This ad started circulating in late 2023, and this article was published on December 4, 2023. We’re re-sharing this teaser solution because of a new surge of questions about it, and we’ve added some mild updates to the bottom, but neither the ad nor this article have changed in any substantial way.

We all know what a powerful impact the advent of fracking and horizontal drilling had on US oil and gas production, creating lucrative oilfields in brand new places and revitalizing the Permian Basin and helping to slash prices for natural gas and turn the US into the largest oil producer in the world… so the tease that there’s something bigger than fracking is a pretty big deal. And Keith Kohl pulls out all the stops to entice us… here’s the intro to his latest ad:

“This small company’s powerful innovation could change the shale oil game forever…

“Igniting a wave of profits that could make the fracking boom look like child’s play…

“And minting a new generation of oil and gas millionaires in America…

“‘[A] design unlike anything most have seen in the shale sector before’ — Journal of Petroleum Technology”

His physical description of the “horseshoe well” is a bit misleading, but the basic idea is that a well can be drilled to the normal depth, turned sideways to send out a lateral and penetrate the shale field, and then instead of “fracking” the well right then, it can turn in a U shape and create another, parallel lateral, potentially doubling the underground area that can be stimulated to produce oil and gas.

And that is indeed a pretty new accomplishment, it was first tried about four years ago and is slowly percolating through the industry… I think Kohl is probably jacking up the hyperbole in calling it a “trillion dollar” technology, but it does have some potential to reduce costs and increase production. But let’s shelve the caution for a moment and dig into the hype — what does Kohl say is happening?

His tease is in an ad for Energy Investor ($99 first year, renews at ?) over at Angel Publishing, here’s how he gets into it…

“The little-known company behind the ‘Horseshoe Well’ has the power to revitalize American oil production, ushering in a new era…

“An era that could produce thousands if not tens of thousands of new millionaires…

“Dwarfing the wealth created by the fracking boom.

“… this company’s revolutionary “Horseshoe Well” is one of the greatest engineering feats of our time.

“And it’s going to usher in an oil boom unlike anything we’ve seen in the history of the oil markets.”

Subtle, right? And better yet, he implies that this “horseshoe well” is somehow “owned” by one small company, and will turn them into an “oil giant”….

“This small Texas firm is an oil giant in the making.

“This firm owns a whopping 150,000 acres in the heart of America’s most prized oil field — the Permian Basin.

“To put that into perspective, that’s an area of oil-rich land nearly the size of New York City!”

Well, OK, but New York City would look like a speck of dust on a map of Texas, that doesn’t tell us much about scale — the big thing about New York City is not its acreage. To put that into a bit more perspective, the giants of the Permian, firms like Occidental (OXY), ExxonMobil (XOM) and Apache (APA), each control close to two million acres of the Permian (almost three million for Occidental).

More clues? From the ad…

“And this tiny oil driller is profitable — very profitable.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“In fact, commenting on the astounding second-quarter results, the CEO said the company ‘had record production’ of over 130,000 barrels of oil and gas produced per day.

“And he’s anticipating a stunning 40% growth in production for the year!

“The CEO is a rock star in the oil and gas business.

“He built his first oil company from scratch in Texas with just $270,000, and he later sold it for a stunning $388 million.

“We’re talking a 143,600% explosion in value!

“And now I believe that the ‘Horseshoe Well’ will be his magnum opus.”

Then he lays it on a bit thicker…

“The ‘Horseshoe Well’ is one of the most efficient and revolutionary drilling technologies ever crafted…

“And it’s set to usher in a golden era of American oil supremacy.

“The implications are colossal.

“This could radically change the global supply picture, eliminating OPEC’s and Russia’s stranglehold on the oil markets.

“Instead, America will be calling the shots on the global energy stage as we produce more oil due to the cutting-edge ‘Horseshoe Well.’

“It isn’t just setting a new standard for the $4.3 trillion oil industry; it’s setting the stage for the future of global energy.

“For those who get in early, the returns could be nothing short of phenomenal.

“I think this could be my best-performing oil and gas stock over the next 12 months.”

And these claims that, frankly, defy logic to some degree:

“Since it effectively DOUBLES the amount of oil you could extract from a single well, it boosts production and profits while minimizing costs and disruptions to the environment.

“And the company is seeing immediate and staggering results from the “Horseshoe Well,” including:

“A massive 50% reduction in drilling time

“A stunning $10 million in savings compared with the cost of traditional methods

“A phenomenal 100% BOOST in production capacity“This innovative approach has the potential to not just double the firm’s oil output but to reshape the $4.3 trillion oil industry.”

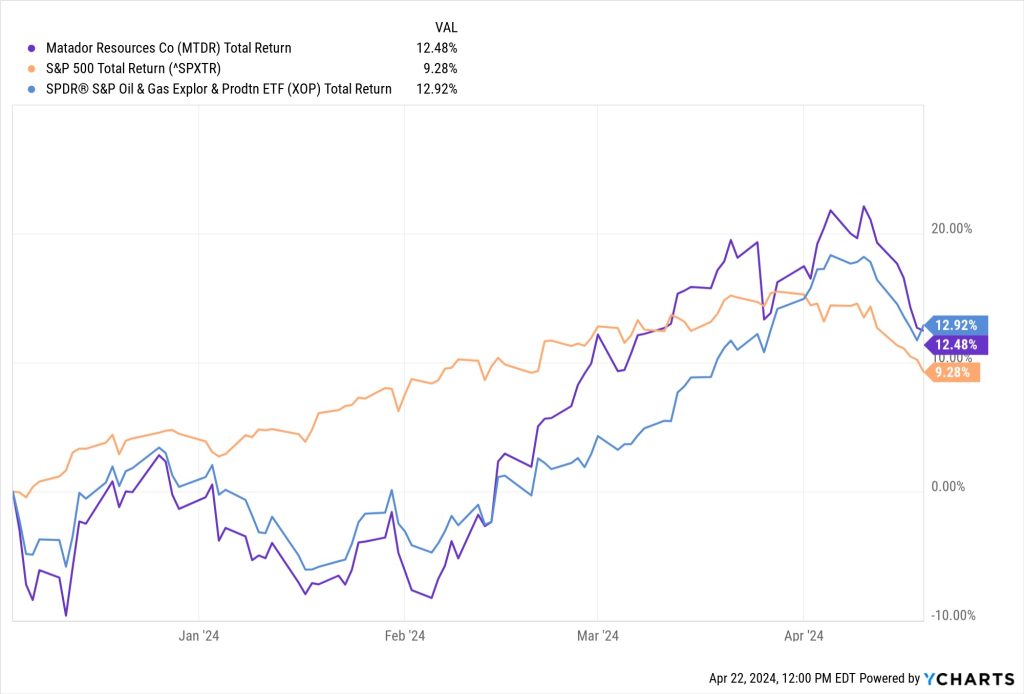

So… hoodat? Thinkolator sez that Kohl is teasing Matador Resources (MTDR), which is indeed a really successful smallish (~$6 billion) oil and gas producer, run by a “rock star” in the energy patch — that’s Joseph Foran, who did indeed build his first oil company from almost nothing in the 1980s and 90s, a company which became Matador Petroleum, and sell it for $388 million in 2003, after which he immediately launched “Matador II,” the current Matador Resources, which then went public in 2012. And has had a very good run, this is the performance of MTDR so far, the total return at MTDR (purple) is currently above the S&P 500 (orange), which is impressive given the sensitivity to oil and gas prices, but it is dramatically above its large peers in the S&P Oil & Gas Exploration & Production sector, as represented by the XOP ETF (blue)…

This is a pretty impressive company, and they acquired more Permian acreage earlier this year from Advance Energy Partners that is helping them to boost production well above what was expected a year ago… as of their last investor presentation, they expect to grow oil production more than 24% and gas a bit less than that, while also spending quite a bit less on CapEx than they had expected six months ago… mostly because they’re spending less on the surface to increase the midstream production capacity, which means they’ll be spreading out their oil and gas production from new wells over a longer period of time, but also because they’re drilling longer and longer laterals, more than two miles of lateral drilling in a lot of their new locations.

What’s not really a big deal for Matador, at least right now, is that “horseshoe” drilling. It exists, and they did highlight it in their last two presentations… first they said they were planning to test this well design over the Summer, and in the October earnings release they included this slide on the cost savings of the two “horseshoe” wells they brought on line…

Which is impressive, even if Matador did not create or develop this technology, but the real driver of results is not necessarily the shape of the well, it’s the length of the lateral — it seems clear that it’s a lot more effective, and cheaper, to drill two two-mile laterals than to drill four one-mile laterals, and that this “horseshoe” design is making that possible in places where the acreage isn’t two miles wide or there are other challenges that mean a straight 2+ mile lateral isn’r an option, which is apparently more likely in the very-chopped-up Permian than it is in a lot of other areas, but it’s not necessarily a magic bullet. Nobody seems to be claiming that a two-mile horseshoe well is a lot more efficient than a two-mile straight well… it’s just more efficient than two one-mile wells.

In their last earnings call, Matador did say that one of their test “horseshoe” wells beat a previous Wolfcamp record when it comes to drilling time, besting it by 20% or so, so that’s impressive, even if it’s just one well, but it’s a far cry from the “50% reduction” touted in the ad. And while they do say that using the horseshoe created that “$10 million” in savings relative to what it could have cost to drill twice as many wells which each had half the lateral length, that’s a comment without much context at this point. They don’t say anything about it providing a “100% boost” to production capacity, so it sounds like that’s just the assumption that a two-mile horseshoe-shaped lateral produces twice as much oil as a one-mile lateral. Which seems reasonable, though it’s not like the second mile is “free,” it still has to be drilled and fractured.

It’s still a pretty new technique, though, for Matador and for the other companies who are trying it, so others will add on with more experiments, with the drilling and completion contractors tweaking their equipment and their strategies as they see the success, and maybe it will get dramatically better, eventually. It wouldn’t be at all surprising if they do more of these U-shaped lateral extensions, it seems like in some areas it’s a very cost-effective way to improve production… but it’s not a huge part of Matador’s production right now. They completed and turned 65 wells to production last quarter (~28 net to Matador, like many oil companies there are a lot of partnerships and joint ventures), so finishing two horseshoe wells is good, as is the fact that they’re generally drilling longer laterals and operating more efficiently in many of their areas, but it seems awfully over-the-top to say that this is a “trillion dollar idea” that’s going to revolutionize the industry or turn Matador into a “major” by itself.

And, of course, it wasn’t Matador’s idea, they’re not the only one trying the “horseshoe” technique, and it’s not a technology they “own” — the first “horseshoe well” was drilled by Shell four years ago and was pretty widely publicized in February of 2020, though most of us were just about to be distracted by much bigger things back then (and oil prices were about to collapse), here’s how that was described by the Journal of Petroleum Technology…

“From an economic perspective, the horseshoe well saved 25% on rig time and about 20% on total cost compared with drilling two wells of the same lateral lengths. To a lesser degree, some savings was achieved on the completions side by requiring only one coiled-tubing run instead of two….

“Though the trajectory of the horseshoe well may appear to push technical limits, Shell’s execution was remarkably straightforward and no major issues were encountered during either the drilling or completion phase.

“‘The beauty of this design is that it utilized off-the-shelf technology,’ emphasized (operations manager Jason) Peart, listing rotary steerable systems (RSS), mud motors, and dissolvable plugs as a few of the enabling components that came from its service providers.”

I am not a petroleum engineer, and I certainly don’t know which innovations or designs will win out, but from looking at the financials I’ll conclude that Matador is a really impressive company, with a good balance sheet, improving drilling efficiency, and good production growth… and like most energy companies, it’s relatively inexpensive, currently valued at about 8X earnings and with a small but growing dividend, but the stock market performance of MTDR has been much better than the average “relatively inexpensive” oil stocks, so perhaps it’s reasonable to hope that outperformance will continue. I like what they’re doing, and the focus on the Permian and on controlling their capital expenditures right now, when oil and gas prices are not at all certain, seems sensible… I just don’t know that there’s magic to this “horseshoe” design, or that it will be a huge game changer for Matador. And, of course, the biggest question for all companies in this space is whether oil prices will go up or down in the next few years, and to a lesser extent natural gas prices, and I don’t know the answer to that, either. You’ll have to make that call on your own.

So what say ye, dear friends? Want a taste of oil in your portfolio? Think Matador is well situated as a reasonably-valued producer with good production growth, or do you have other favorites you think are a better bet? Think you know whether oil and gas prices will go up next year? Please let us know with a comment below.

P.S. Kohl also teases some other “Special Reports” in this ad, including his “Infinite Lithium” stock, which is a pitch for Li-Cycle (LICY), one of the many battery-recycling hopefuls… he originally teased that one almost two years ago, and it has been a full-on disaster at this point, losing 90% or so of its value. The other Kohl pitch that lots of folks are asking about lately is his “TriFuel-238” pitch about nuclear power, which is also a long-running (and so far unsuccessful) teaser that we first covered in mid-2021, pitching Lightbridge (LTBR), which has lost about half its value in the past couple years and has yet to participate in the re-emerging enthusiasm for nuclear power or the small modular reactor (SMR) story.

P.P.S. How do things look as of April 2024? Lightbridge (LTBR) still stinks, it’s one of the few nuclear stocks that has lost money over the past year (and for many years), and Li-Cycle (LICY) has gotten a little lifeline in the form of another investment from Glencore (last month), but remains mostly “on pause” with their battery recycling project while they re-assess costs.

Matador Resources (MTDR), though, the primary focus of the ad, has done OK… Here’s the chart for Matador’s total return compared to its peers (the XOP ETF) and to the S&P 500… they’re essentially on par with the other oil and gas producers:

Otherwise, things are relatively unchanged — Matador still trades at a low valuation, now about 9X earnings, and they posted another earnings “beat” in the fourth quarter, which is pretty typical. That’s up from 8X earnings back in December, but really only because the earnings forecast for 2024 came down substantially, from about $9/share to now $7.40/share. Their first quarter tends to be their lowest earnings quarter of the year, and their first quarter report will come out tomorrow, Tuesday, April 23, after the market close (conference call the following morning).

Still looks like a reasonable oil-heavy play (70% oil, 30% gas, roughly), with likely growing production through 2024. They have generally gotten more efficient with new fracking techniques, and have said that they are now “exploring the possibility of drilling up to 20 U-turn Wells in 2024 and 2025”, so it’s entirely possible that they’ll talk more about those “horseshoe” wells in the next few quarters, but that’s still a small percentage of the number of drilled and operated wells they’re likely to have over the next two years, and it seems unlikely that the “horseshoe” or “U-turn” will be the most important driver of returns in the near future, it’s probably better to assume that they’ll provide a small efficiency boost in areas with tight acreage. They had 245 horizontal wells turned to sales in 2023, of which they are the operator for almost half, and the average lateral was almost two miles, so they’ve done a lot without a need for horseshoe wells to this point — and that’s currently true of the potential drilling locations in their inventory, too, with 1,600+ net possible drilling locations with an average lateral of 9,200 ft (they’re expecting to start sales from 271 wells in 2024, again just under half operated by Matador, all in the Delaware Basin). They did increase their oil production forecast, and their capex forecast, when they reported in February, but that didn’t change the story dramatically — we’ll see what they say tomorrow.

Disclosure: I am not invested in any of the companies mentioned above, and will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

Back on Nov 20 Robert Arlen asked about NEP. I hope you get time to check it out – is that big dividend sustainable?

The frackers in Texas and Oklahoma are facing a bigger challenge than improving drilling efficiency with horseshoes, corkscrews or whatever…that being what to do with the frack water. The established method of disposing of it thru deep well injection is coming under increased scrutiny because of more frequent and stronger magnitude earthquakes. In 2021, the quakes of 4.0 magnitude or better spiked to 15 in Texas. That is the level that can crack walls and foundations and is the level that the Texas Railroad Commission has decided it needs to consider action. So far their action has been minimal, such as temporarily suspending operations at some wells. But the commission has been a patron of the oil industry since they were assigned the task of regulating it over 100 years ago, so I wouldn’t expect any major crackdowns. Some West Texas residents who don’t depend on oil for income are selling their houses, cracked foundations and all, as is and moving away. Those that stay drink only bottled water, as the well water is brackish and salty. A few companies have built facilities for treating the frack water for recycling. One such outfit was Breakwater Energy Partners, which was recently bought by Select Energy Services, a small cap company that is profitable (at the moment). It trades under the ticker WTTR. This will never be a trillion dollar opportunity, even if oil goes to $200/bbl, but the practice may save the fracking business from going under. (Pun intended.)

Spot on Q ! I saw this when it surfaced a few months ago and took a deeper look. Solid concept but nothing unique about it. Any directional drilling outfit still in existence can and will adopt this process if economical in their production analysis.. Matador may be a homerun but I’ll pass…….

As it is Earth Day, I thought it would be fitting to check up on the frac water recycler (WTTR) that I mentioned above. Happily, it’s up about 28% since early December. I didn’t invest and probably won’t, as I also noticed they’ve had five consecutive quarters of declining revenues. They are still profitable and pay a dividend (for now). I was hoping this day would bring some greater environmental reward, such as a couple of my neighbors trading in their gas-guzzling muscle cars for EV’s. I don’t think that happened. They are actually more of a noise pollution problem aside from the CO2, as well as a hazard to my physical health from recently having to help push one of then off the street.

Per Insider Monkey…..

Wednesday, CEO Joseph Wm Foran purchased $108,600 worth of Matador Resources, purchasing 2,000 shares at a cost of $54.30 each. Before this latest buy, Foran purchased MTDR at 5 other times during the past twelve months, for a total cost of $411,589 at an average of $47.57 per share. Matador Resources is trading up about 0.8% on the day Thursday.

Market Edge’s “Second Opinion Weekly,” as of December 1, recommended “avoid” Matador Resources, and says it was downgraded from neutral as of Nov. 9. But, on the other hand, TipRanks Consensus says that Matador Resources is a “Strong Buy” and Refinitive was “positive.” Then another service elsewhere was iffy. But the three specific opinions I mentioned above are all found at this link.

https://www.etrade.wallst.com/research/uploadhandler/z56907c0azdb6526f76f2f4ddf91a1d19d35f757f3.pdf

From another source recently, I saw the opinion that a lot more money is being made offshore compared to drilling on land and that this has held up for a long time and continues to be true today. This other source alluded to some of the same issues that Quincy Adams mentioned – problems with water quality, problems with the ground becoming unstable, cracks in foundations of houses, earthquakes – how much lateral drilling can be done before we get worse problems than have been seen to date? Plus the shale is getting more depleted over time. So, without talking about Matador or any particular company involved in horseshoe wells or lateral drilling – at least one publisher is recommending to stick with companies that are getting their oil offshore.

Since I’m not an expert, I’m just learning, I can’t really give an opinion. I did watch a video in which Warren Buffet was talking about the horseshoe wells in the Permian Basin, and seemed quite pleased with them. I also had received a promo for Prairie Operating Company (PROP) which is doing horseshoe wells out in Colorado. It seemed so good, I did buy some but that is down 36% in about 3 weeks. The location is good, there is definitely oil there, but the company is still OTC and despite the many favorable points in the promo, there is a lot that can’t be known at this stage. I think PROP was being promoted so intensely, that maybe the hype drove sales up briefly, but it’s now about four dollars less than what I paid for it.

So, back to Matador, I’m thinking I might actually buy just a very small number of shares. But I didn’t buy yet because I’m seeing a mixed picture – it’s either a really, really strong buy, or – it’s one to avoid. So, I have not bought Matador yet, though I do want to own some oil stocks, because I do think oil will go up due to limited supply and it’s predicted by some to be a cold winter. I have read about fuel shortages in some of the cold, northern European countries and despite all the “green energy” hype, it’s not supplying nearly enough to meet the needs anywhere in the world, and people are still relying on fossil fuels. But I am thinking more about stocks related to offshore drilling now.

I did think about going with a more well known oil company – Warren Buffet was praising Occidental Petroleum in a recent video – and Occidental is currently trading in the range of about $56, not that much different than Matador Resources, at $54.30 as hunter007 mentioned. Buffet talked about Occidental being in the Permian, and talked about horseshoe wells – my understanding was Occidental was doing those, and he was very pleased overall with Occidental. But since mid-October, Occidental shares are down $10, and Market Edge 2nd Opinion is saying “Avoid” though others are rating it as a “moderate buy” or to “hold” but not buy. But then again, I’ve been reading about investing in offshore companies, so that may be what I will do. I’m not convinced that just doing a horseshow well or being in the Permian at present is going to pay off in over-the-top profits at this point, but – could be reasonably good – just hard to feel confident when there are completely opposite recommendations. It’s not really possible to know at this stage what degree of success to expect.

PS, looking at the key words added to my post – I was not actually referring to Permian Resources, though I also read about them, and seems to me that was sort of a mixed picture, some recommending it, some not, so I was not really thinking about buying that currently, and I did not mention Permian Resources. I did mention Prairie Operating Company (PROP) which has been compared to companies operating in the Permian Basin, but it’s instead operating in Colorado is my understanding, on land that is somewhat similar to the Permian Basin. Of note, PROP did previously have a different stock ticker but I did not buy any shares till it had changed name / stock ticker, so I don’t remember what the previous name / ticker was – it became PROP some time during November. Just fyi.

If you’re new to investing, just buy and sell what Travis does. I’ve been subscribed for many years and have done well with his picks. It’s my belief that he’s pretty much the only one there that has integrity and isn’t trying to manipulate a stock price by analyzing it and then writing an article.

Thanks, I agree with you about Travis. He gives honest, accurate information. I have already gotten burned a couple times by listening to some of the hype from others that didn’t pan out. And they recycle some of the same material knowing very well the stock is really going nowhere.

Thanks Martha. I agree, the simple nature of the “horseshoe” is not likely to provide a real jump in earnings or competitive advantage to most companies, it seems of value mostly in very small leases where the only way to get a 2-mile+ lateral is to “horseshoe” it. Having longer and longer laterals in the Permian is clearly an effective strategy for a lot of operators.

Matador is quite a bit cheaper than Occidental when it comes to the earnings multiple, they’re at about 7X earnings while OXY is around 12X, and it’s far smaller, about 1/10 the size. I imagine OXY still gets a bit of a “Buffett premium”.

Wouldn’t it be apropos if OXY bought Matador. It would be like an hors D’oeuvres. (Had to look that one up) Buffet could use the INTEREST on his $157 Billion cash hoard to do it. They would probably instantly double the value in more OXY shares for Berkshire. Martha buy all THREE of these stocks to build your OIL portfolio. BRK.b can be used to balance out your diversity and still get significant OIL exposure. I see a long – long profitable road for oil.

Matador isn’t exactly a cheap stock. While Macy’s is only 17 dollar range and pays a dividend as well. It my go up to the yearly high of the year $25. I really appreciate the info on the technology. As a small investor I’ve had my butt kicked a few times from these talking heads. So what I would like to see is investment info on some of the more solid cheaper stuff. I appreciate every thing I read here the news letter is worth every cent of the price. I get to read and don’t have to listen to all the fear mongering endless nonsense of the talking heads to get to the point. I enjoy reading all the input from the gang here and It is always a learning experience.

Thanks Lutz. Both Macy’s and Matador are pretty “cheap” in the objective sense — in terms of a multiple of earnings, they’re both trading at a PE of about 7… we don’t get to many ‘cheaper’ stocks than that, though they’re both cheap for different reasons.

I will keep an eye on MTDR. It is a well-managed company as you detailed. With XOP down 24% this year I’m more impressed with Petrobras (PBR) which is up 38% and paid me a 42% dividend. I recently added EC (Ecopetrol) which is up 37% and pays a 23% dividend. Both are South American companies, majority owned by their respective national governments- the gov’t likes collecting the dividends to help finance social programs.

Yep, everyone’s just a little worried about the government changing the rules again 🙂