Looks like Porter Stansberry is getting some traction with his new publishing company… he’s at least catching the attention of Gumshoe readers, according to my inbox, since folks are asking about his new “it’s like Treasuries on steroids” teaser.

This isn’t a big promo — not yet, at least — but it looks like Porter’s marketing strategy these days is to send out free articles that start to tell the story… and then cut off right before he’s about to discuss the specific investment he likes, with the name and details reserved for the paying subscribers. The letter he’s selling is The Big Secret on Wall Street ($1,000/yr, 30-day refund period), which is the first (and so far only) paid newsletter from Porter & Co.

So… can we ID which stock he likes here and discuss it among ourselves? Let’s see… this is how he introduces the tale:

“The REIT we’ll introduce today offers an extra degree of safety. It avoids physical real estate properties entirely, and instead invests primarily in mortgage securities that are effectively backed by the government. And they’re a better buy than government bonds.

“Poor People Have Welfare, Social Security and Medicare: This Is The Dole for Rich People”

Most of Porter’s free lead-in to his stock recommendation is basically an argument that the market is still very risky — that there’s a high probability that the market’s minor decline last year was not enough to burn off the speculative excess of the bubble, and we’ve got more scary times ahead. He notes a few key points — that valuations are still very close to all-time highs, if no longer at the wild extreme of 2021, that past gigantic bear markets all had a “false recovery”, like the bounceback we’ve so far seen this year, that our still-very-inverted yield curve is a recession signal, and that economic indicators remain worrisome, including the ongoing contraction in the U.S. manufacturing sector that is indicated by falling PMI numbers.

More from Porter:

“Deceptive whipsaw rallies aside, we remain firmly in Camp Recession (and, we’d like to think, Camp Common Sense) at Porter & Co. And that means adding defensive names to the portfolio….

“The REIT we’ll introduce today offers an extra degree of safety. It avoids physical real estate properties entirely, and instead invests primarily in mortgage securities that are effectively backed by the government. These securities have zero default risk – they’re as good as Treasury bonds, since they’re backed by the full faith and credit of Uncle Sam.

“And they’re a better buy than government bonds. Today, Treasuries will generate a yield of around 4%, while this REIT’s government-backed mortgage portfolio offers a staggering 15% yield.”

That’s the extent of the “tease” this time… so what’s our stock?

Thinkolator sez this is almost certainly Annaly Capital Management (NLY), the Dean of the Mortgage REITs.

And yes, it is a fairly simple business — it hasn’t been terribly popular in recent years, because it was somewhat hard for them to make a profit when mortgage rates kept falling and all interest rates were near zero, but it’s simple: They buy portfolios of mortgage-backed bonds, specifically Agency bonds (meaning, those that are created by government agencies, like Fannie Mae and Freddie Mac, and therefore carry an implicit government guarantee… if not an explicit one), and they lever those bonds up by borrowing money. The yield is currently very high, roughly 15%, and the dividend, 88 cents per quarter, has been steady for a couple years (it was cut in 2019 and 2020).

Annaly is by far the largest publicly traded mortgage REIT, with something like $80 billion in mortgage bunds in its portfolio (their market cap is around $10 billion, so that’s what we mean by leverage… that’s what allows bonds with themselves have a yield of ~3% to create enough cash flow for Annaly shareholders to cover a 15% dividend). They juice those returns a little bit by investing in some ancillary stuff in the residential finance market, including some non-Agency residential mortgages and mortgage servicing rights (the company that manages the actual mortgages gets to keep a little sliver of the interest paid), but those are a very small slice of the overall portfolio.

The REIT has been through some major swings in the market, and management has been somewhat flexible in shifting their strategy over the years, including the way they hedge their interest rate exposure, but the basic strategy is that they borrow short-term money at low cost, and use that to buy long-term guaranteed returns in the form of mortgage bonds.

The obvious risk is that they need a meaningful gap between what it costs them to borrow money to buy securities, and what they can earn from their portfolio of mortgage-backed securities. Right now, the risk seems to be that their borrowing costs should be rising, since short-term rates have been rising very fast, and that means their rate hedging and their portfolio shuffling have to adjust to higher borrowing costs and higher-yielding mortgage bonds.

For many years, as I’ve watched Annaly from a distance, the biggest challenge was that mortgage bonds kept getting called early because rates were pretty continuously falling, and people were either refinancing or moving and therefore paying off their older mortgages, which meant that Annaly had to buy lower-yielding mortgage bonds to replace those repaid bonds.

Today, the problem is different — nobody is refinancing anymore, and rates are meaningfully higher than they have been in a very long time, so the older bonds should be steady and keep paying, and on that front it’s a great period for them because prepayments will probably be extremely low… but Annaly does still have a lot of 2-3% mortgage bonds in their portfolio, even as they try to “manage through volatility” by gradually selling off some of those bonds (at a loss) and buying more of the higher-coupon bonds that are available in the market now. Even if you don’t think about the leverage aspect, those bonds are losing value fast.

The most dramatic impact of rising rates has been on Annaly’s book value — a mortgage bond they held a year ago, with a 2.5% yield, is worth a lot less today because the prevailing rate, for a new Agency mortgage backed security (MBS) today, would probably be about 5.5% (30-year mortgage rates are currently a little over 6%). That means, if you need to sell your bond today, that you’d be selling it to someone who will insist on a much lower price in order to get a fair yield to maturity. That $1,000 mortgage bond issued a few years ago might get a bid of only $800 if you had to sell it today, and that’s how Annaly has to calculate its book value… so although they have been able to keep their “earnings available for distribution” fairly steady ($1.06 per share last quarter, ranging from $1.11 to $1.22 over the past year), their portfolio has suffered. The book value per share was around $33 in mid-2021, and dipped under $20 last quarter (those numbers are from September, so they seem awfully stale today — they will report their fourth quarter this week, on Wednesday evening).

The challenge, then, is what happens when your portfolio falls in value… but you also have to keep borrowing money to cover the cost of that portfolio. The market for mortgage-backed securities is huge and extremely liquid, so Annaly has been able to finance their portfolio using mostly repurchase agreements (repos), which are best thought of as short-term collateralized debt, and as of September half of that repo financing was extremely short term, maturing in less than 30 days. The good thing is that they’ve hedged pretty much the whole portfolio… the bad thing is that their leverage is back up to 7X now, so the most important thing for an Annaly investor is that you have to have either a clear understanding of their balance sheet and the vicissitudes of the MBS repo market, or you have to take on faith that they are conservative with hedging their portfolio and managing their borrowing costs and duration in a way that probably won’t blow up.

So I’ve got to be honest here: my eyes start spinning on about page six of their investor presentations, their hedging and portfolio management is too complex for me to really think I can give you a rational analysis of how much risk there is as they increase their leverage and probably earn a lower margin on their growing portfolio. I’ll just walk through how I think about Annaly, in hopes that it will give you some perspective.

Their portfolio is funded by about $9 billion in equity (that’s the shares, NLY), another $1.5 billion in preferred equity (there are several preferred tranches, they all trade close to par and yield 8% or so, much less than the common equity dividend yield right now), and another $9 billion in traditional debt — their own bonds, securitized borrowing, etc. That part is pretty easy, but it’s also not all that profitable — that could fund a portfolio of about $20 billion in bonds, with roughly 2X leverage, so the best you could hope for as net income or distributable earnings from that would be a yield that’s a little bit above the yield from the current mortgage bond portfolio that Annaly owns, so maybe something in the 4-6% range if the traditional debt can be financed at a decent rate (their average yield from their portfolio of mortgage bonds, almost entirely 30-year fixed rate mortgages, was about 3.5% in September).

"reveal" emails? If not,

just click here...

The harder to understand or predict (and much more profitable) part is that most of the rest of the portfolio, $50+ billion, is effectively financed using short-term repo lending. So it looks like the real profit engine of this company is borrowing $50 billion at very low rates for very short periods of time (average overall funding cost was about 2% last quarter), and using that short-term borrowing to buy 30-year mortgage-backed securities. As of September, the yield on those mortgage bonds was averaging about 3.5%, with the newer ones they’ve bought yielding over 5% but some older ones less than 2.5%.

When they report this week, I assume the repo funding costs will be much more expensive, because short-term rates in general have spiked. I’m no expert on MBS repo, but it would make sense to me that these repo loans should pretty closely track other very safe short-term borrowing rates. In the third quarter, the 1-month Treasury Note went from about 1.25% to 2.7% (Annaly said their average GAAP cost of borrowing was 2.38% for that quarter, and the average economic cost was 1.54%)… but in the fourth quarter, the 1-month Treasury Note went from 2.7% to 4.1%… and has kept rising, so as of today it’s 4.6%. If Annaly’s repo borrowing rate grew that fast, it’s almost impossible for them to have refreshed their mortgage bond portfolio enough in one quarter to keep up with that — if they got rid of the old 2-3-4% mortgage bonds in the portfolio, they would have had to sell them at a loss to replace them with the newer crop of available 5-6% bonds. Since they have been very active with hedging, they may well be fine… but you’re betting on their ability to hedge, not on a nice clean net margin between the income from their bonds and their cost of borrowing.

Even though Annaly is probably better at managing shifting rate environments than most, it seems like they’re in a challenging environment right now. The average yield will probably go up on their portfolio of mortgage-backed securities (in September it was 3.5%), but will it go up fast enough to keep up with rising repo rates? How much will their hedging protect them if it doesn’t? So far they are holding up OK, they have kept their return on equity strong by using more leverage as their net interest margin shrinks a little… but that’s why I come down to this being a faith-based decision. Do you have faith that Annaly can continue to manage this volatile interest rate environment and continue to provide a strong return for shareholders, either by hedging or by increasing their leverage to maintain their net yield? Might they get lucky and see a stabilization, with short-term repo rates staying low and mortgage rates persisting at a higher level?

I don’t know. If I were to buy a traditional mortgage REIT, it would probably be Annaly, they’ve been doing it the longest and have generally been good at managing during past cycles, so it may well be a decent bet that they’ll keep that up, and the dividend yield is extremely high right now, so that does help… but they’ve only been around for 25 years or so, which means, like most of the rest of us, they’ve been through a major financial crisis and a couple crashes… but they’ve never seen a world of persistently high or rising interest rates, or a yield curve that stays inverted for a long time.

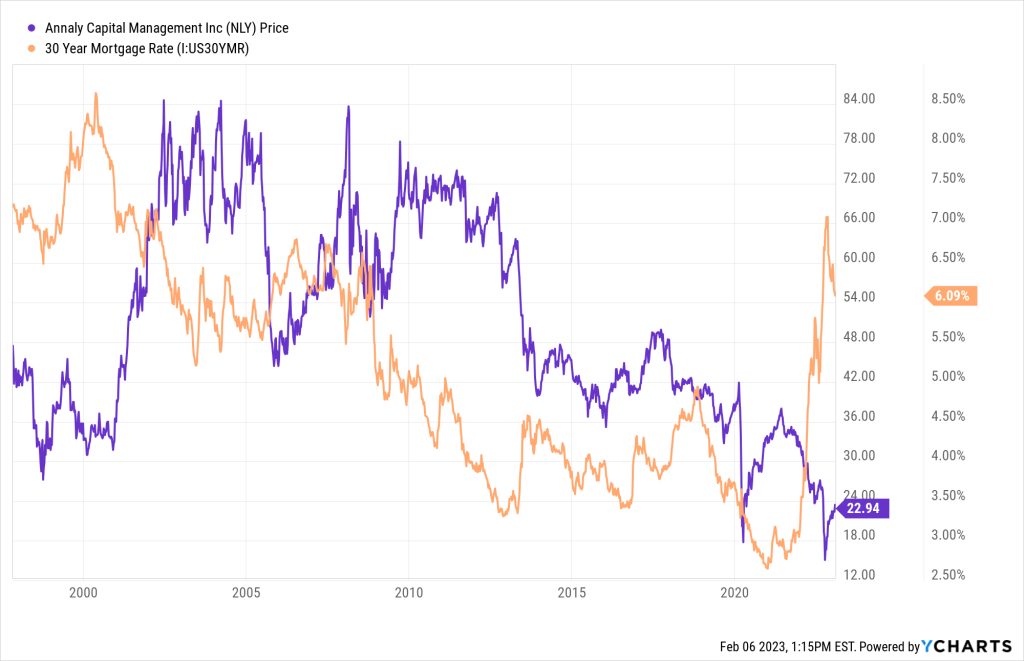

Here’s what Annaly’s share price looks like going back to when they went public in the late 1990s… that orange line is the 30-year mortgage rate, so you can see that the periods of time when mortgage rates fell were positive for them, but the periods when rates rose (like the sharp increase in 2013) were generally negative. The market really ceased to have any meaning when rates went to zero, and COVID had a big impact as well, but the recent spike in interest rates has actually not had quite as negative an impact on the share price as I would have guessed.

For another perspective, here’s the 30-year mortgage rate (in orange) compared to the dividend yield for NLY shares…

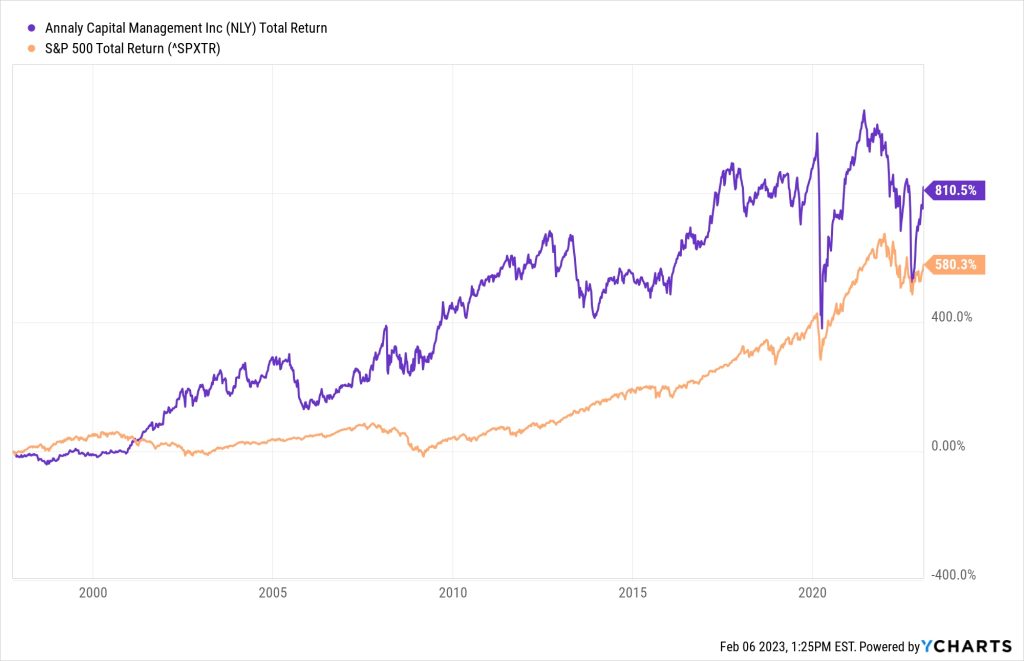

But this is the chart that probably keeps people coming back — through several upheavals in the mortgage market, and a couple waves of interest rate changes, Annaly has generated a very strong total return for investors. This is the total return for NLY since the IPO in 1997:

And it’s certainly possible that the current level of interest rates will work out for NLY shareholders… this is that same chart, but starting instead in January of 2006, which was the last time rates were similar to what we see today — back then, as now, the Fed Funds rate was at 4.5% and rising, and the 30-year mortgage rate was at about 6%.

The world has changed a lot in those 17 years, of course, but one thing stands out — back then, we were just about to reach the blowoff stage of the housing bubble, and investors were willing to buy NLY at a dividend yield of 8%. Today, investors are far more worried about NLY, relatively speaking, and they’re insisting on a 15% yield to buy the shares. Maybe that means it’s a less-loved story, and a bit of a contrarian buy… which is probably a good sign.

Today it’s a pretty cheap bet, on a yield basis. Annaly briefly spiked to a 20% yield a couple months ago, but the current 15% yield, assuming they are able to keep the dividend stable at this level, is otherwise as high as it has ever been… but it’s also, thanks to the fact that lower-coupon bonds lose value as rates rise, been suffering through a pretty long period when the book value has dropped substantially. NLY shares have sometimes traded at a discount to book value, but today they’re at about a 15% premium. Which, coincidentally enough, is also where they traded 17 years ago.

Really, it’s just that question of faith… we’ve really never seen an interest rate regime that changed as fast as this one, and neither has Annaly management, so you have to have faith that they know what they’re doing. We’ll learn a little more on Wednesday afternoon, when they report their fourth quarter numbers, and I’ll be really curious to see what their net margins look like then… but it will still be a bet on their ability to manage and hedge a large and increasingly levered portfolio.

So… feeling confident in Annaly? Think it’s an attractive speculation as we head into earnings, near an all-time high dividend yield as interest rates (perhaps) begin to settle down a little? Too risky to buy this much leverage at a premium to book value? It’s your money, so you get to make the call… we’d love to hear what you’re thinking, though, and I know a few of you out there are happy long-term Annaly shareholders, so please do share your thoughts with a comment below. Thanks!

“…[Y] ou have to have faith that they know what they’re doing…” is exactly what I told myself when I doubled down on the largest energy company in the world at the time, Enron. The black box of mortgage bonds, with their tranches, io strips, synthetics, PPSs, CPRs, and half-lives are weapons in their arsenals. Not just Annaly, I did own them for a while, post 2008 crash, but this entire industry cannot predict the duration of the underlying notes. So, be like the guy in the Big Short, who said, “Now, explain this to me” (or rent the Wolf of Wall Street and have Margot Robbie explain it, because she did a pretty good job). Or be like the wise community banker Gene Stern of Chicago who said: “When am I going to get my money back? Nobody can tell me.”

There was an interest rate regime that more than doubled the going rates, in the late 1970s. The thrift industry, created to fill residential mortgage functions, funded their loans with the same types of shorter-term sources. By the end, around 1985, two-thirds of thrift charters had disappeared.

Well put, that’s the scary possibility.

Somewhat like the folks with money on the crypto platforms FTX exchange, 3 Arrows, Celsius, etc. massive interest rates given but one’s entire investment lost.

I do not understand how a serius an professional people like Porter offers this: ” This is what Porter offered then on a subscription “for life”: Your $99 renewal fee is due next month…

but here’s a way to get ALL of Porter’s

comprehensive research, for life, without having to pay for a subscription ever again…” And then appears in another Co with new services in the same field. Is this legal? He does not keep his word?

Lots of “lifetime” and “forever” stuff being sold out there… but if you look at the fine print, no matter how much they promote the guru as an infallible expert who will make you rich forever, you’re always getting access to a publication, not a person. And whaddya know, sometimes those publications change editors, or stop publishing, or people retire, or quit, or move to a competitor. I did a bit of ranting about this last Summer here, when Porter was starting his new company and Paul Mampilly’s departure from Banyan Hill caught my eye.

Guy is a criminal

I owned NLY some years ago. I’m a Stansberry lifetime member and also a member of other newsletters. I bought NLY based on Strawberry’s recommendation. Great dividend back then and now of course. But there was a big dip in price at one point, the loss about equal to the dividends I had received over a fairly long period. So, I decided to exit the position. I’m older and don’t want the risk you spoke of, especially in this crazy market! BTW thanks for your great work!

Same thing happened to me. Not interested to own it again for the same reason, my age/

Isn’t Porter a suspect in his best friends murder??? Should we be taking his advice?

NLY down 3.2% today. Guess Mr. Market isn’t a Stansberry subscriber.

You don’t get a dividend of 15% for low risk. OTOH, the total return was still good despite falling rates after 2006 but the Fed was buying MBS, essentially subsidizing mortgage originations.

Now they’re not and have indicated they will sell their holdings. That’s 25% of the MBS market coming up for sale.

The Fed’s actions alone will probably maintain or increase mortgage rates, and banks will probably get stricter on lending without the implied government backing.

30% of houses mortgaged in 2022 have less than 10% equity.

So that means for NLY that . . . Aw to hell with it. It makes my brain hurt. I won’t buy anything that I can’t explain to someone else and I definitely can’t explain NLY.

Wise words. I think they can probably handle the shifting long-term mortgage rates over time… it’s their own borrowing rates that would stress me out more. I’d be worrying about a shock all the time.

Though I guess I worry plenty anyway, and worry with a 15% yield is probably better than worry without it. 🙂

I’m just curious about how many received the Trade Smith “free” offer that costs over $11K. Did they send it to you, Travis?

Probably, but if so I haven’t read it yet. What’s the bait?

I’ve held NLY since around 2010. Lots of ups & downs. Some dividend cuts too. Overall I’m up on it. As someone wrote already, you don’t get big yields for free. You can make some money on it, depending on your style of investing.

That’s an impressive level of patience, well done. Even if it doesn’t end up working out for every position, being able to hold through that kind of ugly volatility is a great skill.

Travis, Did you get a chance to look at NLY’s 4th quarter numbers? please share your thoughts. Thanks.

https://www.annaly.com/~/media/Files/A/Annaly-V3/documents/Earnings%20Docs/2022/q4/q4-2022-presentation.pdf

My initial reaction was that their net interest margin is getting even tighter and they’re using more leverage, covering that dividend is getting more challenging… but they must be doing very well with their hedging, still, because the numbers are not as bad as I would have guessed. Will try to spend a little more time with it.

NLY a bit overvalued here. mREITs will have some nice runs after this mess resolves, they are great cyclical traders. RITM is the place to be ATM, with an estimated NAV of $11.75. better Mgmnt, similar div structure.