We got distracted for a moment by the grandiose promises made by Michael Robinson in his “invisible railroad” pitch yesterday… but now we’re back to look at more of those “insider” trades pitched by Alexander Green, as I promised earlier in the week.

The second special report Green teases in his Insider Alert ($1,295/yr, no refunds) ads is called “Make a Fortune From the #1 Royalty Company in America” … and this is how he teases it:

“I’ve uncovered a $16 energy royalty opportunity that’s got insiders in a buying frenzy.

“It is the largest pure-play oil and gas mineral and royalty owner in the U.S.

“It has leading positions in several of today’s most active resource plays.

“It has oil and natural gas interests in 60 productive basins in 41 states.”

And they to through the advantages of being a royalty company, which Gumshoe readers probably already know (we do love our royalties around here)…

“You don’t incur operating costs or have capital spending requirements.

“You benefit directly from technology advances that enhance recovery and well economics.

“And you can partner with operators to initiate or accelerate drilling.

“And its teams includes experienced land and business development professionals who attract development capital onto its more than 20 million acres.

“The company also employs skilled geotechnical staff to evaluate potential acquisition targets and develop prospects.

“And its significant exposure in southern Texas and Louisiana leaves it well positioned to benefit from this country’s growing liquefied natural gas exports.”

Since this is Insider Alert being teased today, we know the insiders are buying… but Green gets specific about those clues:

“Recent financials are top-notch. It’s riding record-high figures for its mining and royalty production.

“And the insiders here are loading up.

“SEC filings reveal that its CEO now owns more than 2.6 million shares. And he purchased 62,500 shares in February. And 31,800 more shares in May.

“And a director in the company bought 34,000 shares this year as well.

“You can hardly blame them. This company currently sells for less than nine times earnings and yields a whopping 11.6%.

“So now is the time to make your move…”

So what’s the stock, and what’s the story? This is Black Stone Minerals (BSM), which I’ve mentioned favorably a few times over the years (I currently own some call options on BSM, but do not own the stock).

And actually, Whitney Tilson was also touting this stock just a couple months ago as a “whisper stock” for his similar Empire Insider Alert, so I’ll mostly just update what I said at that time (there has been another quarter reported since, and the story has changed slightly)…

"reveal" emails? If not,

just click here...

So what’s the story with this company? Well, it’s not actually a corporation — Black Stone Minerals is a limited partnership, and therefore you’re not buying shares of stock, you’re buying units of a partnership. As a tax pass-through (like a MLP or a REIT), they essentially just pass through the partnership’s income and tax obligations to you, the unitholders.

There are lot of corporate structures like this in the energy business, both in passive trusts of various kinds and in the midstream and pipeline businesses that are often structured as master limited partnerships (like Green’s tease of Energy Transfer, a MLP, which we covered earlier in the week).

In essence, that means these often trade as income investments, so they’re sensitive to both interest rates and to the price of oil and gas (since the dividend depends on both how much oil and gas is produced on their lands, and on the price of that energy). The yield is high right now, the last dividend payment was 47.5 cents for the second quarter, and that’s been moving in the right direction lately, it was 45 cents a couple quarters ago and 40 cents a year ago… though it also drops sometimes, like when oil prices collapsed in the early days of COVID (the second quarter 2020 dividend was only eight cents). If the payment stays at this level, that would be $1.90 for a full year, which would provide a very nice yield of 12% at the current $16 share price. There is clearly some risk of the distribution having to be reset lower, however, that was a question on the last conference call and they’re right at the point where they’re already distributing essentially all of their cash flow, so they need production to kick up in some of their royalty areas, which is expected later this year, but things are obviously tight with oil prices down 12% this year and natural gas prices down 36%, and with the rig counts on their royalty lands dropped considerably from last year as producers cut back in the wake of falling prices.

Still, oil and gas prices are pretty steady over the last two months… and the company was fairly confident that they would be able to keep the distribution steady when they reported in early May… so it’s possible things will work out OK.

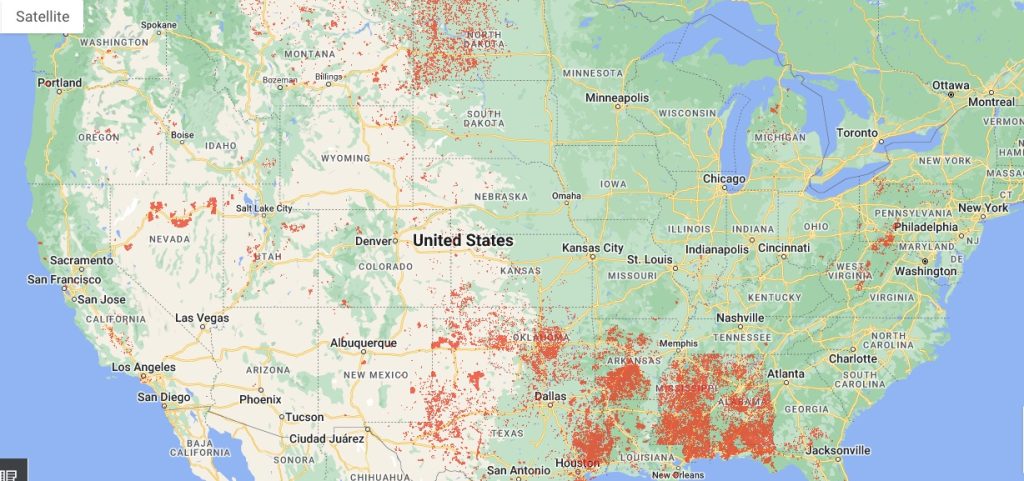

I mostly like BSM because of the geographic diversity of the mineral rights they own, with exposure to many of the big energy producing areas in the country, but, as you might guess when you see that there’s a big concentration in the Haynesville Shale in Louisiana, they do have substantially more reserves in natural gas than in oil… the red dots are their mineral interests, so there’s some Austin Chalk, some Permian Basin, some Marcellus, some Bakken, etc.

Back in February, CEO Thomas Carter, Jr. had this to say in their quarterly update press release:

“Our record fourth quarter results capped a very successful year for Black Stone Minerals. Without issuing additional equity, we reduced our total debt and increased royalty production through our organic growth efforts to attract additional operator capital to our existing acreage positions. The development programs on our Haynesville and Bossier Shelby Trough acreage continues to ramp up with Aethon as our operating partner. In addition, new drilling activity is continuing to increase across numerous operators on our East Texas Austin Chalk acreage. We enter 2023 well positioned to drive further royalty production growth while maintaining our very healthy balance sheet.”

And on May 1, in the first quarter press release, he didn’t moderate that too much despite the falling prices…

“We had a strong start to the year despite headwinds from weaker natural gas prices. We remain constructive on our long-term outlook and are encouraged by our development agreements with Aethon in the Shelby Trough and various operators in the Austin Chalk. As we continue to focus on growth in our existing assets, Black Stone is able to maintain the highest distribution level since going public.”

Other good news? They’ve done a fair amount of hedging for the next two years, to help make sure they get good cash flow from both oil and gas production, and they do have partners actively drilling on their lands to increase future production… they still expect production to grow on their royalty lands by about 5% this year, though it’s not growing yet.

And I like that they have also been pulling back from the net profits interest (NPI) deals they have with operators, so it’s going to be almost entirely (94%) “real” royalties that generate their revenue this year. A “real” royalty, to me, is a passive one, they just collect income and don’t have to do anything — with NPI deals, something a lot of mineral rights owners do to try to increase production, they would generally be responsible for their portion of the capital spending (drilling costs, etc.). NPI deals are a challenge that’s hurting Permian Basin Trust (PBT) right now, for example, since they have to pay their share of the capital investment before they get to collect the revenue, which is why their dividend started the year so low, but BSM has worked recently to offload those NPI deals to partners and remain more passive. They’re still more active than some royalty owners in other ways, since they actively try to recruit producers and make their land more attractive for drilling, and unlike Trusts they are able to actively buy and sell mineral rights, so they do some work… but they’re trying to avoid participating in the actual capital spending.

(That’s why I effectively bet against PBT when I was analyzing them following Marc Lichtenfeld’s pitch for PBT as his #1 Oil Royalty play a while back, and I hedged against that, in part by buying call options on BSM — that trade hasn’t worked to this point, by the way, neither PBT nor BSM have moved dramatically enough for me to make money, but that’s where I’m coming from).

The challenge is that while Black Stone Minerals gets royalties from both oil and gas, their reserves are gas-heavy (70%), and a little more than half their revenue (about 56% last quarter) comes from dry gas, which has been doing much worse than oil and natural gas liquids of late. They expect about 72% of their production to be natural gas (including some natural gas liquids) in 2023.

Other things to keep in mind? Because this is a partnership, you’ll have to deal with K-1 forms when it comes time to do your taxes — they’ll let you know what your share of the net income of the partnership is, which is usually a much smaller number than the distributions you received, and the forms often come in pretty late and can make tax prep a little more complicated (one of the reasons to like these partnerships is that they often provide tax-deferred income — usually a lot of the distribution you receive is actually a return of capital, so you don’t pay taxes on it until you sell the shares and get the capital gain).

And yes, there’s been a little insider buying… CEO Thomas Carter has bought as recently as May 5 (about half a million dollars worth), and Director Mark DeWalch bought a similar amount in March. Most of the insider holdings are from stock-based compensation for directors and executives, and outside of those two individuals most of the insiders are net sellers as a result, but Carter, at least, has been buying pretty steadily over the past year. And I agree, it’s a reasonably attractive investment and would probably be my first go-to if I were buying into energy royalties today. Just be mindful that it is an oil and gas royalty partnership, which means, over the long term, that your returns will probably be driven more by commodity prices than by whether or not the CEO is optimistic.

For some perspective, and a reminder of why I prefer royalty owners to actual commodity producers, as a general rule, here’s the chart going back to BSM’s 2015 IPO — this shows the total return for Black Stone Minerals (in purple) compared to the price of oil (blue) and natural gas (orange), so it has held up quite well… and BSM has done much better than the average oil & gas producer (that’s the S&P Oil & Gas Exploration and Production ETF (XOP) in green):

Of course, you’d generally have been better off under-weighting energy over the past eight years, so that’s a consideration, too — this is the same chart if you add in the S&P 500 as a comparison (in pink):

I don’t know what the future holds when it comes to commodity prices, sadly, but certainly a lot of newsletter folks are still yelling about how super-bullish they are on oil and gas these days… and that’s one more energy industry partnership where at least the CEO is buying big, much like what’s been happening at Energy Transfer, so there’s at least one person who shares Alexander Green’s optimism about this stock.

With your money, of course, it’s what you think that matters… ready to buy into Black Stone Minerals, a semi-passive royalty company in oil and natural gas with a 12% dividend? Prefer the somewhat more stable business of a midstream operator like Energy Transfer? Not willing to follow those CEO buys into either partnership? Let us know with a comment below.

Disclosure: Among the investments mentioned above, I still have a small position in call options on Black Stone Minerals (and a put option on Permian Basin Trust). I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

If you have multiple trading accounts I find it best to put partnership and LPs an investment in your IRA. Less hassle with K-1s I like the BSM trade

It is easier, but you give up the tax benefits of MLPs… and if your positions ever get large enough, you can run into UBTI tax issues.

Hi Travis,

Can you pls give your high-level feedback: 1) buy good but not too much JEPI or other known big monthly ETF such SVOL. 2) put a stop loss of around 10% to manage big loss risk due to a sudden market crash

dividend investing Monthly Dividends

A 10% stop loss is for traders, that means you plan to sell — almost every stock will go down 10% at some point, almost every year.

Have not looked into those specific funds, so all I can really tell you is that I am not doing either of those things with my money today. I tend to use index ETF put options for hedging, but don’t have any such positions at the moment.

Thank you so much .

I really wanted to say i learn a lot because of you.

Thanks

Vintee

Caution – BSM issues a K-1 tax form

Until I had the pleasure of getting one of these from 3 mlp stocks I got last year, I thought What’s the big deal? That was until those 3 investments took more time to understand and prepare than all the tax forms for me, my husband and each of our kids. Wow!!

I use Turbo Tax Premiere for doing my taxes and the K-1’s takes no effort at all. Worst part is waiting to receive them in the mail.

Seems like this could be a good one to buy when we see better energy prices coming. I don’t know when that will be but I imagine at some point we will get there.

True… but if you know when energy prices will turn, you don’t need to pick good companies. I’m not so good at predicting the future.

Wow, A positive comment for a change…..Travis usually HATES every Spam recommendation.

I don’t always HATE… but the default is to counter the hype with some skepticism, if only to balance the picture a little.

Who honestly explains “gumshoe”.