We’ve got another “payouts” pitch from Jason Williams at The Wealth Advisory ($99 first year, renews at ?), so what’s he teasing this time? This is the lead-in to the ad that’s generating reader questions here:

“URGENT: Starting January 17, everyday Americans can get their hands on…

“The Hidden Income Stream that Pays You Money Any Time an Electric Vehicle Plugs Into a Charging Station (Even If It’s Not Yours!)

“Read on to find out all about the special EV companies that are required to split their profits with you. Plus how you can easily claim a slice of this $563 million cash flow.”

We covered the first version of this ad back in July, when “July 19” was the crucial “starting point” for your hidden income stream, and now it has been updated to December 18… has anything else changed?

Not a lot, but we’ll go through the ad again, just to be sure, and explain these investments for you…

It’s basically a way to earn money from the push to roll out more EV charging stations — here’s a bit from the ad, to give you an idea:

“America’s Clean Energy Drive Is Setting You up for Life-Changing Payouts

Let’s start with the facts…“America’s ‘green revolution’ is charging ahead at breakneck speed.

“There’s no doubt that many of our politicians want the entire nation hooked up to the EV network.

“And they want it done sooner rather than later…..

“The White House has pledged to build a network of 500,000 publicly accessible EV chargers by 2030..

“That’s a TENFOLD increase on current numbers of around 50,000….

“Our government is funneling $7.5 billion toward a tiny clique of special companies charged with building the nation’s EV charging network. And these special companies must shell out $563 million in profits with ordinary American citizens.

“For the first time, you can grab a slice of this bounty — as much as $34,200 this year, starting this month.”

OK, so that’s a lot of money — even for your friendly neighborhood Gumshoe, who hasn’t yet paid off that solid-gold bathtub he’s got on layaway. How does one get these “plug in payouts?”

Apparently they’re “required” — here’s what Williams says about that:

“They’re Also Required to Share a Large Slice of Their Income With Everyday Americans

“How much money, exactly?

“At least $563 million of pure profit this year.

“If you get in now, you could pocket as much as $34,200 in 2023, with the first payment due to land in your bank account on JULY 19th.

“And the best part of all…

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“Is that these payouts are only going to get bigger and bigger….”

“You can Receive Your Plug-in Payout by Physical Check or Have It Wired Directly to Your Bank Account — the Choice Is Yours

“It really is this easy to join the smart early movers already accumulating tens — and even hundreds — of thousands of dollars….

“Like Donald W., a husband of 28 years and father of four kids. Today he lives in Maryland, where he works closely with cystic fibrosis charities. Donald recently collected $418,316 from this secret income stream.”

The special report he’s promoting is called “Plug-in Payouts: Get Paid Every Time an Electric Car Plugs In” — so it sounds like you’re getting some kind of royalty stream on those EV chargers, right?

And somebody over at Angel Publishing loves to cite “real people” and give examples of the “payouts” they’re getting, so we get a lot of those examples in this ad….

“I could barely believe it either when I found this income stream.

“Yet I’ve seen firsthand how it allows regular Americans to collect more money than they’ve ever done before:

“Take David F. He worked for many years in the senior living industry. David recently had a Plug-in Payout check for $26,751 land in his mailbox.

“There’s also Christopher A., a husband and father of three daughters from Sacramento, California. Earlier this year he received a payout of $42,500.

“Or how about Milton C.? He recently tallied up his earnings and found that he made a tidy $69,848 in 2022!”

And a few more, just to give you a bigger taste — this is a small portion of the dozens of names and payouts he cites:

“… bank huge Plug-in Payouts every 90 days, beginning this month.

“In just a moment I’ll tell you how to jump on this deal…

“And set yourself up to make easy returns of as much as $34,200 for your efforts.

“But first I want to show you some of the folks who are already claiming these payouts:

“There’s John M., from Newton, Massachusetts. He received $48,590 last year.

“Or Laurie B., a youth charity volunteer. He regularly collects checks for $4,400.

“And Brian D., a certified public accountant. He collected $12,268 in 2022.”

Pretty good chunks of money, right? And those sound like “average Americans” — which is the point, of course, the ad only works if you feel like you’re going to get these kinds of payouts if you “sign up” for The Wealth Advisory.

And Williams preys on the fact that lots of investors don’t know a lot about the workings of the stock market, so they assume the world is awash in this kind of “free money” and they’re just not getting their piece, because of, you know, them…

“Right Now You Have a Unique Opportunity to Collect Easy Money for the Rest of Your Life

“The strategy I’m talking about paid out $563.3 million in income last year.

“Back then it was almost exclusively energy industry insiders and billionaires who were in on the secret.

“That explains why you likely haven’t heard a peep about Plug-in Payouts before today.

“But thanks to a provision buried deep inside the recent Inflation Reduction Act, all of that is now changing rapidly.

“In a nutshell, this provision is sending billions of dollars gushing toward a special group of EV-related firms — firms that are obliged to split their profits with everyday Americans…

“Allowing you to collect up to $34,200 this year…

“Starting on next month.”

That bad grammar in the last line is just a little update error, the last version said “starting this month,” perhaps the intern charged with making the update hiccuped while reading that line.

So what’s the story? Well, in every pitch we’ve deciphered from The Wealth Advisory in the past, and for every tease where there’s a lusty story about monthly or quarterly “payouts,” we can be pretty sure that he’s just talking about investing in a Real Estate Investment Trust.

And how does that play into this big “EV charging infrastructure” talk?

Well, mostly just because EV chargers are generally being put in places like apartment complexes, shopping malls, etc…. and many of those kinds of real estate are owned by Real Estate Investment Trusts.

So, just like when Williams promised that we could get “Prime Profits” and earn a few pennies every time Amazon shipped a package… there is a connection, it’s just much, much more indirect than he’s implying. It’s a way to tell a story and pitch a stock, more than it is a fair way of assessing and explaining how that company makes money.

If you missed that older story, the “Prime Profits” pitch from Williams was just a way of touting ProLogis (PLD), which is one of the largest REITs in the world — ProLogis is a huge global owner of warehouses and logistics facilities, and Amazon is their largest tenant, so Amazon’s rent covers about 5% of the revenue at ProLogis, and ProLogis is a REIT, so they pass through most of their net cash flow to investors as dividends, so you’re very indirectly getting a little share of the rent that Amazon pays to one of its landlords. No, that’s not the same as getting a “royalty” on each package, or anything that exciting, but I guess it’s within walking distance of the truth.

(More recently, Brad Thomas “borrowed” that same theme in his ads, so we covered that earlier this year — he called it “Amazon’s Secret Royalty Program” but was similarly just teasing an investment in ProLogis).

Most likely, we’re looking at a similar pitch here. Not so different from the pitch Jim Pearce made in ads for Personal Finance late last year, when he teased Simon Property Group (SPG), the upscale mall owner, as the “world’s first EV blue chip” and a way to “rake in EV riches,” just because they were installing EV chargers in many of their parking lots.

That was misleading, too, those chargers are never going to be a meaningful part of the revenue for that mall operator, and are not even a measurable part of the revenue today, but who knows, maybe having more EV chargers will bring in more customers, who spend a bit more money, and perhaps that will help those malls survive in the future. I have to think the impact will be marginal, at best, but I guess every little bit helps.

Which stock is Williams pitching this time, though? We do like to get specific when we bother to pull the Thinkolator out of the garage. It’s been chilly and wet up here in New England, and I hate to pull the tarp off without getting you some answers.

Here are a few more clues from the pitch:

“… the government has been forced to look to the private sector for help in meeting its ambitious targets….

“Using a legal “bribe” provision inserted in the recent Inflation Reduction Act.

“Buried in the Fine Print Under U.S. Code 30C Is a Critical Provision — One That Could Be Filling Your Pockets With Easy, Recurring Cash Flow Starting NEXT MONTH.

“It’s called an ‘alternative-fuel vehicle refueling infrastructure tax credit….

“As of January 2023, this credit has slashed the cost of installing new EV charging stations for eligible companies. In fact, these companies can now claim a tax credit worth up to $100,000 per unit installed…

“Giving them a huge incentive to increase the amount of charging stations they put on their premises… “

And we get some more explanation that it’s very likely a REIT being pitched:

“As You Read This Letter, a Clique of “Special Companies” Is Responsible for Installing up to 500,000 New EV Chargers Across America….

… all of those ‘special companies’ involved in the EV charger buildout operate under a specific structure — one that’s designed to put money in your back pocket!”

The “special structure” of REITs and similar investments (BDCs, MLPs, etc.) is that they’re pass-through entities when it comes to taxation — the company doesn’t have to pay corporate income taxes, as long as it pays out 90% of its profits to investors in the form of dividends. That was intended to “democratize” the world of real estate investing, and to a large degree it has worked (partly because the original law that created REITs, signed by President Eisenhower, was juiced with some simplifying legislation in the 1980s).

And the ad implies that somehow those EV charging stations are going to be cash cows, too, which will generate more cash for the owners, which means they’ll pay out more in dividends. That’s a bit of a stretch these days, nobody’s making much money from EV charging… but maybe someday. Here’s how Willams puts it:

“See, as you know, electricity isn’t free…

“In fact, it costs somewhere in the range of $10–$30 to fully charge an electric car.

“And some of that money can be skimmed off as profit by the operator…

“Accumulated…

“And then distributed as a quarterly Plug-in Payout!

“Imagine that…

“Up to 500,000 new chargers servicing an almost never-ending flow of traffic, day and night. These special companies are sitting on a gold mine.

“For every EV that passes through, they shave off a few cents, and those cents add up for quite a bit of cash. It’s basic math — and these firms have a de facto monopoly on all of that cash.

“And like I said, they’re obliged to split these profits with ordinary U.S. citizens.”

Well, no, they’re obliged to pay out a share of the profits to shareholders. Lots of commentary about how this is something you “sign up for” or “put your name on the list” to just alert them that you want to receive money, not so much about how you have to buy into the company to share in the profits.

Until we get to this…

“To start collecting your Plug-in Payouts, all you need to do is stake a claim in one of these special companies. They’re established entities, and they’re already busy putting money in the pockets of hardworking Americans. People including…

“Ethan B., who earlier this year received a lump-sum payment of $20,858.

“Philip C., a professional with 30 years of experience in the private and public sectors. He earned $88,329 last year.

“And Dawn B., who’s raked in more than $160,000 so far in 2023!

“Your name could be on that list as soon as this month.”

And some promises of great stability and safety:

“For those in the know, passive income doesn’t get any easier than this!

“These special companies have a license to print money.

“Even if the market crashes and asset managers start dumping stocks en masse, there’s no way the U.S. government will let these guys go under…

“And all the while, you’ll get to sit back and relax as you collect up to $34,200 in Plug-in Payouts.”

So, where might we find the answer to exactly which stock Williams is touting?

Well, given the absence of other great clues… we can start with the people he cites as the ones receiving “payouts” — because, and I hate to burst your bubble on this, he’s almost certainly referring to company insiders. Those are the only folks whose specific share holdings we can all know about, and it’s easy to calculate the “payout” they’d get for their dividends if we know how many shares they’ve earned for their work (most of these folks never buy shares, they receive them as part of their compensation… but those shares come with the same dividend rights you or I have when we buy the stock).

Occasionally, (very occasionally), these kinds of references in a teaser ad will be to newsletter subscribers who tell the publisher about their great success, or they’ll be lifted from newspaper or magazine coverage of successful dividend investors, but it’s almost always a thinly cloaked reference to insiders, who are usually described by their hobby or their favorite philanthropy or their alma mater, not described as executives or board members of these “special companies.”

So who are those folks who sound like “ordinary Americans” in the ad?

Well, that “David F.” who “worked for many years in the senior living industry” and got a “Plug-in Payout check for $26,751” is almost certainly David Faeder, who is a managing partner of a big real estate investment firm, and who was a founder of Kensington Senior Living.

And the “Donald W.” who “works closely with cystic fibrosis charities” and “recently collected $418,316?” That’s almost certainly Donald Wood, who is actually probably getting dividend payouts today that are closer to $480,000 a year.

Why are they getting such big amounts of money? Well, mostly because they run the company — Donald Wood is the CEO of Federal Realty Investment Trust (FRT), and David Faeder is the Executive Chairman of the Board at that same REIT.

And yes, most of those other “names” are from the insiders list at FRT, too — “Nicole L.” is Nicole Lamb-Hale, who did tour some e-bike factories back when she was an Assistant Secretary at the U.S. Dept. of Commerce a decade ago, but these days she’s a VP and General Counsel at engine giant Cummins, and, yes, a board member of FRT.

And “Daniel G.” who’s “making upwards of $10,000 every single month using this exact Plug-in Payout strategy” is Daniel Guglielmone, the CFO at Federal Realty. He owns 50,782 shares last time I checked, which, at $1.09 in dividends per share, per quarter, would get him “payouts” of about $55,000 every three months, or now about $18,000 a month. That’s probably still somewhat meaningful to him, though he also gets a salary of $575,000 and is granted close to 10,000 more shares each year, with total compensation coming in around $2.1 million/year.

So that tells me that at least one of the stocks being touted by Jason Williams is Federal Realty Trust (FRT). More on that in a minute.

Those payouts put all of those folks, even relative newbie to the Board “Nicole L.,” in pretty rarefied air, compared to those of us who have to buy our shares. She gets about 1,200 shares a year for her service on the Board of Directors, and currently owns 2,538 shares, giving her close to $11,000 now in “payouts” per year on those shares… but for us to buy 2,538 shares today and begin earning that same dividend payout, we’d have to face the sad fact that FRT shares trade for about $93 each today (it was $99 back in July when the first version of this ad ran)… which means “staking your claim” to ~$11,000 in “plug-in payouts” or “putting your name on the list” would cost you close to $250,000.

That doesn’t mean you have to buy 2,500 shares, of course — often, with dividend growth stocks, buying gradually, a little bit every month, can add up to a meaningful stake if you let it grow for decades… but it doesn’t start out exciting. Put down $10,000 or so to buy 100 shares, and you’ll collect about $436 in dividends in your first year… and if you reinvest those in more shares, and the dividend goes up another penny per share next year, then maybe a year from now you’ll own 104 shares, and those shares will pay you almost $460 in dividends, and if they can afford to keep paying the dividend and growing it a little bit, that can go on for a while — it doesn’t mean the share price will stay steady, that mostly depends on sentiment about real estate, which mostly depends on interest rates, with a secondary impact from company-specific stuff, good or bad (tenant defaults, new buildings more successful than expected, etc.), FRT has lost more than half of its value during real estate bear markets several times over the past 50 years… but over long periods of time, if they own high-quality retail and apartment developments, they’ll probably grow in value.

Maybe a reasonable investment idea, if you’re very patient, but certainly not “free money.” As of today, FRT pays an expected dividend yield of just over 4.5%, and the dividend has been growing at a little less than 1% per year. Because so many income-focused stocks have dropped dramatically in value as interest rates have soared in recent months, that’s no longer a particularly appealing dividend yield, especially if they aren’t able to grow the dividend more rapidly than has been the case in recent years. That is about the same income you get from a high-yield savings account right now, and less than you get from a risk-free T-bill, so FRT probably needs growth to stand apart from those kinds of safer income investments, it only makes sense if the dividend can keep going up over time, and 1% growth is obviously not all that enticing, 1% means compounding takes a LONG time.

Are all the names of folks getting these “payouts” from the FRT masthead?

No. Several more of them are, including “Dawn B.” (General Counsel at FRT), but some don’t fit… so there may well be some other similar companies that Williams is touting… might we guess at a couple?

“Or how about Milton C.? He recently tallied up his earnings and found that he made a tidy $69,848 in 2022!”

That’s probably Milton Cooper, Executive Chair at Kimco Realty (KIM), which mostly owns strip malls and grocery-anchored shopping areas… though he was the founder of one of the companies that became Kimco, and his dividends tally up at a helluva lot more than $70K per year — he owns more than 10 million shares of Kimco, and the current dividend is 23 cents per share, so that’s more than $2.3 million per quarter flowing into his accounts. I assume they’re largely owned by trusts or other entities, he’s 94 and must have paid a lot of attention to estate planning, and those “payouts” are not a big deal to him, but it’s still a lot of money.

And “Philip C., a professional with 30 years of experience in the private and public sectors” who “earned $88,329 last year?” That’s likely to be Philip Coviello, also from Kimco… he’s an Independent Director on the Board, and currently owns about 99,000 shares, so his dividend income over the past year would have been somewhere in the $80,000+ range.

But actually, once we dig a little deeper, both Coviello and Cooper are also on the Board of Directors at Getty Realty (GTY), a much smaller REIT, and in those positions those “payout” amounts are actually right in line — Coviello holds about 53,200 shares of GTY, Cooper 46,000. So although this is not their primary enterprise, they’ve both been on the Getty board for decades, and it does pay out a reasonable dividend yield of about 5.3%.

A couple others?

“Todd H., a graduate from Lehigh University in Pennsylvania” who “racked up $7,553 in payouts already this year” is probably Todd Hargreaves, Chief Investment Office and President at Service Properties Trust (SVC), which is one of the REITs managed by RMR (RMR). That company currently pays out 20 cents per quarter, so if you tallied up your numbers after just the first quarter, his dividends could have been in that $7,500 range (he owns a bit over 35,000 shares).

And the “Brian D…. certified public accountant” who “collected $12,268 in 2022” is very likely Brian Donley, CFO at Service Properties Trust. He owns 50,643 shares at the moment, so he would have gotten almost that much in “payouts” in 2022, during which SVC paid out a total of 23 cents pare share (the dividend was one cent per share for most of the year, but popped up to 20 cents for the dividend declared in October).

Given how RMR has destroyed value at their larger commercial REIT, now called Office Properties Income Trust (OPI), I don’t know why you’d have any faith in any of the other RMR-managed REITs, they don’t seem to me to be managed with shareholders in mind… but perhaps that’s just my bias after watching (and writing about) OPI many times over the years.

There are more, and there could be other companies, but we’ll leave that as our assessment of those “ordinary Americans” who collect these “plug-in payouts” — all of those are primarily retail-focused REITs, companies who own shopping centers and stand-alone retail real estate, not so much the big malls like Simon Property Group, but more of the strip malls and the smaller malls, usually not enclosed, that surround big box stores and grocery stores.

So we’ll run them down quick…

Federal Realty (FRT) owns pretty high-class real estate properties, largely in urban areas in the Mid-atlantic and Northeast, from Boston to the ritzy suburbs of Washington, D.C. (along with some California properties) — they are a “dividend aristocrat,” so they have the longest record of unbroken annual dividend increases among REITs, partly because they’re one of the oldest REITs (founded in 1962, they have raised their dividends every year since 1967). There’s a nice interview with CEO Don Wood here that goes over their history and strategy.

Right now, FRT has a dividend yield of a little over 4.5%, paying out $1.09 per share, per quarter — that which should be easily covered by the $6.50+ they’ve told investors to expect in funds from operations in 2023 (a number that they’ve lifted a little bit in each of the past couple quarters, which is encouraging). And that means they’re valued at about 15X FFO, which is a fairly steep valuation these days, since investors are nervous about REITs as we reset to higher interest rates… but they have been quite consistent with (slow) dividend increases, their properties should be a lot steadier than the more office-centered shopping areas (or the office properties themselves), and they’re at least cheaper than they were 18 months ago.

I’d say it’s a high-quality REIT trading at a pretty high valuation… which means it might work out well, over time, if you let the continuing dividend growth stack up and compound your returns, but you should go into it assuming that the dividend will generate most of your returns in the near future. Getting more than that 5%-ish return in the next year or so probably depends more on the direction of interest rates than it does on anything Federal Realty does.

I wouldn’t be surprised if almost all of Federal Realty’s mixed-use and retail properties have EV chargers on site, or are in the process of installing them over the next few years… that’s becoming an amenity that pretty much any shopping or restaurant location is likely to have on site, if they have room. But I would be surprised if EV charging has any meaningful impact on the income statement for Federal Realty in the next five years. The benefit of the new federal incentives for charging infrastructure is that they probably won’t end up having to pay much to add this amenity for their customers, tax breaks or partnership deals with the major charging networks will likely make it a wash, but the economics don’t seem to be there to make it a meaningful profit driver.

Remember, even gas stations don’t make much money on selling gasoline, which is a relatively low-margin commodity — the most profitable ones are the stations that have successful convenience stores attached. That might be even more true in the future, since charging takes longer than filling a tank, and those folks waiting for their recharge might spend money in the shops while they wait… but the length of time it takes also means that the volume of customers for EV charging will be fairly low at most places.

Getty Realty (GTY) is a more directly “automotive” business — though I don’t know that it would make them meaningfully more exposed to EV charging stations, specifically. They describe themselves as a net lease REIT that specializes in “convenience automotive retail,” which means buying “properties where consumers spend money in their cars or on their cars,” including drive-through establishments, car washes, gas stations, auto repair centers, etc. For the most part, that means fairly large convenience store/gas station properties operated by major regional or national chains, and I suppose some of them will have EV charging locations on site as well, or will begin to in the future, but whatever electric vehicle charging revenue Getty gets, directly or indirectly, is probably going to be, at best, a footnote compared to the rent their tenants pay and the cost of servicing their corporate debt.

Even with that automotive focus, EV charging is not yet a big enough driver of the business to be mentioned in their investor presentations or on their conference calls. They are a smaller and riskier REIT than FRT, so it’s not surprising that their dividend yield is higher — they just raised their quarterly payout to 45 cents last quarter (better than a 4% increase from last year’s 43 cents), so at $28 the dividend yield is expected to be about 6.4%.

Service Properties Trust (SVC) is mostly a hotel REIT, they own the properties which are operated as hotels and resorts and managed (mostly) by major hotel brands, though that’s actually only a little over half of the value of their asset portfolio — beyond hotels, which probably all have at least one or two EV chargers and should make much less on those chargers in any given week than they do on a single hotel room, they also own “service focused” properties in other businesses, and their second-biggest group of properties is travel centers (their single largest tenant “brand” is Sonesta Hotels, but second largest is TravelCenters of America)… which, again, like the Getty automotive properties, are probably often good candidates for fast EV chargers. So there is at least a little bit of logical connection to the growing EV charging sector, even though it’s not likely to be meaningful enough to be a major economic driver in the near future. They own much smaller numbers of other “service” properties, mostly restaurants, grocery stores and the like, but hotels and travel centers together are close to 85% of the value of their properties.

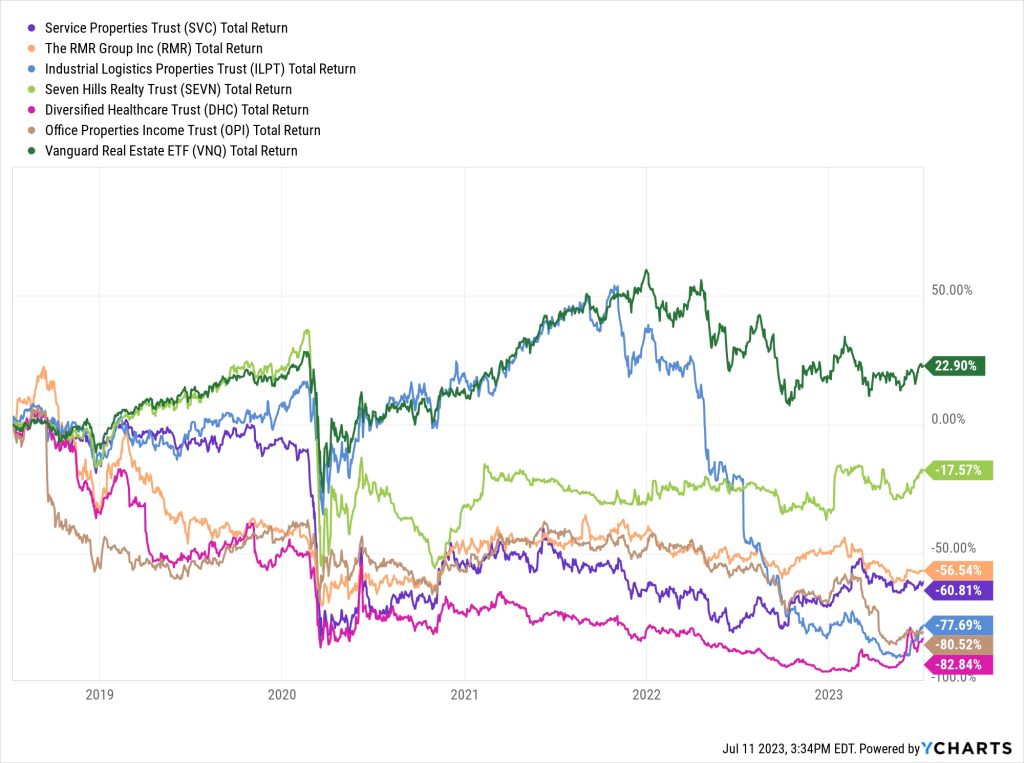

Service Properties Trust is externally managed, by The RMR Group (RMR), and given how RMR has destroyed value at their larger commercial REIT, now called Office Properties Income Trust (OPI), I don’t know why you’d have any faith in any of the other RMR-managed REITs, they don’t seem to me to be managed with shareholders in mind… but perhaps that’s just my bias. You can see the listing of the RMR REITs here, SVC is now the biggest one. Just to hammer that point home a little bit, I’ll share a chart — not a single one of the six current RMR-managed REITs has a positive total return over the past five years (total return includes dividends)… it hasn’t necessarily been an easy period for REITs, but still, the Vanguard Real Estate ETF, made up of mostly big REITs, has managed to return more than 20% during that period (that’s the dark green line at the top), and none of those RMR REITs have even been able to stay close to the “0%” line (I haven’t updated this chart, it’s still based on July numbers, but things haven’t improved much since then):

I’d probably need a good, short-term reason to buy one of the RMR-managed REITs. Unless I worked for them, I suppose.

The good news, from SVC, is that their dividend is MUCH higher than the others — they have been paying 20 cents per quarter since they ramped up the dividend five quarters ago, so at that rate the dividend yield is a little over 10% at $7.70 per share. They are not at all a steady dividend payer, we should note, they slashed the dividend from 53 cents per share to one penny during the COVID collapse, so there are clearly some solid reasons why folks are willing to own other REITs with a 4-5% yield but insist on 10% to take the risk of owning SVC.

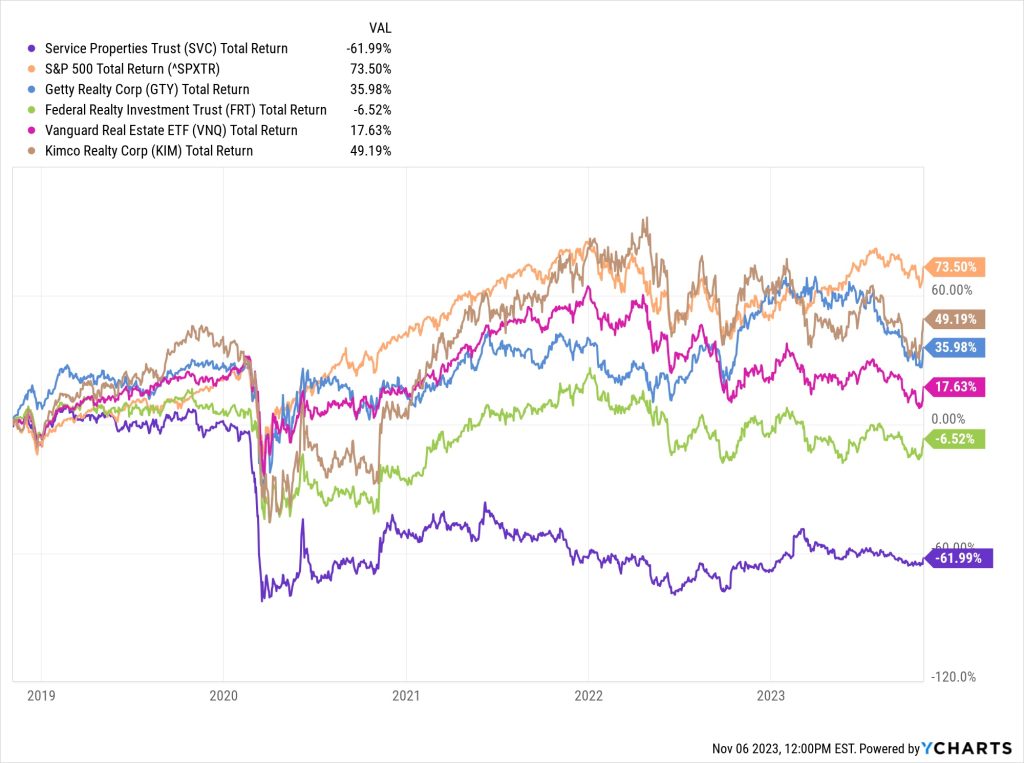

For some perspective, let’s see how all the stocks that match this tease have done in recent years — Getty and Kimco have actually held up pretty well, they’ve both held up as “above average REITs,” even though they’ve trailed the broader market, but big ol’ Federal Realty has actually lost money over the past five years. SVC is more of a train wreck, no surprise. This chart includes dividends.

And there’s one more teased stock here that we should mention… from the ad:

“Let me tell you about one specific company that’s at the heart of this income play…

“It has such a reputation for delivering abundant cash flow, we even have a nickname for it at Angel Publishing…

‘The Monthly Income Company.’

“Every month it shells out a fortune to everyday investors, courtesy of property payments from mega-corporations like Walmart, Starbucks, and GM.

“What’s more…

“The management team is so good at squeezing out cash from these massive firms that our income payments go up once a quarter! It hasn’t missed a monthly payment since it was founded in 1969, nor has it missed a quarterly payment hike since 1997.

“Discover how to get on board inside your free copy of my report ‘How to ‘Backdoor’ America’s Top Fortune 500 Accounts.'”

That one is almost certainly Realty Income (O), which indeed calls itself “The Monthly Dividend Company” — here’s how they describe themselves:

“Realty Income, The Monthly Dividend Company®, is an S&P 500 company and member of the S&P 500 Dividend Aristocrats® index. We invest in people and places to deliver dependable monthly dividends that increase over time. The company is structured as a real estate investment trust (“REIT”), and its monthly dividends are supported by the cash flow from over 13,100 real estate properties primarily owned under long-term net lease agreements with commercial clients. To date, the company has declared 637 consecutive monthly dividends on its shares of common stock throughout its 54-year operating history and increased the dividend 121 times since Realty Income’s public listing in 1994″

Like all REITs, Realty Income has been a beneficiary of the long slide in interest rates over the past 40 years or so, and has suffered a bit as rates have come back to to something “real” over the last year, but at their heart they’ve never been a nosebleed growth story, even though they got overvalued for some chunks of their history — they’ve compounded their dividend at a growth rate of between 4-5% a year over the past 30 years or so, fueled by adjusted funds from operations growth of about 5% a year over that time period, and they raise the dividend a tiny bit each quarter (and pay those dividends out monthly).

They are very much focused on providing a steady return for individual investors, with much lower volatility than most stocks, so they make their case pretty well in their investor materials — you can check out their Investor Presentation here for a good overview. Their largest tenants are dollar stores, Walgreens, 7-Eleven, Walmart and similar kinds of businesses… mostly grocery stores, convenience stores, pharmacies and fast food restaurants… though they also made a net lease deal with Wynn for their casino property recently, which stands out as being a bit different, partly because they’re so big now that it’s easier to make a few big deals than 1,000 small ones, and they own some industrial properties and a few auto dealerships, too.

Today, Realty Income (O) pays a dividend yield of about 6%, and they’re a huge company in this space, with a market cap of about $36 billion (the stock price is down 10-15% since July, when this ad first ran the yield was about 5.2%). They’re likely to continue to be solid in the future, they aren’t playing too close to the edge with riskier tenants, they’re well diversified, and their balance sheet is not as aggressively levered as some real estate companies (and they will probably continue to be able to borrow money at cheaper rates than smaller or more concentrated REITs), so it’s likely to be one of the safer income REITs. Still, their share price in the next few years will probably be driven as much by the Federal Reserve and interest rate policy as anything else — if prevailing rates fall, Realty Income’s 5% slow-growing dividend will look more appealing… if rates keep rising, then investors might be more comfortable with the higher yield they can get from T-Bills (or even their savings account).

The big news from Realty Income, though, is their announcement of a transformative acquisition — they’re buying Spirit Realty Capital (SRC) in an all-stock transaction, and they say it should be “over 2.5% accretive” to their adjusted funds from operations (AFFO) per share. That was better news for SRC shareholders than for O shareholders, but it will probably mean more of the same for Realty Income, giving them a chance to become just a whisker more efficient as they benefit from some cost synergies and economies of scale, and it will help diversify the portfolio a little bit (adding more convenience stores and industrial properties, mostly). Seems like a reasonable deal on the surface, but now O will be one of the half-dozen or so largest REITs in the world so it’s really a slow compounding and “avoid calamity” story to keep chugging along, there’s never going to be an opportunity for them to grow quickly and they could have some minor challenges in a recession, but for now it’s mostly about interest rates and how much yield investors will demand to own a leveraged real estate portfolio.

Other than Realty Income, all the REITs mentioned pay quarterly — and none actually has their “payout” hitting on December, precisely, though some are within a few days of that (FRT pays next in January and goes ex-dividend on 12/30, GTY goes ex-div on 12/27 and pays in January as well, O SVC won’t declare its next dividend until January). If you buy them today, the first dividend payment should hit in January. (“Ex dividend,” for anyone who doesn’t know, is the date on which the stock trades without rights to the current-but-not-yet-actually-paid dividend — just to keep things clear for folks who buy and sell around the time the dividends are being issued).

I wouldn’t try to talk you out of buying Federal Realty, Realty Income, Getty Realty or Kimco… they’re all well-run real estate operations that seem likely, at least on my fairly cursory review, to be sustainable even as they face somewhat higher financing costs with their debt and have to compete with safer yield products for investor attention. If T-Bills stay at 5% or go higher in the next couple years, I’d just as soon own T-Bills, but if 2-5 year interest rates drop back down to 2-4% because of a big drop in inflation or because the Fed starts meaningfully cutting interest rates, perhaps these will pop higher (that’s not the consensus guesstimate about what happens next year, most folks think the Fed will still be at least at 4.5-5% on overnight rates a year from now, but nobody actually knows). I don’t see any of these REITs being driven by the presence of EV charging facilities on their properties in any meaningful way, at least not in the next few years (the economics of the charging business are still really up in the air, in my opinion), but they’ll all probably have some charging stations in their portfolios a decade from now.

If you want to get some kind of direct “royalty” in the future on the installation or management of EV chargers, you’re better off investing in the companies who actually build and manage the largest networks of EV charging equipment (ChargePoint (CHPT), Blink Charging (BLNK), EVgo (EVGO), etc.) — but that’s a far more speculative bet, since none of them are anywhere close to becoming profitable, and the economics and competitive dynamics of the EV charging sector in the future are very unclear. And, of course, none of them pay a dividend, or are likely to in the future, and their stocks have been destroyed this year… so the REITs, at least, have been safer, even if they’re not really particularly “EV-exposed” in a meaningful way.

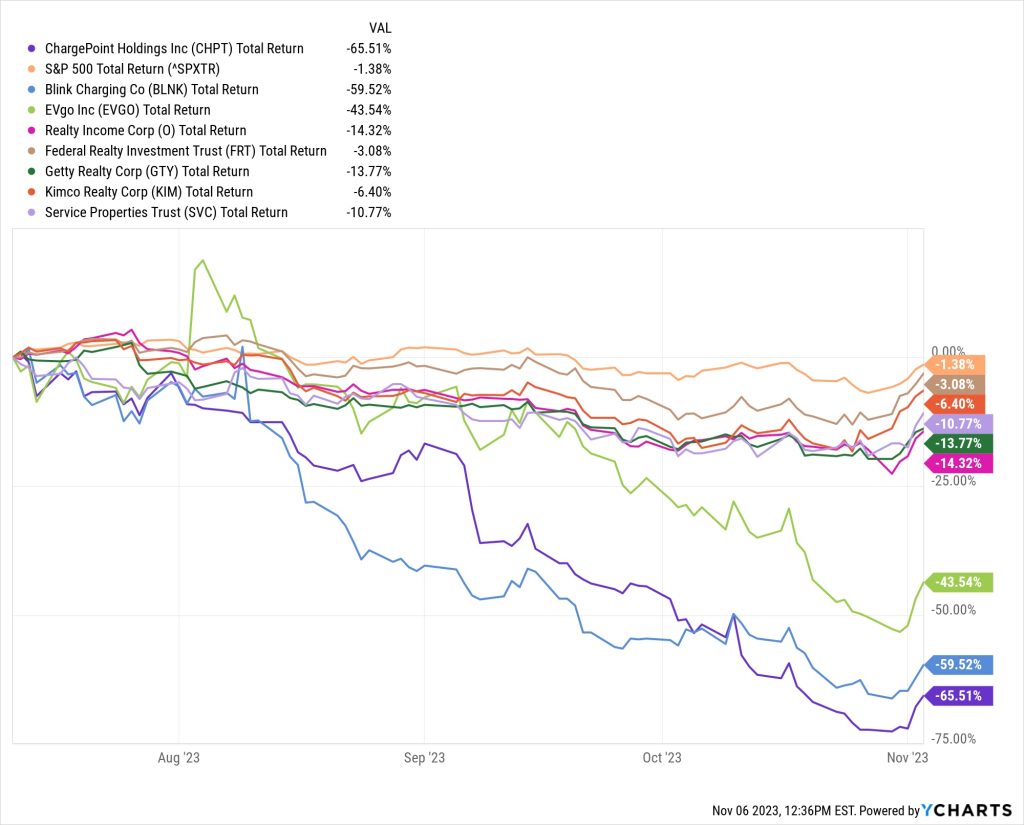

Just for grins, here’s the chart of where those three EV charging stocks and the five REITs we talked about above have done since we covered the first version of this ad, on July 11 — the market has been no great shakes, the S&P 500 (in orange) is just barely negative over those four months, but every single stock I mentioned above has been meaningfully worse than that “average” — the REITs have mostly clustered together in being at least mildy disappointing in the face of rising rates in recent months (losing anywhere from 3-14%), the EV charging companies have just continued their disastrous ways. And yes, that includes dividends — those “payouts” from the REITs have not been enough to soften the blow of the shift in interest rates. At least so far:

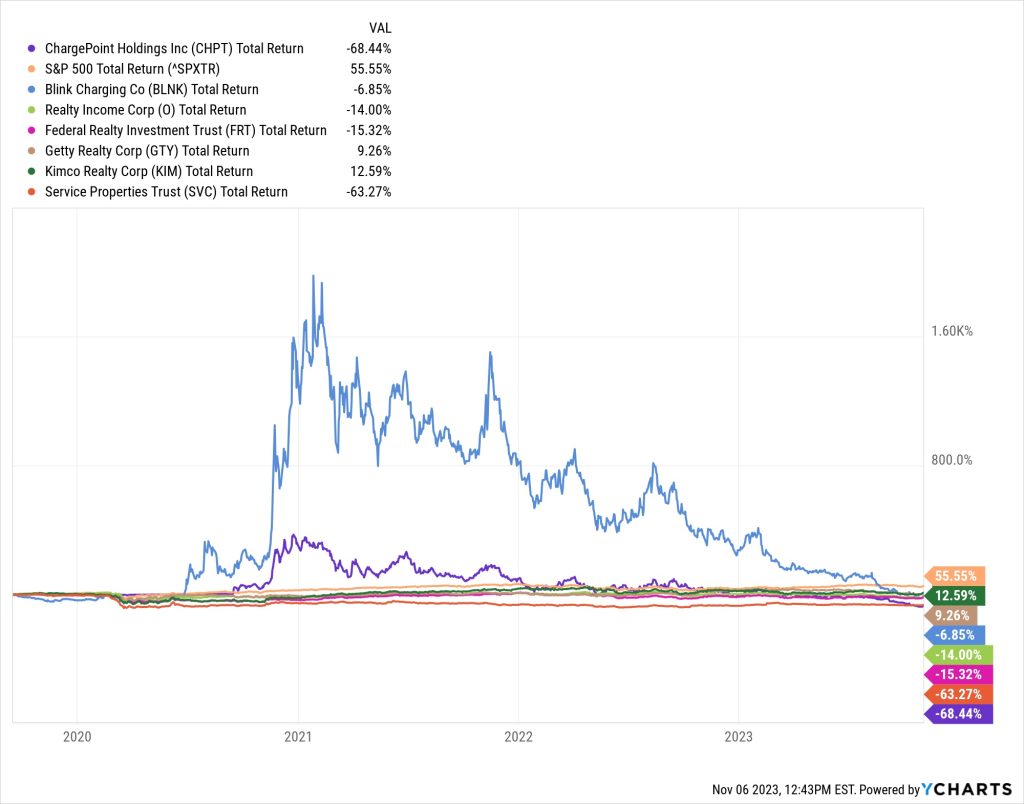

Though, to be fair, the “failing to match the market” performance is not necessarily just because of the interest rate shift in the past few months — here’s the total return for most of those same companies over the past four years, you can see that the EV mania created some excitement in the “pure play” recharging names, but the comedown from that was pretty fast and thorough, all of those companies are still “losing” to the S&P 500 (I had to take out EVGO, it’s a couple years younger):

I look at that and think, “EVs sure might be a looming big business, but nobody has figured out how to make money from recharging them.” At least, not at scale.

Kind of like AI, it’s an obvious and pretty fast-growing trend, and some nimble traders have certainly made money by profiting from the speculative excitement, but the money-making business plan that might emerge has not yet made itself obvious.

Just to get back to the actual focus of today’s article, though, I will note that even though their businesses are not necessarily going to be as easy over the next decade as they were during a decade of near-zero interest rates, the REITs in some cases have held up quite well — here’s the total return for those particular REITs… sometimes GTY and O have done a little better than the S&P 500… just not in the past year or two.

So… some real estate companies will probably receive subsidies to help them add EV charging stations to their properties. That might, according to Jason Williams, help them earn more money, and they pass through their profits to shareholders in the form of dividends. Putting aside how skeptical I might be about how much of that profit is likely to be EV-related in the next few years, is that enough of a “plug-in payout” for you? Ready to buy into some strip malls or similar properties for a 5%ish yield? Or does that not maybe match the bonanza you were expecting after checking out The Wealth Advisory’s pitch? Let us know with a comment below. I’ve kept the comments attached below from our original article, to get you started…

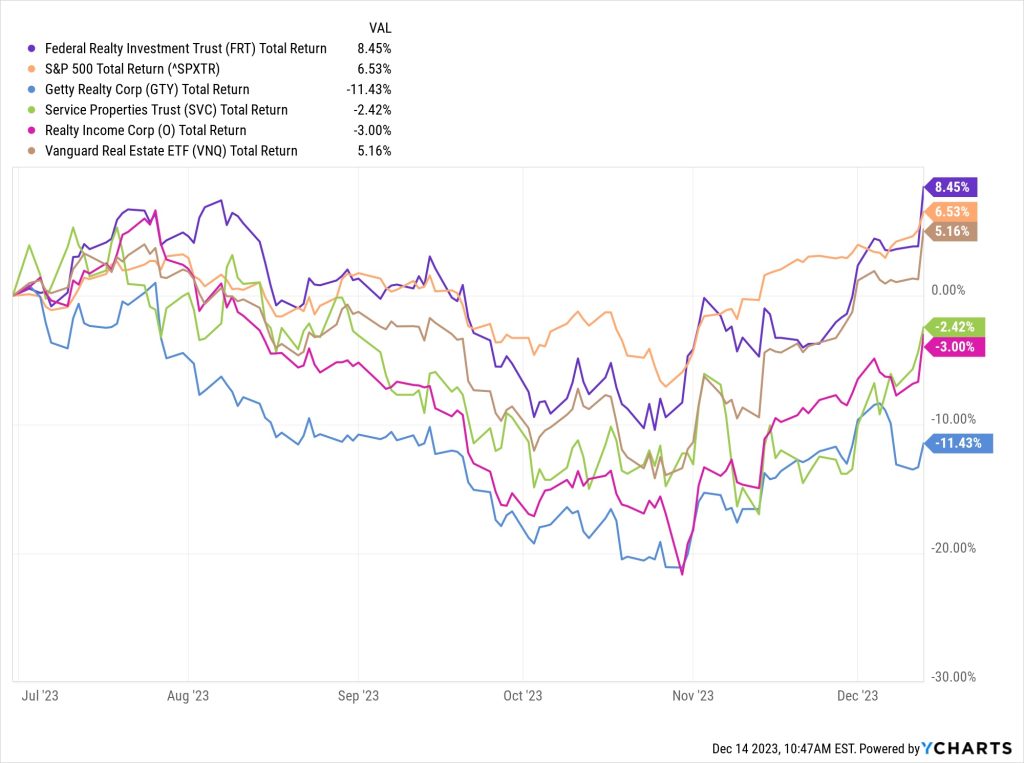

P.S. As of December 14, a few days before the last “deadline” (it’s now January 17, 2024), these stocks have bounced back a bit because of the dramatic fall in interest rates over the past six weeks or so… just like they fell dramatically in the months before that as interest rates spiked higher. Here’s what that looks like for those four stocks I named, compared to the S&P 500 (orange) and the Vanguard Real Estate ETF (VNQ) in the months since the first version of this ad started running (back in July)… you can see that only Federal Realty (FRT) has held up and mostly kept up with the market and the average real estate stock, the others have been significant laggards so far:

(And yes, that’s the total return for all of those investments, including dividends.)

Why not just “invest” in lottery tickets?

Lottery Tickets are a sure thing compared to the BS in Jason Williams news letter.

I suspect that certain retail REITs will indeed get into the EV charging station business not so much for the sales revenue from selling electricity to motorists as for taking advantage of the half-hour or so that recharging will take to lure the drivers and passengers into their tenants’ restaurants, shops and service establishments. Increasing traffic for the leaseholders will benefit the landlord by enhancing the rents that can be negotiated when they are renewed and sometimes more directly through the kind of “percentage of the gross” features in the lease agreements that are already fairly common.

I used to play BLNK when it was trading in the $40-$40 range. That’s when EV and anything related was hot. Now I own some CHPT, and I bought it low, so it’s up for the moment. But I keep an eye on it.

where does evgo “fit” amongst chpt and blnk

Spot on! Well done!

Masterful analysis and great educational overview Travis. Thank you. Once again the pack of” buy this for guaranteed profit ” hawkers show just how far from reality they are prepared to go .. admittedly its not as far as Alex Green’s recent stretch on FLEX LNG where he suggested the shipping company actually trades the LNG itself but its up there…..

Thanks for sharing this information is very great to me.

I am a Wealth Advisory subscriber and can confirm the Thinkolaterès 3 picks were bang on!

Here is an article to consider whether or not chargers will be cash cows:

Climate Expert: Gas Car Cancellation Is Intended to End Private Transport – PJ Media

FROM THE ARTICLE:

“the Democrat and globalist push to replace gas cars with electric vehicles (EVs) isn’t about helping the environment but restricting Americans’ freedom of movement.”

“The intent is not to necessarily force people into an electric vehicle,” Morano went on. “The intent is to collapse our plentiful freedom of movement and force us to use mass transit.”

Everybody sees the world through their own lens.

Lens? If you can call it that. . . The self-proclaimed climate expert quoted by Pajama News has a BA degree in politics and no other education or background in any scientific or research field.

I didn’t look into that at all, but it’s not surprising. The less charitable way to say “Lens” is that most of us subconsciously filter our information for what we agree with first, then for what feels good or makes us feel smart or reassured, and finally, if we’re lucky, for what’s verifiably true or supported by evidence.

I keep hearing how EVs are going to cost jobs. It’s happened before. When the Model T first came in, suddenly carriage factories were closed. Carriages became a niche item. No one had any use for anvils. Livery stables were closed. Horses were put to pasture. We lost a lot of jobs then. This is simply us paying them back.

People in the carriagemaking trade went to work building cars. Anvils were melted down to be made into cars. Livery stables were torn down to make way for housing and parking lots.

Many more jobs were created by the car industry than jobs lost; tire mfg, glass, wire, battery, etc. However, i don’t believe that will be the case with AI, many more lost than gained.

Ah, gee – I thought all I had to do was just sign up someplace and I’d start getting $25k monthly checks. 🙂

We’re going to need a bigger crock. Your analysis was good, Travis, but you need to keep up with the fads. The last EV fad was in about 1910. Still not practical. The solar and wind fads are fading, too. I’m being banned from some sites because I’m not PC or ZC (Zeitgeist Correct). I don’t have enough shares yet, but I can collect $48,000 in dividends every year if I put in $600,000. I’m not on the board, though, so I’ll have to be patient.

Gasoline cars were not practical either, in 1910; no gas stations, so you bought gas 1 gal at a time from the hardware store or pharmacy. Tires got flats constantly – they were like rubber bands. Nobody knew how to fix cars when they broke down. It was a common sight to see a horse pulling a car home. Huge advancements in batteries, charging and electric motors are being made. Try not to be a fuddy-duddy, like the folks in 1910 that mocked horseless carriages.

EVGO is looking to be profitable about the same time as NIO. In 2026. I check them every day; I’ve had both for some years.

how do i nvest

This tease is just tempting you to buy into a dividend-paying stock — so if you wish to follow that suggestion you’d need a brokerage account, and could simply place a buy order for the number of shares you’re interested in owning.

looking for good reit check HI W good comp. and div, worked their 11 years still own it .just FYI

Myself, I wont invest in any Charging station Reit s Mom and Pop charge and Go s or State funded private induced financing. Not until One the Government offers a Infrastructure plan and Two there is a repeat buying evidence of the EV products initially purchased. I think people will not return to the product if the product becomes cumbersome to own, operate and expensive. Wait to see if the Diehards get a following to actually have a productive market that’s investable.

Thanks for all that information. I was wondering what these newsletters were promoting as these ads have been going on for some time and it just couldn’t make sense of what they were selling. What a scam.