Porter Stansberry is great at spinning yarns from finance history to build his arguments about current opportunities, and this “AI Die Up” is no different — he compares the enthusiasm about the “disruptive new technology” of artificial intelligence to the boom in Great Plains cattle ranching after the Civil war, which created boomtowns from Kansas to Wyoming on the back of the “disruptive new technology” of the day, barbed wire.

I won’t rehash the whole story of the investment boom and bust that barbed wire inspired in the late 19th century (you can read it here if you like), but in Porter’s telling it ended with the bitter winter of 1886-7, when the temperature set new record lows and more than a million cows were killed in “the big die up” that wiped out most of the cattle ranches.

So in the end, it’s another story of a bubble that was in search of a pin, and found it in a surprise from nature. Here’s how Porter sums it up:

“The cattle boom of the 19th century was the first genuine global investment mania.

“A new technology (barbed wire) converted the incredible abundance of the Great Plains into an enormous economic engine for beef… and the demand was believed to be unlimited.

“But barbed wire was useless to keep out the snow.

“And in a story that’s all too familiar, investors caught up in the frenzy lost almost everything.

“The desire for quick and easy riches overrode any sober analysis of whether the market could sustain this type of growth or potential risks.

:As more and more investors poured in more and more money, the bubble continued to grow until, eventually, it ended.

“Time and time again, investors get caught in the same trap.

“The South Sea Bubble, the railway mania, the Dot-Com boom, the 2000s housing bubble, the rise of cryptocurrencies…

“History is replete with examples of what happens when a disruptive technology and the promise of market disruption meet excess capital.”

Can’t argue with that. Humans love investment manias, and we tend to gin up a new one every decade or so. And Porter clearly believes we’re in an “AI Bubble” now, which may well be true, though nobody knows how inflated it might become before money stops getting pumped in… or whether it will pop or deflate slowly.

So the loooong lead-in of the ad is basically, “this is another bubble like we saw in 1999-2000, and you oughtta stay away from tech stocks and buy something cheap instead.” And unusually enough, this is not a subscription that Porter’s selling this time, he’s just selling a package of his “Big Die Up Reports,” also called “Trade of the Decade” reports, for $199 (no refunds), though it looks like those reports are probably all things that were already shared with his The Big Secret on Wall Street This Week ($1,425/yr) subscribers at Porter & Co. (including at least one that we’ve covered before). The reports being pitched this time are called “Dirty Energy Fortress,” “Next LNG GIant” and “Better Than Buffett”, and we’ll get into the details of what’s being touted by each report in a moment.

Here’s where the recommendation gets more specific…

“While AI and tech firms are grossly overvalued…

“There is one sector that is massively undervalued.

“It’s out of favor, and has been for years, but if you’re willing to go against the crowd, there are outstanding opportunities for you to build generational wealth.

“I’m talking about once-in-a-decade opportunities.

“In fact, the last time the set up was this ‘perfect’ was in the late ‘90s.

“As investors got swept up in the mania of the internet boom, they ignored other ‘old economy’ sectors.

“By the peak of the Dot Com bubble, these ‘old economy’ companies were at historically cheap valuations which were the inverse of the overvaluations in tech firms.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“Case in point, at the peak of the mania, the tech sector was trading at a price to sales (P/S) ratio of 7 and a price to earnings (P/E) near 60.

“The energy sector on the other hand was trading at a P/S near 1, and an average P/E well below 20.

“When the Dot Com Bubble burst there was a massive ‘mean reversion’ that resulted in energy stocks exploding in value.

“Energy stocks not only outperformed tech stocks but also the broader market for most of the following decade.

“Investors who had been buying energy stocks at their historically low valuations (while everyone else poured into overhyped and overvalued tech stocks) made fortunes.”

So the big picture story about manias and obsession with hot new ideas, whether that’s barbed wire for the beef industry on the frontier or NVIDIA chip for AI projects today, is all pointing at making a contrarian bet on “old economy” energy stocks now. Here’s how Porter puts it, also pulling in a Buffett reference:

“The stage is now set for a similar opportunity.

“Except this time, the returns could be even greater.

“In fact, I believe it’s one of the greatest investment opportunities of the last decade. And I’m not the only one, Warren Buffett has spotted this unique opportunity too….

“Buffett’s total cost basis for Coca-Cola was $1.3 billion.

“And he started buying Apple in 2016 and bought $6.7 billion that year.

“Coca-Cola and Apple are right at the top of his signature stock picks and best performers.

“His energy investments in 2020 were over $29 billion.

“And this year he’s continued to load up on energy stocks with news of a $3.3 billion takeover of Cove Point LNG – a gas export terminal in Maryland.

“Buffett knows supply and demand in the energy market hasn’t been this favorable since the 1970s.

“Not only is the energy sector inexpensive relative to technology firms. It’s incredibly cheap on an absolute basis as well.”

That at least tells us that this is a new pitch being made by Porter, not another rerun, since that Cove Point transaction happened just a few weeks ago (Berkshire Hathaway Energy has been running Cove Point for years as a 25% owner, but they bought out Dominion’s stake on September 1 to bring their ownership to 75%… in case you’re curious, Brookfield owns the remaining 25%. It’s a nice and cash-generating facility, albeit pretty small compared to the newer LNG export terminals in the South, and it’s the only meaningful LNG export facility on the East Coast, so the Marcellus producers long for it to be expanded, but that seems unlikely given the antipathy for natural gas projects in the region and the longstanding worries about huge LNG tankers in the fragile Chesapeake Bay, right next to the Calvert Cliffs nuclear power plant).

But anyway, back on track…

Most of Porter’s argument is similar to what we hear about “clean energy” all the time, and it’s mostly pretty logical…

“Recent research has shown that after two decades of intense support for increased renewable energy …

“The proportion of energy provided by these ‘clean sources’ went from a paltry 13-14% to… get this… 15.7%.

“That’s after global investment and spending on these clean energy solutions hit an estimated $1.4 trillion in 2022.

“Furthermore, reports show if all governments – yes, all of them – deliver on their current climate policies, the world will still only derive 28% of energy through renewables by 2050.

“The timeline to 100% clean energy?

“2207!

“Almost 200 years from now.”

And it’s true that investing in and expanding “fossil fuel” or “dirty” energy production are politically unpopular as folks worry about emissions and pollution and look for ways to reduce atmospheric carbon, so that does set up a logical investment story: If you won’t invest in “old” energy, but are likely to still depend on oil and gas for decades as “clean” sources of electricity take a long time to chip away at that market, then production won’t climb fast enough to meet demand, which means that “old” energy companies should make a lot of money. They can’t or won’t invest in expanding production, but demand will remain high, and supply and demand are still the most important drivers of economic returns. That could shift, of course, if priorities shift or new technologies change the dynamic, but that’s at least one reasonable way to look at things today. Here’s how Porter puts it in the ad:

“Goldman Sachs reports oil and gas firms are investing 40% less of their cash flow than they have done in their long-term history.

“Natural Gas Intel shows how capital investment into new oil and gas production has plunged in recent years.

“This has created huge supply-demand issues.

“Opening the doors to what could potentially be the investment opportunity of a lifetime.

“Not only has progress in the “old” energy sector been suppressed due to years of anti-fossil fuel propaganda and activist pressure…

“But investment in new facilities, new exploration, new drilling, and new infrastructure has been at all-time lows.

“Right at a time when the world economy needs more energy than ever before…”

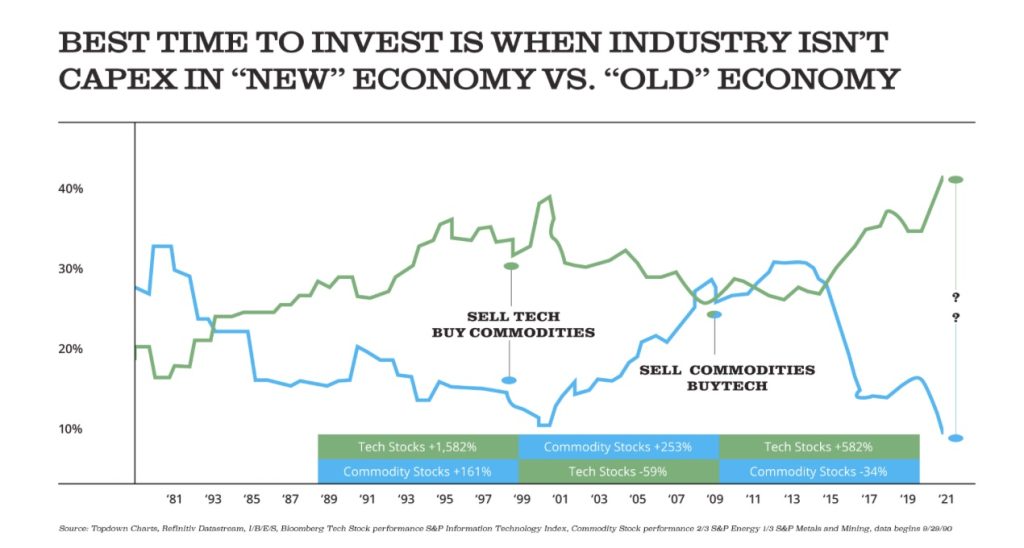

And he sums up the attractiveness of energy by highlighting the cycles of “old economy” and “new economy” investment over the past 40 years with this graphic…

So what does he think you should buy? Here are the hints…

Dirty Energy Fortress

“The first opportunity is a dirty energy ‘fortress.’

“It’s a tremendous opportunity to capitalize on the repeated failure of woke, modern energy policies….

“… we can invest in this unique ‘energy fortress’ that is priced at near-historic lows… and has potentially colossal upside potential in the years ahead.

– It holds a near-monopoly on one ‘dirty’ fossil fuel.

– It generated $1.6 billion in free cash flow over the last year.

– It will be essential to the global economy in the years ahead.

“Better still, with the supply and demand characteristics of the energy markets at perhaps the best they’ve ever been, this company is looking at years of growth.”

The ad says that this “fortress” has a 25% free cash flow yield, and has a subtitle, “Coal Rushes into the “Green Vacuum,” so presumably this particular “dirty energy” is coal.

Which is, I’ll agree, the dirtiest of all the major energy sources, and the worst polluter out there. One area where Porter and I might agree is that we’ve missed a HUGE opportunity to clearly endorse natural gas as a much “cleaner” transition fuel than coal, and push for global cutbacks on coal by aggressively increasing natural gas production and exports. That would probably save more lives and improve global health much more than hoping that solar and wind can gradually eat into coal’s market share… and there are inklings of that working in some places, including here in New England to some degree, where we’ve closed pretty much all the coal plants, but here in Massachusetts we have also pushed back probably too much on any expanded natural gas pipelines, so, as offshore wind projects are slow to get built, we’re desperate to get Maine to allow new transmission lines to bring hydroelectric power down from Quebec.

Sadly, insanely partisan politics on both sides have kept the focus always on “win no matter what,” not on “what’s the rational way forward,” so there never seems to be a long-term plan. And to be clear, we have nobody to blame but ourselves — we’re the ones who vote only for idiots who promise the impossible (Lower taxes for you! And more spending on your favorite things! And we’ll say mean things about people you disagree with, but will never hurt your feelings or tell you you’re wrong!). Energy production is tough and expensive and impacts every business, but also impacts every individual, globally, at the very basic levels of health and safety. Smart energy policy requires compromise.

Sorry, back on track. What’s this coal “fortress?” Thinkolator sez Porter must be pitching Peabody Energy (BTU). Peabody is mostly known in the US as a Powder River Basin producer of thermal coal, and that’s where most of their tonnage is mined, but it’s actually a pretty small chunk of their revenue and earnings (less than 10% of EBITDA last year). Peabody also produces thermal and metallurgical coal in other regions of the world, including a lot of seaborne coal exported from Australia to Asia, which is where they get much higher revenue per tonne — only about 40% of their revenue comes from customers in the US.

Peabody is one of the largest publicly traded US coal companies, and arguably the one with the most diversified business within coal, but there are about a half-dozen companies of pretty similar size, including Alpha Metallurgical Resources (AMR), Alliance Resource Partners (ARLP), Warrior Met Coal (HCC) on the metallurgical coal side, who sell more coking coal to steelmakers, and CONSOL Energy (CEIX) and Arch Resources (ARCH) on the thermal side, who sell more thermal coal to power plants. Those companies are all in the $2-3 billion range for market cap, and they all have high levels of free cash flow (the most expensive of them trades at about 5X free cash flow), but Peabody is the only one that has generated $1.6 billion in free cash flow over the past year, so that’s our best match. Second place in terms of free cash flow isn’t very close — that would be Alpha Natural Resources, with just under $1 billion.

Will Peabody Energy do well? Maybe. They’re certainly cheap — with a trailing PE of under 3 they’re arguably the cheapest of the big US coal companies, though there are no “expensive” stocks in this sector, just about all the big companies have a PE ratio in the 3-5 range. They’ve all got pretty manageable levels of long-term debt relative to their current cash flow, and these are all businesses that look pretty appealing if they’re sustainable.

They’re all expected to shrink, though, so that’s the challenge. Maybe Porter will be right, and the best coal miners have decades more growth left in the tank, but that’s not the assessment of analysts right now — all of these companies are forecast to see falling revenue and earnings over the next couple years. They’ve all got many fewer analysts following them than they did a decade or two ago, to be sure, and I doubt the best and most insightful analysts are getting assigned to the coal companies right now, since that’s probably perceived as a dead end “cigar butt” of a business, so maybe we shouldn’t put much weight on those estimates… but that’s the Wall Street Consensus today: Coal stocks are cheap because their business should shrink over time, and because lots of investors, including big institutions, don’t want to be coal investors.

Sound like an opportunity for you? Jump right in. I think natural gas is a more appealing commodity, as an investor, since there’s no real shortage of coal anywhere and the air pollution profile for coal is so much worse than natural gas, but we’re probably not all that close to really getting rid of coal even in the US, let alone places like China and India that are still importing tons of it, and there’s also a baseload level of metallurgical/coking coal production from many of these companies (most coal companies produce at least some coal for both markets), so I can see why some would be interested in coal as a contrarian play. It’s easier to supplant coal in power generation than it is to do large-scale steelmaking without coking coal.

Better than Buffett

What else does Porter pitch? His second hinted-at idea is a “better than Buffett” recommendation…

“Warren Buffett has been investing in energy like never before.

“He’s been adding to his Occidental Petroleum holding hand over fist and just completed a $3 billion takeover of a Maryland-based LNG export terminal.

“Now you can buy what Buffett is buying, and you’ll likely do very well.

“However, Occidental is a mega-cap stock. And it’s no secret that Buffett loves it. Which, of course, limits its upside potential.

“So while OXY remains a great investment, there is a secret to potentially making far greater profits in energy companies. And I’d bet not more than 1 in 1,000 investors knows about it.”

So what’s this “secret?” The short answer is, “royalties”… here’s how Porter puts it…

“What legendary oil man, T. Boone Pickens, taught me remains one of the best ways to take advantage of this.

“It’s a special way to turn a capital-intensive business into a capital-efficient one.

“The key to understanding these businesses is that they don’t have to pay any of the production costs or take any developmental risks.

“They own the mineral rights, and all capital and operating expenses lie with the operator.

“And that means, as inflation continues to drive energy prices higher, the mineral rights they’ve acquired in the past become more and more valuable.

“These royalty companies can make investing in oil and gas much safer.”

No argument there, I do loves me some royalties. Which ones does Porter like these days?

“This briefing features two energy royalty companies that we have circled for outsized gains…

“The first is, in my opinion, the best oil and gas royalty company in the energy sector.

“It’s one of the most capital-efficient businesses you’ll find anywhere, with 80% free cash flow margins.

“It currently trades at a 15% free cash flow yield – the best valuation since the COVID-19 pandemic – meaning it’s in the perfect buying window.

“The second is one of America’s largest natural gas mineral owners, with an asset base spanning 20 million gross acres across 41 U.S. states.

“Its capital-efficient royalty model converts over 60% of revenue into free cash flow, and the company is enjoying rapid growth due to rising U.S. LNG exports.

“It has a pristine balance sheet with no debt, pays a 12% yield, and trades for less than 9x free cash flow – providing you the potential for considerable income and appreciation.”

Well, there are some interpretations that go into computing “free cash flow yield,” so we can’t be 100% certain about this… but I suspect that Porter is probably re-pitching the “royalty” owner he touted last year, Viper Energy Partners (VNOM), which is trading at its highest free cash flow yield since 2020 right now, probably mostly because of the price gains in oil last year still trickling through on a trailing basis. Right now, this mineral interest owner in the Permian Basin, which was basically spun out to own the mineral interests that are being produced by Diamondback Energy (FANG), is, at $28, about in the middle of the trading range it has been over the past 18 months. The variable dividend is way down from the Russia-driven peak in 2022 (the highest quarterly dividend was 81 cents, five quarters ago), but at the current quarterly payout of 36 cents, assuming they can at least maintain that thanks to rising oil prices, the yield would be about 5%.

If you want more info on VNOM, I covered it in more detail last time Porter pitched it, as part of his long-running “Gods of Gas”/”Boston Blackout”/”Two Men Destroying America” teaser campaigns. If you like the idea of owning a Permian Basin royalty company, I certainly like VNOM much better than the oft-promoted Permian Basin Royalty Trust (PBT), just because PBT is mostly reliant on a net profits interest on their most important property, not a top-line gross revenue royalty, and that has sucked up most of their potential revenue to cover the operator’s drilling costs this year. Gross royalties are great, but “net royalties” aren’t even really royalties, in the way most of us think about that concept, and can sometimes be a trap — especially when the royalty owner, as a passive participant, doesn’t have any control over the capital expenditures budget.

And the second one? That must be my favorite energy royalty company, Black Stone Minerals (BSM). They certainly have the largest footprint, which is why they match this clue perfectly — they do own mineral rights in 41 states, including pieces of most of the major producing basins in the country, and they are levered to natural gas over oil (which has been a negative recently). The current dividend yield is about 11%, at the latest 47.5 cent quarterly rate, and the dividend can go down as well as up, but management has publicly been pretty confident that they’ll be able to maintain the dividend as new natural gas production starts up on some of their mineral lands, particularly in the Haynesville Shale. And yes, as teased, they do not have any debt on their balance sheet — though that’s not a huge differentiator, most of the oil and gas trusts and royalty companies don’t carry much debt (though VNOM does have some long-term debt).

I like BSM, and that would be the first energy royalty stock I’d buy these days — though I’ve also got some conflict of interest here, since I own call options on BSM that expire in a couple weeks, so, to be clear, I’d be better off if y’all bid up the shares right away. I do not yet own the stock outright, though I might exercise some of those options as we approach expiration, depending on how the pricing shakes out. I’ve written about BSM several times this year if you’d like more background, most recently when it was teased by both Alexander Green as the “#1 Royalty in America” back in June, and by Whitney Tilson as his “Chaffee Royalty” play in July. The story hasn’t changed meaningfully in the past few months, but we should get both the next dividend declaration and their next earnings update in late October.

What else is Porter recommending this time? It’s another repeat…

“The Next LNG Giant...

“Currently in the U.S, there are only 8 LNG export terminals.

“The newest is Venture Global’s Calcasieu Pass in Louisiana – and it is privately owned.

“There are, however, two other new LNG plants that are approved and currently under construction.

“And these are both publicly traded.

“One belongs to a partnership between super-major oil company ExxonMobil and Qatar. Called ‘Golden Pass,’ it’s located along the Gulf Coast at Sabine Pass, Texas.

“But the other new, fully-permitted LNG facility that’s being built is owned by a small company – a start-up, whose founder, as I mentioned, has experience building greenfield LNG facilities.

“This new company – known as ‘Driftwood’ in energy circles – has a unique business model that’s designed solely to serve international markets for energy.

“Its plan is to acquire natural gas wells in the Haynesville shale (in northeast Louisiana) and transport that production via pipeline to a new LNG plant it’s building on the Gulf Coast.

“The Driftwood pipeline and LNG plant is a $12 billion piece of energy infrastructure that has the potential to become one of the most valuable energy infrastructure facilities in the world.”

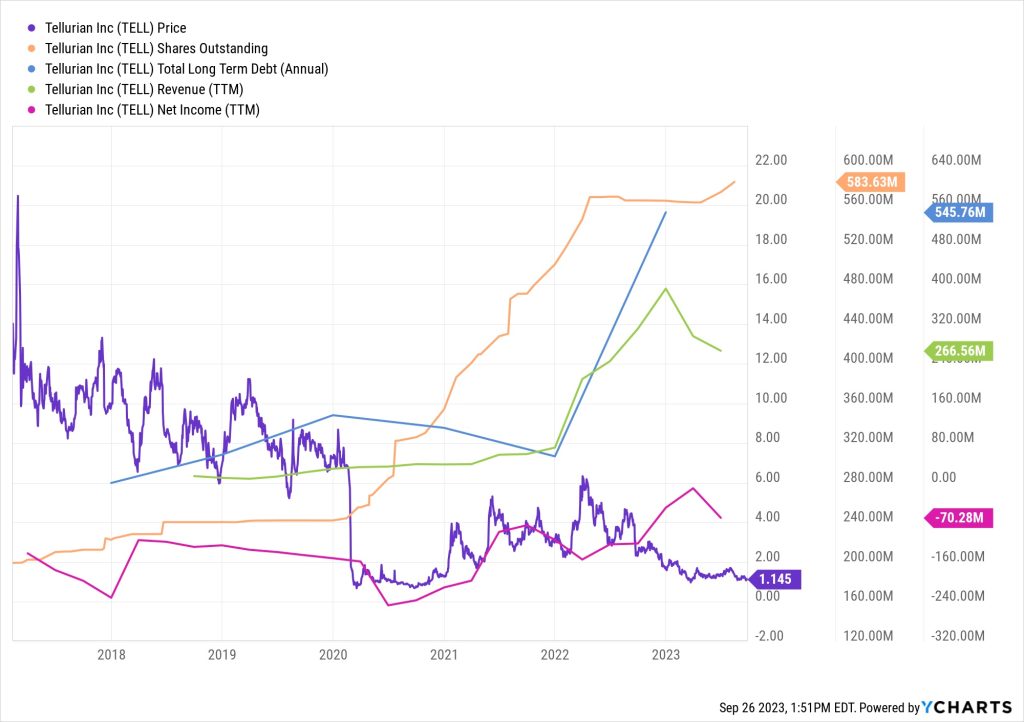

So yes, no real effort to keep this one a secret, that’s another tease for Tellurian (TELL) and its Driftwood project in Louisiana, which Porter has been pitching for over a year now as the “Next LNG Giant” — it’s been a very challenged business, mostly because yes, it is potentially a “$12 billion piece of infrastructure”… but the infrastructure doesn’t exist yet, for the most part, and they still have to raise the $10+ billion they need to build the facility. Their financing plans and offtake deals have mostly fallen apart so far, or become dramatically less enticing now that interest rates are much higher than they were for the first several years of planning.

Porter does admit that this is a speculative stock… in his words:

“It’s going to be financed, in part, from its own natural gas production.

“And, most likely, the project will be purchased, even before it’s completed, by a super major, like Shell, which has spent 50 years developing LNG assets all around the world.

“Such a deal could lead to huge profits for investors in a very short amount of time.

“However, this is still a very small company. It is speculative. And I only recommend buying this firm if you’re willing to accept a lot of volatility.”

But he thinks the “next big move” will be when they finally announce major funding for building Driftwood — which is sort of “under construction” right now, but is really in just the site prep phase, the big spending is on hold until they get some financing.

And they’ve gotten a bit more flexible with their funding plans as months have passed without a deal this year, so they recently opened up their potential future offtake sales to companies who aren’t interested in funding the capital project, presumably in hopes of getting any kind of “win” and refilling their potential order book (some of their original offtake partners have also given up and canceled their deals). Yes, Tellurian does have some natural gas production, but even if gas prices eventually recover it’s nowhere near enough to help finance this massive capital project, that’s much more of a looooong term plan (they have bought up natural gas production mostly because they’re hoping to capture more of the profit, liquefying their own gas for export instead of having to buy it in the future).

Porter says, “I believe this company will be worth at least $100 billion in ten years,” and that’s been his consistent message over the past year or so that he’s touted the shares. That would probably also entail selling a helluva lot of stock to help with financing the project (they’ve roughly doubled their share count over the past three years, just to get construction going at all and build up their portfolio of natural gas assets in the Haynesville Shale), but there’s still certainly room for the share price to rise if they are able to move forward — the stock right now, at about $1 per share and with a $600 million market cap, is really pretty much a levered option on the possibility of the Driftwood LNG project being fully built out and eventually becoming profitable. So if you think LNG export is going to become a much bigger business, and that Driftwood’s odds of success are pretty good, it may be a reasonable speculation — but it has certainly been trying investors’ patience for a long time.

For those of you who don’t mind a flashback, Tellurian came public through what was essentially a reverse merger with Magellan Petroleum back in February of 2017, and was very aggressively promoted by some newsletters, particularly Kent Moors over at Money Map Press, in 2018 and 2019. The mantle was then taken up during the brief LNG boomlet following the invasion of Ukraine last year, by both Porter in July or August as he ramped up his “Gods of Gas” campaign, and Whitney Tilson starting in September. So far, it’s been a stinker… that’s the share price in purple, down from $10 in 2018 and a few dollars last Summer to about a buck now, and the you can see part of the reason why — they do have a little bit of revenue (green) thanks to their Haynesville gas production, but not anywhere near enough to be profitable as they plan for and begin to build Driftwood (“net income” is that negative number in pink), and they’ve been ramping up their debt (blue) and selling a lot of shares (orange) to finance their early Driftwood work and keep the lights on.

Maybe that changes if and when they get some real financing help with Driftwood, and it could even change dramatically. When or if that will happen, I dunno. High risk, high reward — the only real comparison project in the US is Cheniere’s Sabine Pass LNG export terminal, which finally got its financing deal in 2012 and made its first shipment in 2016. That was also run by Charif Souki, the man behind Tellurian (after Cheniere’s board effectively booted him years ago), and this is what Cheniere’s share price looked like starting a year before that 2012 financing agreement, when it had a similar market cap to Tellurian today (roughly $700 million), and ending a year after the first LNG was exported from the facility:

So that’s something to hope for, at least.

Wait, we’re at the end?! I thought we were supposed to talk about AI again!

Sorry, maybe next time.

Thoughts on this “buy old economy vs. new tech?” Agree with Porter that energy stocks have the best risk-reward setup these days, whether or not you’d pick the same exact stocks? Let us know with a comment below… thanks for reading!

Disclosure: of the companies mentioned above, I own shares of Berkshire Hathaway, NVIDIA, Brookfield Corp. and Brookfield Asset Management, and October call options on Black Stone Minerals. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

Thanks, Travis! Always awesome!

Charles Mizrahi is pushing hard on his “The Perpetual Customer Engine” stock lately. You inspired me to do some sleuthing on his clues and the stock he is pitching for his big reveal on Thursday, Sept 28th is Shopify (SHOP).

Adam O’Dell, at Money and Markets, has been pushing hard selling his new service. The clues he gave out for one of the 10 stocks points directly to Beazer Homes USA inc (BZH).

Thanks youwannabet! Always nice to get more teaser solutions out there…

Argh! Mizrahi’s final pitch changed the clues quite a bit and they no longer fit with Shopify (SHOP). The “Perpetual Customer Engine” stock in Fastenal ( FAST) which really fits the final pitch video clues.

Sorry to everyone who read my previous comment.

Thanks, Travis for weeding through all the lines of words that Stansbury puts in their touts to sell their newsletters. Peabody’s dividend is too low for me to consider a buy on it. Its price may go up a few bucks in a few months, but not enough for a buy.

travis will you tell us what is the small Illinois-based tech firm that’s powering AI’s next great leap…

Who’s teasing that one? Doesn’t ring a bell, would need a copy of the ad or some more clues…

Explosive Candidates: Five Stocks Set to Soar up to 1,000% or More… is being touted by Quantum Edge Pro. Any idea what the 5 stocks are? Many inquiring minds here wish to know!

Porter just snagged one of the Stansberry editors for health- Tom Carroll for a new “Partners only” publication Activist Investing and held a one-hour pitch Monday, with 2 must have recommendations TBD for Travis to investigate! I believe one is health care related and the other retail.

I suspect more former Stansberry types (Scott Garliss is already there) will morph to Porter and Co now that he is back as a board member on Marketwise.