I’ll open today by saying that I don’t know if the euro will rise or fall against the dollar over the next two years. And neither does anyone else. Global currency markets are vast and complex and driven by trader sentiment and economic growth and interest rates and unpredictable crises and lots of other influences.

But, of course, that doesn’t stop investors and pundits from trying to predict them, or from having opinions — and they’re strong opinions sometimes, and well-backed by evidence, and they sound compelling and true. Just like the predictions that the US dollar would collapse four years ago sounded compelling and obviously true to many people (the dollar, in case you didn’t notice, has been incredibly strong for years despite the perceived overabundance of liquidity from the Fed, lapping essentially all other major currencies… and helping to keep our inflation rates and commodity costs low, among other things).

So that’s the intro from me — I share that just to remind you that Larry Edelson’s predictions about this next “supercycle” move in the Euro, though they sound compelling and evidence-based, are not necessarily going to come true. We all have a tendency to believe logical arguments, that doesn’t mean the cleanest logic wins in the end when you’re talking about the real world. It doesn’t even mean that people who were right about the strong dollar a few years ago (I wasn’t one of them, to be clear) will be right about what happens in the next few years.

But lots of folks are asking, so what is Edelson’s prediction… and how does he suggest that you can play this prediction to make some money? He drops some hints as he’s teasing us about his money-making idea in the latest ads for his Supercycle Trader ($5,794 for five years in the current “sale”), so let’s see what the Thinkolator can help to extrapolate from the marketing ooze… we’ll start with a little excerpt from Mr. Edelson to get you in the mood…

“I’ve been trying to prepare you for this for many months now.

“I’ve told you repeatedly that the euro currency would be one of the first victims of the supercycle that formed in October.

“I told you that the toxic brew of massive, unpayable debts, a weakening economy and soaring government costs due to the refugee crisis would drive the EU to its knees.

“I’ve begged you, even pleaded with you to invest in things that soar when the euro sinks.

“Now, as if all the crises converging on Europe aren’t enough, the International Monetary Fund itself is pulling the rug out from under the euro.”

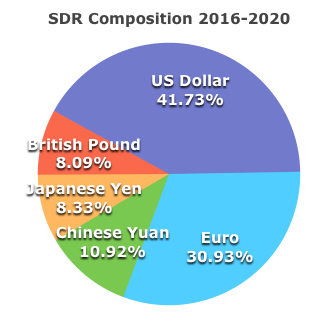

That’s a reference to the IMF “certifying” the Chinese Yuan as a reserve currency, and including it in the Special Drawing Rights (SDR) basket starting next Fall, which is indeed happening — and though many folks have been wringing their hands and fearmongering about what it means for the dollar, there’s no particular reason for it to impact the dollar in a big way — the US dollar’s (dominant) share of the reserve basket stays the same, the Yuan is mostly taking away from the Euro… and the SDR is more a reflection of global trends than it is a determining factor for economic behavior. This addition of the Yuan is much more important symbolically and as an indicator of China’s opening economy than it is a real driver of demand for the currency for economic activity or for sovereign reserves.

Here’s how the SDR will be calculated starting next October:

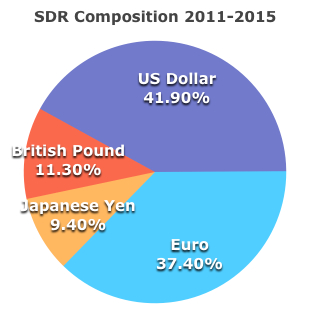

And here’s how it’s calculated today:

So really, though the Euro is losing some presence in the SDR the biggest impact, as a percentage, is in cutting the Pound’s role in the SDR. Not that the British people should panic, either. This doesn’t mean that suddenly 25% of the Pounds in circulation are going to be turned in for Yuan, collapsing the value of the British currency.

Edelson says in the ad that “to make room in banks’ reserves for the yuan, the IMF just REDUCED the amount of euros banks must hold by a full 16%,” and I’d say that’s an extremely aggressive interpretation of what the SDR recalculation means.

In my view, there’s no immediate impact from the SDR change other than in changing the way that some countries exchange a very small portion of their reserves (the vast majority of reserves are in actual currencies in the proportion chosen by each central bank or government, not in SDRs), in some loan programs to developing countries from the IMF, and in the way the IMF keeps its books. There’s no particular reason why this specific move should change exchange rates, as the volume of SDRs is dwarfed by the volume of actual global trade (which is what currencies are really for in the first place) — though exchange rates have been so volatile over this past decade that you’re probably better off assuming that almost anything can happen. Of far bigger impact, I think, would be if China opened up enough that foreign investors began to hold meaningful amounts of Chinese sovereign and corporate debt — and that will probably happen too, probably also very gradually.

But back to our point, the search for an investment that Larry Edelson is hinting at.

So Larry’s argument is that this combination of factors, the SDR change and the rise of the Yuan and the refugee crisis and the faltering economies in Europe, will bring the euro down further. Here’s a bit more from the ad:

“The way I see it, a crashing euro is now virtually guaranteed by not just one, but by four major forces:

- FORCE #1: The massive unpayable debts EU members have run up …

- FORCE #2: Four million Syrian refugees demanding free food … free housing … free medical care … and more …

- FORCE #3: The slow-motion collapse of the EU economy and inevitable decline in government revenues needed to service their exploding debts …

- FORCE #4: This vicious attack on the euro currency by the IMF.

“Urgent recommendation available NOW: 488% gains possible!”

So what is this recommendation? Here are the specifics he drops in the ad:

“It’s a highly leveraged position that strictly limits your risk but NOT your profit potential.

“What’s more, you don’t need a lot of money to begin. You could invest as little as $210 if you like.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“And the best part is, you’ll have up to two years to make your money:

- If the euro falls only ONE-FOURTH as much as I think it will, you could walk away with nearly DOUBLE YOUR MONEY …

- If it falls ONE-HALF as much as I think it will, you could nearly TRIPLE YOUR MONEY, and …

- If the euro plunges to my price target of $0.80 against the dollar, you could make as much as 488%.

“That’s enough to turn every $10,000 you invest into $58,800!”

OK, so “highly leveraged position that limits risk but not profit potential” is code for “options” — buying options contracts is the easiest way to get exposure to the movement (either up or down) in some underlying stock or fund while risking relatively little capital and strictly defining your risk (if you’re selling options the risk exposure is a bit different — but your success rate generally goes way up, too).

But can you trade options on currencies? Yes, you could actually trade futures options on currencies directly using forex options trading through specialized foreign exchange brokers — but without getting into that somewhat different world of trading, you can also trade options on currency ETFs using a regular brokerage account… so, since this Supercycle Trader service is generally focused on using ETFs, I suspect it’s options on these currency ETFs that Edelson is probably recommending, that’s a much more comfortable thing for most US retail investors than is direct forex trading.

Are there options on ETFs that would give you this kind of exposure? Yes. There are eight euro currency ETFs that are designed to track the euro either short or long, some of which are leveraged ETFs that try to double the daily move in the underlying currency. And of those, there are three I’m aware of that have options trading available — FXE, which is the big CurrencyShares ETF that’s probably the easiest one to understand quickly (because one share of the ETF is very close to representing 100 euros in US$ terms); ULE, which is the ProShares version of a “double euro” fund; and EUO, which is the ProShares “double short euro” fund.

You can bet against the Euro using any of those — if you want to bet against the euro you could either short the long euro funds (FXE or ULE) or buy the short euro fund (EUO), and if you want to leverage that bet much further you could do the same with options (buy puts on the long euro funds, or buy calls on the short euro fund).

And yes, we’re just about to the end of 2015 — so the 2018 LEAPs are trading for stocks and funds that have long term options and you could have “up to two years” to make your money using those long-term options (2018 LEAPs trade just like regular call and put options, but have a longer time period to expiration so generally should trade with a higher time premium — LEAPs all have January expirations, so for these three ETFs there are both January 2017 and January 2018 LEAP options available in addition to a regular menu of options expiry dates over the next several quarters).

How do we get to a 488% return, assuming that Larry is right about the euro falling to 80 cents by January 2018?

I’ll run through a couiple examples (I’m not recommending any of these specific trades, of course, just trying to provide some scenarios so you can perhaps think about it more clearly):

You could buy the FXE January 2018 $90 puts. FXE is at $107 today with the Euro/USD exchange rate at about $1.10. That would cost you about $1.35 per share ($135 per contract, each options contract represents 100 shares), so you would need FXE to fall to at least $88.65 by late January 2018 for you to break even.

If FXE falls to $80, which would be fairly close to the euro being worth US$0.80, then your put contract would entitle you to sell 100 shares at $90, so you earn $10 per share… or $1,000 per contract. A nice return of 640% or so in two years ($135 turns into $1,000). If the Euro is still near US$0.90 or so and FXE is above $90, even at $90.05 at expiration, then any options contract held to expiration for that $90 strike price would expire worthless (though options contracts can be opened or sold at the market price anytime… so it might be that if the euro falls that far well before 2018 you could sell it several months before expiration for a profit if folks are anticipating more drop, that’s largely unpredictable).

Similarly, if we want to try to mimic the “invest as little as $210” suggestion from Edelson, you could move up the strike price a bit to give yourself some more room for profit if the euro moves down less than 25% or so by 2018 (a drop from $1.10 to $0.80 would be a 27% drop, FYI) — the $95 FXE put contract would cost you about $210 today ($2.10 per share), and if FXE is at $80 at expiration (euro near 80 cents) then the contract could be worth $1,500 — so about a 615% gain there, similar to the move in the $90 puts. If the Euro just drops to 90 cents, however, and FXE is at $90, then your $95 puts are worth $500 (a gain of 140%) while your $90 puts would be worthless.

Those examples both assume that FXE is trading at exactly 100 euros, which isn’t precisely correct — but it’s close enough to give an idea of the impact of a put option on FXE given any anticipated move in the euro that you might imagine. None of those 2018 options has a huge enough open interest that I’d assume it’s a big recommendation made by a substantial newsletter, but it’s possible — as you might expect, 2017 LEAP options trade in much higher volume and have much larger open interest… partly because 2018 LEAP options have only been created over the last month or two.

How about if we want to put on more leverage? That’s where the leveraged ETFs come into play — these ETFs aim to double the daily move in the underlying index (or currency, in this case), so if the euro falls 5% today they’re supposed to either fall 10% or rise 10% (depending on whether they’re “double short” or “double long”). They do this using derivatives like futures and options themselves to mimic these moves, and it generally works pretty well on a daily basis — but for a variety of reasons the tracking for these leveraged funds tends to lose that connection over the long term. EUO, for example, should be up 40% over the last two years because the euro has fallen 20% against the dollar in that time, but it’s actually up 48%. It’s not a problem if you happen to own EUO as a bet against the euro, of course, but it’s a reminder that you can’t count on the exact double inverse relationship holding firm over longer periods of time.

So if you wanted to “bet” roughly $210 on a fall in the euro, you could buy call options on the double short euro ETF (EUO). EUO is at $25 or so today, and the January 2018 call options that are near $2.10 per share are the $29 strike price — there’s very low volume in these options, so I’m sure they’re not the core recommendation from Edelson, but we’ll look at the example anyway (the 2017 EUO LEAPS might be recommended by a newsletter, some of those have huge open interest and high trading volume).

So if you bought the January 2018 $29 LEAPs on EUO at $2.10, your breakeven becomes $31.10. That would be a $6.10 move from today’s price, so that’s an increase of about 24% in the price of EUO over two years… which should mean that the euro has fallen another 12% against the dollar by January 2018, which would mean a euro exchange rate of about US$0.96 (though the specific tracking is not that perfect, as I mentioned). If the euro drops to $0.80 by 2018, then EUO should be at $38.50 if it tracks the euro perfectly, and in that case the $29 option that you paid $2.10 ($210 per contract) for would be worth $9.50 ($950 per contract), for a gain of about 350%.

Those are just some ideas for you to consider if you’re looking for a way to use the leverage of options to make a longer-term bet on the further fall of the Euro — I can’t tell you exactly which options contract Edelson might be suggesting, he wasn’t that specific in his hints, but if you’re intent on buying exposure all the way to January 2018 then I think the only real options are FXE puts, EUO calls, or ULE puts.

The nice thing about betting with options contracts like that, by buying puts or calls, is that you know up front what you might lose — you might lose 100% of your investment, but no more. If you actually short the ETFs or short the currency and it moves quickly against you, you could lose far more.

On the other hand, if you’re wrong about the extent to which the euro might move or the timing, your chances of a 100% loss are much higher with options than they are with unleveraged bets (like shorting FXE, or buying EUO shares outright) — options means you have to be much more accurate with timing and pricing, because being off a bit means that you lose the whole “bet.”

Even if you generally had the right idea about the euro falling over the next two years, you’d have to pick the right strike price to maximize profit from that fall… if you focused on that 80 cent number and were determined that the euro would fall that far, and noticed that betting on 80 cents is a lot cheaper than betting on 95 cents, then you might forget that if the euro falls to “only” 82 cents your options “bet” loses 100% of its value…. likewise, if you just want to bet that it will fall, not necessarily that you’re sure it will fall by more than 25%, well, a put options contract to sell euro shares for $1.05 in 2018 costs a LOT more than the contract to sell for 80 cents ($5 versus 50 cents, in the case of FXE 2018 puts at $1.05 and at $0.80), so you lose a lot of your potential leverage.

So… will the euro fall another 25%+ over the next two years against the dollar? Think any of these kinds of trades have appeal either as a way to hedge your portfolio or to place leveraged bets on the future? I don’t necessarily disagree with Edelson about the broad trend in the currency, I expect he’s better informed on that than I am, but I’d just caution you that being specifically right on these trades is harder than it might look from a “logically, the euro should drop” perspective. Throw your thoughts on the pile with a comment below.

hmmm

My take on Weiss is that they can be good macro analysts, but are terrible stock pickers. I’ve made more money using their macro ideas and picking my own stocks. Like most others their timing tends to be way early, i prefer to implement trailing stops when their doomsday rhetoric starts, which keeps me in the game as bubbles keep growing.

Could not agree more about doing one’s own work on entry/exit pics. And it seems the cycles keep getting adjusted.

same experience. They are usually way too early. It is best to place your own trades and if you don’t know how to read charts; it will pay off in the long term if you do.

Re: EURO trades. Buy Jan2017 calls @ 1.90 or less Strike Price $28.00 : total risk = $1900.00 Does not seem bad to me. Sovereign is everywhere in Europe France/Germany/Italy/Greece Seems a 70/30 odds in favor of the above.

Yes, Edelson’s view on the euro is difficult to argue with. It’s heading down, with an ever-increasing chance of break-up. By the end of this decade, Europe is going to be an ugly sight.

On gold, silver, and oil, the timing of the trades is usually off, but his recos seem right in the long run. He has been recommending EUO for quite a while, and I agree that the European mess will only get worse. I am short the euro currencies and am in EUO now.They won’t clean their mess up anytime soon.

Great article! Thank you. Although nI am a complete novice in trading options I thhink I understand it better now. Do you know what these supercycle trends are that he refers to? He seems to base all his recommendations on those cycles. I’d like to know what those are.

As I read it he believes that we’re just starting the next “supercycle” that will crush the economy, the first one since 1929. This is the quote of his that I see consistently re-quoted in lots of places:

But no, I’m not sure what he’s basing a “supercycle” call on now — I do understand why he sees the euro going down further, which seems a reasonable guess given the current trends. I don’t know if any bigger picture cycle stuff of his is primarily a demographic call, like Harry Dent’s belief that we’ll be in a deflationary depression for the next five years because of a bunch of converging cycles, or if this “supercycle” is based on something else. In my opinion, “supercycles” (or big shifts in the global economy) make a lot more sense after the fact than they do in the years before they happen… and people love to sell short-term ideas about profiting from perceived “inevitable” cycles, but tend to be terrible at turning big picture, generational changes into successful short-term predictions. Those nice, big clean lines on 100-year charts obscure a lot of ups and downs in any given period of a year or two, and there are, unfortunately, precious few investors anymore who look out more than a year in “placing their bets.”

Edelson seems to be misusing the term “supercycle,” which comes from the (approx) 30-year commodity cycle: one decade grinding up, then a top, then yo-yo-ing in a downward direction for a decade, finally a decade of bottom-feeding getting to a cycle low. Edelson’s approach is to look for coincidences of several shorter-term cycles, the sort of thing that happens only every few generations, like an unusual alignment of planets.

There are many *real* and verified economic cycles with fairly stable structures: Juglar, Kitchin, Kondratieff, etc. Edelson claims to be using these, but I’m not sure what exactly he means. I treat the Dent stuff more seriously when it comes to cycles; he’s used them with much-better-than-random success. Dent also invites others outside his little empire to his conferences, and they talk in their own terms about cycles, not always agreeing with each other. That’s a good sign, because different perspectives on something so complex will make you think for yourself and illuminate different aspects of the issue. Dent has strong views, but he’s not closed-minded. He admits, for example, to being thrown by the massive monetary stimulus unleashed by central banks, which has created new bubbles and reflated old ones in many places. Some of those bubbles — commodities, junk bonds — are collapsing now, and I expect stocks and real estate (in some areas) to follow.

Long-term Elliott wave analysis is also *extremely* valuable as a technical tool. It’s not always predictive, but it will help you filter out impossibilities or improbabilities and focus on what’s likely. The Elliott wave mother ship (EWI) is also forecasting a deflationary period, possibly a depression.

I am a subscriber to a couple services from Dent and EWI. Nonetheless, Money & Markets does have smart people. I’m impressed by Jon Markman, their technology guru.

Edelson is referring to a conjunction of longer and shorter term cycles, including the ones that you mention and some more.

I think I know. Edelson is a following of MArtin Armstrong. Armstong himself identified October 1st 2015 as the “beginning of the end”. His own Cycles (I forget which one) shows everything (and I do mean EVERYTHING) bottoming out in 2037.

I think I know. Edelson is a follower of MArtin Armstrong. Armstong himself identified October 1st 2015 as the “beginning of the end”. His own Cycles (I forget which one) shows everything (and I do mean EVERYTHING) bottoming out in 2037.

If you’re a novice, I would avoid options and stick to buying inverse and leveraged ETFs, with an eye to holding them no more than a few months at a time. (E.g., I bought a set of inv/lev ETFs in late September and am looking to sell soon. I’ll probably get back in when they’re positioned properly.) They are subject to approximately exponential decay (sometimes as strong as linear decay) as the daily reset effect accumulates:

https://www.tradeking.com/education/etfs/leveraged-and-inverse-etfs

Track them on a semi-log chart.

I’m a follower of Money & Markets, Edelson’s mother ship (founded by Martin Weiss, son of the famous investor Irving Weiss), but I don’t subscribe to any of their paid services. While Edelson’s got a lot of valid insights, especially about the dollar, Europe, and Japan, he’s probably way off base on some others:

* It’s unlikely that we’ll have any major commodity bull cycles again for many years — that doesn’t preclude sharp multi-month rallies — but the commodity supercycle that began around 1980 is over. That includes gold, which is overdue for a sharp rally, but will then probably break $1000 before it bottoms in the 600-700 range. It will be around 2030 before we see another major, sustained commodity upswing. (Precious metals may be an exception, as they were in the 1930s.)

* US equity markets are overvalued in a very bad way; by some measures, one of the most overvalued periods ever. The secular bear market that started in 2000 never ended, and valuations still need to come down in a major way. Edelson argues foreign investors will flood into the US stock market and send it to moon, after a big bear correction. They’re far more likely to buy US investment-grade bonds and real estate.

* China is unlikely to enter into a strong period of domestically-driven growth. The 200-300 million Chinese who’ve dramatically benefited from the export machine need foreign demand to keep that going, but that’s cooling a lot. The rest of China (a billion people or so) is dirt-poor and will take decades to get to the level of development seen in the coastal regions. Its labor demographics are poor and worsening. China will grow old before it grows wealthy. And a domestically-oriented economy and the yuan as a major reserve currency require an openness and mobility running counter to Xi’s new and spreading repression — the Communist Party would have to reduce repression, a lot — not likely any time soon.

Leveraged etfs. let alone inverse leveraged etf’s have absolutely atrocious tracking records. They are a suckers play. I would just go with the stock or bond, and once proficient find a youtube course or three on options.

Euro is doomed long term…as a relative currency. The problem is it can take longer to die than most people think. Also as the price drops from say 107 to 95, the 85 will oick up in value if the fall comes fast enough

I don’t know what to make of Larry Edelson. He would like you to believe that his cycles can predict the future. Supposedly, tomorrow is going to be one of those “once in a lifetime” convergences of a whole bunch of nasty cycles. He’s saying they haven’t lined up like this since the Great Depression.

Part of that, I suspect, is because there’s really no payoff for a pundit in making milquetoast predictions — you have to either predict untold wealth, or incredible collapse to get attention… and it really doesn’t matter which one, either extreme will get folks to flock to you… if you’re right, you can take credit with huge headlines and claim to be a brahmin… and if you’re wrong, well, you can make another prediction next year and find a bunch of new folks who didn’t hear (or don’t remember) the last one. That’s how it goes with most newsletter ads: Bold and outrageous gets attention.

That is why he is using two leaps. That should give it enough time to play out.

Edelson’s claim that the IMF has launched a “vicious attack” on the Euro and that it has “just REDUCED the amount of euros banks must hold by a full 16%” is total nonsense. The immediate and medium-term effect on major currencies by adding the yuan to the SDR basket is even less in real terms than Travis suggests. The currencies in this basket are overwhelmingly an accounting index, not an indicator or instigator of changes in international financial transactions. While there might be some psychological effects, e.g. from the naive believing the howls that the sky is falling coming from know-nothing forecasters, the real effects are a couple of notches below minimal. Edelson’s economic credentials are further decimated by his unqualified forecast of the “slow-motion collapse of the EU economy.” Even worse, his analysis, as summarized by Travis, seems to ignore what is arguably the biggest threat to the medium-term value of the Euro–rising U.S. interest rates. If the rise comes faster and bigger than the consensus expects, the increased inflows of capital into the United States from Europe and elsewhere will be significant.

Larry E also predicted Oct 7, 2015 was a doom day and it went by…..Took everything I had to convince my dear old Dad, not to hide his money in a coffee can and bury it. Larry E works on pushing the greed gland or the fear gland. I find the elderly react to ‘fear’ of loosing what they worked so hard for and have saved so diligently for. It’s sad !! Wish 60 Minutes would do a story on these schisters. Dad is a Gummie member he just can never remember how to sign in and therefore misses all the after chatter.

Thanks for this one, Travis. Hopefully Dad reads it.

Checked Open Interest on EUO. Huge number of calls on the Jan 2017 28 strike. Must be Edelson?

Could be, though presumably some other newsletters or other pundits are having similar recommendations that boost OI and volume in these types of options.

There’s a lot of smart (?) money betting against the euro in the next few years. They’re probably right in a general way, but making money requires being right in the details and timing. That’s much harder.

BTW the IMF’s move to alter the SDR basket will have negative effects on the euro in the longer term, because it alters the mix of currencies to be held by banks, including central banks, and alters demand for currencies. But it’s not the main reason for the euro’s decline. The euro is a significant trading currency. But it peaked as a reserve currency in 2012 and has been declining since.

The main winner is the dollar. The irony is that the time has already past for the yuan to become a major trading currency. That requires an open, liquid financial market in mainland China, and China is and will be moving further in the opposite direction.

Larry Edelson is one of many prognosticators who have had success using the insights of Martin Armstrong and “claim” that they have done their own research into the influence of cycles. {Without spending the $100,000,000 and 30 years it takes}

Problem is they can be wrong in drawing conclusions as they are all FAKERS.

The Euro is a doomed, but I would not trust Larry to tell me WHEN.

Having a good track record is an excellent way to sign-up suckers for an expensive newsletter.

I know this subject is quite old now. But I thought I would update all on a few things. fedwatcher is correct. Edelson’s ideas are straight from Martin Armstrong. In fact, a documentary has come out on Martin Armstrong and Larry Edelson is in it!!

https://youtu.be/8MP2QaT2A_A

During one of the clips in the preview of the documentary, Armstrong mentions that Europe will fall first, then Japan and then finally the USA. So, there you go.

Also, instead of sending me an email asking if I’d like to subscribe to Super Cycle Trader, Weiss Research sent me a solicitation in the snail mail. Surprised me.

Now, none of this doesn’t mean I couldn’t make money using Edelson. But so far, I’ve done pretty good playing the stock market without him.

TOTALLY AGREE, Travis wrote an excellent treatise on all the pro’s and cons, and indeed TIMING is everything and Larry has been wrong as often as he has been right, if you consider timing. What bothers me the most is his arrogance, he is so full of himself and certain that he is the only prognosticator that can be trusted that it becomes nauseating.

He once cost me $10,000 dollars because he scared me out of a silver options trade way too early, even though he was right about the long term trend. In short, he is over confident in his own analysis and you need to take his predictions with at least a few grains of the proverbial salt.Nobody can predict the future with absolute certainty based on past cycles, they can be instructive but every economic situation is different to some degree and needs to be evaluated on CURRENT fundamentals.

You’ve talked about Larry Edelson and Harry Dent but nothing on Jim Rickard and the IMPACT model and the Kissinger Method. Your thoughts.

My understanding is that he does currency options trading as well, but I haven’t looked at his ads in detail. There has been a good long-running discussion of his newsletter among Gumshoe readers here: http://www.stockgumshoe.com/2015/05/microblog-jim-rickards-impact-system/

Rickards system is almost exclusively currency options. Thus far the results are borderline terrible. I was a subscriber to another inexpensive newsletter they canned and gave us free access to IMPACT. free access, that should tell you how its performing…

Larry had us in SCO bought at about $100 and got us out two days ago at $122. It was $140 this morning. I know – making money is a good thing and you can’t always make it all but that is the way this trading service has gone. I think I am about to get a refund.

Mary, do you subscribe to his Supercycle newsletter?

Supplement with learning Elliott wave and other technical tools — learn the rudiments of reading charts. You wouldn’t have gotten out so soon. My guess is that SCO will peak around 150 before consolidation, and I wouldn’t rule out a further, final surge to a final peak (final bottom in WTI NYMEX crude).

The EWI site is fabulous. Take advantage of their free resources and then see if you want to subscribe to one of their services.

Also I recommend Harry Dent and his team. Start with free stuff, then consider their cheapest service, before anything else. They collectively have a very respectable track record.

(I don’t work for either EWI or Dent. I’ve been following Dent for about a decade and EWI for longer. Technical analysis, like Elliott, seemed like voodoo when I first saw it. But I gradually changed my mind as I realized that the efficient market idea is wrong, as applied to financial markets, which are heavily — although not exclusively — psychological and do follow clear, repeating patterns that are internally generated and are not just driven by external facts and events.)

D: Do you have a subscription to EWI? If so, have you been happy with their recommendations?

I’ve listened and then re-listened to his videos/audios. I decided that his talks were good to have tucked away in the back of my mind. In his videos he talks about using options. But this means he can make calls regardless of whether his supercycles theory is correct or not.

The final question is whether you think he can make the right calls for when to get it, and most importantly, when to get out of a situation.

I think he will make a number of good calls. But it will be offset by bad ones.

He shut down taking new subscriptions…only to open it back up to get more. Idon’t know whether this means people are bailing or there is a high demand.

Also, I was getting almost weekly updates to how it was all going for him. Then about two months ago…nothing. No more updates. I don’t think that’s a good sign.

I’m still getting updates and solicitations. My guess is that demand for sign up is high, but so are cancellations.

And the solicitations continue. Weiss Inc can be pretty obnoxious in their marketing efforts, but the Supercycle campaign takes the cake. I have never before seen this level of e-mail haranguing, wheedling, cajoling, scaring, and greed-appealing, along with creative and increasingly vague extensions to enrollment deadlines to be able to prolong the enrollment period without appearing to prolong the enrollment period…which, of course, looks bad. There are now references to the “membership application”, as if they will be reviewing qualifications beyond fogging a mirror while coughing up the bucks. It all suggests low enrollment, whether from cancellations or low demand.

Weiss ratings have been valuable over the years but lately they have become very aggressive and obnoxious in their marketing. particularly Kathy Lien and Boris Schlossburg with their Calendar Trading projection of earning $70,000.per month with only $10,000. capital invested. Given risk/reward metrics who but a millionaire would gamble $10,000. on any one trade? The point I made in my cancellation is that I am not prepared to give them $2000. for their trades because the average small retail investor does not have $10,000. to put at risk per trade, and they are talking as many as 7 trades per month to meet their ridiculous projections, but that seems to be par for the course in flogging newsletters these days. Money Morning is one of the worst, they tend to send out duplicate promo’s under the names of all of their analysts as if cluttering up in boxes would increase the chances of responses.

Hi

I just discovered a short Euro ETF which is more leveraged than the EUO:

ETFS 3x Short EUR Long USD (LON:SEU3) – ISIN JE00B3N9C970

Within a year it is about 66% more leveraged than EUO although theoretically I suppose it should be 50%.

Yes, there are a few London-traded ETFs in currencies that offer something slightly different like that — didn’t mention them because most Gumshoe readers can’t easily trade in London, but thanks for the addition!

Be very careful with the daily reset leveraged ETPs. Don’t hold for more than 2-4 months. The cumulative daily reset will eat away at your position. They’re trades, not investments.

In the emails I got from Edelson, he posted a list of all the ETFs he was planning on trading. Unfortunately, I waited too long to get the list (it was free for anyone) and they removed it from their website.

The EUO was an easy call. I trade the EUO in 2014 and also in 2015 and made a nice sum of money.

If ANYONE has his list of ETFs please share them. I have been looking for something Japan related, or Australia related to trade. There is an ETF for shorting the Yen, but not their stock market.

Exchange Traded Funds

and Options on ETFs

for Supercycle Windfall Profits

Larry Edelson

Senior Analyst, Weiss Research

1

Guggenheim S&P 500 Equal Weight ETF (RSP)

iShares Russell 2000 Index ETF (IWM)

iShares S&P 100 ETF (OEF)

iShares Core S&P 500 ETF (IVV)

iShares US Real Estate ETF (IYR)

PowerShares QQQ Trust Series 1 (QQQ)

SPDR Dow Jones REIT ETF (RWR)

SPDR S&P 500 ETF Trust (SPY)

Vanguard S&P 500 ETF (VOO)

Vanguard REIT ETF (VNQ)

And second, I would want to own INVERSE ETFs on the things they’re

selling: The euro currency, and the most vulnerable European stocks.

These include:

Market Vectors Double Short Euro ETN (DRR)

ProShares Short Euro ETF (EUFX)

ProShares UltraShort Euro (EUO)

ProShares UltraShort FTSE Euro (EPV)

After October 7 — as Europe implodes and the flow of euros into U.S.

stocks and other investments becomes a flood, I want to ADD to these

positions as they climb higher.

3

Next year, as Japan collapse and defaults on its debt — triggering a

monstrous tidal wave of yen, all headed for U.S. investments, I’m

recommending to use two additional kinds of investments to go for windfall

profits.

First, I would want to own what Japanese investors are buying with their

flight capital: ETFs that invest in select U.S. stock indexes and real estate.

These include the same U.S.-oriented ETFs just named — the same ones

that will benefit from European flight capital.

And second, I would want to own INVERSE ETFs on the things Japanese

investors will be selling: The yen, Japanese government bonds and Japanese

stocks.

These include:

DB 3x Inverse Japanese Government Bond Futures ETN (JGBD)

DB Inverse Japanese Government Bond Futures ETN (JGBS)

ProShares UltraShort MSCI Japan (EWV)

ProShares UltraShort Yen (YCS)

As this crisis comes to America — and as the United States pays the

price for the largest orgy of debt in more than 5,000 years of human history

— I will recommend using ETFs on U.S. stocks, treasuries, bonds and other

assets as the U.S. dollar and stocks plunge.

These include:

PowerShares DB US Dollar Index Bearish Fund (UDN)

ProShares Short 7-10 Year Treasury (TBX)

ProShares Short 20+ Treasury (TBF)

ProShares Short Dow30 (DOG)

ProShares Short MidCap 400 (MYY)

ProShares Short QQQ (PSQ)

ProShares Short Real Estate (REK)

4

ProShares Short Russell2000 (RWM)

ProShares Short SmallCap600 (SBB)

ProShares Short S&P500 (SH)

ProShares UltraPro Short 20+ Year Treasury (TTT)

ProShares UltraShort 20+ Year Treasury (TBT)

ProShares UltraShort QQQ (QID)

ProShares UltraShort Russell2000 (TWM)

ProShares UltraShort S&P500 (SDS)

As all of these defaults drive gold, silver, energy and other

commodities — mankind’s most reliable hedges against uncertainty

and crisis — sky-high, I would recommend these ETFs …

COMEX Gold Trust (IAU)

DB Agriculture Double Long Exchange Traded Notes (DAG)

DB Agriculture Fund (DBA)

DB Base Metals Double Long Exchange Traded Notes (BDD)

DB Commodity Index Tracking Fund (DBC)

DB Commodity Double Long Exchange Traded Notes (DYY)

DB Energy Fund (DBE)

DB Gold Double Long Exchange Traded Notes (DGP)

DB Gold Fund (DGL)

DB Oil Fund (DBO)

DB Silver Fund (DBS)

Direxion Daily Gold Miners Index Bear 3X Shares (DUST)

Direxion Daily Gold Miners Index Bull 3X Shares (NUGT)

Direxion Daily Junior Gold Miners Index Bear 3X Shares (JDST)

5

Direxion Daily Junior Gold Miners Index Bull 3x Shares (JNUG)

Direxion Daily Natural Gas Related Bull 3X Shares (GASL)

Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 3X Shares (GUSH)

ProFunds Basic Materials UltraSector ProFund (BMPIX)

ProFunds Oil & Gas UltraSector ProFund (ENPIX)

ProFunds Precious Metals UltraSector ProFund (PMPIX)

Proshares Trust-Proshares Ultra Gold Miners (GDXX)

ProShares Ultra Bloomberg Crude Oil (UCO)

ProShares Ultra Bloomberg Natural Gas (BOIL)

ProShares Ultra Gold (UGL)

ProShares Ultra Oil & Gas (DIG)

ProShares Ultra Oil & Gas Exploration & Production (UOP)

ProShares Ultra Silver (AGQ)

S&P GSCI Crude Oil Total Return Index ETN (OIL)

Silver Trust (SLV)

SPDR Gold Trust (GLD)

United States Brent Oil Fund (BNO)

United States Gasoline Fund LP (UGA)

United States Natural Gas Fund LP (UNG)

United States Oil Fund (USO)

Now, let’s list the options I plan to use throughout this supercycle crisis …

Between now and October 7, I’m using call options on two kinds of ETFs

The first category is call options on ETFs that own the U.S. investments that

are soaring due to the influx of European flight capital.

Right now, for instance, I am eyeing call options on the following ETFs:

6

Guggenheim S&P 500 Equal Weight ETF (RSP)

iShares Russell 2000 Index ETF (IWM)

iShares S&P 100 ETF (OEF)

iShares Core S&P 500 ETF (IVV)

iShares US Real Estate ETF (IYR)

PowerShares QQQ Trust Series 1 (QQQ)

SPDR Dow Jones REIT ETF (RWR)

SPDR S&P 500 ETF Trust (SPY)

Vanguard S&P 500 ETF (VOO)

Vanguard REIT ETF (VNQ)

The second category is call options on INVERSE ETFs on the things

Europeans are selling: The euro currency, and the most vulnerable European

stocks.

So I am also looking to pull the trigger on options on the following inverse

ETFs:

Market Vectors Double Short Euro ETN (DRR)

ProShares Short Euro ETF (EUFX)

ProShares UltraShort Euro (EUO)

ProShares UltraShort FTSE Euro (EPV)

As of October 7 — as Europe implodes and the flow of euros into

U.S.stocks and other investments reaches its peak, I will recommend to

continue trading options on these same ETFs.

Next year, as Japan collapses and defaults on its debt — triggering a

tidal wave of yen, all headed for U.S. investments — I’m using two

additional kinds of investments to go for windfall profits”

7

The first category is call options on ETFs that invest in the things Japanese

investors will be buying with their flight capital: Select U.S. stock indexes

and real estate.

This includes call options on the U.S.-oriented ETFs I just named — the

same ones that will benefit from European flight capital.

The second category is call options on INVERSE ETFs on the things Japanese

investors will be selling: The yen, Japanese government bonds and Japanese

stocks.

I will be looking to trade call options on the following ETFs, for instance:

DB 3x Inverse Japanese Government Bond Futures ETN (JGBD)

DB Inverse Japanese Government Bond Futures ETN (JGBS)

ProShares UltraShort MSCI Japan (EWV)

ProShares UltraShort Yen (YCS)

When the crisis comes to America, I will use call options on inverse ETFs

on U.S. stocks, treasuries, bonds and other assets as the U.S. dollar and

stocks plunge.

We will be actively trading call options on the following ETFs:

PowerShares DB US Dollar Index Bearish Fund (UDN)

ProShares Short 7-10 Year Treasury (TBX)

ProShares Short 20+ Treasury (TBF)

ProShares Short Dow30 (DOG)

ProShares Short MidCap 400 (MYY)

ProShares Short QQQ (PSQ)

ProShares Short Real Estate (REK)

ProShares Short Russell2000 (RWM)

ProShares Short SmallCap600 (SBB)

ProShares Short S&P500 (SH)

8

ProShares UltraPro Short 20+ Year Treasury (TTT)

ProShares UltraShort 20+ Year Treasury (TBT)

ProShares UltraShort QQQ (QID)

ProShares UltraShort Russell2000 (TWM)

ProShares UltraShort S&P500 (SDS)

And in each of these phases, we will go for bonus profits as all these

defaults drive commodities sky-high. As soon as the current bear

market in precious metals and commodities ends, I plan to use call options

on ETFs that specialize in gold, silver, energy and other commodities.

And because I am convinced that the beginning of this great new bull

market on commodities is growing closer by the day, I am already eyeing

call options on the following ETFs:

COMEX Gold Trust (IAU)

DB Agriculture Double Long Exchange Traded Notes (DAG)

DB Agriculture Fund (DBA)

DB Base Metals Double Long Exchange Traded Notes (BDD)

DB Commodity Index Tracking Fund (DBC)

DB Commodity Double Long Exchange Traded Notes (DYY)

DB Energy Fund (DBE)

DB Gold Double Long Exchange Traded Notes (DGP)

DB Gold Fund (DGL)

DB Oil Fund (DBO)

DB Silver Fund (DBS)

Direxion Daily Gold Miners Index Bear 3X Shares (DUST)

Direxion Daily Gold Miners Index Bull 3X Shares (NUGT)

Direxion Daily Junior Gold Miners Index Bear 3X Shares (JDST)

Direxion Daily Junior Gold Miners Index Bull 3x Shares (JNUG)

9

Direxion Daily Natural Gas Related Bull 3X Shares (GASL)

Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 3X Shares (GUSH)

ProFunds Basic Materials UltraSector ProFund (BMPIX)

ProFunds Oil & Gas UltraSector ProFund (ENPIX)

ProFunds Precious Metals UltraSector ProFund (PMPIX)

Proshares Trust-Proshares Ultra Gold Miners (GDXX)

ProShares Ultra Bloomberg Crude Oil (UCO)

ProShares Ultra Bloomberg Natural Gas (BOIL)

ProShares Ultra Gold (UGL)

ProShares Ultra Oil & Gas (DIG)

ProShares Ultra Oil & Gas Exploration & Production (UOP)

ProShares Ultra Silver (AGQ)

S&P GSCI Crude Oil Total Return Index ETN (OIL)

Silver Trust (SLV)

SPDR Gold Trust (GLD)

United States Brent Oil Fund (BNO)

United States Gasoline Fund LP (UGA)

United States Natural Gas Fund LP (UNG)

United States Oil Fund (USO)

These are the investments I believe are perfectly designed to help you

multiply your money — over and over again — as long as this crisis lasts.

However, the key to amassing great supercycle wealth will be to buy the

right investments at the right times … and also to sell them when the time

is right.

These “buy” and “sell” decisions cannot be made in advance, but in real

time. They must be made — NOT on the basis of raw emotions or

10

“guestimations” — but on the basis of sound fundamental, cyclical and

technical research and analysis.

You may be comfortable going on from here on your own.

But if you would like a steady hand on your shoulder … a sounding board

and guide to see you through … and specific, unhedged “buy” and “sell”

recommendations … I stand ready to help with Supercycle Trader — the

service I created to help you minimize your risk and maximize your profits

over the next five years.

Yours for supercycle survival and profits,

Larry Edelson

Senior Analyst, Weiss Research

Editor, Supercycle Trader

Interesting discussion. I followed Larry Edelson for years, but what finally turned me off was his arrogance. He increasingly sounded like he alone had all the answers and you needed know other guidance than his. I agree with an earlier poster that he tends to be early, in fact he cost me $10,000 in profit because he scared me into selling a silver option I held, based on his supposedly foolproof signals and charts. While I did okay turning $5000. into over $14,000, had I followed my personal instincts I would have hung on for an additional $10,000. That was typical, like a stopped clock that is right twice a day Larry’s market timing can be hit or miss. Nobody can know the future with precision, so as it says in the book of Proverbs; “in a multitude of counsellors there is safety” in other words get at least a second opinion if not a 3rd or4th making sure you have all the facts available rather than just one persons “opinion” that may be biased or at best a guess. While I too think long term the Euro is toast and the Union will ultimately break up because the cultures, religions and economies of the conglomerate of countries are simply too diverse for a centralized government to work long term. That being said, ask me WHEN and I would have to say I do not know. It could happen in 2 years, on the other hand it could take 10 or more.

That being said, personally I would be more inclined to bet against the U.S. Dollar than the Euro in the immediate future. All depends on Federal Reserve policies as there is little room for error. The U.S. economy is NOT recovering to any great extent and it can not stand further rises in interest rates, in fact I will not be surprised to see another round of “Quantitative Easing” in 2016. It is mathematically impossible for the increasing debt load to be serviced by a shrinking economy, so at some unknown point the debt financing system has to break down. As the dollar loses credibility as a world currency (already in progress) its value may decline and at least temporarily boost the Euro as an alternative. Which will break down first is a highly speculative bet, somewhat like picking the best looking horse in the glue factory. The one person I have found that has studied the situation in depth is Mike Maloney whose “Hidden Secrets of Money” series is one of the best I have seen on explaining the fallacies of fiat currency. He was recently asked the “WHEN” question about the decline of the dollar and i thought he gave a well reasoned answer. You can see his response in a 5 Min. video here; https://www.youtube.com/watch?v=gJ9yOKFf6Qk but don’t stop there, check out his whole Hidden Secrets of Money series on You tube.

I have unfortunately subscribed to his newsletters before and his predictions have been overwhelmingly wrong. He obviously makes his money selling fear through his letters. He is delusional, but a salesman to the core. No integrity here.

Hi Travis, is this the same pitch? Thanks for all you do for the investor Gummunity 🙂

Later today, the transcript of my interview with CNBC regulars Boris Schlossberg and Kathy Lien will be permanently removed from the Internet.

Reason: The information in it is so timely, it wouldn’t be fair to leave it online for even another day.

So this is your final opportunity to go for potential gains of 435% … 881% … up to 1,587% — enough to turn every $10,000 invested into nearly $170,000.

Boris and Kathy say massive changes in China’s economy are about to cause this often-overlooked currency to explode in value …

… While the catastrophe in Europe causes this popular “safe haven” currency to crash and burn.

If they’re right — and I sincerely believe they are — the trade they recommend could make you richer in three big ways.

Click this link to read this timely transcript now, before it’s too late!

Regards,

Larry Edelson Signature Larry Edelson Senior Analyst Weiss Research

Best2You-Ben

Gang, This is just amazing. I am reading some of Martin Armstrong’s writings….and I think we have underestimated Larry Edelson, et al A LOT! It doesn’t necessarily say Edelson is the best person to use, but it does bring things full circle.

Armstrong’s model was confiscated by the Federal Government after he went to prison and was being analyzed in the Twin Towers….then DESTROYED in the 9-11 attack.

The Federal Government was intent on shutting down Armstrong. It was during this time that Martin Weiss of Weiss Research (associated with Larry Edelson) offered to “rent the Institute to keep the forecasts going”

So, there is a very close link between the two. I can’t say it exists to this day, but I guarantee you Wess, Edelson and Armstrong are probably still talking – but that is a monumental guess on my part.

WOW!!!

This thread is 4-5 years old. Unfortunately, Martin Edelson died. Obviously, the timing didnt work out (Europe has not yet collapsed.) And Martin Armstrong has an AI service called Socrates that sounds interesting. But who took over that publication for the Weiss Group called Super Cycle Trader? And are they accurate? And should I be referred to a different site now on StockGumshoe?

Earlier, I thought Mike Burnick took over this letter, but I dont see a lot of promotion for it…..so who is the current king of AI prediction?

Tx for any comments!