Friday Unlock Bonus: “Bud Takes Over Tiny Pot Stock?”

by Travis Johnson, Stock Gumshoe | June 8, 2018 7:00 am

Bonus: marijuana teaser solution from the Friday File

A few weeks ago we covered a teaser pitch for the Irregulars in the Friday File[1], all about Zack Scheidt’s marijuana[2] tease about an expected takeover for a tiny little Canadian pot stock… and today, as a bonus, we’re opening it up for all our regular readers.

Not much has happened since then — the “secret” stock did release it’s first quarter earnings[3], with no real news that I noted, and, surprise surprise, the company has not yet been acquired by Anheuser-Busch… though there’s still some time before that June 20 deadline (is there a sarcasm emoji I could insert here?)

The only other thing that has happened is the stock has fallen, so you haven’t missed much on that front — Agora[4]’s attention drove it from $1 to $1.40 or so in pretty short order, and it’s now back just below a dollar.

With that, dear friends, I’ll leave you with my comments from three weeks ago — what follows appeared as part of the Friday File on May 18 and has not been updated or revised. Enjoy!

—from 5/18/18—

The teaser pitch in question is from Zachary Scheidt[5], who has flitted around a bunch of different Agora newsletters over the years — he’s currently helming a service called The Takeover Alert[6] ($1,750/year) and promising that his “M.A.R.K.E.D. Money Signal System” can identify stocks that are primed to be taken over… starting, this time around, with a marijuana stock that he thinks will be bought by Anheuser-Busch InBev (BUD) — with, to get more ridiculously specific, an announcement of this acquisition coming on or around June 20.

Any caveats we should start with? Well, we could go with the old saying, “don’t buy anything just because you think it’s a takeover target.” I’ve heard that bit of wisdom many times over the years, and it certainly makes sense — buy stocks because you think they have great potential, or are trading at an attractive valuation, not because you think you’re about to get bailed out by a higher bidder. Takeovers are notoriously hard to predict or time.

It would be churlish, I suppose, to note that this ad coincidentally has a 30-Day “Golden Parachute” Refund Guarantee that, for today’s customers, would expire just before June 20… but mostly because that guarantee is without teeth in any event, offering no possibility of a refund but only a “you get credit for some other Agora newsletter” guarantee if you don’t like this one during your first 30 days. Sadly, that’s the case for most of the “premium” newsletters, many of them no longer any kind of refund (by “premium” I mean the upgrade letters you’ll be pitched once you sign up for a $49 newsletter, the premium price newsletters, which cost $1,000 and up… they’re not necessarily “premium performance” letters — I often hear from readers that they don’t find the pricier letters to be any better than the “entry level” publications from the same authors).

And, of course, I’d be remiss if I failed to note that any date added to a newsletter teaser has a strong likelihood of being there just to spur you into action — we’ll see if there’s any reason to think that June 20 means anything, but what it probably means is, “the copywriter thought this was a near-enough date that it would get you to cough up your credit card number without thinking too much about that $1,750 price or the lack of a money-back guarantee.”

OK, I know, I’m soapboxing a little there — what we want to know is, what’s this marijuana stock that Zach Scheidt thinks is going to soar once it gets a takeover offer from our Budweiser friends?

So let’s dig in… here’s a little taste of the ad:

“… according to my research (that I want to share with you as soon as humanly possible), Anheuser-Busch has their sights on one specific microcap marijuana company….

“In fact, we could be looking at turning every $2 share into as much as $179. That’s an exceptional 8,850% return!”

And, as you would probably expect, he uses the one public market comparison to get our attention — that investment that Constellation Brands (STZ… owner of Corona, among others) made in Canadian marijuana leader Canopy Growth (WEED.TO, TWMJF)…

“A recent telltale M&A transaction just set the bar for what’s to come…

“Constellation brands, distributors of Corona beer, snapped up an ownership share of the world’s largest weed company, Canopy Growth Corp…

“Investors in Canopy went on to collect a 176% profit – virtually overnight.”

That’s true — and the investment went a long way toward legitimizing marijuana in the minds of many investors. Constellation bought 10% of Canopy, and the stock (Canopy’s) did surge by about 180% between that announcement and the peak in early January — it has come down a bit since then.

More from the ad:

“But what I’m talking about today is a deal in the works that could send a penny stock soaring so high you could literally cash out after June 20th … collect your giant pile of money… walk into your boss’s office and tell him it’s the last day he’ll ever see your face.”

How’s that for manipulating someone’s emotions on a Friday, eh? Stop for a few beers after work, get good and mad at your boss after an awful week, storm over to the computer and say, “take that, boss, I’m spending a week’s salary to buy this marijuana idea and then you’ll be sorry!”

No? OK, let’s see what the stock is… more from the ad:

"reveal" emails? If not,

just click here...

“There’s no way to sugarcoat this…

“If the beer industry doesn’t take control of the booming marijuana industry, they’re done for.

“It’s a fact already proven out in the states where weed has been legalized.”

Maybe Scheidt has a different definition for “proven out” or “done for” than I do. It’s certainly true that alcohol[7] companies are thinking about marijuana… maybe even worrying about it as a “risk factor,” as Molson Coors has specifically noted[8]. But it’s pretty early in the game to say that the beer industry is “done for” if they don’t take control of the marijuana business. There’s a more nuanced look at the story here from Draftmag[9]… the upshot, as I read it? “Reports of beer’s demise at the hands of pot are grossly exaggerated.”

Of course, stories about the “death of beer” have been around for a while, and the alcohol business definitely fluctuates, from the craft beer craze to immigration trends, the micro-distilleries and the hipster cocktail bars to the up-and-down wine connoisseurship. I can’t keep track, but as far as I can tell people keep drinking beer, with relatively minor fluctuations and brand flip-flops year to year. In fact, as I put the finishing touches on this piece, I’m drinking a lovely Friday afternoon beer right now. It’s a little odd, a Vanilla Cream Ale that tastes a bit too much like candy, but it’s a far sight better than “bongwater flavor.”

Actually, I’d argue that the real revolution might come with some strong regulation so they finally have to stop labeling Bud Lite as a “beer.”

OK, I know, it’s the most popular “beer” in the country, and I just lost half my readers.

Sorry, you can drink what you want. Or smoke what you want, as long as you don’t stand too close to me.

So what’s going to happen with beer drinkers leaving the fold and going to smoke weed instead? The ad says that…

“BUD is Going to Buy These ‘Average-Joe’ Customers back by Becoming Their Weed Supplier

It’s the biggest no-brainer acquisition of the entire year.”

And we’re told that this deal will be much bigger, relatively speaking, than the Canopy deal…

“… that’s nothing compared to what I see coming for this $2 microcap.

“Because the stake we’re looking at is potentially 10 times bigger…

“See, the Constellation deal was a ‘fractional acquisition.’

“They bought just 1/10th of the marijuana company.

“On top of that, the share price impact we’re looking at is potentially 500 times greater, because our $2 microcap is that much smaller than Canopy.”

What other clues do we get? Apparently this is a company that has both some growing capacity and a consumer brand… more clues:

“… this company is already considered by insiders to be THE market leader in recreational marijuana.

“That’s important for two reasons:

“First, while most companies played it safe by focusing on the medical marijuana market, this company took a bigger risk by setting their business up to profit off legalization….

“Second, this benefits BUD because they don’t have to go through the work of establishing a brand from square one…. BUD simply has to apply its massive marketing machine to the hot brand they’ve already created.”

OK, I’m not exactly convinced about the economics for the marijuana business as a whole at the moment… but if there is going to be a winner from this group of pioneers, I’d guess that winner takes the prize because they’re able to build a genuinely differentiated product built around a well-marketed brand that drives steady market share gains in the early years of legalization. That’s a tough order, but, to be fair, both Anheuser-Busch and Constellation have done it before — and with products that are almost entirely driven by marketing and distribution, with strong followings but little-to-no real differentiating “quality” factor (I’m looking at you, Corona and Budweiser).

Other clues about this pot stock?

We get a quote from an outside source:

“Baystreet, a financial media partner of Bloomberg[10] and CNNMoney, hit the nail on the head when they reported this marijuana company is “M&A Ready” and could be:

‘A perfect example of the type of company that the giants will eventually be compelled to take over’ — Baystreet Media Corp”

That is a real quote, though Baystreet, in addition to being a partner with Bloomberg and lots of other media distributors, also publishes sponsored content — and this particular quote is from a paid ad. The company noted, DOJA Cannabis, paid Baystreet $10,000 to say those nice things[11] about it.

So is that the stock? DOJA Cannabis? It’s got the ticker DOJA on the Canadian Securities Exchange (that’s the rinky dink one, even smaller and less regulated than the Venture), or DJACF over the counter in the US.

Indeed it is… but they aren’t called that anymore, they did in fact merge with Tokyo Smoke and form a new company, in a deal that closed back in January — this is now Hiku Brands (HIKU on the CSX, still DJACF in the US).

So that’s the stock… but even though we’ve got the name, let’s look a little more at what Scheidt is saying about it…

“I can also divulge that this company is building a marijuana growing facility that will increase its production 8 times by the end of this year.

“And their retail footprint is expanding so quickly, you can now find their stores in iconic locations like Seattle’s Pike Place Market.”

OK, that’s true — Tokyo Smoke is opening up new wave “coffee[12] shop” locations six in Canada[13] so far and one opening about now in Seattle, and these shops combine coffee and weed… or, in their words…

“Each flagship marries third wave coffee with best in class smoking products, a carefully chosen selection that allows visitors to develop their perfect session.”

You can review the progress of this still-young company just by skimming their 2017 fiscal year press release here[14], if you like… as you might expect, there’s not much in the way of actual financials, most of the business is less than six months old and has yet to really get moving or generate any revenue… but they did get a strategic investment from Aphria, with whom they had been collaborating to supply and distribute some Tokyo Smoke-branded medical marijuana kits, and they also just acquired WeedMD to add more production capacity (and a medicinal brand).

More from the ad:

“So BUD gets product, branding and retail all in a single purchase.

“There is no other marijuana company in the entire world that could be considered a “triple-threat” like this.”

I don’t know about that — the notion that brands and distribution will be important is not lost on other marijuana industry pioneers, either in the US or in Canada, but I haven’t studied the businesses of all of them to see which focus on which aspects. I would say that I don’t have any interest in buying up a company that’s just focusing on marijuana cultivation — I expect there will be a lot of suppliers, and that pricing, at least in Canada, will be lower than they’re hoping (part of the aim, after all, is to squash the black market — you can’t do that if your price is high), and being in a commoditized business is tough… you need that brand, and, as we learned from Marlboro and Budweiser, in the end probably no one will care that much who grows the marijuana (or grain, or tobacco[15]), as long as the blender, producer, manufacturer or distributor has a relatively consistent end product that’s well-marketed so that we know what to like.

In case you want to check the other clues:

“This small marijuana company has a market cap of just $77,100,000….

“Its proprietary strains are already being sold in California, Oregon, Washington and throughout Canada….

“What also sets this company apart is that it’s run by an ex-Google executive who has stated to the media he believes ‘cannabis is the next Internet’. And that his company that will ‘redefine the cannabis marketplace’.”

Again, all matches to Hiku, which was founded by Alan Gertner[16], who was a Google employee for a while before leaving to follow his dream and start a marijuana company (with his dad, Lorne Gertner[17], who started the first licensed medical cannabis company in Canada, Cannasat, way back in 2004).

More from the ad? We get more quotes to bolster the case from other financial pundits, like this:

“‘Anheuser-Busch has shown it can adapt to trends (see how it started snatching up small craft brewers left and right), so as marijuana legalization spreads to more states, having A-B partner …xxxxxx…. becomes more likely.’ – Rich Duprey”

Makes you feel like there’s a specific rumor, right? Here’s what Duprey actually wrote — he’s a Motley Fool[18] writer:

“Anheuser-Busch has shown it can adapt to trends (see how it started snatching up small craft brewers left and right), so as marijuana legalization spreads to more states, having A-B partner with a grower or introducing its own infused beer becomes more likely.”

What does that mean going forward? Well, Hiku has a nice little slide deck[19] if you’d like to get sucked into their prediction vortex — and you can tell that they’ve got some investment savvy in the house, because they use language like “Hiku is a premium cannabis

brand house with vertically integrated operations, positioned for leadership in the adult-use cannabis market.”

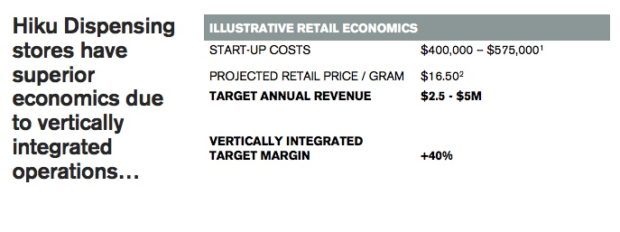

Though they also do include some justification for this brand/experience focus — including a note that whole sale prices in Washington have been cratering since legalization (down 80%). That makes the focus on experience-based dispensaries and brand stores seem worthwhile, with a focus on building a retail chain, and they include some appealing numbers about how those facilities will work… like this:

But, of course, they only have a few stores, and none of them are more than six months old at this point, so they’re certainly not making those “target margins” of 40% right now, and we’re all guessing.

Financially? It’s all guesswork at this point, but they have raised a fair amount of capital and should be in decent shape for at least a few months, as we wait to see how the retail experience is going to be phased in for recreational marijuana in Canada. I would be surprised to see a big takeover anytime soon, since they are really just getting started and there are lots of other competing emerging brands, but you never know.

There is a decent overhang of warrants[20] that could be exercised, presumably from some of those early financings, and I don’t know what the share structure is going to look like when it all shakes out from the WeedMD merger. The Toronto Exchange thinks the market cap is C$215 million after the mergers, and they’re usually quicker to get those numbers right than the US websites, who list it with a $74 million market cap…and the company’s presentation says the Pro Forma capitalization is 377 million shares fully diluted, which would mean a US$450 million market cap… though they’ll also have $77 million in cash when that get through that dilution.

Being a slow-moving fuddy-duddy, I’d probably at least wait for an uplisting to the Venture exchange in Canada, and would try to get some clarity about how big the company can get even if they max out their retail experience as they’ve planned, before thinking about dabbling in this one.

Still, I confess, again, to having a soft spot for marijuana companies who are focusing on the retail experience and the brand, which I expect to be far more important, in the end, than the growing capacity or even the particular strains and varietals that any one company “controls.”

- Friday File: https://www.stockgumshoe.com/tag/friday-file/

- marijuana: https://www.stockgumshoe.com/tag/marijuana/

- release it’s first quarter earnings: https://www.newswire.ca/news-releases/hiku-brands-files-2018-first-quarter-results-684146751.html

- Agora: https://www.stockgumshoe.com/tag/agora/

- Zachary Scheidt: https://www.stockgumshoe.com/tag/zachary-scheidt/

- The Takeover Alert: https://www.stockgumshoe.com/tag/the-takeover-alert/

- alcohol: https://www.stockgumshoe.com/tag/alcohol/

- “risk factor,” as Molson Coors has specifically noted: https://www.thecannabist.co/2018/02/14/molson-coors-legal-marijuana-beer/99014/

- more nuanced look at the story here from Draftmag: http://draftmag.com/legal-recreational-marijuana-breweries/

- Bloomberg: https://www.stockgumshoe.com/tag/bloomberg/

- paid Baystreet $10,000 to say those nice things: http://www.baystreet.ca/stockstowatch/2885/Mergers-Galore-Ahead-of-Cannabis-Legalization

- coffee: https://www.stockgumshoe.com/tag/coffee/

- Canada: https://www.stockgumshoe.com/tag/canada/

- 2017 fiscal year press release here: https://www.newcannabisventures.com/hiku-brands-files-fiscal-year-2017-results/

- tobacco: https://www.stockgumshoe.com/tag/tobacco/

- founded by Alan Gertner: https://www.theglobeandmail.com/report-on-business/small-business/startups/why-i-quit-my-dream-job-at-google-to-launch-a-marijuana-business/article28668428/

- his dad, Lorne Gertner: https://cannasos.com/news/hot-news/lorne-gertner-his-view-on-the-future-of-the-canadian-cannabis-industry

- Motley Fool: https://www.stockgumshoe.com/tag/motley-fool/

- Hiku has a nice little slide deck: https://static1.squarespace.com/static/5a3adefdb7411c03911737b0/t/5ae0e7972b6a28030435265a/1524688845020/PROJECTMAC_APRIL2018.pdf

- warrants: https://www.stockgumshoe.com/tag/warrants/

Source URL: https://www.stockgumshoe.com/reviews/takeover-alert-the/friday-unlock-bonus-bud-takes-over-tiny-pot-stock/

Apart from a belief in “blind faith” in Zack Scheidt’s tease of the potential of DJACF in lieu of the promised takeover there is simply no justification in investing in it right now.

Micro cap ($149 Mill) OTC stock with low average daily trading volume of 209k shares / day trading below 200MA in “Death Cross” zone – agree with Travis, needs of little more confirmation and support before investment is validated.

TOO LATE. i BOUGHT ON MERIT AND AM DOWN A FEW GRAND.

I didn’t know a investment letter was out !

Day late and several dollars short !!!!

bought $200 worth what can go wrong !

Did you have to pay a foreign transaction fee to buy this stock?

Thanks!

Well, I know I don’t.

I bought back in feb. 100 shares @2.03 per on speculation lost half but still watching.i may buy more after this article.

Breaking news…Trump likely to support bill to end the Federal ban on marijuana. I’m buying today.

Since our Pres. is obviously a man of true, heartfelt convictions that is not easily swayed & almost always follows through on his very firm policy statements, I wish you luck. Way too risky for me @ this time.

I love the sarcasm about Trump. And this pick ain’t exactly Canopy Growth or even Aurora Cannibis, or Aphria, or Cronos, or . . . .(put name of pot company here). You can maybe call me shortsighted, but I have stock in ten pot companies, and this one isn’t going to be #11.

Agree, Agree

Look at the year before Trump was elected – flat. It is quite possible the entire stock market’s gains since Nov. 4 2016 are attributable to the bet that he would slash taxes and deregulate dirty industry.

I am a small retail Cannabis Investor. Read Travis 5-18-18 and did not buy HIKU; thank you for your follow-up today Travis.

I do not know financials like Travis does. I explore companies websites & their performance over the last year; I do like large greenhouses production and distribution & and see how vertically integrated they are. I like medical pharma companies using cannabidiol. Travis is right, building brands & being vertically integrated is key.

Here are results, as of closing June 7 of my recent investing, I waited until the first two weeks of April (after the big spike and drop in price in February/March):

started with Travis’ mentioned IIPR & IIPR.PA preferred (REIT) +38.75% and +1.08% respectively. CGC Canopy Growth +40.34%, CNTTF Canntrust Holdings +28.77%, CRON Cronos Group +34.38%, GWPH GW Pharmaceutical +40.48%, HYYDF Hydropothecary +25.14%, SNNVF -10.40% (I really believe in these folks, with California production 1st harvest this fall). I also bought in first two weeks in April and then sold June 1st ACBFF Aurora -6.00%, APHQF Aphria +11,26%, and MEDFF MedReleaf +39.6%; and subsequently bought June 1st KHRNF Khiron Life Science +2.72%, LXRP Lexaria +31.78%, MTTPF Medmen Enterprises -8.42% (the largest US company publicly listed to date on OTC), OGRMF Organigram Holdings +14.19%, and TGODF The Green Organic Dutchman +31.93%.

Most of the above companies are Canadian, I am awaiting US company Acreage Holdings to publicly list.

As always in investing, be aware. In spite of yesterday the Canadian Senate passing on 3rd reading CB-45, legalizing adult recreational use nationwie, (retail should start in approx.3 months), almost all my stocks decreased yesterday and today.

Some tools to consider using in Cannabis investing, as part of your due diligence,

copied from my reply to Martin on May 18, 2018 page 3 of Travis “Ask a Stupid Question” article

“Hi Martin, For pot stocks, you might want to consider another couple websites that were referred to me by Gumshoe Guests derbydude and Shari in Travis’ April 30,2018 discussion “Casey’s “5 Tiny ‘Pot’ Stocks Set to Soar in 2018 Pot Boom” teased in “Become a Marijuana Millionaire in 2018””; from derbydude “I find Ted Ohashi to be excellent. He also has an excellent free newsletter that mostly covers the Canadian market but cannot help but include some US activities like Sunniva. It includes technical analysis of stock averages and specific company activities. You can sign up for his newsletter by emailing him your name and country at LetsTokeBusiness@gmail.com. Tell him Derbydude sent you. ”

from Shari “https://www.newcannabisventures.com/cannabis-companies/ ”

Irregular roberthebel was a big commenter on that thread too – very informative.

you might also want to consider The Marijuana Index https://marijuanaindex.com/

Thank you for the suggestion of (https://greenmarketreport.com), I’ll check it out.”

Happy Investing

US based, Chicago, OTC: GTBIF Green Thumb Industries publicly listed last week; I bought a small $2k speculative purchase. I am still awaiting US company Acreage Holdings to publicly list.

Takeover Alert has been a real scam in my view. I subscribed in the fall of 2017 when Lou Battenese was the author, and I subscribed because of him. A few months later he leaves Agora, and I

m sure Agora knew this when I subscribed, but used his name to get new subscribers. Then Agora appoints Zach to head the newsletter, and very few recommendations have come from him in the last 5 months. If Agora was reputable they would have offerred to refund my subscription, and after two emails to them about this--no response. So Im out $3000. I will NEVER subscribe to anything with Agora`s name, ever, and I would suggest that if you see any recommendation from them to look at it very skeptically.Just checked with Fidelity and since DJACF is NOT an ADR, it will be subject to a $50 fee + commission. In fact it does’t even qualify for any FREE trades.

try td ameritrade

HIKU is a sell. They are supposed to be this cool brand (Tokyo Smoke), which to my mind isn’t even that cool. So what do they do with their cash? They bought a company that supplies nursing homes. Schizophrenic. They are trying to grow MJ also, and claim “handcrafted cannabis production”. Translation: small and expensive. This is a unnecessary distraction thst drains capital (they could just buy quality wholesale with true seed-to-sale tracking and labelling), instead of focusing on retailing (their supposed focus area).

Canada may not even allow specialized packaging (think Marlboro red pack or Kools), but only plain foil with warning labels. Most adults will go for best quality and best price, not an expensive fancy package. So there market is youngsters and hipsters.

All this shows inexperienced management and as a company, little chance of success. Why on earth would anyone buy this micro cap? They basically have nothing, and not even some market share. There are so many other better MJ plays.

For big international players, stick with Canopy and Aurora. For solid companies that are also near term acquisition targets, I like Organigram and Emerald Health. For a reputable US medical and recreational play with seasoned management and tight linkage to Aphria, I prefer Liberty Health Sciences.

HIKU is an extreme long shot, and most likely will end up bankrupt. Save your money. Invest in a real MJ company instead.

FORGET ABOUT the beer companies buying the weed companies out. This is who will control the weed business in Canada and the U.S.

First is Altria group, who makes the Marlboro brand and other tobacco products. They have a free cash flow of $ 45.6 BILLION a year.

Next is British American Tobacco, who is even bigger than Altria.

Both of these companies are just waiting for the regulatory & legal issues to be solved in U.S. Canada is good to go.

They will then start doing weed cheaper than the other weed companies and will then take over the weed market.

Then will be selling weed in seven-elevens and grocery stores also.

I suggest buying these tobacco companies now while their stock prices are down some.

$MO, $PM, $BTI by MF > https://www.fool.com/investing/2018/06/05/better-buy-philip-morris-international-vs-altria.aspx Have a great weekend Gummunity! 🙂 #Best2ALL!

Sounds like John D. Rockefeller and Standard Oil all over again.

There is also Alliance One Internqtional, a tobacco grower that recently bought a Canadian cannabis company and plans to grow hemp and later cannabis in the USA.

$HIKU Maybe we’ll soon find out who knows what they’re talking about, and who’s jes talkin’. I went to enter a change to a buy bid on $HIKU a few hours ago, only to be greeted by the info “Trading on this stock has been halted”. Also got a notice of June 25th Annual & Special Meeting in today’s mail.

GLTA (except Ted Cruz)

If I had to bet BUD might look at natural stuff inc.. A subsidiary of Amfil technologies..(AMFE) Natural stuff sell 28 black.. The kicker is Amfil already has a proprietary blend approved by health canada that hasnt been marketed yet.. I believe we will see it when legalization occurs in Canada.

Amfil has a system to produce “organic” cannabis and pending agreements with several growers.. So natural stuff is a great fit

I live in a recently legalized state and seriously believe there wont be Big Weed. It seems many people are now growing their own- seedlings seed etc on Craiglsist, plus mom and pop operations on Craiglist that actually deliver. And there is a certain camaraderie between people in weed that i dont think will carryover. Many places had they idea of taxing weed but that simply makes it non cost-competitive to mom and pop.

GOD BLESS YOU many thks

Bud as in pot as in beer a paid for rumor only beer company actively talking is Molsen/colors and with the new public company sproutly ant the water extraction method making it physically possible to make a beverage that acts the same as smoking not to many people down in Washington are enjoying drinking a soda waiting for 2 hours to get your groove on only to find you stay stoned for 6 hours after the 2 hour waiting to breakdown and take affect it’s like the beverage you would bring to a greatful dead concert butsproutly fixed the process just waiting on who decides to take advantage of their patents but bud the beer a definite No was just another pot tuner paid for the company that hinted of themselves being on the other end of the deal common practice now that legal is legal just not till oct for average joe but now you need to make your best guesses who you believe will do the best because who ever makes the next big investment the new rules apply you won’t hear about it until the deal is already done not real stocks yet but the secrets have started buy smart you could be holding one of the many pot lottery tickets good luck as always

Last week Canopy CGC announced deal to purchase Haiku, at something like 33% plus then Haiku price. Maybe it will go through / settle.

Agora’s use of “happy adjectives” should wave a big red flag for anyone even thinking of subscribing . Don’t spend thousands thinking you will get quality advice. Paper trade, do your own research. Expensive investment services are happy to take your money and leave you hanging whether their picks helped you or not. As a recent elderly widow left with small account and subscriptions to some happy adjective services I quickly learned not to trust after losing several thousands with non refundable shark services my husband had innocently subscribed to. I Many services do not give you any kind of details of what kind of account you need to have…margin, etc. Just stick with “The Gumshoe”. This is the only truthful and honest advice I have found.

Sorry to name “names” but needs to be done. Investment “lambs” need to know you may be following bad advice.

believe there wont be Big Weed. It seems many people are now growing their own- seedlings seed etc on Craiglsist, plus mom and pop operations on Craiglist that actually deliver. And there is a certain camaraderie between people in weed that i dont think will carryover. Many places had they idea of taxing weed but that simply makes it non cost-competitive to mom and

What’s with all those “mini-infomercials” in the Oxford Club/Oxford Communique newsletter thread? They give the impression that the entire Oxford staff (plus friends and family) are forced to or are getting some kind of reward for putting a good word in for the newsletter — all for free in Stock Gumshoe space, of course.

Not that I frequent the Newsletter Rankings section much, but I do skim through Recent Comments regularly. And when Recent Comments gets clogged by dozens upon dozens of praises for the same company, on the same date, and within minutes of each other, I wish the trolls would just stop. Apparently they don’t understand that the main reason people have turned to Stock Gumshoe is because they’ve had it with or have been burned by pushy, marketing/advertising newsletters often selling snake oil.

Hmm.. don’t know why this ended up in a beer-and-pot discussion, but I thought I clicked on the “Ask a Stupid Question” thread to post the above comment. Oh well, sorry!