shared economy are bringing nontraditional, deep-pocketed players like Apple, Google, Samsung, and Uber into an industry that hasn’t seen a paradigm shift since Henry Ford introduced the assembly line in 1913….

“Silicon Valley’s tech giants view Detroit as an industry ripe for disruption. The Big Three auto makers should take notice.

“This may seem like an American conflict—its technology hub versus its former industrial center—but the implications of the mobility revolution will reach across the globe. And the profits will be unequally distributed to a few companies and their fortunate investors. One Canadian stock, we believe, will likely find itself both in the middle of this conflict AND on the winning side.”

The logic of the ad is pretty interesting — Iain Butler, who is the Chief Investment Adviser at Motley Fool Canada, is telling us that when Apple and Uber and Google want to push forward their own designs for autonomous, robotic or semi-robotic cars, they will choose existing auto suppliers to build the parts or assemble the vehicles that they’re developing… much like Apple kept their design fully in-house and financed the equipment needed by their suppliers, but left the actual manufacturing and assembly work to their Chinese outsourcing partners like Foxconn. This isn’t the way Tesla went, of course, Elon Musk actually bought and modernized an old assembly plant for his Model S and future model development… but Tesla is also, thanks largely to their manufacturing investment and their one-off low-volume design, quite unprofitable.

And, says, Butler, they’re likely to choose one particular Canadian supplier who’s vertically integrated and already doing similar “build us a car” outsourcing for luxury brands. And to top it all off, we’re also told that this company is cheap… so what’s not to like?

Well, let’s ID the stock first — here are the clues from the ad:

“Canada’s Best-Kept Secret?

“The reinvention of this company goes back five years, with the hiring of a fresh, talented CEO that helped usher in a new era. The company’s previously unfriendly dual-class share structure was eliminated, removing a corporate governance headache. An aggressive share buyback policy was put into place; the company has spent $3 billion over the past few years, dropping its share count by 8%. Dividends per share have increased 140%. It sold off its least-profitable division for more than $500 million to focus on higher-return initiatives. Under his watch, the share price has tripled….

“Currently trading at around 12 times earnings, around 11 times forward earnings, and with growth estimates around 15%….

“… with a compounded annual earnings growth rate of 23% over the past three years, this company has a track record of making analyst estimates look silly….

“Significantly largely than its closest competitor, it is a turn-key operation for anyone that needs to ramp up production capacity efficiently. This stock has a track record building mass-market models for popular German luxury brands, but those fancy manufacturers like to hide that little detail from their discerning consumers.”

And he tells us that although the manufacturing part of the business accounts for less than a tenth of revenues, that’s the area he thinks could ramp up quickly if the Silicon Valley guys come calling to burst in on Detroit’s bailiwick. So what’s the stock?

Well, we chop up those clues, mince them nicely, then feed them carefully into the chute of the Mighty, Mighty Thinkolator… and the answer comes out the other side, fully assembled and ready to drive off the lot (*small added fee for undercoating and floor mats): This is Magna International (MGA in NY, MG in Toronto).

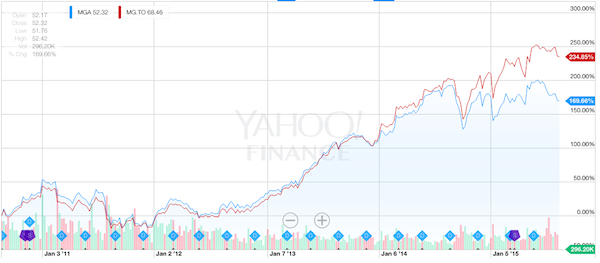

Magna has a market cap of over $20 billion and annual revenue of $35 billion, making it one of the largest auto suppliers in the world (probably the largest one that’s publicly traded and easily investable in North America — there are larger ones, by some measures, in Germany, Korea and Japan). They did get a new CEO in 2010, though he wasn’t really “new” — before that, Don Walker was the co-CEO, and they have boosted the dividend by about 140% since then and bought back a substantial number of shares (they’ve also boosted revenues by about 50%)… and for Canadian shareholders, the shares have “more than tripled” since the founder, Frank Stronach, sold his voting control of the company back for C$860 million in 2010 (meaning, he got rid of the dual-share structure that gave his family control). US shareholders have not done quite so well, since the fall of the Canadian dollar has been a substantial part of that “triple”, but they’ve still done pretty well — here’s a 5-year chart of both MG.TO and MGA to show the importance of that Canadian dollar, particularly recently:

"reveal" emails? If not,

just click here...

That chart actually goes a fair way toward explaining why “currency wars” are a big deal, and why US manufacturers are fretting about the strength of the dollar and the impact it has on their exports… but that’s not our point today (and Magna reports in US dollars and has operations around the world, so the operational impact of currencies is not as clean as that US-Canadian share price comparison) — what we’re wondering is: Is Magna a worthwhile investment?

Well, every investor has to make that call for himself, of course — but if you’re looking for auto parts suppliers with ambition, you could certainly do worse. If you’d like some background, the Canadian press fawns over Walker and Magna thanks to their recent success and you can find Walker’s profile as “CEO of the year” from last Fall here and, lest you think that Iain Butler came up with this “build the Apple Car” idea all on his lonesome, a recent Globe and Mail article opens…

“Magna International Inc. would be an ideal partner to manufacture vehicles for Apple Inc., Google Inc., or other new entrants that might decide to jump into the automotive business, Magna chief executive officer Don Walker says.”

So the idea has at least some traction at the company, and among the investing punditocracy. That’s a future possibility, though, for now Magna is overwhelmingly a parts supplier and, to a limited degree, a contract assembly plant operator for a couple German brands (Daimler and BMW’s Mini). Parts suppliers are not generally richly-valued stocks, aside from the occasional technology breakthrough that investors fall in love with (like Mobileye (MBLY), which we covered here and which has a PE of about 3,000) — the broad-line auto suppliers generally have pretty tight profit margins, and it’s not unusual to see them trade at relatively low PE ratios compared to the overall market. Magna’s valuation (based on PE) has ranged from a low of 7.5X earnings to a high of about 15X earnings over the last five years, so by that measure the current valuation, roughly 11X earnings, is not particularly notable.

Analysts see them growing strongly in 2016, too, so the forward PE is only about 9.5 — not unreasonable at all if earnings are going to grow at a faster than 10% clip into the future, as analysts are predicting.

Magna is a global company, but they are very much weighted to North America and Europe — probably close to 80% of their 100,000 or so employees are in the US, Canada and Central Europe (mostly Austria and Germany), though they do have significant growth pushes to Eastern Europe and South America, and a not-inconsequential presence in Asia. I don’t know what the specific breakdown is for reliance on any one specific automaker, they did get in trouble as we headed into the financial crisis because of their overreliance on the big 3 Detroit automakers, who were all in crisis at the same time, but they appear to be more diversified now. It’s big, it’s complicated, and they do almost everything — power trains, bodies, chassis, transmission, interiors, seating, etc. I don’t know whether Magna’s stock will continue to outperform as it has over the last five years, they’ve enjoyed both a little valuation boost from the removal of the super-voting founder shares and, more importantly, strong long-term management that has been able to push aggressively for expansion at the same time that the global auto market has been on fire, with consistent annual unit sales growth every year since the 2009 doldrums. My initial guess would be that Magna would probably reflect the progress of auto sales over the next few years — if China’s slowdown really hits auto sales there and auto manufacturers hit a soft spot, or the rest of the world fails to get growth re-started, then things could be tough… but if auto sales continue to rise, or at least not fall dramatically, they seem well-positioned to benefit.

Seems to me like an interesting idea, though I can’t claim any great insight and I hadn’t ever looked at the company before this morning — not too expensive, poised to benefit, at least in Europe, if automakers do more assembly outsourcing, and saying lots of good things about aggressive growth in an industry that is generally quite cyclical — cyclical companies are, of course, a risk if you think we’re at the top of the economic growth cycle and are about to see a decline in global economic growth, but I didn’t run across anything company-specific in my brief research today that caused me to worry overly much about Magna… if you have any experience with or insight into this company (or Motley Fool Canada, for that matter), please feel free to share your thoughts with a comment below.

On list, all clear.

I think Magna are a bit more significant in vehicle assembly than you are saying. Their Austrian plant has made over a million vehicles just for BMW, mainly X3’s plus some Mini variants, starting with the X3 back in 2001. Globally they are the leading contract manufacturer for OEM’s.

So they are an obvious option for Apple to be talking to. It would be consistent with the Apple approach to outsource manufacturing, and in fact I’m not sure there is anyone else with the same capability? The location would be interesting – as you say they are mainly Europe and North America based but they do also have some capability in Shanghai. If Apple want to go with carbon fibre bodies they may also look to talk to BMW in the USA for their i3 technology. Cars tend to be assembled in-market – they cost a lot more to ship than an iPhone – so a US assembly plant could be the best option for Magna/Apple.

They’re on pace to do assembly for about 100,000 cars a year, which is not a small number but the parts/supply business is much larger. I didn’t scour their latest earnings release, from a couple weeks ago, but the quarter looks like it was pretty tepid.

They do seem like a logical partner for someone who wants to outsource assembly of a new car, from what I can tell almost all of the existing assembly plants are owned by the auto companies — that’s really what they do, after all, they make very few parts but still do their own assembly and marketing.

I tend to view the existing auto makers as finance companies that use their products as vehicles (pun intended) for the finance deals. They usually also have large pension schemes attached.

It did occur to me also that Apple would most likely need Tesla to supply batteries – another reason to assemble in the US. Car plants are large – I wonder if any significant real estate deals will be spotted soon?

There is a small company on the Canadian Venture Exchange that used to be known as Zenn but have since changed their name to EEstor, symbol ESU. They are involved with the manufacturing of electric cars

I tend to agree that Magna is much more than some sort if Whitney Catalogue operation on steroids. True, a mainstay of their business is custom parts; however, they are much, much more.

MAY BUY A FEW SHARES. IN ANY CASE, IF I DON’T BUY I WILL PUT ON MY “WATCH’ list.

This is one I think I will do a little research on… Perhaps toss some money at about 50 shares of MGA.

Let us know what your research tells you, Thane!

Frank Stronach is a well known “fairy tale story” in Canada. His daughter Brenda if memory serves became an executive of the company and even got into politics on the federal level and had an affair with a famous Maple Leaf’s hockey player. The family probably took Magna about as far as it could go under their leadership. There was a lot of complaining by shareholders about the special shares that allowed Frank voting control so new managem,end is probably a good thing. At one point it was rumoured that Magna would built their own “Canadian car”, but it never materialized. Canada is certainly a big enough country and history of building cars to justify having its own brand, and Magna has the expertise to do it. Too expensive a stock for me to seriously consider a stake in the Co. but over the years it could had been a winner for a nimble trader.

Actually, Ms. Stronach is Belinda. Further to Lulu’s observation, notoriety is her long suit.

According to website MyNews:

“Stronach announced last spring that she would not seek re-election. She continues to be a prodigious fundraiser sought by Liberal candidates across the country, and has raised hundreds of thousands of dollars to buy mosquito nets to prevent the spread of malaria and other diseases in Africa.

But the daughter of billionaire auto parts manufacturer Frank Stronach has made as much news for her romantic adventures as she has for her political ambitions. She began dating Peter MacKay, now the minister of National Defence, when both sat as Conservative opposition MPs.

That relationship ended with Stronach crossing the floor to enter the Liberal cabinet of former prime minister Paul Martin.”

# Some updates, and an anecdote (with paraphrase from elder memory)

Mr. McKay has held several cabinet posts since his DND days, and has recently retired from Stephen Harper’s Cabinet altogether.

Ms. Stronach has recently been released from hospital after breast cancer reconstructive surgery.

Anecdote: Following her crossing the floor, one of B. Stronach, MP’s colleagues was being queried by a former Conservative colleague, wondering what had so changed her political persuasion. The Liberal MP replied that it was really no surprise, since the lady had really never had a Conservative bone in her body – well, maybe one!

Of course Ken is right, (Belinda Stronach) typo or memory glitch, had forgotten about her dating Peter McKay, fame is so fleeting. as no doubt Justin Trudeau will soon find out

If it were not for his last name, nobody would pay any attention to his campaign based on “soaking the rich” to reduce taxes for the middle class. Politicians love to re-distribute wealth they had no part in creating while spending the countries money recklessly on promises they can only keep by running defects. If the public will not go into debt to keep the fractional reserve banking Ponzi scheme alive then you can count on the politicians to be the “borrowers of last resort” by borrowing money that will have to be paid back by future generations, unless the system is changed, when it finally blows up in their face. Makes no difference which side of the border you are on, both sides and all parties operate from the same play book, borrow and spend, not save and reduce government central planning and interference in the marketplace.

What do Tie Domi, Peter McKay and Belinda Stronach have to do with the original question about the would-be Canadian Apple supplier? Digress much?

What about Linamar? Symbol LNR on the TSX.

Yes, she was quite something else that one. Daddy’s money took her quite far…..but hence even the toothless hockey player decided against her. Boo Hoo……Oh i think I woke up nasty today

The Motley Fool newsletter makes a number of far fetched assumptions in its mythbusting.

1. ‘Myth No 2 Detroit is ready for this fight’. Actually Detroit lost the fight 3 decades ago in the 1980’s when Chrysler got bailed out by Mr. Reagan. Squeezed between the technology and performance of the Germans and the quality control and low cost of the Japanese, the US auto makers have yet to come up with a car that can that can compete on the world stage. The US government will eventually give up rescuing them.

2. “Cars are the ultimate mobile device” Well maybe but then one can argue that they they are the ultimate wheeled luggage or ultimate chick magnet. Fundamentally a car is a ride. Mankind has an ancient connection to our “Rides”. In almost every culture, ancient or modern, the individual desires to possess his own ride whether it’s a horse, horse cart, lllama, donkey, mule, yak, canoe, raft or car. That individual ride represents freedom and power. Sharing that ride for payment turns it into a taxi. Just because Uber has introduced an unlicensed taxi service to the net does not mean that people are going to stop owning cars. You only share those things to which you do not have an emotional connection.

3. While we love the idea of electric cars, we are terrified of running out of charge in one of them. If you run out of gas, you probably can lug a couple of liters a couple of miles from a gas station. Not so with a dead battery. And until someone comes up with a battery that charges in 5 minutes and runs the car for the whole week, we are not going to adopt electric cars on a global scale.

4. North America does not have the electrical grid infrastructure to provide high amperage current to charging stations in every home, parking lot and condo building.

5. The plug in electric just makes people feel enviro-friendly. The same people who, incidentally, have the highest per capita carbon footprint. The rest of the world will continue to drive on gasoline and diesel.

Excellent observations. I agree completely with most except for #2. Young people in general do not have an emotional connection with automobiles. I am older and love cars and driving. Every town, small and large, has car clubs. Most of the members of these car clubs are seniors. I think in the future ownership will go down and utility, cost, and environmental footprint will become paramount.

technology chief Swamy Kotagiri will take em there as eventually new ceo

Magna will be apple of automatically driving car technology

I bought some a month ago. I have a good feeling about them. Out of 51 stocks i own this was the only one that didnt drop on this last run.