This makes two days in a row we’re talking about next-level “AI” teaser pitch — not so much the “pure play” AI stocks, but the companies who might benefit from AI, or might supply needed parts and services that make AI work. Yesterday it was Porter Stansberry with his “Artificial Illusion” stocks that he calls “AI Railroad” companies… today it’s Karim Raheumtulla, selling his Trade of the Day Plus service ($99/yr) for Monument Traders Alliance.

And these teaser pitches from Rahemtulla are always a little odd, because he’s selling a short-term trading service — “Trade of the Day” says they typically close a trade within a few months — but he’s teasing longer-term investments with “3-5 years” projections, so we can’t really know how these picks he’s teasing compare to the real strategy of his newsletter. His last heavily promoted teaser pitch was pretty successful, he started teasing Rolls-Royce (RR.L, RYCEY, RYCEF) in March of 2022, and is apparently out of that trade now if we go by the language in this latest pitch (“my READERS had the chance at tremendous returns on that recommendation from March 2022 to July 2023”) — that means he bought at about $1.25 and sold around $2, which is very good for a year and a half (not as good as if he held today, it’s now well over $3… but what can one expect from a short-term trading service?)

So yes, I can give Rahemtulla a hard time for saying that his Rolls-Royce recommendation in 2022 was inspired by Netflix and their innovative “subscription” service strategy for jet engines, when Rolls-Royce had exactly that same strategy a decade ago when it was at $20 a share and this was really a bet on the recovery of air travel after COVID, particularly air travel in China, and on the well-publicized restructuring and leadership shift at Rolls-Royce, but that’s neither here nor there — it was a successful short term pick, and he was right about the stock being too cheap when if fell to a buck (and later fell below that, for a little while).

Will he be right this time around? Let’s see what he’s pitching… this is the intro to the ad:

“The #1 Most Critical Tech for the AI Revolution

“It’s NOT clean energy, computer chips or data.

“But it’s projected to grow 35% faster than AI itself!”

And not unlike Porter yesterday, Karim thinks the gains in the bit tech stocks and “name brand” AI ideas have already had their run…

“Right now, I’m seeing millions of Americans making one HUGE mistake… with artificial intelligence.

“They are buying all the obvious AI stocks…

“The ones that are already making headlines…

“And the ones that are already up hundreds of percentage points.

“The big players in AI… the Microsofts, Nvidias and Metas… have already delivered the vast majority of their gains.”

And he says there’s a layer of stocks underneath that, supporting AI, that will be the next winners…

“While the big companies make headlines…

“The truly life-changing money comes from the lesser-known companies that are supporting the massive trends.

“This has been true of every major tech development going back decades.”

So what are those “lesser-known companies” this time around? He starts to hint at the reason they’re going to boom…

“… under-the-radar companies that solve a problem for big companies can make money hand over fist….

“The opportunity here is staggering….

“The Wall Street Journal calls it ‘on par with transformative technologies that fed the industrial revolution or the information age’….

“But all that growth simply won’t happen unless one problem is solved.

Are you getting our free Daily Update

"reveal" emails? If not,

just click here...“Because there’s one critical bottleneck that every single AI company has to deal with no matter its size….

“All the promises of what AI can do…

“All of that will come to a screeching halt unless we solve ONE issue bottlenecking a massive tsunami of progress.”

So what’s that bottleneck? He dances around the idea for a while…

“The problem is NOT legislation…

“It’s NOT processing power (quite the opposite, actually)…

“It’s not access to chips or data…

“And it’s DEFINITELY not a sci-fi AI apocalypse.

“Rather, it has to do with a physical byproduct of artificial intelligence.

“One that can cause significant ‘hardware damage and poor performance’ for these systems, according to a leader in the field.”

So what’s that “physical byproduct?” I’ll skip ahead a bit and just tell you that yes, it’s heat.

You’ve probably already guessed the answer to that, if only because you’ve spent time using a laptop computer on your lap, heard the fan rev up like an airplane taking off, and risked third-degree burns when doing anything processor-intensive. Heat is the byproduct of all the energy consumed by more and more powerful processors, and dealing with that heat has been the core challenge of every data center and one of the biggest issues for most device makers for decades, this is not a new “AI” problem… and he does eventually reveal that “secret”….

“One tech repair expert explains that extreme heat can cause irreversible damage and will ‘significantly shorten the lifespan’ of computer components.

“As Nvidia puts tens upon tens of thousands of new cards into the market, all of them jammed into ever-tighter spaces… the heat generation is going to be off the charts.

“Consider this… In order to get more power out of these cards, the amount of wattage per chip has been increased by more than 365%.

“All of this heat could destroy equipment and stall the AI revolution.

“However, Big Tech is turning to a specialty technology to solve the problem… and I’ve hand-picked the one stock I believe is set to make a fortune as a result.”

None of this is at all new, of course, just like Rolls-Royce and GE pushing customers into service subscription plans for their jet engines wasn’t new last year — cooling uses up almost as much energy in a typical data center as the computers themselves, and data center design has evolved over the years to incorporate lots of different strategies for cooling. Here’s what Rahemtulla says is the answer:

“The tech AI NEEDS in order to survive is called…

“Liquid cooling….

“Data centers use up to 40% of their energy powering cooling systems. And these cooling systems cost them nearly as much as the actual computer processing!

“Air cooling a data center is like running the air conditioning on high while your oven is open at 450 degrees.

“But with liquid cooling…

“You can pack as much as 20 TIMES the processing power into each square foot of your data center.”

That’s a little extreme, the data center studies I’ve seen about testing liquid cooling indicates that it can reduce energy consumption by something like 10-15%, which is impressive enough. Not many data centers have implemented full liquid cooling, particularly at the device level (where there’s water circulating through the racks and directly touching the heat sink areas in the servers), presumably because it’s very expensive to build and may not integrate well with older systems in places where lots of different kinds of servers are colocated, but it clearly works pretty well. I don’t know what the hurdle is for absorbing the cost to upgrade existing data centers, but I’d assume that most new data centers are being designed with liquid cooling as at least part of their heat-management solution.

Here’s more from Rahemtulla…

“In direct-to-chip liquid cooling, small tubes filled with water run through the parts that generate the most heat.

“CPUs, GPUs, memory chips, stuff like that. These components can heat to somewhere in the neighborhood of 200 degrees Fahrenheit.

“Then, the heated water is cycled out of the computer to cool.

“And get this…

“Water can be as hot as 113 degrees Fahrenheit and still be used to cool computer processors.

“This means all you have to do is put the super-hot water outside to cool it – as long as it’s not more than 113 degrees outside!

“The water naturally cools down to the outside temperature and becomes usable again.

“The Maharaja Institute of Technology calls this ‘free cooling’ that ‘can be done by using atmospheric air or water which is relatively at a lower temperature.’

“It’s literally called FREE cooling because it’s so much cheaper.

“And because you don’t need all that empty space for air cooling…

“You can pack a LOT more processing power into the same facility…”

He quotes a bunch of sources who argue that the big surge in AI processing is going to be too much for the existing data center fleet, and that one way to reduce the need for building tons more data centers could be to push liquid cooling to make the centers more efficient. Which is true, though that has been the chatter in the data center world for many years, it’s just that the demands of AI are bringing it to the surface again.

And the ad goes on…

“Big Tech knows this and has quietly started to shift away from air cooling….

“Microsoft is busily adding liquid cooling tanks to its data centers….

“Google is turning to liquid cooling to handle the massive AI power needed for Gmail, Google Photos and more….

“Any company that provides liquid cooling to Microsoft, Google, any of the big guys…

“Could see stunning stock gains.

“Because liquid cooling, frankly, will be the lifeblood of this industry going forward.

“It’s the Companies You Don’t Think About That Produce the Biggest Gains”

Well, sometimes. And he throws in what feels like some false urgency about this whole situation… which I guess is no surprise, because without urgency, marketing doesn’t work (if they can’t get you excited about getting rich next week, then you’re less likely to shell out a hundred bucks to learn the “secret”).

“I predict liquid cooling will be the ‘hot tech’ on Wall Street a few months from now, though it may be a matter of weeks or even days.

“You have a very limited window to get in before all the headlines start blasting.

“Right now, it’s mostly IT industry publications talking about how liquid cooling is necessary for AI.

“Soon, it’ll be the financial mainstream.

“But when you see a headline about liquid cooling on Yahoo Finance or in The Wall Street Journal, it’s probably too late.”

So… who will this emerging winner be? There have been a lot of startups that focus on “liquid cooling” for years, so we need to remember that this fascination with “AI” is not new in the computer world — “machine learning” and “big data” and even massive growth in video streaming have been taxing processing power in data centers for years, and lots of entrepreneurs and HVAC companies have been innovating in the “liquid cooling” space, so this is not a secret that is just being discovered.

But with that caveat, let’s see what Rahemtulla likes. He teases several stocks as plays on this “liquid cooling” business, but he starts out with his favorite:

“I’ve hand-picked the one stock with the most potential to lead the liquid cooling revolution.

“I can virtually guarantee your broker hasn’t talked about this stock…

“And I’d be shocked if CNBC picked up on this opportunity before it was trading at 10 or even 20 times its current value.

“By that time, this stock could be a cash-gushing behemoth after raking in billions from Big Tech.”

OK, so what do they do? What’s their secret sauce that will make us rich? More from Rahemtulla…

“This company provides cooling solutions to over 300 data center owners and operators.

“One of their crown jewel projects is an UNDERGROUND data center that was built in a former Pennsylvania limestone mine.

“This company retrofitted the old mine to ‘control environmental heat and humidity’ for a client’s data center….

“They also built a data center in an abandoned nuclear bunker deep underground in Sweden.

“Not only did they make a deal to cool multiple data centers…

“But they also engineered a way to use the excess heat to keep people warm in freezing Scandinavia.”

How about some numbers?

“… its year-over-year annual net income more than DOUBLED recently.

“And best of all, its future profits are protected by 18,869 patents.

“I’m projecting the stock to rise as much as 120% over the next three to five years.”

Rahemtulla calls this, “The #1 Underground Liquid Cooling Play for the AI Revolution” … so what is it?

Thinkolator sez: That’s Carrier Global (CARR), the HVAC pioneer (Willis Carrier invented modern air conditioning 120 years ago), whose AquaEdge chillers and other cooling equipment are used both by Bahnhof at their underground data center in Stockholm, which is indeed under a mountain in an old nuclear bunker, and designed to look like the lair of a James Bond villain… and by Iron Mountain at their limestone-mine data center in Pennsylvania.

And Carrier has been pretty busy refocusing on their core HVAC business of late — they decided to sell their commercial refrigeration and fire & security businesses and buy the Climate Solutions division of Viessmann, a decision which is not at all about “liquid cooling” but is entirely focused on Carrier’s core business, heating and cooling solutions for homes and businesses. That includes Viessmann’s heat pump technology, which is expected to be a major beneficiary of the transition to electric heating and away from natural gas and oil, particularly in Europe but really throughout the global North.

Will the long-anticipated switch to more liquid cooling in data centers give Carrier a big boost? I don’t know. Data centers are obviously a big deal, they consume probably 2-3% of the electricity produced on the planet, but they’re not as big a deal as all the other heating and cooling systems in buildings around the world, and nothing in Carrier’s investor materials indicates that data centers are the primary focus of their strategy. Commercial HVAC in general is the majority of their revenue, likely around 60% once the Viessman deal goes through in January and they offload their refrigeration and other ancillary businesses, and the rest is residential HVAC, but they don’t say how much of their commercial work is specifically for data centers. I’d guess it’s growing, they’ve made some acquisitions in this area in the past few years, but I don’t know how much weight it carries on their income statement.

Carrier is a very large company, currently with a $43 billion market cap (that will change a bit as they sell divisions and issue shares to Viessman for that acquisition), and their GAAP earnings are probably going to be a bit goofy as they go through this transition, as is almost always the case when companies offload or acquire divisions, but their adjusted earnings are expected to come in at about $2.87 per share next year ($2.70 for 2023 is the current guidance). That means they’re trading at about 18X forward earnings (at $52 a share today), and they’re a pretty slow grower on the revenue front, roughly 4-6% a year, but have been squeezing some efficiencies out of the business and significantly improving the “lifecycle” earnings of their equipment, particularly through commercial service deals, so they expect to be able to continue to improve margins. Analysts see that pushing earnings growth to more like 8-10%. 10% earnings growth for an industry leader that’s valued at 18X earnings is pretty reasonable, I’d say, though it’s not as cheap as some of the other companies in the building services and equipment sector.

I don’t know that the stock price will surge quickly higher anytime soon — if it does, that would likely be a result of some good offers for the divisions they’re selling and some positive commentary about how well they’re going to integrate and cross-sell their Viessmann customers, it does not look like the data center/liquid cooling business is going to move fast enough, or be a big enough part of Carrier’s revenue stream, to cause a dramatic shift in the valuation in the next few quarters… but, well, it’s the future, I don’t really know what’s going to happen.

Solid company, growing dividend, reasonable valuation, increasing corporate focus on some nice growth areas like heat pumps and energy efficiency, I won’t try to talk you out of buying Carrier Global. I’m sure they would get hurt if there’s a real sharp stop to commercial construction around the world, though Carrier was part of United Technologies until a few years ago so I’m not sure what happened to their business during the 2008 downturn… but presumably any slowdown in the HVAC business wouldn’t last forever… and HVAC systems don’t last forever, either, so there’s a constant need for service and replacement and the business is unlikely to go away. Investors seem unworried, to the extent that Carrier recently even refinanced a couple billion dollars of debt at pretty reasonable rates — including less than 6% for 10 years.

So that’s the “#1 Underground Liquid Cooling Play” — even though I’ll repeat that it’s a little odd for this short-term trading service to be pitching CARR for its 3-5 year potential. What else does Rahemtulla like?

“The Microsoft of Liquid Cooling”

“Another company I see securing billions from Big Tech is a long-established titan of the cooling industry.

“This company is using its decades of experience to pioneer ‘infrastructure-as-a-service’ for data centers in the same way Microsoft pioneered software-as-a-service…

“Where they collect major recurring revenue in exchange for ongoing support.

“I love companies like these because they make money around the clock. Data centers never shut down.

“Not to mention, this company’s products are some of the most efficient in the world.

“One of their liquid cooling units can save data centers $4 MILLION across the life of just one unit.”

OK… other clues?

“Sales for this company’s data center unit rocketed 131% higher in just one year.

“And as AI companies do whatever they can to stay ahead of the competition in the next 12 months…

“I believe they’ll throw even more money at this liquid cooling company.

“Future profits are protected here by 26,435 patents.

“I’m projecting up to 70% gains over the next three years.”

Hard to get people that lusty about “up to 70% gains in three years” if you’re using this “AI boom” as your hook, I imagine, but still, hoodat?

This is very likely Carrier’s biggest competitor, Daikin Industries (6367 in Tokyo, DKILY or DKILF OTC in the US), which is often called the world’s largest manufacturer of air conditioners. Their “Applied” AC business, which is where they categorize their data center sales, is indeed a strong growth spot for them, it has been growing at well over 100% this year, though they’ve been hurt by sluggish sales and the need to cut prices in their core residential HVAC business, now that the super-aggressive building and renovation waves from COVID have slowed and there’s been some softness in those end markets as the economy slows and interest rates rise.

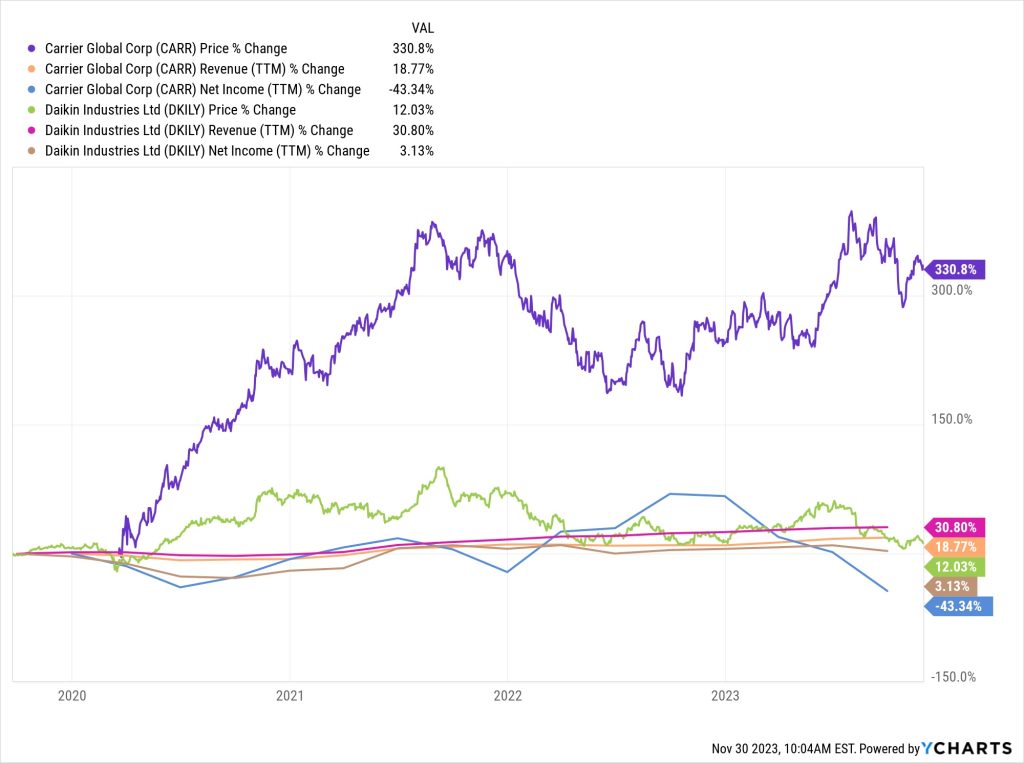

I don’t know where things will go for Daikin, but they trade at a similar valuation to Carrier, about 22X trailing earnings — though they haven’t been as good at generating free cash flow, and the dividend is lower and slower-growing. Here are the two side by side, including revenue growth and net income over the past three years or so, since Carrier was spun out of the breakup of United Technologies…

In many ways Daikin has performed better, with faster revenue growth and more consistent income growth, but clearly investors see a lot more to like with Carrier so far, with dramatically better stock performance and, at the moment, a somewhat lower valuation. Things are complicated a bit by Daikin being a Japanese company, I imagine, so the currency impact could be meaningful, but given the current valuation, pending catalysts, product mix, and outlook, I’d be more interested in Carrier than Daikin today.

Not that I own either, so that opinion is worth what you paid for it.

Though, to be fair, a lot of that performance from Carrier’s stock price probably came from the fact that it was a spinout at a low valuation at an odd time in the markets — if you go back just two years, you can see that the two have much more similar performance:

But wait, there’s more! Here’s the third pick being teased…

“The Stock on the Cutting Edge of Liquid Cooling.

“This Cooling Company Makes Money Every Time a Smartphone Is Sold – Anywhere in the World

“The third company is another longtime giant of the cooling industry.

“Carrying 25,951 patents globally, not only does this company provide cooling technology via gas and advanced materials…

“According to its website, the company had a hand in 100% of the latest-generation smartphones.”

And we get some numbers with this one, too…

“It’s no surprise that its earnings are up 451% year over year.

“So while this company, which supplies the entire world with smartphone technology, quietly pivots to liquid cooling…

“You’ll be invested in its stock.

“But they’re only just getting started.

“Now that even smartphones are beginning to implement liquid cooling…

“I’m projecting a 30% return for this stock over the next two years… plus a solid and growing dividend.”

And they’re apparently getting into “liquid cooling” for larger scale products, too…

“They are also getting into cooling data centers. And on top of that…

“The company is already providing something called “extreme cooling” to an entirely new type of supercomputer that will take AI to true exponential growth.

“One expert in the field told Forbes, “AI and machine learning algorithms are perfect candidates for [this new type of] processing.”

“So not only are we looking at the extremely near-term opportunities to profit from the AI sector…

“I’m looking ahead to the next “next big thing” for artificial intelligence.”

That last bit is about “extreme cooling” for quantum computers, which is certainly part of that “cooling” industry but is still really an R&D project for all players involved, it is not a meaningful part of the demand for cooling equipment or technology right now.

And the Thinkolator sez this one must be Air Liquide (AIQUY, AIQUF), which is a giant chemical and gas supply company. Like its peers, Air Liquide is very involved in providing chemicals and gases for health facilities and for manufacturing, and they’re also investing pretty heavily in the hydrogen economy, trying to build up low-carbon hydrolyzer capacity and support the use of hydrogen as a transportation fuel. They are involved in cooling technology, including liquid cooling, but their primary role in technology is as a supplier of high-purity gases to the semiconductor industry and to device manufacturers.

And in all of those parts of the business, this company is essentially the middle player in a three-company global oligopoly… and like its larger competitor Linde (LIN) and the smaller player Air Products (APD), Air Liquide has been a pretty steady performer — they rarely have breakout numbers, but are almost always profitable and growing.

Thanks to their very diversified customer base, these firms are all driven more by the broad economy and the cycles of industrial demand than by any particular segment within the business… Air Liquide certainly talks up their cooling work more than Linde does, but it doesn’t raise to the level of being a core segment that drives discussion on their earnings calls. They all sell to semiconductor manufacturers, hospitals, factories of all kinds, fertilizer companies, even the vendors of helium balloons.

And they’re all growing, and are valued like the dominant specialty chemicals companies they are, even if most of their chemicals are more likely to be gases than liquids — none of these dominant companies are cheap, and they are cyclical to some degree, so it might be tough to swallow the valuation at 25-30X earnings for these companies that have generally been growing earnings at well under 10% per year, but they’re certainly not fly-by-night operations (Linde is a $200 billion company, Air Liquide about $100 billion, APD roughly $60 billion… this is not an oligopoly you’d want to have to fight your way into). They’ve all done pretty well for a long time, though Air Liquide has been the laggard and none have really outpaced the S&P 500 — here’s the 10-year chart for all three, that’s Air Liquide in green at the bottom, alongside their pink net income line:

And yes, Air Liquide is very active in the electronics business, along with the other two specialty gas companies their products are used in the manufacturing of essentially everything in the technology world, and they’ve got thousands of patents, including some for liquid cooling technologies — though the business of selling high-purity gases to the semiconductor industry is a much bigger deal for them than any specific “liquid cooling” products they’re trying to develop or sell. If they’ve got some secret growth boom coming from liquid cooling, it’s not obvious to me — at roughly the same valuation as Linde, which has a much bigger push into hydrogen, I’d probably stick with the larger player… but that’s just off of ten minutes of research, so don’t listen too closely to me on that point.

And we get one more stock along these lines… a specialist in a different kind of liquid cooling…

“The Next Frontier in Liquid Cooling….

“Right now, water is the main fluid used in liquid cooling. It’s plentiful, it’s cheap and it works.

“But as the AI race has heated up, companies have been looking for every advantage they can find.

“A new tech, called ‘immersion cooling,’ is the next frontier of efficiency.

“In this type of setup, the computer chips are dunked fully in a special liquid coolant.

“It’s nonconductive, so you don’t have to worry about the electronics shorting out.

“Obviously, this liquid needs the utmost precision to make sure the millions of dollars’ worth of high-end AI processors keep working.

“Buy from the wrong company, and you’re risking millions of dollars’ worth of chips.

“But there’s one company that’s been at the forefront of this specialty fluid industry for decades.

“Their cooling fluid is already used in electric car batteries, which – like AI – NEED liquid cooling.

“Battery temperatures as low as 85 degrees Fahrenheit can degrade the performance and longevity of electric vehicles.

“At 100 degrees, the range of an EV battery is slashed by nearly one-third.

“And in extreme cases, the battery can catch fire.

“This is high-stakes stuff.

“That’s why I’m confident that Big Tech will turn to this company for liquid immersion cooling.

“The company already has relationships with…

- Adobe

- Apple

- Cisco Systems

- Dell

- HP

- IBM

So… who are we dealing with here?

Well, again, there are a lot of “immersion cooling” companies who are pushing new designs and selling systems into data centers, and there are a variety of different strategies, from spray mists to actual submerged racks, but given Rahemtulla’s focus so far on very large companies, and the clue about battery cooling fluids, I expect this could be any of several large chemical companies who supply specialized chemicals for both EV batteries and immersion cooling systems in data centers. There’s not enough clues to be specific, but I’d narrow it down to DuPont (DD) or its much smaller spinoff Chemours (CC). Given what we’ve learned about the kinds of stocks Ramemtulla is thinking about above, it’s probably the big fella.

There’s been a big swing in margins in most of the specialty chemicals businesses over the past few years, driven by a few specific material bottlenecks and by the big swing in demand during and after the COVID pandemic — it was probably most obvious in building materials like PVC, which roughly doubled in price in 2021 and then came back down last year, but similar dynamics have impacted a lot of specialty chemicals, helping to cause some big swings in the share prices of these companies… but at the moment, Dupont looks like it’s on a pretty even keel, trading at about 20X forward earnings and with some significant earnings growth over the past five years. And they do supply chemicals for a lot of liquid cooling applications, including immersion cooling and EV batteries, though one risk is also that the first wave of these cooling chemicals were mostly PFAS compounds, and many of them still are… so Dupont has been taking share from 3M as it faces down litigation and shuts down their PFAS plants, but Dupont is also probably under the litigation microscope, which is a risk I don’t know how to quantify.

We’ll have to mark that down as a guess. And note that for all of these larger specialty chemicals companies, even the ones like Dupont who do count the electronics industry and semiconductor manufacturers as major customers, the actual cooling business, supply of chemicals for cooling systems of all kinds, is relatively small. DuPont’s future earnings will not primarily be determined by whether or not data centers adopt immersion cooling, and my guess is that the sales of those chemicals are unlikely to ever be more than a rounding error on their income statement. Which doesn’t mean it’s a bad investment, just that there’s no need to get wrapped up in the “liquid cooling” or AI enthusiasm if you’re considering an investment, you’ve got time to think it over.

And finally, Rahemtulla throws in a fourth investment idea that’s also a background play on AI…

“The #1 Metal AI Needs to Survive….

… it’s a metal that investors often ignore because it’s not as ‘sexy’ as gold or silicon.

“But as I’ve shown you… I specialize in these overlooked (yet lucrative) investments.

“This metal’s ‘high conductivity, durability and workability’ give it a ‘dominant role’ in the cooling industry, according to The Economic Times.

“It’s also needed in construction, electrical systems and even your smartphone.

“Analyst Guy Wolf says it’s ‘the only metal with locked-in demand growth.’

“The Wall Street Journal reports, “According to analysts, it is more of a ‘when,’ not an ‘if’ demand [for this metal] is likely to surge.”

“In fact, there’s already a shortage…

“And AI will only increase the global demand for this metal, which is projected to double by 2035.

“On the other hand, the price of gold is projected to fall to around $1,600 by 2035.”

First of all, if you want to be taken seriously, don’t try to predict what the price of a metal will be 12 years from now.

But as you might have guessed, this “#1 Metal AI needs” is just copper — which is certainly at the heart of almost all electronic technologies, including the spread of acccess to elecricity itself, and is widely expected to see increasing demand as the world further electrifies… though the cooling industry is not a particularly major demand center for copper, relatively speaking (the big driver is just electrical infrastructure in general, and building construction that uses wiring and copper piping… but major growth areas are alternative energy, since both solar power and wind turbines use a lot more copper than natural gas or coal power plants, and electric vehicles, which use ~4X as much copper as conventional vehicles).

Rahemtulla doesn’t comment on what his favorite play in this space might be, but if we’re talking big companies (and everything Rahemtulla has pitched here is a big company), it could be anyone from Freeport-McMoran (FCX) or BHP (BHP) to Ivanhoe (IVN.TO), Southern Copper (SCCO), Lundin (LUN.TO) or Teck (TECK). There are lots of copper miners out there, most of them look at least somewhat rationally priced if you assume copper prices will go up over time. Among those, TECK is probably the most interesting to me — they’re still mostly dependent on metallurgical coal, so not at all a “pure play” on copper, but they’re selling the coal business next year and their copper business is booming.

But given that it’s the easy name, with impressive reserves and a strong track record, I’d guess that Rahemtulla is probably taking the simple path here and just recommending Freeport-McMoran (FCX), which is the first name almost everyone at Wall Street pulls up when they’re thinking about copper… but that’s really just a guess, given the lack of clues.

If you’re looking for other copper ideas, we haven’t written about many of them this year we’ve covered a little copper royalty company that got teased pretty heavily in 2021 and 2022, though that’s been a weak performer so far as copper has come off of its 2021 highs, and also dug into some of the other ideas when Whitney Tilson was talking up copper as “Gold 2.0” about a year ago.

Have a favorite copper stock to share with us? Other ideas that are more direct plays on upgrading data centers for liquid cooling or otherwise increasing capacity for AI processing? Let us know with a comment below.

Disclosure: Of the companies mentioned above, I own shares of Google parent Alphabet and Nvidia. I will not trade in any covered stock for at least three days after publication, per Stock Gumshoe’s trading rules.

Hi Travis, Thanks for your insights, nice to see someone thinking outside of the box without going to your typical AI play. I did get in on Rolls Royce however and after reading up on them their CEO hired from BP says he plans to quadruple their profits by 2029, interesting stuff.

Yes, RR has had a nice recovery, finally — still a shadow of its former self (this was a $100 billion company a decade ago, and bottomed out around $7 billion last year, the timing of COVID was disastrous for them), but the new CEO has clearly had an impact in shaking up the company and getting them refocused… and the fact that airline travel finally did pick up and dramatically increase their service revenue certainly is helping.

I don’t know enough about copper to have a favorite stock, but I think Aurubis AG is interesting. They say they’re a global supplier of non-ferrous metals and one of the world’s largest copper recyclers. They could have exposure to energy prices in Europe, which I can’t predict (or the weather).

Thanks for the work! All of the companies mentioned seem pretty decent to me and should do fine well into the future.

VRT for cooling is becoming the go to play.

That Rolls-Royce should recover as planes flew again was a compelling pitch. I got in at a dollar eight cents and continue to hold. It’s the nuclear bit which I hold hope will provide a positive surprise in future Rolls-Royce news. Otherwise, it feels like a fairly safe hold.

Suggesting a rise in copper use is inevitable however (or cooling fluids for that matter), seems pretty bold considering the likely eventual emergence of the most conductive and electrically lossless to heat material known material known, i e George Gilders touted graphene; it’s just hard to say which of and when, one of the hundreds of graphene companies, or one of the two or so Gilder touted and mainly uninvestable companies said to be improving cost and supply of quality graphenes, might begin offer practical Solutions.

Bought a butt load of RYCEY @ $1.12, looking good at $3.51, and

what a picture perfect yearly chart.

It is probably listed in another place,, but what is the company that is a key supplier to

Googles

Gemini Project, being touted by Colin Tedards of Brownstone Research

Haven’t written about that one, but probably Broadcom (AVGO)

Tedards is pushing AVGO.

Pretty well-timed story this time — and interestingly enough, Barron’s has a big piece on AI that focuses on liquid cooling and data center infrastructure today… and they highlight SMCI and VRT, just like I did in the Quick Take above. Wouldn’t be surprised if those stocks pop quite a bit on Monday from the Barron’s front page attention.

Wondering if the HVAC folks will get new customers and thus new revenue streams or simply be upgrading existing customers which, may increase revenues, but not as much as NEW customers would…