Jim Rickards, an economist and lawyer who has been peddling newsletters for Agora for a couple years, has a new ad out for his Strategic Intelligence newsletter that tries, as so many have for the past five years, to lather readers up into a panic about the imminent demise of the U.S. Dollar.

And, of course, it’s a newsletter ad — so there has to be a deadline. There’s no urgency to sign up unless they tell you that this huge opportunity will only last until a specific date… and without urgency, of course, we’re free to wander off and think about other things. Just like car salesmen frantically try to get you not to you leave the dealership by throwing their “best deal” at you and saying the car you like may be gone tomorrow, newsletter pitchmen are panicked that you might click away from their ad without buying. The customer who waits to think things over is much less likely to buy.

And the deadline this time is September 30 — and Rickards makes it seem even more imminent and “insider-y” by putting a time on it, too:

“This time, and on top of every other pressure our cash already has to face, there’s an exact deadline on the calendar . In a nutshell, it’s an event scheduled for Friday, September 30th.

“By my best estimate, what’s coming will go down around 4 pm.

“And when it does, you’ve got no idea yet how radically this could end up impacting your financial safety.

“Not only could this event gut the U.S. stock market… and cannibalize your retirement savings… but it could ultimately END what we’ve come to know as the American way of life.”

No soft-pedaling there, right? Soft pedaling doesn’t sell newsletters, strong opinions and urgency sell newsletters. Just ask Porter Stansberry about his “End of America” presentation from 2010 and 2011 that predicted riots in the street, food shortages and more as the dollar loses its “reserve currency” status.

As we’ve seen with most “doomsayer” pieces over the past 40 years (Porter’s “End of America” piece was the most aggressively marketed, but there were lots of other people saying much the same thing about the dollar’s demise not only in 2010, but for years before that… and from time to time over the past few years, too), these arguments usually have plenty of reasonable-sounding logic in them and there were and are real risks, not least because the general trend of all “fiat” currencies is to inflate the currency base and gradually erode the value of the currency over time.

But believing in the “fear” message or the specific predictive power of a particular pundit too strongly would have likely led to tremendous opportunity costs for investors who bunkered down and missed out on the big run in stocks, bonds and the US dollar over the past five years. People were already afraid of stocks after the 2008-2009 crash, they were ready to hear the message that “the end is nigh” and hide in the cellar, and that’s not so likely to have worked out well for most of them (depending, of course, on the specific pundit and spiel you’re talking about — but there were a lot of them from 2009-2012, at least, predicting Dollar “doom”… and that has continued in more recent years as well).

I tend to get too blathery when talking about the risks of believing in a compelling-sounding story coming from a reasonable-sounding “expert,” so I’ll try to be relatively brief in looking at what Rickards is actually talking about. Just remember: One of our great weaknesses (and gifts) as a species is our love of storytelling, and our tendency to build a narrative around events that makes us believe we can predict the future is ingrained and very strong.

So what is it that Rickards sees coming this time? Here’s a little more from the ad:

“… there is a new form of currency that’s about to flood the world economy. It’s not money for you. You’ll never get to withdraw it from an ATM, even if you travel overseas.

“This new form of money is strictly created for the financial elite.

“We call it ‘world money’ because of what it could ultimately do — and soon — which is replace U.S. dollar reserves around the world.

“That’s right — this is as close to the end of ‘king dollar’ as we’ve ever come.

“Now, what does that mean exactly? After all, what do you care if the people in Asia, Europe or the Middle East suddenly decide the dollar no longer gets #1 status around the world? ….

“Losing our #1 status means giving up a whole slew of benefits you never knew you had….”

He goes through some things that he thinks will happen “when central banks empty their vaults to make room for ‘world money'” … he notes that it “could push world stock markets off a cliff,” “gut your savings account,” “hike up prices you pay for everything” and “send U.S. tax rates soaring as D.C. scrambles for another source of cash.”

So that sounds pretty apocalyptic… but then, more from Rickards:

“Is this the monetary apocalypse? Not exactly.

“In fact, it’s not even the first time we’ve had a currency implosion like the one I’m warning you about now. It’s happened three times just in the last century — in 1914, 1939 and 1971.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“What I am telling you though is that you will want to take steps to get ready.

“In case you still doubt the accuracy of this September 30th date… or what’s about to replace the dollar… I’ve even got some smoking-gun proof.

“It’s an actual 42-page blueprint… buried deep on the website of the world’s most powerful financial institution. This document lays out exactly how “world money” works.

“Inside the document, it says…

“If there were political willingness to do so, these [“world money”] securities could constitute an embryo of global currency.”

Translation?

“The financial elites are saying this could be the “money” that replaces the dollar in central bank vaults the world over.”

And the panic sets in:

“If you’ve got even a nickel in dollar-denominated wealth, you need to pay attention.

“Because, make no mistake, the day ‘world money’ fills that role… the value of the dollars in your bank account will plunge in value, virtually overnight.”

So what’s he talking about? As best I can tell this is, once again, a hullabaloo about the fact that the IMF is going to change the makeup of its special drawing rights (SDR) calculation for reserve currencies on October 1.

The move is well-known and well-telegraphed, and it’s really about China more than it is about the US dollar (unless, of course, you’re reading between the lines and predicting that this is a first step in the IMF taking over global currencies — which is a conspiracy theory line of thinking. Conspiracy theories are not necessarily wrong every time, but they rarely make for good investment strategies).

The SDR is a derivative reserve currency created by the IMF to try to diversify global reserve currencies, and to some degree that’s intended to lessen the reliance on the US dollar as the single reserve currency — though it’s not new. The SDR has been around since the late 1960s, and was originally based on gold and the US dollar (since major currency exchange rates were still fixed back then, under the Bretton Woods postwar system that collapsed a couple years later). Now, I’d describe the SDR as an attempt to have a global reserve currency that’s more representative of global trade flow and economic power — it exists as a currency, sort of, in that countries can exchange it and it’s occasionally used in some exchange rate calculations, but the most widespread use has been the 2009 attempts to bolster some economies whose balance sheets were in trouble, and I think the only real value of the SDR is that it can be exchanged for the currencies that make it up.

Currently, the SDR is made up of the U.S. dollar (41.9%), euro (37.4%), Japanese yen (9.4%), and pound sterling (11.3%). As of October 1, in a move that was announced last November but delayed a bit to allow more time for the Chinese Yuan to become more freely tradable, the makeup will be: U.S. dollar relatively unchanged at (41.73%), and weightings for the euro (30.93%), yen (8.33%) and pound (8.09%) fall to make room for a 10.92% slot for the Chinese currency.

Similar words of panic about the fall of the dollar were distributed by a number of pundits last year, leading up to the decision to include the Chinese currency in the SDR basket and therefore acknowledge China’s importance as a global financial player, and the fear then was also largely that the US dollar would fall because suddenly all this money would flock into “SDRs”.

Which, of course, didn’t happen. There are precious few SDRs in existence (a few hundred billion, I think — there are roughly 10 trillion US dollars in the global money supply), and as a non-economist myself it seems like more of a political, foreign aid, and bookkeeping tool than anything else (I’m sure Rickards knows a lot more about the use of the SDR than I do, but it seems quite limited to me). SDRs are made of money, and the only reason they haven’t been completely obliterated in value over the past couple years is that the US$ and Japanese Yen make up half of the SDR — the other components have been getting clobbered, even before the Brexit drop.

And if the worry is that there’s a new global currency that’s going to replace the current system, which is dominated by the dollar but also includes huge flows of cash between every major currency every day in a fairly seamless dance, I can’t help but think that ship has sailed. If there’s anything we’ve learned about global politics over the past few years, it’s that countries are now suddenly aware that giving up control of their own currency creates the potential for economic disaster. Controlling your currency, either by deflation or inflation or by actual curbs on trade or on money flow, is one of the key capabilities of any nation — and those who give it up often find (hello, Greece) that their partners (hi, Germany) have different priorities when it comes to currency values and stability.

So… could the US dollar lose its status as the preeminent “reserve currency” for the globe? Sure. That’s sort of been happening, to some gradual degree, for years — the euro (until the last year or so, at least) was starting to take a piece of that role to some degree, and central banks that are cash-rich, like China, have spent the past decade talking about diversifying their reserves.

But from what I can see, this is moving very, very slowly. Certainly no one is really dumping the dollar, because they’re all too aggressively trying to dump their own currencies to try to create local inflation and raise exports to keep their citizens happy. This has been going on for several years, central bank reserves seem to be getting a little less dollar-centric, and other currencies (mostly the Yuan) are rising in global importance… but the only major currency that has been going up in value versus other currencies is the US dollar. Old habits die hard.

Here’s a chart for the past five years — I used the currency surrogates that are easiest for small investors to trade, the CurrencyShares ETFs (Blue FXY is Yen, red FXB is Pound, green FXCH Yuan Renminbi, orange FXE Euro) and the Dollar Index (purple AMEX). You can see that the Japanese Yen has had a bit of a recovery in the past year or so, but otherwise the only trend of the past five years has been “sell everything else, buy more dollars.” (This isn’t a completely fair representation of those currencies, but it’s pretty close)

That’s the past, of course, not the future — but it’s important to note that 2014 and 2015 saw several waves of very similar “the dollar is dying because the SDR basket is changing” arguments from newsletters and other pundits (as well as the “FT-900 shift” that was fretted about as a “dollar killer” back in 2014). They’ve all been very wrong so far, other than the fact that most of those folks have urged investment in higher-quality gold mining or gold royalty investments which have now finally gotten some traction. That doesn’t mean they’ll be wrong forever, or that their insight into trends might not be worth considering, but when they promise a change that’s going to happen on a specific date we should be very skeptical.

So what does Rickards think you should do to avoid this “disaster” that will be coming “around 4pm” on September 30?

More from the ad:

“The first shows you how to hedge your wealth against an immediate backslide in the dollar. At minimum, it’s a way to halt your savings from going to zero. At the outer reaches, there’s the potential for an extraordinary eight-to-one return.

“Then I’ll show you how to avoid another 2008-level wipeout in the stock market. My risk models exposed the last bust over two years in advance. This time, they’re signaling an even bigger fall. But that doesn’t mean you have to hang on for the ride.

“I’ll show you specific, household-name stocks that look especially toxic for the coming collapse. I can also show you how to make money even as Wall Street comes undone. In my own career, I’ve made gains on falling shares as high as 3,000%.

“Finally, I can show you how to own a stake in ‘new money’ itself, before it replaces the dollar and takes over the #1 slot as a world financial reserve. This would normally NOT be possible for most regular investors. However, I’ve found a completely original way for you to do it.”

OK, so that last one is easy — if you want to own a stake in this SDR “new money,” just buy the currencies that make up the SDR. It’s not rocket science (though it is, unfortunately, a little bit of math). I don’t even see any reason to be precise, frankly — if you round things a bit you get to 40% US dollar, 30% euro, and 10% each of Yuan, Pound and Yen. You can buy all of those either through a foreign currency-denominated bank account (probably Everbank makes this easier than most, though many big banks can provide accounts in foreign currencies and I don’t know if they’re necessarily the best), or using those same CurrencyShares ETFs in your regular brokerage account. And, frankly, if you live in the U.S, you’ve already probably got lots of dollar exposure, so you could just split your “mimic the SDR” allocation up among the others — half in euros, half split roughly evenly among the other three. Easy enough. (This is not a recommendation, of course, and I’m not doing this, I’m just trying to approximate what a “buy the SDR” decision would look like for an individual investor.)

I assume that his “potential for an extraordinary eight-to-one return” pitch is related to much of what he says in the remainder of the ad (and in his book, The New Case for Gold) is about investing in gold — that gold mining stocks have the potential to provide highly levered returns. Which is true, and in an era of competitive currency devaluation it’s logical to me that gold should do well… or, at least, should help to protect against any really dramatic loss of value in a particular currency.

The “avoid another 2008-level wipeout in the stock market” is presumably a reference to hedging — which is fairly expensive, as a general rule. You can bet against the broad market either using options (like buying put options on the S&P 500 through the SPY ETF or one of the many other broad-market ETFs), or by using inverse ETFs that use futures contracts to move up when the market they’re tracking moves down. Both will work if you’re reasonably accurate about time frame, but both also have substantial time decay if you’re wrong — which is a fancy way of saying that holding those levered bearish positions costs money, so if you don’t end up needing the hedge (because the market doesn’t go down) you will have wasted quite a bit of cash. Sort of like insurance, though compared to most kinds of insurance contracts these bets against the market are much more expensive.

The cheaper solution would just be to short the market, or to short particular stocks that you think will fall particularly hard — that doesn’t carry as much cost, other than whatever it costs you to borrow the shares that you’re selling short, but it carries a larger risk (shorted positions can theoretically post infinite losses, since a stock could go up forever) and it doesn’t provide any additional leverage like an option or a 2X or 3X inverse ETF will… so you may need to hold a big short position to make up for the risks you think you have in the rest of your portfolio.

Personally, I’m a long-term investor and a long-term optimist about the future of the stock market, so my preference during times of uncertainty (which I’ll agree we seem to find ourselves in) is to do any hedging in active investments (like buying gold miners, which can hedge against some adverse markets or currency changes but not, of course, against everything bad that could happen) and, perhaps more importantly, to be mindful of individual company risk, think in advance about whether I want to use stop losses for particular holdings, and to keep more cash than is usual in my brokerage accounts. That last one is a position I’ve been trying to adhere to most of the time for the past couple years, with more cash than is usual for me… and that extra cash has hurt performance in my portfolio, though not, of course, as much as an active bet against the market would have.

Here’s one more bit of the scary scenario laid out by Rickards:

“After September 30, bank vaults worldwide could opt to swap dollars for “world money.”

“This could send a tidal wave of cash back to the U.S.

“And you know what happens when there’s too much of anything.

“It makes everything that’s there worth less.

“Imagine paying twice what you pay now to buy a car, an iPhone, or gasoline. Companies that do business overseas could see every cost advantage vaporize. Will that bring jobs back home too?

“Don’t count on it.

“Because weaker dollars will make costs soar here too. You could see mass layoffs. Some companies will just shut their doors forever. They won’t have any other option.

“Of course that will slam the stock market.

“As global investors flee, you could see stocks crash 50%… 60%… or more.”

That “too much money makes it less valuable” argument should work, but it hasn’t really, not yet — we’ve been churning out more and more dollars by cutting interest rates and doing quantitative easing, and most other major currencies have also been churning out more and more and easing monetary conditions as well, so all currencies should be falling. And they are, in relation to asset prices — that easy money is why real estate is again going up in the US and in many other places, and it’s a big part of the reason why the stock market is going up (which is why everyone’s panicked about what happens if interest rates really start to go up, which could also begin in September… though the betting on that is decidedly mixed). And it’s probably why gold has finally been rising this year, though that rise has been widely anticipated by lots of newsletter guys for at least a couple years.

Does that mean we’ll see a crash? Or that October 1 will bring a sea change in the global economy? I really doubt it. Not that the market won’t go down — the market is pretty expensive and obviously jittery, and it wouldn’t take much in the way of bad news to cause a correction in the stock market — but I don’t think it will have a lot to do with the change in the SDR or the possible continuing transition to having less dollar-centric reserves around the world (global reserves are roughly 60% in US$, from what I’ve read, and the IMF SDR basket is 40% US$… but do you see a lot of central bankers making big bets on the euro or yuan right now? I don’t, I expect change in that world to continue to be gradual and political and not all that meaningful to most long-term investors. I could be wrong, of course, and I’ll agree that the “free ride” the US has gotten on our massive debt and overspending should slow down… but I don’t see much profit to be made in trying to predict the month when that will happen.

And then Rickards leaves us with a couple more hints about specific things he thinks we should do to protect ourselves:

“I tell anybody who listens to take 10% of whatever they’ve got set aside, whether that’s $5,000 or $5 million. And then put that in physical gold. That’s enough to build a foundation.

“And how to lock in gold and silver ownership for tomorrow at a low fixed price. It’s like getting a special ‘call option’ on the rising price of gold and sliver. With a long-haul expiration date.

“Plus, income streams with a built in hedge against a crashing dollar. As cash unravels, these income streams should go up. You can own a percentage stake as they do.”

That’s essentially all commodities-based — owning some physical gold, and 10% of savings or 10% of a portfolio seems like a rational number to me; “locking in” gold and silver at a low fixed price is likely a reference to either streaming or royalty companies, who do just that, or even, more conceptually, to “gold bank” companies who buy up projects that have gold in the ground but don’t have plans to actually mine it themselves.

And income streams that hedge against the dollar could also be most any dividend-paying commodity stock, at least in theory, though I imagine he’s probably still talking about streaming and royalty companies. A few years ago a similar argument might have extolled the value of oil royalty companies, but most folks are a little too timid to recommend those after the beating they’ve taken since the oil price collapsed starting two years ago.

Finally, we get one “must buy” investment from Rickards:

“… you’ll want to own the one must-buy I name in the same report.

“It gives you a claim on special ‘streaming contracts’ to buy gold for as little as $400 an ounce… and silver as low as $4 an ounce. These deals are already locked into place. Which could send these shares skyrocketing as metals price start to soar.”

If that’s a reference to a single investment, then it’s most likely a reference to Silver Wheaton (SLW), which is by far the biggest of the big royalty/streaming companies (and, despite the name, has branched out to include gold in recent years).

There are now a decent handful of cash-flowing royalty and streaming stocks, but clearly Silver Wheaton, Franco-Nevada (FNV), and Royal Gold (RGLD) stand above the rest, and, honestly, any of them would be a decent core holding for someone who wants precious metal exposure without a lot of risk tied to one specific mine — though they’re all quite expensive based on current fundamentals. There are smaller players in the space, too, including Sandstorm Gold (SAND), which has been my favorite for many years (though it has done worse than the others until this year) and Osisko Gold Royalties (OR), and there are a lot of little companies who own royalties on specific projects.

The basic difference, if you’re looking into these kinds of investments, is that “streaming” means you have a contract to buy a certain portion of a mine’s output at a fixed price, while “royalty” usually means you more passively receive a percentage of the value of the metal (or whatever) that comes out of the smelter. The general rule is that streaming deals have been done mostly on projects that are closer to production or on secondary products of a mine, and royalties are often bought (or awarded) based on much earlier-stage exploration projects (often a junior miner or landowner, for example, will sell a project very early on and receive a royalty as part of that compensation), though there are lots of variations.

Royalty companies and streaming companies are clearly levered to commodity prices, both because the mines are more likely to be built and production maximized if prices are good (and they don’t get anything from mines that aren’t producing) and because they have upside to higher prices without having any additional cost as prices rise (so if Silver Wheaton’s deal is to buy silver at $4 an ounce from a mine, for example, their profit doubles as silver goes from $8 to $12). They don’t have any protection, really, if commodity prices fall — mines can get shut down and make their royalties at least temporarily worthless — but they are generally at least without obligation. They don’t have to put any money into the mines after they’ve bought their streaming deal or royalty (though sometimes they do, particularly if they’re trying to “rescue” their partner and help the mine get built).

So I’d reckon that Rickards is probably recommending Silver Wheaton (SLW), which is likely to be a nicely levered play on both gold and silver — though it’s important to note that it’s also involved in a very active tax dispute with the Canadian government, and the outcome of that could have huge implications for Silver Wheaton’s income (hundreds of millions of dollars in unpaid taxes). It’s probably not a “company killer” of a tax ruling if they lose, since they have huge assets and a $12 billion valuation, but it could easily cause the company to get revalued much lower and I don’t know if it would impact the anticipated earnings in the future (perhaps they’ve changed their structure to route less income through the Caymans for tax avoidance, I don’t know). I can’t claim to have any particular expertise on this, but the filings and reports I’ve read (there’s a good Globe and Mail article here, for example) indicate that Silver Wheaton has been more aggressive about this tax shelter activity than the others (yes, even more than Sandstorm Gold, which was founded by Silver Wheaton’s old CFO).

I’d say that Silver Wheaton is the cheapest of the streaming and royalty firms, but is cheap at least partly because of the risk (and probably because they get about 60% of their revenue from silver, which doesn’t get as much love as gold) — Franco-Nevada is the oldest company in the space and probably the safest bet, and Sandstorm Gold is my personal favorite largely because it’s small and has more rapid growth potential.

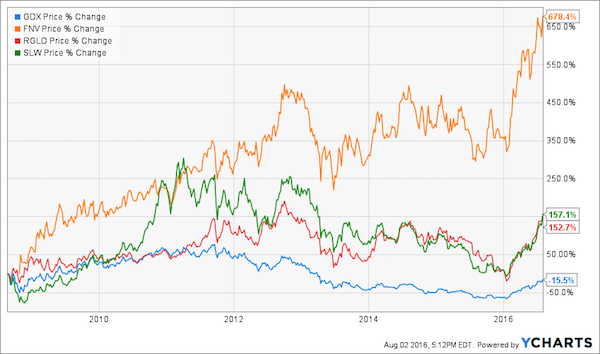

But they’ll all probably do quite well if precious metals prices keep rising, so to some degree you’re splitting hairs — if you don’t want to pick individual stocks, my favorite gold mining ETF is Sprott Gold Miners (SGDM), which, unlike the more popular Van Eck Gold Miners ETF (GDX) does not have a substantial weighting in Franco-Nevada or Silver Wheaton… but which does include both Sandstorm Gold and Royal Gold among the actual miners in its portfolio. And as you’ll notice on this chart, royalty companies don’t have as much upside as the average miner when there’s an ebullient market like we’ve had so far this year:

That’s a year to date chart, and it shows that the two big ETFs have done far better than most of the royalty/streaming firms, the two outliers who have done worse have been Franco Nevada and Osisko — the former probably because it started rising before the miners and would have been by far the better performer if we went out two years, the latter probably because it’s not yet very diversified. You do get a reduction in mine-specific risk from a royalty company, and you do arguably get an easier “one purchase” bit of leverage and diversification… but you also get that from a good ETF, so you don’t necessarily have to make things all that complicated while you’re in a bull market. Over the long term it makes a difference, partly because royalty companies can compound their earnings, so Franco Nevada and Royal Gold have clobbered the GDX ETF over the past decade… as in this chart:

… but if you’re just thinking about what will happen if gold goes up by 20% in the next year, the difference is likely to be less substantial.

I can’t claim any great prescience about the speed with which economies adjust… but I certainly did put substantially more into gold investments early this year and have added to some of those (particularly SGDM) and taken profits on some others, my gold exposure is now a little bit more than 10% of my portfolio, particularly if you include Altius Minerals (ALS.TO, ATUSF) which is only slightly exposed to gold (that’s more of a copper, potash, coal royalty play).

And really, I’ve written similar things about diversification and being wary of predictions of doom for quite a while — so I’ll leave you with these words that I wrote in a Friday File back in the Spring of 2014, when people were also worried (they always are, particularly when making people worried is a good business):

We’ve written some in these parts about the many, many predictions of a US dollar collapse and an associated economic and societal collapse — recent newsletter pitches that spin this “doom” story have come fast and furious from Porter Stansberry and several others, and they are a pretty popular stock in trade in the world of investment newsletter marketing … though Porter did raise the bar considerably with his huge (and probably extremely successful) marketing investment in the “End of America” video promotions that he started to run several years ago.

That doesn’t mean that the predictions of doom are wrong… just that we’re well reminded that they are marketing. They are selling the fear of what might happen, and the fear of being unprepared or missing out. These pundits may well actually believe that the worst will happen, or that the trend for the US economy is bad enough that something very bad is very likely to happen, and they might even be right… but the wording and the emotional drama of the ads are simple advertising. And it works. I get worried when I read these ads or listen to the presentations.

I don’t sell all my stocks and put my IRA into gold and buy a citizenship in St. Kitts and Nevis or an estate in Nicaragua or Argentina because I fear the US will descend into chaos… but I do worry.

And there are very reasonable, mainstream things that people do every day to protect their savings against confiscatory governments or future inflation or currency devaluation… and, of course, reasonable things that every family can do to protect themselves from disasters both natural and man-made.

And really, if you subscribe to most of these newsletters I expect that’s going to be the advice that you will actually receive… be prepared, but don’t sink all your money into gold or guns or cans of beans in the basement and don’t stop thinking about ways to grow your net worth in the stock market. The disaster prognosis sells books and tries to kick-start some “outside the box” thinking, and there’s probably nothing wrong with that unless you get overwhelmed by the fear-based marketing, but meanwhile the newsletters these folks write and sell continue to recommend various types of real, mainstream investments that you can trade on the stock market.

So sure, as far as I’m concerned I think folks should feel free to buy an air horn to protect yourself from burglars, or buy a little farmland in the country if that’s feasible for you and you think you’ll need to plant beans to survive, keep an emergency kit and some supplies like most folks started doing after 9/11… and heck, if you suffer from the greatest fear of the wealthy, that your savings will be confiscated and you’ll be in the same boat as everyone else, feel free to buy that yacht to get you out of the country, and that home in Panama, and that overseas bank account (make sure to report it to the IRS). But most people can’t afford those things, or would be pretty minimally protected by having $10,000 of their savings in a bank in Canada or Panama.

It is very easy to go beyond reasonable preparation and bring yourself to the edge of panic — particularly if you’re also angry at the stock market, or at big business or the banks, or at the government or our elected leaders. Panicked people don’t make smart or well-timed choices very often, but they do buy newsletters and freeze-dried beef stroganoff and, apparently, collectible silver coins if the ads I’m seeing are any indication. I think there’s plenty of reason to worry that people might be shocked by some future economic downturn, whatever the cause, but I also think people who spent hours and huge amounts of psychic energy worrying about how to get some money out of the US would have been better off figuring out how to save more money and focusing on diversification. Better, I think, to deal with the crisis we know we have, a population of people who, on average, expect 30 or 40 “golden years” of retirement but haven’t saved nearly enough to live that retirement. Panic a little less, diversify, and save a lot more.

I love diversification. I like diversifying so that my stock portfolio isn’t dependent solely on the US economy and includes a large weighting in companies who operate elsewhere or globally and own “real” hard assets or valuable and irreplaceable businesses (though to some degree that diversification has been a drag on my portfolio in recent years), I like diversifying so that my savings is not solely in US dollar bank accounts (largely with physical precious metals and with foreign currencies, though I don’t currently hold any foreign currency CDs as I often have in the past)… but I don’t fool myself into thinking that I will know when the stock market is going to have its next crash, or when the dollar will reverse course and lose value against hard assets or other currencies.

I do think the US$ will lose value over time, but that’s like saying that water will run downhill — the dollar has almost always lost value over time, though often very slowly. That’s why people invest their money instead of sitting on it. Recent blowouts in the amount of government debt, and expected weakness in the US economy as we hit the demographic morass of the Baby Boomer retirement, are obviously frightening and largely unprecedented… and it is especially difficult to calculate the impact US debt and unfunded obligations might have on the currency because the world has never been as interconnected and interdependent as it is today.

The US must logically be nearing the end of the currency “free ride” that we’ve enjoyed by lending people money in a currency that loses value over time, and that we control the issuance of, but demand is still extraordinarily high for the dollar and for US assets and, yes, for US debt. It is ridiculous that people are willing to lend money to our very broke government at less than the average historic rate of inflation… but it has been ridiculous for a long time. The original “End of America” video from Porter came out in the Fall of 2010, if memory serves, suggesting farmland, gold and silver coins and foreign bank accounts among his protection ideas as the US dollar loses its status as the global reserve currency, more or less the same kinds of “escape from the dollar” things he and other pundits have typically suggested more recently.

Those are not necessarily crazy ideas, in moderation, nor is there any reason to avoid diversification, but there is a substantial opportunity cost when you go beyond diversification and let panic send you “all in” on your “escape from the dollar” plan. If you had put all your savings into gold in late 2010, for example (not what Porter was suggesting, to be clear), you would have lost about 10% on that position to today… not so bad as a hedge… but you would have also missed out on the opportunity to have made a 20% gain by holding long term government bonds during that time, or 50% by holding a broad basket of stocks like the S&P 500.

So that’s what I said back in May of 2014, in response to a different teaser pitch (that one was from the Weiss folks)… and I still think it makes sense now. And I still think I’d likely find those words to be sensible if I look back on them five years from now. Don’t panic, don’t bet the farm that the dollar will crash on October 1, but the dollar probably will go down over time and it makes sense to be diversified enough that your portfolio can handle that. Beyond that, well, I don’t know what will happen this Fall — and worrying about what the world will do in a few months or a few years takes me away from stuff I might be able to understand, like the analysis of a particular company.

It’s your money, though, so what matters is what you think — are you panicked about the adjustment to the SDR? Anticipating a collapse in the dollar and an end to our way of life here in the currency-charmed US? How would you prepare? Let us know with a comment below…

Disclosure: among the investments noted above I have personal positions through either common stock, options or warrants in Sandstorm Gold and in the ETFs SGDM and GDX, and own physical gold and silver (mostly bullion coins). I will not trade in any covered stock for at least three days following publication per Stock Gumshoe’s trading rules.

Mr. Rickards’s warning of the cataclysmic effects of including the Chinese yuan in determining the valuation of the IMF’s Special Drawing Rights (SDRs) is based on a total misreading and ignoring of facts and a massive shoveling of BS onto his gullible readers. The current amount of SDRs in the IMF’s computer is about $285 billion (source: IMF website). Even if it were legally possible for all central banks to exchange their dollar holdings for SDRs, they couldn’t do it. The SDR total is a tiny fraction of the $4.6 TRILLION that central banks hold in dollars (source: IMF website).

Increases in the amount of SDRs created must be voted by a super-majority of weighted voting by IMF members. The U.S. has sufficient voting power to have a de facto veto over proposed increases in SDRs. The latter were created in strictly limited amounts. They are designed to augment the declining reserve holdings of IMF member countries experiencing balance of payments crises. A country requesting to draw from its strictly limited SDR allocation must get approval of the IMF, which then designates a convertible currency to be credited to the drawing country’s account. The currency received can then be used to pay for imports, etc. Once a country draws down its strictly limited SDR allocation, that’s the end of the line.

There needs to be an accounting mechanism to give a value to SDRs which are computer generated assets in effect created out of thin air. The SDR has thus been given an de facto exchange rate based on a basket of major currencies. Adding the yuan to the accounting mix adds prestige to China and its currency, which in turn MIGHT make it marginally more attractive for some central banks and private investors to hold more yuan. It does NOT in any way change the amount of “world money” or set up a run on the dollar.

For those who predict the sky is falling (or about to fall) do not understand SDRs or foreign exchange markets. True, the dollar will have its ups and downs over time like any other asset. But to claim that the world is about to stop lending to the spendthrift U.S. government is to ignore the basic fact that the U.S. dollar does not need to be great in absolute terms. It needs to be at least as attractive as the alternatives–which right now don’t look so great. The know-nothings have been predicting for some 10 years that if the U.S. budget deficit is not quickly reduced, inflation will soar and the dollar will tumble. Only the delusional will fail to see that the global situation will have to change drastically from unforeseen developments before the next cycle in the value of the dollar commences.

In the meantime, unless Mr. Trump wins the election, I suggest that Mr. Rickards’ Sept. 30 doomsday warning be dismissed unequivocally. (For the record, I am a retired professor of international economics, not a stock market guru.)

I sure enjoyed reading twice so far, this very level-headed contribution you have given us. Have you done so otherwise some place that I might be able to access, Stan

Rickards is trying to sell you a newsletter.

His books are good.

Good for what fireplace kindling or…Oh never mind.

Not really. Just longish, often boring books. Thanks for the compliment.

SDRs which are computer generated assets in effect created out of thin air.

So just like every countries denomination, SDR’s are just plain paper with no backing.

That is the main fact to me. It re-inforces my belief that there are higher powers involved and in control of the game, and no offence to Peter De Witt, it doesn’t include anyone in the religious realm.

SDRs….paper and computer entries, backed by more paper and computer entries from a bigger gang of thieves, enlarging the fiat money disaster to an ever wider pool of participants.

Hi econprof.

Has the law of supply and demand been suspended ?

Last time I looked, fiat currency was being created in unprecedented amounts. I seem to recall vaguely from Econ 101 that plentiful supply of a commodity will impact it value negatively.

Is there a new PhD thesis somewhere at Harvard or Brown that invalidates this concept ?

The law of supply and demand has not been suspended. The supply of SDRs is strictly limited.

Limited by what ?

One issue not emphasized in the Brexit debates and also in discussions of the IMF startegy is that SOVEREIGN NATIONS do not surrender control of their money. The ability to issue currency is ipso facto an indispensible power of a sovereign nation.

Any move to “internationalize” the decision making on our money should be resisted and rejected strenuously. It is legally unconstitutional and morally and philosophically repugnant.

I believe that most are underestimating the problems facing the US Dollar Reserve Currency system… think the financial calamity of 2008, but much worse. If you understand that nothing was “fixed” after 2008, that the global financial system is much worse today, then you might realize that Keynesian policies have failed miserably… that world governments won’t be given a choice of continuing to debase currencies. Governments, including the U.S.A., will be forced into a more sound currency system to restore trust for international trade. China is front-running this sea change in perspective. I believe that is what Rickards is putting his reputation on the line for, that behind closed doors, the G20 nations’ plans to gradually reset the currency system are coming the forefront.

Gold will be used indirectly to ensure trust-worthiness in currencies such as the Yuan. Eventually, they US and other nations will have to compete for the “benefits” of having a secure currency backed with Gold to conduct trade and investments in stock and debt markets.

Again, nations will realize that a currency backed with a percentage of gold has much lower risks than those generated by the unstable and unsound paper dollar system. Implementing a modern quasi-gold standard can be met if the transition is gradual and transparent and, most of all, if markets are used to establish the final rate of exchange between the dollar, other currencies and gold such that overall prices reflect today’s levels of global debt, and there is no forced reduction in wages.

What the critics of a gold-backed currency standard refuse to admit is that, for all of its faults, (for instance) the performance of the U.S. economy under a gold standard was far superior to the paper dollar system loved by those who believe in government power and economist, who believe in the ability of elites, such as themselves, to manage the economy by manipulating the value of the dollar. The 40-year experiment with a paper dollar has failed to produce the higher growth rates, less unemployment, milder recessions and increased financial stability that were and even today are promised by its advocates.

Again, it won’t be a matter of preference, but out of necessity that nations will adopt “sound money” (currency system backed with a percentage of gold).

G’day Travis,

this article could not have come at a better time because only yesterday i read an almost identical sales pitch from Bill Bonner on The Great American Credit Collapse. who also writes a newsletter for Agora. I enjoyed reading your article on how they use fear to sell their publications. After reading both i am left with one question on whether or not you have made one mistake in the numerical digits you have quoted.

You have said in your reply to the Agora articals that there is ” roughly US$10 trillion in global money supply, where as Bill Bonner and Jim Rickards both quote that there is US$1.2 trillion in global money supply which they probably got from US$ information on google which quotes the same. There is a big difference between the two amounts, can you please tell me where you got the US$10 trillion figure from as i would like to read that also.

Sincerely,

Don Bright

I was being very general with that one, the number I was thinking of is M2 money supply, which is a Fed number for the US. That’s around $13 trillion, my $10 trillion number was a few years old. The total dollars in global central bank currency reserves is about $4 trillion, that’s a bit over 60% of global currency reserves.

Sorry for the lack of clarity — it is surprisingly difficult to say how many dollars exist — largely because there are so many different definitions. There is only about $1 trillion in actual banknotes (and coins) at any given time.

…a trillion here…a trillin there….

Equating newsletter pitchmen with car salesmen is an insult to all car salesmen.

Yes, used car salesmen have endured decades of uncalled for abuse, I remember a campaign slogan asking if you’d buy aused car from Dick Nixon.

Thank you for yet again a thorough analysis. Yours is a wonderful newsletter and helps us pedestrian investors understand what’s really happening in those breathless pitches 😉 Paul A.

Thank you so much, Travis. I’ve been reading your site for several years now and you keep me sane in the midst of all these newsletter writers whose tactics I think are quite un-ethical.

You must do quite well Travis, to own mostly billion coins. 🙂 Good work as usual.

Oops!

Obviously Travis has a billion bullion coins.

Rickards is pitching Franco-Nevada (FNV)

Long FNV. Can agree with Rickards on that one.

Thank you so much for the solid down to earth info -If you, at some point in time could comment upon the probability (in my mind) of China/USSR forcing us to return to the gold standard (do we even have any?) that would be sweet icing on the very tasty cake–God Bless–

According to official reported reserves numbers, the US has by far the largest gold reserves in the world.

I can see why Russia and China would want their currencies to have more weight in the world, and in the case of China that’s likely to happen, somewhat gradually (my guess).

But I don’t see any reason why China or Russia would want to have their currency bound to gold — don’t think of it as a strategic advantage versus the US$ (which is theoretical and could go the other way), think of it as a country tying their currency to a fixed commodity and saying they’re not going to tinker with the value of their currency — they won’t try to boost their currency to cool down exports or improve standard of living, they won’t try to bring the currency down to help exports or create inflation to encourage spending. I think the gold standard is a global non-starter because even countries with decent gold holdings, like China, don’t want to give up that much control of their economy, financial sector, and exchange rate.

That may not be accurate, but that’s my opinion based on my understanding of the strategic imperatives of the world’s major countries. Neither China nor Russia could easily “force” anything like a global gold standard on the US, and I don’t think they’d want to. I personally think we’d have to have a severe currency crisis,

Far worse than 2008, with bank runs everywhere, before any attempt might be made to rebuild some sort of asset-backed standard for global currencies.

More likely, perhaps, is that a country could set a gold standard for its own currency in an effort to boost that currency — but I don’t see anyone large who could easily do that, or anyone of any size whose leaders would want to do that. Everyone wants a weaker and “more competitive” currency these days, from what I can tell, not a stronger one.

All the governments of the developed countries have an interest in maintaining control of fiat currencies.

The Chinese have hedged their bets. Internally they set up a limited yuan-gold bullion exchange mechanism, but they are now playing ball in the IMF also.

“According to official reported reserves numbers, the US has by far the largest gold reserves in the world.”

Also according to official sources, the economy is recovering, unemployment is 4.9%, and everything is OK.

Travis, I believe that most are underestimating the problems facing the US Dollar Reserve Currency system (of the past 40 years)… the financial calamity of 2008 was just the start. If one understands that nothing was “fixed” after 2008, that the global financial system is much worse today, then one might realize that Keynesian policies have failed miserably… that world governments won’t be given the choice of continuing to debase currencies (as they like to control). Governments, including the U.S.A., will be forced into a more sound currency system to restore trust for international trade. If China is front-running this sea change in perspective as I believe that are, then in makes sense that Rickards is putting his reputation on the line, that behind closed doors, the G20 nations’ are working to gradually reset the currency system, and the results are coming the forefront this fall.

Gold will be (once again) used this time to indirectly ensure trust-worthiness in currencies such as the Yuan. Eventually, the US and other nations will have to compete for the “benefits” of having a secure currency backed with Gold with the benefits of conducting trade and investments in stock and debt markets.

Again, nations will realize (especially in the coming financial calamity that will be much worse than 2008) that a currency backed with a percentage of gold has much lower risks than those generated by the unstable and unsound paper dollar system. Implementing a modern quasi-gold standard in a “risk off” world can be met if the transition is gradual and transparent and, most of all, if markets are used to establish the final rate of exchange between the dollar, other currencies and gold such that overall prices reflect today’s levels of global debt, and there is no forced reduction in wages.

What the critics of a gold-backed currency standard refuse to admit is that, for all of its faults, (for instance) the performance of the U.S. economy under a gold standard was far superior to the paper dollar system loved by those who believe in government power and economist, who believe in the ability of elites, such as themselves, to manage the economy by manipulating the value of the dollar. The 40-year experiment with a paper dollar has failed to produce the higher growth rates, less unemployment, milder recessions and increased financial stability that were and even today are promised by its advocates.

Again, it won’t be a matter of preference, but out of necessity that nations will adopt “sound money” (currency system backed with a percentage of gold).

This is not at all what any person in their right mind I’ll add that a rapid rise in price inflation (not to be confused with monetary inflation), will be the catalyst for the stock and bond markets to correct and for world governments to yield to what is currently considered “drastic” solutions such as a currency reset that involves a gold backing (against all current logic). Worse, because market consensus is so complacent about Keynesian monetary policy governments taking such an “illogical” step to restore confidence, such action would be a complete surprise… big surprises and changes always occur when things appear relatively calm. Currently there is isn’t a threat of inflation on the horizon. But as the Bond market finally begins its bear leg, rates will rise tanking the stock market and dragging down the US Dollar with it… governments will panic and print yet more money (QE-4 for the US) so much so that people will dump the currencies in exchange for tangible assets (especially Gold and Silver coins and bullion).

Although governments continue to tell their citizens that all is well (improving), in the case of the USA, the fact that the Treasury Bills continue to fall to historic lows suggests otherwise.

If we had a strong economy, rates would be on the rise. Instead, we are seeing the fear trade take U.S. Treasury rates to increasing heights in a dangerous dangerous blow-off. Historically, such blow offs turn suddenly in the opposite direction.

I believe the above will become obvious to everyone this fall… some are already connecting the dots as to what is coming while most are complacent.

Quite reasonable in many ways, but be careful about having any certainty about timing — almost exactly the same thing could have been said a year ago and two years ago. Things can seem illogical for a lot longer than you might imagine.

Thank you Travis…a very enlightening response and I respect your advice about diversification of Portfolio.

You sure have caused a stir with this article but I cannot help but observe how tunnel visioned some of your contributors have been about the strength of the Dollar vs the SDR. It is inevitable that with the Debt the US lives with (all borrowed money by rich and poor alike) the end is not too far.

Compare the debt per capita of the Chinese to the American and you can see clearer why the Yuan should have a place in the SDR from September 30th.

Better still wait till November when you have an empty headed Red Neck Idiot as a leader then you will all be glad to have the fallback of the SRD with the Yuan,eventually as the mainstay of global economy or we are back to the Gold Standard …..how can anyone even think of voting for a MAN in your next Election !!!

One thing you can say about Trump is that he did not contribute to us getting into this mess. If you like the direction and results of the current

establishment, then by all means vote for more of the same.

Which empty headed Red Neck Idiot leader are you referring to? Twiddle DE or twiddle DUMB!

I gotten better ideas out of a Fortune Cookie than these 2 have.

This thread is not for politics, but if you are going to start name-calling

you might just as well start with Slippery, Lying, Establishment

Status-Quo Tool Girl.

Politics doesn’t affect the economy or visa versa in which universe? Get your head out of your wherever before blood starts coming out of it.

The thread is for investment analysis.

It is not for partisan debate.

We all have our opinions, but name-calling of Presidential candidates serves no purpose.

My head is in its proper location, thanks very much.

We have a thread for this discussion. The unmentionables thread in which we discuss all other topics. Religion, politics, etc. Come over and have your discussion there.

Donald Trump said the market is going to crash and considering the accuracy of almost everything he says, that gives me a warm and fuzzy feeling about the market.

I too have read Jim Rickard’s books and having studied the issues being discussed in the comments on the response article by Travis for over 60 years, I think I can contribute something of value to the discussion and perhaps point out some missing pieces of the puzzle that nobody has mentioned, but are very relevant to the discussion.

First of all I do agree with Travis that FEAR is a strong motivating factor in selling newsletters (or books) and as usual he provides some sober “second thought” on how seriously we should take any one specific prediction of a date when a specific event will trigger a given reaction.

That being said, I think the most notable words in his article were, “NOT YET” in other words an author can be quite right in his assumptions on future events based on historical precedents and obvious trends but still be very wrong when setting specific dates for something to happen, and that may well be the case here. AS Travis pointed out in his well balanced article, these things can take much longer to play out, and what seems obvious SHOULD HAPPEN takes longer than expected.

It just so happens that I spent the morning listening to a series of 5 YOU TUBE video.s on this very subject by Peter Schiff and Mike Maloney.

I highly recommend their discussion of economic fumdamentals which you can access @ https://www.youtube.com/watch?v=RapC2-oxSRM for the first one and on the right hand side of the page the others will be listed as well. I also recommend Mike Maloney’s series titled “The Hidden Secrets of Money” Anything by these 2 authors will give you a sound grounding in economic realities, and I am very surprised these 2 names never came up in the comments section. Peter made the point very well that just because something hasn’t happened yet that he had predicted, dosen’t mean that it won’t ever happen. It is like religious leaders predicting a date for the return of Jesus Christ, that has always been wrong so far.

Another thing that surprised me is the fact the role of the FED was not mentioned in any comments, IMO a glaring error.

That is where I started my studies as a precocious teenager questioning the status quo. Best book on that subject is “The Creature From Jekyll Island” available at the author G. Edward Griffins website.

My personal opinion is that the most likely trigger for the final demise of the dollar as a preferred world currency is what Warren Buffett described as “financial weapons of mass destruction” DERIVATIVES, of which Deutsche Bank is the most highly leveraged and several major American banks are not far behind. When those dominoes begin to fall it will take the dollar with them. date unknown and unknowable, but certainly a highly likely event somewhere in our future.

It is really immaterial whether Jim Rickard’s is right that the advent of SDR’s as a primary replacement for settlement of world trade Oct 1st is the key, the fact remains that the world is awash in DEBT that can never be repaid in sound money, the question is how did we get to this stage?

How many are aware that the U.S. National Debt since Obama was elected EQUALS the amount of debt accumulated under all previous administrations? How long do you think this run away debt accumulation can continue before the whole Ponzi scheme of the FRAUD known as “fractional reserve banking” collapses as all Ponzi schemes eventually do.

Here are the questions not even being asked by our economists, bankers and politicians, let alone addressed in any meaningful way, simply printing more money is just an “extend and pretend” exercise that only prolongs the agony but solves nothing.

(1) WHY should our currency supply have to be borrowed into existence as DEBT which the privileged bankers under the Federal Reserve Act of 1913 create out of thin air?

(2) You doubt that, then you have swallowed one of the biggest lies ever told, that banks make their money on the SPREAD between the miniscule interest they pay on deposits and the interest they charge on loans, the premise being that they keep 10% of deposits as RESERVES and loan out the other 90% at a higher rate of interest, but now we actually have “negative interest rates, (which is economic madness) who in their right mind would pay a bank to hold your deposits?

(3) TRUTH! In sworn testimony before Canada’s Parliamentary Banking Committee our chief Central Banker Graham Towers testified in 1939 that, “every bank loan is a new creation of money. and when it is paid back it ceases to exist” i.e. is cancelled out, and therefore for an economy to function, new loans must be taken out collectively by individual citizens, corporations and all levels of government indebting themselves to the bankers who collect the interest, WHICH IS NEVER CREATED!

(4) What this means in practical terms is that the level of new loans (read DEBT) means the debt pyramid must constantly expand to cover the accumulated interest, in short a recipe for perpetual DEBT.

(5) America supposedly ABOLISHED SLAVERY when Lincoln was President, but in reality it was reinstated in 1913 with the passing of the Federal Reserve Act because it effectively launched Central Banking as designed by the secret cabal of Bankers who met in secrecy on Jekyll Island to design this system of DEBT slavery fractional reserve banking has imposed on the whole world, we are all slaves to this perpetual debt.

(6) WHO do the natural resources of a country belong too, timber, minerals, rich soil, water etc. would it not be the citizens by birthright?

Now ask yourself these questions: (A) When we elect a government, should it not be for administering those resources for the benefit of all citizens?

(B) If we have the resources and manpower to build and create anything that is physically possible and desirable, can and should it not be made financially possible?

(C) Unless the bankers somehow got title to everything that exists, WHY should we be paying interest to them for printing numbers on pretty pieces of paper to finance projects to which they neither contributed labor or raw materials?

The simple truth is that the printing plates should be taken away from the bankers and restored to the people through a government that reflects the interests of the people rather than professional bankers.

As former Congressman Ron Paul has advocated for years, the FED should be ABOLISHED unless or UNTIL it represent the interests of the people instead of special interest which also requires some drastic electoral reform so that elections can not be bought by bankers by financing both parties so that no matter who wins they get favourable legislation that allows them to enslave citizens with perpetual DEBT.

As the late Sheldon Emery put it in his excellent little booklet. Billions For The Bankers, DEBTS For The People. now unfortunately out of print, the bankers have learned how to actively keep people “barking up the wrong tree” by setting up straw men, unions vs management, Republications vs Democrats etc. so the people at large never have time to identify who the real culprits are! Would love to see someone of the caliber of Peter Schiff or Mike Maloney up date Sheldon Emery’s booklet.

Unfortunately some things can not be proven in real terms, they remain conjecture, you either believe the fiction that the U.S. has the largest reserve of gold in the world, or you question whether Fort Knox could either be empty or at best what gold exists is not actually owned by other countries or at worst has been leased etc. DOUBT is based solely on two major pieces of circumstantial evidence

(1)) The FED and highest levels of government have resisted every effort to force an audit, so if the gold is there and ownership is provable, WHY the hesitation? (2) The failure to meet Germany’s request to repatriate their gold stored in the U.S. is a strong indication there is some serious chicanery going on behind the scenes.

Maybe I am being too cynical, but I have learned not trust government blindly.

Right on Myron. By the way, Congress is supposed to make all decisions pertaining to the currency. They have abdicated this resposibility.

See Article 1, Section 8 of the Constitution.

Very well written/articulated. There is an interesting book put out by 95 year old former Minister of Defense of Canada entitled “The Money Mafia” and was quite insightful and he also strongly recommended shutting down the FED Reserve and letting OUR OWN US GOV. print OUR OWN MONEY! (gee, what a novel concept!) He then illustrates that our new “real money” be given to major infrastructure projects (NOT LOANED thus creating more debt!) at a rate of approx $2Tril per year for approx 7 years. It will cause some inflation but at reasonable levels which would solve many of our US debt/monetary problems/pull us out of this Depression and solve many systemic issues…………….seemed like a great common sense idea to me! Great book, worth reading, although somewhat amusing to have a Canadian “showing us the way out”!$

Hey that’s a political comment you two faced waco bird.

jrlartful, I assume your snide comment was directed at me. But I never said politics should not be mentioned, or that it had no impact on economics.

I said words to the effect that political debate was not the purpose of the thread.

Instead of making ad hominem attacks and crude comments, how about a useful investment idea about something ?

Another thing. “Waco” is a city in Texas.

“Wacko” is slang for crazy.

And two-faced has a hyphen.

Try learning how to read and spell.

Concur Myron; interesting to compare notes to 2012 pre-election: http://www.stockgumshoe.com/reviews/forecasts-and-strategies/the-other-three-must-buy-before-the-election-picks-from-mark-skousen/#comment-297719 article and comment 🙂 Best2You – Ben 🙂

Great reply… I’ve studied the markets since the late 80s and have come to a similar conclusion. People will look back and wonder why they didn’t connect the dots… 2016-2017 would be / are key as a group of us have been predicting for 2 decades now. After many have “cried wolf” over the years, a great transition is occurring now and only a few are connecting the dots. So when Rickards cries wolf, everyone remains complacent having been burned in the past… they look at the central bank’s actions that relied on old Keynesian models that have utterly failed. Nothing has been fixed, only can-kicked down the road. Points of recognition happen suddenly when market consensus leasts expects it. If one connects the dots occurring today on a global basis to what has occurred the past three decades, one can understand that a currency reset that has been in the works for many years will soon be recognized by the crowd. This fall’s G20 will be instructive, however, the real fireworks don’t happen until 2017… gold will be the major benefactor.

What are Chris Mayer’s newest picks since Bonner has started his new letter ???

I am so curious for your thoughs about Dent cs. who- up to me- have a different opinion

Dent has a new book forecasting deflation, including gold.

Previously he was adamant about gold going down to $700 THIS YEAR.

One of the other publishing investment gurus challenged him to a bet that at no time this year, would gold go below $1000. Four months to go to see who is right.

Dent has extended his deflation collapse scenario to a longer time frame.

I would be very surprised if Dent’s forecasts come true. But I have not read his new book, perhaps it would persuade.

Travis,

I am one of Jim Rickards’ subscribers so I can tell you that his “World Money” play is actually something you would never guess. He has set up two “motifs” at motifinvesting.com. I don’t think I’m supposed to share what he would consider confidential information, but you could easily have discovered this for yourself.

Keep up the great work,

J. Jay Forbes

Cape Coral, FL

Good stuff Travis, thanks. I have been following Rickards for a few months and he has been on a roll. Some picks as you write about (FNV, RGLD, SAND, SLW, etc). The whole FEAR thing wears me out but keeps us reading. I have now idea what happens next but I think we all can agree it cannot continue. US is the “last safe haven” and we owe $19.5T in National Debt and another $103T in unfunded liabilities ($860K per taxpayer) which can NEVER be paid for. So the question is…when does it all come tumbling down?

Texasranger…Nobody knows ! That’s what is so exciting !

…and don’t forget the corporate debt, the state debt, and the municipal debt,

the bad car loans, the bad student loans, the margin loans on the stock market, and the home mortgages !

Predicting the future is a tough business. I like the diversification approach. I own (sgdm), (sand), and one low cost silver producer( hl). I took profits on (slw).

It’s impossible to predict how the future will unfold, anyone who does just made a lucky guess.

But I’ll make one prediction right here: There are going to be record defaults on corporate, individual private, and public debt. The amounts owed cannot be paid back. The situation could be technically softened by inflation; that is why the Powers are trying so hard to inflate.

But that is government default in disguise,and simply shifts the pain from one set of entities (mostly debtors) to another (mostly creditors).

HN, You and I have debated how to invest in such times before and there is unfortunately, no clear answer. But IMHO your prediction will be correct and thus Travis’s advice to get/stay diversified seems prudent. I personally think PMs and natural resources are good alternatives to stocks and bonds right now and I am at an all time high in my percentage of cash allocations, though I have to admit that I do have some speculative biotech issues in my mad money account. But, I also have significant hedges in place on my stock and bond investments. The trouble is that, unless you open that foreign account and convert your dollars to something else that will not be impacted by a dollar shock and/or invest in foreign real estate where it is unlikely that the government will be overthrown, we are still investing using dollars. If the dollar suffers a shock and is replaced by some other currency suddenly, those dollar based investments would seem to be at great risk regardless of what stock, bank, or other investment instrument you choose. If I were 100% sure the dollar would be replaced by whatever on a given date, the smart guys will have already moved their wealth into whatever the assets are that would protect me and so my trade would be at a peak price with little room for appreciation. I think the only thing that we can be sure of is that as savers (creditors) we are screwed. We can hope that we invest wisely so we are on the less screwed end of the teeter totter. I do take some solace in realizing that I’ve been reading these end of the world pitches since I was just out of college in the 80s.

I have followed Jim Rickards since he published Currency Wars. Actually I have been fearful and anxious since ’08 watching us lose our Constitutional rights and not seeing any public response. It took a while to get past the denial and anger phases and begin to accept this reality, and deal with its outcomes. Many dots have connected over the years that are consistent with the opinions of: Rickards, Shiff, Casey, Maloney, Bonner, and others

regarding our underlying circumstances, and the inevitable crisis that is developing.

On this current thread Travis needs to be congratulated for his grounded perspective, and willingness to concede the future may well be concealing dire outcomes, “but not today” or any time soon. Agora is guilty as charged. What is relevant is Rickards typically recommends long dated options.

There is more info from Rickards in links of Agora’s “5 things you need to know” daily. He quite clearly states the impact of SDR’s would be felt in ’18, and he feels sure his Shanghai Accord Thesis coming out of the last G20 in Feb meeting causing the dollar to fall as the Euro and Yen rose (lasted for few weeks) will be reaffirmed in this Sept.4 G20 meeting. He also points out nothing that would hurt Clinton or help Trump is likely to occur if it can be helped, before the election.

I’m sure he hates the urgency BS marketing hype too, when if fact he is recommending long term options. Seems a big advantage here is the potential for taking long term capital gains for the tax advantage.

I acknowledge none of us doomsayers imagined the money printing could go on and on, and spread throughout the world, and that all markets could be managed this long. Truly an epic world debt now, but you are reminded that the Fed & Gov have been seeking inflation. Recall Bush Jr. pitching how it will improve our exports, and never mentioning how it would increase the cost of our imports. Bottom line : This desire to meet their inflation mandate is their path to lowering the “cost” of our debt by reducing the value of our money still further.

This is the path they appear to seek, but for some obvious reasons have been “failing to achieve” until they ready, or a geopolitical accident disrupts their feudal objectives.

Brexit was a vote for freedom I celebrated, and hope this leads to others following this path, but Mark Twain tempers my enthusiasm with his observation ” It is easier to fool others than to convince them they have been fooled”. How true.

Keep an open mind, take in the data from lots of sources, follow the money, then think for yourself. Mike Maloney’s “origins of money” video should be required viewing for every American.

BTW…Rickards recommended a Call on SLW back on June 21 in another newsletter. Those Options are up 145%…wish I would have put $$ more in back then. Perhaps after reading Travis I should exit??

Couldn’t say, even if I knew your strike and expiration.

If the expirations are short I don’t know if I’d have the stomach to stay in. A quick but temporary drop could wipe out your gains.

If your expirations are far out I’d be more comfortable staying pat.

Rickards is having a live “The Day the Dollar Died” call on Tuesday AM. “During this month’s event, Jim will cover what could happen to the dollar on Sept. 4, 2016 when the G20 meets in China. He’ll also update his Shanghai Accord thesis.” And taking questions…

Long SLW, FNV, SAND.

One thing about SLW, they have a policy of giving shareholders 20% of free cash flow (this is a corporate policy, not a by-law). So a big increase in PM prices might result in a nice dividend for us.

On the legal problems, they express confidence pro-forma confidence in their position and have appealed to the Canadian tax court which is set up to hear complainants who think the Canadian revenue service is being unfair. Of course, once in court, anything can happen.

$FNV, long:

Franco-Nevada Reports Record Gold-Equivalent Ounces, Revenue

Tuesday August 09, 2016 09:18

Royalty and streaming company Franco-Nevada Corp. (TSX: FNV; NYSE: FNV) reports second-quarter net income of $42.3 million, or 24 cents per share, and adjusted net income of $40 million, or 22 cents per share. This topped the consensus estimate of analysts, reports BMO Capital Markets. Franco-Nevada lists a record 112,787 gold-equivalent ounces and a record $150.9 million in revenue for the quarter.