Louis Basenese has a new ad promoting his VentureCap Strategist newsletter ($2,000 a year), and it gets our attention with lots of hot air about “White Oil” … which, he says, is explosive in both chemical terms and investment potential.

Here’s a taste of the intro:

“This new White Oil is spiking 9X faster than the price of gold…

“The investment analysts at Goldman Sachs call it ‘the new gasoline.’ And MIT-trained chemical scientists call it ‘the holy grail.’ Because it’s 2116 times more powerful than the black oil you’re pumping into your engine now….

“… our models show potential for a 33,700% sector growth explosion….

“Drive 3 hours north from Las Vegas — like our venture cap strategy team just did — and you can hold a jar of this White Oil in your own hands.

“Feeling greedy? You can claim your stake in an entire MOUNTAIN of it today with just one click of your mouse.”

Basenese even includes a video of a “drunk hillbilly” setting a jar of salt water on fire… and implies that this new fuel will be a savior without “alternative energy” tax breaks:

“… what the salt water in that jar contains is valued at trillions upon trillions of dollars….

“… it’s the final American kill-shot that will put Vladimir Putin and the Saudi royal family out of business.

“For good.

“With no need for ‘alternative energy’ gizmos that run on sunbeams, good wishes, or pork-barrel tax breaks either.

“Because this White Oil burns more than three times as clean as the oil and natural gas we use now.

“And just a little of it goes a long, long way.”

He even goes so far as to say that his camerman drove the six hour round trip to Clayton County, Nevada from Las Vegas in a Chevy coupe that was “running 100% on White Oil” and used “just two tablespoons.”

So what the heck is he talking about? Some kind of saltwater fuel that you pump out of the ground and burn in your car? That’s what it sounds like, right? Especially when he has prominent notes like this in his ad:

“It’s a liquid fuel. You pump it out of the ground. You refine it. You put it in your car. You drive. Then you fuel up again… 8 years later.”

But, of course, it’s not a fuel at all (even though yes, the source brine can be flammable or even explosive). What Basenese is talking about (though he doesn’t once mention the word in his ad) is lithium. Lithium prices are often quoted as “lithium carbonate equivalent (LCE)”, and he does slip up and use that “LCE” term a few times…

… and, of course, anyone who’s been paying attention to the lithium market lately will know that Clayton County, Nevada is the only current lithium production site in the US (that’s Albemarle’s , and that it has also hosted a land grab in the last couple years as companies have staked out potential future production because of the hotly anticipated multi-year lithium demand spike coming on the heels of Tesla’s Gigafactory opening and other lithium battery production increases for the electric car market.

If you’ve not been paying attention to the whole electric vehicle trend, lithium is the lightest metal on the periodic table and is one of the key ingredients in lithium-ion batteries. That basic battery technology has been around for decades, and is what powers most portable electronics (laptops, phones, etc.), but the big new(ish) anticipated demand increase is from electric vehicles… thanks largely to the fact that Tesla, since the first roadster was built, has based their battery designs on huge networks of what are, for lack of a better term, standard laptop batteries.

So we’ve seen lithium stocks pitched off and on over the past five years, and those pitches have heated up in recent years as Tesla’s Gigafactory is being built and going online in Nevada — that’s mostly because the Gigafactory is, above all, designed to dramatically cut the price of batteries… and the only way it can do that is if it is extremely efficient and produces a huge number of batteries to achieve economies of scale, which is why it’s so incredibly massive (when finished, it is expected to have the largest footprint of any building in the world).

That size and dramatic ramp-up in production of batteries, which will be needed if Tesla is to achieve real commercial scale, producing hundreds of thousands of cars a year at more modest price points than their current luxury models, is also going to require a huge amount of lithium carbonate. It will also require a lot of graphite, which accounts for more of the weight of the battery than the lithium does, but graphite is by no means in short supply… and lithium might be.

"reveal" emails? If not,

just click here...

That’s not because lithium is rare. It’s not particularly hard to find, and vast reserves are known — particularly in the real heart of global lithium production, in the high desert peaks of the Andes of South America, but also in Australia and China. and, to a smaller degree in Nevada and a few other places… but production is not high enough to satisfy anticipated future demand from a booming electric car market, so there are lots of projects on the drawing board to both build new capacity and expand existing production. That makes resource investors and speculators smell money, and lithium prices have already risen pretty dramatically over the past couple of years as customers sense that future supply pressure… so, naturally, the newsletter guys are beating the bushes to find exciting lithium stories to tell and lithium stocks to recommend.

This is what lithium production looks like from the sky — most lithium is not mined (though some is, particularly in Australia, where there is substantial mined production from spodumene — but that’s generally a more expensive production method), the best concentrations of lithium are in underground salt brine “lakes” and most lithium is produced by pumping that saltwater out of the ground, evaporating the water in huge pools (one reason why production is all in sunny, arid locations), and processing the lithum carbonate out of the resulting “ore.”

This is what lithium production looks like from the sky — most lithium is not mined (though some is, particularly in Australia, where there is substantial mined production from spodumene — but that’s generally a more expensive production method), the best concentrations of lithium are in underground salt brine “lakes” and most lithium is produced by pumping that saltwater out of the ground, evaporating the water in huge pools (one reason why production is all in sunny, arid locations), and processing the lithum carbonate out of the resulting “ore.”

These underground salt lakes (salars) and evaporation pools also generally have high concentrations of other minerals, often including magnesium and iodine and potassium… usually, in fact, more potassium than lithium, so agricultural demand for fertilizers also has a substantial impact on the economics of most lithium producers (economic plans for lithium projects often use an assumption about potassium prices as a net credit to offset the production cost for lithium, much the same way a gold mine in its investor materials might use the “credit” of the silver they also produce to offset the per-ounce cash cost of the gold production). SQM in Chile has for many years been the global giant of lithium, but they’re also a major fertilizer company… none of the big three lithium producers, SQM, Albemarle and FMC, have historically gotten anything close to a majority of their revenue from lithium (that “big three,” to be clear, is no longer quite as dominant as they were when lithium demand was sleepier a decade ago, thanks to some new producers and a bigger push from Chinese companies into the business, but they still control a huge amount of global lithium production).

If you want to see some other images or get an idea of the massive scale of the lithium production projects or of the Gigafactory itself, check out this post on a Google Earth blog for some pictures.

We’ve already written about a bunch of these over the past couple years… so, what specifically is it that Basenese is talking about within the lithium space?

We don’t get a lot of detailed clues, but we get some hints that will help us give you at least an idea of the stocks he has in mind…

“This is the only ‘pure play’ on White Oil that covers all the best mining sites in Nevada.

“That’s why I’ve identified the top five White Oil stocks for you….

“… my own personal map of White Oil country. The one I began sketching out after that jar of this fuel exploded right in front of my eyes.

“But this is more than just a map. It’s also a five-stock venture cap strategy alert that shows you how to ‘R.I.N.G.’ the entire Clayton County White Oil reserve. Including the mine that’s already operating in Silver Peak. And the other four around it that have the highest growth potential… in other words, stocks that could go up many times higher than White Oil in general.”

So that leads me to think that he’s focused on Clayton County, as many folks are — partly because it’s a lot closer to the Tesla Gigafactory than the other sources of lithium supply around the world, though I expect that will not be that big a deal… it’s not like they’re going to get all their cobalt or nickel or graphite from Nevada, almost all the raw materials are going to be shipped in from far and wide like they are for most factories. And production is already being boosted to meet the demand of the Gigafactory — according to the FT, FMC has already agreed to boost production almost enough to meet the Gigafactory’s immediate goal of supplying enough batteries for 500,000 cars, and is also already planning to triple their lithium hydroxide refining capacity, and that lithium is likely coming from Argentina and being refined in either China or North Carolina (not sure which location does which products).

But anyway, what would these top five Clayton Valley stocks be? Basenese does not provide any further clues, but we can make some speculations:

First is Albemarle (ALB), the only US producer of lithium and owner of the Silver Peak mine. Albemarle has made some substantial efforts to increase lithium production in Chile and to boost their refining capacity since taking over Rockwood’s lithium projects after the merger a few years ago… but I have seen no indication that they plan to expand Silver Peak or intend to make that a bigger part of their supply. That gives me some pause, since it indicates to me that there’s something more attractive about the South American properties — lower costs, better product, better access to refining or to skilled labor or whatever, I don’t know… but the big companies are expanding like crazy in South America, and Silver Peak is just chugging along as a relatively small global player and a small part of Albemarle’s production.

Second are the companies whose properties surround Albemarle’s Silver Peak. As you’re probably aware, whenever there’s a successful mine you’ll see miners (often tiny guys) staking the property around the mine to see if they can piggyback on that success, with the theory generally being that “if there’s good stuff here, there will be good stuff next door, too.”

That leads us to probably the most hyped two stocks in the US lithium space over the past year, Pure Energy Minerals and Lithium X.

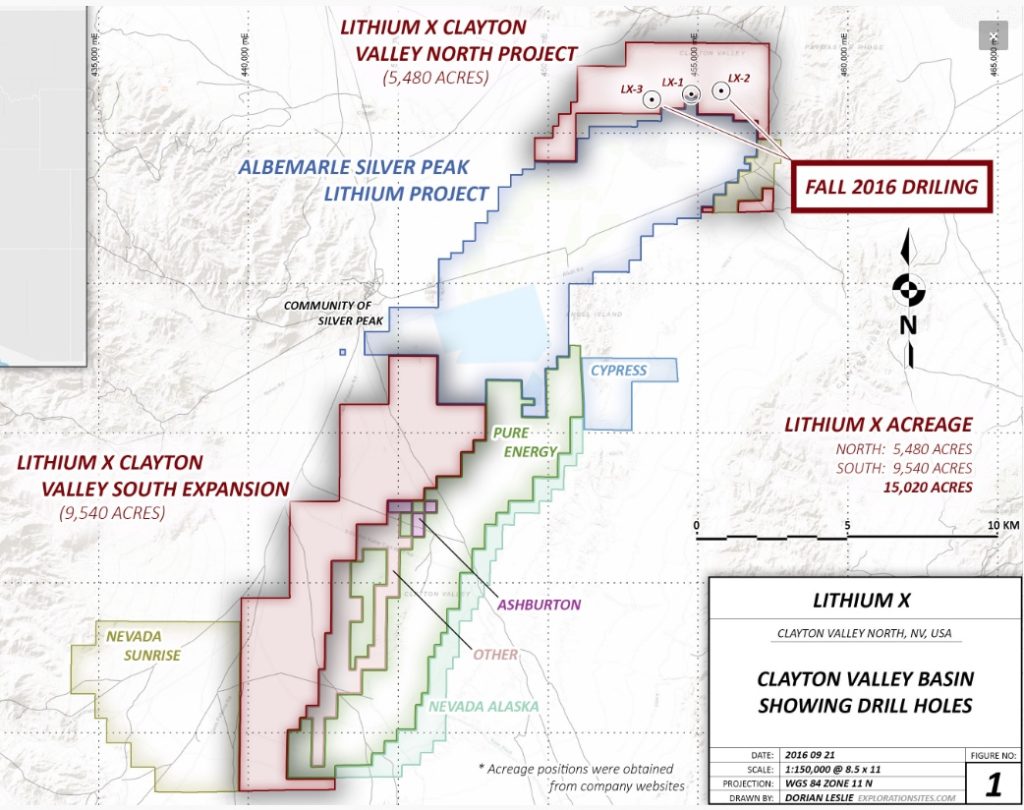

Pure Energy Minerals (PE.V, PEMIF) has a position to the south of Silver Peak, and Lithium X (LIX.V, LIXXF) has acreage both south and north of the operating Silver Peak project, you can get a better idea of the acreage from this map that I borrowed from the Lithium X website:

I’ve written about both of those before — Pure Energy was teased as a play on “Extraterrestrial Gold” by Oil & Gas Trader earlier this year, and my opinion on that one hasn’t really changed. They’re trying both to test the brines (which apparently is going fine so far) and to continue testing their refining technology — they are trying to develop a faster lithium extraction process, using solvents, that can extract the lithium and then return the brine to the earth fairly quickly instead of building giant evaporation pools.

That has captured the attention of a lot of investors, but I’d be pretty skeptical of the potential — there’s plenty of lithium that can be profitably extracted using the low-cost evaporation method, and from what I can tell Pure Energy hasn’t gotten close to an economic analysis of their Clayton Valley project, either, using their new refining process or conventional pools, though perhaps they have estimates of what it might cost that I haven’t seen.

My current thinking today is that I’d be a little skeptical of any early-stage lithium dreamer, given the huge reserves that current producers already have to work with — usually the exit plan for a junior miner is to get bought out because the existing producers are running short on reserves, and I don’t think that’s the case for anyone in lithium world… the juniors will probably actually have to have economically reasonable projects, and they might even have to build them themselves like Orocobre (ORL.TO, OROCF) did in Argentina over the past few years. Pure Energy gets mentioned a lot, and it has a good story to it, and that means it will participate in any bubble that we might see among the lithium stocks… but I wouldn’t put my money into it and sock that holding away for five years, I’d consider these stocks to be pretty wild early-stage speculations that don’t really have any underlying fundamentals to talk about yet — it’s all story and hope.

Lithium X is perhaps a little further along, though that’s debatable… it’s certainly larger, and it has two meaningful projects, the Clayton Valley land and their project in Argentina, which I’d be a bit more optimistic about actually getting built and being meaningful. It’s also very much a hyped-up story, thanks partly to the fact that Canadian resource legend and entrepreneur Frank Giustra was the initial financier… I wrote about that a few weeks ago here (it may not have been the right answer for that tease, which I noted at the time, but it has certainly been covered by other newsletter folks like Nick Hodge), nothing big has happened with this one in recent weeks.

The other names on that map are…

Cypress Development (CYP.V, CYDVF), which is an almost impossibly tiny company — their large plot to the east of Silver Peak is part of a joint venture deal with Pure Energy Minerals, but Cypress is far smaller and really shouldn’t be public. You could look at that stock as well if you like, but the market cap is only $2 million and teensy junior mining stocks in “hot” sectors like this are prone to severe manipulation… so be careful. I don’t know if there’s something “real” behind the company or not.

Nevada Sunrise (NEV.V, NVSGF), which has mostly been a gold explorer but started turning itself into a lithium company about a year ago. They’re tiny, but they have three possible sites in Nevada for lithium and apparently they also own some water rights in Clayton Valley that they think will be important for lithium extraction (I have no idea what the politics of water are in that area when it comes to salt brines, though the evaporation ponds are not generally a beloved part of the landscape and also may also create environmental concerns when it comes to migratory birds, etc…. I don’t know if those are serious concerns or not).

And I’ll throw out a guess that perhaps number five in this Clayton Valley stock report might be Advantage Lithium (AAL.V, AVLIF), which has partnered with Nevada Sunrise on five of their lithium projects, including the Clayton Northeast one near Lithium X’s northern projects.

So that’s what I’ll throw out as guesses for your five Clayton Valley lithium stocks… though I will also be a fuddy duddy and reiterate that I’m not all that excited about US lithium production, I think the South American projects are more compelling, so the only ones I’d think of as having more fundamental potential are Lithium X and Albemarle.

None of the lithium stocks are really cheap right now, but they will all likely have growing lithium production to help meet demand. Scaling up takes some time, but it is happening — the major producers don’t need to buy new properties to expand, they just have to be confident enough in demand to put the money into developing and refining their existing reserves.

Basenese says that this investment might be appealing “if you could be sure of just a few things” (if you’re not sure of anything, he says “buy gold”):

“But what if you could be sure of JUST A FEW THINGS? Because:

“You agree with Warren Buffett that White Oil could fuel America’s future . No matter what else happens.

“That’s why the ‘Oracle of Omaha’ has already made his first investment in what we’ve been calling White Oil — and is up a tidy 300% plus profit for his trouble.

“And why we believe it’s possible that Uncle Warren may want to use White Oil instead of coal and diesel to power all the trains that run across the 32,500 miles of North American railway he owns.”

Buffett has not made any direct investments in lithium as far as anyone knows, though he has invested heavily in alternative energy through his utility companies (mostly wind and solar projects)… so presumably this reference is to the investment Berkshire made many years ago in BYD, the Chinese lithium-ion battery company that turned itself into an electric car (and now electric bus) company. That investment is up roughly that much since Charlie Munger urged Buffett to buy in about eight years ago.

“You agree with America’s #1 CEO that White Oil could ‘transform the entire energy infrastructure of the world.’ No matter what else happens.

“That’s why the man who recently won Inc. magazine’s Entrepreneur of the Year, Esquire’s Most Influential People award, Smithsonian’s American Ingenuity Award and Fortune’s Businessman of the Year is ‘all in’ on this new fuel.

“And why he’s buying every tablespoon of White Oil he can get his hands on, to power the new car engines he plans to make in that giant research laboratory he’s building out in the desert.”

That’s Elon Musk, of course, and he genuinely is a true believer in the power of lithium ion batteries to revolutionize energy infrastructure… and that “giant research laboratory” is the huge Gigafactory that Tesla is building in partnership with Panasonic.

And he continues to make the same spurious argument about white oil being cleaner and more efficient than “black oil”…

“Remember, White Oil is already more than 2,000 times more efficient than black oil — because you can drive your car 229 miles on just one tablespoon. (That would take you more than nine gallons of regular oil.)

“And White Oil is more than three times as clean as black oil, too. So you can forget about any hand-wringing from environmentalists. This is the real deal. The knockout punch. Goodbye Putin, goodbye Saudi royal family, hello American energy dominance for the next century and beyond.

“But even so, those scientists are working around the clock to increase the power of White Oil even further. They even announced in August that they’d just doubled it (again).”

Lithium isn’t a source of energy or potential energy, though it can be used to store energy as part of a battery, and the energy density of lithium relative to its weight is a prime reason it’s used in batteries. “Black oil” is a store of energy itself — you extract it from the earth, and all you have to do is burn it to get the potential energy out of the oil. “White oil” is part of a storage battery — it doesn’t come with energy, you have to add that, so you add it by putting electricity into the battery… and a certain amount of that electricity, depending on the efficiency of the battery, can then be extracted to run the electric motors that make your Tesla move. Then it’s out of energy, and you recharge it again by plugging it in to add more energy… depending on where you are and where your electricity comes from, that electricity could be created in the first place by burning natural gas, or burning coal, or from nuclear reactors or solar panels or windmills or other sources. I don’t know where Basenese gets his image of using “a couple tablespoons” of lithium to drive a few hundred miles.

There are other battery chemistries and technologies, of course, but lithium has been in use for a long time, is very light and relatively inexpensive (even after recent price spikes, lithium is still priced by the tonne… it doesn’t create enough of a per-unit cost to have a meaningful impact on phone or car prices, and it might be that nickel, graphite, cobalt or other major components of those batteries have as much of an impact on price as lithium), and works well in batteries, and the challenges created by the flammable nature of those batteries can apparently be pretty well managed by auto designers (though fears always crop up when Samsung phones or Dell laptops start catching fire), so lithium ion batteries seem to still be the “go to” battery chemistry. That might change in the future, I don’t really know.

I’ve probably harped on this before, but it is important to note for those of us who are used to “rare” minerals or the difficulty of finding big new gold deposits and the like… although we may see spurts of demand from the Gigafactory and electric cars, and price spikes to help absorb that demand, there is plenty of lithium in the world, and we shouldn’t see long-lived prices in the “crazy” range — though prices can certainly fluctuate wildly, in part because it takes at least several years to add meaningful new capacity using the current techniques (it takes time for that water to evaporate).

Even if you just count the current mineable reserves we know about and could produce economically at prices well below today’s price, there are decades of reserves — as a rep from Tesla was quoted in a greentech media article last year, “There are more than enough reserves of lithium world-wide to serve the growth of the battery markets, including Tesla’s projected needs. Even if we wanted to build 10 or 20 Gigafactories, we would not have to search beyond the known reserves that can be economically mined.” (That article actually made the point that nickel and cobalt are of more concern when it comes to a secure supply for batteries — but that’s largely a political/security question, not a matter of those metals having a lack of available in-the-ground reserves).

Which means, to me, that I’d be pretty confident about the future of companies that have meaningful production capacity, or feasible projects that you’re pretty sure can be built and profitable at current lithium prices (or lower prices), but I wouldn’t go hog-wild over just any company with some staked ground in a salty desert and the word “lithium” in its name. Lithium exploration doesn’t excite me very much, because there’s no shortage of lithium reserves and I don’t see any huge geopolitical issues rising up to make lithium from South America or Australia hard to get, but I can see being tempted by large lithium companies who have meaningful and economical production. That’s why I’ve noted my fondness for Orocobre a few times in the past, because it sits in a bit of a sweet spot as a significant producer but not a diversified global chemicals or fertilizer company, so it will be much more impacted by lithium prices than will Albemarle, FMC, or SQM (or Talison, which is the fourth big player that gets mentioned frequently but which is 49% owned by Albemarle).

I never did buy Orocobre shares, unfortunately, and the price got pretty out of hand this year, but perhaps this pullback on the operational and “scaling up” problems they’ve had will continue and that will get more attractive… otherwise, I’d probably be boring and stick with a stodgier “blue chip” lithium company like Albemarle (ALB), even though it’s pretty pricey at about 20X next year’s earnings.

So, bottom line: The guy’s pitch is for a real thing, but everything he says about it is intentionally misleading and deceptive. Investing in “white oil” is investing in battery/solar which might not be a bad idea but you definitely shouldn’t trust Mr. Baseness.

That about sum it up?

SQM has an overall neutral rating by multiple analysts followed by Fidelity, and ALB and FMC have bearish ratings, with PCRFY having a very bearing rating. Maybe those newsletter that are touting lithium know something that analysts don’t, but I don’t see all the hype about hybrid cars. I just rented a nice hybrid Ford Fusion and got 38 mpg on about 1800 miles out west, but my 2002 4 cylinder Camry got 35 mpg on the highway. If I were going to invest in an energy stock, I would choose SHI (Sinopec), which has a very bullish rating.

There is no Clayton County in Nevada…

How to invest in White Oil ??

Japan just announced Copper Solid State Batteries that never wear out, 20 % more efficient than Li and they own the IP on this Technology.

Go Toyota !

Cypress Development is indeed the REAL DEAL and not a scam! If you read the website and Press releases it will surprise you. Technical report with numbers due in 3 weeks! Numbers will knock your socks off per Rick Mills head of the herd. http://aheadoftheherd.com/Newsletter/2018/Cypress-releases-technical-report.pdf

I have followed this company for 12 years and just gave you a gift! I am not a stock broker so ask your own for advise. Please post comments after reading up on the projects