This article was originally published on January 3, though the ad had been running for some time before that. It continues to run now, and we get a lot of questions about it, so we’re re-posting our teaser solution here for your information.

It has not been updated or revised since 1/3/24, the company has reported one quarter since then, which was relatively uneventful and didn’t really change the story, but in mid-February the A.I. enthusiasm heated up again and the stock jumped higher (it’s very small, and has been very volatile). Real news is still “pending” on their latest chip products, and likely will be for a while. Here’s the article we first shared a couple months ago:

Here’s the intro to the ad which sits in pole position today… it’s a pitch for Keith Kohl’s entry level Technology & Opportunity letter over at Angel Publishing ($49/year, six-month refund period):

“The ‘NVIDIA KILLER’ Could Make You 120X Your Investment

“A tiny Californian company is about to dethrone Nvidia as the “King of AI.” If you get in BEFORE one critical announcement, a modest stake could turn into a fortune.

“***WARNING: You only have ONE chance to act.***”

NVIDIA (NVDA) has often been the best-performing large cap stock in the world over the past seven or eight years, and has provided investors with a return of about 1,300% over just the past five years and 12,000% over a decade, though earning those gains would have also meant sitting through a 60% decline in both 2019 and 2022, which is very difficult for most investors… so that’s the promise, that we have that kind of gain ahead from whatever secret stock Kohl is pitching.

And the “critical announcement” and “only one chance to act” are probably mostly hooey, but we’ll see. Teaser ads have to have a deadline and a catalyst to get people to commit to a subscription, but most of the time that short-term urgency doesn’t mean much.

So what’s our stock? Let’s sift the clues out of the ad for you, and see what the Thinkolator can tell us… here’s how the hints begin to rain down…

“You would never know it from the outside of this building in Sunnyvale, California…

“But the engineers working in this nondescript place are on the brink of something shocking.

“They’re about to unleash the most powerful technology humanity has ever seen.”

That’s just an image of a completely generic industrial park office building in California, but we’ll see if it matches our clues later on.

And the wild promises about potential gains are mostly just the generic “AI is gonna be huge” headlines we’ve all been seeing for the past year…

“… the engineers working in this nondescript place are on the brink of something shocking.

“They’re about to unleash the most powerful technology humanity has ever seen.

“Forbes calls this technology “the greatest profit engine in history”…

“Bill Gates says, “It will change the world”…

“And Bank of America claims, “It could revolutionize everything.”

“Wired magazine predicts it will unlock $15 trillion… while one insider even believes we’re facing a stunning $100 trillion windfall.

“And investors who position themselves correctly today could easily make 10x or even more than 100x their money.

“That’s enough to turn a modest $10,000 stake into $1 million.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“Such massive gains may sound unbelievable…

“But this technology just minted the youngest self-made billionaire in the world — a 25-year-old college dropout.”

That’s probably Alexander Wang, who’s one of the founders of Scale AI, I think he beat Austin Russell at Luminar Technologies to “youngest billionaire” when his ownership of Scale AI hit that valuation over the summer, just six years after he dropped out of MIT. Both rode wild enthusiasm and a wash of venture capital money to “paper billionaire” status in their mid-20s, though I think Wang was a few months younger when that level was breached. Russell hit that level a couple years ago, not long after dropping out of Stanford, so the key advice here, of course, is “drop out of a top-ten college if you wanna be a billionaire early” … though that’s also the path to a rewarding career in used car sales or photocopy machine repair, so choose carefully (Russell may have retreated from ‘billionaire’ at this point, I haven’t checked the value of his Luminar shares, but I’m sure he’s still doing just fine).

So what’s the big opportunity? Kohl says that AI will change the world, but that it faces a problem which will keep it “half-baked” …

“The major flaw I’m going to reveal today lies at the heart of it all.

“If this problem isn’t solved, AI will stay half-baked for years to come.

“But the little-known company from Sunnyvale I discovered owns the patent-protected key to unlock AI’s real potential.

“I predict this tiny firm is going to be flooded with hundreds of millions and even billions of dollars…

“Because major tech companies have no other choice than to switch to this new technology. Otherwise they won’t be able to ride the $100 trillion AI wave.”

I’m guessing that Kohl here is talking about the hardware and processing logjam created by heat, which was also the hook Karim Rahemtulla used for an AI pitch a few months back. Rahemtulla was talking up the necessity of data centers moving to liquid cooling to make it possible to absorb all the heat from all these high-end NVIIDA processors that make things like ChatGPT seem magical, but I think Kohl is taking a different tack.

Let’s move on to some more clues…

“… as you’ll see in a moment, the company I discovered is destined to dethrone Nvidia as the “King of AI.”

“And I’m not the only one who says so.

“One analyst recently confirmed on Fox News that this firm is superior to Nvidia’s AI technology.”

And a few specifics…

“… this little-known firm has a market cap of just $153 million.

“Now compare this with Nvidia, which recently crossed the $1 trillion threshold.

“In other words, this firm is about 6,500x smaller than Nvidia. That’s why the growth potential you can seize today is totally off the charts.”

And yes, Kohl’s “NVIDIA Killer” is, in fact, another chip designer…

“This company from Sunnyvale developed a patent-protected chip that blows its competitors out of the water.

“You see, AI apps require almost infinite data-crunching, and this firm’s flagship chip outperforms other chips by a factor of 100 on big-data workloads.

“And that’s not all. These chips also consume far less power.

“Take Nvidia’s A100. It devours 400 watts of electricity. However, this firm’s chip runs on only 60 watts. That’s 85% less power consumption.

“This kind of performance slashes the cost of running AI systems radically and unleashes AI’s true potential.

“This firm’s customers include tech and defense giants like Lockheed Martin, Cisco, General Dynamics, Honeywell, Nokia, Raytheon, and Rockwell.

“Yet hardly any retail investors know this company’s name.

“But that’s all going to change soon because I believe this firm is about to dominate the entire AI sector.

“Like I said, this could be a replay of Nvidia’s incredible 12,035% surge….”

And Kohl has picked out a point in NVIDIA’s development when it was key to buy the shares, back when Stanford built a supercomputer using NVIDIA chips in 2013, so that’s his corollary here — he thinks this secret little stock is about to make a similar breakthrough.

So before we get to that, I’ll just caution you that NVIDIA had already been working on AI for some years at that point, and had been a solidly profitable and mostly growing leader in the graphics chip business, mostly for higher-end video games, for more than a decade. It certainly took off starting a few years later, as their self-driving car chipsets grew, the video game business continued to expand, and they began to have meaningful sales of their data acceleration chips for data centers… but it was already an established company, worth close to $10 billion at that point. And yes, back then, a decade ago, $10 billion still seemed like a lot of money (they were just a little smaller than Broadcom (AVGO) at the time, and Intel (INTC), which was by far the biggest semiconductor company back then, had a market cap of about $120 billion). You don’t necessarily have to start with a penny stock to get NVIDIA-like returns, though it does fuel the imagination.

So it sounds like what Kohl is talking about is what has widely been touted as the “next wave” for AI — chips that are specifically designed for various AI tasks, not just high-end “do anything” graphics powerhouse chips that are great at general AI tasks today, like the ones being snapped up from NVIDIA and Advanced Micro Devices (AMD).

That has generally been the evolutionary process in semiconductors — new technology and new software are created by and fueled by the most powerful chips, and then once the needs are better understood, and the market becomes big enough to justify designing custom silicon, application specific integrated circuits (ASICs) are fine-tuned for the processing tasks needed, and ASICs are a lot cheaper and more efficient than the high-end chips that are used in the initial breakthrough. That’s what happened most recently with cryptocurrency mining, which used first regular CPUs, then as competition heated up a lot of mining moved to NVIDIA GPUs (because “crypto mining” really means “winning the race to calculate faster”), and then, once the market got big enough, a few companies invested in designing custom mining chips and hardware, and those took over a big chunk of the business.

Will that happen with AI? I don’t know. Probably, eventually. Certainly there’s enough money pouring into AI projects for a lot of custom ASIC designs to be funded, and there are a lot of different types of AI processing tasks, so the market might get chopped up as lots of different hardware enters the fray.

Is that what Kohl is pitching? Not exactly, we’re not talking about custom ASICs just yet, but it sounds like he has a chip company that has a different design for managing the memory bottlenecks and the high-throughput required for AI…

“… this company avoids the von Neumann bottleneck altogether.

“By computing data directly in the memory array.

“As a result, data doesn’t need to be moved around. This brilliant concept is a totally new way of processing.

“Crunching data directly where it’s stored upends how computers were designed for more than 70 years. It’s a radical upgrade to the von Neumann architecture…

“And it’s leaving competitors like Nvidia, Intel, and AMD in the dust.

“Like I said, this chip outperforms other processors by as much as 100x while consuming 85% less power.

“The best part about it?

“This company’s technology is protected by 125 patents, building an impenetrable moat around its vital technology.

“That’s why I expect this firm to be overwhelmed with orders soon. In fact, we can witness it unfolding already.

“The U.S. Air Force and Space Force secured this high-performance chip for a top-secret project…

“The Israeli Ministry of Defense successfully tested this technology for a sophisticated object-recognition app…

“And Elta, a major player in the aerospace industry, wants to use it for a breakthrough image-processing AI.

“Shares of this company recently jumped 512% within a few short weeks, but it’s not too late to get in.”

And what’s that “one time opportunity” that Kohl pitches? Here’s how he puts it:

“This company is preparing the launch of a brand-new version of this chip as we speak.

“You see, the first version had a highly limited run. Only a few researchers and a couple high-end clients were granted access.

“I’m talking about organizations like the U.S. Air Force or the Weizmann Institute. This world-leading research facility used it to accelerate the search for coronavirus treatments….

“The company’s CEO revealed in a recent conference call that the new version will be even faster and more energy-efficient than its predecessor.

“And when this company announces the release of the second generation, I expect it to be swamped with orders…

“And the stock to go parabolic as a result.”

Other hints? The stock recently “surged 512%” and the insiders held on to their shares, so company insiders own 31% of the company still.

And it trades for “a couple bucks.”

And that’s it, those are our clues… so what’s the stock? Well, if you give me a moment to pull the Thinkolator out of the garage, and get her warmed up, we’ll have some answers in a moment — it’s pretty cold up here in Massachusetts, and we’re all feeling a little slow and rusty.

But it shouldn’t take long… and this one tickled a little sensor way back in your friendly neighborhood Gumshoe’s memory banks, the stock was teased about a dozen years ago by a now-defunct newsletter. Keith Kohl is almost certainly touting GSI Technology (GSIT), which was touted by Lou Basenese about a dozen years ago, when it was a $200 million penny stock with a new memory chip design. It still has that SRAM chip product, and they peaked at close to $100 million in revenue back in 2011, but the business has been slowly shrinking since then. And it’s now far below a $200 million valuation, let alone Kohl’s teased $152 million.

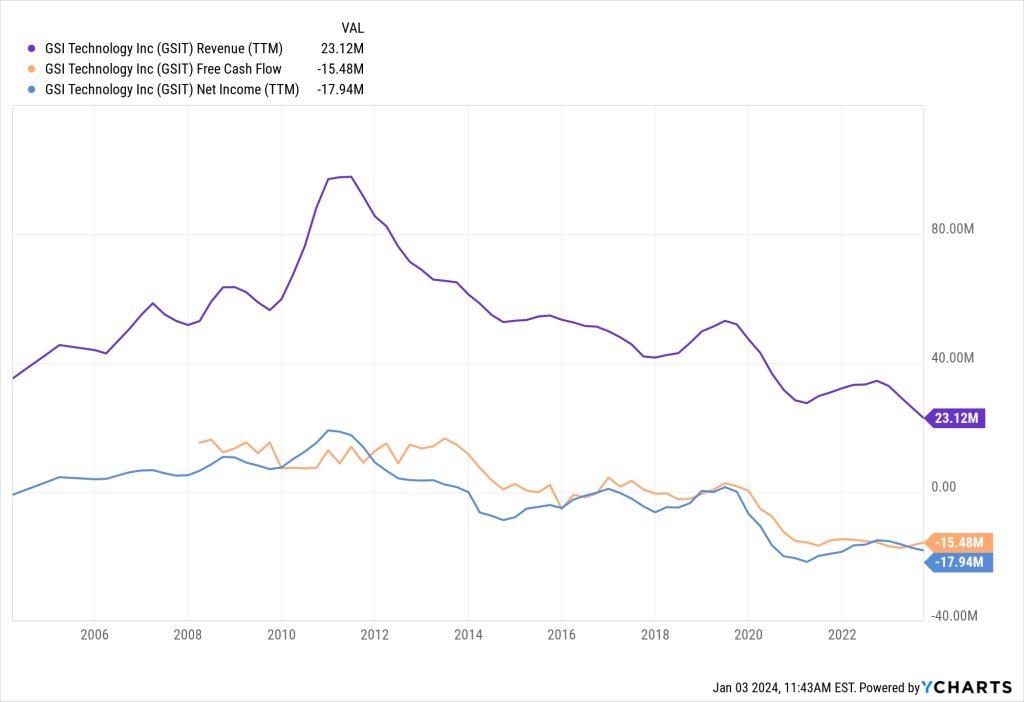

I am generally very suspicious about these kinds of little niche tech companies that promise great things but haven’t ever done much, so I might be a little too harsh on GSIT… but this is how their performance looks if we go back to their first data filings, close to 20 years ago — that purple line is revenue, and those negative numbers at the bottom are free cash flow (orange), and net income (blue):

It’s not shocking to see a very small chip company losing money, that’s often how it goes for startups… but we’re talking about 20 years here.

Now, in their favor, we should note that they have not burned through hundreds of millions of dollars — they’ve mostly been a pretty small operation, and they have consistently had revenue coming in the door and even had a few profitable years here and there, but they haven’t fallen into the trap that we so often see for always-remain-small tech firms that can’t transform themselves or grow: They haven’t issued tons of new shares every year just to keep the lights on.

That might be changing in recent years too, however — here’s the 15-year chart of GSIT’s share price and their number of shares outstanding — they did a share buyback in 2013 and 2014, despite the fact that revenue was falling pretty precipitously back then, but this new initiative to develop new products and chips for the defense and satellite industries and for AI four or five years ago started to suck up cash again, and they’ve issued shares every quarter for several years. Not overwhelming at this point, but with the share price falling pretty dramatically in recent years it could become a death spiral (that’s when you have to issue more shares to keep operating, but the share price is falling because things aren’t going well, so you keep selling more shares at lower and lower prices — we see it with biotech stocks all the time, but any small and unprofitable company can succumb).

And yes, as you can see from that spike in the purple line a few months ago, the stock did soar 512% earlier this year — it jumped from $1.45 or so up to over $9 for a brief moment, back in May and June when anything with an AI-focused press release surged higher — but that was short-lived and didn’t get them any real opportunity to raise money at that higher valuation.

GSI Technology’s (GSIT) stock price is around $2.50 these days, so it’s far off of Kohl’s $152 million teased market cap (the current valuation is about $65 million). The ad from Kohl is undated and in heavy circulation right now, and this is the first time I’ve seen this version of it, but one would like to charitably assume that it was written over the Summer when the price was higher. As of last quarter, they expected their cash burn to be about $14 million for all of 2023, and “if nothing improves” they expected to have enough cash to last “at least a couple of years.”

So… will GSIT make it to the big leagues with their latest AI chip design? Here’s what they say about themselves:

“Founded in 1995, GSI Technology, Inc. is a leading provider of SRAM semiconductor memory solutions. GSI’s newest products leverage its market-leading SRAM technology. The Company recently launched radiation-hardened memory products for extreme environments and the Gemini® APU, a compute-in-memory associative processing unit designed to deliver performance advantages for diverse AI applications.

“The Gemini APU’s architecture features parallel data processing with two million-bit processors per chip. The massive in-memory processing reduces computation time from minutes to milliseconds, even nanoseconds, while significantly reducing power consumption in a scalable format. Gemini excels at large (billion item) database search applications like facial recognition, drug discovery, Elasticsearch, and object detection. Gemini is ideal for edge applications with a smaller footprint and lower power consumption, where rapid, accurate responses are critical.”

And they are still moving forward with the Gemini II, which they hope will be a larger volume product, and designing Gemini III, which they want to push into the data center market — though the timeframe does not seem terribly “urgent” to me, this is how they described it on the last conference call (in October):

“The second milestone was the completion of the Gemini-II tape-out, which we announced last week. As a result, we are on track to have the chip back in our hands early next calendar year and expect to begin sampling the device in the second half of 2024. We are targeting Gemini-II partners and customers in low-power data center expansion and enabling data center functions at the edge. Examples of edge applications would include advanced driver assistance systems and HPC in delivery drones, autonomous robots, unmanned aerial vehicles, and satellites….

“In addition to advancing the tape-out of Gemini-II, a significant area of recent focus has centered around our ongoing engagements with a key hyperscale partner. I am delighted to report that these discussions are making notable progress. Through our constructive dialogues with this leading cloud computing provider, we have gleaned invaluable insights into the precise design specifications required for Gemini-III to align with their requirements.

“This collaborative effort has enabled us to chart a roadmap while identifying potential partners who can bring the essential financial and engineering resources to the table for the successful development, manufacturing, and launch of Gemini-III. This evolution will leverage the incorporation of High bandwidth memory into the APU architecture, thereby harnessing the full potential of in-memory compute advantages.”

Will this Gemini chipset be meaningful for the future of AI, particularly Edge AI? I dunno, maybe. But this is pretty early days, and there are a lot of chip designers working on AI chips for various applications, including some, like GSI’s Gemini, that are relatively low-power. Maybe their integration of memory is critical, I have no idea, but that’s not the kind of “which chip design technology is better” call I’m ever going to be able to make — I’m not a data scientist or a chip designer, so when it comes to these kinds of situations I usually have to wait and let the company’s customers tell me when their product is important. That comes in the form of orders and sales and revenue, and GSI Technology is not there yet.

When might we learn more? Well, it will probably be pretty gradual — chip design and production is a lot slower and more iterative than a lot of investors might assume, given the excitement over headlines. The tapeout stage is a big deal, at least for the chip designers, that’s when the computer file of the design becomes a physical thing, creating the photomask and enabling the start of actual production (by Taiwan Semiconductor (TSM), in this case)… but it isn’t necessarily a one-step moment when production begins, they’ll have to run through fabrication and testing and packaging and produce the first Gemini II chipsets, then GSI Technology will have to test them internally to see if they work as expected, then perhaps have a couple key customers test them in the real world, and it wouldn’t be surprising if there are changes to the design before it’s ready for volume production. Maybe that happens in a few months, maybe it takes all of next year, or longer, I have no idea. On the last call, they said they will probably have benchmarking data for the chip’s performance “around summertime,” and any revenue from Gemini II would fall into their 2025 fiscal year (which starts in April). If you’re looking for the commercial release to be that “goes parabolic” moment that Keith Kohl is promoting, I’d guess it will probably be sometime in the Fall of 2024. Delays are the norm in this business, I expect, and the actual “tape out” for the Gemini II came about a year after it was originally expected.

They are still very hopeful that what they see as a hugely appealing chip with faster processing and lower power consumption will be in high demand for some AI applications, and that the still-in-preliminary-design Gemini III might even be a viable tool for the hottest AI projects, the ChatGPT-like large language models and similarly intensive releases… but most of that is still very hypothetical, with only the Gemini I actually in silicon and available and being sold right now. There won’t be a big surge of orders or profit when they announce their next quarter, which will probably be in about three weeks — the guidance they offered for this quarter was essentially that their revenue will be about the same as the last two quarters (in the $5 million range), and that Nokia (their biggest single customer) and various Defense customers will generate more than half of that revenue, much of which comes in the form of research awards that could turn into early-stage commercial projects in the future. It sounds like much of their order flow continues to come from military and satellite customers, in large part because of the radiation-hardened design of their memory products, and Gemini I is apparently radiation-tolerant, too, so perhaps that focus will continue to be important.

So that’s what I see, dear friends — a company with a design for AI chips that they’re really excited about, but this is a small-scale chip designer that’s been around for a long time without really breaking through to high-volume sales, and it’s still not necessarily ready for prime time yet when it comes to things like generating actual orders or revenue. In most ways, it’s really a start-up that has some lingering, if shrinking, business in selling memory to the military — they transitioned to focusing on AI and their Gemini program in 2019, using technology they bought in 2015, and released Gemini I in 2020, and so far it looks to me like it’s been a slow burn.

We’ll probably see press releases through the Spring as they actually get the Gemini II chips in hand and can begin testing, but for now it’s a cool-sounding design from a cash-burning company. It may well work out, I have no idea how Gemini II will look to customers a year from now, or whether Gemini III will move forward with some key hyperscale partners and actually get designed, let alone built… but either way, it’s likely to require some patience. I’ll let it get more “real” before I tempt myself, but I know many of you are interested in early-stage projects, and I’m sure some of you understand the chip design and the potential appeal better than I do, so perhaps some of our favorite readers will want to take a closer look (and hopefully let us know what they find).

And I’ll hand it back over to you… think this Gemini II (or III) will be the NVIDIA killer? See other chip designers that you think have a clearer path to AI greatness? Have an opinion on GSI Technology? Let us know with a comment below. Thanks for reading!

Disclosure: Of the companies mentioned above, I own shares of NVIDIA. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

Happy New Year and happy investing Travis!

Thanks for your first de-tease of 2024, much appreciated, as always.

Atomera just got endorsed by STMicoro as it licensed their MST as the cheap alternative to ever more expensive shrinking of chips. A solution that boosts current chips and has the hope of being more beneficial as chips get smaller. Any thoughts?

A good reminder of how slow the process of shaking up chip making can move — that deal was first signed in 2018 and didn’t get to final commercial agreement until last spring, about five years later.

I haven’t looked at ATOM in a couple years, but finally getting to commercial scale with a partner was always the teased goal, and STM was always the biggest partner and most likely to commit… the newsletter guys just thought it would move a LOT faster than it did.

I didn’t seen any news on STM/ATOM?

The substantive news came out last year, maybe 6 months ago

Happy New Year and thanks for teasing this one out. The price is incredibly tempting. Looking forward to everyone’s thoughts.

I’ll stay on the sidelines for this one.

Do you mind if I ask you what your apprehension is? It’s an interesting and well timed “story”. In addition it is an attractive entry price.

I’m not apprehensive for any product or tech reasons, just not interested until the story becomes orders or revenue. I don’t know the science or the sector well enough to speculate otherwise, particularly when a company has mostly been burning cash, albeit slowly, for 20 years, so I have to wait until their customers vote with their $$. Cool story, and certainly AI enthusiasm is high, but there are also billions of venture and R&D dollars chasing that enthusiasm, while GSIT’s share price drops and they’re down to their last 12-18 months of cash, most likely, so the range of possible outcomes is vast.

Doesn’t mean it won’t pop 100% on any exciting news, of course, but that’s not the investment strategy I’m most comfortable with.

I’m relatively new to stockgumshoe; however, I love that you do the work for us by deciphering the teasers and then give us a friendly tip on what to do with the info. In this one, you gives us the time frame for the teaser and the time frame for us to invest (wait and see). Love it! Thank you. I pay for the “Irregulars Quick Take”service now, but appreciate what you are doing for the community either way the consumers consume the information.

Thanks! I don’t always end up with a specific opinion about the stocks I end up covering, but I’ll always be honest with you.

Hi Travis and team,

all the best for the New Year io you and thank you very much for deciphering this teaser.

I think it could be interesting for the community to know, that GSIT announced yesterday

that they received a contract about $ 1.1 Mio. from U.S. Air Force Research Laboratory…

Yep, those kinds of research/early stage grants and awards have kept them going for a long time.

I love your writing style. Well backed statistical evidence splashed with occasional wit and humor. Makes for informative and enjoyable reading.

Thanks Russ!

I think I will stick with ASML

I wonder if they have the manufacturing capacity and capability to easily switch from memory chips to this AI chip, might provide a very quick delivery ramp up if the design is successful. Alot quicker than a company that needs to add the manufacturing capacity for the new product.

Their chips are made by TSM, I think on one of the lower-cost nodes (not the most advanced stuff, I think these are on 16nm but that’s just going from memory), so there may be some flexibility. Don’t know how long it would take to ramp up, or how much that would cost.

I’m not familar with this market, however, I like the way you think and report your findings. Thanks for the great insight into a very risky and time consuming product evolution.

Hi Travis and team,

All the best for 2024 to yourselves and your followers.

Have you ever heard of or looked into this small company that has also developed a ground breaking chip.

BRN.AX

BrainChip Holdings Ltd develops software and hardware accelerated solutions for artificial intelligence (AI) and machine learning applications in North America, Oceania, Europe, the Middle East, and Asia. The company primarily focus on development of Akida Neuromorphic Processor to provide ultra-low power and fast AI Edge Network for vision, audio, olfactory, and smart transducer applications.

Yes, we’ve looked at Brainchip a couple times — most recently when Tim Bohen was pitching it last month: https://www.stockgumshoe.com/reviews/stockstotrade-advisory/inception-tiny-stock-teased-as-next-nvidia-by-tim-bohen/

I was linked to this article from ChatGBT: It found two articles that mention a “NVIDIA Killer” chip that could be a potential competitor to the A-100 chip (and uses 85% less power)?

One of the articles mentions that a company from Sunnyvale developed a patent-protected chip that outperforms other chips by a factor of 100 on big-data workloads – GSI Technology (stockgumshoe).

Another article mentions that GSI Technology, a company that focuses on high-performance, low-power solutions for the AI space, could be the “NVIDIA Killer” stock (affiliateunguru).

However, ChatGBT was not able to confirm if GSI Technology developed the 100x Chip as described by Keith Kohl? So, is the AI chatbot providing anything in addition to an ordinary google search?

#GSIT

talking ASIC, most likely ST micro

One characteristic of the GSIT Chips is they are supposedly “rad proof” . I think this means the chip are effected by radiation. Including heat? If so, maybe there is something valuable there.

That’s to meet specifications for military and satellite chips. Not particularly unusual, but too expensive for chips that don’t require radiation hardening.

If effective against cosmic rays or whatever in space, would not the same principle apply to heat? If so, does Kohl have a point? Barrons just published an article detailing the heat problem for Ai chips. As for expense, cost can come way down with appropriate volume.

To further Kohl’s point please consider what Perplexity.ai came up:es, a company that has mastered radiation abatement has value, particularly in industries and sectors where radiation is a significant concern. Radiation abatement refers to the reduction or control of radiation exposure to protect human health and the environment. Companies with expertise in this area can offer valuable products and services in various fields, including:

Nuclear Energy: In the operation and decommissioning of nuclear reactors, managing radiation is critical for safety and regulatory compliance

4

.

Medical Industry: Radiation is used for sterilization of medical devices and in medical treatments, so effective radiation abatement techniques are essential for patient and worker safety

2

6

.

Space Exploration: Radiation-hardened components are necessary for spacecraft and satellites to ensure they function properly in the harsh space environment

1

3

7

.

Defense: Military applications often require radiation-hardened electronics to ensure reliability in nuclear or radiological environments.

Industrial Radiography: Non-destructive testing using radiation requires abatement measures to protect workers and the public

2

.

Research and Development: Laboratories that use radioactive materials for research purposes need to implement radiation protection standards

1

3

.

The value of such a company is not only in its ability to provide radiation protection solutions but also in its potential to innovate and lead in safety standards, which can be a competitive advantage. Additionally, the company’s expertise can be crucial for meeting regulatory requirements and for the successful execution of projects that involve radiation, thereby reducing risks and potential liabilities

1

2

3

4

.

Sure. But there are dozens of very large chip companies who sell rad-hardened chips. No idea of anyone has a particular edge in that area.

Which other companies make both rad-hardened rad and heat resistant chips?

Meant rad-hardened and heat resistant.

Looks like Mr. Johnson cannot say which other companies make both rad hardened and heat resistant chips, simply because there are not any. Big plus for GSIT

I don’t know whether GSIT will “win” or not, of course, I’m NOT trying to talk you out of investing in the company, just trying to make the point that they don’t “own” that space. The makers of rad-hardened chips include almost any big player in automotive or defense industry chips, and everyone who works on space (satellites, particularly), so that would include Microchip, BAE Systems, Renesas, Infineon, STMicro, and lots of others. Those are all $40+ billion companies. And that’s not an exhaustive list.

The Air Force picked GSIT chips over all the companies that you mentioned . Also, the idea is both rad hardened and heat resident. Note that NDVA”s CEO was emphasizing his lower power use and the GSIT chips required even less power. The path for GSIT, is likely not to be a unicorn company that goes from $2 per share to $1.000. Likely, GSIT will be acquired by a much bigger company. If I were running Intel I would snap up GSIT for $500k or so and give the GSIT engineers and scientists long term employment contracts. If it works, Could see Intel stock overr $150.

Sounds like you’re thoroughly convinced — I hope it works out! It’s early days in getting qualified and convincing customers, but the Gemini chips sound pretty impressive. Hopefully their testing of the Gemini II in the second half of the year goes well.

The Air Force, like the rest of the military, can only buy US-made chips, so there has definitely been a cottage industry in smaller fabs selling to the government, even if they’re not globally competitive. Don’t know if that’s the case with GSIT specifically, but that’s a big part of why several smallish chipmakers have survived in the US since the 1980s, despite being small-scale operations.