“Tesla’s Revenge… Just About EVERY Industry You Can Think of Is Headed For a ‘Wi-Po’ Upgrade”

by Travis Johnson, Stock Gumshoe | June 9, 2016 2:19 pm

What's the Wireless Power company teased by Ray Blanco for Technology Profits Confidential?

Nikola Tesla has probably gotten more attention in the last five years than at any other time since he passed away during World War 2… for a while it was enough that the car company named after him was a daily headline generator and stock market darling, but now he’s also being connected to work that’s a lot closer to the dreams he had of providing a global wireless electricity network in the years after he left Edison’s employ.

The Tesla/Edison feud that has been called the “War of Currents” was not about wireless electricity — that was the argument, which was really probably more accurately (but less colorfully) a Westinghouse[1]/Edison feud, about whether to use AC or DC for the power grid then in the early stages of being built, but Tesla was an advocate of AC (and sold some patents to Westinghouse — he was an incredible visionary and a terrible businessman) and an inventor of electric engines and lots of other things, in addition to his development of the “Tesla Coil” that he used transmitting electricity through the air. (The AC/DC feud brought us a name for a great band[2], of course, and also an excellent rap battle[3] a few years ago.)

We’ve seen Tesla’s story and the idea of wireless electricity used to sell a few different newsletters, most recently with the pitches from Microcap Millionaires[4] (“Expose the #1 ‘Deadly Flaw’ in Every Single Smartphone”[5]) and Nick Hodge[6] (“Apple’s Going Wireless”[7]). Both of those were teasing Energous (WATT)[8], which has most recently been over-the-top hyped largely on the premise that Apple is going to say something in their WWDC keynote next week about wireless charging, and use wireless charging technology from Energous for the iPhone by next year. If that meeting passes on June 13 without any wireless charging news from Apple (I have no inside information on what the odds are), it might be “look out below” for WATT — when newsletters and pundits drive a frenzy about a small cap “story” stock and a specific date when a catalyst is expected, the stock tends to move sharply if that date passes without the catalyst happening, or with the wrong catalyst. I’ve got a small bearish position (put options[9]) on WATT just because of the possibility that the super-hype from Agora[10] causes short-term selling when there’s no WATT news on Monday.

This latest pitch that uses the Tesla name, though, is from Ray Blanco[11] for his Technology Profits Confidential[12], and it’s teasing a different company. So, naturally, we want to know what it is… and preferably, we’d like to know without having to pony up $49 for a subscription to that newsletter.

I know I repeat myself on this matter all the time, but some folks don’t read every single article I write (shocking, I know!): please don’t ever subscribe to a newsletter just to learn about a “secret” earthshaking stock that’s being teased — that puts you in poor position to consider the investment rationally. Check with us, think about the stock on your own, then you can subscribe to their letter if you feel like it. It can really make a difference — most of us suffer from cognitive biases that mean our brains tend to overweight both information that we pay for and the first information we hear about an investment. Of course, sometimes getting the “first information” about a stock from yours truly isn’t that much better, since I’m likely to put more of a skeptical spin on things to counteract the hype of an ad… but thanks to the lack of “called strikes” in investing, being too cautious costs you only potential opportunity, not actual money.

So… back to work, digging into the teaser pitch. Here’s how Ray Blanco sucks us in:

“‘Tesla’s Revenge’

“His works was smeared in the U.S. press… his research confiscated by government thugs… and he died penniless and alone.

“Now watch America’s greatest forgotten genius get his ultimate REVENGE… with a ‘lost’ breakthrough that will disrupt a $268 billion industry….

“Military and air-traffic control radar and seventeen of the patents used to invent the radio… early robotics and the remote control you use in your TV room…

“Wireless Internet… hydroelectric power… and early versions of the very same transistors you have in the computer in your office and the smartphone in your pocket…

“You wouldn’t have any of it, without Tesla’s genius.

“But his biggest breakthrough yet… a discovery he never got to see finalized while he was alive… is one that’s just recently resurfaced. And it could make you very rich.”

And he puts the promise for gains up front, as usual….

“If I’m right you could see as much as 21 times every dollar invested.

“In just a second I’ll show you how.

“Keep in mind, this won’t be overnight — and of course there’s no guarantee that any investment will pan out exactly as planned, let alone one with such massive gains.

“We’re looking here at a potential long-haul boom with years of growth ahead.

“Think Intel, Apple, Microsoft and Google.”

No one ever says, “think Blackberry, Digital Equipment Corp, Palm and Atari” — investing in the next big thing at the early stages almost always seems dangerously easy, partly because of the skills of copywriters who sell ideas and partly because of survivorship bias… our brains forget about the failed and gone companies that seemed once to be ready for enduring greatness, and fixate on the world dominators that stand astride the economy today.

This is, at least, a real business… according to Blanco:

“In fact, according to at least one independent source, a very early form of this brand new technology market is already closing in on $2 billion in annual sales! ….

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“The same high-end source says the market for this breakthrough could grow by 4,000% over the next 8 years. How’s that for massive potential?”

So what’s the wireless power company being teased here? A few more clues for you:

“This move I’ve uncovered links investors to over 900 patents, either held or pending… and many of which represent the heart of this rapidly emerging industry….

“And it’s still incredibly cheap — anybody could get a reasonable stake for as little as $200 to start….

“… modern scientists have finally cracked Tesla’s secret.

“At places like MIT and Stanford, they’ve figured out how to send power without wires.

“No, we don’t have a way to make energy for free — yet.

“And we STILL can’t send wireless power 26 miles… safely or otherwise.

“What we can do now is send real electricity across short distances.

“This is already have a far bigger impact that you can possibly imagine.

“In short, wireless power is no longer science fiction.

“It’s already generating over $1.7 billion for early players….

“Getting in now could be like buying Intel in 1972… Apple or Microsoft in the early ‘80s… or Google when it first went public in 2004 — for a 1,302% return as I write.

“I’ve already told you about some of the brand-name companies already buying into this breakthrough. It reads like a Silicon Valley phonebook, with giants like…

“Microsoft, Google, Apple, Sony, Qualcomm, Intel, Belkin and more… plus Phillips, AT&T, Canon, 3M, LG and Samsung, Toyota, even the furniture giant Ikea…”

I’d be plenty willing to take another Google, that’s one of the few stocks I bought early and have held for more than a decade, and the 1,000% return is certainly lovely… but they don’t come around all that often. So what is this stock?

Final clues:

“You May Even Have One of These Early Devices Yourself — Without Realizing It!

“See, millions of new smartphones have wireless power chips tucked away inside.

“So do millions smartwatches, already in the hands of consumers.

“You can even charge your phones wirelessly now in Starbucks!….

“Have you ever used the free wifi in a coffee[13] shop? ….

“It might sound hard to believe, but wireless power — “wi-po” as we call it — is just as safe.

“In fact it could be even safer than plugging into the wall!

“How so?

“Because wi-po doesn’t work the way you might think.

“That is, the way we’re using it now, it does not involve filling the air with volts of electricity.

“Instead it’s done with magnets.

“There’s a powered coil that creates a magnetic field… and it gets picked up by another coil in the nearby device… using a magnetic field that connects them between.

“It’s called ‘resonance induction coupling.'”

OK, so that’s quite different from the “maybe someday” power transmitters that Energous is trying to commercialize, those try to transmit over much longer distances, 10-20 feet, and send power to targeted receivers via radio frequencies.

This description of “resonance induction coupling” is much more like what is pretty widespread now, with the feasible distance between the transmitting coil (the charger) and the receiving coil (the phone, or whatever) being determined in part by the size of the coil and the efficiency of transmission that’s required… but generally not more than a couple centimeters. If you have an Apple Watch, or a rechargeable electric toothbrush, or one of the Samsung phones that can charge on a mat instead of through a plug, you’re using these relatively well-accepted magnetic coupling charging standards (like those described by the Wireless Power Consortium[14]).

And yes, there are some Starbucks that have these close-proximity charging mats, and Ikea is selling furniture with these kinds of transmitters built in. I think saying that these remove the clutter of cords, or release you to a truly mobile existence away from your plugs, is a bit of an exaggeration — you do, after all, still have to plug in the charging mat or pod or whatever you call the little device that includes your power transmission coil.

Blanco says that “Just about every industry you can think of is headed for a ‘Wi-Po’ upgrade,” which seems like a reasonable forecast of of a possible future but certainly not an imminent fast-moving revolution — wireless transmission of power, even in close contact, is meaningfully less efficient than plugged in power, and it comes with other inconveniences even with mobile phones that you might not think of unless you’re this guy[15]. And there have been “no plug” TVs and other products introduced many times over the past few years, but none have made a commercial impact — there was a TV shown at the CES back in 2010 that was powered by magnetic resonance[16] and was thus genuinely without wires (it got the TV signal wirelessly as well), which sounds awfully cool and like a no-brainer for the OCD folks among us who are obsessed with hiding wires… but they never sold it, and Sony announced a similar breakthrough in 2009[17].

And a few more clues:

“… there’s one company that’s already making the most versatile, multi-use wireless chip on today’s market… ready made for millions of today’s ‘wi-po’ equipped products.

“They have competitors… but they’re cornering huge markets.

“Imagine, for instance, if this same company captures the ‘wi-po’ market for body cameras, bluetooth headsets, sports watches and smartwatches too.

“We’re talking over 275 million wearables by 2017.

“And yet, this company already makes the key ‘wi-po’ tech inside the Apple watch.”

OK, OK, we’ll take you out of your misery — Thinkolator sez this tease is all about Interactive Device Technology (IDTI).

Which won’t be new to the Gumshoe faithful — we wrote about IDTI about a year ago when Louis Navellier[18] was teasing the stock as a way to turn $1,000 into $200,000. The shares have been on a mild, OK for kids-type rollercoaster since then with just one scary drop, when it fell more than 20% in one day in early February.

A year ago, this is what I said about IDTI:

“This chipmaker is in a bit of a turnaround as they refocus on better business segments, including wireless charging, and get some design wins — analysts are optimistic, so at a current-year PE of about 16 the valuation is reasonable, and there’s a buyback to support the shares. (Much) Larger competitors like BRCM and TI are similarly valued and probably safer, but aren’t expected to grow as fast.”

The shares have recovered some of their losses from that February collapse, and now sit right about midway between the highs and lows for the year at $23… so is it worth a look today?

Well, you’ll have to decide for yourself (of course — it is, after all, your money)… but I did skim through the news of the past year to see what’s been happening.

That collapse back in February came after they released their fourth quarter results, and the results were not shocking — they were more or less in line with what analysts had expected… but the company’s forecast for the year was much weaker than investors had been anticipating. Growth was what investors were looking for in IDTI, so when they guided to lower growth a lot of them ran for the exits without asking any questions.

Why lower growth, if this wireless charging business is going to bring such a boom? Well, partly because that’s not their only business… or even their largest business. Here’s how they describe their business in the 10-K:

“We develop system-level solutions that optimize our customers’ applications in key markets. IDT’s market-leading products in radio frequency (RF), timing, wireless power transfer, serial switching, interfaces and sensing solutions are among our broad array of complete mixed-signal solutions for the communications, computing, consumer, automotive and industrial segments. These products are used for development in areas such as 4G infrastructure, network communications, cloud datacenters and power management for computing and mobile devices.”

That sounds pretty impressive, but a lot less sexy than “we’re going to make everything wireless!”

Their power management division, which includes their wireless charging products, is part of their Computing, Consumer and Industrial segment — here’s how they describe that part of the business:

“Power Management Solutions: Our power management portfolio includes the industry’s first true single-chip Qi-certified wireless power transmitter and Qi compliant wireless power receiver ICs, as well as dual-mode single-chip wireless power receivers that support both the Wireless Power Consortium (WPC) Qi and the Power Matters Alliance (PMA) standards. We offer an expanding selection of power management integrated circuits (PMICs), including intelligent, scalable, distributed power management for portable multi-core processors.

“We are a leader in wireless power transmitter and receiver solutions for battery[19] charging applications, with proven expertise in developing solutions for both magnetic induction and magnetic resonance technologies. Addressing all major standards and technologies, our highly integrated and innovative transmitter ICs are designed for use in wireless charging stations in homes, offices, libraries, stores, public waiting areas, airports and airplane seats. Our receiver ICs are targeted for use in portable devices and accessories. We participate in all major industry associations and ecosystems, including the WPC and AirFuel Alliance (formed from the merger of the PMA and Alliance for Wireless Power).”

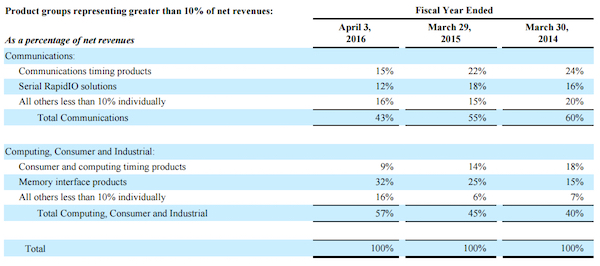

So they are doing this work, particularly with the leading Qi standard for wireless charging… and they do have the power management chip in the Apple Watch, for example, and have worked with Samsung to develop their wireless charging system for the Galaxy smartphones. But it’s not a huge amount of the business, and it brings in currently something less than 10% of their revenue. Here’s how the revenue picture breaks down for IDTI, I grabbed this from the annual report that covers the period ending on April 3:

Wireless power is small in relation to their other major divisions, but it is growing — they do credit wireless power with adding $10 million in revenue growth, though that also offsets some areas of substantial weakness and some of the businesses they’ve divested. Here’s more from the annual report:

“Revenues in our Computing, Consumer and Industrial segment increased $135.9 million , or 52% , to $395.2 million in fiscal 2016 as compared to $259.3 million in fiscal 2015. The increase was primarily due to a $80.2 million increase in memory interface product revenues as a result of higher demand combined with a $42.9 million increase in shipments of wireless power products as our wireless business continues to grow, a $24.4 million revenue contribution from the ZMDI business, which mainly included sensing products for mobile, automotive and industrial end-markets, and a $5.5 million higher revenue from other consumer products. The increases were offset in part by a $17.1 million decrease in timing products.”

So yes, wireless power is a growing business for them… but it’s still very small, and does not yet account for 10% of sales (overall sales were about $700 million last year, so wireless power is generating less than $70 million in revenue). The growth has been accelerating, which is a good sign… wireless power products were responsible for $10 million in revenue growth the prior year, and that part of the business is on the way to becoming one of their lead segments if this growth continues.

Which, clearly, analysts and investors are counting on — this is a semiconductor company that’s involved in a lot of very competitive lines of business in communications chips, timing products, power management chips, and memory management chips, among other things, and some of those businesses sag sometimes. Like most chip companies, they have to keep innovating and fighting for market share and cutting their prices, so the hope is that some of their new products that they acquired when they bought the industrial chip maker ZMDI will be “sticky” and get them into new lines of business, and, it appears, that wireless power grows substantially as a business.

I don’t know if wireless power will grow fast enough to make up for softness in PCs or competition in other areas, but the analysts are still expecting growth for IDTI — they’re probably not all that accurate, as analysts usually aren’t, but I bet their estimates are way better than my wild guesses would be. Those forecasts are for $1.52 in earnings this year (ending next March), which would be about 10% earnings growth… and they expect earnings to grow another 7% or so the following year, but there’s some hope for something more dramatic after that because they have penciled in 18% annual earnings growth over the next five years.

That five year number is important and probably overused by investors, because it’s the denominator for the PEG ratio favored by Peter Lynch[20] — if annual growth averages 18% over the next five years, then the current-year expected PE of 15 gives a PEG ratio of 0.8 or so and it looks like you’re buying growth on the cheap… if you think growth will be more like 7%, then the PEG ratio is over 2 and it makes the stock look expensive.

But for the current year, 15 times earnings means the stock is cheaper than average, if not super-cheap… so it’s not a terrible idea even if we might be waiting for several years to see if they maintain the early lead they have in wireless power (and if these types of wireless power solutions continue to grow rapidly). It would take real breakout growth in their wireless power products, as in growth of several hundred percent for a couple years, to make IDTI really a “pure play” wireless power company, but it is, at least, a real company with several profitable business lines and some decent revenue growth and perhaps, pending who knows what kind of advancements or patent litigation might ensue over the next few years, somewhat of a “first mover advantage” in the wireless charging business.

And that’s all I’ve got on this “Tesla’s Revenge” wireless charging idea. Sound like your kind of investment? Have any experience with IDTI? Let us know with a comment below.

P.S. Over the past year that means we’re at a tally of two newsletters teasing IDTI for “wireless power”, and three teasing WATT… who will jump on the wireless charging tease-wagon next? Will it be about one of those two companies or someone else? We’ll keep our eyes peeled…

Disclosure: I don’t own IDTI or WATT shares. I do own call options and/or shares of Apple and Alphabet/Google, which are mentioned above, and put options on WATT. I will not trade any stock covered here for at least three days per Stock Gumshoe’s trading rules.

- Westinghouse: https://www.stockgumshoe.com/tag/westinghouse/

- a great band: https://www.youtube.com/watch?v=pAgnJDJN4VA

- an excellent rap battle: https://www.youtube.com/watch?v=gJ1Mz7kGVf0

- Microcap Millionaires: https://www.stockgumshoe.com/tag/microcap-millionaires/

- “Expose the #1 ‘Deadly Flaw’ in Every Single Smartphone”: http://www.stockgumshoe.com/reviews/penny-stock-fortunes/this-no-name-company-is-set-to-expose-the-1-deadly-flaw-in-every-single-smartphone-and-tablet-on-the-planet/

- Nick Hodge: https://www.stockgumshoe.com/tag/nick-hodge/

- “Apple’s Going Wireless”: http://www.stockgumshoe.com/reviews/alternative-energy-speculator/apples-going-wireless-pick-teased-by-nick-hodge/

- Energous (WATT): https://www.stockgumshoe.com/tag/watt/

- options: https://www.stockgumshoe.com/tag/options/

- Agora: https://www.stockgumshoe.com/tag/agora/

- Ray Blanco: https://www.stockgumshoe.com/tag/ray-blanco/

- Technology Profits Confidential: https://www.stockgumshoe.com/tag/technology-profits-confidential/

- coffee: https://www.stockgumshoe.com/tag/coffee/

- the Wireless Power Consortium: https://www.wirelesspowerconsortium.com/technology/magnetic-resonance-and-magnetic-induction-making-the-right-choice-for-your-application.html

- you’re this guy: http://www.howtogeek.com/233205/why-you-dont-want-to-wirelessly-charge-your-smartphone/

- TV shown at the CES back in 2010 that was powered by magnetic resonance: http://www.engadget.com/2010/01/07/haiers-wireless-hdtv-lacks-wires-svelte-profile-video/

- a similar breakthrough in 2009: http://www.techradar.com/us/news/television/sony-makes-wireless-tv-charging-breakthrough-640184

- wrote about IDTI about a year ago when Louis Navellier: http://www.stockgumshoe.com/reviews/emerging-growth/why-this-companys-stock-price-could-double-in-a-year/

- battery: https://www.stockgumshoe.com/tag/battery/

- Peter Lynch: https://www.stockgumshoe.com/tag/peter-lynch/

Source URL: https://www.stockgumshoe.com/reviews/technology-profits-confidential/teslas-revenge-just-about-every-industry-you-can-think-of-is-headed-for-a-wi-po-upgrade/

pretty sure it is $NXPI not $IDTI

I don’t think so, though Blanco may like NXPI too (I prefer NXPI to either IDTI or WATT, but not because of wireless power). IDTI has the wireless charging chip in the Apple Watch and has 900ish patents, NXPI has 9,000ish patents issued or pending (and does have the NFC controller in the Apple Watch).

NXP does have wireless charging chips in its product portfolio, as several other chipmakers do, but it’s not a meaningful business for them at this point.

Here’s another couple clues to confirm it’s IDTI, I thought I was already getting too long so I didn’t include them:

That cash number is exactly what IDTI had in December — NXPI, of course, has far more cash (about $1.5 billion now). The other clues could probably be applied to either company — both acquired companies in the auto chip business, and both actually closed the deals on the same day in December, though NXPI’s deal to buy Freescale for $12 billion was far more dramatic than IDTI’s acquisition of ZMDI for $310 million. IDTI also did double net income, from $94 million to $195 million, partly helped by that acquisition (NXPI doubled that year, too).

I’d buy NXPI before IDTI any day of the week because of their strong positions in automotive, security and NFC… but the wireless charging business could probably go up by 1,000% over the next year or two without having any impact on NXPI’s income statement.

Like I said, $NXPI

Latest teaser points directly at WATT…from Addison Wiggen’s Daily Reckoning.

Martin Cooper is the give away!

Like I said, $NXPI

It’s IDTI, nobody beats the detective. By the way this Bianco letter is a good surprise. Serious work on a Computer Techno part and Biotech part. Moreover, he shows the closed trades even those with a loss. Of course volatility is present in this type of investment but altogether, for the price, it’s a good deal.

it is $NXPI

Nope, it’s not. From someone who knows otherwise…

I just finished reading ‘rude awakening’s take on a tiny no name Ca, company

that supposedly on 6/13, will make a debout on wireless charging. It looks to be some kind

of powered transponder/ hub device that can be put on a table top, and charge any personal mobile device. These hubs can be mounted on telephone poles and charge many

phones at once. Question is how does it talk to your phone, to know if it needs charging?

Maybe it’s NFC chip that you use on pay apps? Of coarse the tease is to subscribe to

Agora financial service for a mere 2500.00 . Just to get this company.

What’s your take? I DTI or NXPI???

I want to say WATT. I believe Travis did a piece on a tease which the Thinkolator came up with Watt on it recently and the 6/13 date was quoted as the Apple announcement date. WATT is up about 27% since that tease.

Yep … http://www.stockgumshoe.com/reviews/penny-stock-fortunes/this-no-name-company-is-set-to-expose-the-1-deadly-flaw-in-every-single-smartphone-and-tablet-on-the-planet/

Dear Travis,

I enjoy reading your write ups. Thank you. I am only telling you this because if you are cutting and pasting you should make the correction. When you sign off you say there and should say three days

Possibly TRTC

IDTI ?

is that IDT Corp ?